USA Microencapsulation Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD6807

December 2024

87

About the Report

USA Microencapsulation Market Overview

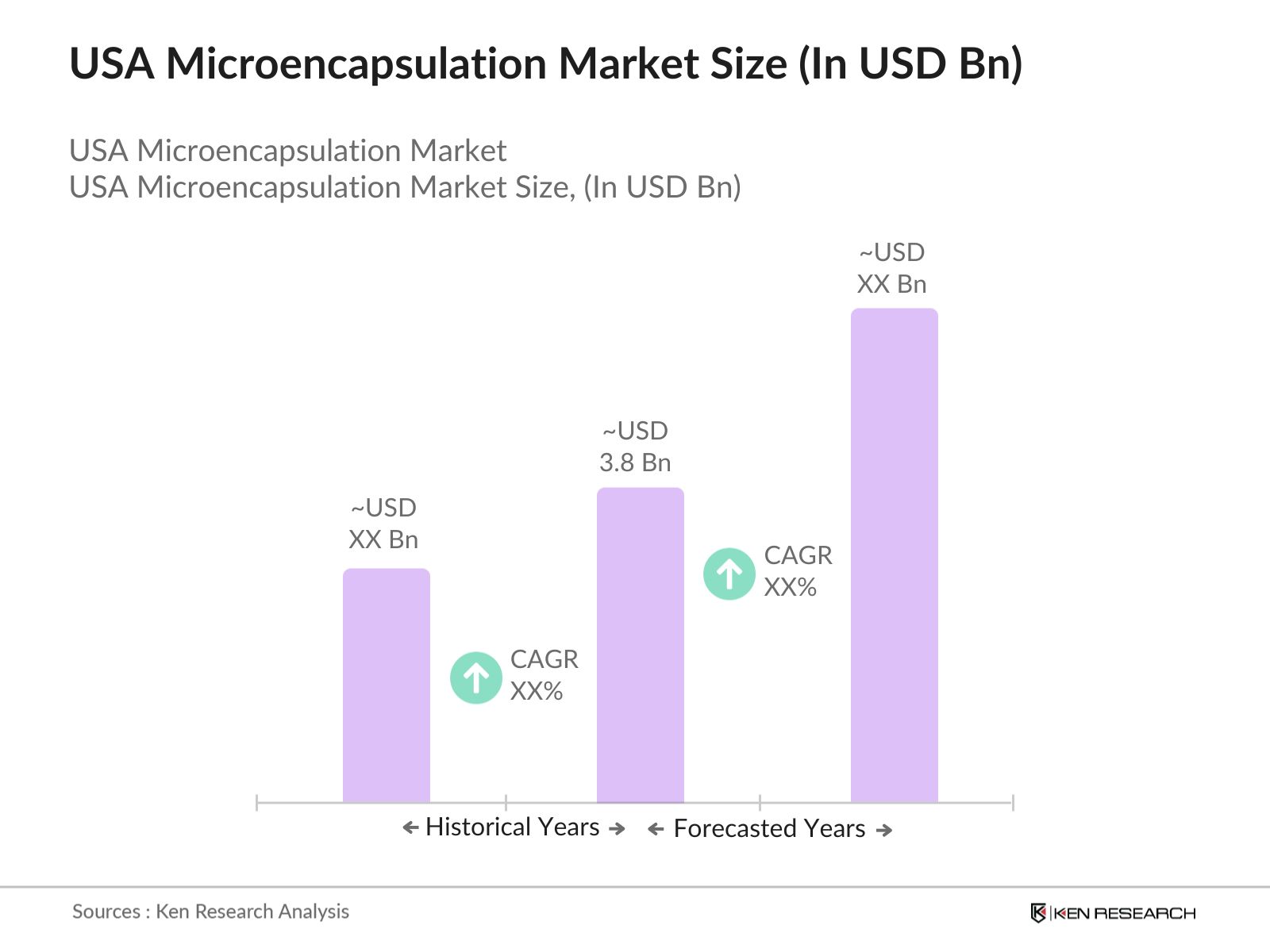

- The USA Microencapsulation Market is valued at USD 3.8 billion, primarily driven by advancements in encapsulation technologies and the expanding applications across diverse industries. With increasing demand in sectors like pharmaceuticals, food & beverages, and personal care, microencapsulation is becoming essential for controlled release and improved ingredient stability. The rising focus on nutrient stability in food products and precise drug delivery in healthcare applications further propels the market's growth, showcasing its critical role in enhancing product efficacy across various domains.

