USA Industrial Robotics Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD2833

December 2024

83

About the Report

USA Industrial Robotics Market Overview

- The USA Industrial Robotics market, currently valued at USD 2 billion, has grown significantly over recent years, primarily driven by the increasing automation demands in manufacturing industries. Automation solutions, including industrial robots, have become vital for enhancing operational efficiency, reducing production time, and lowering labor costs. The growth of advanced technologies, such as artificial intelligence (AI), machine learning, and the integration of the Internet of Things (IoT), is accelerating the adoption of robotics in key sectors like automotive and electronics manufacturing.

- In terms of dominance, cities like Detroit and Chicago lead the USA Industrial Robotics market due to their deep-rooted history in automotive manufacturing and industrial development. Detroit, known as the hub of the U.S. automotive industry, hosts a vast number of automotive manufacturers that heavily rely on robotic automation for mass production. Meanwhile, Chicago, with its diversified manufacturing landscape, continues to adopt industrial robots in sectors ranging from machinery to food processing, further consolidating its position as a key player in the U.S. robotics market.

- The U.S. Occupational Safety and Health Administration (OSHA) and the International Organization for Standardization (ISO) have set stringent safety regulations for industrial robots. OSHA regulations, such as 29 CFR 1910.212, ensure the safe operation of robotics in the workplace by mandating safeguards like interlocked barriers and emergency stop functions. In 2023, OSHA reported a 5% decrease in workplace injuries related to industrial robots due to improved compliance with these standards.

