USA Legal Marijuana Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD11140

November 2024

99

About the Report

USA Legal Marijuana Market Overview

- The USA Legal Marijuana Market is valued at USD 12 billion, driven primarily by rapid state-level legalization, increasing consumer acceptance, and heightened medical applications. With both recreational and medical marijuana gaining broader public support, consumer demand has surged, especially in regions like California, Colorado, and Illinois, where mature legal frameworks facilitate growth.

- California, Colorado, and Illinois dominate the USA Legal Marijuana Market due to progressive legalization frameworks, established dispensary networks, and consumer base maturity. California's significant population, coupled with its pioneering stance on legalization, makes it the largest market. Colorado and Illinois follow, owing to robust regulatory environments, extensive cultivation capacities, and the presence of multiple dispensaries, driving consumer accessibility and market expansion.

- Licensing remains a critical compliance challenge, with states like California requiring businesses to adhere to detailed cultivation, distribution, and retail regulations. In 2023, Californias Department of Cannabis Control issued over 8,000 licenses, demonstrating regulatory complexity and the need for substantial compliance resources. These requirements also influence costs, impacting profitability for smaller operators

USA Legal Marijuana Market Segmentation

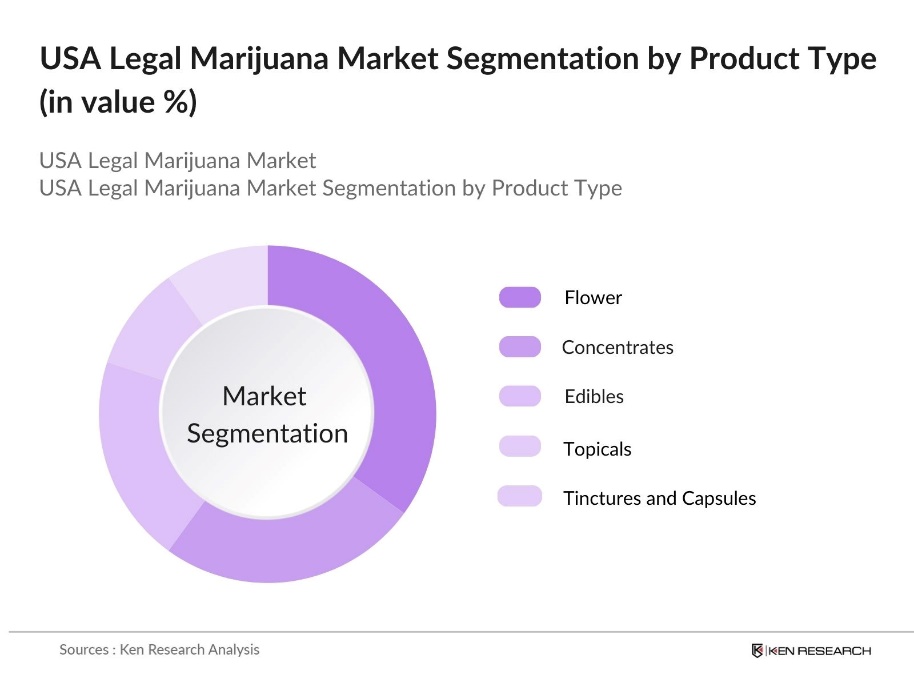

By Product Type: The market is segmented by product type into flower, concentrates, edibles, topicals, and tinctures/capsules. Recently, flower holds a dominant market share under this segmentation due to its traditional consumer popularity, ease of access, and cost-effectiveness compared to other forms. As flower remains the most recognizable form of marijuana, consumers new to the market often choose it, contributing to its dominance.

