USA Maize Market Outlook to 2030

Region:North America

Author(s):Shambhavi Awasthi

Product Code:KROD942

July 2024

98

About the Report

USA Maize Market Overview

- The USA maize market in 2023 is volumed at 346.74 million metric tons, driven by high domestic consumption and strong export demand. The market has grown due to advancements in agricultural technology and increased ethanol production.

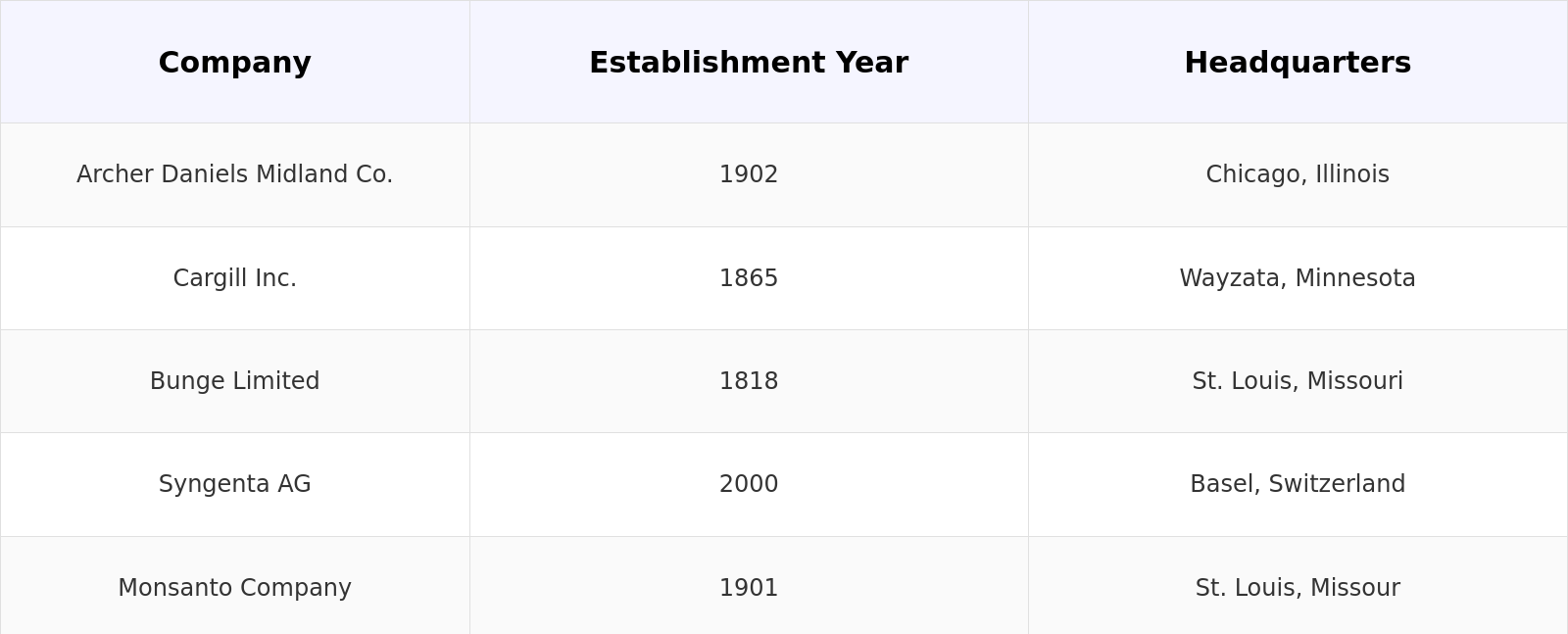

- The key players in the USA maize market include Archer Daniels Midland Company, Cargill Inc., Bunge Limited, Syngenta AG, and Monsanto Company. These companies are involved in various stages of maize production, from seed development and cultivation to processing and distribution, ensuring a robust supply chain that meets domestic and international demands.

- In 2023, a notable development in the maize market was the USDA's introduction of new genetically modified maize varieties that promise higher yields and better resistance to pests and diseases. This innovation is expected to significantly boost productivity and reduce losses, enhancing the overall efficiency of maize farming in the USA.

USA Maize Current Market Analysis

- One of the primary growth drivers for the USA maize market is the increasing demand for biofuels. In 2023, the production of ethanol, a maize-based biofuel, reached 15.8 billion gallons, up from 15 billion gallons in 2022 (Renewable Fuels Association). The Renewable Fuel Standard (RFS) program mandates the blending of renewable fuels into the transportation fuel supply, driving the demand for maize in ethanol production.

