USA Insurtech Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD4330

December 2024

81

About the Report

USA Insurtech Market Overview

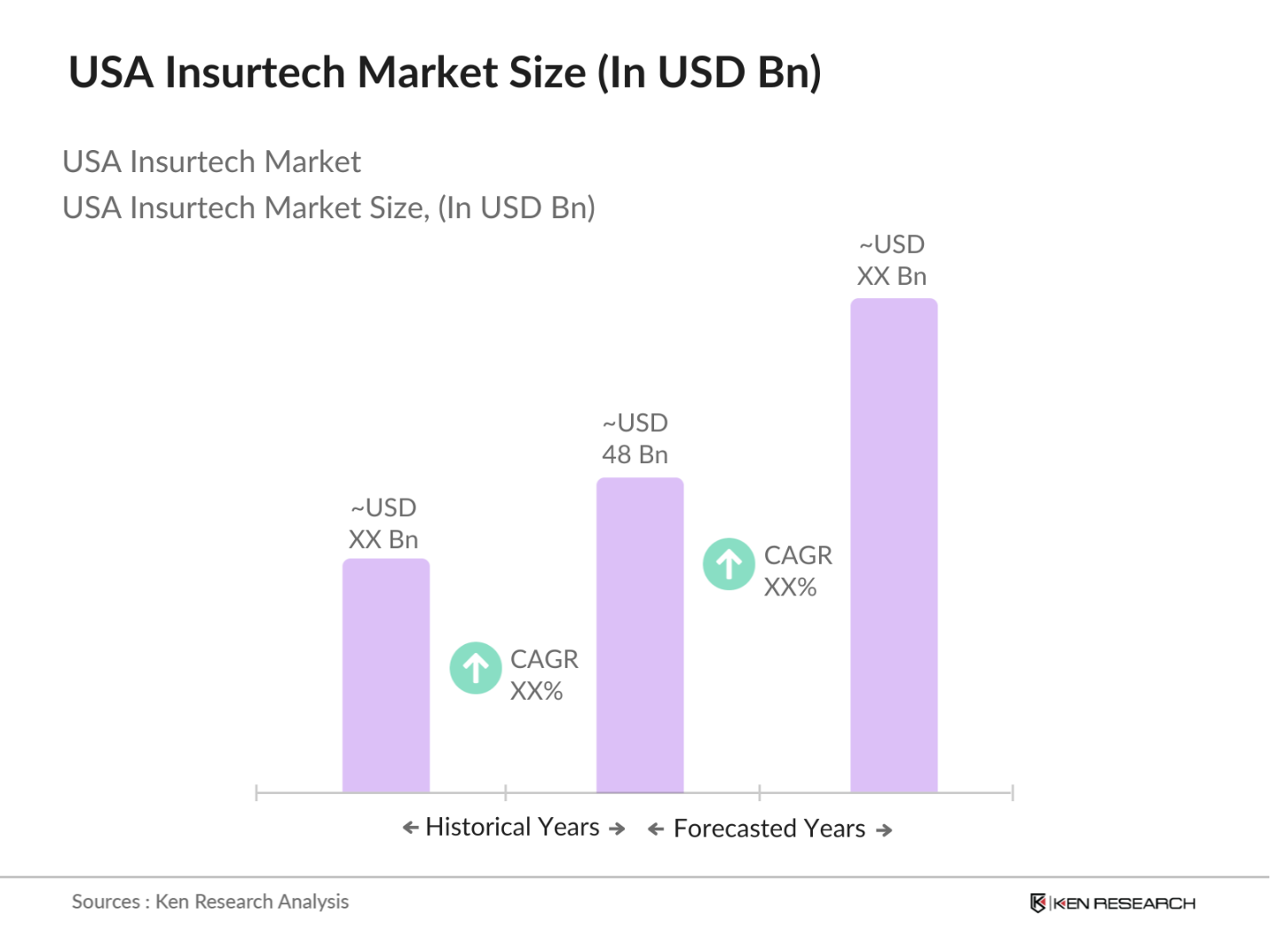

- The USA Insurtech market is valued at approximately USD 48 billion, reflecting a robust growth trajectory propelled by digital transformation and consumer demand for personalized insurance solutions. Factors such as increasing adoption of artificial intelligence and big data analytics have significantly contributed to this market size. Insurers are increasingly leveraging technology to enhance customer experiences and streamline operations, resulting in efficient risk assessment and claim processing. Furthermore, the market is projected to witness continued expansion in the coming years, driven by evolving consumer preferences and advancements in technology.

