USA Medical Gadgets Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD5659

November 2024

96

About the Report

USA Medical Gadgets Market Overview

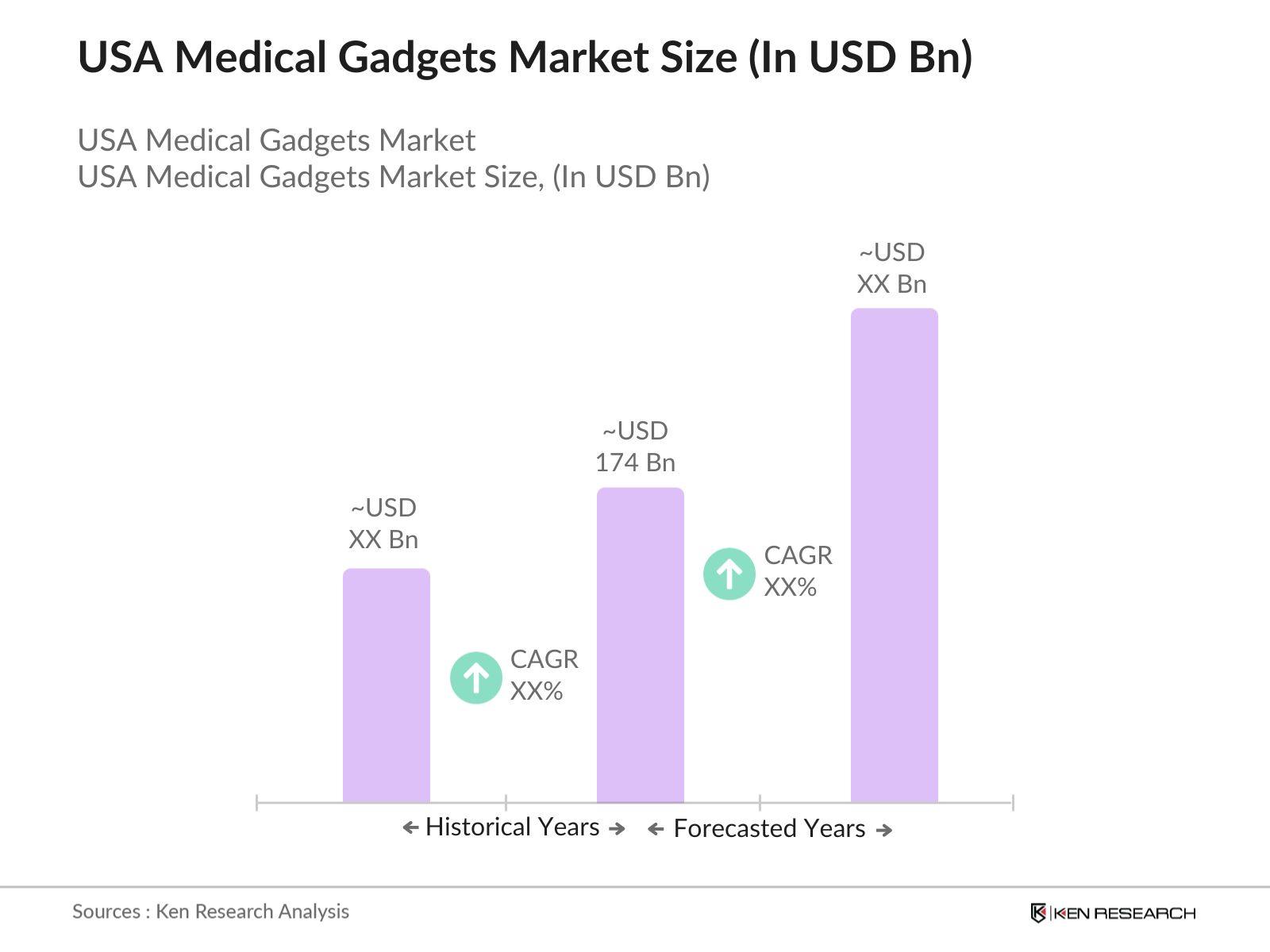

- The USA medical gadgets market is valued at USD 174 billion, based on a five-year historical analysis. This market has been primarily driven by the increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, which demand advanced diagnostic and monitoring devices. The rising demand for minimally invasive surgeries and technological advancements in wearable medical gadgets further contribute to the markets growth. With continuous innovation, the integration of IoT (Internet of Things) in medical devices is reshaping how healthcare is delivered, leading to more personalized and efficient treatments.

