USA Non-Destructive Testing (NDT) Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD3893

December 2024

93

About the Report

USA Non-Destructive Testing (NDT) Market Overview

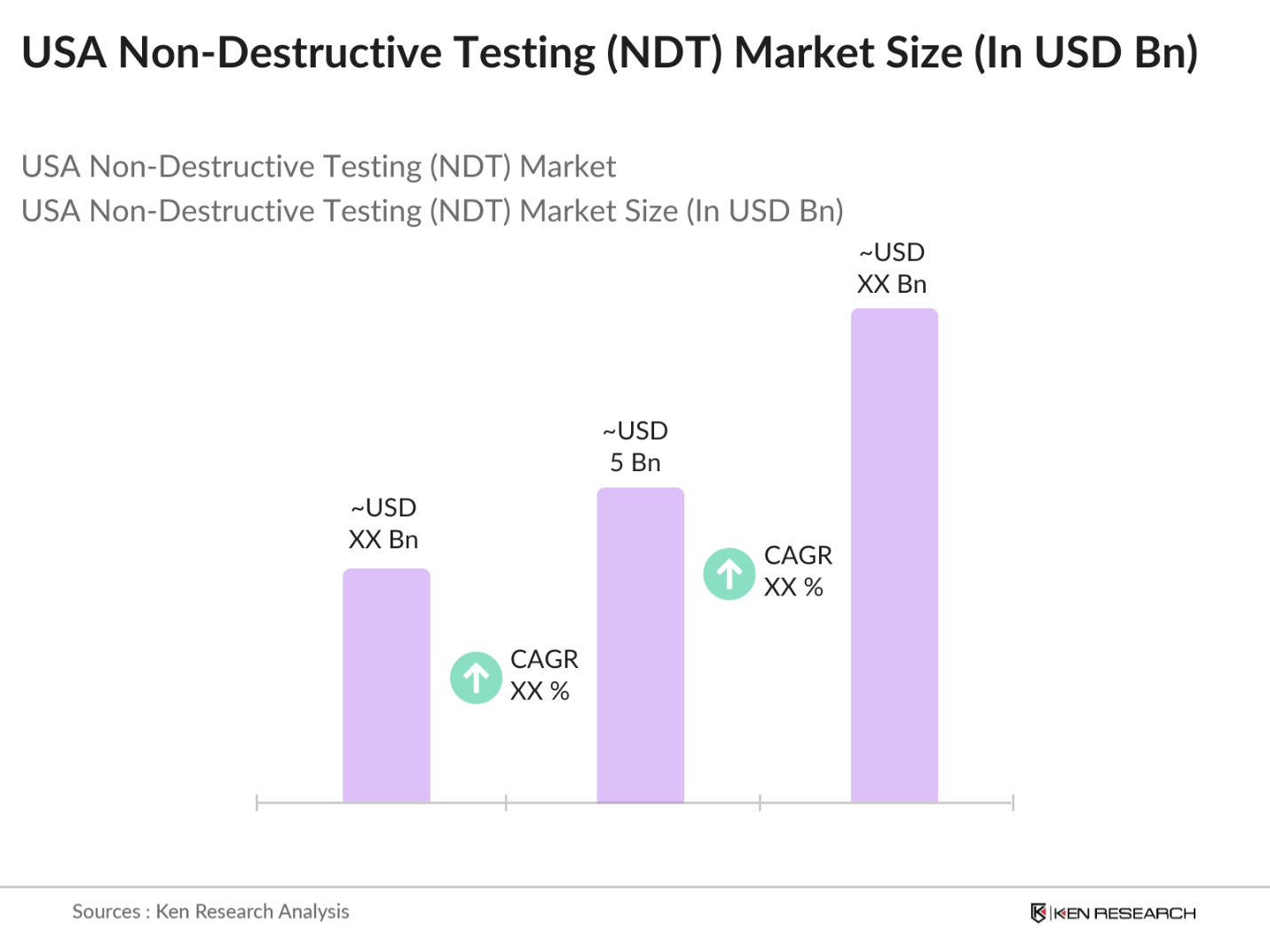

- The USA Non-Destructive Testing (NDT) market is valued at USD 5 billion, based on a five-year historical analysis. This market is driven by the increasing focus on infrastructure maintenance, technological advancements, and stringent safety standards across key industries such as oil & gas, aerospace, and automotive. The growing need for ensuring the integrity of aging infrastructure and the implementation of regulatory standards are major contributors to the demand for NDT solutions in the country. The adoption of advanced technologies, such as phased array ultrasonic testing (PAUT) and digital radiography, further supports the markets growth by enhancing inspection precision and reducing operational costs.

- Cities like Houston, Texas, and Los Angeles, California, dominate the market due to their strategic importance in the oil & gas and aerospace industries. Houstons proximity to the Gulf of Mexico and its status as a hub for energy companies result in a high demand for NDT services in the region. Los Angeles, with its extensive aerospace and defense infrastructure, further propels the adoption of advanced NDT solutions to meet stringent federal and defense requirements.

