USA Maintenance, Repair, and Operations (MRO) Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD5220

December 2024

100

About the Report

USA MRO Market Overview

- The USA MRO market is valued at USD 91 billion, based on a five-year historical analysis. The markets growth is driven by the increasing need for operational efficiency across manufacturing, automotive, and energy sectors. Key advancements in predictive maintenance, IoT integration, and automation tools are ensuring minimal downtime for industrial operations, boosting demand for MRO services and products across the country. The focus on enhancing asset longevity and reducing equipment failure is further propelling the markets expansion.

- The market dominance is primarily seen in industrial regions such as Texas, California, and Illinois, where the presence of large-scale manufacturing plants, oil refineries, and advanced aerospace and defense facilities drive the demand for MRO services. These regions are also favored due to established supply chain networks, skilled labor, and proximity to end-use industries that require continuous maintenance and repair operations.

- In 2024, stricter environmental regulations imposed by the U.S. Environmental Protection Agency (EPA) are shaping the MRO market. MRO providers are required to comply with emission standards and hazardous waste management guidelines, with non-compliance leading to fines and operational shutdowns. For instance, the EPAs National Emission Standards for Hazardous Air Pollutants (NESHAP) mandates stringent control measures for industrial processes, directly affecting the materials and chemicals used in MRO operations.

