USA K-Beauty Skincare Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD7184

December 2024

94

About the Report

USA K-Beauty Skincare Market Overview

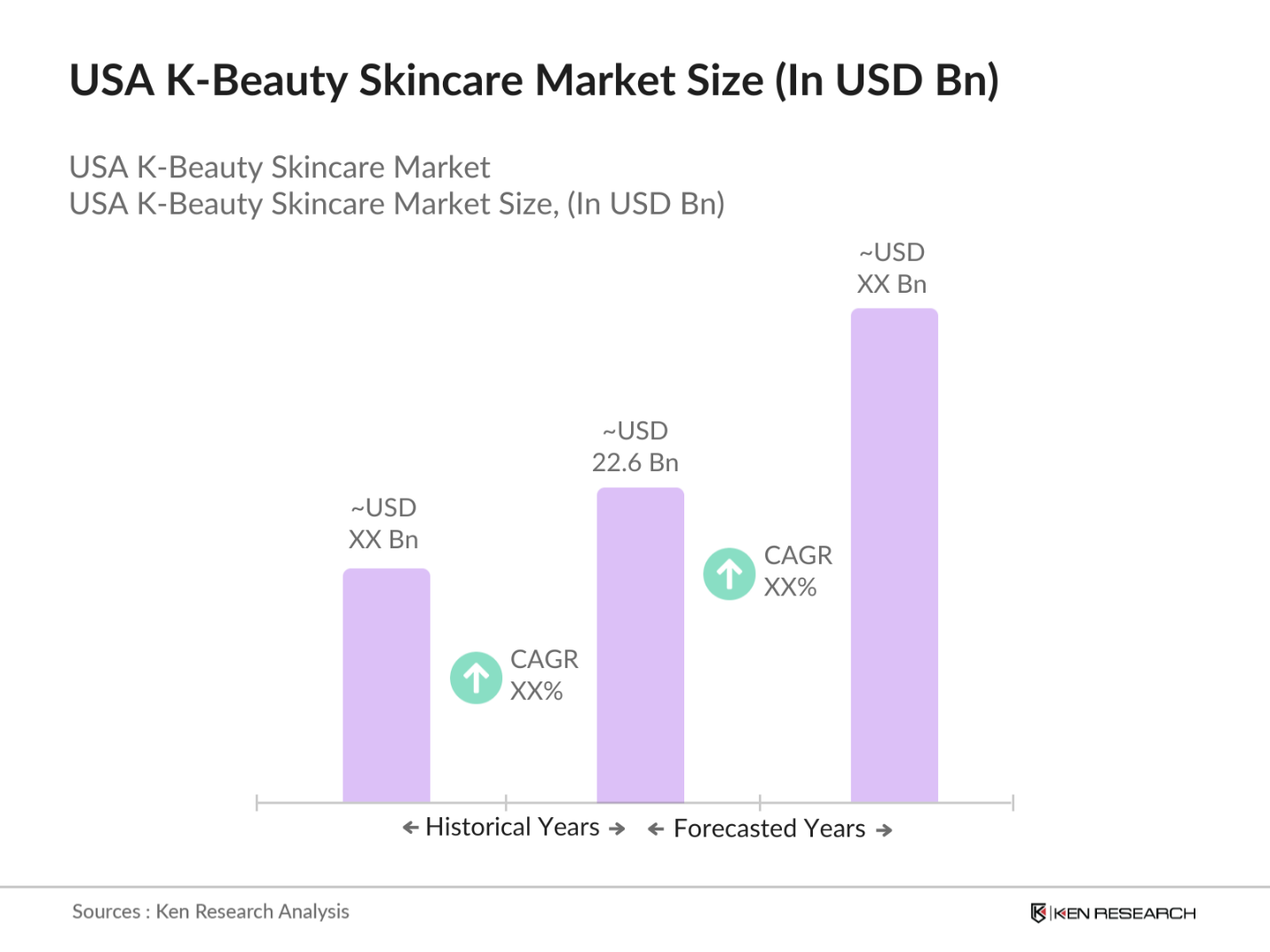

- The USA K-Beauty skincare market is valued at USD 22.6 billion, based on a five-year historical analysis. This market is primarily driven by the surging consumer interest in skincare routines influenced by South Korean beauty trends, renowned for their emphasis on natural ingredients and multi-step regimes. The market is also fueled by the growing awareness of advanced skincare solutions and the increasing presence of K-Beauty products in major retail and e-commerce platforms.

