USA Liposomes Drug Delivery Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7231

November 2024

100

About the Report

USA Liposomes Drug Delivery Market Overview

- The USA Liposomes Drug Delivery Market is valued at USD 1.47 billion, driven by advancements in nanotechnology and increasing demand for targeted drug delivery systems. Liposomes have gained significant traction in delivering chemotherapy, antifungal drugs, and vaccines due to their ability to encapsulate both hydrophilic and lipophilic drugs, improving drug efficacy and reducing toxicity.

- The USA remains the dominant player in the liposomes drug delivery market, largely due to the presence of leading pharmaceutical companies, extensive healthcare infrastructure, and advanced R&D capabilities. Major cities like Boston, San Francisco, and New York are hubs for biotech innovation, housing top universities and research centers that fuel technological advancements. Furthermore, the country benefits from a supportive regulatory framework, allowing the rapid approval and commercialization of new liposomal drugs, which contributes to its market dominance.

- The FDA has established stringent guidelines for the development and approval of liposomal drugs to ensure their safety and efficacy. As of 2024, the FDA has updated its guidelines to include specific requirements for bioequivalence studies, manufacturing processes, and quality control measures for liposomal drug formulations. These regulations are essential in maintaining the safety standards of liposomal products.

USA Liposomes Drug Delivery Market Segmentation

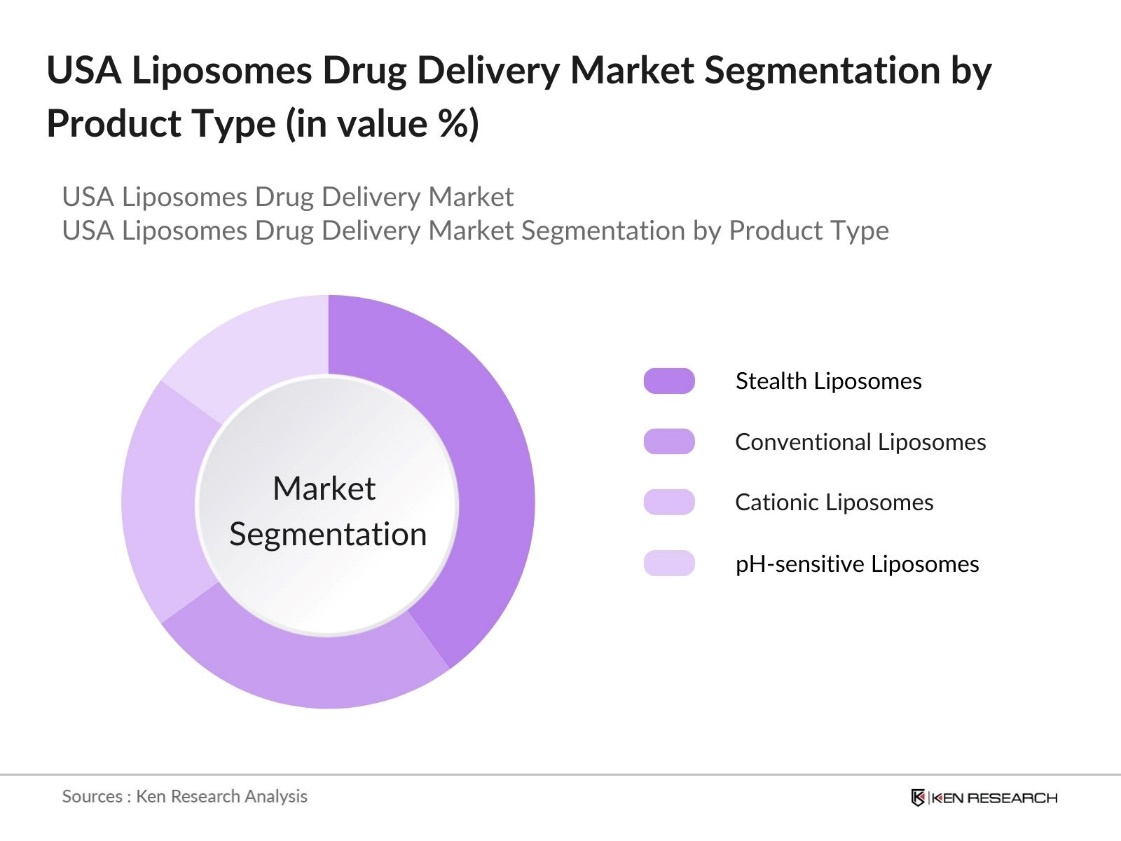

By Product Type: The USA liposomes drug delivery market is segmented by product type into conventional liposomes, stealth liposomes, cationic liposomes, and pH-sensitive liposomes. Among these, stealth liposomes have a dominant market share due to their enhanced circulation time and ability to evade detection by the immune system. This makes them particularly effective for delivering chemotherapeutic agents, especially in cancer treatment. Their unique composition, involving polyethylene glycol (PEG) coatings, significantly improves drug delivery efficiency, making them the preferred choice in modern therapies.