- The market is primarily dominated by cities like New York, Boston, and San Francisco. These regions host renowned medical institutions, extensive healthcare infrastructure, and high-tech innovation hubs. Boston, for instance, is a global leader in medical technology development due to its strong academic institutions and access to venture capital. Similarly, Silicon Valley (San Francisco) leads in medical gadgets development due to its convergence of tech firms and biotech innovators. These cities benefit from a robust healthcare ecosystem and are key players in driving medical device advancements.

- The U.S. medical gadgets market is heavily regulated by the FDA, which ensures that all devices meet safety and efficacy standards. In 2023, the FDA cleared over 2,000 new medical devices through its 510(k) premarket notification program. Compliance with these regulations is critical for manufacturers, although the rigorous approval process can slow down time-to-market for innovative gadgets.

USA Medical Gadgets Market Segmentation

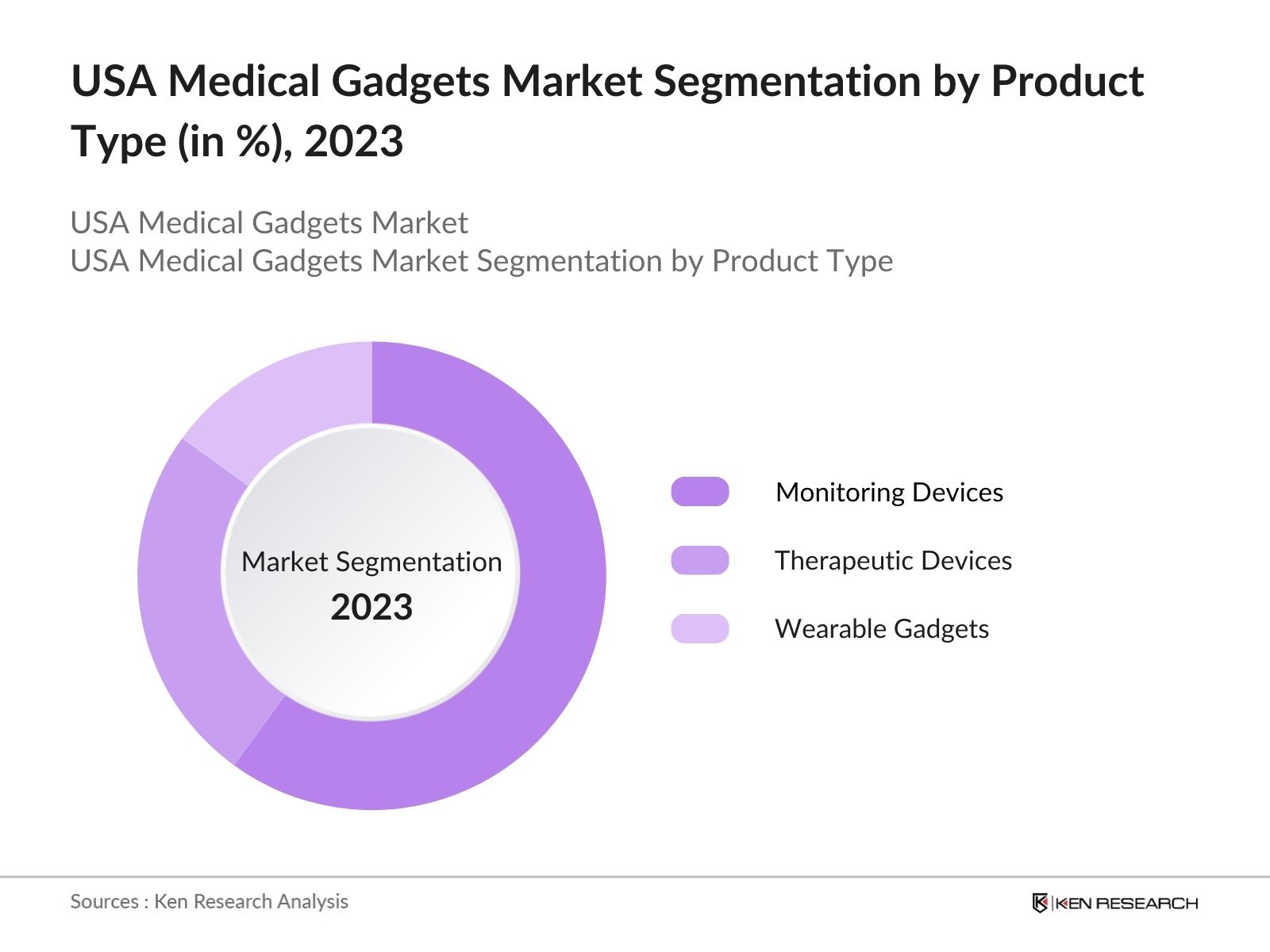

By Product Type: The market is segmented by product type into diagnostic devices, Monitoring Devices, Therapeutic Devices, And Wearable Gadgets. Monitoring devices have a dominant market share due to the rising cases of chronic conditions like diabetes and heart disease. Devices like glucose monitors, blood pressure cuffs, and heart rate monitors are essential for managing long-term diseases. Their usage is increasing as more patients adopt home-based healthcare services, reducing the strain on healthcare facilities while improving quality of care.