- Key cities such as San Francisco, New York, and Chicago play a pivotal role in the dominance of the USA Insurtech market. These metropolitan areas serve as hubs for innovation and technology, attracting a diverse pool of talent and investment. The presence of a mature financial ecosystem, coupled with a strong entrepreneurial culture, fosters the development of Insurtech startups. Additionally, states like California and New York, with their progressive regulatory environments, provide a conducive atmosphere for insurtech firms to flourish and drive industry advancements.

- Blockchain technology is emerging as a key trend in the U.S. insurtech space. By 2023, nearly 25% of U.S. insurers had implemented blockchain-based systems to enhance transparency and reduce fraud in policy underwriting. Blockchains decentralized nature allows for secure, verifiable transactions, which can significantly improve efficiency in the claims process. This trend is driven by the broader adoption of blockchain in financial services, where investments reached $10 billion in 2023.

USA Insurtech Market Segmentation

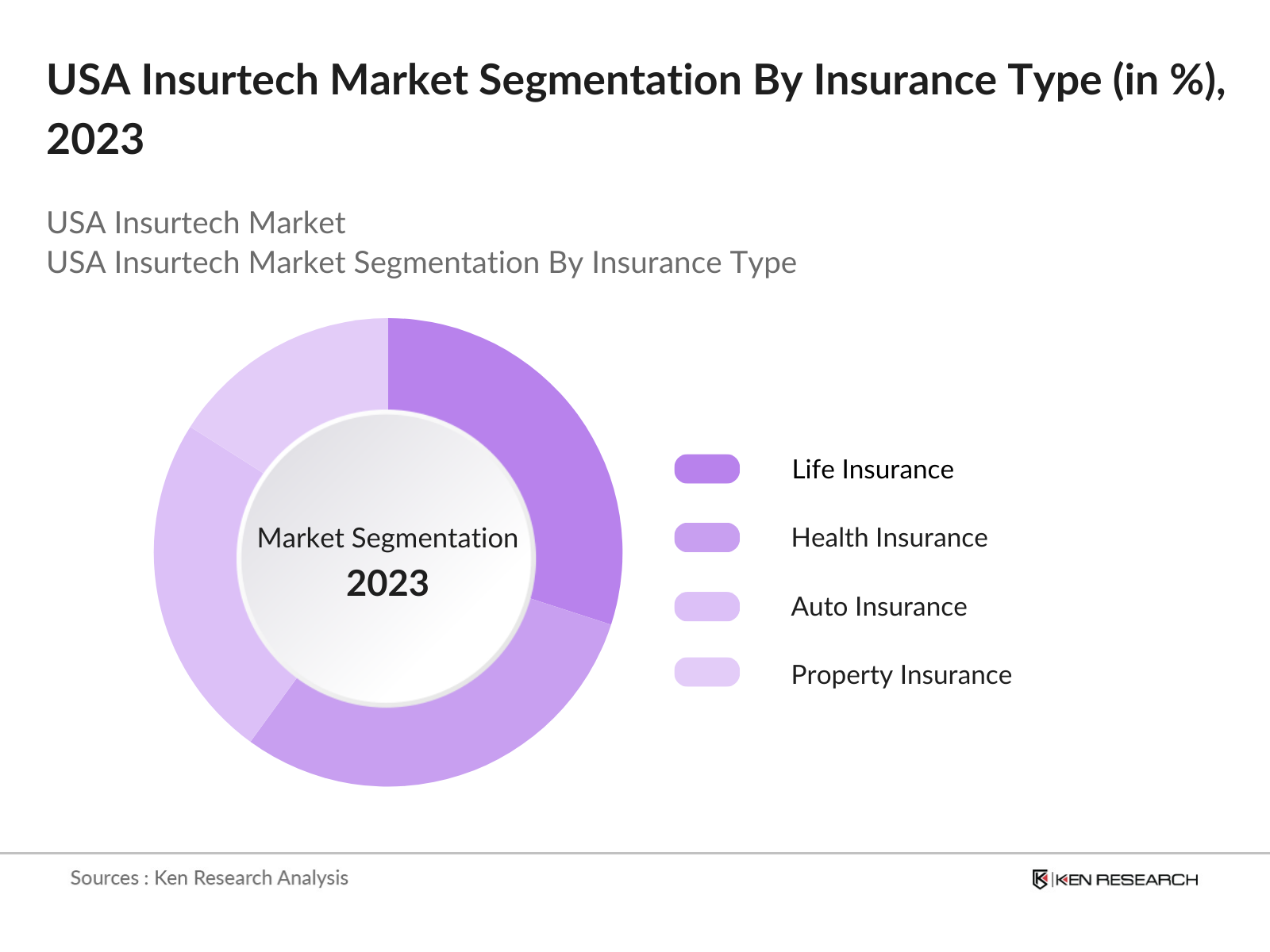

By Insurance Type: The USA Insurtech market is segmented by insurance type into life insurance, health insurance, auto insurance, property insurance, and specialty insurance. Among these, health insurance currently holds a dominant market share, largely due to the rising costs of healthcare and increasing consumer awareness regarding the importance of health coverage. As employers and individuals alike seek innovative solutions to manage health-related expenses, Insurtech companies are leveraging technology to offer more personalized and affordable health insurance options, driving significant growth in this sub-segment.