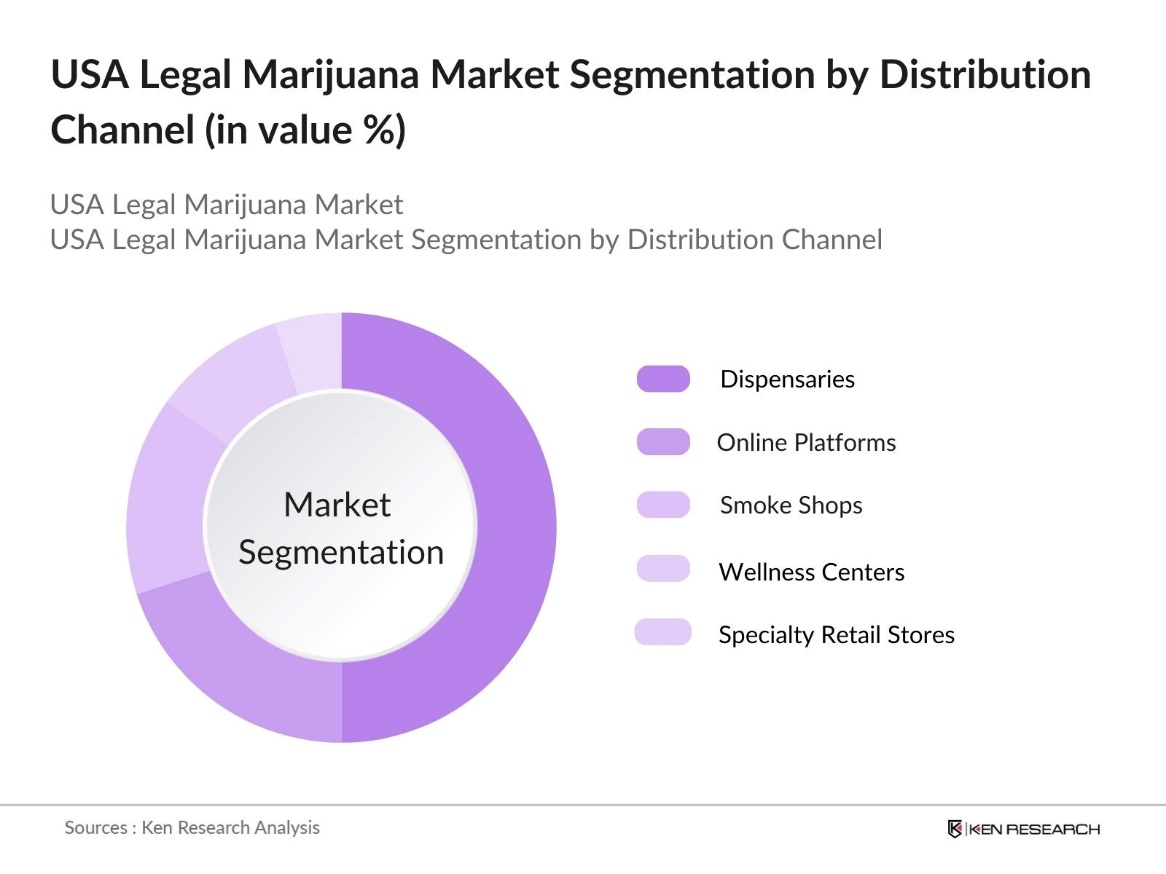

By Distribution Channel: The market is segmented by distribution channel into dispensaries, online platforms, smoke shops, wellness centers, and specialty retail stores. Dispensaries dominate this segment, largely due to regulatory preferences for direct sales and in-person purchasing requirements in several states. Dispensaries also offer an opportunity for consumer education, personalized recommendations, and access to regulated products, making them the most favored channel.

USA Legal Marijuana Market Competitive Landscape

The USA Legal Marijuana Market is dominated by major players with established reputations and extensive distribution networks, including Curaleaf Holdings, Green Thumb Industries, Trulieve Cannabis Corp., Cresco Labs, and Canopy Growth Corporation. This consolidation underscores the market's competitive nature and the advantage held by companies with significant capital, experience in regulatory compliance, and diversified product portfolios.

USA Legal Marijuana Industry Analysis

Growth Drivers

- Legalization Trends: The trend of legalizing marijuana in the U.S. has notably strengthened in 2024, with 24 states fully legalizing recreational use. States like New York and New Jersey recently rolled out adult-use dispensaries, increasing access to regulated cannabis products and generating revenue streams for state governments. In New York alone, legalized marijuana contributed and illustrating its economic impact. This trend is fueled by potential tax revenues; Colorado.

- Medical and Therapeutic Applications: In 2024, nearly 4 million Americans utilized medical marijuana prescriptions, covering a broad spectrum of conditions, including chronic pain, epilepsy, and PTSD. Research published by the National Institutes of Health (NIH) suggests that cannabis-based therapies are associated with a 27% reduction in opioid prescriptions in states with legalized medical marijuana. This demonstrates marijuanas therapeutic role in curbing opioid dependence while serving as an alternative treatment, especially in states with high rates of opioid-related fatalities.