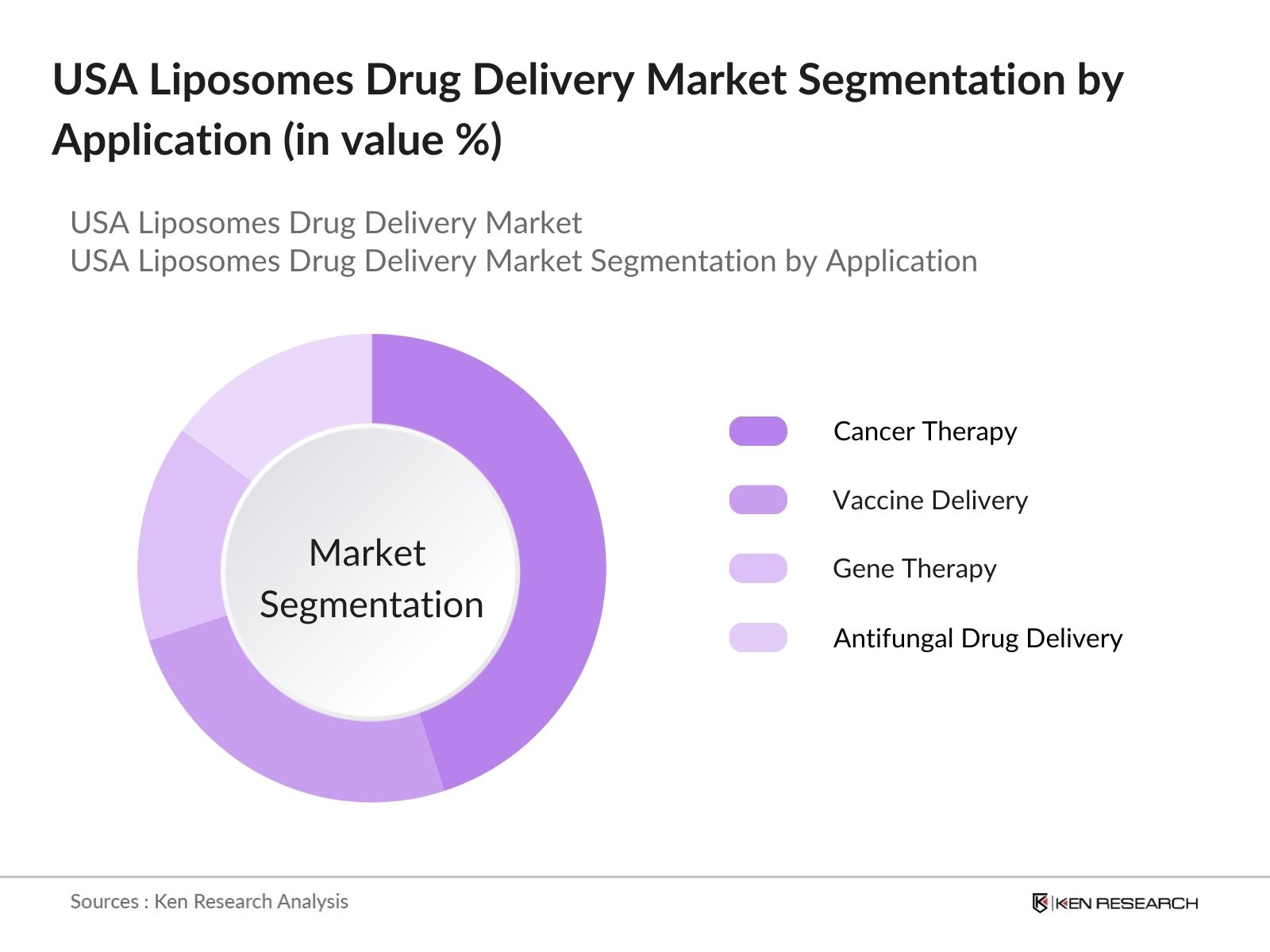

By Application: The USA liposomes drug delivery market is further segmented by application into cancer therapy, vaccine delivery, gene therapy, and antifungal drug delivery. Cancer therapy holds a significant share in the market, as liposomes have proven to be highly effective in delivering cytotoxic drugs to tumor sites while minimizing side effects. The ability to specifically target cancer cells without damaging healthy tissue has made liposomal formulations a preferred approach in oncology, contributing to the strong demand for liposomal drug delivery systems in cancer treatment.

USA Liposomes Drug Delivery Market Competitive Landscape

The market is dominated by several major players who lead in innovation, research, and development. This consolidation highlights the significant role of these companies in shaping market dynamics, driving growth through advanced drug delivery technologies.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Spending |

Geographic Presence |

Revenue |

Strategic Partnerships |

Key Innovations |

|

Gilead Sciences, Inc. |

1987 |

Foster City, CA |

||||||

|

Pfizer, Inc. |

1849 |

New York, NY |

||||||

|

Novartis AG |

1996 |

Basel, Switzerland |

||||||

|

Celsion Corporation |

1982 |

Lawrenceville, NJ |

||||||

|

Pacira BioSciences, Inc. |

2007 |

Parsippany, NJ |

USA Liposomes Drug Delivery Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases: The prevalence of chronic diseases such as cancer and cardiovascular diseases is a major driver for the liposomes drug delivery market in the USA. According to the CDC 129 million people in the U.S. have at least one major chronic disease, such as heart disease, cancer, diabetes, or hypertension. This rise directly correlates with the need for more advanced drug delivery mechanisms, including those for chemotherapy drugs.

