USA Luxury Car Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD6427

December 2024

99

About the Report

USA Luxury Car Market Overview

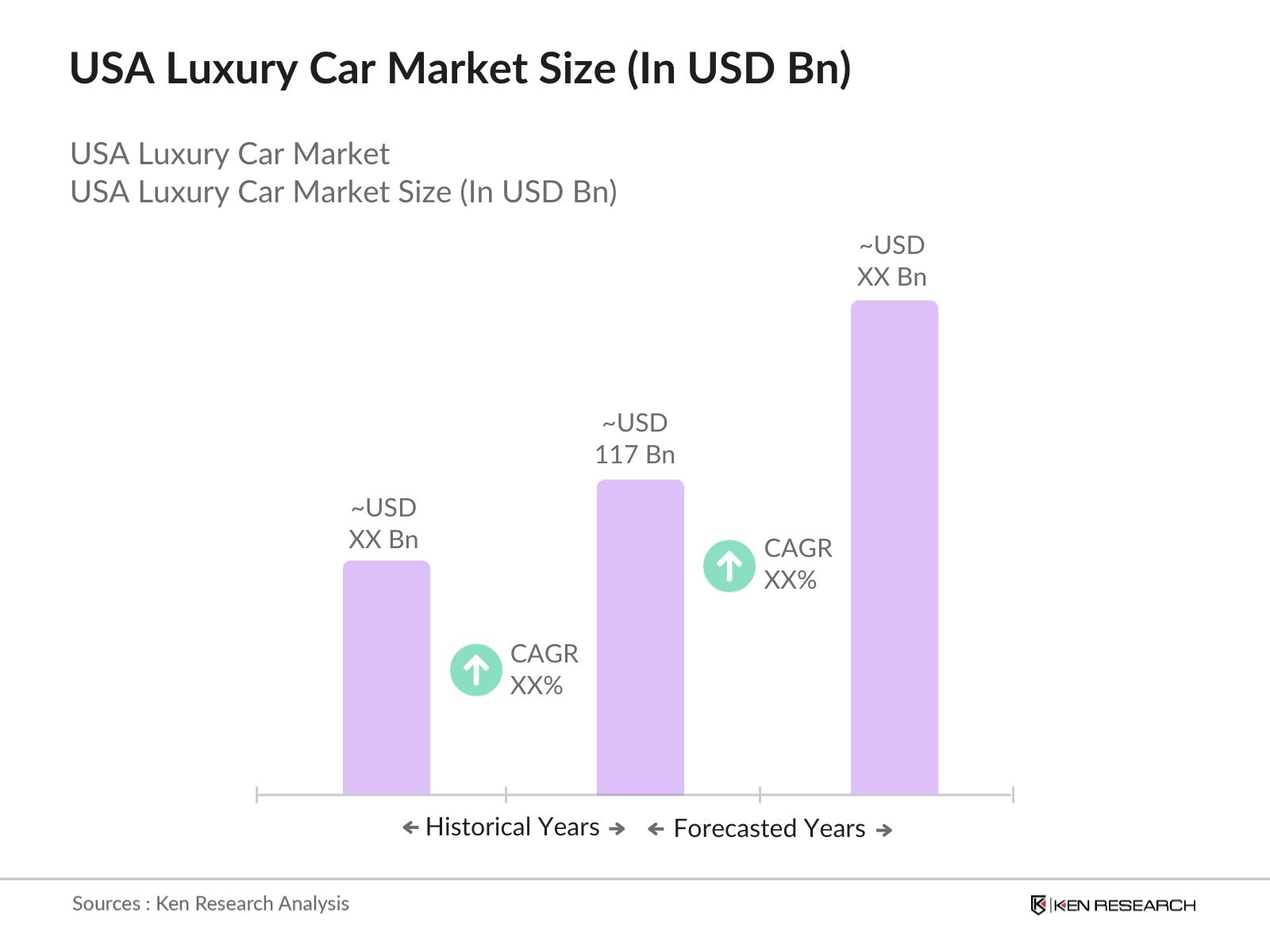

- The USA luxury car market is valued at USD 117 billion, primarily fueled by the increasing consumer preference for high-performance vehicles that offer advanced technology, safety, and customization. With luxury brands continuously innovating with electric vehicles (EVs), self-driving capabilities, and high-end infotainment systems, demand has surged. Additionally, growing environmental consciousness and stringent emission standards are driving the shift to hybrid and EV luxury cars. Thus, the market remains dynamic, with a strong emphasis on sustainable luxury and technological advancements.