USA MRO Market Segmentation

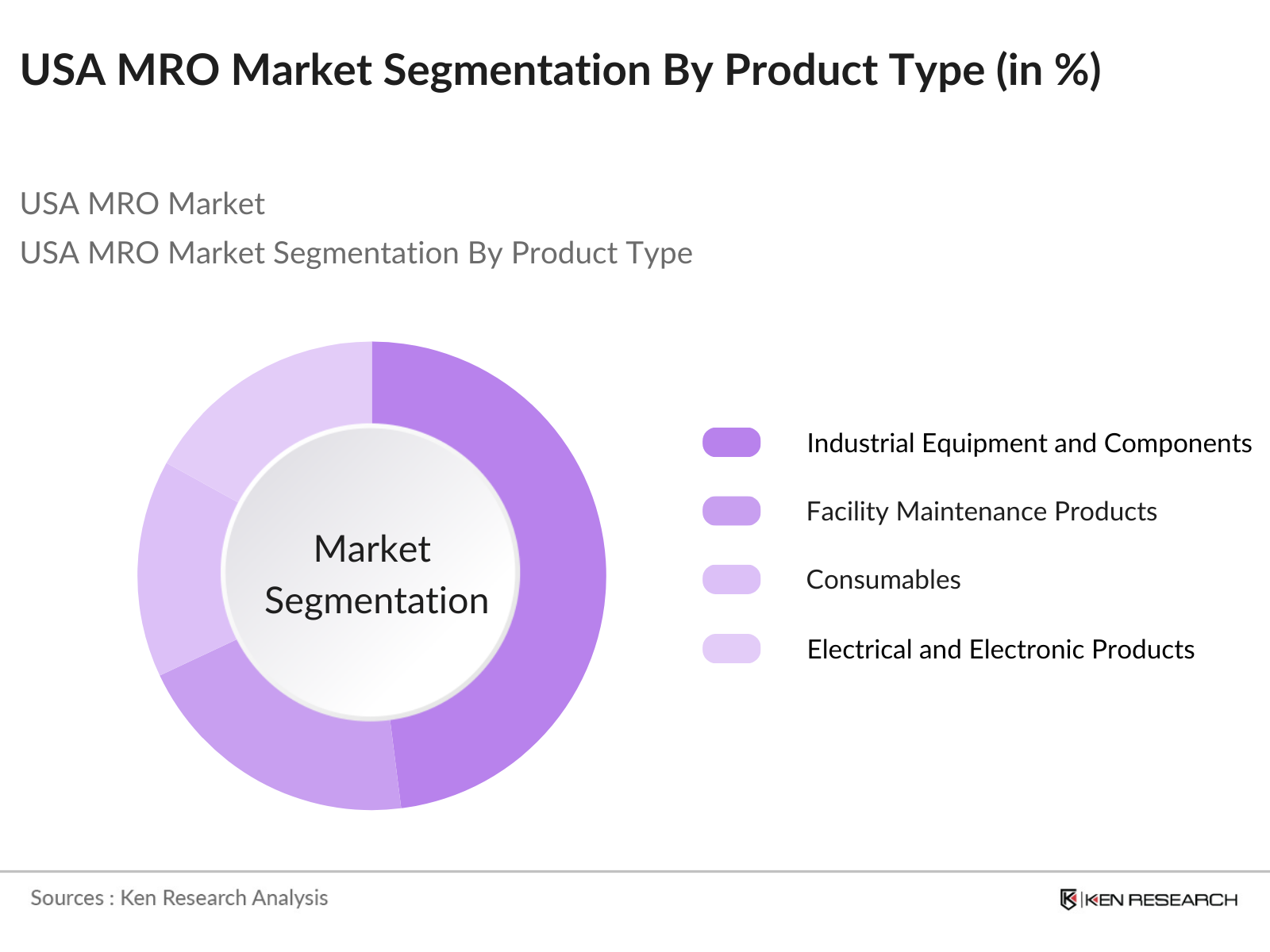

By Product Type: The market is segmented by product type into industrial equipment and components, facility maintenance products, consumables, electrical and electronic products, and safety and PPE equipment. Among these, industrial equipment and components hold a dominant market share due to the essential role they play in ensuring the operational continuity of machinery in sectors such as manufacturing and energy.