- Major metropolitan areas in the United States, including New York, Los Angeles, and Chicago, dominate the microencapsulation market due to the high concentration of industries that benefit from microencapsulation technologies, such as pharmaceuticals, food & beverages, and cosmetics. These regions are hubs for research, innovation, and production facilities, fostering technological advancements and encouraging adoption across sectors. The strong presence of healthcare facilities and demand for innovative drug delivery solutions further boost microencapsulation adoption in these key areas.

- The FDA's Current Good Manufacturing Practice (CGMP) regulations, updated in 2023, outline stringent requirements for the production of pharmaceuticals, including those utilizing microencapsulation techniques. These standards mandate rigorous quality control measures, such as validation of encapsulation processes and thorough testing of final products to ensure safety and efficacy. Adherence to CGMP is essential for market approval and maintaining public trust in pharmaceutical products.

USA Microencapsulation Market Segmentation

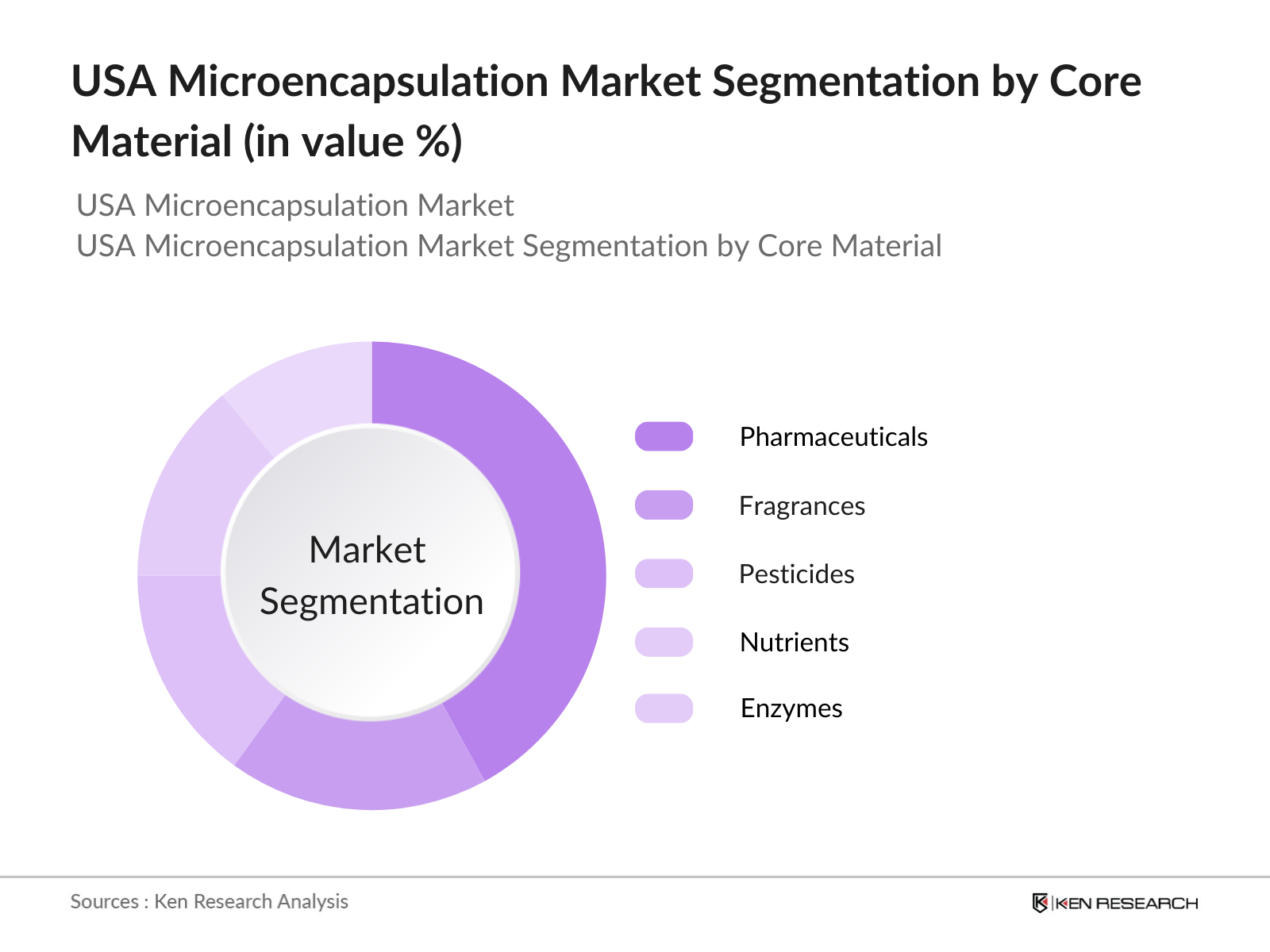

By Core Material: The market is segmented by core material into pharmaceuticals, fragrances, pesticides, nutrients, and enzymes. Pharmaceuticals hold a dominant market share in the core material segment due to their essential role in targeted drug delivery and controlled release mechanisms. The focus on enhancing drug bioavailability and patient compliance, coupled with the growing number of new drug formulations, reinforces the demand for microencapsulation in this sector.