- Key cities like New York, Los Angeles, and San Francisco dominate the market due to their large urban populations, cultural diversity, and consumer receptivity to international beauty trends. These cities have a significant number of specialty stores, beauty boutiques, and high consumer spending power, making them prime hubs for the proliferation of K-Beauty products.

- Obtaining certifications such as USDA Organic, Leaping Bunny, and EWG Verified can enhance the marketability of K-Beauty products in the U.S. In 2023, the Environmental Working Group (EWG) reported a 30% increase in applications for its EWG Verified mark, reflecting a growing emphasis on product transparency and safety. Achieving these certifications requires compliance with stringent standards but offers a competitive advantage by appealing to health-conscious and ethically minded consumers.

USA K-Beauty Skincare Market Segmentation

By Product Type: The market is segmented by product type into cleansers, toners, essences and serums, moisturizers, and sheet masks and treatments. Essences and serums have a dominant market share under this segmentation due to their targeted approach to addressing specific skin concerns such as hydration, anti-aging, and brightening. The popularity of products like ampoules and serums is driven by their high concentration of active ingredients, which offer quick and noticeable results, aligning with consumer expectations.

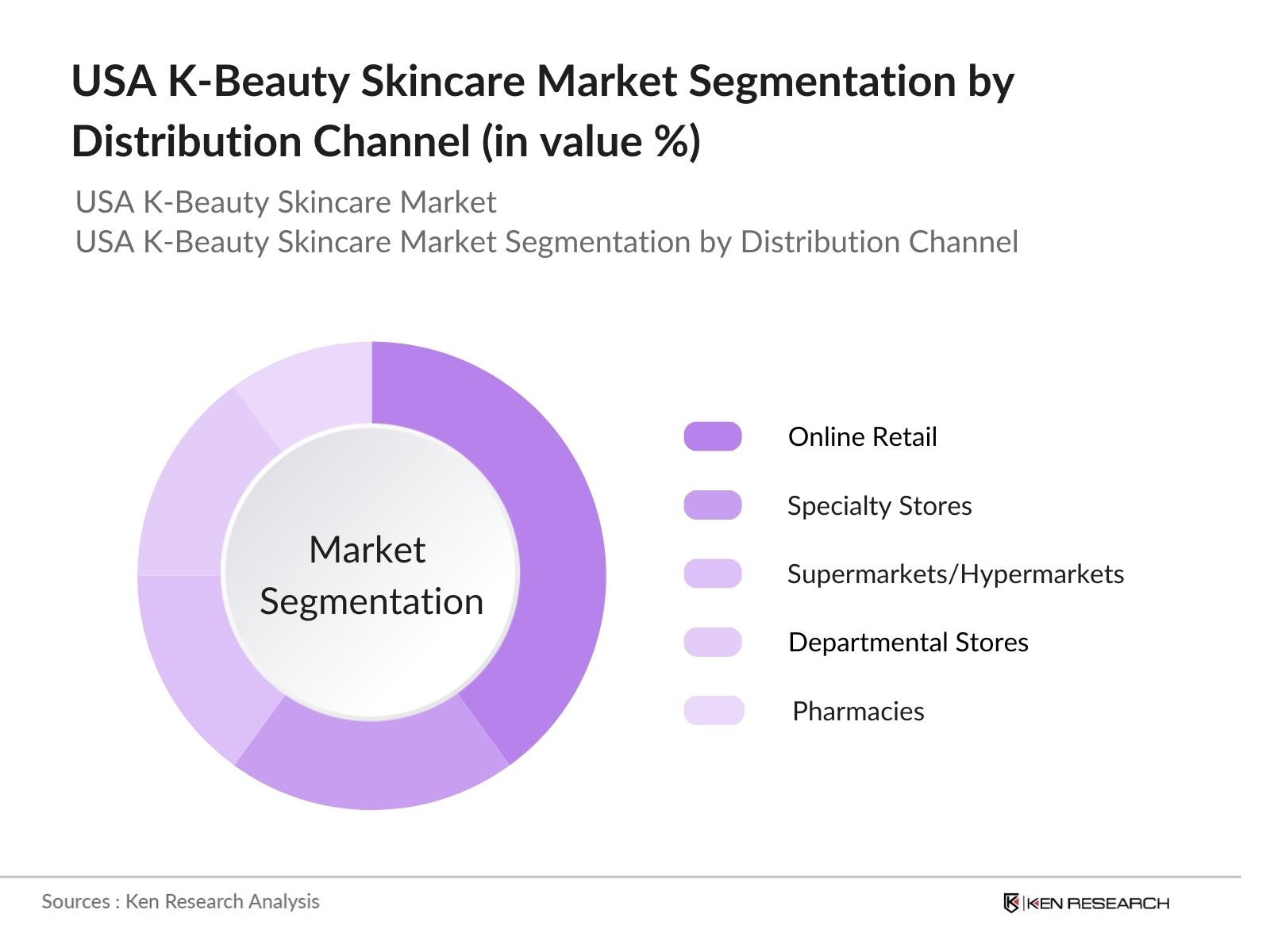

By Distribution Channel: The market is also segmented by distribution channels into online retail, specialty stores, supermarkets and hypermarkets, departmental stores, and pharmacies. Online retail holds a dominant share due to the widespread use of digital platforms and consumer preference for convenience and accessibility. The rise of e-commerce giants like Amazon and specialized beauty platforms such as Soko Glam has significantly contributed to this channels growth, allowing consumers nationwide to access a vast array of K-Beauty products.

USA K-Beauty Skincare Market Competitive Landscape