- The USA maize market plays a vital role in the country's economy. It supports the livelihoods of millions of farmers and contributes to the agricultural sector's overall growth. The market also influences related industries such as food processing, animal feed, and biofuels. The stability and growth of the maize market have a significant impact on rural communities, agricultural employment, and the nation's food security.

- The Midwest region, particularly states like Iowa, Illinois, and Nebraska, dominates the USA maize market. Iowa alone accounted for 16% of the total maize production in 2023 (USDA). The region's dominance is attributed to its favourable climatic conditions, fertile soil, and well-developed agricultural infrastructure.

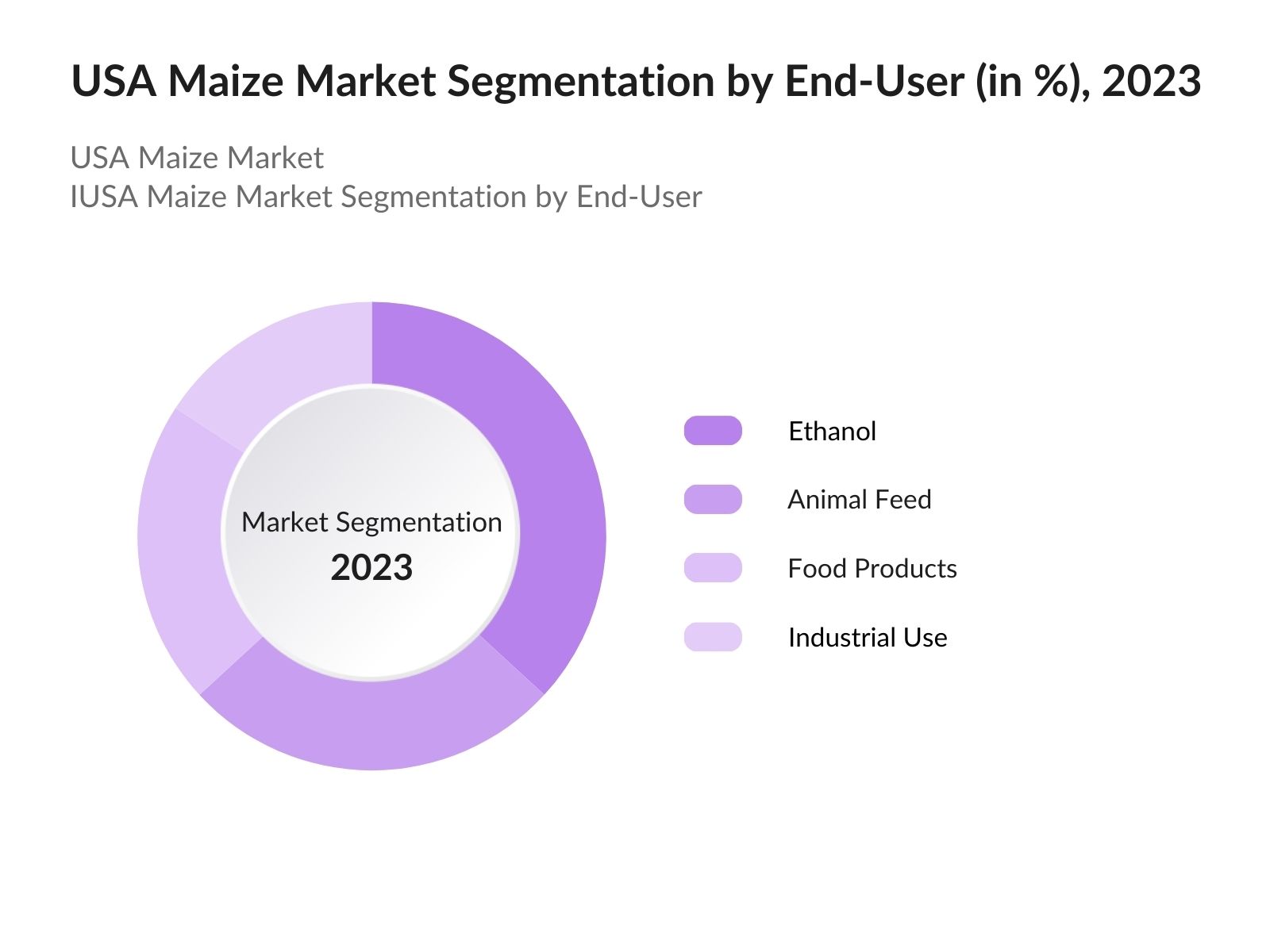

