USA Natural Hair Products Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4536

November 2024

82

About the Report

USA Natural Hair Products Market Overview

- The USA Natural Hair Products market is valued at USD 1.5 billion, driven by a combination of increasing consumer awareness of natural and organic ingredients, environmental sustainability, and the growing preference for cruelty-free products. The market has seen consistent growth over the past five years, backed by the rise in demand for clean-label beauty products and evolving consumer preferences towards safe and eco-friendly options. This shift towards natural hair care is propelled by health-conscious consumers who are avoiding chemical-laden products and seeking alternatives that maintain hair health.

- Major urban centers such as New York, Los Angeles, and Atlanta dominate the USA Natural Hair Products market due to their diverse populations, high consumer awareness, and large Afro-American and ethnic communities that prioritize natural hair care. These cities are also home to several established beauty brands and retail networks that cater specifically to the needs of natural hair care consumers, enhancing the markets concentration in these regions.

- The USDA Organic certification is critical for natural hair care brands that market their products as organic. In 2023, the USDA certified over 500 new personal care products, a 10% increase from the previous year, highlighting the growing demand for organic certifications. These certifications ensure consumer trust and open up new market opportunities for brands.

USA Natural Hair Products Market Segmentation

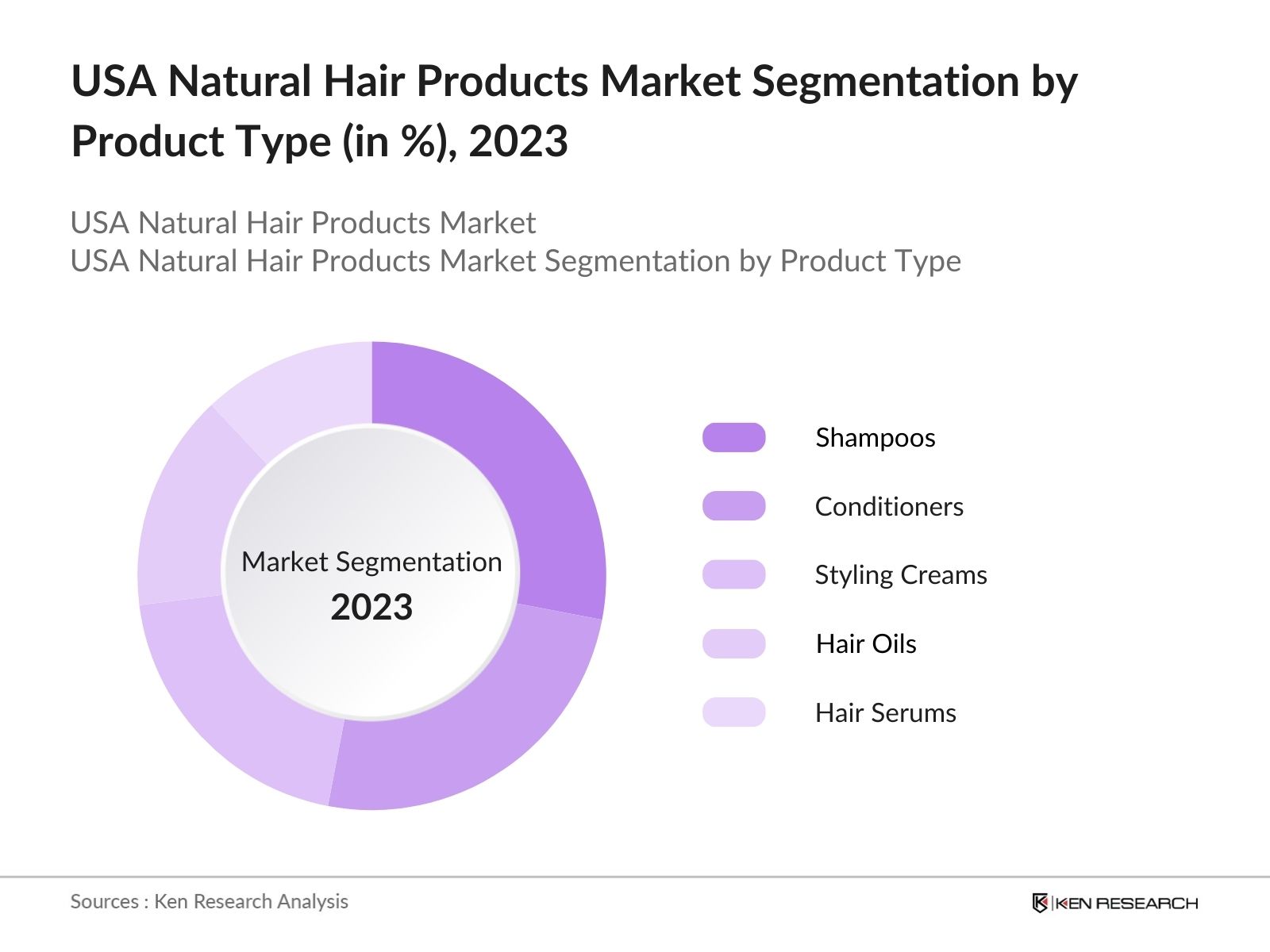

By Product Type: The market is segmented by product type into shampoos, conditioners, styling creams, hair oils, and hair serums. Recently, shampoos and conditioners have captured a portion of the market under this segmentation, driven by their frequent use and essential nature in hair care routines. The growing demand for sulfate-free, paraben-free, and organic shampoos and conditioners has contributed to the dominance of this sub-segment. Brands like SheaMoisture and Mielle Organics have further driven growth by offering specialized products tailored to natural hair textures and needs, such as moisture retention and curl enhancement.