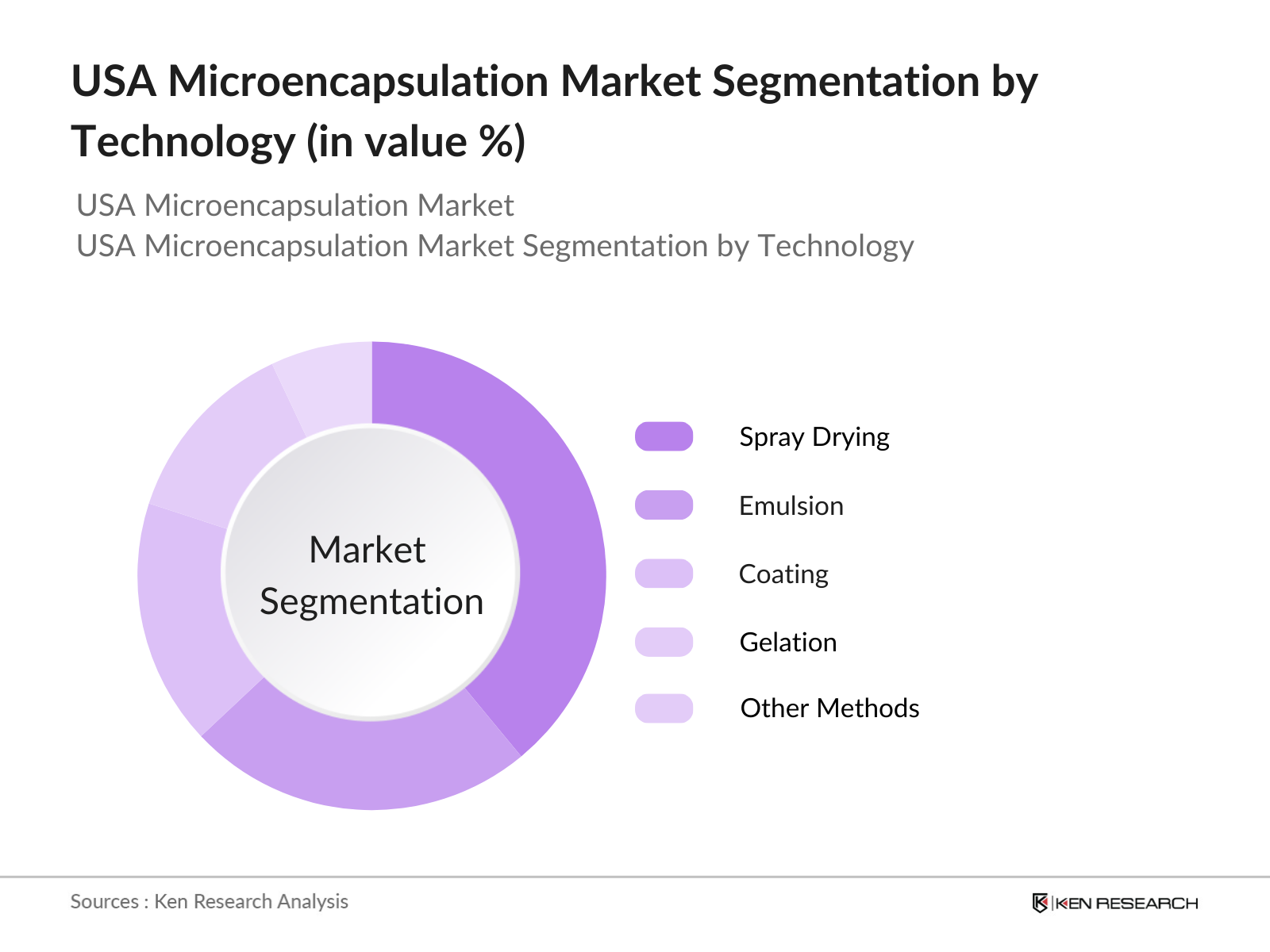

By Technology: The market is segmented by technology into spray drying, emulsion, coating, gelation, and other methods. Spray drying is the leading technology, widely used due to its cost-effectiveness, scalability, and ability to encapsulate various materials effectively. This technologys prominence is further bolstered by its applications across diverse industries, particularly in food & beverages and pharmaceuticals, where it enhances ingredient stability and controlled release.

