USA LMS Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD3853

October 2024

98

About the Report

USA LMS Market Overview

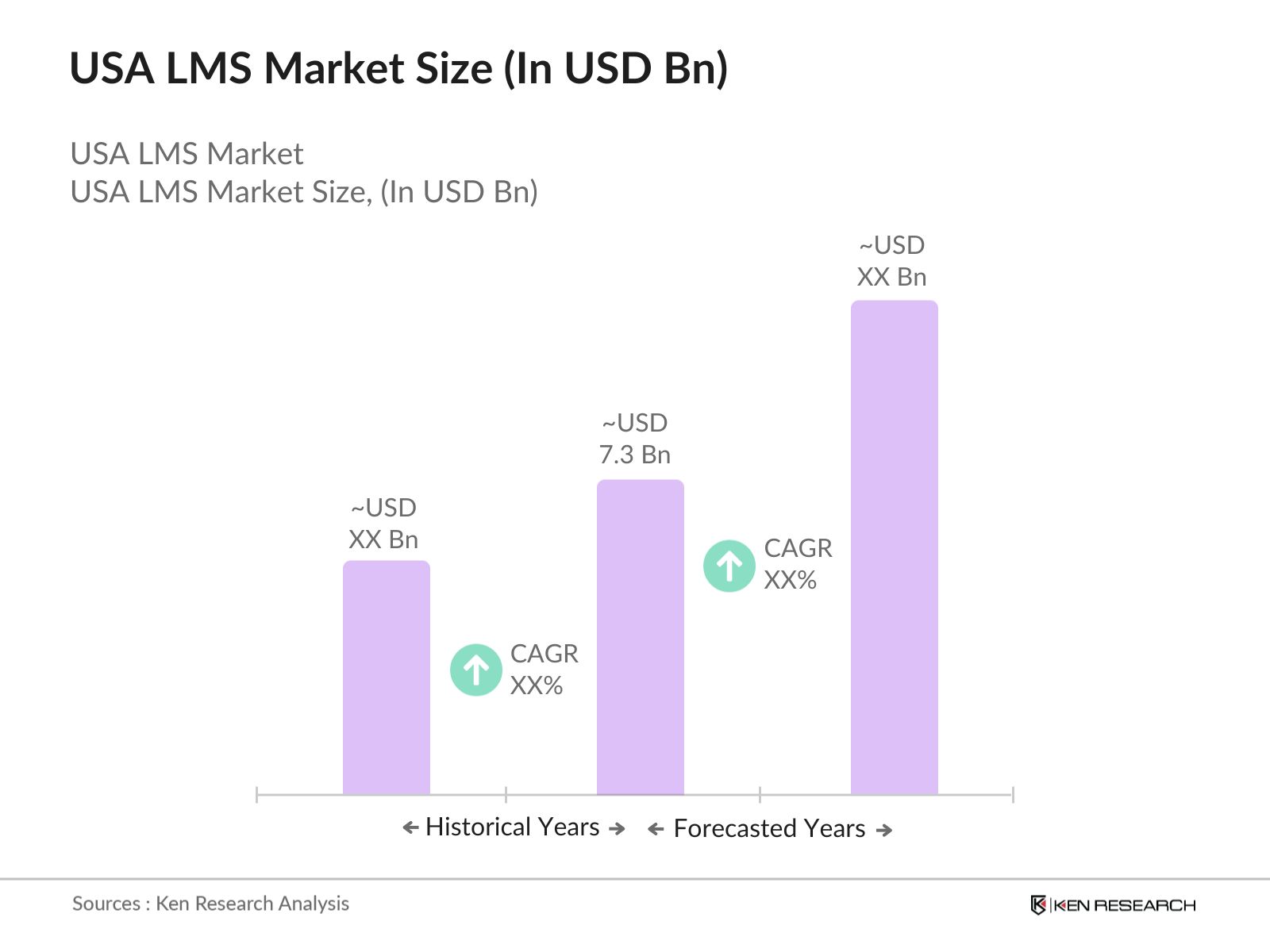

- The USA Learning Management System (LMS) market is valued at USD 7.3 billion, driven primarily by the increasing demand for digital education and corporate training programs. With the rise of remote learning and advancements in cloud technology, educational institutions and enterprises have widely adopted LMS platforms to enhance online education and employee training. Additionally, government initiatives supporting digital learning in schools and higher education further propel market growth, making the LMS market a cornerstone of modern education and corporate training.