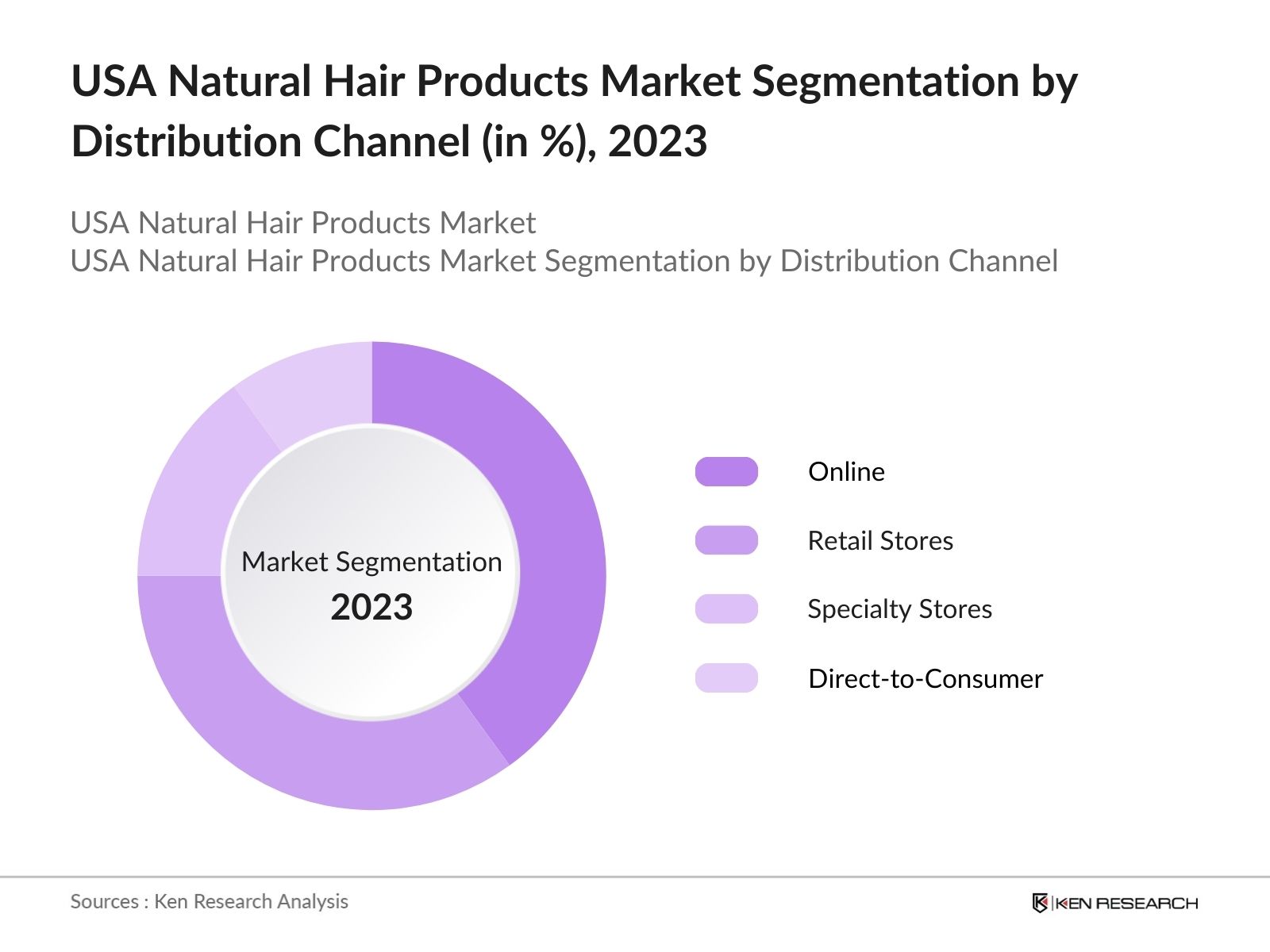

By Distribution Channel: The market is further segmented by distribution channels, including online, offline (retail stores and specialty stores), and direct-to-consumer (DTC) channels. Recently, the online distribution channel has emerged as a dominant segment, due to the increasing popularity of e-commerce platforms like Amazon and brand-specific websites. This shift is fueled by the convenience of shopping online, the availability of a wider variety of products, and the presence of exclusive deals that attract a large customer base. Moreover, online platforms offer in-depth product information, ingredient transparency, and consumer reviews, which influence purchasing decisions, especially for natural and organic products.

By Distribution Channel: The market is further segmented by distribution channels, including online, offline (retail stores and specialty stores), and direct-to-consumer (DTC) channels. Recently, the online distribution channel has emerged as a dominant segment, due to the increasing popularity of e-commerce platforms like Amazon and brand-specific websites. This shift is fueled by the convenience of shopping online, the availability of a wider variety of products, and the presence of exclusive deals that attract a large customer base. Moreover, online platforms offer in-depth product information, ingredient transparency, and consumer reviews, which influence purchasing decisions, especially for natural and organic products.

USA Natural Hair Products Market Competitive Landscape

USA Natural Hair Products Market Competitive Landscape

The USA Natural Hair Products market is dominated by several key players, each of which has contributed to market growth through product innovation, strategic marketing, and the expansion of distribution networks. Brands like SheaMoisture and Mielle Organics are at the forefront, offering products that are free from harmful chemicals and tailored to textured hair types. Furthermore, the market is highly competitive, with emerging brands offering niche products targeting specific hair needs, such as moisture retention, curl definition, and scalp care.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD) |

Product Range |

Sustainability Focus |

Distribution Reach |

R&D Investment |

|

SheaMoisture |

1991 |

New York, USA |

|||||

|

Mielle Organics |

2014 |

Indiana, USA |

|||||

|

Carols Daughter |

1993 |

New York, USA |

|||||

|

As I Am |

2010 |

Georgia, USA |

|||||

|

Cantu |

2003 |

Texas, USA |

USA Natural Hair Products Industry Analysis

