USA Juice Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD4876

October 2024

91

About the Report

USA Juice Market Overview

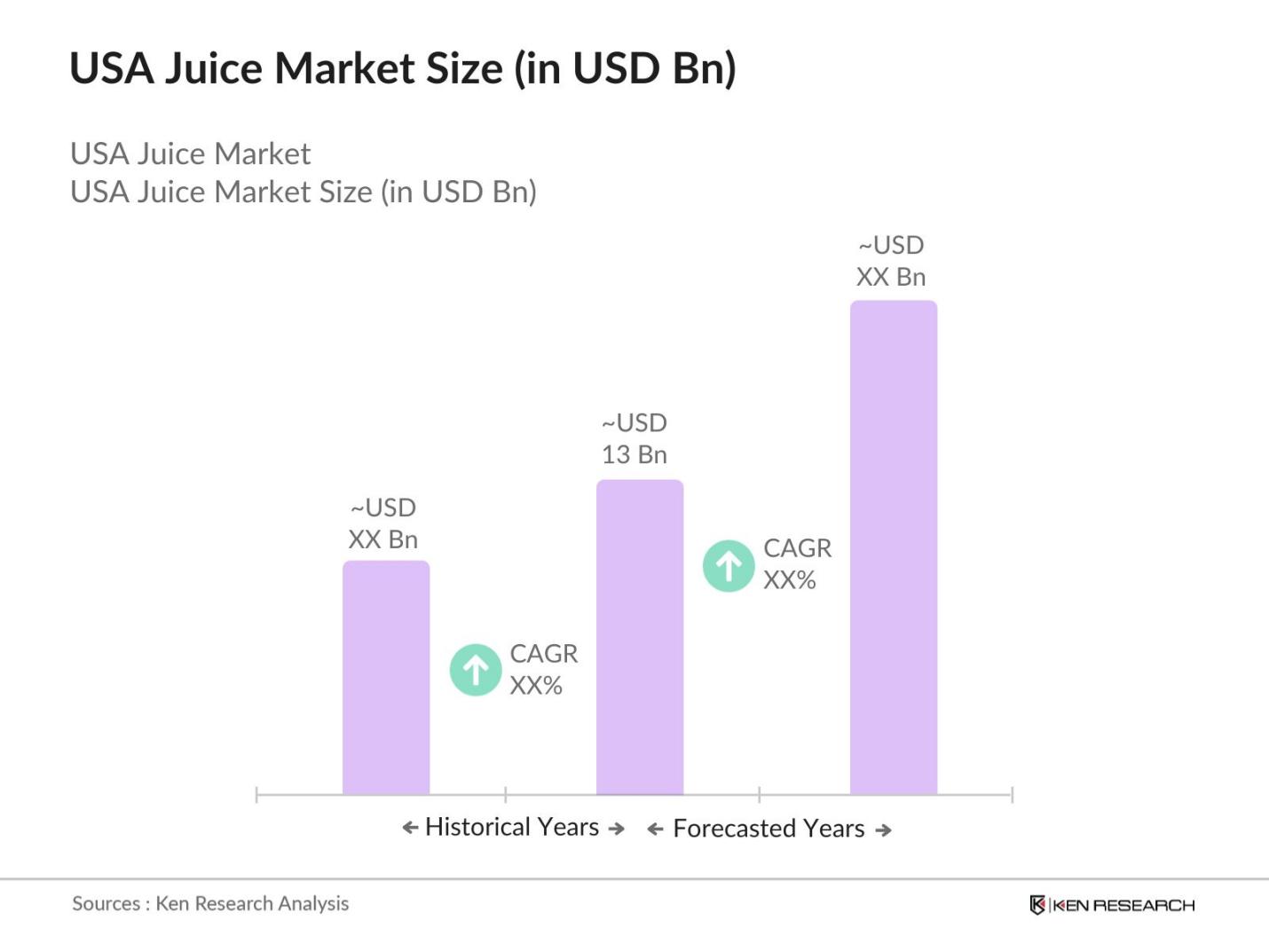

- The USA Juice market is valued at USD 13 Bn, driven by increasing health consciousness and a growing preference for natural, organic, and functional beverages. The market is being propelled by consumers shifting towards healthier options, such as cold-pressed and organic juices. It is expected to witness stable demand, particularly due to the rise in wellness trends and the emphasis on products with no added sugars or artificial additives, supported by growing product innovation from key manufacturers.