- Economic Impact and Job Creation: The legal marijuana industry significantly boosts the U.S. economy, creating numerous jobs across cultivation, manufacturing, and retail sectors. In states with legalized cannabis, thousands of positions are filled annually, supporting local economies. Additionally, tax revenues from cannabis sales contribute to state budgets, funding public services like health and education, making cannabis legalization a powerful catalyst for economic growth and community development.

Market Challenges

- Federal Restrictions: Federal prohibition remains a major challenge for the cannabis industry, despite state-level legalization. Cannabis is still classified as a Schedule I substance, creating significant legal and financial obstacles for businesses, particularly in accessing banking services. Without federal support, many cannabis businesses struggle with compliance and security issues, as legislation aimed at providing financial protections continues to face delays, restricting the industrys growth potential.

- Taxation and Compliance Costs: Cannabis businesses face unusually high tax rates due to limitations on deductions, which reduces profitability. Unlike other sectors, cannabis companies cannot deduct regular business expenses, creating a significant tax burden. Additionally, complex compliance requirements add financial strain, putting cannabis businesses at a competitive disadvantage. These taxation and compliance hurdles make it challenging for smaller businesses to thrive and limit the overall industry growth.

USA Legal Marijuana Market Future Outlook

Over the coming years, the USA Legal Marijuana Market is projected to maintain strong growth, driven by increased state-level legalization, expanding applications in medical and wellness spaces, and growing consumer education and demand. Major players are expected to scale operations as federal attitudes continue to evolve, fostering market expansion and investment in research, quality control, and distribution innovations.

Market Opportunities

- Expansion into New States and Regions: The expansion of cannabis legalization into additional states presents a significant opportunity for industry growth. As more states move towards recreational and medical legalization, new markets are opening up, increasing consumer access and demand. Regions with limited current access, particularly in the southeastern U.S., have considerable growth potential, as changes in state policies allow for more comprehensive cannabis markets and broader consumer adoption.

- International Market Opportunities: With global cannabis markets gradually emerging, U.S. companies have opportunities to expand internationally. Countries like Germany and Mexico are advancing their legalization efforts, creating a demand for expertise and products that established American companies can provide. Canadas experience with nationwide legalization offers a model for U.S. companies looking to enter international markets, particularly in Europe, where cannabis legalization is steadily progressing.

Scope of the Report

|

By Product Type |

Flower Concentrates Edibles Topicals Tinctures and Capsules |

|

By Distribution Channel |

Dispensaries Online Platforms Smoke Shops Wellness Centers Specialty Retail Stores |

|

By End-Use |

Medical Use Recreational Use Industrial Hemp Personal Care and Cosmetics |

|

By Cannabinoid Profile |

THC-Dominant CBD-Dominant Balanced THC/CBD Minor Cannabinoids (CBG, CBN) |

|

By Region |

West Northeast Midwest South Federal Territories |

Products

Key Target Audience

Cannabis Cultivation Firms

Cannabis Extraction and Processing Companies

Pharmaceutical and Biotechnology Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, USDA)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Curaleaf Holdings

Green Thumb Industries

Trulieve Cannabis Corp.

Cresco Labs

Canopy Growth Corporation

Tilray, Inc.

Aurora Cannabis

MedMen Enterprises

Aphria Inc.

TerrAscend

Table of Contents

1. USA Legal Marijuana Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Legal Milestones and Developments

1.4. Regulatory Landscape Overview

2. USA Legal Marijuana Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Legislative Milestones

3. USA Legal Marijuana Market Analysis

3.1. Growth Drivers

3.1.1. Legalization Trends

3.1.2. Shifts in Public Perception and Usage

3.1.3. Medical and Therapeutic Applications

3.1.4. Economic Impact and Job Creation

3.2. Market Challenges

3.2.1. Federal Restrictions

3.2.2. Taxation and Compliance Costs

3.2.3. Interstate Commerce Limitations

3.2.4. Supply Chain and Product Safety Standards

3.3. Opportunities

3.3.1. Expansion into New States and Regions

3.3.2. International Market Opportunities

3.3.3. Investment in Research and Development

3.3.4. Consumer Education and Product Innovation

3.4. Trends

3.4.1. Emergence of Edibles and Beverages

3.4.2. Rise of Online and Delivery Services

3.4.3. Integration with Wellness and Fitness

3.4.4. Greenhouse and Indoor Cultivation Technology

3.5. Regulatory Framework

3.5.1. State-Level Legalization Status

3.5.2. Licensing and Compliance Requirements

3.5.3. Product Labeling and Safety Standards

3.5.4. Advertising and Marketing Restrictions

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Legal Marijuana Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Flower

