USA Mobile Phone Insurance Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD6676

December 2024

88

About the Report

USA Mobile Phone Insurance Market Overview

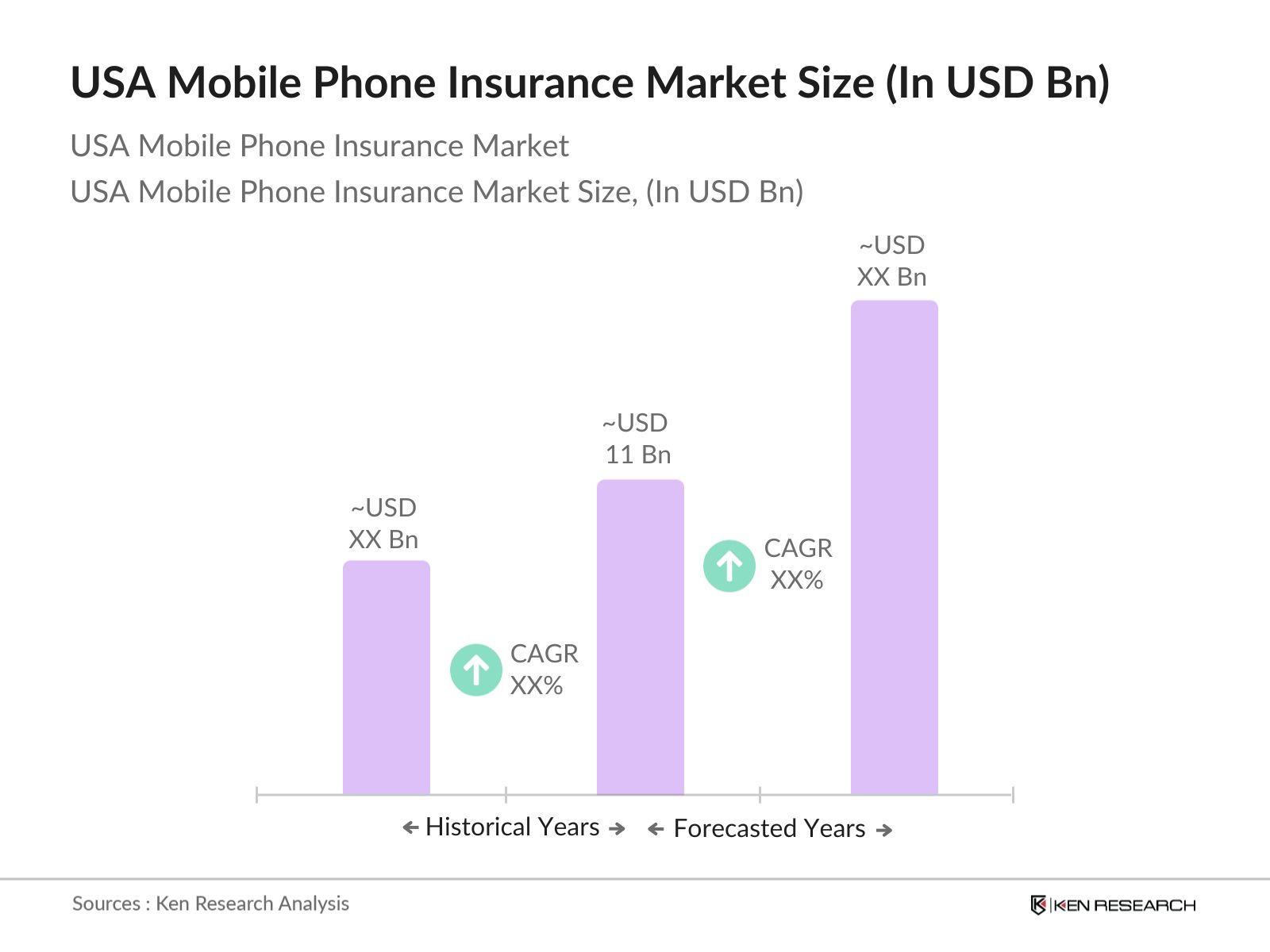

- The USA Mobile Phone Insurance market is valued at USD 11 billion, driven by increasing smartphone penetration and the high cost of device repairs and replacements. Over the past five years, the market has experienced steady growth as more consumers seek protection against accidental damage, theft, and loss. This demand is particularly evident in urban areas where the use of high-end smartphones is prevalent. The growth in 2024 is expected to continue as advancements in digital insurance platforms make it easier for consumers to access insurance services directly from their devices.