- Regions like California, New York, and Florida lead in luxury car demand within the USA, primarily due to the high concentration of affluent consumers and well-developed infrastructure for EVs. California stands out as an epicenter for electric luxury vehicles, benefiting from incentives for EV purchases and an extensive EV charging network. New York and Florida see high demand due to established urban wealth, with consumers seeking prestigious brands that offer enhanced performance and sustainability.

- One significant government initiative impacting the luxury car market, particularly in the context of electric vehicles, is the Bipartisan Infrastructure Law, enacted in November 2021. This legislation allocates USD 7.5 billion specifically for the expansion of electric vehicle (EV) charging infrastructure across the United States. The initiative aims to facilitate the widespread adoption of electric vehicles by ensuring that consumers have access to convenient and reliable charging options. As of 2023, the goal is to install at least 500,000 public charging stations nationwide by 2030.

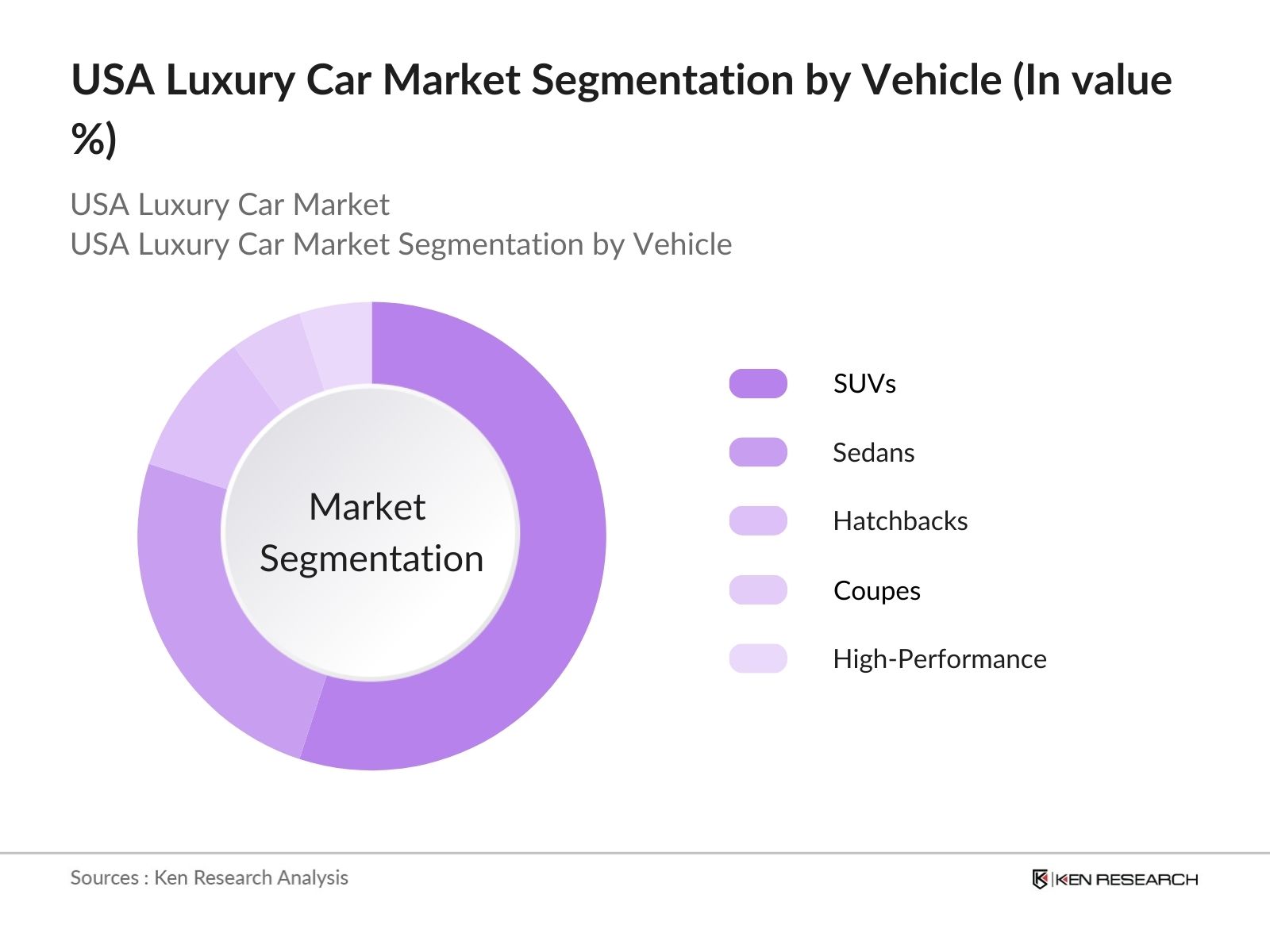

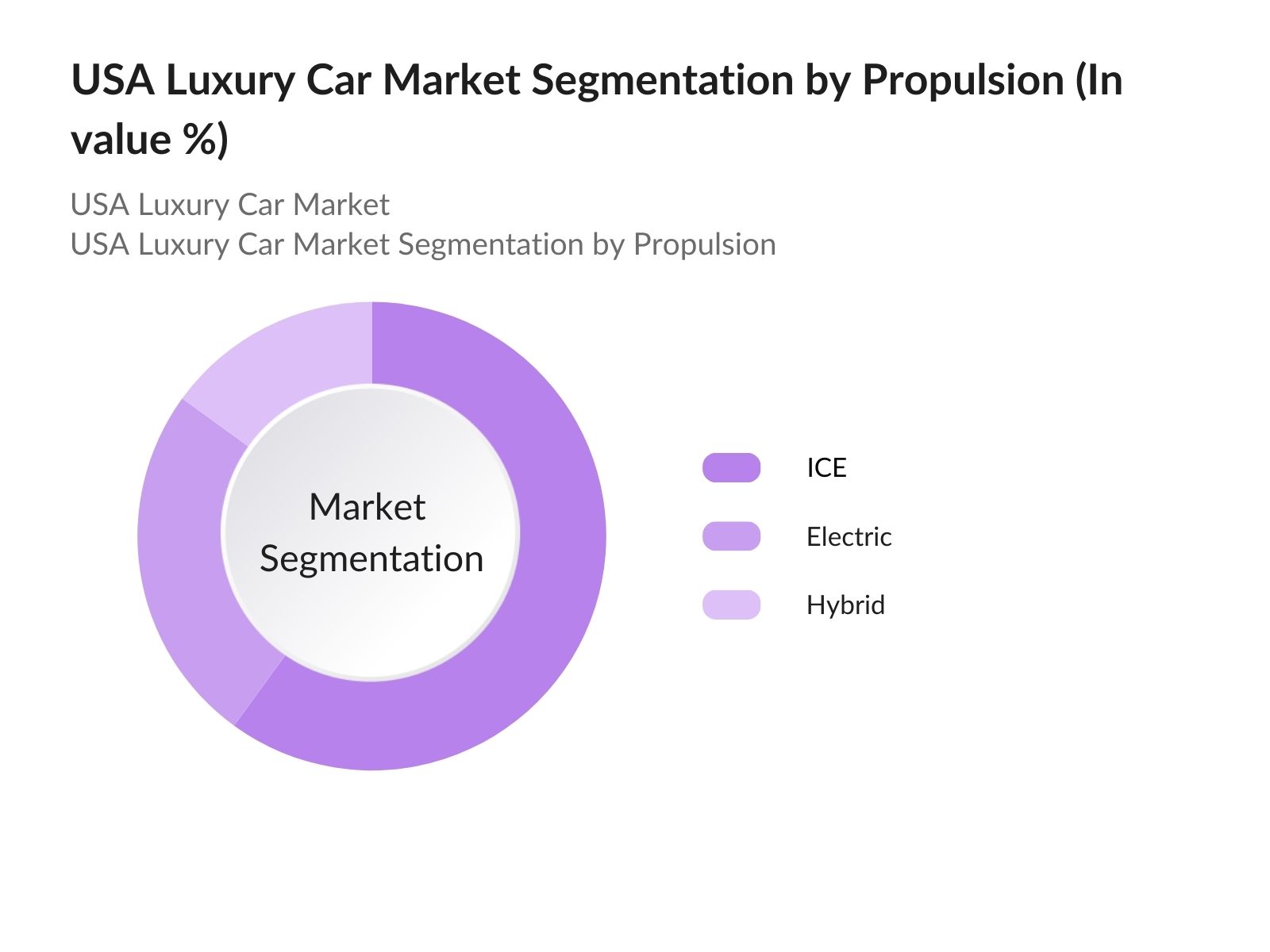

USA Luxury Car Market Segmentation

- By Vehicle Type: The market is segmented by vehicle type into sedans, SUVs, hatchbacks, coupes, and high-performance vehicles. Currently, SUVs dominate this segment due to their versatile appeal, spacious interiors, and enhanced safety features. Their elevated driving position and larger cargo capacity make them particularly attractive to families and individuals seeking both luxury and functionality. Brands like Mercedes-Benz and BMW have introduced popular SUV models that cater to a growing preference for luxury with practicality.