- New York, California, and Florida dominate the USA juice market due to their high population density, health-conscious consumer bases, and large retail networks. California, in particular, leads in organic juice production due to its robust agricultural infrastructure, while Florida's dominance in the citrus juice sector is attributed to its vast orange groves. The states' economic capabilities, combined with their diverse consumer preferences, position them as leading regions for both production and consumption.

- In response to rising concerns about sugar consumption, the U.S. government has introduced new regulations aimed at reducing sugar content in beverages, including juices. In 2023, the FDA introduced new guidelines that require juice manufacturers to limit added sugars and clearly label total sugar content. These regulations align with broader health initiatives, such as the Dietary Guidelines for Americans, which recommend limiting sugar intake. As a result, juice manufacturers are reformulating their products to meet these guidelines, with many introducing low-sugar or sugar-free options to cater to health-conscious consumers.

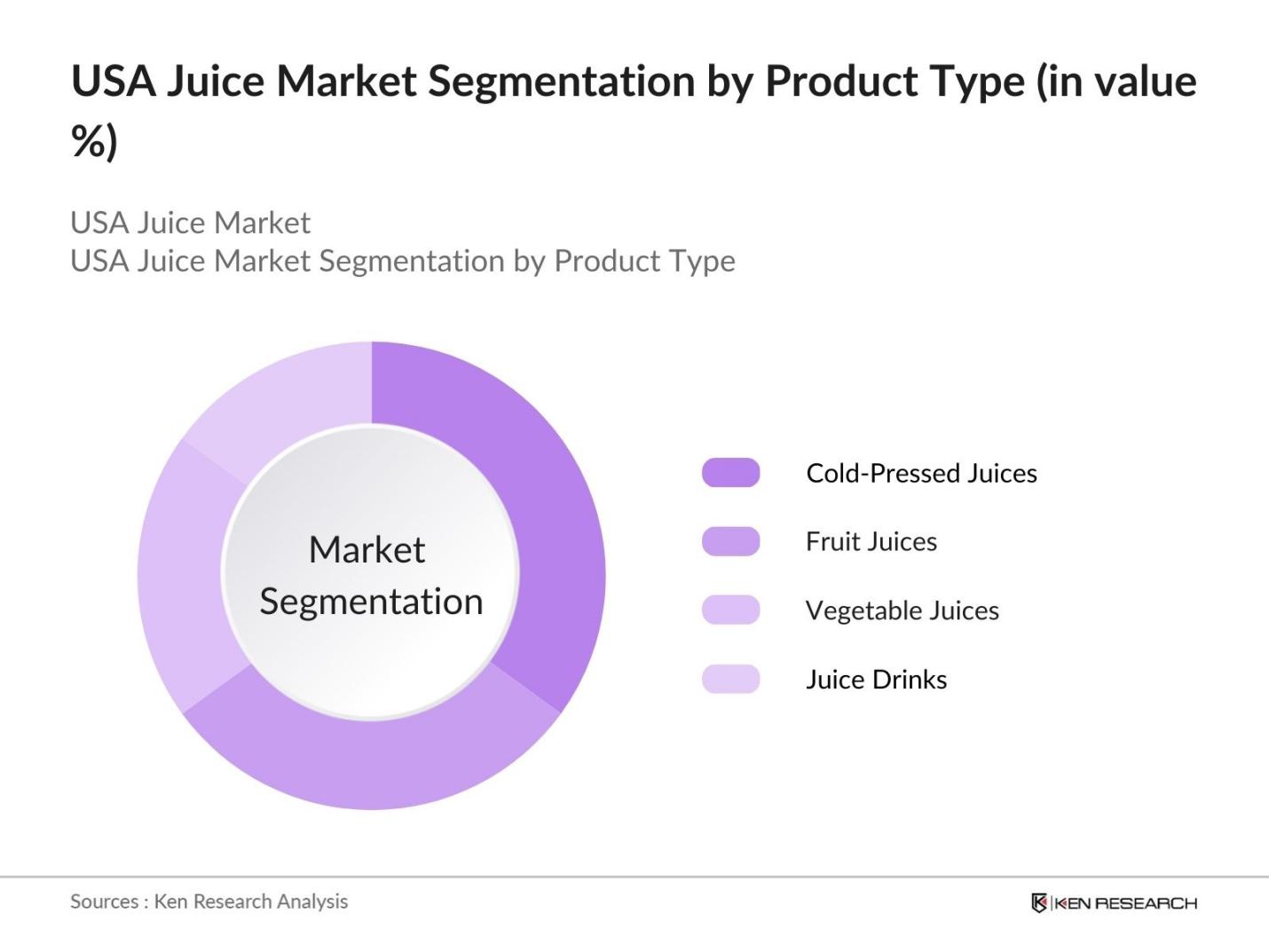

USA Juice Market Segmentation

By Product Type: The market is segmented by product type into fruit juices, vegetable juices, juice drinks, and cold-pressed juices. Cold-pressed juices have gained a dominant market share in recent years. Their popularity is attributed to consumer preferences for minimally processed beverages that retain higher nutritional content. Brands like Suja and Evolution Fresh have capitalized on this trend by offering cold-pressed juices with diverse flavor profiles and functional health benefits, which resonate with the health-conscious millennial demographic.

