USA Joint All Domain Command and Control (JADC2) Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD6304

November 2024

84

About the Report

USA Joint All Domain Command and Control Market Overview

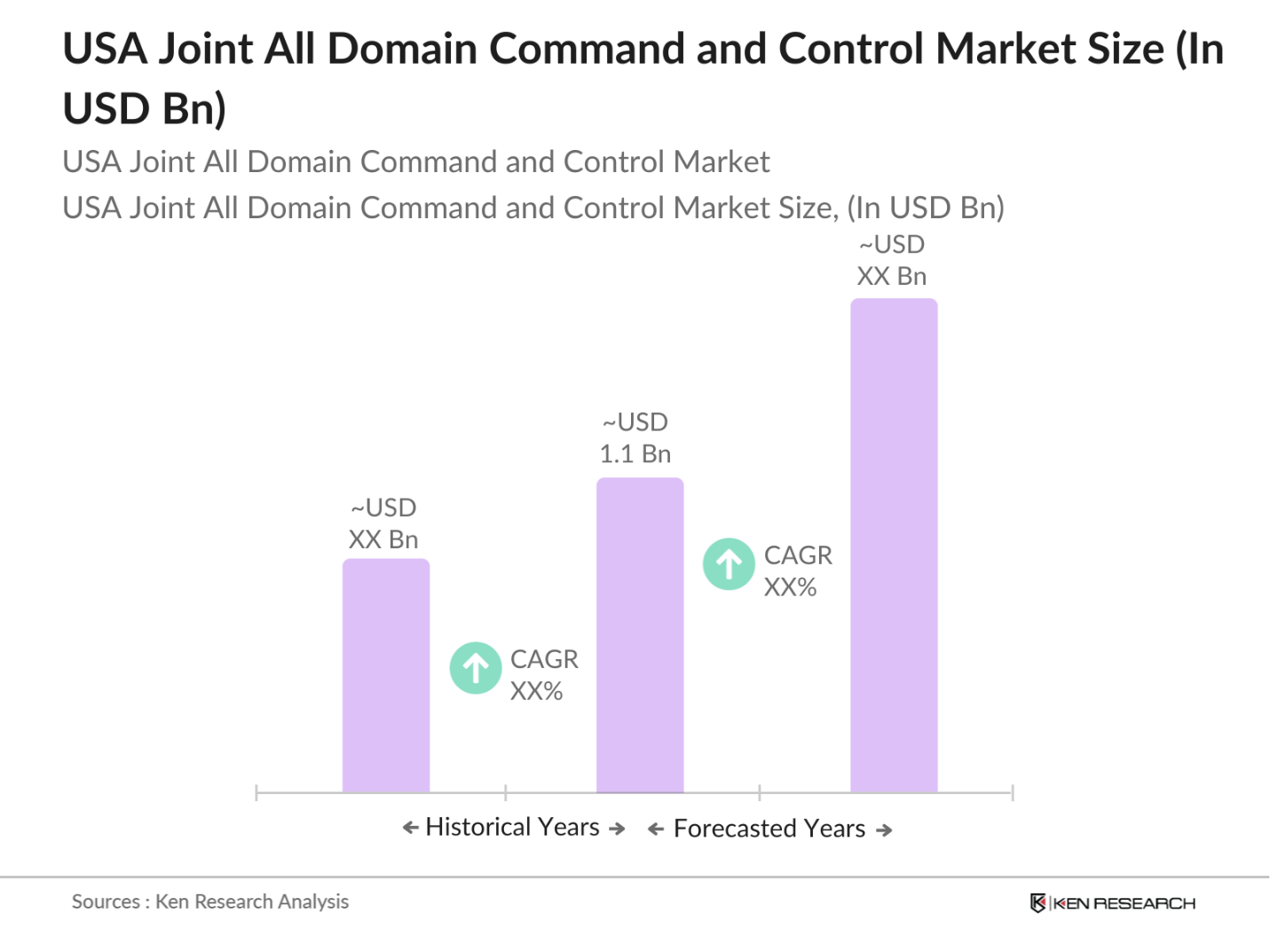

- The USA Joint All Domain Command and Control (JADC2) market is valued at USD 1.1 billion, based on a five-year historical analysis. The market is driven by the increasing integration of advanced technologies such as artificial intelligence, big data analytics, and 5G connectivity into military operations. This is aimed at enhancing the ability of the U.S. military to operate across air, land, sea, cyber, and space domains seamlessly. The push for modernizing military systems, alongside rising defense budgets, is contributing significantly to the growth of the JADC2 market.