- By Propulsion Type: Segmentation by propulsion type includes internal combustion engine (ICE), electric vehicles (EV), and hybrid vehicles. Electric vehicles have gained significant traction in recent years, driven by regulatory incentives and a growing consumer demand for sustainable transportation options. This shift is further fueled by state and federal initiatives promoting the adoption of EVs, such as tax credits and rebates for buyers. Leading brands like Tesla, Mercedes-Benz, and BMW dominate this segment by offering premium EVs that align with the markets shift toward low-emission and high-performance vehicles.

USA Luxury Car Market Competitive Landscape

The USA luxury car market remains competitive, with major players like Mercedes-Benz, Tesla, and BMW at the forefront. These companies lead with robust production capacities, innovative EV portfolios, and strong R&D investments to meet evolving consumer demands for sustainable and technologically advanced luxury vehicles.

USA Luxury Car Market Analysis

Growth Drivers

- Increasing Disposable Income and High Net-Worth Individuals: The rise in disposable income among high-net-worth individuals (HNWIs) in the United States has significantly influenced the luxury car market. According to the World Bank, the U.S. GDP per capita increased from USD 76,400 in 2021 to approximately USD 77,900 in 2023, showcasing a growing capacity for consumers to invest in luxury vehicles. Moreover, the number of HNWIs in the U.S. rose to 9.4 million in 2022, according to Credit Suisse, indicating a solid consumer base for luxury car purchases. This increase in wealth and disposable income directly supports higher expenditures on premium vehicles and their associated features.

- Rising Demand for Premium Features and Advanced Technologies: Consumers are increasingly prioritizing premium features and advanced technologies in luxury cars, such as enhanced infotainment systems, driver assistance technologies, and connectivity options. A report from the U.S. Department of Commerce highlights that majority