USA Industrial Refrigeration Systems Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD8295

December 2024

94

About the Report

USA Industrial Refrigeration Systems Market Overview

- The USA Industrial Refrigeration Systems Market is valued at USD 5 billion, based on a five-year historical analysis. The market's growth is primarily driven by the increasing demand for cold storage facilities, which support the expansion of food processing and pharmaceutical industries. This growth is further supported by stringent energy efficiency standards, pushing the adoption of advanced refrigeration technologies to reduce energy consumption and operating costs.

- The dominance of states like California, Texas, and Florida in the market is attributed to their large agricultural and food processing sectors, which demand significant cold storage capacity for preserving perishable goods. These states have a robust logistics infrastructure, facilitating efficient distribution across the country, which supports the deployment of industrial refrigeration systems. Additionally, these regions experience high temperatures, increasing the demand for reliable refrigeration solutions to maintain optimal temperatures in industrial settings.

- In 2023, the U.S. Environmental Protection Agency (EPA) implemented a significant mandate to reduce hydrofluorocarbon (HFC) consumption. This directive aims for a 40% reduction in HFC usage from baseline levels established in 2020. The measure is part of a broader initiative under the American Innovation and Manufacturing (AIM) Act, which seeks to phase down HFCs by 85% by 2036, aligning with international commitments under the Kigali Amendment to the Montreal Protocol.