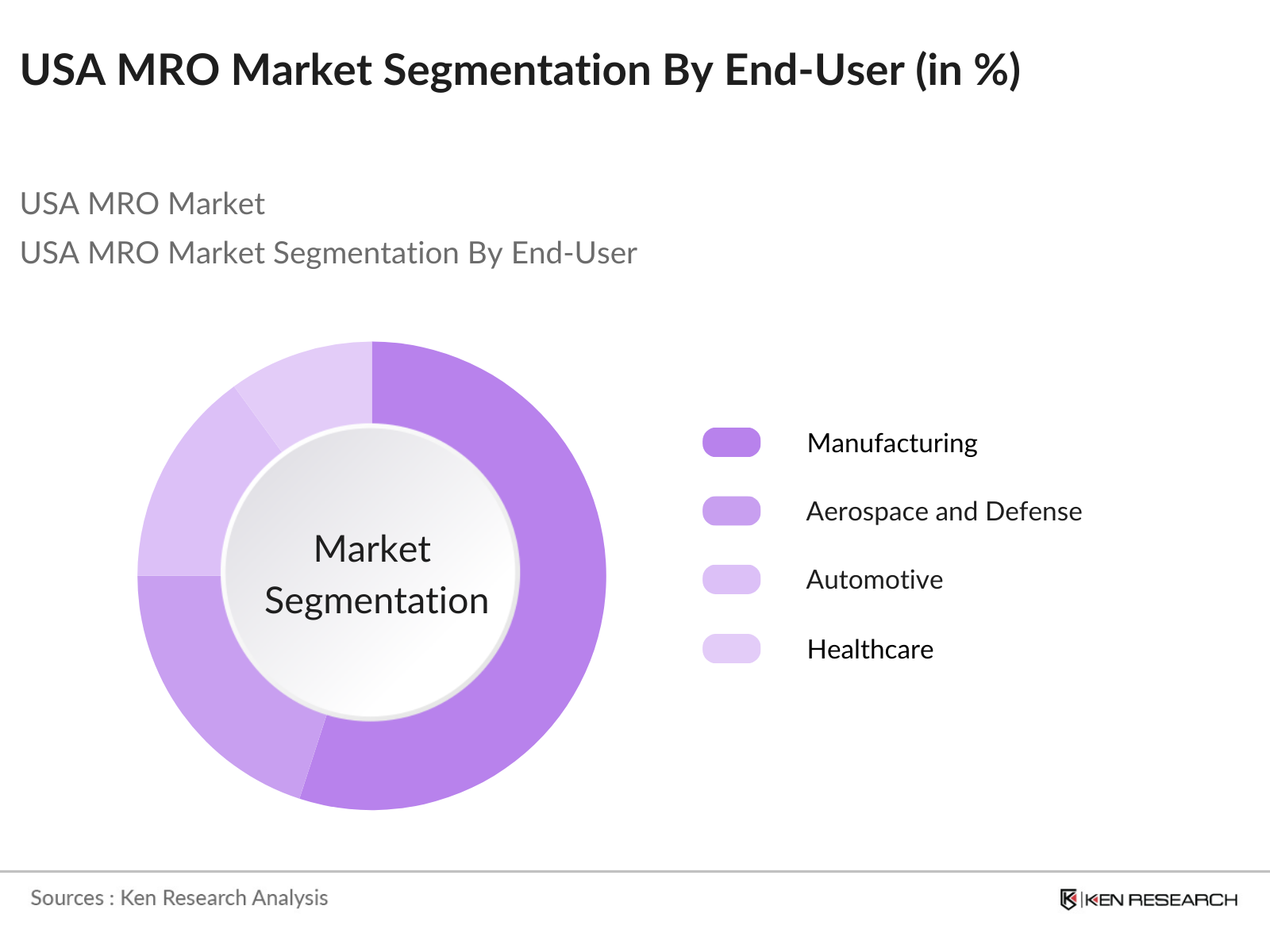

By End-Use Industry: The market is segmented by end-use industry into manufacturing, aerospace and defense, automotive, healthcare, and energy and utilities. Manufacturing leads the market share due to the high demand for equipment maintenance, repair services, and the use of MRO supplies to keep production lines operational. The need for minimizing downtime and enhancing productivity across factories and production facilities reinforces the importance of MRO in this sector.

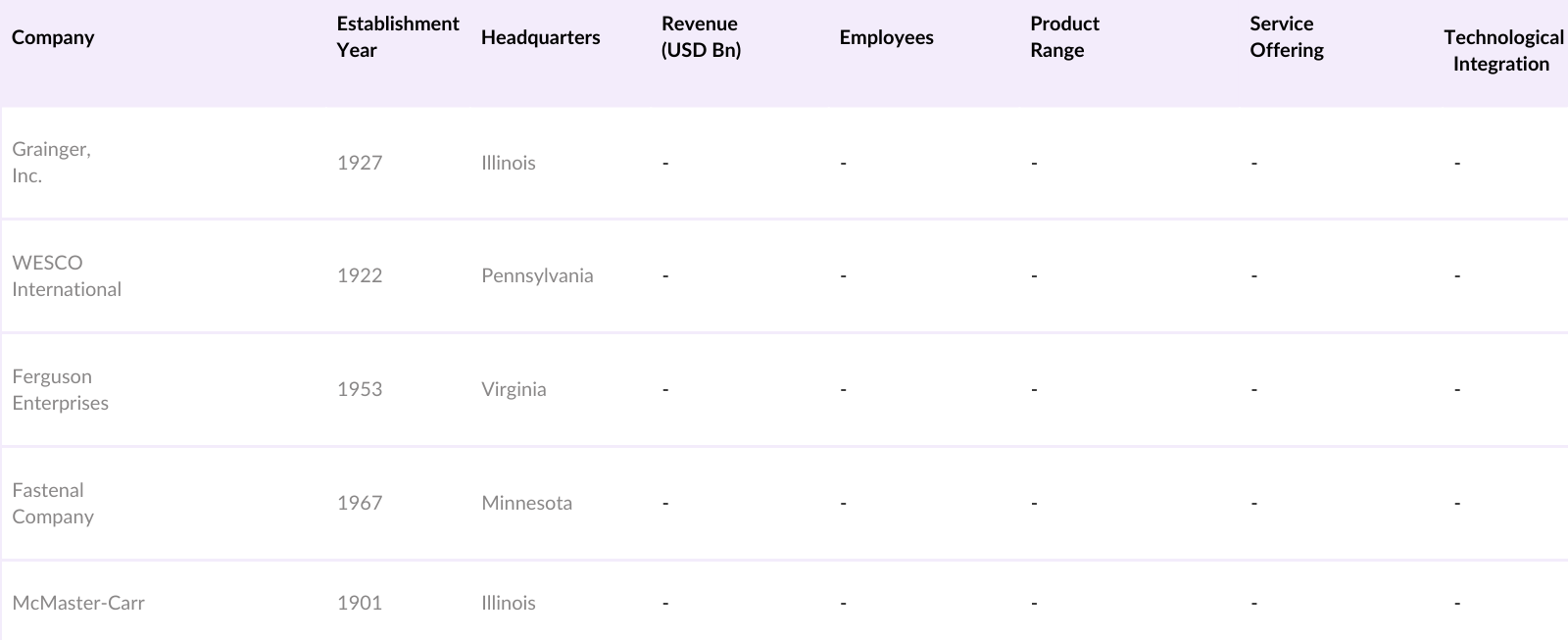

USA MRO Market Competitive Landscape

The USA MRO market is dominated by established players who have extensive supply chain networks and a diverse portfolio of products and services. The market is highly competitive due to the presence of both national distributors and regional suppliers. Companies such as Grainger, WESCO, and Fastenal have built strong distribution networks and are investing in technology to improve inventory management and supply chain efficiency.

USA MRO Industry Analysis

Growth Drivers

- Increase in Industrial Manufacturing Activity: The industrial manufacturing sector in the USA has seen notable growth in 2024, largely driven by federal policies aimed at boosting domestic production. According to the U.S. Census Bureau, industrial output in the USA reached over $5.5 trillion in 2023, with an increase in capital goods manufacturing. This growth directly impacts the Maintenance, Repair, and Operations (MRO) market, as facilities require more frequent and advanced maintenance solutions to ensure operational efficiency.