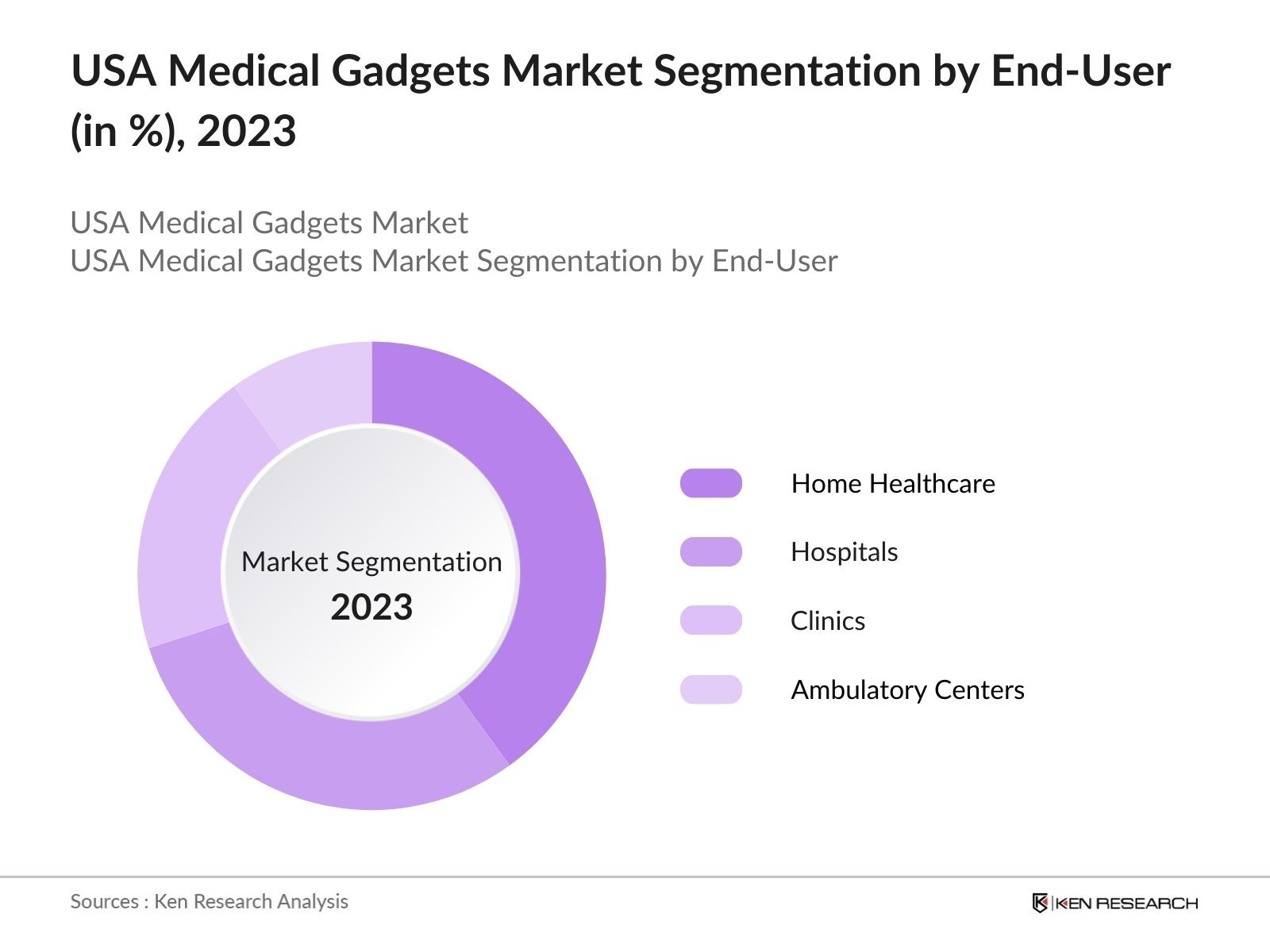

By End-User: The market is also segmented by end-users, including hospitals, home healthcare, clinics, and ambulatory surgical centers. Home healthcare dominates the market share as more patients prefer monitoring their health conditions at home, driven by the increasing availability of user-friendly, compact, and accurate devices. Additionally, home healthcare reduces hospital visits, proving more convenient and cost-effective for patients, especially for the elderly and those with chronic diseases. This segment has gained traction post-pandemic, where the need for remote care significantly increased.

USA Medical Gadgets Market Competitive Landscape

The USA medical gadgets market is dominated by global players like Medtronic, Johnson & Johnson, and GE Healthcare, alongside domestic companies such as Boston Scientific Corporation and Abbott Laboratories. These companies have established strong market presence through extensive product portfolios and continuous innovation in medical device technologies. The growing demand for advanced diagnostic tools, wearable medical devices, and home-based healthcare solutions has led to consolidation among leading players, positioning them to meet the needs of a rapidly evolving market.

|

Company |

Established |

Headquarters |

Product Focus |

No. of Employees |

Revenue (2023) |

R&D Investment |

Key Strategic Initiative |

|

Medtronic |

1949 |

Minneapolis, MN |

|||||

|

Johnson & Johnson |

1886 |

New Brunswick, NJ |

|||||

|

GE Healthcare |

1892 |

Chicago, IL |

|||||

|

Boston Scientific Corporation |

1979 |

Marlborough, MA |

|||||

|

Abbott Laboratories |

1888 |

Abbott Park, IL |