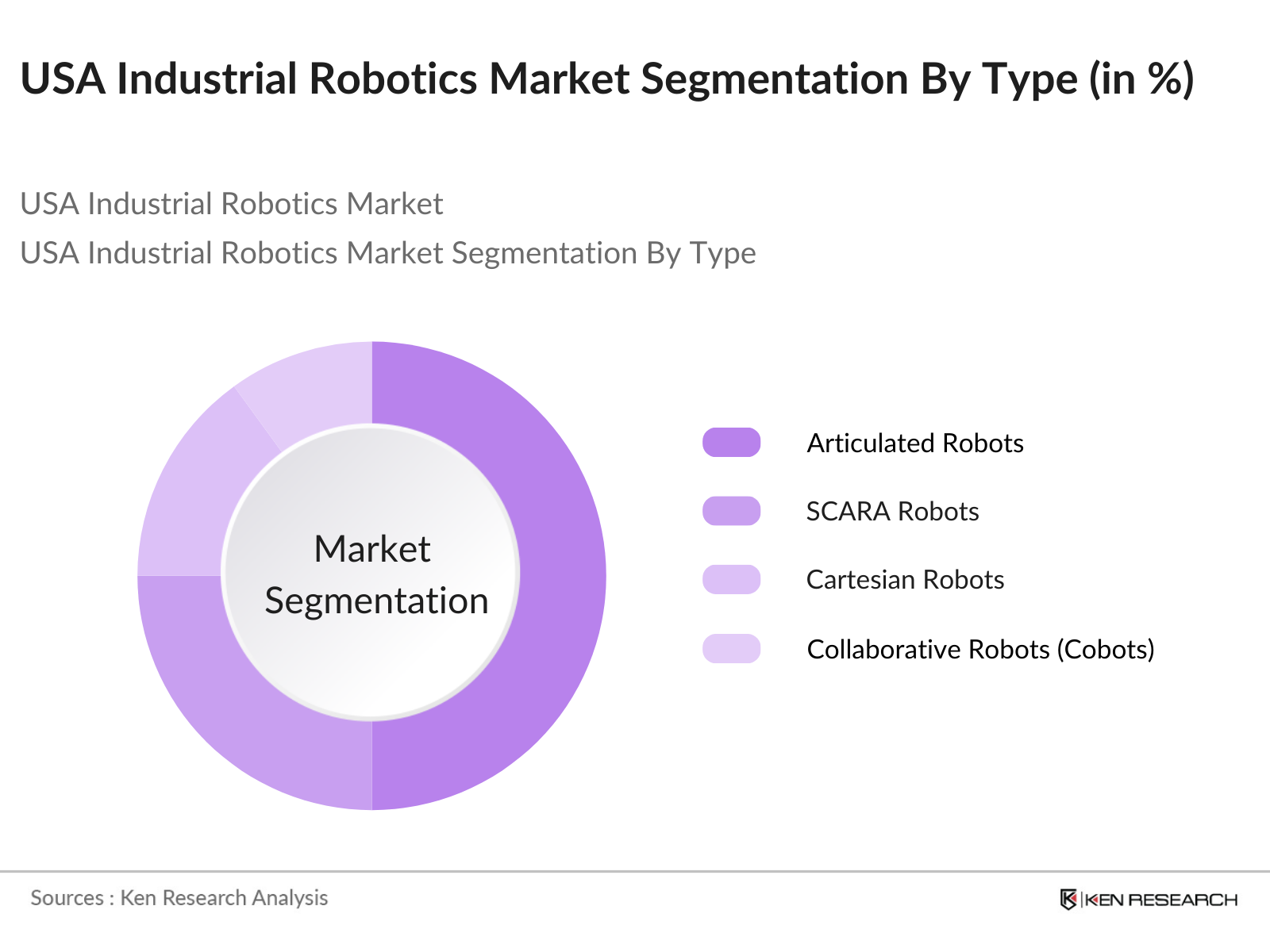

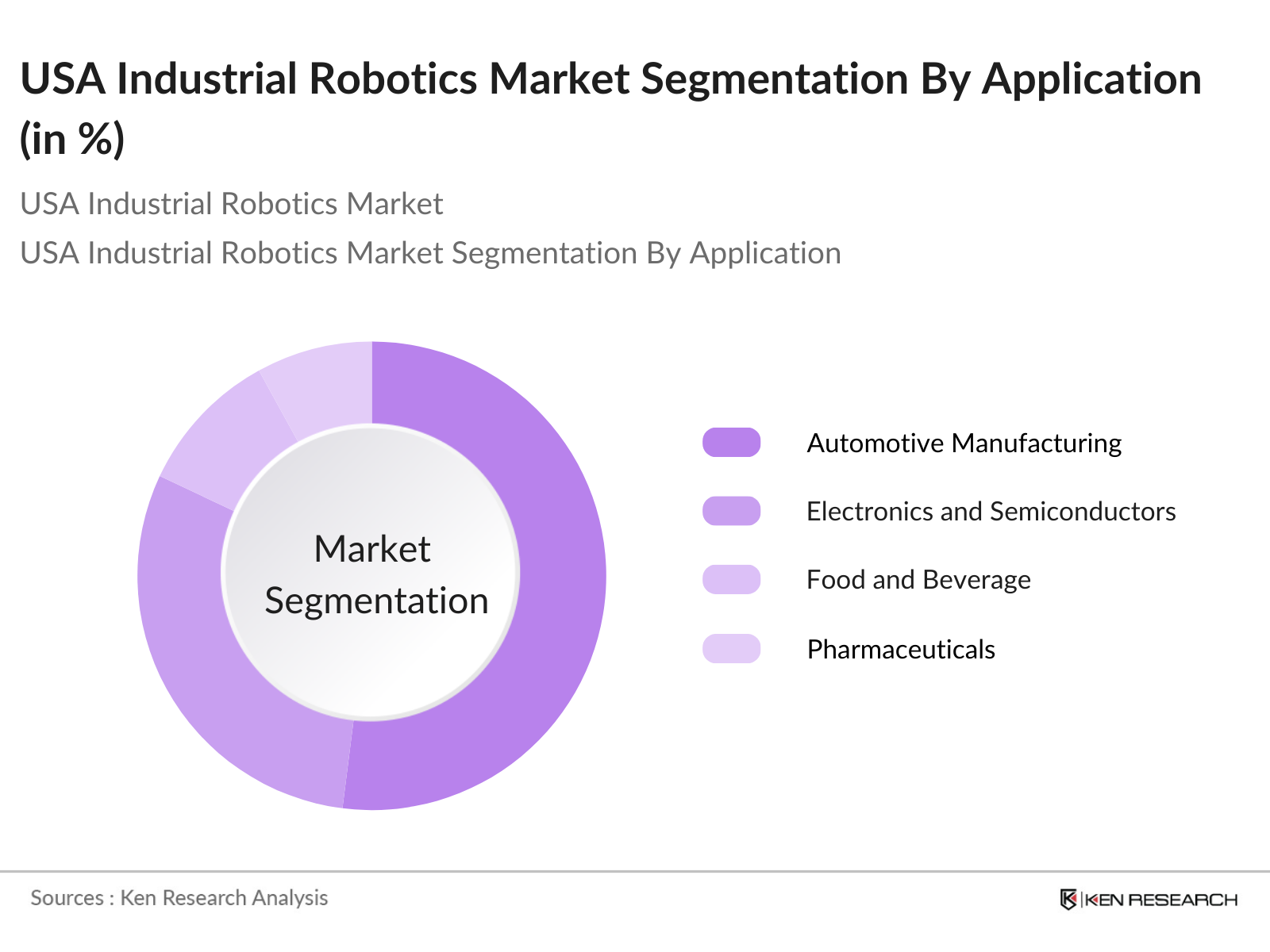

USA Industrial Robotics Market Segmentation

By Type: The market is segmented by robot type, including articulated robots, SCARA robots, Cartesian robots, collaborative robots (cobots), and parallel robots. Articulated robots currently hold a dominant market share due to their flexibility and versatility in performing complex tasks across multiple industries. These robots are widely utilized in sectors such as automotive and electronics for applications like welding, material handling, and assembly.

By Application: The USA Industrial Robotics market is also segmented by application into automotive manufacturing, electronics and semiconductors, food and beverage, pharmaceuticals, and logistics. Automotive manufacturing dominates the market under this segmentation, driven by the high demand for precision, speed, and automation in car assembly lines. Industrial robots are integral to the automotive sector, particularly in welding, painting, and assembly operations.

USA Industrial Robotics Market Competitive Landscape

The USA Industrial Robotics market is dominated by a few major players, each offering innovative robotic solutions to meet the demands of diverse industries. Key manufacturers include both local and international companies, contributing to the competitiveness of the market. These companies maintain a strong foothold due to their extensive R&D investments, innovative product offerings, and strategic partnerships.

USA Industrial Robotics Market Analysis

Growth Drivers

- Increased Automation in Manufacturing (Robotic Density, Factory Automation Adoption Rate): The U.S. has seen a significant rise in automation, with 293 robots per 10,000 employees in manufacturing, according to the International Federation of Robotics. The automotive sector, in particular, leads with nearly 40% of all industrial robots installed in 2023, driven by the need for increased productivity and efficiency. Factory automation adoption rates have also grown due to enhanced production capabilities, supported by federal initiatives such as the Advanced Manufacturing Partnership (AMP).