- Emphasis on Operational Efficiency (MRO Services): In 2024, the increasing focus on operational efficiency has led companies to invest heavily in MRO services. According to the U.S. Bureau of Economic Analysis (BEA), U.S. industrial firms allocated over $1.3 trillion in 2023 for operational efficiency improvements, part of which is dedicated to advanced MRO services. This investment is driven by the need to reduce operational downtimes, improve productivity, and minimize energy consumption.

- Rising Adoption of Predictive Maintenance Solutions: Predictive maintenance, a strategy that uses data analytics to predict equipment failures, has seen widespread adoption across industries in the U.S., especially in manufacturing. By 2024, the adoption of predictive maintenance solutions has grown significantly, with 64% of U.S. manufacturers reportedly using it to extend equipment life and minimize unexpected downtimes. According to a report from the National Institute of Standards and Technology (NIST), predictive maintenance can lead to 10-20% reduction in maintenance costs, while increasing machinery lifespan by 10-15%, providing substantial benefits for industries relying on continuous operations.

Market Challenges

- Price Fluctuations in Raw Materials: The MRO market in the USA faces challenges due to price volatility in raw materials like metals and energy. In 2023, the U.S. Energy Information Administration (EIA) reported that energy costs saw fluctuations, with crude oil prices ranging between $70-$100 per barrel, which directly impacts the cost of materials used in maintenance products. Similarly, the price of key metals such as steel has risen, which affects the pricing of MRO tools and components, making it difficult for companies to manage costs effectively.

- Shortage of Skilled Workforce in Maintenance Operations: In 2024, the shortage of skilled maintenance technicians continues to be a critical challenge for the U.S. MRO market. The U.S. Bureau of Labor Statistics (BLS) reported a shortfall of 60,000 skilled workers in the maintenance and repair industry in 2023. As industries become more reliant on complex machinery, the need for highly trained personnel has grown, creating a demand-supply gap that impacts the timely execution of maintenance tasks.

USA MRO Market Future Outlook

The USA MRO market is expected to experience robust growth over the next five years, driven by the increasing adoption of Industry 4.0 technologies, the growing focus on predictive maintenance, and the need for operational efficiency across industries. The introduction of AI and IoT in asset management is likely to reduce downtime and streamline the supply chain, contributing to the market's expansion. The continued growth of manufacturing, healthcare, and energy sectors will further increase demand for MRO products and services.

Market Opportunities

- Growth in Technological Integration (Smart MRO Solutions, IoT): Technological advancements, particularly in smart MRO solutions and IoT integration, present significant growth opportunities. By 2024, IoT-enabled MRO systems are being used by over 45% of U.S. manufacturing firms to monitor equipment in real time and perform predictive maintenance. The U.S. Department of Energy estimates that smart MRO technologies can reduce maintenance costs by 30%, while improving asset utilization by up to 20%. This shift towards digitalization in MRO processes is creating demand for technologically skilled labor and innovative service providers.

- Increasing Outsourcing of MRO Services: In 2024, more U.S. companies are outsourcing MRO services to specialized providers to focus on core business activities. According to the U.S. Census Bureau, approximately 35% of manufacturing firms outsourced MRO services in 2023, marking a shift towards third-party managed services to reduce costs and improve service quality. Outsourcing allows firms to access specialized expertise and advanced technologies without having to make large capital investments, contributing to the growth of the MRO service provider market.

Scope of the Report

|

By Product Type |

Industrial Equipment and Components Facility Maintenance Products Consumables Electrical and Electronic Products Safety and PPE Equipment |

|

By End-Use Industry |

Manufacturing Aerospace and Defense Automotive Healthcare Energy and Utilities |

|

By Service Type |

Repair Services Maintenance Services Operations Support Services |

|

By Distribution Channel |

Direct Distribution Third-Party Providers |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Industrial Equipment Manufacturers

Aerospace and Defense Companies

Automotive Parts Suppliers

Healthcare Institutions

Energy and Utilities Firms

Safety and PPE Suppliers

Government and Regulatory Bodies (OSHA, EPA)

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Grainger, Inc.

WESCO International

Ferguson Enterprises

Fastenal Company

McMaster-Carr

Rexel USA, Inc.