USA Medical Gadgets Industry Analysis

Growth Drivers

- Increase in Chronic Diseases: The rise in chronic diseases in the USA is a major factor driving the medical gadgets market. According to the Centers for Disease Control and Prevention (CDC), 6 in 10 adults in the U.S. have at least one chronic disease, such as heart disease or diabetes, as of 2023. This increase has led to higher demand for medical gadgets like glucose monitors and portable ECG devices. The aging population further exacerbates this trend, as older individuals are more prone to chronic illnesses, fueling the need for these devices in managing their health.

- Rising Aging Population: The U.S. Census Bureau reports that 54 million people in the U.S. are aged 65 or older, representing a growing demographic that heavily relies on medical gadgets for various health conditions. As of 2024, this number is projected to continue increasing, creating a substantial demand for devices such as blood pressure monitors, mobility aids, and wearable health trackers. The aging population's rising healthcare needs directly contribute to the growth of the medical gadgets market.

- Technological Advancements: Technological advancements in medical gadgets, such as artificial intelligence (AI) and machine learning (ML), are revolutionizing the healthcare industry. AI-driven diagnostic tools like portable ultrasound devices have become more accurate, while ML models are improving real-time data interpretation in wearable health trackers. This rise in technology adoption is enabling more efficient disease management. The U.S. Food and Drug Administration (FDA) has approved over 400 AI-enabled medical devices, supporting technological integration in this sector.