- The cities dominating the USA LMS market are San Francisco, New York, and Seattle due to their strong tech infrastructure and the presence of leading tech companies and educational institutions. These cities are home to many organizations that require robust LMS solutions for training, compliance, and learning purposes. Furthermore, the concentration of tech startups and venture capital investment in these areas accelerates LMS adoption for corporate learning and development needs.

- Data protection laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) significantly impact LMS providers in the U.S. As of 2023, compliance with these regulations is mandatory for all educational institutions and corporations utilizing LMS platforms. Failure to comply can result in fines exceeding USD 10 million, according to data from the U.S. Federal Trade Commission. These regulations ensure that LMS platforms implement strict user data protection mechanisms.

USA LMS Market Segmentation

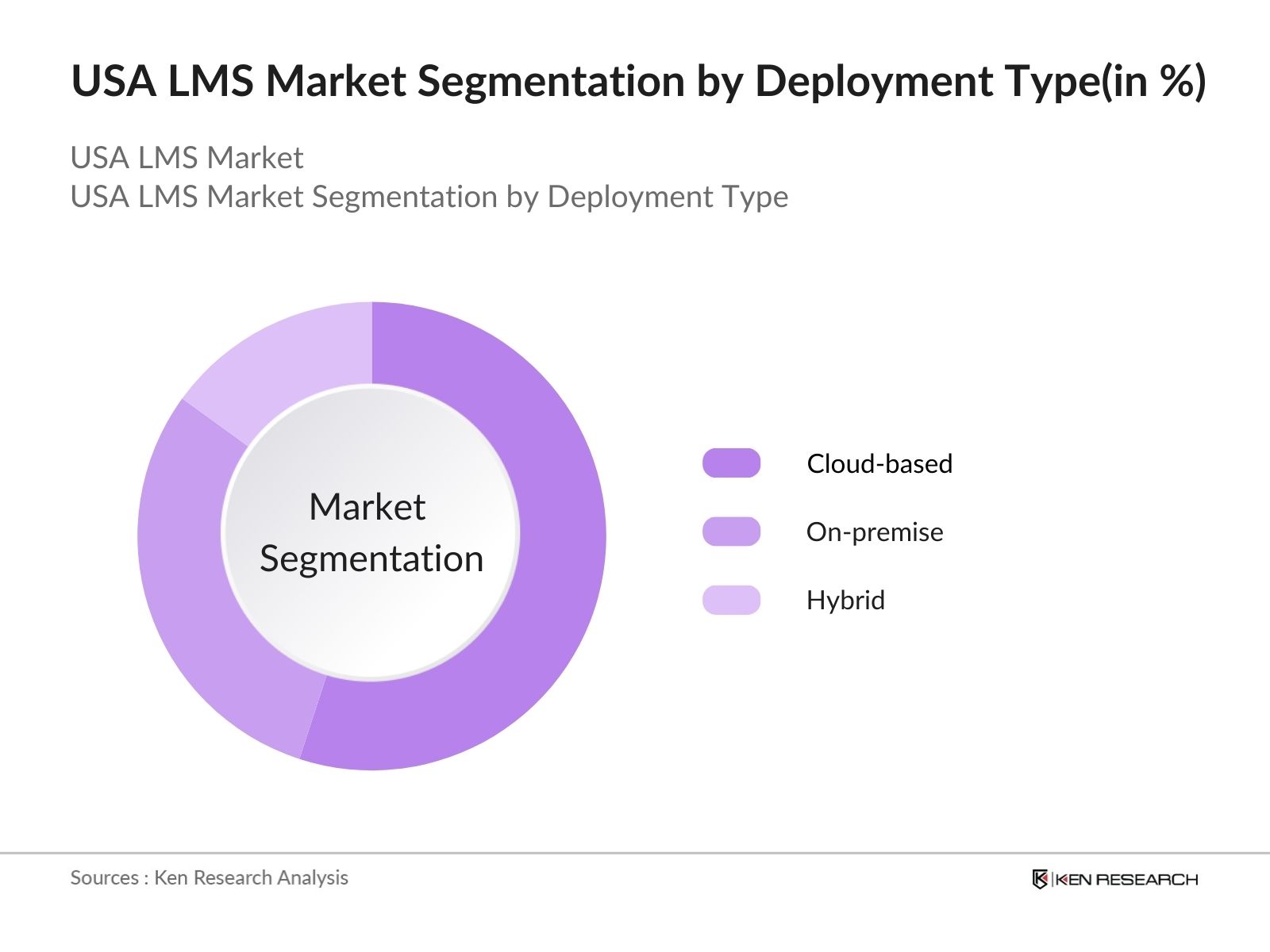

- By Deployment Type: The market is segmented by deployment type into cloud-based, on-premise, and hybrid solutions. Cloud-based LMS platforms have dominated the market due to their flexibility, cost-effectiveness, and ease of implementation. Organizations, especially small and medium-sized enterprises (SMEs), prefer cloud-based solutions for their low upfront costs and scalability. These platforms allow for seamless access to learning resources without the need for extensive IT infrastructure, which has driven their widespread adoption.

