USA Interactive Patient Care Solutions Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD1401

November 2024

89

About the Report

USA Interactive Patient Care Solutions Market Overview

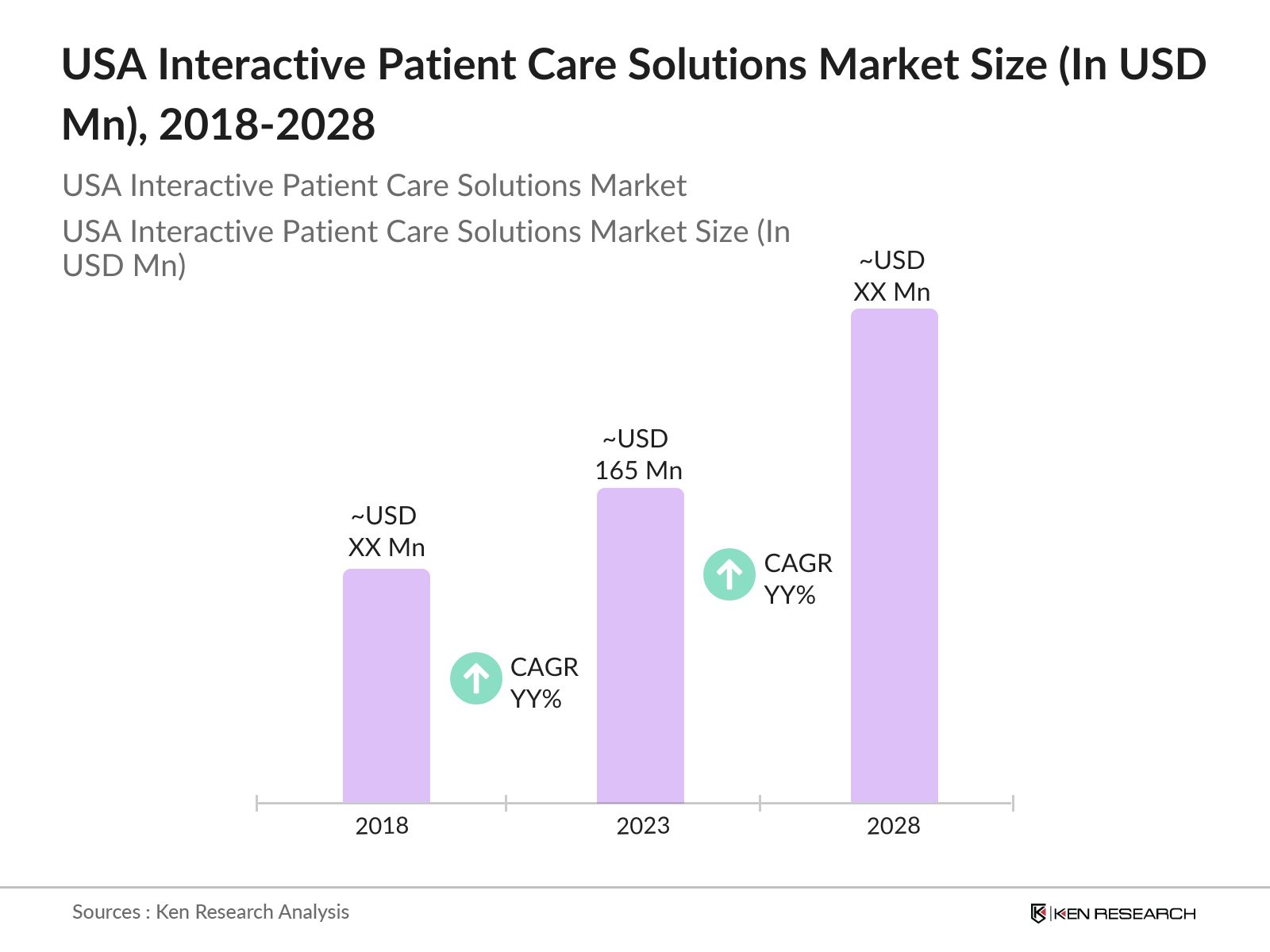

- The USA Interactive Patient Care Solutions Market size was valued at USD 165 million in 2023. The growth of this market is primarily driven by the increasing adoption of digital health technologies, the need for patient engagement, and the rise in healthcare expenditure in the United States.

- The major players in the USA Interactive Patient Care Solutions market include GetWellNetwork, SONIFI Health, Epic Systems Corporation, and Allscripts Healthcare Solutions. These companies provide a range of patient care solutions, including interactive patient engagement platforms, telehealth services, and digital therapeutics, addressing the diverse needs of healthcare providers across the country.

