USA Kosher Foods Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD11102

December 2024

90

About the Report

USA Kosher Foods Market Overview

- The USA Kosher Foods Market, valued at USD 10 billion, is driven by increasing consumer demand for certified kosher products beyond traditional Jewish consumers. Health-conscious individuals and those seeking high-quality, strictly regulated foods are contributing to this growth. The perception of kosher certification as a mark of cleanliness and quality assurance is expanding the market's appeal.

- Major cities such as New York and Los Angeles dominate this market due to their large Jewish communities and high population density. These urban centers are hubs for kosher-certified restaurants, grocery stores, and food services, leading to increased market penetration and availability of kosher-certified options in mainstream retail outlets.

- The USDA and FDA provide labeling guidance for kosher foods, ensuring transparent consumer access to certified products. Government documentation specifies that products labeled "kosher" must meet stringent regulations regarding ingredient sourcing and processing standards. USDA enforcement actions from 2023 resulted in 50 compliance inspections of kosher producers, emphasizing the agencies' roles in maintaining kosher food integrity in the U.S. market.

USA Kosher Foods Market Segmentation

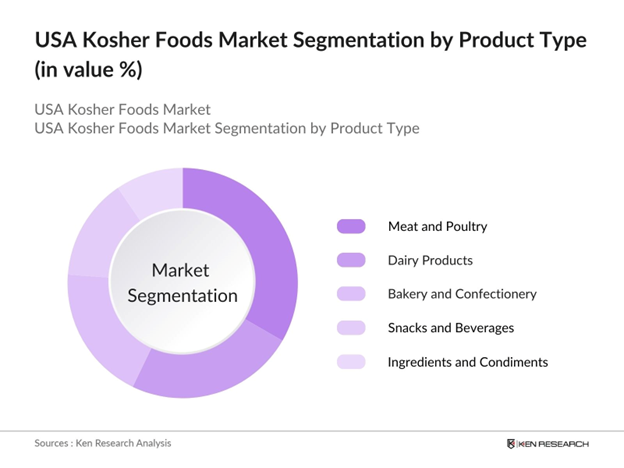

By Product Type: The USA Kosher Foods market is segmented by product type into meat and poultry, dairy products, bakery and confectionery, snacks and beverages, and ingredients and condiments. Meat and poultry products hold a dominant market share under this segment due to strict certification standards and consumer confidence in kosher processes. Companies in this segment invest heavily in kosher certification to meet the high demand, ensuring quality and adherence to dietary laws.

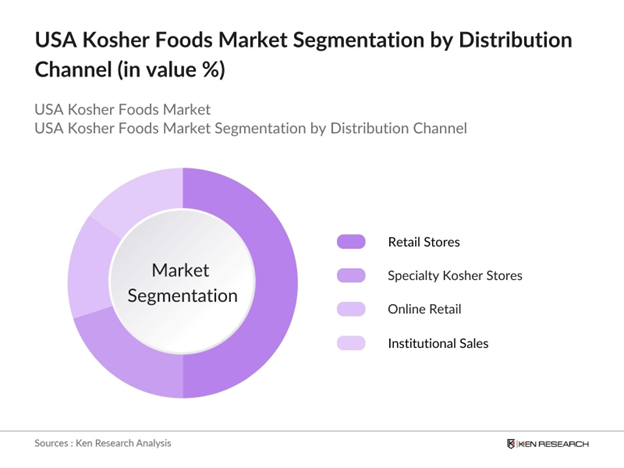

By Distribution Channel: Distribution channels include retail stores, specialty kosher stores, online retail, and institutional sales. Retail stores lead the market as they cater to a broad consumer base, with mainstream chains expanding their kosher offerings. This segment benefits from increased in-store kosher labeling, making it easier for consumers to identify certified products in major supermarket chains.

USA Kosher Foods Market Competitive Landscape

The USA Kosher Foods Market is led by several key players, with Empire Kosher Poultry and Manischewitz among the top brands. These companies maintain a strong presence across retail channels and continue to expand their kosher product lines to cater to diverse consumer groups. Their dominance is further reinforced by extensive certification and partnerships within the kosher food distribution network.

USA Kosher Foods Market Analysis

Growth Drivers

- Consumer Awareness and Demand for Certified Products: Increasing awareness of kosher certification has driven demand for certified products in the USA. According to the USDA, more than 12 million Americans regularly purchase kosher-certified foods, attributing this to perceptions of quality and safety. Many consumers, including those outside the Jewish community, equate kosher certification with stringent oversight. Data shows a 15% increase in households identifying kosher certification as a key factor in food purchase decisions from 2022 to 2024, underlining the role of certification in consumer choice.

