USA IoT Market Outlook to 2030

Region:North America

Author(s):Shubham

Product Code:KROD2659

October 2024

88

About the Report

USA IoT Market Overview

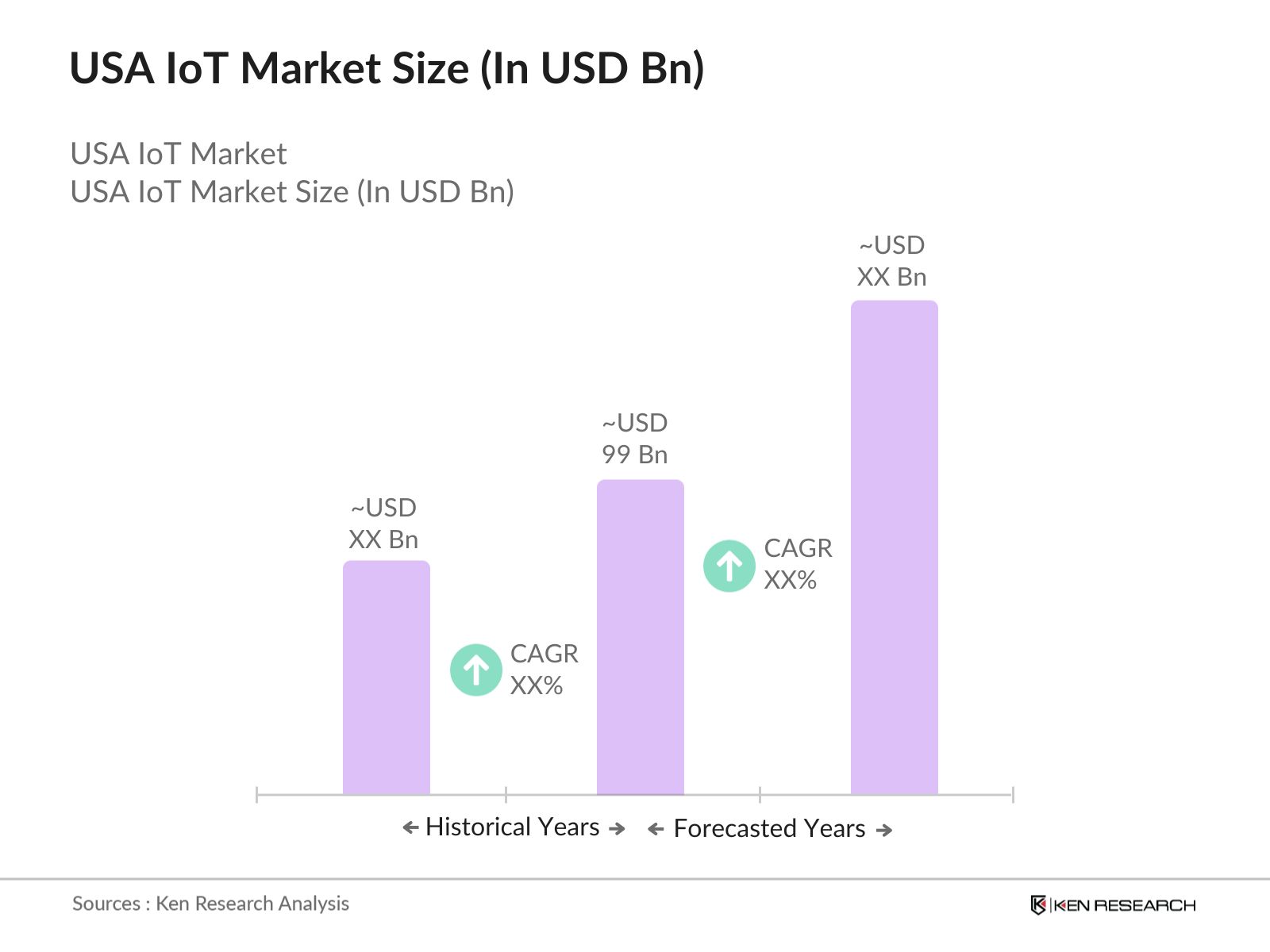

- The USA IoT (Internet of Things) market is valued at USD 99 billion, based on a five-year historical analysis. This market is driven by the rising adoption of IoT technologies across industries such as healthcare, manufacturing, transportation, and retail, along with advancements in AI, machine learning, and cloud computing. The integration of IoT with big data analytics is enabling businesses to harness real-time data for enhanced decision-making, driving demand for IoT devices and platforms.