The USA K-Beauty skincare market is competitive, with both established South Korean brands and emerging local players influencing the landscape. The market is dominated by well-known brands that leverage innovation, unique formulations, and strong marketing strategies. The USA K-Beauty market is defined by the presence of these key players, showcasing innovative product lines and strong global outreach.

USA K-Beauty Skincare Industry Analysis

Growth Drivers

- Rising Consumer Preference for Natural Ingredients: In the United States, there is a significant consumer shift towards natural and organic skincare products. According to the Organic Trade Association, the U.S. organic personal care market, which includes skincare products, reached $4.6 billion in sales in 2022. This trend aligns with the K-Beauty industry's emphasis on natural ingredients like ginseng, green tea, and snail mucin, making these products increasingly appealing to health-conscious American consumers.

- Growing Popularity of Multi-step Skincare Routines: The multi-step skincare regimen, a hallmark of K-Beauty, has gained traction among U.S. consumers seeking comprehensive skincare solutions. A survey by the NPD Group in 2023 indicated that 40% of American women aged 18-34 follow a skincare routine involving three or more steps, reflecting the influence of K-Beauty practices. This adoption underscores the demand for diverse skincare products, including cleansers, toners, serums, and moisturizers.

- Technological Advancements in Skincare Products: K-Beauty brands are at the forefront of integrating innovative technologies into skincare. The incorporation of ingredients like hyaluronic acid and peptides, known for their efficacy in skin hydration and anti-aging, has resonated with U.S. consumers. Additionally, the development of products utilizing fermentation processes enhances ingredient potency, catering to the American market's demand for effective skincare solutions.

Market Challenges

- High Competition from Domestic and International Brands: The U.S. skincare market is highly competitive, with established domestic brands and international entrants vying for consumer attention. According to research, the U.S. skincare market generated $18 billion in revenue in 2023, with numerous brands competing for market share. This saturation presents a challenge for K-Beauty brands to differentiate themselves and capture a significant portion of the market.