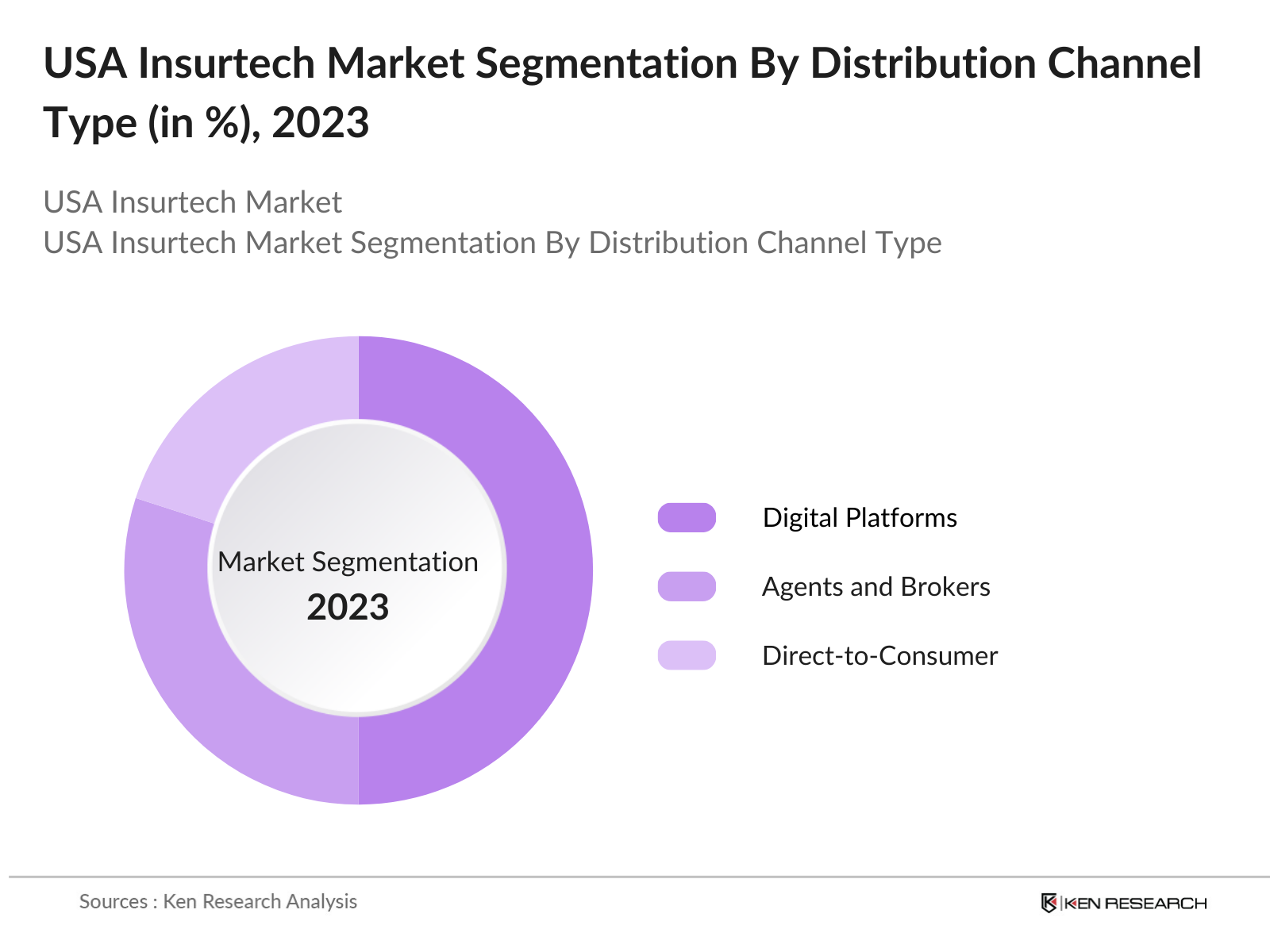

By Distribution Channel: The market is also segmented by distribution channel into direct-to-consumer, agents and brokers, and digital platforms. The digital platforms segment has emerged as the leading distribution channel in the Insurtech market, driven by the increasing prevalence of online services and mobile applications. Consumers are increasingly inclined to manage their insurance needs through digital channels, attracted by the convenience, speed, and accessibility offered. This shift has compelled traditional insurers to adapt their strategies and invest in digital solutions to meet evolving customer expectations effectively.

USA Insurtech Market Competitive Landscape

The USA Insurtech market is characterized by a competitive landscape dominated by a mix of established players and emerging startups. Major companies like Lemonade, Root Insurance, and Oscar Health are at the forefront, showcasing innovative technologies and customer-centric solutions. This consolidation of key players highlights the significant influence these companies exert on market dynamics, driving advancements in technology and reshaping the insurance industry.

|

Company Name |

Establishment Year |

Headquarters |

Product Offerings |

Revenue (USD) |

Market Reach |

Innovation Index |

Customer Satisfaction |

Regulatory Compliance |

|

Lemonade |

2015 |

New York, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Root Insurance |

2015 |

Columbus, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Oscar Health |

2012 |

New York, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Hippo Insurance |

2015 |

Palo Alto, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Next Insurance |

2016 |

Palo Alto, USA |

_ |

_ |

_ |

_ |

_ |

_ |

USA Insurtech Industry Analysis

Growth Drivers

- Digital Transformation in Insurance: The insurance industry in the U.S. is undergoing rapid digital transformation, driven by increasing consumer expectations for digital-first experiences. In 2023, the U.S. insurance sectors IT spending reached $60 billion, supporting the adoption of cloud computing, automated claims processing, and digital customer service platforms. The shift is also influenced by the broader economy, with 87% of insurance executives stating that improving digital capabilities is a top priority. The Federal Reserves emphasis on improving digital infrastructure in the financial services sector reflects this growing trend.