- Dominant regions in the USA Mobile Phone Insurance market include major metropolitan cities like New York, Los Angeles, and San Francisco. These cities dominate the market due to their higher concentrations of smartphone users, affluent consumer bases, and increased awareness of the benefits of mobile insurance. Additionally, the prevalence of flagship smartphone models from brands like Apple and Samsung in these regions contributes to the high demand for insurance services, as consumers look to safeguard their expensive devices.

- Mobile insurance providers in the USA are subject to stringent consumer protection laws, enforced by the Federal Trade Commission (FTC). In 2023, the FTC issued over $30 million in fines related to misleading insurance practices, highlighting the importance of transparency and fair practice in this market. The regulatory landscape ensures that consumers are safeguarded against unfair terms, and insurers are held accountable for claims processing, premium rates, and customer service. This regulatory oversight enhances consumer trust in mobile phone insurance.

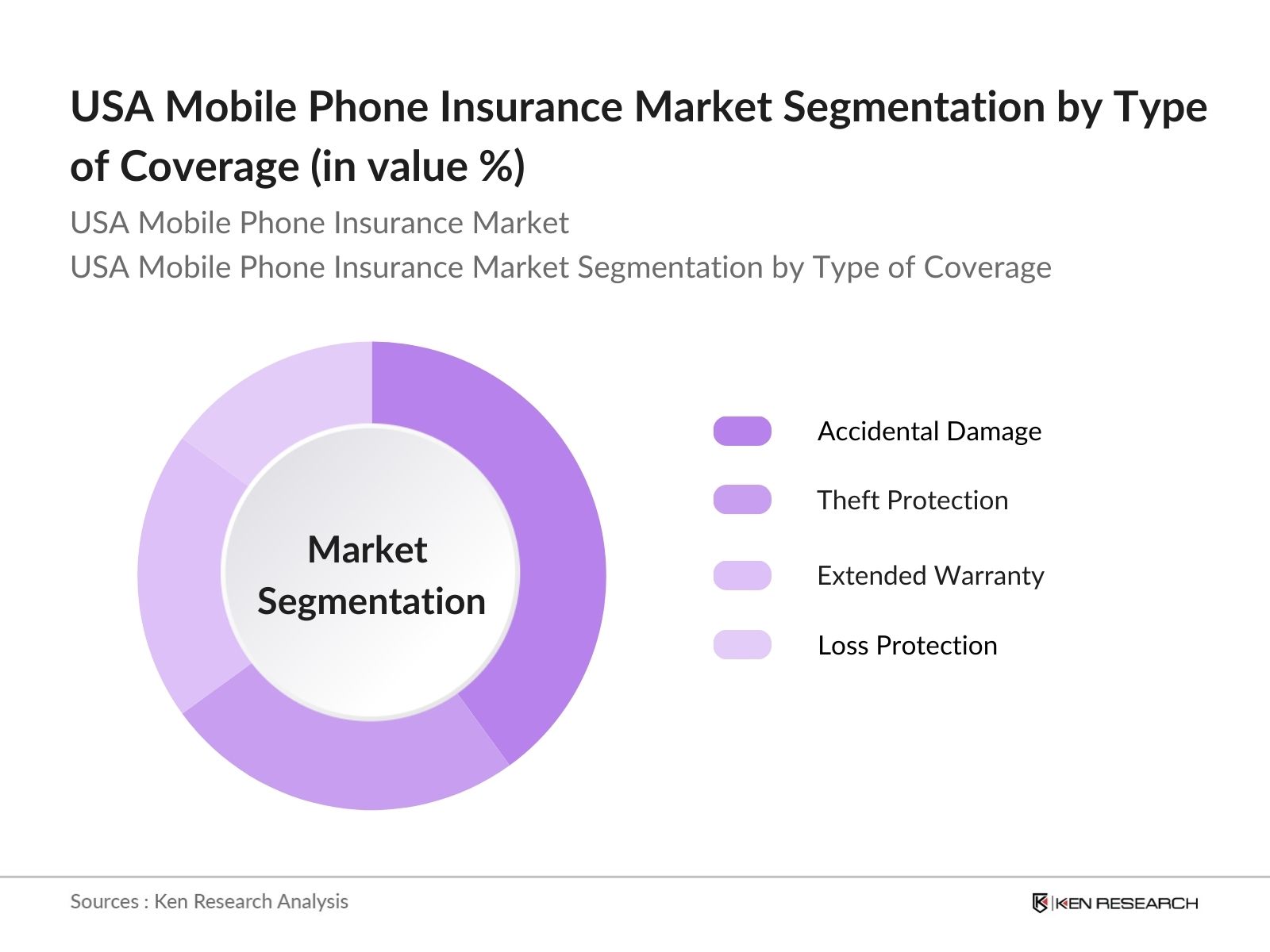

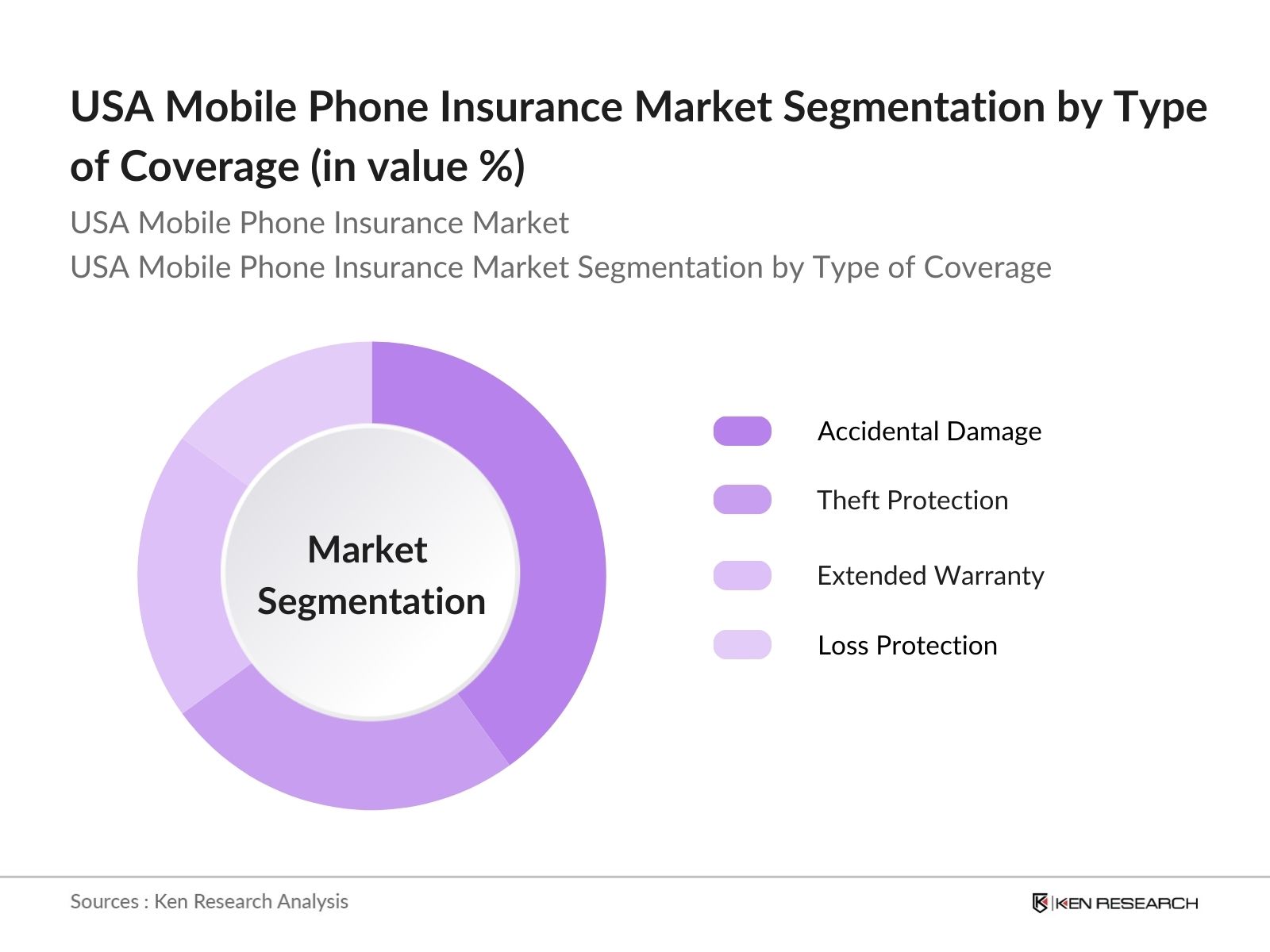

USA Mobile Phone Insurance Market Segmentation

- By Type of Coverage: The USA Mobile Phone Insurance market is segmented by type of coverage into accidental damage, theft protection, extended warranty, and loss protection. Among these, accidental damage coverage holds a dominant market share due to the frequent occurrence of device breakage, especially cracked screens. High repair costs for flagship models like iPhones and Samsung Galaxy devices make consumers prioritize this coverage. The popularity of accidental damage coverage is also driven by growing consumer awareness and the ease of claim processes that many insurance providers now offer.

