USA Mobile Games Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4480

November 2024

91

About the Report

USA Mobile Games Market Overview

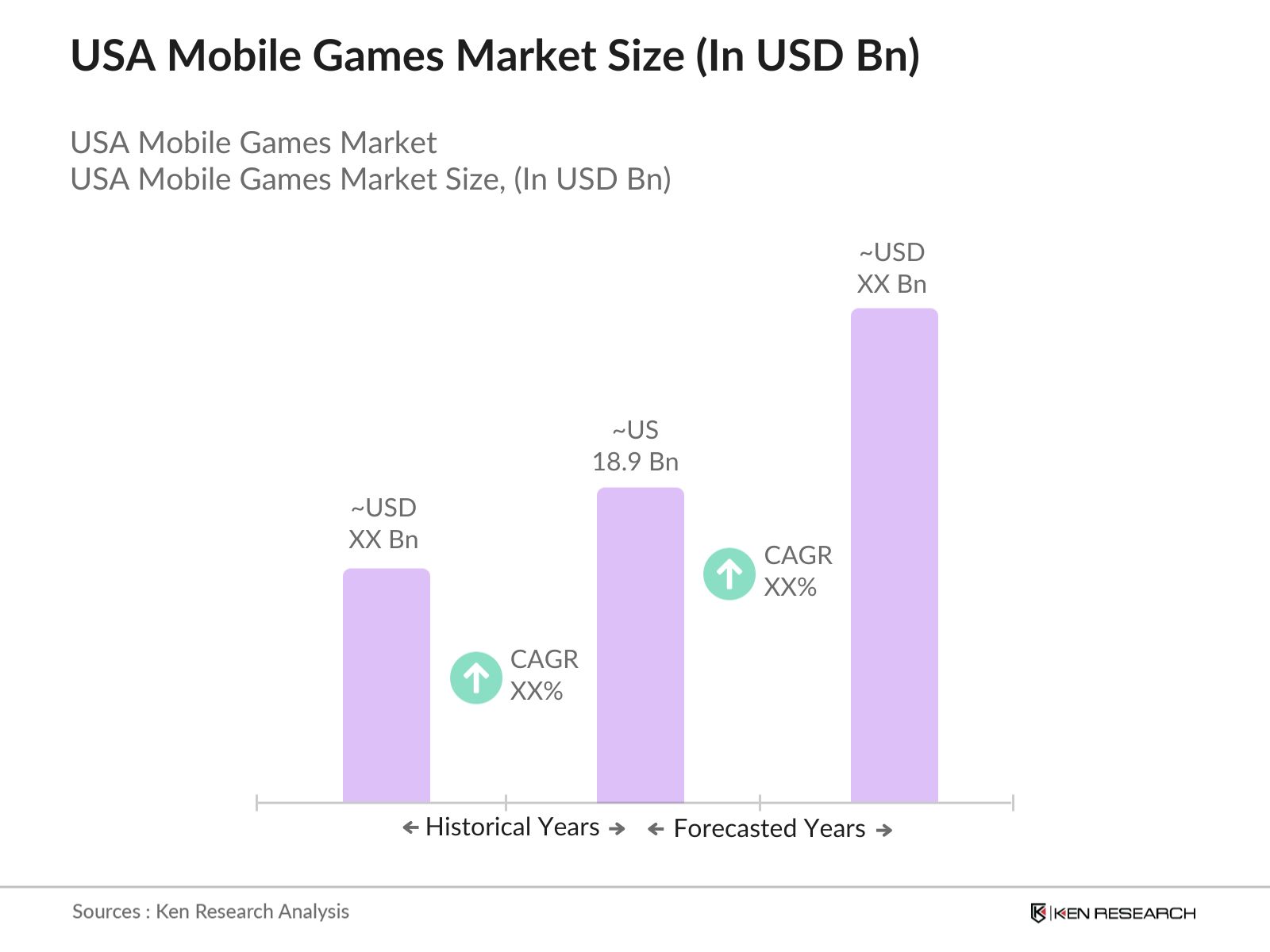

- The USA mobile games market is valued at USD 18.9 billion, based on a five-year historical analysis. This market is largely driven by the widespread adoption of smartphones, enhanced mobile internet infrastructure, and the popularity of mobile-based entertainment. The rise of in-app purchases and mobile advertisements has also contributed significantly to market growth, further fueled by the increasing availability of advanced gaming devices, such as tablets and wearables.