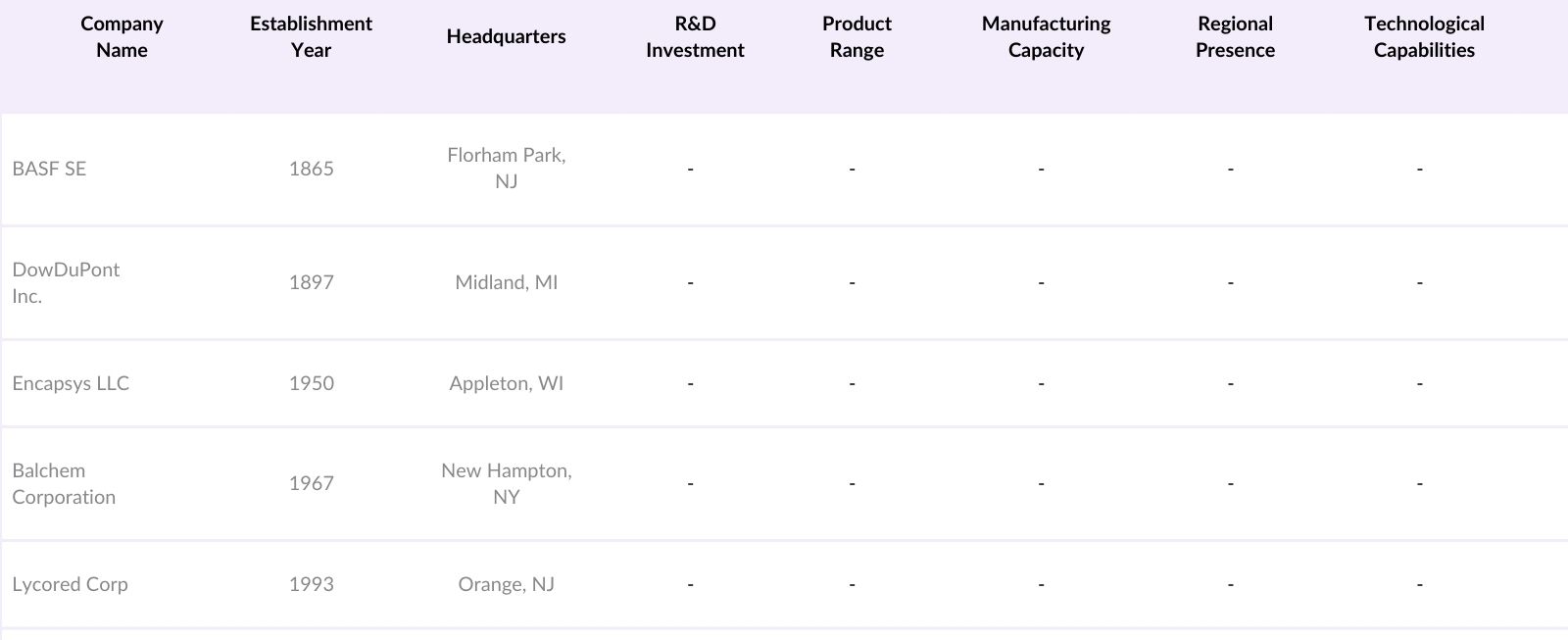

USA Microencapsulation Market Competitive Landscape

The USA Microencapsulation market is led by key players that emphasize technological advancements, R&D investments, and strategic partnerships to maintain a competitive edge. This consolidation underscores the strong influence of established companies that provide specialized encapsulation technologies tailored to diverse industry requirements.