- By Distribution Channel: The market is also segmented by distribution channels into mobile carriers, retailers, direct-to-consumer (D2C), and online platforms. Mobile carriers dominate this segment with a notable share, as they offer seamless mobile insurance enrollment at the point of purchase. Customers are more inclined to opt for insurance when it is bundled with their mobile plans. The integration of mobile insurance into monthly carrier billing also reduces the friction associated with paying for standalone insurance, making this a highly preferred option.

USA Mobile Phone Insurance Market Competitive Landscape

The USA Mobile Phone Insurance market is dominated by several major players that offer a range of services, including device protection plans, extended warranties, and loss coverage. The competitive landscape is characterized by partnerships between insurance providers, mobile carriers, and manufacturers. These partnerships have allowed for an integrated insurance offering, improving accessibility for consumers.

Company Name | Establishment Year | Headquarters | Number of Claims Processed (Annual) | Customer Satisfaction Rate | Partnerships with Carriers | Claim Processing Time (Average) | Revenue (USD Mn) | Service Availability (States) |

Asurion | 1994 | Nashville, TN | - | - | - | - | - | - |

Assurant | 1892 | New York, NY | - | - | - | - | - | - |

SquareTrade | 1999 | San Francisco, CA | - | - | - | - | - | - |

AppleCare | 1976 | Cupertino, CA | - | - | - | - | - | - |

Brightstar | 1997 | Miami, FL | - | - | - | - | - | - |

USA Mobile Phone Insurance Market Analysis

USA Mobile Phone Insurance Market Growth Drivers