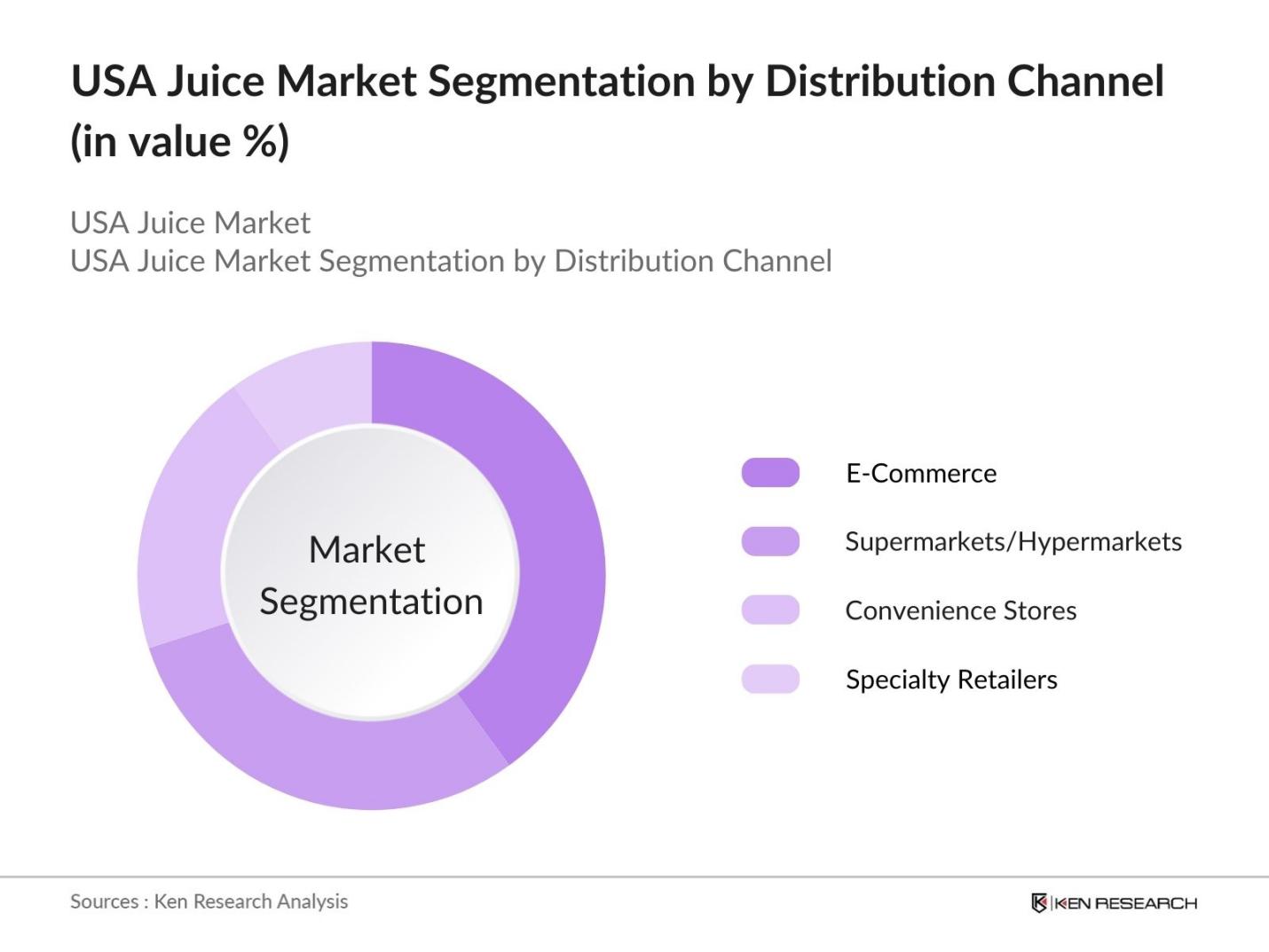

By Distribution Channel: The market is also segmented by distribution channel, including supermarkets/hypermarkets, convenience stores, e-commerce, and specialty retailers. E-commerce has emerged as a dominant distribution channel, driven by the convenience of online shopping, especially post-pandemic. The rise of subscription-based juice delivery services has made it easier for consumers to access fresh, cold-pressed, and organic juices at home. This growth is amplified by brands partnering with online platforms like Amazon and developing direct-to-consumer models.

USA Juice Market Competitive Landscape

The USA juice market features global giants such as PepsiCo and The Coca-Cola Company, alongside innovative health-focused brands like Suja Life, LLC. The market is highly competitive due to the presence of both long-established beverage companies and niche brands that emphasize quality, sustainability, and wellness-focused products.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

|

PepsiCo |

1965 |

Purchase, NY |

||||

|

The Coca-Cola Company |

1892 |

Atlanta, GA |

||||

|

Suja Life, LLC |

2012 |

San Diego, CA |

||||

|

Evolution Fresh |

1995 |

San Bernardino, CA |

||||

|

Pressed Juicery |

2010 |

Los Angeles, CA |

USA Juice Industry Analysis

Growth Drivers

- Increasing Health Awareness: Increased health awareness has led to a shift in consumer preferences towards cold-pressed juices and functional beverages. According to the U.S. Department of Agriculture, the demand for organic and natural products has surged in 2024, aligning with consumer preferences for clean, nutrient-dense beverages. Cold-pressed juices, known for retaining nutrients, have seen growth due to their perceived health benefits. The U.S. retail sales of organic products reached $60 billion in 2023, with functional beverages, including juices enriched with probiotics, vitamins, and minerals, gaining traction in major cities across the country.