- Labor Shortages and Rising Labor Costs (Wage Inflation, Skilled Labor Gap): Labor shortages continue to be a driving factor for automation adoption, with over 10.8 million unfilled jobs in 2023, according to the U.S. Bureau of Labor Statistics. Rising labor costs, spurred by wage inflation at an annualized rate of 4.4%, have made industrial robotics an attractive alternative. Additionally, the skilled labor gap has left nearly 2 million positions in manufacturing unfilled, pushing companies toward robotic solutions.

- Advanced Manufacturing Technologies (AI, Machine Vision, IoT Integration in Robotics): Technological advancements, such as AI and machine vision, have enabled smarter robotics capable of performing complex tasks. The U.S. witnessed a 30% rise in AI-integrated robotic systems in 2023, primarily driven by automotive, electronics, and healthcare sectors. The integration of IoT in robotics has further enhanced real-time monitoring and predictive maintenance.

Market Challenges

- High Initial Capital Investment (Cost per Robot Unit, Installation Costs): While robotics can enhance efficiency, the high upfront capital investment remains a challenge for many businesses. In 2023, the average cost of a single industrial robot was $70,000, with installation costs averaging an additional $30,000. Small and medium enterprises (SMEs) often struggle to justify such investments due to lower production volumes.

- Cybersecurity Concerns in Automation (Data Security, Network Vulnerabilities): The integration of robotics with IoT and other digital technologies has made automation systems more vulnerable to cyberattacks. In 2023, over 32% of U.S. manufacturing companies experienced a cybersecurity breach, with industrial robots being a key target. Vulnerabilities in network security and inadequate encryption protocols pose risks to data integrity and operational continuity.

USA Industrial Robotics Market Future Outlook

Over the next five years, the USA Industrial Robotics market is expected to see significant growth, driven by continuous technological advancements, government support, and the increasing demand for automation across key sectors. The automotive and electronics industries are projected to remain key contributors to the markets expansion, as manufacturers seek to improve production efficiency and meet growing consumer demands. Additionally, the rise of Industry 4.0 and smart factory initiatives will play a crucial role in accelerating the adoption of robotics.