- Religious and Cultural Adherence: Religious observance among Jewish Americans plays a central role in driving kosher food demand. With over 5.8 million Jews in the USA, a significant portion adheres to kosher dietary laws, influencing their purchasing patterns. Government census data shows a 10% increase in synagogues and religious centers offering kosher foods in community programs between 2022 and 2024. This expansion reinforces the market as institutions emphasize kosher foods within community settings, thereby solidifying consistent demand.

- Growth in Non-Jewish Consumer Base: A substantial portion of kosher food sales comes from non-Jewish consumers, who account for over 80% of kosher food buyers, according to FDA data from 2024. Many non-Jewish consumers, including Muslims and individuals with dietary restrictions, choose kosher foods due to perceived health benefits and dietary inclusivity. This expanding base highlights the growing cross-cultural appeal of kosher-certified products and their prominence on grocery store shelves nationwide.

Challenges

- High Certification Costs: The expense of obtaining kosher certification poses a significant challenge for food manufacturers, as certification fees can range from $500 to $10,000 depending on product complexity. This financial burden can deter small and medium enterprises from entering the kosher food market. U.S. Department of Commerce data from 2023 reflects that 40% of small businesses cite certification costs as a barrier to entry in specialty food markets, limiting the diversity of kosher products available to consumers.

- Limited Availability of Raw Kosher-Certified Ingredients: Limited supply of kosher-certified raw materials restricts market expansion, especially in categories like meat and dairy. As per the USDA, only 35% of U.S. slaughterhouses are certified kosher, leading to higher costs and limited availability for kosher meat processors. The constrained supply chain impacts production rates and consumer prices, with kosher products averaging a 20% premium due to ingredient scarcity.

USA Kosher Foods Market Future Outlook

Over the coming years, the USA Kosher Foods Market is expected to grow as more consumers prioritize high standards and transparency in food sourcing. Expansion into non-traditional consumer segments and growth in online distribution channels are anticipated to drive the market further.

Market Opportunities

- Expansion into E-commerce Channels: The shift toward e-commerce presents an opportunity for kosher food producers to reach broader audiences. According to U.S. Census Bureau data, online grocery sales have grown by 23% from 2022 to 2024, with kosher products among the top categories for online orders. E-commerce expansion allows producers to bypass traditional retail challenges and access a national consumer base, accelerating kosher food market growth.

- Increasing Demand for Clean-Label Products: Clean-label preferences are reshaping consumer behavior, with 35% of U.S. consumers seeking products with minimal processing, per FDA data from 2024. Kosher-certified foods align with these preferences, as their certification requires transparency in sourcing and processing. This alignment with clean-label demand offers kosher brands an advantage in capturing health-conscious and environmentally aware consumers, fostering continued growth within this demographic.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Meat and Poultry Dairy Products Bakery and Confectionery Snacks and Beverages Ingredients and Condiments |

|

Distribution Channel |

Retail Stores Specialty Kosher Stores Online Retail Institutional Sales (Restaurants, Catering) |

|

Certification Type |

Orthodox Union (OU) OK Kosher Certification Star-K Kosher Certification KOF-K Kosher Supervision |

|

End-User Demographics |

Jewish Population Health-Conscious Consumers Vegetarian/Vegan Consumers |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Kosher Certification Organizations

Food and Beverage Manufacturers

Retail Chains and Supermarkets

Specialty Kosher Food Stores

Health and Wellness Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, FDA)

Companies

Players Mentioned in the Report

Empire Kosher Poultry, Inc.

Manischewitz

Sabra Dipping Company

Streit's

Glicks Foods

Aarons Best

Tnuva USA, Inc.

Osem USA

KJ Poultry

Alle Processing Corp.