Market Challenges

- High Cost of Advanced Medical Devices: The high cost of advanced medical devices, such as robotic surgical systems and AI-enabled diagnostic tools, limits market access for smaller healthcare facilities. For example, robotic surgery systems can cost hospitals upwards of $2 million, making these technologies inaccessible for many. Even though these devices improve healthcare outcomes, the initial cost of acquisition is a major barrier to adoption, particularly in rural or underfunded healthcare centers.

- Stringent FDA Regulations: The medical gadgets market faces challenges due to stringent FDA regulations that ensure safety and efficacy but extend approval timelines. On average, FDA approval for high-risk Class III medical devices can take 3 to 7 years. Although these regulations are crucial for patient safety, they significantly delay the introduction of innovative technologies into the market, slowing growth opportunities for manufacturers.

USA Medical Gadgets Market Future Outlook

Over the next five years, the USA medical gadgets market is expected to experience robust growth, fueled by rising healthcare expenditure, the increasing prevalence of chronic diseases, and rapid technological advancements. The shift toward home healthcare solutions and the adoption of IoT-enabled devices are anticipated to shape the future of the market. Moreover, the integration of artificial intelligence (AI) in medical devices will revolutionize patient care by enabling real-time data analysis, personalized treatment, and improved clinical outcomes.

Future Market Opportunities

- Growth in Home Healthcare Devices: The shift towards home healthcare, driven by a preference for at-home treatment and the high cost of hospital stays, presents an opportunity for medical gadgets. Devices like remote patient monitoring systems, oxygen concentrators, and digital thermometers are witnessing increased demand. The U.S. healthcare system spends $20 billion annually on home healthcare services, supporting the market for home-based medical devices, particularly among elderly patients managing chronic conditions.

- Adoption of Wearable Gadgets for Health Monitoring: The adoption of wearable gadgets like smartwatches and fitness trackers has skyrocketed, with over 60 million adults in the U.S. using wearable health devices in 2023. These gadgets are increasingly used for monitoring heart rate, sleep patterns, and blood oxygen levels, contributing to early detection of health issues. The integration of real-time health data with electronic health records (EHR) systems further boosts this trend, offering significant growth opportunities in the market.

Scope of the Report

|

Product Type |

Diagnostic Devices Therapeutic Devices Monitoring Devices Surgical Devices |

|

Application |

Hospitals Clinics Home Healthcare Ambulatory Surgical Centers |

|

Technology |

Wearable Technology IoT-Enabled Gadgets Wireless Technology AI-Integrated Devices |

|

End-User |

Healthcare Professionals Patients Health Insurance Providers |

|

Region |

Northeast Southeast Midwest West Coast |

Products

Key Target Audience

Hospitals and Healthcare Providers

Home Healthcare Service Providers

Medical Device Manufacturers

Health Insurance Companies

Government and Regulatory Bodies (FDA, CMS)

Investors and Venture Capitalist Firms

Banks and Financial Institutes

Technology Providers (IoT and AI integration specialists)

Distribution and Supply Chain Partners

Companies

Major Players

Medtronic

Johnson & Johnson

GE Healthcare

Boston Scientific Corporation

Abbott Laboratories

Siemens Healthineers

Stryker Corporation

Philips Healthcare

Zimmer Biomet

Becton Dickinson & Company

ResMed Inc.

Baxter International

3M Health Care

Terumo Corporation

Edwards Lifesciences

Table of Contents

USA Medical Gadgets Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

USA Medical Gadgets Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Medical Gadgets Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Chronic Diseases

3.1.2. Rising Aging Population

3.1.3. Technological Advancements

3.1.4. Favorable Government Policies

3.2. Market Challenges

3.2.1. High Cost of Advanced Medical Devices

3.2.2. Stringent FDA Regulations

3.2.3. Cybersecurity Concerns in Medical Gadgets

3.3. Opportunities

3.3.1. Growth in Home Healthcare Devices

3.3.2. Adoption of Wearable Gadgets for Health Monitoring

3.3.3. Expansion in Telemedicine

3.4. Trends

3.4.1. Rise of AI-Enabled Medical Gadgets

3.4.2. Miniaturization of Devices

3.4.3. Increasing Adoption of IoT in Medical Gadgets

3.5. Government Regulation

3.5.1. FDA Regulations and Certifications

3.5.2. Data Privacy Laws (HIPAA Compliance)

3.5.3. Medicare Reimbursement Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

USA Medical Gadgets Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Diagnostic Devices