- The U.S. Department of Transportation requires regular non-destructive testing (NDT) inspections for crucial infrastructure elements, such as bridges and highways, to ensure safety and regulatory compliance. These inspections help identify potential structural issues early, thereby minimizing the risk of major failures and enhancing public safety standards.

USA Non-Destructive Testing (NDT) Market Segmentation

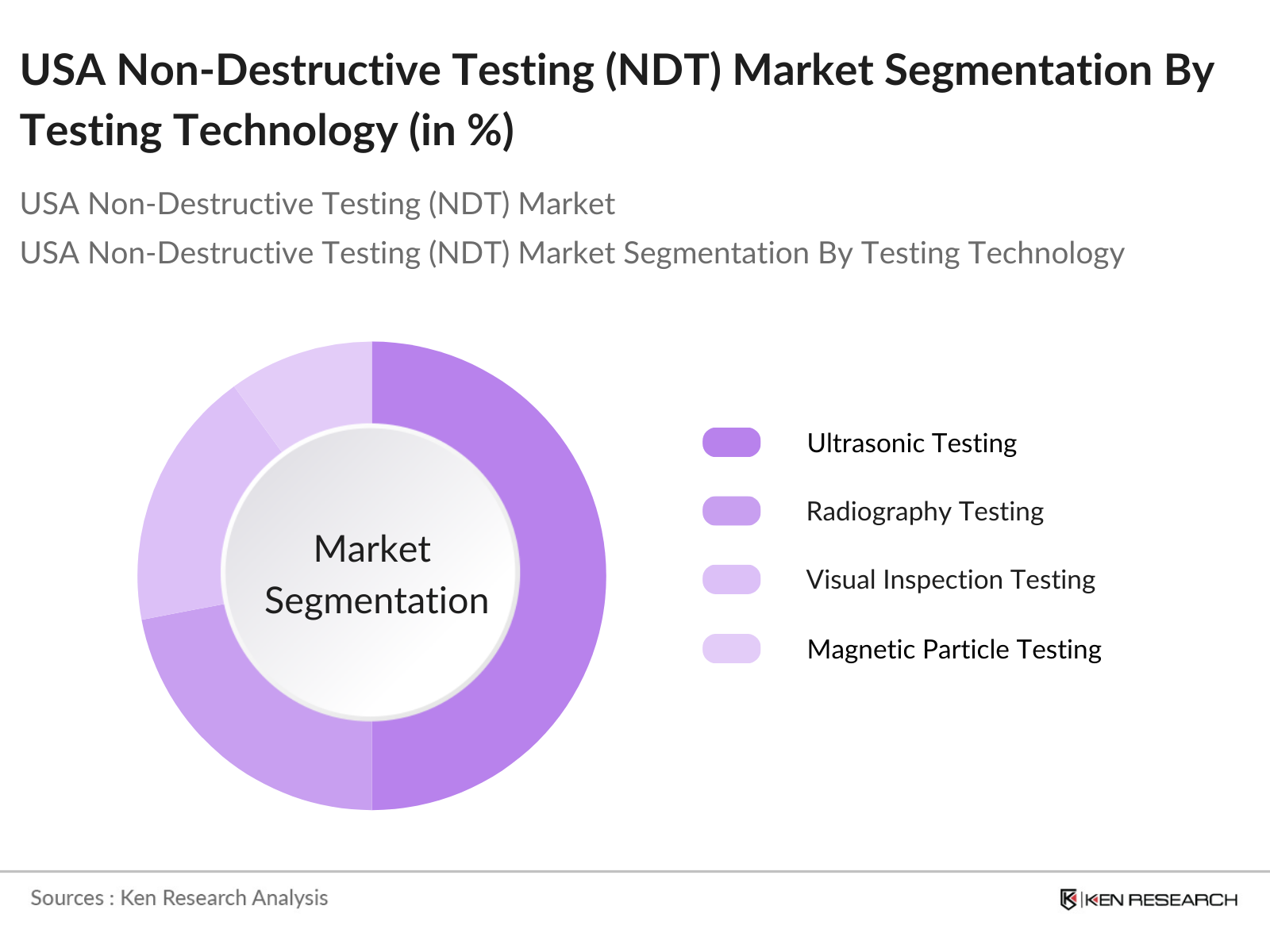

By Testing Technology: The market is segmented by testing technology into Ultrasonic Testing, Radiography Testing, Visual Inspection Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Eddy Current Testing, and Acoustic Emission Testing. Among these, ultrasonic testing holds the largest market share due to its ability to detect internal defects, measure thickness, and evaluate material properties. It is preferred in critical industries like aerospace and automotive, where high precision is required.