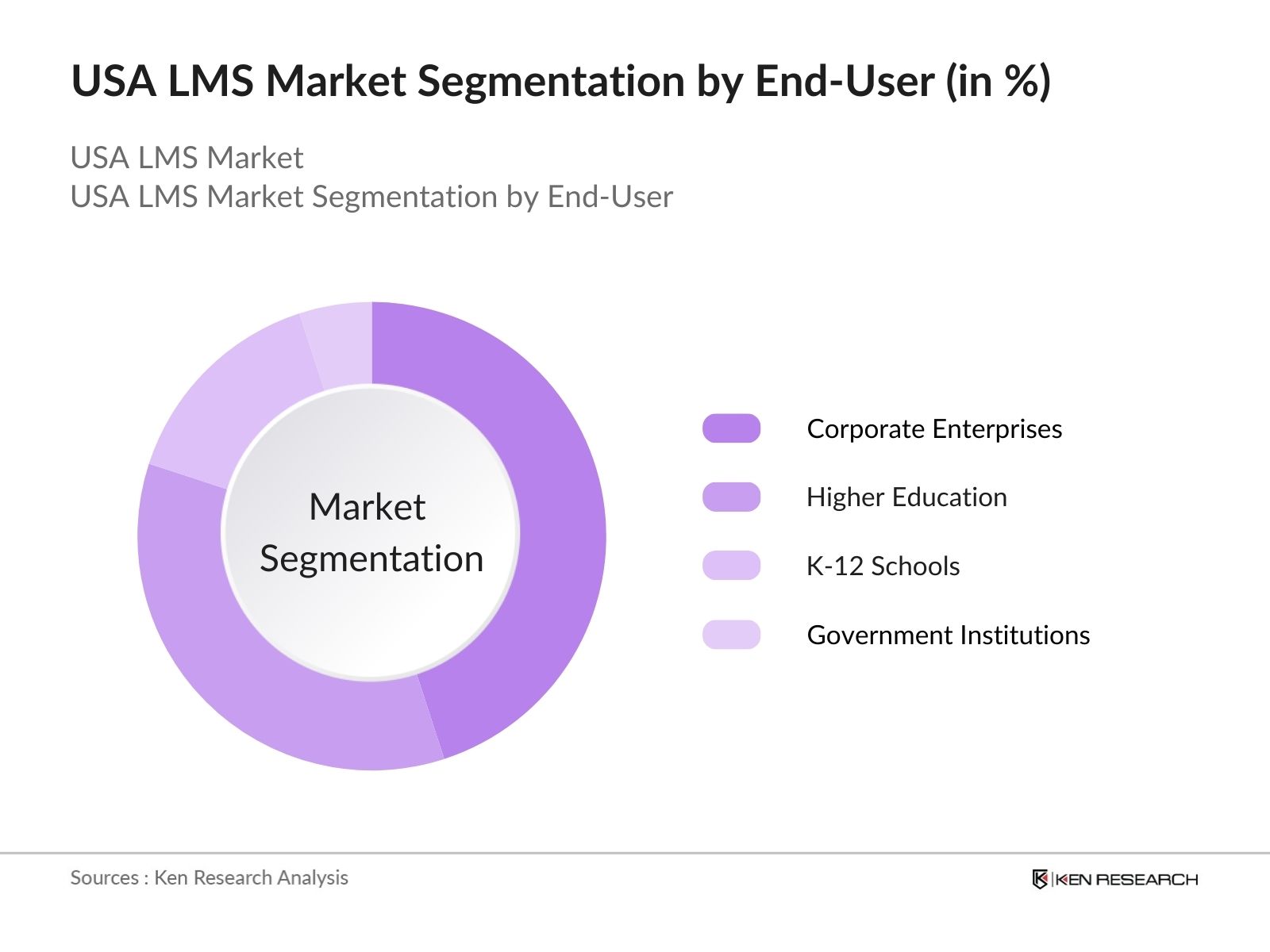

- By End-User: The market is segmented by end-users into K-12 schools, higher education institutions, corporate enterprises, and government institutions. Corporate enterprises dominate the market share in this segment, driven by the need for ongoing employee training, compliance management, and leadership development. The ability of LMS platforms to provide customized learning paths, track employee performance, and meet compliance standards makes them indispensable in the corporate environment.

USA LMS Market Competitive Landscape

The USA LMS market is highly competitive, with several major players dominating the space. These companies provide diverse solutions catering to different industries and educational needs. The competitive landscape is shaped by product innovation, acquisitions, and the adoption of emerging technologies such as artificial intelligence (AI) and big data.

|

Company |

Year of Establishment |

Headquarters |

Deployment Type |

No. of Users |

Global Reach |

Key Partnerships |

Revenue (USD Mn) |

AI Integration |

|

Blackboard Inc. |

1997 |

Washington, D.C. |

||||||

|

Instructure Inc. (Canvas) |

2008 |

Salt Lake City |

||||||

|

D2L Corporation |

1999 |

Kitchener, Canada |

||||||

|

Cornerstone OnDemand |

1999 |

Santa Monica, CA |

||||||

|

SAP Litmos |

2007 |

Walldorf, Germany |

USA LMS Industry Analysis

Growth Drivers

- Increase in Digital Learning: The surge in digital learning is a significant growth driver for the USA Learning Management System (LMS) market. As of 2023, over 76 million students in the U.S. are engaged in some form of digital learning, driven by both K-12 and higher education sectors. This is supported by increased internet access, with broadband availability at 93% across households as of 2022. This growth is further amplified by remote learning requirements and flexible learning schedules. LMS platforms like Canvas and Blackboard are increasingly relied upon to deliver content efficiently. Data from the World Bank notes an 80% increase in online education adoption globally.