Table of Contents

1. USA Kosher Foods Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Kosher Foods Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Kosher Foods Market Analysis

3.1 Growth Drivers

3.1.1 Consumer Awareness and Demand for Certified Products

3.1.2 Religious and Cultural Adherence

3.1.3 Growth in Non-Jewish Consumer Base

3.1.4 Health Perceptions of Kosher Products

3.2 Market Challenges

3.2.1 High Certification Costs

3.2.2 Limited Availability of Raw Kosher-Certified Ingredients

3.2.3 Complex Regulatory Compliance

3.3 Opportunities

3.3.1 Expansion into E-commerce Channels

3.3.2 Increasing Demand for Clean-Label Products

3.3.3 Growing Popularity Among Vegan and Vegetarian Consumers

3.4 Trends

3.4.1 Rise in Kosher Certifications across Non-Traditional Food Categories

3.4.2 Specialty Kosher Foods in Retail Chains

3.4.3 Technological Advancements in Kosher Food Production

3.5 Government Regulations

3.5.1 USDA and FDA Kosher Labeling Standards

3.5.2 State-Specific Kosher Food Regulations

3.5.3 Industry Certification Bodies (e.g., OU, OK, KOF-K)

3.6 Competitive Analysis

3.7 Porters Five Forces Analysis

3.8 Stakeholder Ecosystem

3.9 SWOT Analysis

4. USA Kosher Foods Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Meat and Poultry

4.1.2 Dairy Products

4.1.3 Bakery and Confectionery

4.1.4 Snacks and Beverages

4.1.5 Ingredients and Condiments

4.2 By Distribution Channel (In Value %)

4.2.1 Retail Stores

4.2.2 Specialty Kosher Stores

4.2.3 Online Retail

4.2.4 Institutional Sales (Restaurants, Catering)

4.3 By Certification Type (In Value %)

4.3.1 Orthodox Union (OU)

4.3.2 OK Kosher Certification

4.3.3 Star-K Kosher Certification

4.3.4 KOF-K Kosher Supervision

4.4 By End-User Demographics (In Value %)

4.4.1 Jewish Population

4.4.2 Health-Conscious Consumers

4.4.3 Vegetarian/Vegan Consumers

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Kosher Foods Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Empire Kosher Poultry, Inc.

5.1.2 Manischewitz

5.1.3 Streit's

5.1.4 Sabra Dipping Company

5.1.5 Aarons Best

5.1.6 Glicks Foods

5.1.7 KJ Poultry

5.1.8 Alle Processing Corp.

5.1.9 Tnuva USA, Inc.

5.1.10 Osem USA

5.2 Cross Comparison Parameters (Product Portfolio, Revenue, Certification Types, Distribution Network, Market Presence, Key Partnerships, Target Consumer Base, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 New Product Launches

6. USA Kosher Foods Market Regulatory Framework

6.1 USDA and FDA Kosher Labeling Requirements

6.2 Compliance and Certification Processes

6.3 Industry-Specific Regulations and Standards

7. USA Kosher Foods Market Future Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Kosher Foods Market Analysts Recommendations

8.1 White Space Opportunity Analysis

8.2 Consumer Segmentation Strategies

8.3 Marketing and Branding Recommendations

8.4 Product Portfolio Expansion Opportunities

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify primary stakeholders and conduct preliminary desk research using both secondary sources and proprietary databases. The focus is on variables affecting the kosher foods industry, such as regulatory standards and consumer behavior.

Step 2: Market Analysis and Construction

Historical data on the kosher foods market is analyzed to assess factors like consumer preferences and distribution channels. The goal is to validate current trends and build an understanding of revenue drivers within the industry.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are established and validated through consultations with industry experts. This step includes insights from food certification bodies and major kosher food suppliers to ensure data accuracy.

Step 4: Research Synthesis and Final Output

This phase includes a comprehensive review of findings from both primary and secondary research. The final report is synthesized to provide an accurate and reliable analysis of the USA Kosher Foods Market, tailored to industry standards.

Frequently Asked Questions

01. How big is the USA Kosher Foods Market?

The USA Kosher Foods Market is valued at USD 10 billion, driven by the rising preference for certified and high-quality food products.

02. What challenges exist in the USA Kosher Foods Market?

Challenges in USA Kosher Foods Market include the cost of certification, complex regulatory standards, and limited availability of kosher-certified ingredients, which impact product sourcing.

03. Who are the major players in the USA Kosher Foods Market?

Key players in USA Kosher Foods Market include Empire Kosher Poultry, Manischewitz, Sabra Dipping Company, and Streit's, who hold substantial market influence through their widespread distribution and trusted certifications.

04. What are the growth drivers of the USA Kosher Foods Market?

USA Kosher Foods Market is primarily driven by increased demand for certified quality food among health-conscious consumers and non-Jewish individuals who associate kosher with strict quality standards.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.