Growth Drivers

- Rise in Consumer Shift Toward Natural Ingredients: Consumers in the USA are showing a shift toward natural and organic ingredients, driven by increased awareness of potential health hazards from chemical-based products. With over 41.6 million African Americans, many individuals prefer hair care products that are free from parabens, sulfates, and synthetic dyes. USDA organic certifications on products have become increasingly popular as more consumers look for "clean" labels on their hair care items. A report by the FDA indicates that 75% of newly introduced hair care products in 2023 contained primarily natural ingredients, a steep rise from previous years.

- Growth of E-commerce and Direct-to-Consumer Models: The rise of e-commerce has transformed how consumers purchase natural hair care products, making direct-to-consumer (DTC) channels a popular choice. In 2023, over 23% of hair care product sales occurred through online platforms. Retail giants like Amazon and specialty platforms like Thrive Market have witnessed rapid sales growth of natural hair care products. E-commerce platforms allow small and medium-sized enterprises (SMEs) to compete with larger companies, democratizing access to organic and sustainable products, enhancing consumer choices, and boosting demand.

- Increasing Demand for Sustainable Packaging: In 2024, sustainability is a key focus in the natural hair products market, with consumers demanding eco-friendly packaging solutions. Data from the Environmental Protection Agency (EPA) shows that packaging waste makes up 30% of total waste in the U.S. in 2023. Brands are responding by utilizing recyclable materials like glass and biodegradable plastics. Major players have shifted 50% of their packaging to eco-friendly materials, driving demand for sustainable packaging across all segments of the natural hair care market. Government incentives for green manufacturing further promote this trend.

Market Challenges

- High Production and R&D Costs of Natural Ingredients: The production costs associated with natural ingredients are considerably higher than those for synthetic materials. Research from the USDA shows that organic farming, which produces raw materials for natural products, requires up to 20% more resources than conventional methods. Additionally, compliance with FDA regulations concerning ingredient safety adds another layer of expense, increasing the final product cost. In 2023, natural hair care brands reported a 15% higher cost of goods sold compared to conventional products.