USA Microencapsulation Industry Analysis

Growth Drivers

- Demand in Pharmaceuticals: The U.S. pharmaceutical sector is experiencing a surge in demand for advanced drug delivery systems. Microencapsulation enhances encapsulation efficiency and allows for controlled release profiles, improving therapeutic outcomes. For instance, the National Institutes of Health (NIH) reported that over 50% of new drug formulations in 2023 incorporated microencapsulation techniques to optimize bioavailability and patient compliance.

- Expansion in Food & Beverage Applications: The U.S. food and beverage industry is increasingly adopting microencapsulation to enhance nutrient stability and enable controlled release of flavors and additives. The Food and Drug Administration (FDA) noted a 30% increase in approvals for microencapsulated food products between 2022 and 2024, reflecting the industry's commitment to innovation and consumer health.

- Innovations in Cosmetic Ingredients: The U.S. cosmetics market is leveraging microencapsulation to improve the stability and efficacy of active ingredients. The Personal Care Products Council reported that 40% of new skincare products launched in 2024 utilized microencapsulation for controlled release of active compounds, enhancing product performance and consumer satisfaction.

Market Challenges

- High Cost of Microencapsulation Techniques: Implementing microencapsulation can be costly, with initial setup expenses ranging from $500,000 to $2 million, depending on the scale and complexity. The U.S. Small Business Administration (SBA) reported that 60% of small enterprises in 2023 found these costs prohibitive, limiting widespread adoption across industries.

- Technical Barriers: Achieving optimal encapsulation requires precise control over particle size and material compatibility. The American Chemical Society (ACS) noted in 2023 that 35% of microencapsulation projects faced challenges related to particle size uniformity and core-shell material interactions, affecting product efficacy and consistency.

USA Microencapsulation Market Future Outlook

Over the next five years, the USA Microencapsulation market is anticipated to experience substantial growth due to advancements in polymer science, rising demand in food and pharmaceutical sectors, and increased investment in eco-friendly and sustainable encapsulation materials. The expansion of applications in nutraceuticals and growing R&D activities in controlled-release solutions are expected to shape the market landscape, opening new opportunities for innovation.

Future Market Opportunities

- Advancements in Polymer and Material Science: Recent developments in biodegradable polymers have expanded microencapsulation applications. The National Science Foundation (NSF) funded over 50 research projects in 2023 focused on novel encapsulating materials, paving the way for more sustainable and efficient delivery systems.

- Expanding Applications in Nutraceuticals: The U.S. nutraceutical market, with a growing segment utilizing microencapsulation to enhance bioavailability. The Council for Responsible Nutrition (CRN) reported that 45% of new nutraceutical products launched in 2024 incorporated microencapsulation, meeting consumer demand for effective health supplements.

Scope of the Report

|

Material Type |

Polymers |

|

Technology |

Spray Drying |

|

Core Material |

Pharmaceuticals |

|

Region |

Northeast USA |

Products

Key Target Audience

Food & Beverage Manufacturers

Pharmaceutical & Healthcare Companies

Cosmetic and Personal Care Product Manufacturers

Chemical and Agrochemical Companies

Nutraceutical Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, USDA)

R&D and Innovation Labs

Companies

Major Players

BASF SE

DowDuPont Inc.

Encapsys LLC

Lycored Corp

Balchem Corporation

International Flavors & Fragrances Inc.

Aveka Group

Symrise AG

Givaudan SA

Ronald T. Dodge Company

Ashland Global Holdings Inc.

TasteTech Ltd.

Capsularis Technologies

FrieslandCampina Kievit

Watson Inc.