- Regulatory Compliance and Import Tariffs: Navigating the U.S. regulatory landscape poses challenges for K-Beauty brands. The Food and Drug Administration (FDA) enforces stringent guidelines on cosmetic imports, requiring accurate labeling and safety compliance. Additionally, import tariffs can affect pricing strategies, potentially impacting the competitiveness of K-Beauty products in the U.S. market.

USA K-Beauty Skincare Market Future Outlook

Over the next five years, the USA K-Beauty skincare market is expected to witness sustained growth fueled by continued consumer interest in personalized skincare solutions, technological advancements in product formulations, and the increasing trend of holistic beauty routines. As consumer awareness grows, there will be a stronger demand for transparency in ingredient sourcing and sustainable practices, reinforcing the markets emphasis on eco-friendly products.

Future Market Opportunities

- Expansion into Mens Skincare and Grooming: The men's grooming market in the U.S. is experiencing growth, with research reporting sales of men's personal care products reaching $11.6 billion in 2023. K-Beauty brands have the opportunity to cater to this segment by offering specialized skincare solutions tailored to men's needs, such as lightweight moisturizers and aftershave treatments.

- Collaborations with Influencers and Celebrity Endorsements: Influencer marketing continues to be a powerful tool in the beauty industry. A study by Influencer Marketing Hub reported that businesses earn an average of $5.20 for every dollar spent on influencer marketing in 2023. K-Beauty brands can capitalize on this by partnering with influencers and celebrities to enhance brand visibility and credibility among U.S. consumers.

Scope of the Report

|

Product Type |

Cleansers Toners Essences and Serums Moisturizers Sheet Masks and Treatments |

|

Skin Type |

Normal Skin Oily Skin Dry Skin Sensitive Skin Combination Skin |

|

Distribution Channel |

Online Retail Specialty Stores Supermarkets and Hypermarkets Departmental Stores Pharmacies |

|

End-User |

Individual Consumers Spas and Salons Dermatology Clinics Hotels and Resorts Online Subscription Services |

|

Region |

West Coast East Coast Midwest South Mountain States |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, U.S. Trade Commission)

K-Beauty Skincare Product Manufacturers

Online and Offline Retailers

Dermatology Clinics and Professional Associations

Spa and Wellness Centers

E-commerce Platforms

Distributors and Wholesalers

Companies

Major Players

Amorepacific Corporation

LG Household & Health Care

The Face Shop

Dr. Jart+

Innisfree

COSRX

Sulwhasoo

Laneige

Etude House

Missha

Banila Co.

Klairs

Skinfood

Nature Republic

Tony Moly

Table of Contents

1. USA K-Beauty Skincare Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA K-Beauty Skincare Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA K-Beauty Skincare Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Preference for Natural Ingredients

3.1.2. Growing Popularity of Multi-step Skincare Routines

3.1.3. Influence of Social Media and K-Pop Culture

3.1.4. Technological Advancements in Skincare Products

3.2. Market Challenges

3.2.1. High Competition from Domestic and International Brands

3.2.2. Regulatory Compliance and Import Tariffs

3.2.3. Supply Chain Disruptions

3.2.4. Consumer Perception and Trust Issues

3.3. Opportunities

3.3.1. Expansion into Mens Skincare and Grooming

3.3.2. Sustainable and Eco-Friendly Product Demand

3.3.3. Rising Demand for Customizable Skincare Solutions

3.3.4. Collaborations with Influencers and Celebrity Endorsements

3.4. Trends

3.4.1. Clean Beauty and Minimalist Skincare

3.4.2. Inclusion of Advanced Dermatology Technologies

3.4.3. Rise of Vegan and Cruelty-Free Skincare

3.4.4. Growth of E-commerce and Subscription Boxes

3.5. Government Regulation

3.5.1. FDA Regulations and Labeling Requirements

3.5.2. Import Duties and Trade Policies

3.5.3. Compliance with US Cosmetic Safety Standards

3.5.4. Certifications and Approval Processes

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. USA K-Beauty Skincare Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cleansers