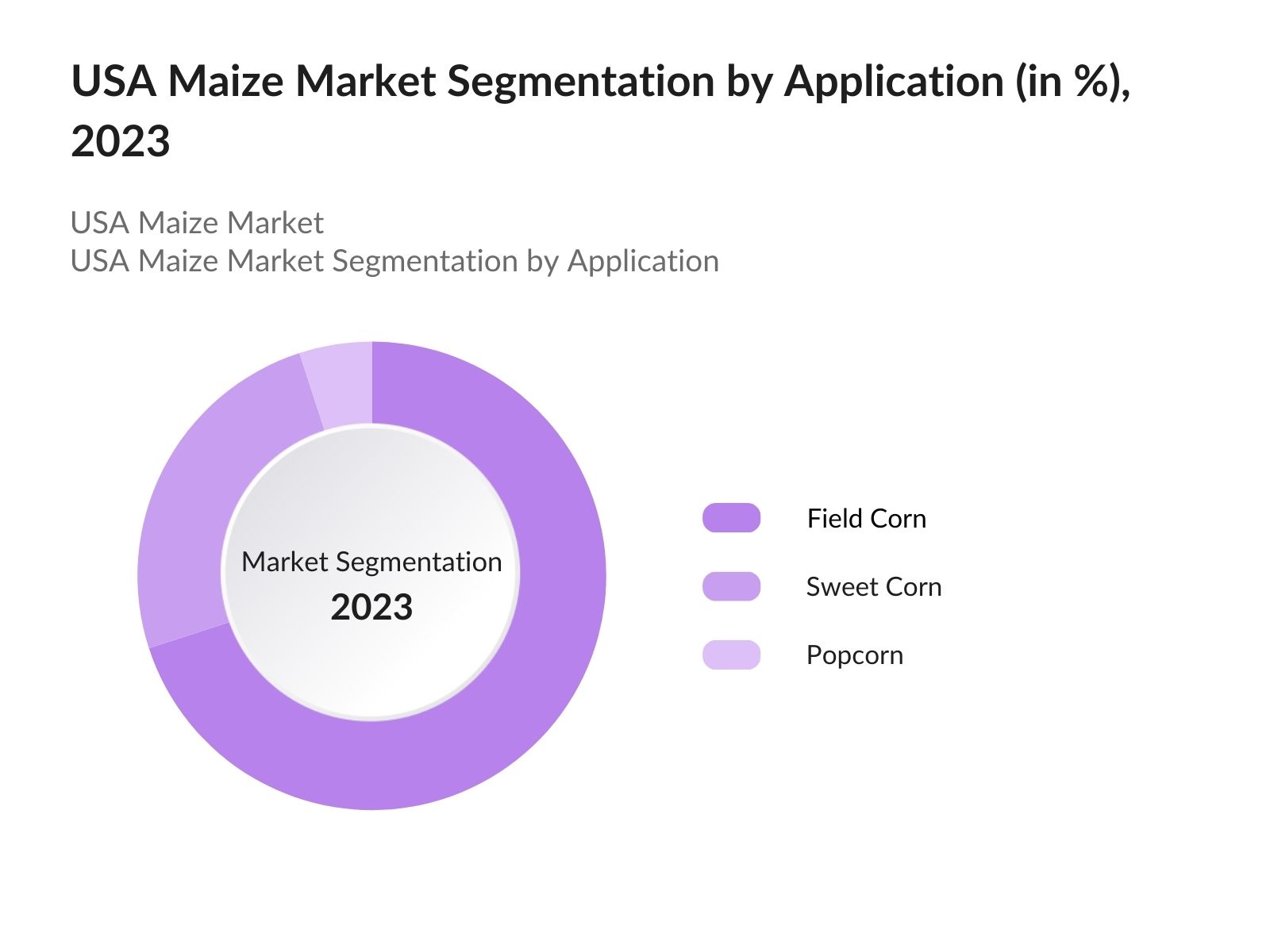

USA Maize Market Segmentation

By End-User: USA Maize Market is segmented by end users into Ethanol, Animal Feed, Food Products and Industrial Use. In 2023, the ethanol segment dominates due to policies like the Renewable Fuel Standard, which mandates the blending of ethanol with gasoline. This has led to a consistent demand for maize in ethanol production, making it a crucial segment.

By Type: USA Maize Market is segmented by type into Field Corn, Sweet Corn and Popcorn. In 2023, field corn, particularly dent and flint varieties, dominates due to their high yield and versatility, used in animal feed, ethanol production, and various industrial applications. Sweet corn, valued for its taste and texture, finds extensive use in the food industry, both fresh and processed.