- Advancements in Nanotechnology: Recent breakthroughs in nanotechnology have significantly contributed to the growth of the liposomes drug delivery market. Liposomes, being nanoscale carriers, are increasingly utilized in delivering drugs to target cells more effectively. In 2024, the global research focus on nanotechnology-enabled drug delivery systems has seen significant funding, exceeding USD 3 billion, supported by government and private R&D initiatives. This technology enhances the precision of drug delivery, particularly in fields like oncology and infectious diseases, where targeted therapies are crucial for treatment success.

- Rising Demand for Targeted Drug Delivery: Targeted drug delivery has become crucial in treating complex diseases like cancer and neurological disorders. Liposomes are central to this approach, as they enhance treatment precision by minimizing off-target effects and reducing toxicity. By delivering drugs directly to affected areas, liposomes improve therapeutic outcomes and are increasingly adopted by healthcare providers to enhance the efficacy of treatments for complex conditions.

Market Challenges

- High Manufacturing Costs: Producing liposomal drugs presents a major challenge for manufacturers due to the complex processes involved. These processes require stringent quality control and expensive raw materials, making liposomal formulations more costly compared to traditional drugs. This cost disparity can hinder the wider adoption of liposomal drugs, creating challenges for healthcare systems that seek to provide affordable treatments while maintaining high-quality standards.