- In terms of dominant regions, the USA mobile games market is largely centered around major urban hubs like New York, Los Angeles, and San Francisco, where there is high penetration of technology and gaming culture. These cities are home to several prominent gaming companies, making them crucial for the market. Additionally, the presence of a highly tech-savvy population with access to faster internet speeds and better mobile devices boosts the dominance of these cities.

- Data protection laws, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), significantly impact the mobile games industry in the U.S. As of 2024, around 75,000 companies operating in the USA must comply with CCPA, impacting how mobile games handle user data. These regulations impose stringent requirements on data collection, storage, and sharing, with penalties for non-compliance reaching up to $7,500 per violation. Game developers must ensure their apps meet these standards, increasing operational complexity and costs.

USA Mobile Games Market Segmentation

By Game Type: The market is segmented by game type into casual games, role-playing games (RPG), strategy games, and action-adventure games. Recently, casual games have gained dominance due to their accessibility and broad appeal. Casual games are lightweight, often free-to-play, and require minimal time commitment, making them highly popular among users of all age groups. Games like Candy Crush and Among Us have surged in popularity, backed by easy monetization through in-app purchases and ads, particularly appealing to a mass market.

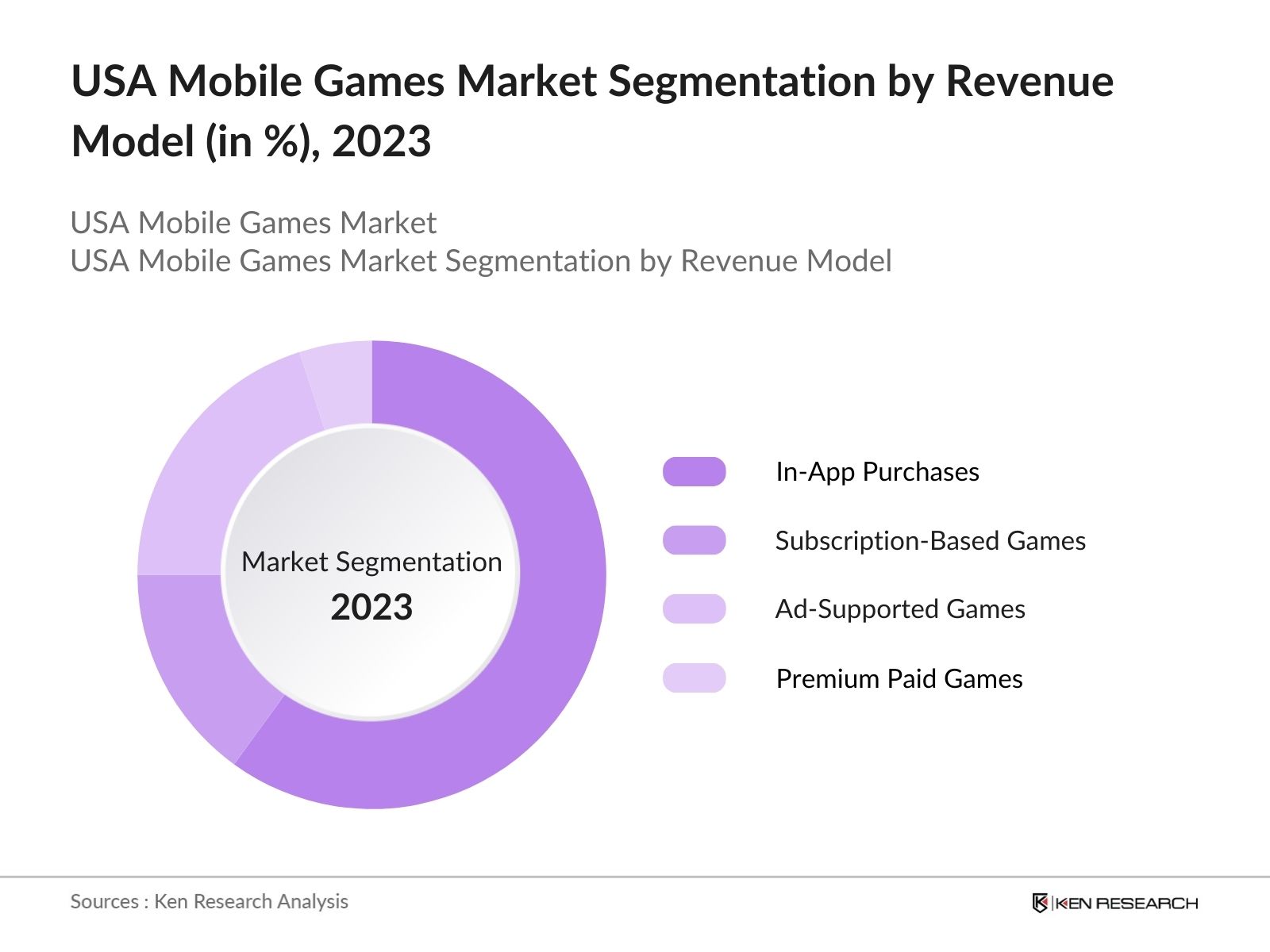

By Revenue Model: The games market is also segmented by revenue model, which includes in-app purchases, subscription-based games, ad-supported games, and premium paid games. Among these, in-app purchases dominate, primarily due to the freemium model's success. This model allows users to download and play the basic game for free while offering paid enhancements or content upgrades. This monetization strategy has become the cornerstone for game developers and publishers, contributing to a large portion of the market's revenue.

By Revenue Model: The games market is also segmented by revenue model, which includes in-app purchases, subscription-based games, ad-supported games, and premium paid games. Among these, in-app purchases dominate, primarily due to the freemium model's success. This model allows users to download and play the basic game for free while offering paid enhancements or content upgrades. This monetization strategy has become the cornerstone for game developers and publishers, contributing to a large portion of the market's revenue.

USA Mobile Games Market Competitive Landscape