- Customer Demand for Personalization: As of 2024, customer expectations for personalized insurance products are rising. Approximately 70% of U.S. consumers seek tailored insurance solutions based on individual risk profiles, according to surveys by industry associations. This shift is linked to broader consumer behavior trends observed in the U.S. economy, where disposable income has increased steadily, allowing consumers to demand more specialized services. The personal income growth rate, which reached $23 trillion in 2023 (Bureau of Economic Analysis), underpins the rising consumer purchasing power for customized insurance offerings.

- Regulatory Changes: The U.S. insurance market has seen significant regulatory updates in 2023, particularly around digital platforms. The Federal Insurance Office (FIO) has enacted new guidelines that encourage the adoption of Insurtech innovations while tightening compliance in areas such as data protection. For instance, the 2023 reforms under the National Association of Insurance Commissioners (NAIC) now mandate stricter cybersecurity measures for insurance platforms, affecting how digital products are rolled out. The regulatory framework has been designed to ensure consumer protection while enabling technological growth in the sector.

Market Challenges

- Cybersecurity Risks: With digital transformation, U.S. insurers face growing cybersecurity risks. The Federal Bureau of Investigation (FBI) recorded a 20% rise in ransomware attacks targeting the financial services sector in 2023, highlighting the vulnerability of insurtech platforms. The financial impact of these breaches is significant, with the average cost per cyber incident exceeding $5 million. As the insurtech market becomes more digitized, protecting consumer data from cyber threats remains a critical concern, demanding substantial investments in cybersecurity infrastructure.

- Regulatory Compliance Costs: Complying with evolving insurance regulations in the U.S. has led to rising operational costs for insurtech firms. In 2023, compliance-related spending for insurance companies rose by $10 billion due to increased cybersecurity mandates and stricter financial reporting standards. Insurtech companies must navigate complex state and federal laws, often requiring the implementation of new legal frameworks that demand additional resources and expertise. These compliance costs can hinder smaller players from entering the market or scaling up efficiently.

USA Insurtech Market Future Outlook

Over the next five years, the USA Insurtech market is expected to experience substantial growth, driven by continuous technological advancements, increasing consumer expectations, and evolving regulatory frameworks. The integration of artificial intelligence, machine learning, and big data analytics is anticipated to transform underwriting processes and risk assessment. Furthermore, the growing popularity of on-demand insurance models is expected to provide consumers with more tailored coverage options, enhancing overall market dynamics and consumer satisfaction.

Opportunities

- Expansion of On-Demand Insurance Models: On-demand insurance, which provides flexible coverage options, has gained significant traction in the U.S. market. In 2023, around 10 million policies were sold through on-demand platforms, supported by macroeconomic trends like the rise of the gig economy. With over 59 million gig workers contributing to the U.S. economy, on-demand insurance is poised to cater to their unique needs. The sectors growth is supported by government programs aimed at increasing financial inclusion among underserved populations.

- Growth of Peer-to-Peer Insurance: Peer-to-peer (P2P) insurance models are becoming popular in the U.S., driven by consumer demand for community-based risk-sharing solutions. In 2023, approximately $2 billion in premiums were managed through P2P platforms, offering a collaborative approach to insurance coverage. The rise of these platforms reflects broader economic trends, with consumer confidence in alternative financial services increasing as traditional insurance becomes more expensive. U.S. government statistics show that peer-based business models are flourishing, particularly in states with supportive regulatory environments.

Scope of the Report

|

By Insurance Type |

Life Insurance Health Insurance Auto Insurance Property Insurance Specialty Insurance |

|

By Distribution Channel |

Direct-to-Consumer Agents and Brokers Digital Platforms |

|

By Technology |

Artificial Intelligence Blockchain Big Data Analytics Internet of Things (IoT) |

|

By Customer Segment |

Individual Consumers Small and Medium Enterprises Large Corporations |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Department of Insurance)

Insurance Companies

Technology Companies

Risk Management Companies

Large Corporations with Insurance Needs

Healthcare Providers

Companies

Major Players in the Market

Lemonade, Inc.