- The majority of the market activity is concentrated in regions like Silicon Valley, Texas, and Washington, where innovation in IoT infrastructure and investments are at their peak. These regions are home to large enterprises and startups focusing on automation, smart cities, and connected devices. Additionally, the increasing adoption of IoT in agriculture and industrial sectors in the Midwest highlights the expanding reach of this technology across the USA.

- Regulatory frameworks like the Federal Trade Commission's (FTC) guidelines for IoT devices emphasize security and data protection. In 2023, the FTC introduced new rules requiring IoT manufacturers to ensure robust security protocols to protect consumer data, which has pushed companies to adopt more secure IoT architectures. These regulations are crucial for protecting personal and corporate information, making compliance a critical concern for IoT device manufacturers.

USA IoT Market Segmentation

- By Component: The USA IoT market is segmented by component into hardware, software, and services. Hardware dominates the market share due to the increasing deployment of IoT sensors, gateways, and devices across industries. Companies like Cisco Systems and Intel lead in this segment, focusing on providing high-performance devices that support large-scale IoT deployments. The software segment is also growing rapidly, driven by the demand for IoT platforms that offer real-time analytics and connectivity management.

- By Connectivity Technology: IoT technologies are categorized into Wi-Fi, cellular, LoRa, and LPWAN (Low Power Wide Area Network). Cellular technology holds a dominant share due to its extensive use in applications such as connected cars, smart cities, and industrial automation. However, LPWAN is gaining traction, particularly in agricultural and rural applications, as it enables long-range communication with minimal power consumption.

USA IoT Market Competitive Landscape

The USA IoT market is highly competitive, with several major players focusing on innovation, partnerships, and acquisitions to strengthen their market positions. Leading companies such as Cisco Systems, Intel Corporation, IBM, and Microsoft dominate the market, with a focus on enhancing IoT security and expanding the use of AI-driven IoT solutions.

USA IoT Industry Analysis

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (2023) |

Key IoT Products |

R&D Investment |

Key Clients |

Partnerships |

Market Focus |

|

Cisco Systems |

1984 |

California, USA |

|||||||

|

Intel Corporation |

1968 |

California, USA |

|||||||

|

IBM |

1911 |

New York, USA |

|||||||

|

Microsoft |

1975 |

Washington, USA |

|||||||

|

Google (Alphabet) |

1998 |

California, USA |

Growth Drivers

- IoT Cybersecurity Improvement Act (Federal Regulations): The IoT Cybersecurity Improvement Act, enacted in 2020, sets cybersecurity standards for IoT devices used by federal agencies in the USA. This regulation mandates that all IoT devices purchased by the government meet specific security guidelines issued by the National Institute of Standards and Technology (NIST). As of 2024, federal agencies are required to comply with updated NIST guidelines for vulnerability disclosures and patching mechanisms. The U.S. government has a substantial to bolster IoT cybersecurity across federal departments, with a focus on securing connected systems in defense and critical infrastructure. The act ensures heightened protection against increasing cyber threats.

- Data Protection and Privacy Laws (FTC Guidelines, CCPA Compliance): The Federal Trade Commission (FTC) has established comprehensive guidelines to protect consumer data in IoT ecosystems. In 2023, the FTC enforced multiple actions against companies violating data privacy in IoT devices. The California Consumer Privacy Act (CCPA), which grants consumers control over their personal data, has forced IoT manufacturers to ensure compliance. Companies operating in California must provide transparency on data collection and give consumers the right to opt out of data sharing. Compliance with the CCPA has increased operational costs by $2 million per enterprise on average.

- Infrastructure Funding for Smart Cities (Federal Grants, Public-Private Partnerships): The U.S. federal government continues to prioritize infrastructure development for smart cities through grants and public-private partnerships. In 2023, the government substantial grants to fund smart city initiatives across transportation, energy management, and public safety. Cities like San Francisco and Boston have received significant federal backing for deploying IoT-enabled systems that manage urban infrastructure efficiently. Additionally, public-private partnerships have facilitated the deployment of IoT-based traffic management systems, contributing to an annual savings of millions in reduced congestion costs.

Market Challenges

- Cybersecurity Concerns (Data Breaches, Device Vulnerabilities): Cybersecurity risks remain a significant challenge for IoT in the USA. The increasing use of connected devices has made sectors like healthcare, manufacturing, and critical infrastructure vulnerable to cyberattacks. These risks are particularly pronounced in IoT ecosystems where unsecured devices are deployed without robust security protocols. Vulnerabilities in devices, including lack of encryption and insecure firmware, have driven government actions to enhance security measures. The National Institute of Standards and Technology (NIST) introduced updated cybersecurity guidelines in 2024 to address these concerns, focusing on vulnerability management and security-by-design principles for IoT systems.