- Regulatory Approval Complexities: Regulatory approval for liposomal drugs remains a significant obstacle. The FDA enforces strict guidelines, requiring extensive clinical trials to ensure safety and efficacy. These regulatory demands often result in lengthy and costly approval processes, making it difficult for companies to bring new liposomal formulations to market efficiently. This further complicates efforts to meet market demands.

USA Liposomes Drug Delivery Market Future Outlook

Over the next five years, the USA liposomes drug delivery market is expected to exhibit substantial growth, driven by continuous advancements in nanotechnology, increasing applications in oncology, and a surge in research funding for drug delivery systems. Liposomes are anticipated to play a critical role in emerging therapies, such as RNA-based vaccines and personalized medicine. Government support for pharmaceutical innovations, coupled with collaborations between biotech companies and academic institutions, will further fuel the market's expansion, establishing the USA as a leader in drug delivery technologies.

Market Opportunities

- Expansion of Personalized Medicine: Personalized medicine offers significant growth potential for the liposomes drug delivery market. Liposomal formulations can be tailored to individual patient profiles, enhancing the effectiveness of personalized therapies. This flexibility allows for the delivery of customized drug dosages, making liposomes a vital component in personalized treatment plans, especially in oncology, where precise targeting of therapies is crucial for improving patient outcomes.

- Increasing Research and Development Funding: Research and development funding for drug delivery technologies, including liposomal systems, has seen significant growth. Increased investments are focused on developing advanced liposomes with improved stability, drug loading efficiency, and targeted delivery. This enhanced R&D effort aims to expand the use of liposomes across various therapeutic areas, such as oncology, infectious diseases, and neurology, driving innovation and application in the drug delivery sector.

Scope of the Report

|

Product Type |

Conventional Liposomes Stealth Liposomes Cationic Liposomes pH-sensitive Liposomes |

|

Application |

Cancer Therapy Vaccine Delivery Gene Therapy Antifungal Drug Delivery |

|

Drug Type |

Small Molecule Drugs Nucleic Acids Proteins and Peptides |

|

Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Pharmacies |

|

End-User |

Hospitals Specialty Clinics Research and Academic Institutes |

Products

Key Target Audience

Pharmaceutical Manufacturers

Biotech Startups

Investors and Venture Capitalist Firms

Contract Research Organizations (CROs)

Drug Distribution and Supply Chain Companies

Government and Regulatory Bodies (FDA, NIH)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Gilead Sciences, Inc.

Pfizer, Inc.

Novartis AG

Celsion Corporation

Pacira BioSciences, Inc.

Johnson & Johnson

Spectrum Pharmaceuticals, Inc.

Luye Pharma Group

Ipsen Pharma

Sun Pharmaceutical Industries Ltd.

Table of Contents

1. USA Liposomes Drug Delivery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Liposomes Drug Delivery Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Liposomes Drug Delivery Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Chronic Diseases