- Government Initiatives for E-learning (Government Support): Government support for e-learning, especially through initiatives like Every Student Succeeds Act (ESSA), is propelling LMS adoption in schools. The U.S. Department of Education has allocated over USD 16 billion in funding between 2022 and 2023 for digital tools and infrastructure improvements. Additionally, states like California and Texas have invested heavily in school-based digital platforms. Such initiatives aim to improve the quality of education across public schools, thereby driving demand for robust LMS solutions across the country.

- Technological Advancements (Cloud Integration, AI): Technological advancements such as cloud-based platforms and AI integration are transforming LMS capabilities. For example, nearly 75% of all LMS systems deployed in the U.S. by 2023 are cloud-based, enabling scalability and cost efficiency. AI algorithms are being incorporated into LMS platforms for personalized learning, improving engagement by over 30% according to IMFs 2023 report on digital infrastructure. AI-driven analytics also aid in tracking learner progress, making LMS platforms indispensable for educational institutions and enterprises alike.

Market Challenges

- High Initial Costs: High implementation costs for LMS platforms remain a challenge, particularly for small and medium-sized enterprises (SMEs) and educational institutions. Initial setup for an enterprise LMS system involves significant expenses, including customization and ongoing maintenance. While government grants and subsidies are available, the financial burden can be considerable for smaller organizations. The high costs associated with these systems can be a deterrent, especially for institutions with limited budgets.