The USA mobile games market is dominated by a mix of local and global companies, with some of the largest gaming studios based in the United States. Companies like Activision Blizzard and Electronic Arts lead in game development, and others like Supercell and Tencent have secured strong footholds in the market through successful partnerships. This competitive environment highlights the industry's consolidation, where a few key players hold substantial influence.

|

Company |

Established |

Headquarters |

Revenue Model |

Top Game Titles |

No. of Employees |

Platform Dominance |

Global Reach |

Investment in AR/VR |

Mobile Game Subsidiary |

|

Activision Blizzard |

2008 |

Santa Monica, CA |

|||||||

|

Electronic Arts |

1982 |

Redwood City, CA |

|||||||

|

Supercell |

2010 |

Helsinki, Finland |

|||||||

|

Zynga |

2007 |

San Francisco, CA |

|||||||

|

Tencent Games |

2003 |

Shenzhen, China |

USA Mobile Games Industry Analysis

Growth Drivers

- Mobile Internet Infrastructure: The expansion of 4G and 5G infrastructure has drastically improved mobile internet speeds, enabling smoother and more immersive mobile gaming experiences. In 2024, over 80% of U.S. cities have widespread 5G coverage, with an estimated 290 million people having access to high-speed internet services. The faster internet speeds not only enhance game performance but also enable real-time multiplayer gaming and cloud-based mobile gaming. These developments increase engagement time and drive revenue for mobile gaming platforms through in-app purchases and advertisements.

- In-App Purchase Ecosystem: In-app purchases have emerged as a major revenue driver in the mobile games sector. In 2023, it was reported that American users spent $87 billion on in-app purchases, with mobile games accounting for a large chunk of this expenditure. The seamless integration of payment systems like Google Pay and Apple Pay has further streamlined the process, making it easier for users to make in-game transactions. The growing number of casual and serious gamers contributes to this ecosystem, ensuring constant revenue inflows for mobile game developers.

- Increased Gaming Adoption Across Demographics: Mobile gaming in the U.S. has witnessed unprecedented adoption across various age groups, with children, teenagers, and adults contributing to its rapid expansion. In 2024, the number of mobile gamers aged 18-34 stood at 85 million, reflecting widespread acceptance beyond the younger generation. This demographic shift is pivotal in driving market growth, as older age groups also invest in in-app purchases and gaming subscriptions. The flexibility of mobile gaming to appeal to both casual and dedicated gamers further amplify the market's growth potential.