Table of Contents

1. USA Microencapsulation Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Key Value Chain Analysis

2. USA Microencapsulation Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Microencapsulation Market Analysis

3.1. Growth Drivers

3.1.1. Demand in Pharmaceuticals (Encapsulation Efficiency, Release Profiles)

3.1.2. Expansion in Food & Beverage Applications (Nutrient Stability, Controlled Release)

3.1.3. Innovations in Cosmetic Ingredients (Controlled Release, Enhanced Stability)

3.1.4. Environmental Applications (Encapsulation of Biodegradables, Controlled Release of Pesticides)

3.2. Market Challenges

3.2.1. High Cost of Microencapsulation Techniques

3.2.2. Technical Barriers (Encapsulation Compatibility, Particle Size Constraints)

3.2.3. Regulatory Compliance

3.3. Opportunities

3.3.1. Advancements in Polymer and Material Science

3.3.2. Expanding Applications in Nutraceuticals

3.3.3. Research in Targeted Drug Delivery Systems

3.4. Trends

3.4.1. Biodegradable Encapsulation Material Demand

3.4.2. Shift Towards Natural and Organic Microencapsulation

3.4.3. Growth in Encapsulation for Probiotics

3.5. Government Regulations

3.5.1. FDA Guidelines on Encapsulated Food Products

3.5.2. Compliance Standards in Pharmaceuticals

3.5.3. Environmental Safety Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Microencapsulation Market Segmentation

4.1. By Core Material (in Value %)

4.1.1. Pharmaceuticals

4.1.2. Nutrients

4.1.3. Fragrances

4.1.4. Enzymes

4.1.5. Pesticides

4.2. By Technology (in Value %)

4.2.1. Spray Drying

4.2.2. Emulsion Techniques

4.2.3. Coating

4.2.4. Gelation

4.2.5. Other Emerging Technologies

4.3. By Shell Material (in Value %)

4.3.1. Polymers

4.3.2. Gums & Resins

4.3.3. Lipids

4.3.4. Carbohydrates

4.3.5. Proteins

4.4. By Region (in Value %)

4.4.1. Northeast

4.4.2. Midwest

4.4.3. South

4.4.4. West

5. USA Microencapsulation Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. DowDuPont Inc.

5.1.3. Encapsys LLC

5.1.4. Lycored Corp

5.1.5. Balchem Corporation

5.1.6. Symrise AG

5.1.7. International Flavors & Fragrances Inc.

5.1.8. Aveka Group

5.1.9. Ronald T. Dodge Company

5.1.10. TasteTech Ltd.

5.1.11. Watson Inc.

5.1.12. Givaudan SA

5.1.13. Capsularis Technologies

5.1.14. Ashland Global Holdings Inc.

5.1.15. FrieslandCampina Kievit

5.2. Cross Comparison Parameters (Technology Capabilities, Product Range, Market Reach, R&D Investments, Regulatory Compliance, Application Specialization, Manufacturing Capacity, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Microencapsulation Market Regulatory Framework

6.1. Standards for Food Applications

6.2. Pharmaceutical Compliance

6.3. Certification Processes for Encapsulation Materials

6.4. Environmental Regulations for Encapsulated Pesticides

7. USA Microencapsulation Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Microencapsulation Future Market Segmentation

8.1. By Core Material (in Value %)

8.2. By Technology (in Value %)

8.3. By Shell Material (in Value %)

8.54 By Region (in Value %)

9. USA Microencapsulation Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this phase, an ecosystem map was created for the USA Microencapsulation Market, covering essential stakeholders and applications. Extensive desk research utilizing both proprietary and public databases provided a foundational understanding of core market influences.

Step 2: Market Analysis and Construction

This step involved compiling historical data, analyzing market penetration, and evaluating key market segments to determine revenue trends. Each segments revenue generation was assessed to validate the accuracy of estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through interviews with industry experts across core microencapsulation segments. These interviews provided crucial financial and operational insights, ensuring data accuracy.

Step 4: Research Synthesis and Final Output

The final analysis synthesized primary data from industry consultations, enabling a comprehensive view of product segments, consumer preferences, and market dynamics. This approach confirmed the robustness of market insights and validated revenue statistics.

Frequently Asked Questions

01. How big is the USA Microencapsulation Market?

The USA Microencapsulation Market, valued at USD 3.8 billion, is driven by the increasing demand for encapsulation in pharmaceuticals and food products, enhancing product stability and efficacy.

02. What are the challenges in the USA Microencapsulation Market?

Challenges in the USA Microencapsulation Market include the high costs associated with advanced encapsulation technologies and regulatory hurdles in the pharmaceutical and food industries, which impact the scalability of solutions.

03. Who are the major players in the USA Microencapsulation Market?

Key players in the USA Microencapsulation Market include BASF SE, DowDuPont Inc., Encapsys LLC, Lycored Corp, and Balchem Corporation, each holding a strong market position due to their expertise in encapsulation technology and extensive distribution networks.

04. What are the growth drivers of the USA Microencapsulation Market?

The USA Microencapsulation Market is propelled by innovations in drug delivery systems, demand for nutrient stability in food products, and the expanding application of microencapsulation in personal care and cosmetics.

05. Which sectors are primary users of microencapsulation in the USA?

The primary sectors utilizing microencapsulation in the USA Microencapsulation Market include pharmaceuticals, food & beverages, cosmetics, and agrochemicals, where encapsulation enhances the functionality and delivery of active ingredients.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.