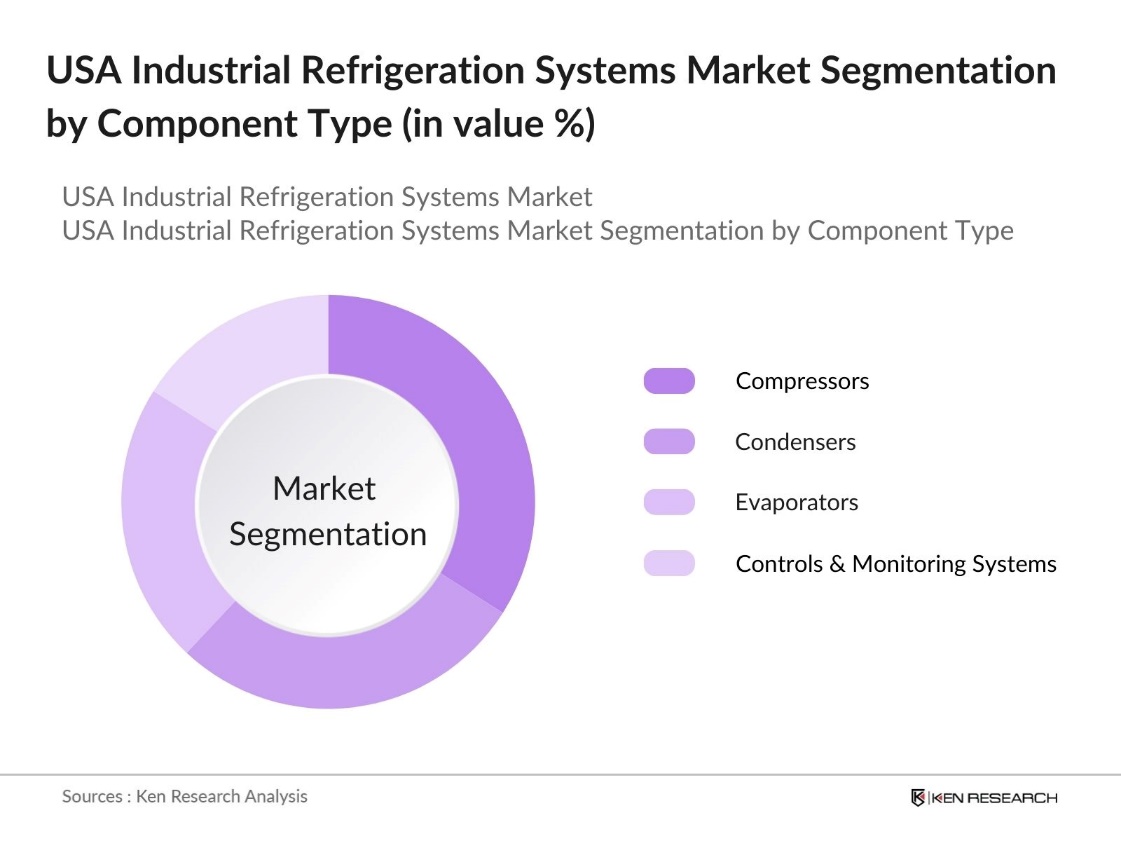

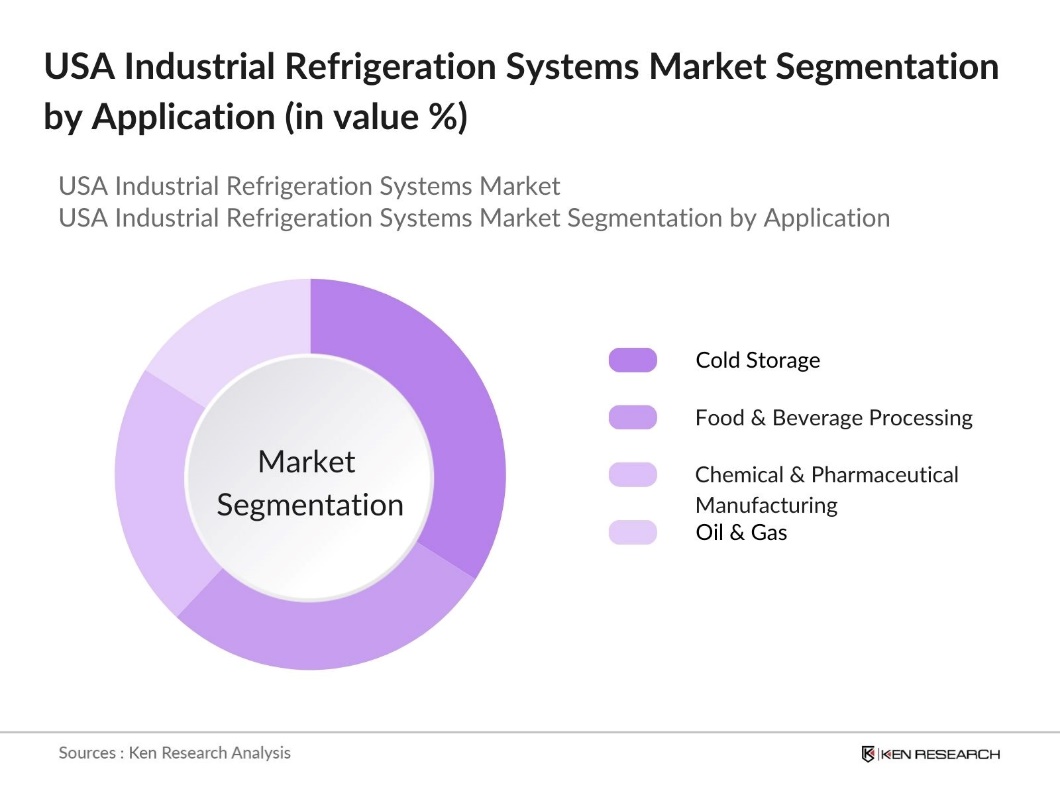

USA Industrial Refrigeration Systems Market Segmentation

By Component Type: The USA Industrial Refrigeration Systems market is segmented by component type into compressors, condensers, evaporators, and controls & monitoring systems. Recently, compressors have gained a dominant market share due to their crucial role in maintaining the desired cooling capacity within refrigeration systems. The demand for energy-efficient and low-maintenance compressors is increasing as businesses strive to lower operational costs while adhering to environmental regulations. Technological advancements in variable-speed compressors have also contributed to the growth of this segment.