Root Insurance

Oscar Health

Hippo Insurance

Next Insurance

Policygenius

Clover Health

CoverWallet

Zego

Trv

Shift Technology

Ethos Life

Metromile

Bright Health

GetInsured

Table of Contents

1. Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of Artificial Intelligence and Machine Learning

3.1.2. Increasing Digitalization in Insurance Services

3.1.3. Rising Consumer Demand for Personalized Insurance Products

3.1.4. Surge in Venture Capital Investments

3.2. Market Challenges

3.2.1. Regulatory Compliance Complexities

3.2.2. Data Privacy and Cybersecurity Concerns

3.2.3. Integration with Legacy Systems

3.3. Opportunities

3.3.1. Expansion of Usage-Based Insurance Models

3.3.2. Growth in On-Demand Insurance Services

3.3.3. Collaboration with Traditional Insurers

3.4. Trends

3.4.1. Emergence of Blockchain in Insurance

3.4.2. Utilization of Big Data Analytics

3.4.3. Proliferation of Insurtech Startups

3.5. Government Regulation

3.5.1. State-Level Insurance Regulations

3.5.2. Federal Data Protection Laws

3.5.3. Insurtech Sandbox Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces

3.9. Competitive Landscape

4. Market Segmentation

4.1. By Business Model (in Value %)

4.1.1. Carrier

4.1.2. Enabler

4.1.3. Distributor

4.2. By Insurance Type (in Value %)

4.2.1. Life Insurance

4.2.2. Non-Life Insurance

4.3. By Technology (in Value %)

4.3.1. Artificial Intelligence

4.3.2. Blockchain

4.3.3. Cloud Computing

4.3.4. Internet of Things (IoT)

4.4. By Service (in Value %)

4.4.1. Consulting

4.4.2. Support & Maintenance

4.4.3. Managed Services

4.5. By Region (in Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lemonade

5.1.2. Root Insurance

5.1.3. Oscar Health

5.1.4. Clover Health

5.1.5. Hippo Insurance

5.1.6. Metromile

5.1.7. Next Insurance

5.1.8. Bright Health

5.1.9. Gusto

5.1.10. American Well

5.1.11. Policygenius

5.1.12. Trov

5.1.13. Slice Labs

5.1.14. Insurify

5.1.15. Bind Benefits

5.2. Cross Comparison Parameters (Number of Employees, Headquarters Location, Year of Establishment, Annual Revenue, Key Technologies, Market Share, Customer Base, Funding Received)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Regulatory Framework

6.1. Insurance Licensing Requirements

6.2. Data Protection and Privacy Regulations

6.3. Anti-Money Laundering (AML) Compliance

6.4. Consumer Protection Laws

7. Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1. By Business Model (in Value %)

8.2. By Insurance Type (in Value %)

8.3. By Technology (in Value %)

8.4. By Service (in Value %)

8.5. By Region (in Value %)

9. Market Analysts’ Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Segmentation and Cohort Analysis

9.3. Marketing and Distribution Strategies

9.4. Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Insurtech market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA Insurtech market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple Insurtech manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Insurtech market.

Frequently Asked Questions

1. How big is the USA Insurtech Market?

The USA Insurtech market is valued at USD 48 billion, driven by increasing digital transformation and consumer demand for personalized insurance solutions. The ongoing advancements in technology continue to enhance customer experiences and operational efficiencies.

2. What are the challenges in the USA Insurtech Market?

Challenges in the USA Insurtech market include regulatory compliance costs, cybersecurity risks, and the integration of legacy systems. As technology advances, these issues become more complex, posing risks to market players.

3. Who are the major players in the USA Insurtech Market?

Key players in the USA Insurtech market include Lemonade, Root Insurance, and Oscar Health. Their significant market presence stems from innovative technology and a strong focus on customer-centric solutions.

4. What are the growth drivers of the USA Insurtech Market?

The growth drivers of the USA Insurtech market include digital transformation, regulatory changes, and increasing consumer awareness. These factors collectively push traditional insurance companies to adopt Insurtech solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.