- Competition from Established Brands: The natural hair products market is highly competitive, with large multinational companies dominating shelf space in both physical and online retail environments. New entrants and smaller brands face challenges in gaining visibility. In 2023, multinational companies held over 60% of the market share in the U.S., leaving limited room for smaller brands to establish themselves. This intense competition has forced smaller brands to find niche markets or invest heavily in marketing and innovation.

USA Natural Hair Products Market Future Outlook

Over the next five years, the USA Natural Hair Products market is expected to experience notable growth due to increasing consumer interest in organic and vegan hair products, technological advancements in sustainable manufacturing, and a rise in environmental consciousness. The expansion of e-commerce and direct-to-consumer models is likely to drive future growth, as brands can reach wider audiences and offer more personalized experiences. Additionally, government regulations supporting cruelty-free and eco-friendly products will play a role in shaping the market.

Future Market Opportunities

- Collaborations with Local and Independent Hair Salons: Partnering with local and independent salons is another opportunity for growth in the natural hair care market. According to the U.S. Bureau of Labor Statistics, there are over 260,000 hair salons in the country as of 2023, many of which are moving toward offering organic and natural products. Small brands can leverage these partnerships to build brand loyalty and gain local market penetration without the high costs associated with mass retail.

- Innovations in Sustainable Manufacturing Technologies: New technologies in sustainable manufacturing, such as waterless products and carbon-neutral production methods, are opening opportunities for innovation in the natural hair care sector. In 2023, over 100 manufacturers adopted new techniques for reducing water usage during production, according to the U.S. Environmental Protection Agency (EPA). These innovations not only reduce environmental impact but also help brands meet consumer demand for greener products.

Scope of the Report

|

Product Type |

Shampoos Conditioners Styling Gels Hair Oils Hair Serums |

|

Application |

Retail Salons E-commerce Drug Stores |

|

Ingredient Type |

Organic Natural Vegan Cruelty-Free |

|

Distribution Channel |

Online Offline (Specialty Stores, Supermarkets) Direct Sales |

|

Consumer Demographics |

Women Men Children |

Products

Key Target Audience

Natural Haircare Manufacturers

Banks and Financial Institutes

Online Marketplaces

Salons and Beauty Parlors

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, U.S. Department of Agriculture)

Ingredient Suppliers (Organic, Vegan, Natural Ingredients)

E-commerce Platforms

Companies

Major Players

SheaMoisture

Carols Daughter

Mielle Organics

As I Am

Cantu

Ouidad

Aunt Jackie's

The Mane Choice

Kinky Curly

Alikay Naturals

Briogeo

TGIN

Design Essentials

Camille Rose Naturals

Pattern Beauty

Table of Contents

1. USA Natural Hair Products Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Natural Hair Products Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Natural Hair Products Market Analysis

3.1 Growth Drivers (Increasing Preference for Organic Products, Consumer Awareness on Ingredients, Rise in Afro-American Population, Sustainability Focus, Direct-to-Consumer Channels)

3.1.1 Rise in Consumer Shift Toward Natural Ingredients

3.1.2 Growth of E-commerce and Direct-to-Consumer Models

3.1.3 Government Regulations Favoring Organic Ingredients

3.1.4 Increasing Demand for Sustainable Packaging

3.2 Market Challenges (High Production Costs, Limited Ingredient Availability, Intense Market Competition)

3.2.1 High Production and R&D Costs of Natural Ingredients

3.2.2 Complex Regulatory Compliance

3.2.3 Competition from Established Brands

3.2.4 Scalability Challenges for Small Manufacturers

3.3 Opportunities (Expansion in Rural Areas, Collaborations with Local Salons, Rise in Vegan Hair Products Demand, Technological Innovations)

3.3.1 Expansion Opportunities in Underdeveloped and Rural Markets

3.3.2 Collaborations with Local and Independent Hair Salons

3.3.3 Growth in Vegan and Cruelty-Free Product Lines

3.3.4 Innovations in Sustainable Manufacturing Technologies

3.4 Trends (DIY Haircare, Customizable Hair Products, Growth of Male Grooming, Ingredient Transparency)

3.4.1 Increasing Popularity of DIY and Customizable Hair Products

3.4.2 Growth in Male Grooming and Natural Haircare

3.4.3 Ingredient Transparency and Clean Label Trend

3.4.4 Adoption of Social Media Influencer Marketing

3.5 Government Regulation (FDA Guidelines, Organic Certifications, Import/Export Regulations, Eco-Friendly Packaging Laws)