3.1.2. Advancements in Nanotechnology

3.1.3. Rising Demand for Targeted Drug Delivery

3.1.4. Government Initiatives for Drug Delivery Innovations

3.2. Market Challenges

3.2.1. High Manufacturing Costs

3.2.2. Regulatory Approval Complexities

3.2.3. Limited Product Shelf Life

3.3. Opportunities

3.3.1. Expansion of Personalized Medicine

3.3.2. Increasing Research and Development Funding

3.3.3. Growing Adoption in Oncology Treatments

3.4. Trends

3.4.1. Growing Use of Liposomes in Vaccine Development

3.4.2. Emergence of Liposomal Delivery for RNA-Based Therapies

3.4.3. Development of Next-Generation Liposomes

3.5. Government Regulation

3.5.1. FDA Guidelines on Liposomal Drugs

3.5.2. Patent Regulations and Exclusivity Periods

3.5.3. Funding Support for Drug Delivery Research

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem

4. USA Liposomes Drug Delivery Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Conventional Liposomes

4.1.2. Stealth Liposomes

4.1.3. Cationic Liposomes

4.1.4. pH-sensitive Liposomes

4.2. By Application (in Value %)

4.2.1. Cancer Therapy

4.2.2. Vaccine Delivery

4.2.3. Gene Therapy

4.2.4. Antifungal Drug Delivery

4.3. By Drug Type (in Value %)

4.3.1. Small Molecule Drugs

4.3.2. Nucleic Acids

4.3.3. Proteins and Peptides

4.4. By Distribution Channel (in Value %)

4.4.1. Hospital Pharmacies

4.4.2. Retail Pharmacies

4.4.3. Online Pharmacies

4.5. By End-User (in Value %)

4.5.1. Hospitals

4.5.2. Specialty Clinics

4.5.3. Research and Academic Institutes

5. USA Liposomes Drug Delivery Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Gilead Sciences, Inc.

5.1.2. Novartis AG

5.1.3. Pfizer, Inc.

5.1.4. Celsion Corporation

5.1.5. Pacira BioSciences, Inc.

5.1.6. Johnson & Johnson

5.1.7. Spectrum Pharmaceuticals, Inc.

5.1.8. Luye Pharma Group

5.1.9. Ipsen Pharma

5.1.10. Sun Pharmaceutical Industries Ltd.

5.1.11. Jazz Pharmaceuticals

5.1.12. Evonik Corporation

5.1.13. Merrimack Pharmaceuticals, Inc.

5.1.14. Polymun Scientific Immunbiologische Forschung GmbH

5.1.15. SkyePharma

5.2. Cross-Comparison Parameters (Product Portfolio, Manufacturing Capacity, R&D Spending, Geographic Presence, Market Share, Partnerships, Acquisitions, Innovation Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. USA Liposomes Drug Delivery Market Regulatory Framework

6.1. FDA Regulatory Pathways

6.2. Patent Regulations

6.3. Clinical Trial Requirements

7. USA Liposomes Drug Delivery Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Liposomes Drug Delivery Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Application (in Value %)

8.3. By Drug Type (in Value %)

8.4. By Distribution Channel (in Value %)

8.5. By End-User (in Value %)

9. USA Liposomes Drug Delivery Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all relevant stakeholders in the USA liposomes drug delivery market, including pharmaceutical manufacturers and healthcare providers. Secondary research from proprietary databases is conducted to define variables influencing market growth.

Step 2: Market Analysis and Construction

Historical data is compiled to assess the penetration of liposomal drugs across therapeutic areas, focusing on oncology and vaccine delivery. Revenue generation data is validated against industry benchmarks to ensure the accuracy of the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through in-depth interviews with industry experts. This consultation provides insights into the operational challenges and growth opportunities, ensuring the robustness of market data.

Step 4: Research Synthesis and Final Output

The final output involves integrating data from pharmaceutical companies to provide a comprehensive market analysis, including segment-wise performance, future outlook, and competitive landscape, ensuring data accuracy and relevance.

Frequently Asked Questions

01 How big is the USA Liposomes Drug Delivery Market?

The USA Liposomes Drug Delivery Market is valued at USD 1.47 billion, driven by advancements in drug delivery technologies and the growing demand for targeted therapies, especially in oncology.

02 What are the challenges in the USA Liposomes Drug Delivery Market?

Challenges in USA Liposomes Drug Delivery Market include high production costs, regulatory approval complexities, and limited stability of liposomal formulations, which can affect product shelf life and market penetration.

03 Who are the major players in the USA Liposomes Drug Delivery Market?

Key players in USA Liposomes Drug Delivery Market include Gilead Sciences, Pfizer, Novartis, Celsion Corporation, and Pacira BioSciences, Inc., leading the market with advanced drug delivery solutions.

04 What are the growth drivers of the USA Liposomes Drug Delivery Market?

The USA Liposomes Drug Delivery Market growth drivers include increasing demand for targeted drug delivery systems, advancements in nanotechnology, and growing R&D investments in personalized medicine and cancer therapies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.