- Data Privacy and Security Concerns: Data privacy and security concerns are critical in the LMS market, especially with the increasing reliance on cloud-based solutions. The U.S. enforces strict compliance regulations such as the Family Educational Rights and Privacy Act (FERPA) and California Consumer Privacy Act (CCPA) to ensure user data is protected. However, security breaches and compliance issues still pose risks, potentially leading to penalties and loss of trust. Ensuring robust data protection protocols is essential for maintaining compliance and safeguarding sensitive information.

USA LMS Market Future Outlook

Over the next five years, the USA LMS market is expected to continue growing, driven by the increasing need for flexible, personalized learning solutions in both education and corporate sectors. The continuous advancements in cloud technology, AI integration, and mobile-based learning are likely to reshape the LMS landscape. Additionally, with the increasing focus on employee reskilling and upskilling, corporations will further invest in advanced LMS platforms to stay competitive in a rapidly evolving job market.

Market Opportunities

- Increasing Demand for Mobile-based Learning Platforms: The increasing demand for mobile-based learning presents a significant growth opportunity for the LMS market. In 2023, mobile internet access in the U.S. reached over 310 million users, with a growing preference for learning on-the-go. Approximately 65% of learners in the U.S. access LMS platforms via mobile devices, particularly in higher education. This demand drives innovation in mobile-responsive LMS platforms, which are projected to become a standard feature in the education sector.

- Integration with AI and Big Data: AI and Big Data integration into LMS systems offers tremendous growth opportunities. In 2023, 60% of LMS providers incorporated AI tools for personalized learning experiences, such as chatbots and adaptive learning paths. Big Data allows institutions to analyze user data and optimize content delivery. The U.S. governments support for AI development, with over $2 billion allocated in 2023 for educational technology advancements, is further accelerating this trend.

Scope of the Report

|

By Deployment Type |

Cloud-based On-premise Hybrid |

|

By End-User |

K-12 Schools Higher Education Corporate Enterprises Government Institutions |

|

By Application |

Training and Development Compliance Management Content Management Assessment and Evaluation |

|

By Component |

Solutions Services |

|

By Region |

North East West South |

Products

Key Target Audience

Corporate Enterprises

Higher Education Institutions

K-12 Schools

Government Institutions (U.S. Department of Education)

E-learning Content Providers

Learning and Development Departments

Investment and Venture Capitalist Firms

Banks and Financial Institutes

Government and Regulatory Bodies (Federal Trade Commission)

Companies

Major Players in the Report

-

Blackboard Inc.

Instructure Inc. (Canvas)

D2L Corporation (Brightspace)