HD Supply

Airgas USA, LLC

Lawson Products

Graybar Electric Company

Table of Contents

1. USA MRO Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA MRO Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA MRO Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Industrial Manufacturing Activity

3.1.2. Emphasis on Operational Efficiency (MRO services)

3.1.3. Rising Adoption of Predictive Maintenance Solutions (Maintenance Strategy Adoption)

3.2. Market Challenges

3.2.1. Price Fluctuations in Raw Materials

3.2.2. Shortage of Skilled Workforce in Maintenance Operations

3.2.3. Complex Supply Chain Structures

3.3. Opportunities

3.3.1. Growth in Technological Integration (Smart MRO Solutions, IoT)

3.3.2. Increasing Outsourcing of MRO Services

3.3.3. Expansion into Emerging Industrial Sectors (Renewables, Electric Vehicles)

3.4. Trends

3.4.1. Adoption of Industry 4.0 Solutions (Digital Twin, Automation in MRO)

3.4.2. Sustainable and Green MRO Solutions (Environmental Impact Minimization)

3.4.3. Expansion of Aftermarket Services by OEMs

3.5. Government Regulations

3.5.1. Environmental Standards for MRO Processes

3.5.2. Occupational Safety and Health Administration (OSHA) Regulations

3.5.3. Incentives for Energy-Efficient MRO Solutions

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (End-User Sectors, OEMs, Service Providers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA MRO Market Segmentation

4.1. By Product Type (In Value %) 4.1.1. Industrial Equipment and Components

4.1.2. Facility Maintenance Products

4.1.3. Consumables (Lubricants, Cleaning Agents, etc.)

4.1.4. Electrical and Electronic Products

4.1.5. Safety and PPE Equipment

4.2. By End-Use Industry (In Value %) 4.2.1. Manufacturing

4.2.2. Aerospace and Defense

4.2.3. Automotive

4.2.4. Healthcare

4.2.5. Energy and Utilities

4.3. By Service Type (In Value %) 4.3.1. Repair Services

4.3.2. Maintenance Services

4.3.3. Operations Support Services

4.4. By Distribution Channel (In Value %) 4.4.1. Direct Distribution

4.4.2. Third-Party Providers

4.5. By Region (In Value %) 4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA MRO Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Grainger, Inc.

5.1.2. WESCO International

5.1.3. Ferguson Enterprises

5.1.4. Fastenal Company

5.1.5. Motion Industries

5.1.6. McMaster-Carr

5.1.7. Graybar Electric Company

5.1.8. Applied Industrial Technologies

5.1.9. HD Supply

5.1.10. Airgas USA, LLC

5.1.11. Rexel USA, Inc.

5.1.12. MSC Industrial Direct

5.1.13. Lawson Products

5.1.14. Avnet, Inc.

5.1.15. Anixter International

5.2. Cross Comparison Parameters

No. of Employees, Headquarters, Inception Year, Revenue, Specialization in MRO Products, After-Sales Service Offerings, Technological Integration, Green MRO Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA MRO Market Regulatory Framework

6.1. Environmental Standards for MRO Products

6.2. Compliance Requirements for Safety and Efficiency

6.3. Certification Processes for MRO Suppliers

7. USA MRO Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA MRO Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Service Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. USA MRO Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we map out the key stakeholders within the USA MRO market, using extensive secondary research and proprietary databases. This phase focuses on identifying critical variables such as market demand, technological trends, and competitive dynamics.

Step 2: Market Analysis and Construction

We then analyze historical data related to the MRO market, covering product categories, revenue generation, and service quality. This stage ensures the accuracy of market estimates through detailed data examination.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and tested through interviews with industry experts. These consultations help us validate the assumptions and enhance the precision of market projections.

Step 4: Research Synthesis and Final Output

In the final stage, we consolidate data from manufacturers, service providers, and industry operators to deliver comprehensive insights, ensuring the validity of the market forecast and analysis.

Frequently Asked Questions

01. How big is the USA MRO Market?

The USA MRO market is valued at USD 91 billion, based on a five-year historical analysis. The markets growth is driven by the increasing need for operational efficiency across manufacturing, automotive, and energy sectors.

02. What are the challenges in the USA MRO Market?

Challenges in the USA MRO market include fluctuating raw material prices, a shortage of skilled labor, and complexities in managing an extensive supply chain network.

03. Who are the major players in the USA MRO Market?

Major players in the USA MRO market include Grainger, WESCO International, Ferguson Enterprises, Fastenal Company, and McMaster-Carr, which dominate due to their strong distribution networks and comprehensive product portfolios.

04. What are the growth drivers of the USA MRO Market?

The USA MRO market is driven by the expansion of industrial manufacturing, the increasing adoption of predictive maintenance technologies, and the need for operational efficiency across industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.