- Countries like the United States dominate the JADC2 market primarily due to their large defense budgets and cutting-edge technological capabilities. The U.S. has invested heavily in multi-domain operations, particularly focusing on integrating real-time data sharing across various military domains. The dominance is also fueled by significant partnerships with key defense contractors and the strategic importance of maintaining a global military presence across all five domains of warfare.

- Data-centric warfare is becoming a defining trend in modern military operations, focusing on leveraging data for strategic advantage. In 2023, the DoD committed $2 billion to data management and analytics initiatives to improve decision-making processes. This emphasis on data utilization is evident in the implementation of the Advanced Battle Management System, which aims to integrate data from various sources for real-time situational awareness. By prioritizing data-driven strategies, the military is adapting to the complexities of contemporary warfare, positioning itself to respond more effectively to emerging threats.

USA Joint All Domain Command and Control Market Segmentation

By Domain: The USA Joint All Domain Command and Control market is segmented by domain into air, land, sea, cyber, and space. Recently, the cyber domain has been gaining dominance under this segmentation. This is due to the increasing reliance on digital networks for command and control operations, and the rising frequency of cyber threats targeting critical military infrastructure. The importance of securing data and maintaining operational integrity in a networked warfare environment positions the cyber domain at the forefront of JADC2 strategies.