- Changing Consumer Lifestyles: Modern consumer lifestyles have created a demand for convenience products, including on-the-go juices. With more Americans seeking quick meal alternatives, the market for ready-to-drink (RTD) beverages has grown significantly. According to the U.S. Census Bureau, over 33% of Americans purchase convenience beverages weekly. Juice brands are capitalizing on this by offering single-serve and portable packaging. The shift towards convenient, grab-and-go options, coupled with urbanization and busier work schedules, has led to an increased demand for such products, contributing to overall market growth.

- Government Regulations and Support: The U.S. Food and Drug Administration (FDA) has played a key role in regulating juice products, particularly in enforcing safety and labeling standards. In 2024, FDA's Hazard Analysis and Critical Control Point (HACCP) guidelines continue to ensure juice safety, reducing contamination risks. Additionally, the National Organic Program, under the U.S. Department of Agriculture, mandates strict organic juice labeling. This support has bolstered consumer confidence, with more than 75% of organic juice consumers stating that these labels are a significant purchasing factor, as reported by a 2023 USDA study.

Market Challenges

- High Cost of Raw Materials: Supply chain disruptions, particularly in 2022 and 2023, have impacted the juice market, leading to higher costs for raw materials. Extreme weather conditions in key agricultural regions, such as California and Florida, have resulted in lower fruit yields, driving up the cost of juice production. The price of organic produce, a key ingredient in premium juice brands, has fluctuated, causing strain on both producers and consumers. According to the USDA, organic fruit prices increased by 8% in 2023, contributing to higher juice prices and challenging market growth for cost-sensitive consumers.