of luxury vehicle buyers consider advanced safety features critical when making a purchase decision. Additionally, the sales of vehicles equipped with advanced driver-assistance systems (ADAS) surged to over 2 million units in 2023. This increasing demand reflects a consumer trend towards higher quality and technologically advanced vehicles, driving manufacturers to innovate and enhance their luxury offerings.

- Consumer Shift to Electric Luxury Vehicles: The transition towards electric luxury vehicles is reshaping the market landscape, with sales expected to continue their upward trajectory. The U.S. Environmental Protection Agency (EPA) reported that electric vehicle sales reached 817,000 units in 2022, representing a notable increase in consumer interest in sustainable luxury options. Furthermore, the U.S. government has allocated USD 7.5 billion for EV charging infrastructure under the Bipartisan Infrastructure Law, which is projected to enhance accessibility and convenience for electric vehicle owners. This commitment underscores the growing market demand for luxury electric vehicles and the supportive infrastructure being developed to facilitate their adoption.

Challenges

- High Cost of Ownership and Maintenance: One of the primary barriers to luxury car purchases is the high initial cost of ownership. The average price of a luxury vehicle in the U.S. has surpassed significant thresholds, making it a considerable investment that often deters potential buyers, especially amidst economic uncertainty. Additionally, the annual cost of ownership for luxury vehicles can be substantial when factoring in expenses such as insurance, maintenance, and depreciation. This combination of high purchase prices and ongoing ownership costs creates a challenging environment for attracting new luxury car buyers, as many consumers may hesitate to commit to such significant financial obligations.