- Increasing Smartphone Penetration: Smartphone penetration continues to rise steadily in the USA, with 290 million people owning smartphones by the end of 2023, representing a increase from the previous years. This high level of penetration contributes to the demand for mobile insurance as consumers increasingly seek to protect their devices from theft, loss, or damage. Macroeconomic indicators show that the USAs GDP grew to $26.7 trillion in 2023, supporting higher consumer spending on electronic devices, including smartphones. As smartphones become more integral to daily life, mobile insurance becomes a necessary expenditure for many.

- Rising Incidents of Device Theft and Damage: The U.S. Federal Communications Commission (FCC) reported that around 1.4 million smartphones were stolen in 2023, highlighting the need for comprehensive mobile insurance. Additionally, 20 million devices were damaged due to accidents, leading to an increased demand for protection plans. The rise in theft and accidental damage is linked to the countrys urbanization rate, which reached 83% in 2023. This trend has created a substantial market opportunity for mobile phone insurance providers as consumers become more aware of the risks to their devices.

- Consumer Awareness About Mobile Insurance: A 2023 study conducted by the National Telecommunications and Information Administration (NTIA) found that nearly 65% of smartphone users in the USA were aware of mobile phone insurance options, driven by rising educational campaigns and increasing awareness from telecom carriers and insurers. Consumer awareness is fueled by better access to information, with over 95% of the population having access to high-speed internet, further enabling users to explore insurance options. The trend of awareness correlates with the strong digital infrastructure across the country, which promotes informed decision-making regarding device protection.