4.1.2. Therapeutic Devices

4.1.3. Monitoring Devices

4.1.4. Surgical Devices

4.2. By Application (In Value %)

4.2.1. Hospitals

4.2.2. Clinics

4.2.3. Home Healthcare

4.2.4. Ambulatory Surgical Centers

4.3. By Technology (In Value %)

4.3.1. Wearable Technology

4.3.2. IoT-Enabled Gadgets

4.3.3. Wireless Technology

4.3.4. AI-Integrated Devices

4.4. By End-User (In Value %)

4.4.1. Healthcare Professionals

4.4.2. Patients

4.4.3. Health Insurance Providers

4.5. By Region (In Value %)

4.5.1. North East

4.5.2. South East

4.5.3. Midwest

4.5.4. West Coast

USA Medical Gadgets Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Medtronic

5.1.2. Johnson & Johnson

5.1.3. GE Healthcare

5.1.4. Abbott Laboratories

5.1.5. Boston Scientific Corporation

5.1.6. Siemens Healthineers

5.1.7. Stryker Corporation

5.1.8. Philips Healthcare

5.1.9. Zimmer Biomet Holdings

5.1.10. Becton Dickinson & Company

5.1.11. ResMed Inc.

5.1.12. Baxter International

5.1.13. 3M Health Care

5.1.14. Terumo Corporation

5.1.15. Edwards Lifesciences

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, Product Portfolio, Market Share, R&D Expenditure, Innovation Pipeline, Key Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

USA Medical Gadgets Market Regulatory Framework

6.1. FDA Approval Process

6.2. Quality Certifications (ISO 13485)

6.3. Reimbursement Policies

6.4. Data Privacy & Cybersecurity Regulations

USA Medical Gadgets Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Medical Gadgets Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

USA Medical Gadgets Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Development Strategies

9.3. Market Penetration and Expansion Strategies

9.4. Strategic Partnerships and Collaborations

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying and mapping the USA medical gadgets market ecosystem. This includes analyzing various stakeholders such as device manufacturers, healthcare providers, and regulatory bodies. A combination of secondary research and proprietary databases is used to identify critical variables influencing market growth.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data on product adoption rates, market penetration, and revenue generation from the medical gadgets market. The data gathered is assessed to ensure accurate estimates of market size and growth potential, based on past trends and existing conditions.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are tested through expert consultations, using computer-assisted telephone interviews (CATIs). Industry experts provide insights into current trends, technological advancements, and expected changes within the market, helping to validate our analysis.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all data and insights to produce a comprehensive analysis. Detailed market insights are drawn from primary research interviews, ensuring the final report provides accurate, validated, and reliable market data.

Frequently Asked Questions

01. How big is the USA Medical Gadgets Market?

The USA medical gadgets market was valued at USD 174 billion, driven by increasing adoption of advanced diagnostic tools, wearables, and home healthcare solutions.

02. What are the challenges in the USA Medical Gadgets Market?

Challenges include the high cost of advanced medical devices, strict FDA regulations, and cybersecurity concerns related to connected medical gadgets, which create hurdles for smaller companies.

03. Who are the major players in the USA Medical Gadgets Market?

Key players in the market include Medtronic, Johnson & Johnson, GE Healthcare, Abbott Laboratories, and Boston Scientific Corporation. These companies lead the market due to strong R&D investment, innovative product offerings, and established distribution networks.

04. What are the growth drivers of the USA Medical Gadgets Market?

The market is propelled by the increasing prevalence of chronic diseases, advancements in technology, growing demand for home healthcare solutions, and favorable government policies supporting the adoption of medical devices.

05. What are the trends shaping the USA Medical Gadgets Market?

Trends include the growing use of AI in diagnostics, increasing adoption of wearable medical gadgets, and the integration of IoT in healthcare systems to enable real-time patient monitoring.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.