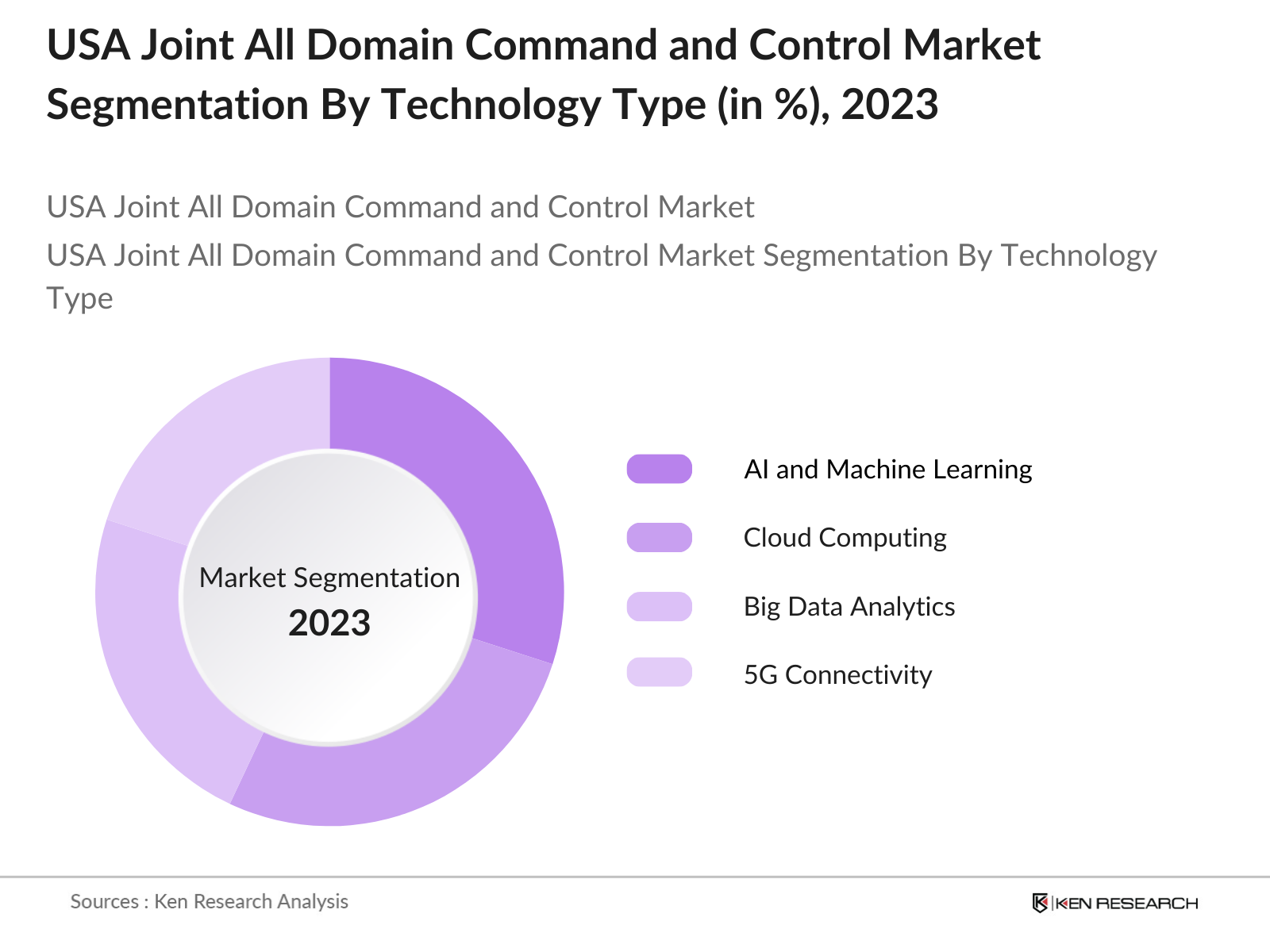

By Technology: The market is further segmented by technology into AI and machine learning, cloud computing, big data analytics, 5G connectivity, and Internet of Things (IoT). Among these, AI and machine learning hold the dominant market share, driven by their crucial role in enabling real-time decision-making and predictive analytics in warfare. AI helps process massive amounts of battlefield data, offering insights that enhance situational awareness, streamline command operations, and improve responsiveness during multi-domain operations.

USA Joint All Domain Command and Control Market Competitive Landscape

The USA JADC2 market is characterized by the presence of several major players, each contributing significantly to the technological advancements and overall market competitiveness. The market is dominated by companies such as Lockheed Martin, Raytheon Technologies, and Northrop Grumman. These companies have solidified their positions through long-term defense contracts, innovation in multi-domain technologies, and strategic partnerships with government agencies.

USA Joint All Domain Command and Control Industry Analysis

Growth Drivers

- Integration of AI/ML in Defense Systems: The integration of artificial intelligence (AI) and machine learning (ML) into defense systems is pivotal for enhancing decision-making capabilities and operational efficiency. The U.S. Department of Defense (DoD) allocated approximately $1.3 billion in 2022 specifically for AI and ML initiatives, highlighting its commitment to advanced technologies in military applications. The ongoing development of AI-driven systems is expected to bolster the capabilities of Joint All Domain Command and Control (JADC2) operations, enabling real-time data processing and improved situational awareness. This investment reflects a broader trend towards leveraging AI in defense to maintain strategic advantages.

- Rising Military Modernization Efforts: Military modernization is a key driver of the JADC2 market, with the U.S. government prioritizing upgrades to its defense infrastructure. The Biden administration's defense budget for 2023 reached $857 billion, emphasizing modernization programs, including advanced command and control systems. This budget allocates significant resources towards next-generation technologies, ensuring that U.S. military forces remain competitive globally. In 2022 alone, over $30 billion was directed towards modernizing command and control capabilities, underlining the urgent need for improved operational effectiveness.

- Enhanced Focus on Cross-Domain Operations: The increasing complexity of warfare necessitates enhanced cross-domain operations, integrating land, air, sea, cyber, and space capabilities. In 2022, the U.S. military conducted more than 1,200 cross-domain exercises, showcasing its commitment to this operational paradigm. This focus is supported by initiatives like the DoD's "Cross Domain Strategy," which outlines objectives for seamless integration across domains. Moreover, the Pentagon's investment in multi-domain operational capabilities is expected to exceed $20 billion annually through 2025, reflecting the critical nature of cross-domain operations in modern warfare.