- Perishability and Short Shelf Life: The perishable nature of fresh juices remains a challenge for manufacturers and retailers. Juices, particularly those without preservatives, have a limited shelf life, often lasting only a few days. This leads to higher costs in storage, transportation, and waste management. According to a 2023 report from the USDA, nearly 25% of fresh juice products in retail stores are discarded due to spoilage, highlighting the issue of perishability. This short shelf-life impacts profitability, especially for cold-pressed and organic juice products, which are more susceptible to rapid deterioration.

USA Juice Market Future Outlook

Over the next five years, the USA juice market is expected to experience steady growth, driven by the continued rise in health consciousness, increasing demand for natural and organic products, and the growing popularity of functional beverages. Manufacturers are anticipated to invest heavily in innovation, focusing on plant-based beverages and fortifying juices with vitamins, minerals, and other health-boosting ingredients. The expansion of e-commerce and subscription-based delivery models is likely to further boost market growth as consumer convenience becomes a pivotal factor.

Future Market Opportunities

-

Introduction of Innovative Flavors: The U.S. juice market has seen growing interest in innovative flavors and functional additives. Exotic fruits like acai, dragon fruit, and lychee have been incorporated into juices, appealing to adventurous consumers seeking new taste experiences. Additionally, functional additives, such as adaptogens and antioxidants, are gaining popularity. According to a 2023 study by the U.S. Department of Agriculture, consumer demand for functional beverages, including juices infused with superfoods, rose by 10%, presenting a significant opportunity for juice brands to differentiate themselves through creative flavor and ingredient combinations.

- Expansion into Emerging Markets: There is a growing demand for regional and ethnic juice varieties in the U.S., particularly in multicultural urban areas. Juices derived from tropical fruits, such as guava and tamarind, are becoming increasingly popular among Hispanic and Asian communities. According to the U.S. Census Bureau, by 2024, ethnic minorities will make up over 40% of the U.S. population, reflecting the growing influence of diverse cultures on consumer preferences. This presents an opportunity for juice brands to cater to the evolving tastes of these demographic groups, boosting market growth.

Scope of the Report

|

By Product Type |

Cold-Pressed Juices Fruit Juices Vegetable Juices Juice Drinks |

|

By Distribution Channel |

E-commerce Supermarkets/Hypermarkets Convenience Stores Specialty Retailers |

|

By Consumer Segment |

Health-Conscious Consumers Families Millennials |

|

By Packaging Type |

PET Bottles Glass Bottles Cartons Cans |

|

By Region |

North East South West |

Products

Key Target Audience

Juice Manufacturers

Juice Packaging Providers

Ingredient Suppliers

Juice Distributors and Wholesalers

E-commerce Platforms (e.g., Amazon, Instacart)

Banks and Financial Institutes

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Companies

Players Mentioned in the Report:

- The Coca-Cola Company

- PepsiCo

- Tropicana Products, Inc.

- Naked Juice Company

- Suja Life, LLC

- Evolution Fresh

- Ocean Spray Cranberries, Inc.

- Welch’s

- Del Monte Foods, Inc.

- Simply Orange Juice Company

- Bolthouse Farms, Inc.

- Pressed Juicery

- R.W. Knudsen Family

- Lakewood Organic

- Odwalla

Table of Contents

1. USA Juice Market Overview

1.1. Definition and Scope (Fruit Juices, Vegetable Juices, Juice Blends)

1.2. Market Taxonomy (By Juice Type, By Distribution Channel, By Packaging)

1.3. Market Growth Rate (Volume Consumption, Market Penetration, Consumer Preference Shifts)

1.4. Market Segmentation Overview (By Product Type, By Consumer Segment, By Region)

2. USA Juice Market Size (In USD Bn)

2.1. Historical Market Size (By Value and Volume)

2.2. Year-On-Year Growth Analysis (Market Expansion, New Entrants)

2.3. Key Market Developments and Milestones (Mergers & Acquisitions, Product Innovations)

3. USA Juice Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness (Rise in Cold-Pressed Juices, Functional Beverages)