4.1.2. Toners

4.1.3. Essences and Serums

4.1.4. Moisturizers

4.1.5. Sheet Masks and Treatments

4.2. By Skin Type (In Value %)

4.2.1. Normal Skin

4.2.2. Oily Skin

4.2.3. Dry Skin

4.2.4. Sensitive Skin

4.2.5. Combination Skin

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Specialty Stores

4.3.3. Supermarkets and Hypermarkets

4.3.4. Departmental Stores

4.3.5. Pharmacies

4.4. By End-User (In Value %)

4.4.1. Individual Consumers

4.4.2. Spas and Salons

4.4.3. Dermatology Clinics

4.4.4. Hotels and Resorts

4.4.5. Online Subscription Services

4.5. By Region (In Value %)

4.5.1. West Coast

4.5.2. East Coast

4.5.3. Midwest

4.5.4. South

4.5.5. Mountain States

5. USA K-Beauty Skincare Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amorepacific Corporation

5.1.2. LG Household & Health Care

5.1.3. The Face Shop

5.1.4. Dr. Jart+

5.1.5. Innisfree

5.1.6. COSRX

5.1.7. Sulwhasoo

5.1.8. Laneige

5.1.9. Etude House

5.1.10. Missha

5.1.11. Banila Co.

5.1.12. Klairs

5.1.13. Skinfood

5.1.14. Nature Republic

5.1.15. Tony Moly

5.2. Cross Comparison Parameters (Market Share %, Revenue, Innovation Index, Sustainability Practices, Marketing Strategies, Brand Popularity, Distribution Network, Product Diversification)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

5.9. Joint Ventures and Partnerships

6. USA K-Beauty Skincare Market Regulatory Framework

6.1. FDA Skincare Product Regulations

6.2. Import and Export Regulations

6.3. Labeling and Marketing Standards

6.4. Compliance with International Trade Norms

7. USA K-Beauty Skincare Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA K-Beauty Skincare Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Skin Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USA K-Beauty Skincare Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Consumer Behavior and Cohort Analysis

9.3. Marketing Initiatives

9.4. Identification of White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

This phase involved mapping the ecosystem of stakeholders in the USA K-Beauty skincare market. Extensive desk research was conducted using secondary and proprietary databases to gather comprehensive industry insights and define critical variables influencing market trends.

Step 2: Market Analysis and Construction

We compiled and assessed historical data on the markets penetration and the performance of various product segments. This step included evaluating product sales data, consumer purchasing patterns, and revenue trends to develop reliable estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through structured interviews with industry experts, including top-level executives from major K-Beauty brands. This input was crucial for corroborating data and refining our analysis.

Step 4: Research Synthesis and Final Output

Data gathered was synthesized and analyzed to create an actionable report. Cross-verification was conducted with market participants to ensure accuracy and reliability, supporting a thorough examination of the USA K-Beauty skincare market.

Frequently Asked Questions

01 How big is the USA K-Beauty Skincare Market?

The USA K-Beauty skincare market is valued at USD 22.6 billion, driven by strong consumer interest in Korean beauty regimens and a well-established distribution network.

02 What are the key growth drivers of the USA K-Beauty Skincare Market?

The USA K-Beauty skincare markets growth is propelled by increased awareness of Korean skincare practices, the efficacy of unique product formulations, and the influence of social media and K-Pop culture.

03 Who are the major players in the USA K-Beauty Skincare Market?

Key players in the USA K-Beauty skincare market include Amorepacific Corporation, LG Household & Health Care, The Face Shop, Dr. Jart+, and COSRX, known for their innovative products and strong distribution channels.

04 What are the challenges faced by the USA K-Beauty Skincare Market?

Challenges in the USA K-Beauty skincare market include high competition from both domestic and international brands, regulatory compliance issues, and supply chain disruptions impacting product availability.

05 What trends are shaping the future of the USA K-Beauty Skincare Market?

Trends in the USA K-Beauty skincare market such as clean beauty, vegan products, personalized skincare, and technological advancements in product formulation are significantly shaping the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.