- Data Privacy Regulations (CCPA, GDPR Compliance): Data privacy regulations such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) pose compliance challenges for IoT companies in the U.S. These regulations require IoT businesses to provide transparency on how data is collected, stored, and shared, imposing strict data protection obligations. Non-compliance can lead to significant legal repercussions, including fines and restrictions on business operations. Companies face the added challenge of ensuring that their IoT devices and systems comply with varying regional privacy laws, which often necessitates additional resources and adjustments in data management processes.

USA IoT Market Future Outlook

The USA IoT market is expected to witness robust growth over the next five years, driven by technological advancements, increasing investments in AI and machine learning, and expanding IoT applications across diverse industries. The integration of 5G technology is set to further enhance IoT connectivity, enabling faster data transmission and improved device-to-device communication. As more businesses adopt IoT solutions to streamline operations and improve efficiency, the market is poised for significant expansion.

Market Opportunities

- IoT in Agriculture (Smart Farming, Precision Agriculture): IoT is playing a transformative role in U.S. agriculture, with precision agriculture technologies like soil sensors and automated irrigation systems helping farmers increase yield substantially. The U.S. Department of Agriculture (USDA) invested USD 300 million in 2023 to promote smart farming technologies, benefiting over 100,000 farms nationwide. Drones equipped with IoT sensors are also being used for crop monitoring, helping reduce fertilizer and water usage.

- Retail Industry Adoption (Omnichannel Retailing, Supply Chain Optimization): Retail adoption of IoT is expanding, with 80% of large U.S. retailers using IoT for inventory tracking and supply chain optimization in 2023. Walmarts use of IoT-enabled inventory management reduced stockouts substantially, saving the company nboteworhty amount in operational costs. IoT sensors are also helping retailers optimize energy usage in stores, leading to reduction in electricity consumption, supported by federal energy efficiency programs.