USA Mobile Phone Insurance Market Challenges

- High Premiums for New Devices: High premiums for new smartphone models are a major barrier for mobile phone insurance uptake. A survey by the U.S. Bureau of Labor Statistics in 2023 highlighted that insurance premiums for flagship devices like iPhones could exceed $150 annually, which many consumers find prohibitive, especially in an economic environment where inflation increased to 3.2% in 2023. The rising costs of insurance are largely driven by the higher replacement costs of advanced devices, particularly those with premium features like OLED screens and multi-camera systems.

- Competition from OEM-Provided Insurance: Original Equipment Manufacturers (OEMs) like Apple and Samsung have increased their market share in device insurance by offering competitive insurance packages. According to the Consumer Electronics Association, OEM-provided insurance accounted for 45% of mobile insurance policies in the USA by 2023. These plans are often integrated with device purchases, making them more convenient for consumers, thereby limiting the market share available to third-party insurance providers. The rise of bundled OEM insurance packages presents a challenge for independent insurers seeking to compete in a price-sensitive market.

USA Mobile Phone Insurance Future Outlook

Over the next five years, the USA Mobile Phone Insurance market is expected to witness substantial growth driven by increased demand for device protection plans due to rising smartphone prices and the growing adoption of 5G devices. With technological advancements in the mobile insurance industry, including artificial intelligence (AI) and automation, the claim process is becoming faster and more efficient. The expanding use of mobile-first solutions will further simplify the customer experience, driving the market's future growth. In addition, partnerships between insurance providers and mobile manufacturers will continue to enhance the accessibility and appeal of mobile insurance products.

USA Mobile Phone Insurance Market Opportunities

- Expansion of Online Insurance Channels: Online insurance channels have been growing steadily, driven by the rising use of digital services. The U.S. Census Bureau recorded that 79% of all insurance purchases, including mobile phone insurance, were made online in 2023. This shift towards digital platforms opens opportunities for insurers to reach tech-savvy consumers who prefer the convenience of purchasing policies online. The increasing penetration of mobile devices has also led to a surge in mobile-first insurance solutions, providing growth potential for insurers investing in seamless digital platforms.

- Increasing Demand for Multi-Device Plans: With the growing number of connected devices per household in the USA, there is rising demand for multi-device insurance plans. As of 2023, the average American household had 3.5 connected devices, including smartphones, tablets, and wearable technology. Insurance companies have started to offer comprehensive plans that cover multiple devices under a single policy, responding to consumer demand for cost-effective and streamlined insurance solutions. The demand for multi-device plans is expected to support the diversification of the mobile insurance market, providing growth opportunities for insurers.

Scope of the Report

By Type of Coverage | Accidental Damage Theft Protection Extended Warranty Loss Protection |

By Distribution Channel | Mobile Carriers Retailers Direct-to-Consumer Online Platforms |

By Device Type | High-End Smartphones Mid-Range Smartphones Low-End Smartphones Tablets Wearables |

By Service Provider | Telecom Carriers Device Manufacturers Insurance Companies |

By Region | Northeast Midwest South West |

Products

Key Target Audience

Mobile Network Operators (MNOs)

Device Manufacturers (Apple, Samsung, etc.)

Insurance Providers (Asurion, Assurant)

Retailers (Best Buy, Amazon)

Online Insurance Platforms

Banks and Financial Institutions

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Communications Commission (FCC), National Association of Insurance Commissioners (NAIC))

E-commerce Platforms (Amazon, eBay)

Companies

Players mentioned in the report

Asurion

Assurant

SquareTrade

AppleCare

Verizon Protect

T-Mobile Protection 360

Sprint Complete

Allstate Protection Plans

Brightstar Device Protection

Worth Ave. Group

Table of Contents

1. USA Mobile Phone Insurance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Mobile Phone Insurance Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Mobile Phone Insurance Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Smartphone Penetration