3.5.1 FDA Regulations on Natural Haircare Products

3.5.2 Organic Certification Standards

3.5.3 Import and Export Regulatory Framework

3.5.4 Eco-Friendly and Sustainable Packaging Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Distributors, Salons, Retailers, E-commerce Channels)

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. USA Natural Hair Products Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Shampoos

4.1.2 Conditioners

4.1.3 Styling Gels and Creams

4.1.4 Hair Oils

4.1.5 Hair Serums

4.2 By Application (In Value %)

4.2.1 Retail

4.2.2 Salons

4.2.3 E-commerce

4.2.4 Drug Stores

4.3 By Ingredient Type (In Value %)

4.3.1 Organic

4.3.2 Natural

4.3.3 Vegan

4.3.4 Cruelty-Free

4.4 By Distribution Channel (In Value %)

4.4.1 Online

4.4.2 Offline (Specialty Stores, Supermarkets)

4.4.3 Direct Sales

4.5 By Consumer Demographics (In Value %)

4.5.1 Women

4.5.2 Men

4.5.3 Children

5. USA Natural Hair Products Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 SheaMoisture

5.1.2 Carols Daughter

5.1.3 As I Am

5.1.4 Mielle Organics

5.1.5 Cantu

5.1.6 Ouidad

5.1.7 Aunt Jackie's

5.1.8 The Mane Choice

5.1.9 Kinky Curly

5.1.10 Alikay Naturals

5.1.11 Briogeo

5.1.12 TGIN

5.1.13 Design Essentials

5.1.14 Camille Rose Naturals

5.1.15 Pattern Beauty

5.2 Cross Comparison Parameters (Revenue, Headquarters, Distribution Reach, Product Range, Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Investments

5.8 Brand Loyalty and Customer Retention Strategies

6. USA Natural Hair Products Market Regulatory Framework

6.1 Organic and Natural Certification Processes

6.2 FDA Compliance for Natural Hair Products

6.3 Sustainability Compliance Requirements

6.4 Intellectual Property and Trademark Considerations

7. USA Natural Hair Products Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Natural Hair Products Future Market Segmentation

8.1 By Product Type

8.2 By Application

8.3 By Ingredient Type

8.4 By Distribution Channel

8.5 By Consumer Demographics

9. USA Natural Hair Products Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 White Space Opportunity Analysis

9.3 Marketing and Promotional Strategies

9.4 Product Innovation and Sustainability Initiatives

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involved defining critical variables within the USA Natural Hair Products market. We utilized a blend of proprietary databases, government resources, and secondary research to identify the market's key growth drivers, challenges, and consumer preferences.

Step 2: Market Analysis and Construction

Historical data analysis provided insights into product demand, consumer behaviors, and revenue generation. This step enabled a clear understanding of the revenue contributions from different market segments, including product type and distribution channels.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were tested through interviews with industry experts. These consultations helped refine our understanding of product innovation, the impact of sustainability trends, and future growth projections for the natural hair products market.

Step 4: Research Synthesis and Final Output

Finally, data from primary interviews were integrated with secondary sources to verify market dynamics. The research synthesis provided comprehensive insights into product performance, market competitiveness, and future market opportunities.

Frequently Asked Questions

01. How big is the USA Natural Hair Products Market?

The USA Natural Hair Products market is valued at USD 1.5 billion, driven by growing consumer demand for organic, natural, and cruelty-free products, alongside increasing environmental awareness.

02. What are the challenges in the USA Natural Hair Products Market?

Challenges in the USA Natural Hair Products market include high production costs of organic ingredients, intense market competition from established brands, and regulatory hurdles around organic and cruelty-free certifications.

03. Who are the major players in the USA Natural Hair Products Market?

Key players in the USA Natural Hair Products market include SheaMoisture, Mielle Organics, Carols Daughter, As I Am, and Cantu, all of which dominate due to their wide distribution reach, strong brand presence, and focus on natural and organic haircare.

04. What are the growth drivers of the USA Natural Hair Products Market?

The USA Natural Hair Products market is propelled by consumer awareness regarding the harmful effects of chemical-laden products, increasing preference for clean beauty, and the rise of e-commerce platforms that offer a wide range of natural haircare options.

05. Which distribution channel dominates the USA Natural Hair Products Market?

In the USA Natural Hair Products market, the online distribution channel is currently dominant, driven by the convenience of e-commerce, broader product selection, and exclusive deals offered by online platforms like Amazon.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.