Scope of the Report

|

By Component |

|

|||||

|

By Connectivity |

Wi-Fi Cellular LPWAN Satellite Bluetooth |

|||||

|

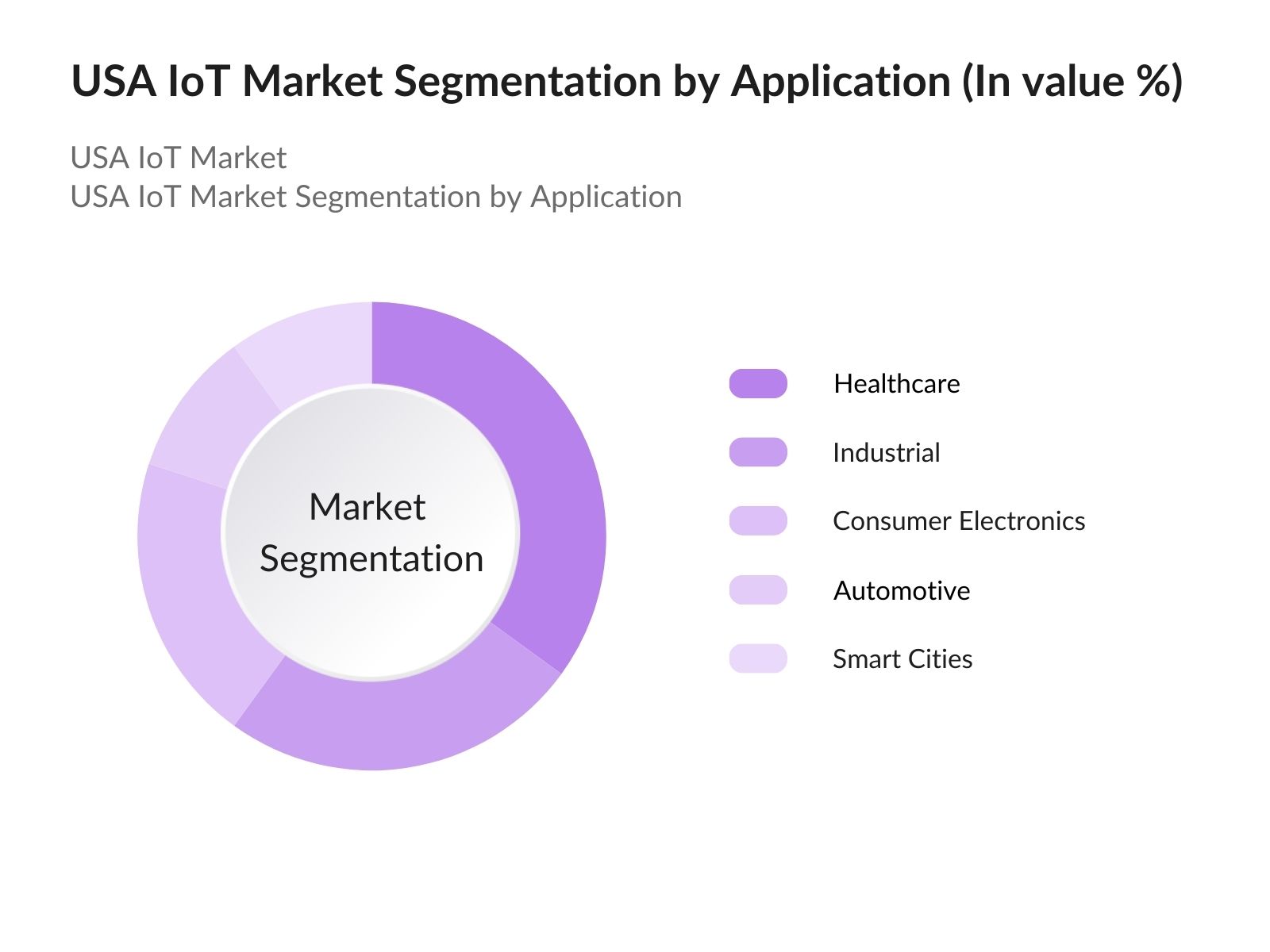

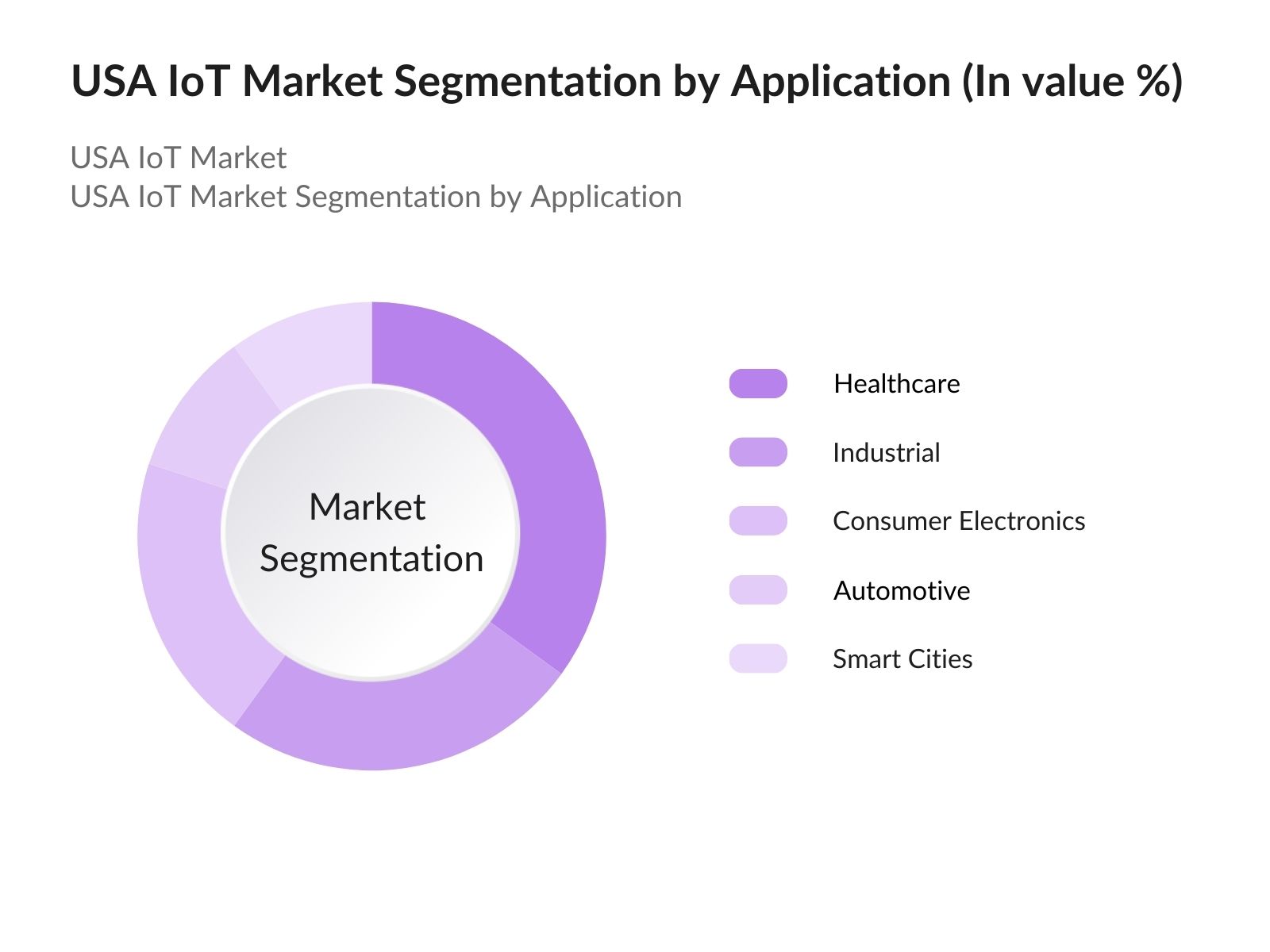

By Application |

|

|||||

|

By Deployment Mode |

On-Premise Cloud, Hybrid |

|||||

|

By Region |

North-East Midwest West Coast Southern States |

|

Hardware (Sensors, Gateways, Actuators) |

|

Software (Platforms, Analytics) |

|

Services (Managed, Professional) |

|

Healthcare Industrial Consumer Electronics |

Products

Key Target Audience

IoT Hardware Manufacturers

Software and Platform Providers

IoT Solution Integrators

Automotive Industry Players

Smart City Solution Providers

Government and Regulatory Bodies (Federal Communications Commission, National Institute of Standards and Technology)

Healthcare Service Providers

Investments and Venture Capitalist Firms

Companies

Major Players in the USA IoT Market

-

Cisco Systems

Intel Corporation

IBM

Microsoft

Google (Alphabet)

Amazon Web Services (AWS)

Oracle Corporation

Siemens AG

AT&T

Qualcomm Technologies

Verizon Communications

Honeywell International

GE Digital

Rockwell Automation

Hewlett Packard Enterprise (HPE)

Table of Contents

1. USA IoT Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA IoT Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA IoT Market Analysis

3.1 Growth Drivers

3.1.1 Technological Advancements (AI, 5G, Cloud Computing)

3.1.2 Industrial Automation (IIoT, Predictive Maintenance, Robotics Integration)

3.1.3 Increasing Demand for Connected Devices (Consumer Electronics, Healthcare)

3.1.4 Adoption in Smart Cities (Public Safety, Energy Management, Transportation)