3.1.2. Changing Consumer Lifestyles (Demand for Convenience, On-the-Go Products)

3.1.3. Government Regulations and Support (FDA Guidelines, Organic Juice Labeling)

3.1.4. Expanding Distribution Channels (E-Commerce, Supermarkets, Specialty Stores)

3.2. Restraints

3.2.1. High Cost of Raw Materials (Supply Chain Disruptions, Organic Juice Price Fluctuations)

3.2.2. Growing Competition from Alternatives (Plant-Based Beverages, Enhanced Waters)

3.2.3. Perishability and Short Shelf Life

3.3. Opportunities

3.3.1. Introduction of Innovative Flavors (Exotic Fruits, Functional Additives)

3.3.2. Growth in Organic and Non-GMO Juices

3.3.3. Expansion into Emerging Markets (Regional Juices, Ethnic Varieties)

3.4. Trends

3.4.1. Adoption of Clean Labeling and Sustainability Initiatives

3.4.2. Rise in Cold-Pressed and Functional Juices

3.4.3. Increase in Plant-Based Juice Alternatives

3.5. Government Regulations

3.5.1. FDA Juice HACCP Regulation (Hazard Analysis, Critical Control Points)

3.5.2. Organic Certification Requirements

3.5.3. Labeling and Nutritional Claims (FDA Compliance)

3.5.4. Sugar Content Regulations and Consumer Health Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Supply Chain, Retailers, Consumers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Juice Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. 100% Fruit Juice

4.1.2. Juice Drinks (25%-99% Juice)

4.1.3. Cold-Pressed Juices

4.1.4. Organic Juices

4.1.5. Vegetable Juices

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. E-commerce

4.2.4. Specialty Retailers

4.3. By Consumer Segment (In Value %)

4.3.1. Health-Conscious Consumers

4.3.2. Families

4.3.3. Millennials

4.4. By Packaging Type (In Value %)

4.4.1. PET Bottles

4.4.2. Glass Bottles

4.4.3. Cartons

4.4.4. Cans

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. USA Juice Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. The Coca-Cola Company

5.1.2. PepsiCo

5.1.3. Tropicana Products, Inc.

5.1.4. Naked Juice Company

5.1.5. Ocean Spray Cranberries, Inc.

5.1.6. Del Monte Foods, Inc.

5.1.7. Welchs

5.1.8. Evolution Fresh

5.1.9. Suja Life, LLC

5.1.10. Simply Orange Juice Company

5.1.11. Bolthouse Farms, Inc.

5.1.12. Pressed Juicery

5.1.13. R.W. Knudsen Family

5.1.14. Lakewood Organic

5.1.15. Odwalla

5.2 Cross Comparison Parameters (Revenue, Distribution Network, Product Portfolio, Innovation, Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Funding

5.8 Government Grants and Subsidies

6. USA Juice Market Regulatory Framework

6.1. FDA Juice HACCP Regulations

6.2. Organic Certification Process

6.3. Labeling and Nutritional Information Compliance

6.4. Health and Safety Standards

7. USA Juice Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Juice Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Segment (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. USA Juice Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step in researching the USA juice market involves identifying all the significant variables, such as product innovation, consumer health trends, and distribution models. Extensive secondary research was conducted to map the industry ecosystem and gather reliable data from reputable sources.

Step 2: Market Analysis and Construction

In this phase, historical data on product segments, distribution channels, and sales performance were collected and analyzed to build an accurate model of the USA juice market. The analysis includes revenue generation and distribution trends.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were tested through consultations with industry experts, providing insights into consumer behavior, distribution shifts, and product preferences. These consultations were essential to verify the accuracy of the data and market projections.

Step 4: Research Synthesis and Final Output

The final synthesis of data was complemented by in-depth interviews with juice manufacturers and distributors, confirming the reliability of the findings. This ensured that the final report presents a validated and accurate picture of the USA juice market.

Frequently Asked Questions

01. How big is the USA Juice Market?

The USA juice market is valued at USD 13 Bn, driven by the growing demand for natural and organic juices and the increasing health consciousness among consumers.

02. What are the challenges in the USA Juice Market?

The key challenges in USA juice market include fluctuating raw material costs, competition from alternative beverages like enhanced water and plant-based drinks, and the need to comply with stringent regulatory guidelines.

03. Who are the major players in the USA Juice Market?

Key players in the USA juice market include PepsiCo, The Coca-Cola Company, Suja Life, LLC, Evolution Fresh, and Tropicana Products, Inc., with strong product innovation and distribution networks.

04. What are the growth drivers of the USA Juice Market?

The USA juice market is driven by rising health awareness, a shift towards clean-label products, and the growing popularity of cold-pressed and organic juices. E-commerce and subscription models are also significant contributors to growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.