By Application: The USA Industrial Refrigeration Systems market is segmented by application into cold storage, food & beverage processing, chemical & pharmaceutical manufacturing, and oil & gas. Cold storage facilities dominate this segment due to the rising demand for preserving perishable products like fruits, vegetables, dairy, and pharmaceuticals. This segment's growth is supported by the expansion of e-commerce and grocery delivery services, which require reliable refrigeration solutions for warehousing and transportation. The need for precise temperature control in cold storage facilities further propels investments in advanced refrigeration technologies.

USA Industrial Refrigeration Systems Market Competitive Landscape

The USA Industrial Refrigeration Systems market is characterized by the presence of key players offering diverse product portfolios and advanced technologies. The market is dominated by these key players, who focus on strategic acquisitions, product innovation, and maintaining a strong service network to enhance their market position. These companies leverage their expertise in refrigeration technologies to cater to diverse industry needs, thus consolidating their influence in the market.

|

Company |

Establishment Year |

Headquarters |

Cooling Efficiency |

Product Portfolio |

Global Reach |

Energy Efficiency Focus |

Customer Support |

Technological Innovation |

Strategic Partnerships |

|

Johnson Controls International plc |

1885 |

Cork, Ireland |

|||||||

|

Carrier Global Corporation |

1915 |

Palm Beach Gardens, FL |

|||||||

|

Emerson Electric Co. |

1890 |

St. Louis, MO |

|||||||

|

GEA Group AG |

1881 |

Dsseldorf, Germany |

|||||||

|

Danfoss A/S |

1933 |

Nordborg, Denmark |

USA Industrial Refrigeration Systems Industry Analysis

Growth Drivers

- Demand for Cold Storage Solutions: The USA has seen a significant surge in the demand for cold storage facilities, driven by the growth in e-commerce and online grocery delivery services. In 2023, the USDA reported that the total gross refrigerated storage capacity in the United States was approximately 3.70 billion cubic feet. This growth is partly attributed to the increasing storage needs for perishable food items, such as dairy, seafood, and meat, which require consistent low temperatures. The expansion of such facilities is also supported by the U.S. Department of Agriculture's grants, which aim to enhance the cold chain infrastructure across rural areas.

- Technological Advancements in Refrigerants: The shift towards eco-friendly refrigerants has driven technological advancements in the U.S. industrial refrigeration market. In January 2023, Danfoss partnered with Microsoft to enhance sustainable food retail through digital solutions. This collaboration focuses on developing digital services to monitor temperature and energy usage in supermarket refrigeration, promoting more efficient and sustainable practices within the industry.

- Rising Energy-Efficiency Standards: Stricter energy efficiency standards for commercial refrigeration systems have been implemented, encouraging businesses to adopt more advanced, energy-efficient technologies. These regulations aim to reduce energy consumption and operational costs, prompting companies to upgrade their refrigeration systems. The focus on energy efficiency also supports broader sustainability goals by reducing the carbon footprint of the industrial refrigeration sector, making it an important area of improvement for businesses looking to align with environmental regulations.

Market Challenges

- High Initial Investment Costs: The U.S. industrial refrigeration market faces challenges due to high initial investment costs. Installing large-scale refrigeration systems requires significant upfront expenses, which can be a barrier for small and medium-sized enterprises. Additionally, maintenance and the need for specialized installation further contribute to the complexity and overall costs. These financial requirements can limit market growth, making it difficult for smaller companies to adopt advanced refrigeration technologies.

- Stringent Environmental Regulations: The regulatory landscape for industrial refrigeration in the U.S. has become more stringent, focusing on reducing the use of certain refrigerants. New regulations require companies to transition to systems that use low-GWP refrigerants, which often involves investing in new equipment. This shift adds to operational challenges as businesses must adapt quickly to meet compliance requirements. The need to avoid penalties and adhere to new standards contributes to increased compliance costs.

USA Industrial Refrigeration Systems Market Future Outlook

The USA Industrial Refrigeration Systems market is anticipated to continue its growth trajectory over the next five years, driven by technological advancements in refrigeration, increased investment in energy-efficient systems, and growing demand from the food processing and pharmaceutical sectors. Additionally, the transition towards sustainable refrigerants and the implementation of stricter environmental regulations are expected to reshape the market landscape, promoting innovation and adaptation among manufacturers.