3.1.5 Government Initiatives (Funding for Smart Infrastructure, IoT Security Regulations)

3.2 Market Challenges

3.2.1 Cybersecurity Concerns (Data Breaches, Device Vulnerabilities)

3.2.2 Data Privacy Regulations (CCPA, GDPR Compliance)

3.2.3 High Initial Investment (IoT Infrastructure, Edge Computing Deployment)

3.2.4 Integration Complexities (Interoperability, Legacy Systems)

3.3 Opportunities

3.3.1 IoT in Agriculture (Smart Farming, Precision Agriculture)

3.3.2 Retail Industry Adoption (Omnichannel Retailing, Supply Chain Optimization)

3.3.3 Growth in Healthcare (Remote Patient Monitoring, Wearable Devices)

3.3.4 Expansion in Automotive Industry (Connected Vehicles, V2X Communication)

3.3.5 Edge Computing Growth (Reducing Latency, Real-time Data Processing)

3.4 Trends

3.4.1 Integration of AI and Machine Learning with IoT

3.4.2 Proliferation of IoT-Enabled Devices in Smart Homes

3.4.3 Rise of LPWAN Networks for Low-Power IoT Applications

3.4.4 Increasing Adoption of Digital Twins for IoT Asset Management

3.4.5 Sustainable IoT Practices (Energy-Efficient Devices, Eco-Friendly Technologies)

3.5 Government Regulation

3.5.1 IoT Cybersecurity Improvement Act (Federal Regulations)

3.5.2 Data Protection and Privacy Laws (FTC Guidelines, CCPA Compliance)

3.5.3 Infrastructure Funding for Smart Cities (Federal Grants, Public-Private Partnerships)

3.5.4 IoT Spectrum Allocation Policies

3.5.5 Environmental Regulations for IoT Devices (Energy Consumption Standards)

3.6 SWOT Analysis

3.7 Stake Ecosystem (Manufacturers, Distributors, End-Users)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. USA IoT Market Segmentation