3.1.2. Rising Incidents of Device Theft and Damage

3.1.3. Consumer Awareness About Mobile Insurance

3.1.4. Technological Advancements in Insurance Platforms

3.2. Market Challenges

3.2.1. High Premiums for New Devices

3.2.2. Competition from OEM-Provided Insurance

3.2.3. Limited Customer Knowledge on Coverage Details

3.3. Opportunities

3.3.1. Expansion of Online Insurance Channels

3.3.2. Increasing Demand for Multi-Device Plans

3.3.3. Growth of Refurbished Smartphone Market

3.4. Trends

3.4.1. Partnerships with Retailers and Mobile Carriers

3.4.2. Customizable Insurance Plans

3.4.3. Digital Transformation and Mobile-First Solutions

3.5. Regulatory Framework

3.5.1. Mobile Insurance Licensing Requirements

3.5.2. Consumer Protection Laws

3.5.3. Insurance Claim Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Mobile Phone Insurance Market Segmentation

4.1. By Type of Coverage (In Value %)

4.1.1. Accidental Damage

4.1.2. Theft Protection

4.1.3. Extended Warranty

4.1.4. Loss Protection

4.2. By Distribution Channel (In Value %)

4.2.1. Mobile Carriers

4.2.2. Retailers

4.2.3. Direct-to-Consumer (D2C)

4.2.4. Online Platforms

4.3. By Device Type (In Value %)

4.3.1. High-End Smartphones

4.3.2. Mid-Range Smartphones

4.3.3. Low-End Smartphones

4.3.4. Tablets and Wearables

4.4. By Service Provider (In Value %)

4.4.1. Telecom Carriers

4.4.2. Device Manufacturers

4.4.3. Insurance Companies

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Mobile Phone Insurance Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Asurion

5.1.2. Assurant

5.1.3. SquareTrade

5.1.4. AppleCare

5.1.5. Verizon Protect

5.1.6. AT&T Mobile Insurance

5.1.7. T-Mobile Protection 360

5.1.8. Sprint Complete

5.1.9. Allstate Protection Plans

5.1.10. Brightstar Device Protection

5.1.11. Worth Ave. Group

5.1.12. ProtectCELL

5.1.13. AKKO Insurance

5.1.14. Safeware

5.1.15. Gadget Guard

5.2. Cross Comparison Parameters (Number of Claims Processed, Market Share, Service Coverage, Claim Processing Time, Pricing Strategy, Customer Satisfaction, Retention Rate, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Incentives

5.8. Private Equity Investments

6. USA Mobile Phone Insurance Market Regulatory Framework

6.1. Mobile Insurance Regulations

6.2. Consumer Protection Standards

6.3. Certification Processes and Compliance

7. USA Mobile Phone Insurance Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Mobile Phone Insurance Future Market Segmentation

8.1. By Type of Coverage (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Device Type (In Value %)

8.4. By Service Provider (In Value %)

8.5. By Region (In Value %)

9. USA Mobile Phone Insurance Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, we focus on identifying all major stakeholders in the USA Mobile Phone Insurance Market. Extensive desk research, combined with access to proprietary databases, helps define the critical factors influencing market growth.

Step 2: Market Analysis and Construction

Historical data regarding market performance, insurance claims, and sales figures are compiled to provide a comprehensive market analysis. This step ensures accuracy in revenue estimation and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with key industry experts. Insights from mobile carriers and insurance providers are gathered to understand the market's operational nuances and customer preferences.

Step 4: Research Synthesis and Final Output

The final phase includes the synthesis of data from all primary and secondary sources to produce a detailed market report. Verification with major industry players ensures accuracy and completeness of the report.

Frequently Asked Questions

01. How big is the USA Mobile Phone Insurance Market?

The USA Mobile Phone Insurance market is valued at USD 11 billion, driven by rising smartphone adoption, high repair costs, and consumer demand for extended protection plans.

02. What are the challenges in the USA Mobile Phone Insurance Market?

Challenges in the USA Mobile Phone Insurance market include high competition among providers, the complexity of claims processing, and rising premium costs for high-end devices. Consumer education on coverage details is also an ongoing issue.

03. Who are the major players in the USA Mobile Phone Insurance Market?

Key players in the v include Asurion, Assurant, SquareTrade, AppleCare, and Verizon Protect. These companies dominate through strong distribution networks and partnerships with major mobile carriers.

04. What are the growth drivers of the USA Mobile Phone Insurance Market?

Growth in the USA Mobile Phone Insurance market is driven by rising smartphone prices, increased consumer awareness of device protection, and the expanding use of digital insurance platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.