Market Opportunities

- Growth in Pharmaceutical Cold Chain: The rising demand for biopharmaceuticals and vaccine storage has increased the need for advanced refrigeration systems within the pharmaceutical sector. These temperature-sensitive products require precise cooling solutions to maintain their efficacy, creating a growing opportunity for manufacturers to provide specialized refrigeration systems for the pharmaceutical cold chain. This trend highlights the importance of reliable and efficient cooling technologies to support the sector's storage and distribution requirements.

- Adoption of Natural Refrigerants: The transition towards natural refrigerants is creating new opportunities in the U.S. industrial refrigeration market. As companies seek more environmentally friendly solutions, the shift to natural refrigerants like ammonia and CO2 is becoming a key focus. This change aligns with global sustainability goals and supports efforts to reduce environmental impact. The emphasis on low-GWP refrigerants encourages businesses to adopt these alternatives, fostering growth and innovation in the sector

Scope of the Report

|

Component Type |

Compressors Condensers Evaporators Controls & Monitoring Systems |

|

Application |

Cold Storage Food & Beverage Processing Chemical & Pharmaceutical Manufacturing Oil & Gas |

|

Refrigerant Type |

Ammonia (NH3), Carbon Dioxide (CO2) Hydrofluorocarbons (HFCs) Hydrocarbons (Propane, Butane) |

|

End-User Industry |

Food Processing Plants Dairy and Ice Cream Plants Breweries Chemical Processing Plants |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Industrial Refrigeration Manufacturers

Food & Beverage Processing Companies

Pharmaceutical Manufacturing Companies

Energy Service Companies (ESCOs)

Government and Regulatory Bodies (U.S. Environmental Protection Agency, Department of Energy)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Johnson Controls International plc

Carrier Global Corporation

Emerson Electric Co.

GEA Group AG

Danfoss A/S

Mayekawa Mfg. Co., Ltd.

BITZER Khlmaschinenbau GmbH

Daikin Industries, Ltd.

Ingersoll Rand Inc.

Lennox International Inc.

Table of Contents

1. USA Industrial Refrigeration Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Metrics (Cooling Capacity, Energy Efficiency Ratio, Refrigerant Types)

1.4. Market Segmentation Overview

2. USA Industrial Refrigeration Systems Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

3. Key Market Developments and Milestones

3. USA Industrial Refrigeration Systems Market Analysis

3.1. Growth Drivers

3.1.1. Demand for Cold Storage Solutions

3.1.2. Expansion of Food and Beverage Industry

3.1.3. Rising Energy-Efficiency Standards

3.1.4. Technological Advancements in Refrigerants

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Stringent Environmental Regulations

3.2.3. Complexity of System Integration

3.3. Opportunities

3.3.1. Growth in Pharmaceutical Cold Chain

3.3.2. Adoption of Natural Refrigerants

3.3.3. Automation and Smart Control Systems

3.4. Trends

3.4.1. Shift Toward Low-GWP Refrigerants

3.4.2. Integration with IoT for Predictive Maintenance

3.4.3. Modular and Packaged Refrigeration Solutions

3.5. Government Regulations

3.5.1. U.S. Environmental Protection Agency (EPA) Standards

3.5.2. Energy Star Certification Requirements

3.5.3. Phase-Out of Hydrofluorocarbons (HFCs)

3.5.4. State-Specific Refrigeration Guidelines

3.6. SWOT Analysis

3.7. Value Chain Analysis (Manufacturers, Distributors, End Users)

3.8. Porters Five Forces

3.9. Competitive Landscape

4. USA Industrial Refrigeration Systems Market Segmentation

4.1. By Component Type (In Value %)

4.1.1. Compressors

4.1.2. Condensers

4.1.3. Evaporators

4.1.4. Controls & Monitoring Systems

4.2. By Application (In Value %)

4.2.1. Cold Storage

4.2.2. Food & Beverage Processing

4.2.3. Chemical & Pharmaceutical Manufacturing

4.2.4. Oil & Gas

4.3. By Refrigerant Type (In Value %)

4.3.1. Ammonia (NH3)

4.3.2. Carbon Dioxide (CO2)

4.3.3. Hydrofluorocarbons (HFCs)

4.3.4. Hydrocarbons (Propane, Butane)

4.4. By End-User Industry (In Value %)

4.4.1. Food Processing Plants

4.4.2. Dairy and Ice Cream Plants

4.4.3. Breweries

4.4.4. Chemical Processing Plants

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Industrial Refrigeration Systems Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson Controls International plc