- Supply Chain Constraints and Material Shortages: The luxury car market continues to face significant challenges due to the global semiconductor shortage and related supply chain disruptions. The ongoing semiconductor shortage has reduced vehicle production in the U.S., leading to increased prices and extended waiting periods for consumers. This scarcity has caused frustration among potential buyers and has impacted their purchasing decisions. Industry analysts suggest that while the situation is improving, ongoing disruptions remain a concern, limiting the availability of luxury models that rely heavily on advanced electronic components. The automotive industry must navigate these challenges to restore stability and meet consumer demand effectively.

USA Luxury Car Market Future Outlook

The USA luxury car market is expected to grow significantly through the next five year, supported by rising demand for EVs, advancements in automotive technology, and a focus on eco-friendly luxury solutions. As regulatory mandates push for sustainable vehicles, luxury car manufacturers are investing heavily in EV and hybrid models. This focus on sustainability, combined with innovations in autonomous driving, will open new avenues for market growth and enhance the appeal of luxury cars among a broader demographic.

Future Market Opportunities

- Technological Advancements in Autonomous Driving and AI: The luxury car market is poised for growth through technological advancements in autonomous driving and artificial intelligence. Current investments in AI and machine learning technologies are driving innovation in luxury vehicles, with major automakers committing billions to develop self-driving capabilities. In 2022, companies like Tesla and Waymo invested over USD 2 billion in autonomous vehicle technology, indicating robust future potential. The growing demand for automated features is supported by a significant increase in public acceptance of autonomous driving, with majority of consumers expressing interest in purchasing an autonomous vehicle, according to a recent AAA survey.

- Increased Demand for Personalized Customer Experiences: Consumers are increasingly seeking personalized experiences when purchasing luxury vehicles, opening new avenues for market growth. A McKinsey report indicates that more than half of luxury car buyers value tailored services, such as personalized vehicle configurations and exclusive customer support. Luxury brands are responding by enhancing their customer engagement strategies, leveraging digital tools to provide bespoke experiences. In 2023, investments in customer relationship management (CRM) technology among luxury car manufacturers surged substantially, reflecting the industry's commitment to meeting evolving consumer expectations.

Scope of the Report

|

By Vehicle Type |

Sedans SUVs Hatchbacks Coupes High-Performance |

|

By Propulsion Type |

Internal Combustion Engine Electric Hybrid |

|

By Price Segment |

Entry-Level Luxury Mid-Level Luxury Ultra-Luxury |

|

By Drive Type |

AWD RWD FWD |

|

By Region |

West Coast Northeast South Midwest |

Products

Key Target Audience

High Net-Worth Individuals and Affluent Consumers

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (U.S. Environmental Protection Agency)

Automotive Component Manufacturers

Electric Vehicle Infrastructure Providers

Technology Providers for Autonomous and AI Systems

Automobile Dealership Networks

Companies

Players Mentioned in the Report

Mercedes-Benz Group AG

Tesla, Inc.

BMW Group

General Motors (Cadillac)

Rolls-Royce Motor Cars

Aston Martin Lagonda

Toyota Motor Corporation (Lexus)

Jaguar Land Rover Automotive PLC

Volkswagen Group (Audi, Porsche)

Ford Motor Company (Lincoln)

Fiat Chrysler Automobiles

Volvo Car Corporation

Ferrari S.p.A.

Bentley Motors Limited

Lamborghini S.p.A.

Table of Contents

01 USA Luxury Car Market Overview

Definition and Scope

Market Taxonomy

Market Dynamics and Growth Patterns

Market Segmentation Overview

02 USA Luxury Car Market Size (USD Billion)

Historical Market Analysis

Year-on-Year Growth Analysis

Key Developments and Milestones

03 USA Luxury Car Market Analysis

Market Drivers

Increasing Disposable Income and High Net-Worth Individuals

Rising Demand for Premium Features and Advanced Technologies

Consumer Shift to Electric Luxury Vehicles

Expansion of Financing and Leasing Options

Market Challenges

High Initial Cost of Ownership

Semiconductor Shortage and Supply Chain Disruptions

Limited EV Charging Infrastructure

Opportunities

Technological Advancements in Autonomous Driving and AI

Increased Demand for Personalized Customer Experiences

Growth in Subscription-Based Luxury Car Models

Trends

Integration of Smart Mobility Solutions (Autonomous Driving, Retina Recognition)