Market Challenges

- Cybersecurity Threats in Networked Operations: Cybersecurity remains a critical challenge for JADC2, with cyberattacks on military networks rising dramatically. In 2022, the DoD reported over 1,300 significant cyber incidents, emphasizing the vulnerabilities of networked operations. Furthermore, a study indicated that 60% of defense contractors faced cybersecurity breaches, raising concerns about the integrity of command and control systems. The estimated cost of cyberattacks on the defense sector in 2023 reached $8 billion, highlighting the urgent need for robust cybersecurity measures to safeguard military operations.

- High Implementation Costs: Implementing advanced command and control systems comes with substantial costs, which can hinder adoption. In 2022, the average expenditure for transitioning to modern JADC2 systems was approximately $500 million per program. Moreover, a report from the Government Accountability Office (GAO) indicated that many defense projects face budget overruns, with 30% exceeding initial cost estimates. These financial constraints can slow the pace of modernization and limit the integration of essential technologies into military operations. Source

USA Joint All Domain Command and Control Future Outlook

Over the next five years, the USA Joint All Domain Command and Control market is expected to experience substantial growth, fueled by continuous advancements in military technology, increasing cyber threats, and growing defense budgets. The U.S. military's focus on integrating autonomous systems, real-time data analytics, and enhancing cross-domain capabilities will be key growth drivers. Furthermore, the development of next-generation AI and 5G technologies is set to transform how multi-domain operations are executed, allowing for quicker response times and improved decision-making in complex environments.

Opportunities

- Adoption of Autonomous Systems: The adoption of autonomous systems in military operations presents significant growth opportunities for the JADC2 market. In 2022, the U.S. military invested $1.5 billion in research and development of unmanned systems, with plans to increase this figure in the coming years. Autonomous technologies, including drones and ground vehicles, enhance operational efficiency and reduce risks to personnel. Current projects, such as the Army's Robotic Combat Vehicle program, are expected to drive innovation and create new avenues for JADC2 integration. The ongoing trend towards automation reflects a commitment to transforming military operations for future effectiveness.

- Expansion of 5G Technology in Military Applications: The expansion of 5G technology in military applications is set to revolutionize command and control capabilities. In 2023, the DoD invested $600 million to implement 5G in military bases across the U.S., aiming to enhance connectivity and data sharing. This technology facilitates faster communication, enabling real-time decision-making in critical scenarios. Moreover, the anticipated increase in data throughput is expected to support up to 1 million connected devices per base, significantly improving operational efficiency and responsiveness. The integration of 5G is poised to drive advancements in JADC2 systems.

Scope of the Report

|

By Domain |

Air Land Sea Cyber Space |

|

By Technology |

AI and Machine Learning Cloud Computing Big Data Analytics 5G Connectivity Internet of Things (IoT) |

|

By Component |

Hardware Software Services |

|

By Application |

Combat Operations Intelligence Surveillance Reconnaissance (ISR) Logistics and Support Cybersecurity |

|

By Region |

North America Europe Asia-Pacific Middle East and Afric Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Defense Contract Companies

Military Technology Industries

U.S. Department of Defense (DoD)

NATO Member States

Cybersecurity Companies

Government and Regulatory Bodies (U.S. DoD, National Security Agency)

Investor and Venture Capitalist Firms

Telecommunication Companies Specializing in 5G Infrastructure

Companies

Players Mentioned in the Report

Lockheed Martin Corporation

Raytheon Technologies Corporation

Northrop Grumman Corporation

Boeing Defense, Space & Security

L3Harris Technologies, Inc.

BAE Systems

Leidos

CACI International Inc

SAIC (Science Applications International Corporation)

Elbit Systems

Table of Contents

1. USA Joint All Domain Command and Control Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Joint All Domain Command and Control Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Joint All Domain Command and Control Market Analysis

3.1. Growth Drivers

3.1.1. Integration of AI/ML in Defense Systems

3.1.2. Rising Military Modernization Efforts

3.1.3. Enhanced Focus on Cross-Domain Operations

3.1.4. Increased Defense Spending

3.2. Market Challenges

3.2.1. Cybersecurity Threats in Networked Operations

3.2.2. High Implementation Costs

3.2.3. Interoperability Issues Between Legacy Systems

3.3. Opportunities

3.3.1. Adoption of Autonomous Systems

3.3.2. Expansion of 5G Technology in Military Applications

3.3.3. Growing Focus on Space as a Military Domain

3.4. Trends

3.4.1. Increasing Utilization of Data-Centric Warfare

3.4.2. Multi-Domain Integration Efforts

3.4.3. Shift Toward Decentralized Command Structures

3.5. Government Regulations

3.5.1. U.S. Department of Defense JADC2 Strategy

3.5.2. Cybersecurity Maturity Model Certification (CMMC)

3.5.3. National Defense Authorization Act (NDAA) Provisions

3.5.4. Military AI Ethics Guidelines

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Joint All Domain Command and Control Market Segmentation