Market Opportunities

- Emergence of Collaborative Robots (Cobots Adoption, Human-Robot Interaction): Collaborative robots, or cobots, have seen growing adoption in U.S. industries, especially in the automotive and electronics sectors. In 2023, 17,000 cobots were installed in the U.S., with a 25% increase in adoption from the previous year. These robots offer flexibility, requiring minimal safety barriers and enabling close human-robot interaction.

- Technological Advancements in AI and Machine Learning (Predictive Maintenance, Smart Robots): AI and machine learning advancements have paved the way for smart robotics capable of predictive maintenance and self-diagnostics. In 2023, approximately 45% of U.S. manufacturers using robotics employed AI-driven predictive maintenance, reducing downtime by 15%. AI-driven smart robots can optimize production by autonomously adjusting operations based on real-time data, resulting in improved output quality and operational efficiency, particularly in sectors such as aerospace and electronics.

Scope of the Report

|

By Type |

Articulated Robots SCARA Robots Cartesian Robots Collaborative Robots (Cobots) Parallel Robots |

|

By Application |

Automotive Manufacturing Electronics and Semiconductors Food and Beverage Pharmaceuticals Logistics and Warehouse |

|

By Function |

Material Handling Welding and Soldering Assembly Packaging Inspection |

|

By Payload Capacity |

Small Payload (Below 10 kg) Medium Payload (10-100 kg) Heavy Payload (Above 100 kg) |

|

By End-User Industry |

Automotive Electronics Aerospace Healthcare Metals and Machinery |

Products

Key Target Audience

Automotive Manufacturers

Electronics and Semiconductor Companies

Pharmaceutical Manufacturers

Food and Beverage Processing Companies

Logistics and Warehouse Companies

Government and Regulatory Bodies (e.g., Occupational Safety and Health Administration - OSHA)

Investments and Venture Capitalist Firms

Industrial Machinery Manufacturers

Companies

Players Mentioned in the Report

ABB Ltd.

FANUC Corporation

KUKA AG

Yaskawa Electric Corporation

Mitsubishi Electric Corporation

Universal Robots

Omron Adept Technologies

Epson Robots

Denso Wave

Rethink Robotics

Table of Contents

1. USA Industrial Robotics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Industrial Robotics Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Industrial Robotics Market Analysis