- In early 2024, GetWellNetwork renewed and expanded 14 partnerships with health systems, enhancing patient engagement. Their Social Determinants of Health solution screened over 5,000 patients, connecting many to essential resources. Recognized as a top Market Leader for Patient-Driven Care Management by KLAS, GetWellNetwork continues to innovate with evidence-based digital care plans.

- The states like New York and Massachusetts dominated the USA Interactive Patient Care Solutions Market in 2023. This dominance can be attributed to the regions advanced healthcare infrastructure, high concentration of hospitals, and early adoption of digital health technologies.

USA Interactive Patient Care Solutions Market Segmentation

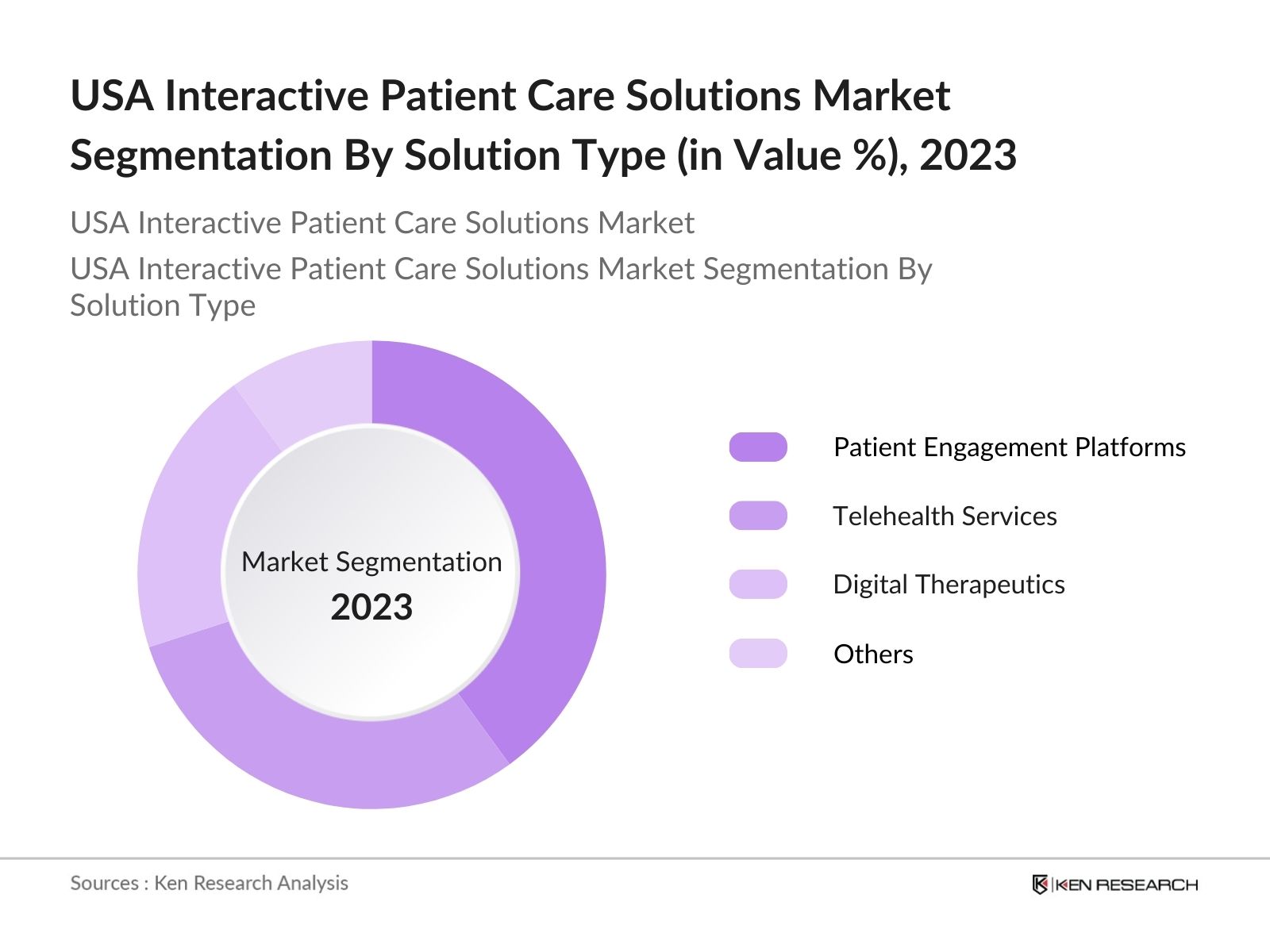

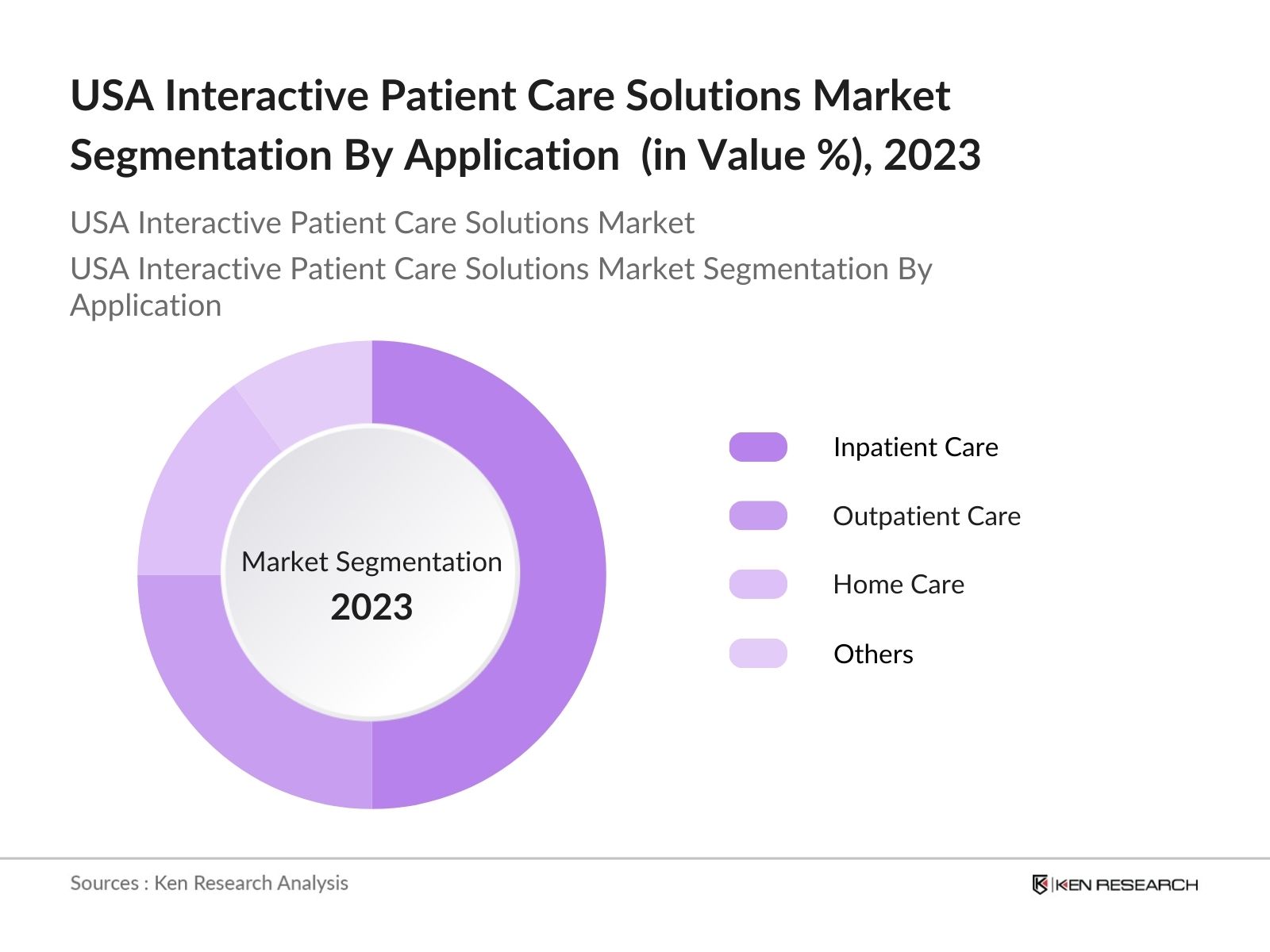

The USA Interactive Patient Care Solutions Market is segmented into solution type, application, and region.

- By Solution Type: The market is segmented by solution type into patient engagement platforms, telehealth services, digital therapeutics, and others. Patient engagement platforms held the dominant market share in 2023, driven by their widespread adoption in hospitals and clinics for enhancing patient communication and education.