Market Challenges

- Data Privacy and Security Concerns: Data privacy and security are increasingly becoming critical concerns in the mobile gaming industry. The U.S. government has strengthened its data protection regulations, such as the California Consumer Privacy Act (CCPA), which affects how game developers collect and store user data. In 2024, over 210,000 complaints were filed against companies for violating data privacy, with mobile app developers making up a notable portion. This creates compliance challenges for game developers and increases their operational costs, as they must invest heavily in cybersecurity to protect user data.

- High Development and Marketing Costs: The costs associated with developing and marketing mobile games in the USA have surged. In 2023, the average cost of developing a high-quality mobile game ranged from $500,000 to over $2 million, depending on the complexity. Marketing expenses are equally daunting, with successful games requiring multi-million-dollar budgets for user acquisition. For instance, a report from 2023 indicated that the top 100 mobile games spend an average of $1.2 million monthly on marketing. These high costs pose significant challenges for smaller developers.

USA Mobile Games Market Future Outlook

Over the next five years, the USA mobile games market is expected to experience substantial growth driven by the continuous improvement of mobile internet infrastructure, the evolution of cloud gaming services, and increased consumer demand for high-quality mobile gaming experiences. Innovations such as augmented reality (AR) and virtual reality (VR) integration in mobile games are likely to contribute to market expansion, further supported by rising investments from venture capitalists in mobile gaming startups. Additionally, the shift towards more complex and immersive mobile gaming experiences will open new monetization opportunities for game developers.

Future Market Opportunities

- Cloud Gaming Integration: Cloud gaming presents a significant opportunity for mobile games in the USA. In 2024, approximately 34 million users engaged with cloud gaming services, a number expected to rise due to improved 5G networks. Cloud gaming eliminates hardware limitations, allowing users to stream high-quality games directly on their mobile devices. As mobile network speeds increase, this feature is anticipated to become more popular, enabling developers to offer more complex and resource-heavy games without requiring high-end devices.

- Monetization Models: The rise of freemium and subscription-based models offers new revenue streams for mobile games. As of 2024, 26 million U.S. mobile gamers subscribe to platforms like Apple Arcade and Google Play Pass, driving the adoption of subscription services in gaming. Subscription models provide recurring revenue for game developers and offer users an ad-free experience and exclusive content. Additionally, freemium games with in-app purchases continue to dominate, with over 85% of top-grossing mobile games in the U.S. relying on this model.

Scope of the Report

|

By Game Type |

Puzzle and Casual Games Action and Adventure Games Role-Playing Games (RPG) Strategy and Simulation Games Multiplayer Online Battle Arena (MOBA) |

|

By Revenue Model |

In-App Purchases Subscription-Based Games Ad-Supported Games Premium Paid Games |

|

By Platform |

iOS Android Cross-Platform |

|

By Age Group |

Children Teens Adults Senior Citizens |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Mobile Game Developers

Mobile Game Publishers

App Distribution Platforms (Apple App Store, Google Play)

Mobile Advertising Networks

Investor and Venture Capitalist Firms

Banks and Financial Institutes

Government and Regulatory Bodies (FCC, FTC)

Mobile Network Operators (Verizon, AT&T)

Cloud Gaming Service Providers

Companies

Major Players

Activision Blizzard

Electronic Arts

Supercell

Zynga

Tencent Games

Glu Mobile

Scopely

Rovio Entertainment

Kabam

Ubisoft Mobile

Netmarble

Niantic

Playtika

Jam City

King Digital

Table of Contents

USA Mobile Games Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

USA Mobile Games Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Mobile Games Market Analysis

3.1. Growth Drivers

3.1.1. Smartphone Penetration

3.1.2. Mobile Internet Infrastructure (4G, 5G Rollouts)

3.1.3. In-App Purchase Ecosystem

3.1.4. Increased Gaming Adoption Across Demographics

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. High Development and Marketing Costs