4.1. By Domain (In Value %)

4.1.1. Air

4.1.2. Land

4.1.3. Sea

4.1.4. Cyber

4.1.5. Space

4.2. By Technology (In Value %)

4.2.1. AI and Machine Learning

4.2.2. Cloud Computing

4.2.3. Big Data Analytics

4.2.4. 5G Connectivity

4.2.5. Internet of Things (IoT)

4.3. By Component (In Value %)

4.3.1. Hardware

4.3.2. Software

4.3.3. Services

4.4. By Application (In Value %)

4.4.1. Combat Operations

4.4.2. Intelligence, Surveillance, and Reconnaissance (ISR)

4.4.3. Logistics and Support

4.4.4. Cybersecurity

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

5. USA Joint All Domain Command and Control Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lockheed Martin Corporation

5.1.2. Raytheon Technologies Corporation

5.1.3. Northrop Grumman Corporation

5.1.4. Boeing Defense, Space & Security

5.1.5. General Dynamics Corporation

5.1.6. L3Harris Technologies, Inc.

5.1.7. BAE Systems

5.1.8. Leidos

5.1.9. CACI International Inc

5.1.10. SAIC (Science Applications International Corporation)

5.1.11. Elbit Systems

5.1.12. Thales Group

5.1.13. Kratos Defense & Security Solutions

5.1.14. Booz Allen Hamilton

5.1.15. Parsons Corporation

5.2. Cross Comparison Parameters

(Company Revenue, Military Contracts, Geographical Presence, Defense Partnerships, AI Integration Level, Cybersecurity Focus, R&D Expenditure, Number of Patents)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Defense Contracts

5.9. Private Equity Investments

6. USA Joint All Domain Command and Control Market Regulatory Framework

6.1. DoD Regulations

6.2. Certification Processes

6.3. Cybersecurity Requirements

6.4. Operational Standards for AI and Autonomous Systems

7. USA Joint All Domain Command and Control Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Joint All Domain Command and Control Future Market Segmentation

8.1. By Domain (In Value %)

8.2. By Technology (In Value %)

8.3. By Component (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. USA Joint All Domain Command and Control Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase includes mapping the entire USA JADC2 market ecosystem, identifying key stakeholders such as defense contractors, government agencies, and technology providers. Comprehensive desk research is conducted to define the critical factors that influence the market.

Step 2: Market Analysis and Construction

Historical data on the USA JADC2 market is compiled and analyzed. Factors like defense budgets, military operations data, and technology adoption rates are reviewed to determine market penetration and segment performance.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts and stakeholders are conducted to validate the initial findings. These consultations provide valuable insights into market challenges, technological integration, and defense operational needs.

Step 4: Research Synthesis and Final Output

In this final stage, insights from major defense contractors are integrated to ensure a comprehensive understanding of market dynamics, product performance, and end-user preferences. The data is refined and verified using both top-down and bottom-up methodologies.

Frequently Asked Questions

01. How big is the USA Joint All Domain Command and Control Market?

The USA Joint All Domain Command and Control market is valued at USD 1.1 billion, driven by increasing technological integration into military operations across multiple domains.

02. What are the challenges in the USA Joint All Domain Command and Control Market?

Challenges include cybersecurity threats, interoperability issues between legacy systems and modern technologies, and the high cost of implementing advanced multi-domain systems.

03. Who are the major players in the USA Joint All Domain Command and Control Market?

Key players in the market include Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Boeing Defense, and L3Harris Technologies.

04. What are the growth drivers of the USA Joint All Domain Command and Control Market?

The market is driven by advancements in AI, 5G connectivity, and increasing defense spending on multi-domain operations. The push for real-time data sharing across domains also fuels growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.