- By Application: The market is segmented by application into inpatient care, outpatient care, home care, and others. Inpatient care held the largest market share in 2023, attributed to the increasing demand for interactive patient care solutions in hospitals to improve patient outcomes and satisfaction.

- By Region: The market is segmented by region into North, South, East, and West. The Western region dominated the market in 2023 due to its advanced healthcare infrastructure, high concentration of hospitals, and early adoption of digital health technologies.

USA Interactive Patient Care Solutions Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

GetWellNetwork |

1999 |

Bethesda, Maryland, USA |

|

SONIFI Health |

2000 |

Sioux Falls, South Dakota, USA |

|

Epic Systems Corporation |

1979 |

Verona, Wisconsin, USA |

|

Allscripts Healthcare Solutions |

1986 |

Chicago, Illinois, USA |

|

Cerner Corporation |

1979 |

North Kansas City, Missouri, USA |

- SONIFI Health: SONIFI Health's new interactive platform, unveiled at HIMSS 2024, emphasizes hospitality-centered patient engagement. The cloud-based solution anticipates patient and clinician needs, enabling better healing environments. Research-driven features like interactive TVs, digital whiteboards, and virtual care integrate seamlessly to improve care delivery and patient experience across U.S. hospitals.

- Epic Systems Corporation: Epic Systems Corporation is a prominent player in the interactive patient care solutions market, particularly in the U.S. The company's MyChart bedside application enhances patient engagement by providing a seamless experience for users in various healthcare settings. Epic continues to expand its offerings, contributing to the projected growth of the market, expected to reach $300 million by 2027.

USA Interactive Patient Care Solutions Market Analysis

USA Interactive Patient Care Solutions Market Growth Drivers:

- Rising Healthcare Expenditure: U.S. healthcare spending reached $4.5 trillion in 2022, growing by 4.1% from 2021. This increase was primarily driven by strong growth in Medicaid and private health insurance, reflecting a focus on improving patient outcomes and reducing costs through enhanced care solutions.

- Increasing Adoption of Digital Health Technologies: The rise in insured individuals reached a historic high of 92% in 2022, driven by a 6.1 million increase in Medicaid enrollment. This surge in coverage supports the adoption of digital health technologies, including telehealth and electronic health records, as healthcare providers seek to engage patients effectively.

- Rising Incidence of Chronic Diseases: The increasing prevalence of chronic diseases is a major growth driver. For instance, the burden of chronic conditions such as diabetes, obesity, and cardiovascular diseases is rising, with around 6 in 10 adults in the U.S. living with a chronic disease. This trend necessitates enhanced patient engagement solutions to manage these conditions effectively, driving demand for interactive patient care systems.

USA Interactive Patient Care Solutions Market Challenges:

- Data Privacy and Security Concerns: The rise of digital health technologies increases the risk of cyber-attacks and data breaches, posing some challenges for the interactive patient care solutions market. A 74% surge in global cyberattacks on healthcare organizations in 2022 emphasizes the need for robust cybersecurity measures and HIPAA compliance.

- High Implementation Costs: Implementing interactive patient care solutions presents high costs, particularly for small and medium-sized healthcare providers. The investments required for infrastructure, training, and maintenance can deter organizations from adopting new technologies. This challenge is exacerbated by the need for secure platforms that comply with regulatory standards.

USA Interactive Patient Care Solutions Market Government Initiatives:

- Medicare Telehealth Services Expansion: In 2023, the U.S. government expanded Medicare coverage for telehealth services, enabling broader patient access to remote care. Telehealth visits surged from 840,000 in 2019 to nearly 52.7 million in 2020. Many expansions were extended through December 2024 to assess their impact on healthcare outcomes and inform future policies.

- HITECH Act Support for EHR Adoption: The HITECH Act continues to support EHR adoption through incentive programs, resulting in nearly 90% of hospitals and 75% of office-based physicians utilizing EHR systems by 2023. This initiative promotes the integration of interactive patient care solutions with EHRs, enhancing patient engagement and care coordination across healthcare settings.

USA Interactive Patient Care Solutions Market Future Market Outlook

The USA Interactive Patient Care Solutions Market is expected to grow in the coming years. The market is likely to see a shift towards more integrated and comprehensive patient care solutions that combine patient engagement, telehealth, and digital therapeutics.