4.1 By Component (In Value %)

4.1.1 Hardware (Sensors, Gateways, Actuators, Cameras)

4.1.2 Software (IoT Platforms, Analytics, Connectivity Management)

4.1.3 Services (Managed Services, Professional Services, Consulting)

4.2 By Connectivity Technology (In Value %)

4.2.1 Wi-Fi

4.2.2 Cellular (5G, 4G LTE)

4.2.3 LPWAN (LoRa, Sigfox, NB-IoT)

4.2.4 Satellite IoT

4.2.5 Bluetooth and Zigbee

4.3 By Application (In Value %)

4.3.1 Healthcare (Remote Patient Monitoring, Smart Hospitals)

4.3.2 Industrial (Predictive Maintenance, Asset Tracking)

4.3.3 Consumer Electronics (Smart Homes, Wearables)

4.3.4 Automotive (Connected Cars, Telematics, V2X Communication)

4.3.5 Smart Cities (Traffic Management, Public Safety, Waste Management)

4.4 By Deployment Mode (In Value %)

4.4.1 On-Premise

4.4.2 Cloud

4.4.3 Hybrid

4.5 By End-User Industry (In Value %)

4.5.1 Healthcare

4.5.2 Automotive

4.5.3 Retail

4.5.4 Manufacturing

4.5.5 Energy

5. USA IoT Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Cisco Systems

5.1.2 IBM

5.1.3 Intel Corporation

5.1.4 Microsoft

5.1.5 Google (Alphabet)

5.1.6 Amazon Web Services (AWS)

5.1.7 Oracle Corporation

5.1.8 Siemens AG

5.1.9 AT&T

5.1.10 Qualcomm Technologies

5.1.11 Verizon Communications

5.1.12 Honeywell International

5.1.13 GE Digital

5.1.14 Rockwell Automation

5.1.15 HPE (Aruba Networks)

5.2 Cross Comparison Parameters (Revenue, Employees, R&D Investment, Market Share, IoT Focus, Key Partnerships, Product Innovation, Geographical Reach)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Collaborations, New Product Launches)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA IoT Market Regulatory Framework

6.1 IoT Security Standards

6.2 Data Privacy Compliance (CCPA, GDPR)

6.3 Certification Processes (FCC, NIST Standards)

6.4 IoT Device Safety Regulations

6.5 IoT Network and Spectrum Guidelines

7. USA IoT Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA IoT Future Market Segmentation

8.1 By Component (In Value %)

8.2 By Connectivity Technology (In Value %)

8.3 By Application (In Value %)

8.4 By Deployment Mode (In Value %)

8.5 By End-User Industry (In Value %)

9. USA IoT Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the entire USA IoT ecosystem, identifying major stakeholders, and conducting detailed desk research using proprietary databases and secondary sources. This process helps define key variables that influence market trends, including technological advancements and regulatory factors.

Step 2: Market Analysis and Construction

Historical data is compiled to analyze market dynamics, including the penetration of IoT solutions across different industries. The analysis also includes an evaluation of market size, segmentation, and the key growth drivers that shape demand in different sectors.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses are tested through interviews with industry experts from leading IoT companies. These consultations help refine assumptions and validate market estimates, ensuring accuracy in data forecasting and market trends.

Step 4: Research Synthesis and Final Output

In this step, we consolidate all insights from primary and secondary research, generating a detailed report with a clear narrative on the USA IoT market. The final output includes a comprehensive analysis of market size, competitive landscape, and growth opportunities.

Frequently Asked Questions

01. How big is the USA IoT Market?

The USA IoT market is valued at USD 99 billion, driven by the integration of IoT technologies across industries such as healthcare, manufacturing, and retail.

02. What are the challenges in the USA IoT Market?

Challenges include cybersecurity concerns, data privacy regulations, and the high cost of initial IoT infrastructure deployment, which hinders adoption for smaller enterprises.

03. Who are the major players in the USA IoT Market?

Key players in the market include Cisco, Intel, IBM, Microsoft, and Google. These companies dominate due to their vast product offerings and strategic partnerships across industries.

04. What are the growth drivers of the USA IoT Market?

The market is driven by advancements in 5G, AI, and cloud computing, alongside the increasing demand for real-time analytics and predictive maintenance solutions in industries like healthcare and manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.