5.1.2. Carrier Global Corporation

5.1.3. Emerson Electric Co.

5.1.4. GEA Group AG

5.1.5. Danfoss A/S

5.1.6. Mayekawa Mfg. Co., Ltd.

5.1.7. BITZER Khlmaschinenbau GmbH

5.1.8. Daikin Industries, Ltd.

5.1.9. Ingersoll Rand Inc.

5.1.10. Lennox International Inc.

5.1.11. Evapco, Inc.

5.1.12. Ritchie Engineering Co., Inc.

5.1.13. Baltimore Aircoil Company

5.1.14. SPX Cooling Technologies, Inc.

5.1.15. Parker Hannifin Corporation

5.2. Cross-Comparison Parameters (Cooling Efficiency, Product Portfolio, Market Presence, Technological Innovation, Revenue, Customer Support, Sustainability Initiatives, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Collaborations, Geographic Expansions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Incentives

5.9. Private Equity Investments

6. USA Industrial Refrigeration Systems Market Regulatory Framework

6.1. Environmental Standards

6.2. Safety Regulations

6.3. Energy Efficiency Standards

6.4. Certification Processes

7. USA Industrial Refrigeration Systems Future Market Size (In USD Bn)

7.1. Key Factors Driving Future Market Growth

7.2. Market Expansion Opportunities

8. USA Industrial Refrigeration Systems Future Market Segmentation

8.1. By Component Type (In Value %)

8.2. By Application (In Value %)

8.3. By Refrigerant Type (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. USA Industrial Refrigeration Systems Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the industrial refrigeration ecosystem in the USA, including manufacturers, end-users, and regulatory bodies. Extensive desk research using secondary databases is conducted to gather industry-specific information, focusing on key variables like cooling capacity and refrigerant type.

Step 2: Market Analysis and Construction

Historical data analysis is performed to evaluate market size and penetration, assessing the adoption of refrigeration systems across different applications. This includes examining cold storage requirements and technological advancements in components like compressors and condensers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through interviews with industry professionals, including refrigeration system manufacturers and distributors. These consultations provide insights into market trends, investment behavior, and regulatory challenges, aiding in data validation.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data from industry reports and direct interactions with stakeholders to produce a comprehensive analysis of the USA Industrial Refrigeration Systems market. This ensures accuracy in evaluating the market dynamics and provides actionable insights.

Frequently Asked Questions

01. How big is the USA Industrial Refrigeration Systems Market?

The USA Industrial Refrigeration Systems Market is valued at USD 5 billion, driven by increased demand from the food processing and pharmaceutical industries, as well as the push for energy-efficient refrigeration solutions.

02. What are the challenges in the USA Industrial Refrigeration Systems Market?

Challenges in USA Industrial Refrigeration Systems Market include the high initial costs associated with system installation, adherence to stringent environmental regulations, and the need for skilled technicians to manage complex refrigeration systems.

03. Who are the major players in the USA Industrial Refrigeration Systems Market?

Key players in USA Industrial Refrigeration Systems Market include Johnson Controls, Carrier Global Corporation, Emerson Electric Co., GEA Group, and Danfoss, known for their extensive product portfolios and focus on innovation.

04. What drives growth in the USA Industrial Refrigeration Systems Market?

The USA Industrial Refrigeration Systems Market growth is driven by rising demand for cold storage facilities, advancements in refrigeration technology, and incentives for energy-efficient systems, making these factors crucial in shaping the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.