By Region: USA Maize Market is segmented by region into north, south, west and east. In 2023, the dominant region is the west region which is also known as the "Corn Belt”. It is the leading maize producer due to its fertile soil and favourable climate, accounting for over half of the USA's production. The South contributes significantly, especially for animal feed and food products, leveraging its extensive agricultural infrastructure.

USA Maize Competitive Landscape

- Cargill Inc.: In 2023, Cargill expanded its corn milling operations in Eddyville, Iowa, investing $225 million to increase production capacity by 200 million bushels annually. The expansion focuses on producing corn syrup and ethanol, meeting the growing demand in these segments and enhancing Cargill's position in the market.

- Archer Daniels Midland (ADM): ADM invested $350 million in a bioproducts plant in Clinton, Iowa, set to open in late 2023. The facility will process 300,000 tons of maize annually to produce biodegradable plastics, significantly expanding ADM's sustainable product offerings and supporting the demand for eco-friendly materials.

- Bunge Limited: In 2023, Bunge partnered with Chevron to produce 100 million gallons of renewable diesel per year from maize oil. This joint venture utilizes Bunge's maize processing plants to support the transition to sustainable energy sources, aligning with global efforts to reduce carbon emissions.

- Green Plains Inc.: Green Plains acquired Fluid Quip Technologies for $100 million in 2023 to enhance maize processing and ethanol production. The acquisition is expected to increase ethanol output by 120 million gallons annually, leveraging advanced technologies for better efficiency and positioning Green Plains as a leader in the biofuels industry.

USA Maize Market Analysis

USA Maize Market Growth Drivers

- Increasing Demand for Ethanol Production: The demand for ethanol, which uses maize as a primary feedstock, continues to grow. In 2024, ethanol production is expected to reach 16 billion gallons, driven by federal mandates and renewable fuel standards. The Renewable Fuels Association reports that the increase in ethanol production is leading to higher maize consumption, with an estimated 5 billion bushels dedicated to ethanol production alone.

- Growth in Food and Beverage Sector: The food and beverage sector's demand for maize-based ingredients is another crucial driver. In 2024, the sector is expected to consume 2.8 billion bushels of maize for products such as corn syrup, cornmeal, and snack foods. The increasing popularity of maize-based snacks and convenience foods drives this demand.

- Innovation in Farming Practices: Technological advancements in farming practices, such as precision agriculture and genetically modified maize varieties, are enhancing crop yields and reducing losses. In 2024, these technologies are anticipated to boost maize yields to 180 bushels per acre, up from 175 bushels per acre in the previous year.

USA Maize Market Challenges

- Climate Change and Weather Variability: Climate change poses a significant challenge to maize production. In 2024, erratic weather patterns, including increased instances of drought and flooding, are projected to affect 2 million acres of maize crops. These adverse conditions can lead to reduced yields and increased production costs.

- Pests and Diseases: Pests and diseases continue to threaten maize crops, with the corn rootworm and fall armyworm being the most notorious. In 2024, pest infestations are expected to affect 1.5 million acres of maize, leading to yield losses and increased expenditure on pest control measures. The USDA has highlighted the importance of integrated pest management strategies to combat these threats effectively.

- Market Volatility and Price Fluctuations: Market volatility and price fluctuations present ongoing challenges for maize producers. In 2024, maize prices are expected to fluctuate between USD 5.50 and USD 6.00 per bushel due to varying demand and supply dynamics. This volatility can impact farmers' profitability and planning.

USA Maize Market Government Initiatives

- Renewable Fuel Standard (RFS) Program: The Renewable Fuel Standard (RFS) Program, administered by the Environmental Protection Agency (EPA), mandates a certain volume of renewable fuel, including ethanol made from maize, to be blended into transportation fuel. In 2023, the EPA set the renewable fuel volume requirement at 20.09 billion gallons, with 15 billion gallons allocated for ethanol.

- Farm Bill (2018): The Farm Bill, reauthorized in 2018 and effective through 2023, includes various provisions to support maize farmers. It provides subsidies, crop insurance, and conservation programs that benefit maize producers. For instance, the Price Loss Coverage (PLC) program offers financial protection when market prices for maize fall below reference prices. In 2022, over 90 million acres of maize were insured under the federal crop insurance program.

- Market Facilitation Program (MFP): The Market Facilitation Program (MFP), introduced by the U.S. Department of Agriculture (USDA), provides direct payments to farmers affected by trade disruptions. In 2019, maize farmers received approximately $3.6 billion in MFP payments to offset losses from reduced export opportunities due to international trade tensions.