USA Interactive Patient Care Solutions Market Future Market Trends:

- Increased Integration of AI and Machine Learning: By 2028, the integration of AI and machine learning into interactive patient care solutions is expected to rise exponentially. AI enhances diagnostic accuracy and treatment selection, leading to improved patient outcomes. Studies show AI reduces diagnostic errors and improves patient monitoring, revolutionizing healthcare delivery.

- Growth of Remote Patient Monitoring: By 2028, demand for remote patient monitoring solutions is projected to grow substantially due to the rising prevalence of chronic diseases. Nearly 60% of U.S. adults live with chronic conditions, necessitating ongoing management. Remote monitoring technologies enable continuous health tracking, facilitating timely interventions and improving patient engagement.

Scope of the Report

|

By Solution Type |

Patient Engagement Platforms Telehealth Services Digital Therapeutics Others |

|

By Application |

Inpatient Care Outpatient Care Home Care Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Medical Device Manufacturers

Pharmaceutical Companies

Healthcare Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

GetWellNetwork

SONIFI Health

Epic Systems Corporation

Allscripts Healthcare Solutions

Cerner Corporation

Meditech

Philips Healthcare

Siemens Healthineers

TeleHealth Services

eVideon

HCA Healthcare

GE Healthcare

Vocera Communications

Spok Inc.

PatientPoint

Table of Contents

1. USA Interactive Patient Care Solutions Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Interactive Patient Care Solutions Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Interactive Patient Care Solutions Market Analysis

3.1. Growth Drivers

3.1.1. Rising Healthcare Expenditure

3.1.2. Increasing Adoption of Digital Health Technologies

3.1.3. Rising Incidence of Chronic Diseases

3.2. Restraints

3.2.1. Data Privacy and Security Concerns

3.2.2. High Implementation Costs

3.3. Opportunities

3.3.1. Growth of Remote Patient Monitoring

3.3.2. Integration of AI and Machine Learning

3.4. Trends

3.4.1. Increased Integration of AI and Machine Learning

3.4.2. Growth of Remote Patient Monitoring

3.5. Government Regulation

3.5.1. Medicare Telehealth Services Expansion

3.5.2. HITECH Act Support for EHR Adoption

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. USA Interactive Patient Care Solutions Market Segmentation, 2023

4.1. By Solution Type (in Value %)

4.1.1. Patient Engagement Platforms

4.1.2. Telehealth Services

4.1.3. Digital Therapeutics

4.1.4. Others

4.2. By Application (in Value %)

4.2.1. Inpatient Care

4.2.2. Outpatient Care

4.2.3. Home Care

4.2.4. Others

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. USA Interactive Patient Care Solutions Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. GetWellNetwork

5.1.2. SONIFI Health

5.1.3. Epic Systems Corporation

5.1.4. Allscripts Healthcare Solutions

5.1.5. Cerner Corporation

5.1.6. Meditech

5.1.7. Philips Healthcare

5.1.8. Siemens Healthineers

5.1.9. TeleHealth Services

5.1.10. eVideon

5.1.11. HCA Healthcare

5.1.12. GE Healthcare

5.1.13. Vocera Communications

5.1.14. Spok Inc.

5.1.15. PatientPoint

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Interactive Patient Care Solutions Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Interactive Patient Care Solutions Market Regulatory Framework

7.1. Data Privacy and Security Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Interactive Patient Care Solutions Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Interactive Patient Care Solutions Future Market Segmentation, 2028

9.1. By Solution Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. USA Interactive Patient Care Solutions Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

11. Disclaimer

12. Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the USA Interactive Patient Care Solutions market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple interactive patient care solution providers and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us in validating statistics derived through the bottom-to-top approach from the patient care solution providers.

Frequently Asked Questions

01. How big is the USA Interactive Patient Care Solutions Market?

The USA Interactive Patient Care Solutions Market was valued at USD 165 million in 2023, driven by rising healthcare expenditure and the increasing adoption of digital health technologies in the USA.

02. Who are the major players in the USA Interactive Patient Care Solutions market?

The major players in the USA Interactive Patient Care Solutions market include GetWellNetwork, SONIFI Health, Epic Systems Corporation, and Allscripts Healthcare Solutions.

03. What are the growth drivers of the USA Interactive Patient Care Solutions market?

The growth drivers of the USA Interactive Patient Care Solutions market include rising healthcare expenditure, increasing adoption of digital health technologies, and government initiatives for patient-centered care.

04. What are the challenges in the USA Interactive Patient Care Solutions market?

The USA Interactive Patient Care Solutions market faces challenges such as data privacy and security concerns and high implementation costs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.