3.1. Growth Drivers

3.1.1. Increased Automation in Manufacturing (Robotic Density, Factory Automation Adoption Rate)

3.1.2. Labor Shortages and Rising Labor Costs (Wage Inflation, Skilled Labor Gap)

3.1.3. Advanced Manufacturing Technologies (AI, Machine Vision, IoT Integration in Robotics)

3.1.4. Government Incentives and Policies (R&D Funding, Tax Incentives for Automation)

3.2. Market Challenges

3.2.1. High Initial Capital Investment (Cost per Robot Unit, Installation Costs)

3.2.2. Cybersecurity Concerns in Automation (Data Security, Network Vulnerabilities)

3.2.3. Lack of Skilled Workforce for Advanced Robotics (Training Gaps, Workforce Reskilling Needs)

3.2.4. Complex Integration with Legacy Systems (Interoperability Issues, Downtime)

3.3. Opportunities

3.3.1. Emergence of Collaborative Robots (Cobots Adoption, Human-Robot Interaction)

3.3.2. Technological Advancements in AI and Machine Learning (Predictive Maintenance, Smart Robots)

3.3.3. Growing Demand in SMEs for Affordable Automation Solutions (Entry-Level Robotics, Modular Solutions)

3.3.4. Expansion in Key Sectors (Healthcare, Logistics, and E-commerce Automation)

3.4. Trends

3.4.1. Adoption of Industry 4.0 and Smart Factories (Robotics in IoT-enabled Environments)

3.4.2. Rise of Robotics-as-a-Service (RaaS) (Subscription Models, Pay-per-Use)

3.4.3. Increased Investment in Autonomous Mobile Robots (AMRs) (AGVs, Fleet Automation)

3.4.4. Sustainable Robotics (Energy Efficiency, Eco-Friendly Automation Solutions)

3.5. Regulatory Framework

3.5.1. U.S. Safety Standards for Industrial Robots (OSHA Regulations, ISO Standards)

3.5.2. Labor and Employment Laws Impacting Robotics Adoption (Automation Labor Policies)

3.5.3. Environmental Regulations Impacting Robotics Manufacturing (Energy Use, Waste Reduction)

3.6. Competitive Landscape

3.6.1. Major Robotics Manufacturers (Revenue, Market Share)

3.6.2. Technological Collaborations (Partnerships, Joint Ventures)

3.6.3. Product Differentiation Strategies (Customization, Scalability)

3.6.4. Emerging Players and Startups (Disruptive Technologies, New Entrants)

3.7. SWOT Analysis

3.8. Porters Five Forces Analysis

3.9. Stakeholder Ecosystem

4. USA Industrial Robotics Market Segmentation

4.1. By Type (In Value %)

4.1.1. Articulated Robots

4.1.2. SCARA Robots

4.1.3. Cartesian Robots

4.1.4. Collaborative Robots (Cobots)

4.1.5. Parallel Robots

4.2. By Application (In Value %)

4.2.1. Automotive Manufacturing

4.2.2. Electronics and Semiconductors

4.2.3. Food and Beverage Industry

4.2.4. Pharmaceutical and Medical Device Manufacturing

4.2.5. Logistics and Warehouse Automation

4.3. By Function (In Value %)

4.3.1. Material Handling

4.3.2. Welding and Soldering

4.3.3. Assembly

4.3.4. Packaging and Labeling

4.3.5. Inspection and Testing

4.4. By Payload Capacity (In Value %)

4.4.1. Small Payload (Below 10 kg)

4.4.2. Medium Payload (10-100 kg)

4.4.3. Heavy Payload (Above 100 kg)

4.5. By End-User Industry (In Value %)

4.5.1. Automotive

4.5.2. Electronics

4.5.3. Aerospace and Defense

4.5.4. Healthcare and Medical Devices

4.5.5. Metals and Machinery

5. USA Industrial Robotics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. FANUC Corporation

5.1.3. KUKA AG

5.1.4. Yaskawa Electric Corporation

5.1.5. Mitsubishi Electric Corporation

5.1.6. Universal Robots

5.1.7. Omron Adept Technologies

5.1.8. Epson Robots

5.1.9. Denso Wave

5.1.10. Rethink Robotics

5.1.11. Staubli Robotics

5.1.12. Kawasaki Heavy Industries

5.1.13. Boston Dynamics

5.1.14. Teradyne

5.1.15. Nidec Corporation

5.2. Cross Comparison Parameters (Revenue, Headquarters, Employee Count, Patents, R&D Investment, Market Penetration, Regional Focus, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Industrial Robotics Market Regulatory Framework

6.1. U.S. Regulatory Standards for Robotics Safety

6.2. Certification Requirements for Robotics Manufacturers

6.3. Intellectual Property Rights for Robotics Innovations

7. USA Industrial Robotics Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Industrial Robotics Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Function (In Value %)

8.4. By Payload Capacity (In Value %)

8.5. By End-User Industry (In Value %)

9. USA Industrial Robotics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Strategic Growth Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Industrial Robotics market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data about the USA Industrial Robotics market. This includes assessing market penetration, the ratio of robots deployed to manufacturing processes, and the resultant revenue generation. Additionally, an evaluation of industry statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple industrial robot manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Industrial Robotics market.

Frequently Asked Questions

01. How big is the USA Industrial Robotics Market?

The USA Industrial Robotics market was valued at USD 2 billion in 2023, driven by increasing automation needs in manufacturing sectors, particularly in automotive and electronics.

02. What are the challenges in the USA Industrial Robotics Market?

Challenges include the USA Industrial Robotics market high initial capital investment, cybersecurity risks associated with automation, and the lack of a skilled workforce to operate and maintain advanced robotics systems.

03. Who are the major players in the USA Industrial Robotics Market?

Key players in the USA Industrial Robotics market include ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, and Mitsubishi Electric Corporation. These companies dominate due to their innovative product offerings and extensive R&D investments.

04. What are the growth drivers of the USA Industrial Robotics Market?

The USA Industrial Robotics market is driven by factors such as increasing demand for automation, the rise of advanced manufacturing technologies, and the growing need to reduce labor costs and improve operational efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.