3.2.3. Platform Fragmentation (iOS vs. Android)

3.3. Opportunities

3.3.1. Cloud Gaming Integration

3.3.2. Monetization Models (Freemium, Subscription Services)

3.3.3. Expansion into Emerging Markets

3.4. Trends

3.4.1. Augmented Reality (AR) and Virtual Reality (VR) Games

3.4.2. Cross-Platform Gaming Ecosystem

3.4.3. Esports and Competitive Mobile Gaming

3.5. Government Regulation

3.5.1. Data Protection Laws (GDPR, CCPA)

3.5.2. Age Restrictions and Parental Controls

3.5.3. Microtransaction Legislation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

USA Mobile Games Market Segmentation

4.1. By Game Type (In Value %)

4.1.1. Puzzle and Casual Games

4.1.2. Action and Adventure Games

4.1.3. Role-Playing Games (RPG)

4.1.4. Strategy and Simulation Games

4.1.5. Multiplayer Online Battle Arena (MOBA)

4.2. By Revenue Model (In Value %)

4.2.1. In-App Purchases

4.2.2. Subscription-Based Games

4.2.3. Ad-Supported Games

4.2.4. Premium Paid Games

4.3. By Platform (In Value %)

4.3.1. iOS

4.3.2. Android

4.3.3. Cross-Platform

4.4. By Age Group (In Value %)

4.4.1. Children

4.4.2. Teens

4.4.3. Adults

4.4.4. Senior Citizens

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

USA Mobile Games Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Activision Blizzard

5.1.2. Electronic Arts

5.1.3. Supercell

5.1.4. Zynga

5.1.5. Glu Mobile

5.1.6. Niantic

5.1.7. Tencent Games

5.1.8. Rovio Entertainment

5.1.9. Gameloft

5.1.10. Netmarble

5.1.11. Scopely

5.1.12. Kabam

5.1.13. Playtika

5.1.14. Ubisoft Mobile

5.1.15. Jam City

5.2. Cross Comparison Parameters (Number of Active Users, Game Portfolio Size, Revenue Models, Geographic Reach, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA Mobile Games Market Regulatory Framework

6.1. Mobile App Distribution Policies (Google Play, Apple App Store)

6.2. Compliance Requirements for In-App Purchases

6.3. Certification Processes for Game Age Ratings

USA Mobile Games Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Mobile Games Future Market Segmentation

8.1. By Game Type (In Value %)

8.2. By Revenue Model (In Value %)

8.3. By Platform (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

USA Mobile Games Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. User Cohort Analysis

9.3. Monetization Strategy Recommendations

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key stakeholders within the USA mobile games ecosystem, including developers, publishers, app platforms, and mobile network operators. Secondary research methods are used to gather data from public and proprietary databases, focusing on market dynamics and consumer behavior patterns.

Step 2: Market Analysis and Construction

This phase includes analyzing historical market data for mobile games, including user penetration, revenue from various monetization models, and the distribution channels for mobile games in the USA. The market construction is done based on qualitative and quantitative insights, ensuring data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to market growth drivers and challenges are validated through interviews with industry experts from leading mobile game development companies. These consultations help refine market assumptions and revenue models, contributing to a more accurate projection.

Step 4: Research Synthesis and Final Output

The final stage focuses on validating insights through additional interviews with stakeholders across the value chain, including mobile game publishers and app platform representatives. This synthesis ensures that the findings are accurate, comprehensive, and applicable to the USA mobile games market.

Frequently Asked Questions

01. How big is the USA Mobile Games Market?

The USA mobile games market is valued at USD 18.9 billion, driven by high smartphone penetration, faster mobile internet speeds, and the growth of in-app purchase models.

02. What are the challenges in the USA Mobile Games Market?

Challenges in the USA mobile games market include rising competition among game developers, increasing user acquisition costs, and regulatory concerns around data privacy and microtransactions in mobile gaming.

03. Who are the major players in the USA Mobile Games Market?

Major players in the USA mobile games market include Activision Blizzard, Electronic Arts, Supercell, Zynga, and Tencent Games, all of which have established a strong presence through popular game titles and effective monetization strategies.

04. What are the growth drivers of the USA Mobile Games Market?

Growth drivers in the USA mobile games market include the widespread adoption of smartphones, advancements in mobile gaming technologies such as AR/VR, and increasing consumer spending on in-app purchases and subscriptions.

05. What are the dominant game types in the USA Mobile Games Market?

In the USA mobile games market Casual games dominate the market due to their accessibility and low barriers to entry, attracting a wide range of users across different age groups.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.