Shift from Sedans to Luxury SUVs and Crossovers

Digital Showroom Experiences and Omnichannel Sales Models

Regulatory Landscape

Emissions Standards and Compliance

Tax Incentives for Electric Vehicles

State-Level Luxury Tax Policies

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competitive Ecosystem Analysis

04 USA Luxury Car Market Segmentation, 2023

By Vehicle Type (USD Billion)

Sedans

SUVs and Crossovers

Hatchbacks

Coupes and Convertibles

High-Performance Vehicles (e.g., Sports Cars)

By Propulsion Type (Market Value %)

Internal Combustion Engine (ICE)

Electric Vehicles (EV)

Hybrid Vehicles

By Price Segment (Market Value %)

Entry-Level Luxury (USD 50,000-79,999)

Mid-Level Luxury (USD 80,000-149,999)

Ultra-Luxury (USD 150,000+)

By Drive Type (Market Value %)

All-Wheel Drive (AWD)

Rear-Wheel Drive (RWD)

Front-Wheel Drive (FWD)

By Region (Market Value %)

West Coast (California, etc.)

Northeast (New York, etc.)

South (Texas, etc.)

Midwest

05 USA Luxury Car Market Competitive Analysis

Detailed Profiles of Major Companies

Mercedes-Benz Group AG

BMW Group

Tesla, Inc.

General Motors (Cadillac)

Ford Motor Company (Lincoln)

Stellantis N.V. (Chrysler)

Volkswagen Group (Audi, Porsche)

Toyota Motor Corporation (Lexus)

Aston Martin Lagonda Limited

Ferrari S.p.A

Jaguar Land Rover Automotive PLC

Volvo Car Corporation

Bentley Motors Limited

Rolls-Royce Motor Cars

Automobili Lamborghini S.p.A.

Cross-Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, R&D Spending, Market Share, EV Portfolio, Global Reach)

Market Share Analysis by Competitor

Strategic Initiatives and Partnerships

Recent Mergers and Acquisitions

Investment Landscape Analysis

06 USA Luxury Car Market Regulatory Framework

Federal Emission Standards and Environmental Regulations

Compliance and Certification Requirements

Incentives for Hybrid and Electric Luxury Vehicles

07 USA Luxury Car Future Market Size (USD Billion)

Market Size Forecast and Projections

Key Growth Drivers for Future Market Expansion

08 USA Luxury Car Future Market Segmentation

By Vehicle Type

By Drive Type

By Price Segment

By Propulsion Type

By Region

09 USA Luxury Car Market Analysts Recommendations

TAM/SAM/SOM Analysis

Customer Profiling and Segmentation Strategy

Digital Marketing Initiatives

Expansion Opportunities in Emerging Markets

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

Key variables are identified based on an ecosystem map, covering all relevant stakeholders within the USA Luxury Car Market. This step involves desk research and data collection from secondary sources to outline critical factors driving market trends.

Step 2: Market Analysis and Construction

Historical data from multiple sources is compiled to construct the market size, focusing on industry penetration and segmentation. Revenue and production data from the last five years provide a basis for future market projections.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through direct interviews with industry experts, including car manufacturers and EV infrastructure providers. These insights are used to adjust market dynamics and assess the impact of recent developments.

Step 4: Research Synthesis and Final Output

A synthesis of the research data, validated by consultations, forms the final analysis. Market segmentation and growth projections are cross-checked to ensure accuracy, providing a comprehensive outlook on the USA Luxury Car Market.

Frequently Asked Questions

01 How big is the USA Luxury Car Market?

The USA luxury car market is valued at approximately USD 117 billion, driven by rising consumer demand for premium and electric vehicles with advanced technologies.

02 What are the challenges in the USA Luxury Car Market?

The USA luxury car market faces challenges such as high ownership costs, supply chain disruptions, and material shortages, which impact production and consumer accessibility.

03 Who are the major players in the USA Luxury Car Market?

Leading players in the USA luxury car market include Mercedes-Benz, Tesla, BMW, General Motors, and Rolls-Royce, known for their innovation and strong presence in the USA market.

04 What are the growth drivers of the USA Luxury Car Market?

Key growth drivers in the USA luxury car market include the shift towards electric and autonomous vehicles, demand for personalized luxury, and government incentives for low-emission cars.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.