Cornerstone OnDemand

SAP Litmos

Google Classroom

Absorb LMS

TalentLMS

Schoology

Adobe Captivate Prime

Moodle

iSpring Learn

Docebo

LearnUpon

Edmodo

Table of Contents

1. USA LMS Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Growth Rate

1.5. Market Segmentation Overview

2. USA LMS Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Key Market Developments and Milestones

2.3. Year-on-Year Growth Analysis

3. USA LMS Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Digital Learning

3.1.2. Government Initiatives for E-learning (Government Support)

3.1.3. Technological Advancements (Cloud Integration, AI)

3.1.4. Corporate Sector Adoption (Enterprise Segment)

3.2. Market Challenges

3.2.1. High Initial Costs (Implementation Costs)

3.2.2. Data Privacy and Security Concerns (Compliance Regulations)

3.2.3. User Adoption Challenges (End-user Adoption Rates)

3.3. Opportunities

3.3.1. Increasing Demand for Mobile-based Learning Platforms

3.3.2. Integration with AI and Big Data

3.3.3. Personalized Learning Solutions (Customization Features)

3.4. Trends

3.4.1. Gamification of LMS

3.4.2. Rise of Microlearning (Content Bite-sized Learning)

3.4.3. Expansion of Hybrid Learning Models (Blended Learning)

3.5. Government Regulations

3.5.1. Data Protection Laws (GDPR, CCPA Compliance)

3.5.2. E-learning Standards (SCORM, AICC Compliance)

3.5.3. National Education Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA LMS Market Segmentation

4.1. By Deployment Type (In Value %) 4.1.1. Cloud-based

4.1.2. On-premise

4.1.3. Hybrid

4.2. By End-User (In Value %) 4.2.1. K-12 Schools

4.2.2. Higher Education

4.2.3. Corporate Enterprises

4.2.4. Government Institutions

4.3. By Application (In Value %) 4.3.1. Training and Development

4.3.2. Compliance Management

4.3.3. Content Management

4.3.4. Assessment and Evaluation

4.4. By Component (In Value %) 4.4.1. Solutions (LMS Platforms)

4.4.2. Services (Managed Services, Professional Services)

4.5. By Region (In Value %) 4.5.1. North

4.5.2. West

4.5.3. East

4.5.4. South

5. USA LMS Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors 5.1.1. Blackboard Inc.

5.1.2. Instructure Inc. (Canvas)

5.1.3. D2L Corporation (Brightspace)

5.1.4. Cornerstone OnDemand

5.1.5. SAP Litmos

5.1.6. Google Classroom

5.1.7. Absorb LMS

5.1.8. TalentLMS

5.1.9. Schoology

5.1.10. Adobe Captivate Prime

5.1.11. Moodle

5.1.12. iSpring Learn

5.1.13. Docebo

5.1.14. LearnUpon

5.1.15. Edmodo

5.2. Cross Comparison Parameters (No. of Employees, Inception Year, Revenue, Deployment Model, Integration Capabilities, Customer Base, Global Reach, Key Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Funding

5.8. Venture Capital Investments

6. USA LMS Market Regulatory Framework

6.1. Data Privacy and Security Regulations

6.2. Compliance with Education Standards

6.3. Government Funding Programs

7. USA LMS Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Factors Driving Future Growth

8. USA LMS Market Analysts Recommendations

8.1. Customer Cohort Analysis

8.2. TAM/SAM/SOM Analysis

8.3. Product Diversification Strategies

8.4. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The first step involves creating a detailed ecosystem map encompassing all significant stakeholders in the USA Learning Management System (LMS) Market. This includes extensive desk research, relying on a mix of secondary data sources and proprietary databases to collect comprehensive information. The goal is to identify key variables influencing market dynamics such as adoption rates, technological advancements, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, historical data related to the USA LMS Market is analyzed. This includes evaluating factors like market penetration, deployment types (cloud-based and on-premise), and the ratio of service providers to end-users. The gathered data is then processed to develop revenue estimates and growth projections based on current trends in the LMS ecosystem.

Step 3: Hypothesis Validation and Expert Consultation

At this stage, key market hypotheses are developed and validated through interviews with industry experts. These consultations, conducted through computer-assisted telephone interviews (CATI), involve professionals from leading LMS companies. The information gathered through these discussions helps refine market data, providing critical insights into emerging trends, operational challenges, and growth drivers.

Step 4: Research Synthesis and Final Output

The final step involves consolidating all the data and insights gathered from both primary and secondary sources. Direct engagement with LMS vendors provides deeper insights into market segments, user preferences, and technological innovations. This step ensures that the final report provides an accurate, comprehensive, and validated analysis of the USA LMS Market.

Frequently Asked Questions

01. How big is the USA LMS Market?

The USA LMS Market was valued at USD 10.5 billion, driven by the widespread adoption of digital education tools and corporate training solutions. The markets growth is supported by cloud-based innovations and the demand for flexible, scalable learning platforms.

02. What are the challenges in the USA LMS Market?

Challenges in the USA LMS Market include high initial setup costs for advanced platforms, concerns over data security and privacy, and integration difficulties with legacy systems. Additionally, the lack of skilled professionals to manage sophisticated LMS systems can be a hindrance to adoption.

03. Who are the major players in the USA LMS Market?

Key players in the USA LMS Market include Blackboard Inc., Instructure Inc. (Canvas), Cornerstone OnDemand, SAP Litmos, and TalentLMS. These companies dominate due to their robust platforms, widespread enterprise adoption, and continuous innovation.

04. What are the growth drivers of the USA LMS Market?

The LMS market in the USA is primarily driven by the growing trend of remote learning, increasing corporate demand for employee training platforms, and government support for digital education initiatives. Furthermore, technological advancements in cloud-based LMS solutions contribute significantly to the markets growth.

05. Which cities lead the USA LMS Market?

Cities like San Francisco and New York lead the USA LMS Market due to their high concentration of tech companies and educational institutions that are early adopters of digital learning technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.