USA Maize Market Future Outlook

The USA maize market is poised for significant growth over the next five years, driven by increasing demand for biofuels, advancements in agricultural technology, and expanding export opportunities. By 2028, maize production is expected to rise, supported by sustainable farming practices and innovations in crop genetics.

Future Market Trends

-

- Increased Adoption of Sustainable Farming Practices: In the coming years, the maize market is set to witness a notable shift towards sustainable farming methods. Practices like conservation tillage, cover cropping, and integrated pest management are gaining traction, aiming to enhance soil health and reduce environmental impact. This trend towards sustainability reflects broader industry efforts to meet growing consumer and regulatory demands for eco-friendly agricultural practices.

- Growth in Biofuel Demand: The maize market is poised to benefit from rising global demand for biofuels, particularly ethanol. This demand surge, driven by environmental regulations and increased adoption of renewable energy sources, is expected to propel maize’s role as a key feedstock for biofuel production. The market’s expansion is thus bolstered by the dual drivers of domestic consumption and international export opportunities in the biofuels sector.

Scope of the Report

|

By End User |

Ethanol Animal Feed Food Products Industrial Use |

|

By Type |

Field Corn Sweet Corn Popcorn |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Maize Producers and Farmers

Ethanol and Biofuel Manufacturers

Agricultural Equipment Manufacturers

Seed and Agrochemical Companies

Government Institutions and Policy Regulators (USDA, EPA etc.)

Agricultural Cooperatives and Associations

Exporters and Trade Organizations

Financial and Investment Firms

Logistics and Supply Chain Companies

Biotechnology Firms

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

- Archer Daniels Midland Company

- Cargill Inc.

- Bunge Limited

- Monsanto Company

- Syngenta

- DuPont Pioneer

- Bayer CropScience

- BASF

- Corteva Agriscience

- Ingredion Incorporated

- Roquette Frères

- Tate & Lyle PLC

- Louis Dreyfus Company

- Green Plains Inc.

- Valero Energy Corporation

Table of Contents

1. USA Maize Market Overview

1.1 USA Maize Market Taxonomy

2. USA Maize Market Size (in USD Mn mt), 2018-2023

3. USA Maize Market Analysis

3.1 USA Maize Market Growth Drivers

3.2 USA Maize Market Challenges and Issues

3.3 USA Maize Market Trends and Development

3.4 USA Maize Market Government Regulation

3.5 USA Maize Market SWOT Analysis

3.6 USA Maize Market Stake Ecosystem

3.7 USA Maize Market Competition Ecosystem

4. USA Maize Market Segmentation, 2023

4.1 USA Maize Market Segmentation by End User (in value %), 2023

4.2 USA Maize Market Segmentation by Type (in value %), 2023

4.3 USA Maize Market Segmentation by Region (in value %), 2023

5. USA Maize Market Competition Benchmarking

5.1 USA Maize Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. USA Maize Future Market Size (in USD Mn mt), 2023-2028

7. USA Maize Future Market Segmentation, 2028

7.1 USA Maize Market Segmentation by End User (in value %), 2028

7.2 USA Maize Market Segmentation by Type (in value %), 2028

7.3 USA Maize Market Segmentation by Region (in value %), 2028

8. USA Maize Market Analysts’ Recommendations

8.1 USA Maize Market TAM/SAM/SOM Analysis

8.2 USA Maize Market Customer Cohort Analysis

8.3 USA Maize Market Marketing Initiatives

8.4 USA Maize Market White Space Opportunity Analysis

9. Disclaimer

10. Contact Us

Research Methodology

Step 01 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 02 Market Building:

Collating statistics on USA Maize Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Maize Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 03 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 04 Research Output:

Our team will approach multiple Maize companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Maize companies.

Frequently Asked Questions

01 How big is the USA Maize Market?

The USA maize market in 2023 is volumed at 346.74 million, driven by high domestic consumption and strong export demand and growth in the food and beverage sector.

02 What are the challenges in the USA Maize Market?

Challenges in the USA maize market include climate change and weather variability, pests and diseases, market volatility and price fluctuations, and supply chain disruptions.

03 Who are the major players in the USA Maize Market?

Key players in the USA maize market include Archer Daniels Midland Company, Cargill Inc., Bunge Limited, Syngenta AG, and Monsanto Company. These companies have a significant impact due to their extensive supply chains and technological innovations.

04 What are the growth drivers of the USA Maize Market?

Growth drivers of the USA maize market include the increasing demand for ethanol production, expansion of the animal feed industry, growth in the food and beverage sector, and technological advancements in farming.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.