4.1.2. Concentrates

4.1.3. Edibles

4.1.4. Topicals

4.1.5. Tinctures and Capsules

4.2. By Distribution Channel (In Value %)

4.2.1. Dispensaries

4.2.2. Online Platforms

4.2.3. Smoke Shops

4.2.4. Wellness Centers

4.2.5. Specialty Retail Stores

4.3. By End-Use (In Value %)

4.3.1. Medical Use

4.3.2. Recreational Use

4.3.3. Industrial Hemp

4.3.4. Personal Care and Cosmetics

4.4. By Cannabinoid Profile (In Value %)

4.4.1. THC-Dominant

4.4.2. CBD-Dominant

4.4.3. Balanced THC/CBD

4.4.4. Minor Cannabinoids (CBG, CBN, etc.)

4.5. By Region (In Value %)

4.5.1. West

4.5.2. North

4.5.3. East

4.5.4. South

5. USA Legal Marijuana Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Curaleaf Holdings

5.1.2. Green Thumb Industries

5.1.3. Trulieve Cannabis Corp.

5.1.4. Cresco Labs

5.1.5. Canopy Growth Corporation

5.1.6. Tilray, Inc.

5.1.7. Aurora Cannabis

5.1.8. MedMen Enterprises

5.1.9. Aphria Inc.

5.1.10. TerrAscend

5.1.11. Harvest Health & Recreation Inc.

5.1.12. Acreage Holdings

5.1.13. Charlotte's Web Holdings, Inc.

5.1.14. Planet 13 Holdings

5.1.15. Columbia Care Inc.

5.2 Cross Comparison Parameters (Market Reach, Revenue, Product Portfolio, Brand Value, Market Cap, Operational Territories, R&D Investments, Profit Margins)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. USA Legal Marijuana Market Regulatory Framework

6.1. Licensing Standards and Requirements

6.2. Compliance and Enforcement Policies

6.3. Federal vs. State Regulations

6.4. Taxation Policies and Structure

7. USA Legal Marijuana Future Market Size (In USD Mn)

7.1. Projected Market Growth

7.2. Key Drivers Shaping Future Market Size

8. USA Legal Marijuana Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-Use (In Value %)

8.4. By Cannabinoid Profile (In Value %)

8.5. By Region (In Value %)

9. USA Legal Marijuana Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Consumer Cohort Analysis

9.3. Strategic Market Positioning

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage focuses on mapping all key stakeholders and influential factors within the USA Legal Marijuana Market. This involves an in-depth desk research phase, gathering data from both secondary and proprietary databases to define critical market drivers and variables impacting the markets trajectory.

Step 2: Market Analysis and Construction

This phase involves a thorough assessment of historical data, examining market growth patterns and revenue streams. The analysis includes factors such as market penetration and the ratio of recreational to medical use cases to ensure data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses are validated through industry expert consultations. Structured interviews with stakeholders provide insights into financial performance, operational challenges, and strategic goals, enhancing data reliability.

Step 4: Research Synthesis and Final Output

Final data synthesis integrates direct input from cannabis producers, ensuring comprehensive analysis of market segments, consumer trends, and operational insights. This method guarantees a validated, data-driven report tailored to the needs of industry stakeholders.

Frequently Asked Questions

01 How big is the USA Legal Marijuana Market?

The USA Legal Marijuana Market is valued at USD 12 billion, with growth driven by state-level legalization, consumer demand, and expanding applications in medical and wellness fields.

02 What challenges does the USA Legal Marijuana Market face?

Key challenges in USA Legal Marijuana Market include stringent federal restrictions, complex state-by-state regulations, high compliance costs, and limitations on interstate commerce, all impacting operational efficiencies.

03 Who are the major players in the USA Legal Marijuana Market?

Major players in USA Legal Marijuana Market include Curaleaf Holdings, Green Thumb Industries, Trulieve Cannabis Corp., Cresco Labs, and Canopy Growth Corporation, with strong market presence and diversified offerings.

04 What drives the growth of the USA Legal Marijuana Market?

The USA Legal Marijuana Market growth drivers include expanded state legalization, increasing consumer acceptance, and rising demand for medical marijuana, all supported by a maturing regulatory landscape.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.