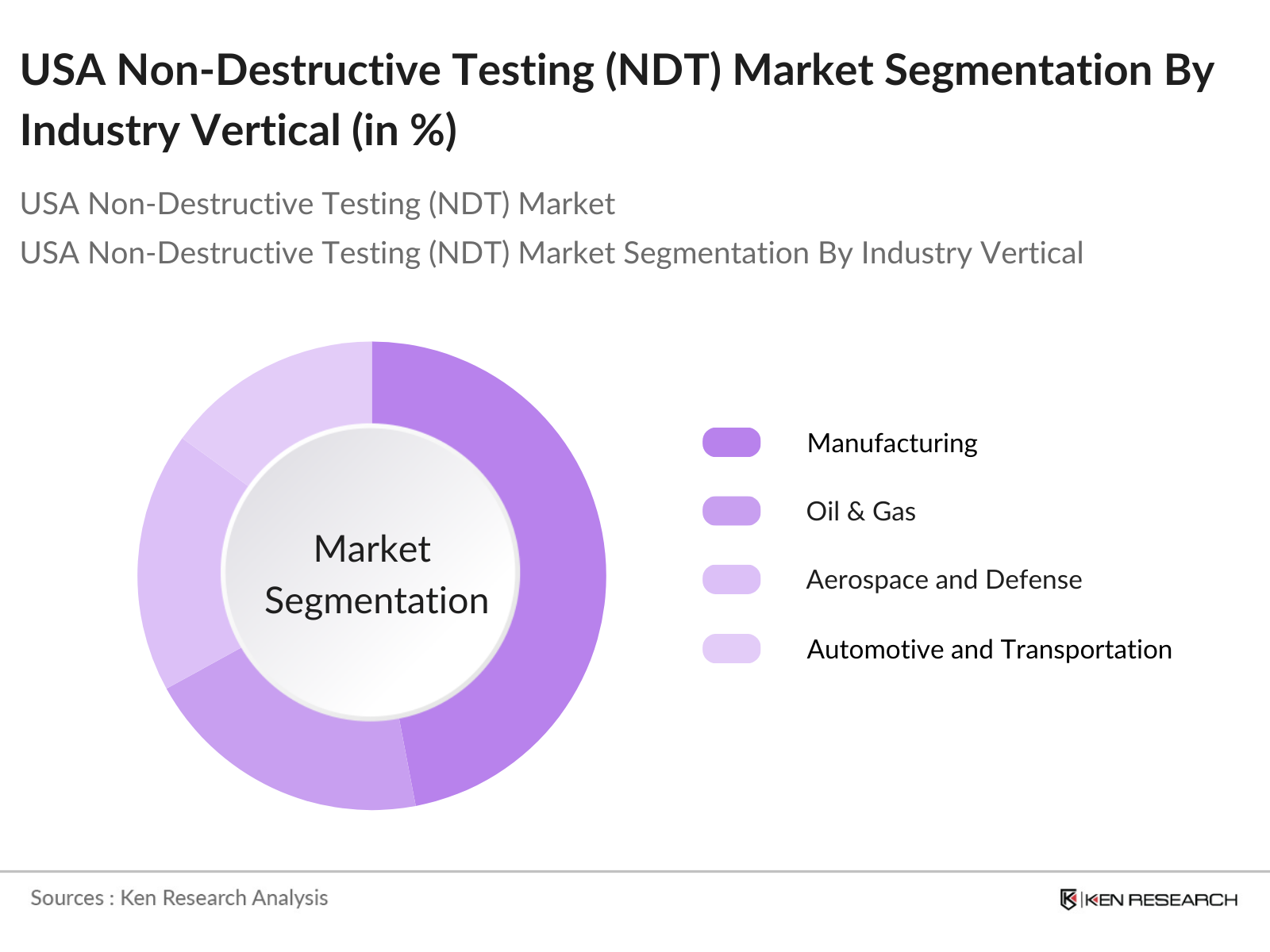

By Industry Vertical: The market is segmented by industry vertical into Manufacturing, Oil & Gas, Aerospace and Defense, Automotive and Transportation, Power Generation, Public Infrastructure, and Construction. The manufacturing industry dominates the market share due to its need for non-invasive testing solutions that ensure product quality and safety.

USA Non-Destructive Testing (NDT) Market Competitive Landscape

The USA NDT market is dominated by both domestic and international players, with companies focusing on mergers, acquisitions, and technological advancements to expand their market presence. The USA NDT market is highly consolidated, with key players focusing on geographical expansion and the adoption of new technologies like AI and IoT for enhanced inspection capabilities.

USA Non-Destructive Testing (NDT) Industry Analysis

Growth Drivers

- Rising Demand for Infrastructure Maintenance: The aging infrastructure in the United States has created a significant demand for maintenance and monitoring services. According to data from the World Bank, over 45% of bridges in the U.S. are more than 50 years old, leading to increased need for non-destructive testing (NDT) to assess the structural integrity and safety of these assets. The U.S. Department of Transportation mandates regular inspections, further driving the demand for NDT services to ensure compliance with safety standards.

- Growth in Manufacturing Sector (Automotive, Aerospace): The manufacturing sector, particularly in automotive and aerospace, has been expanding. The aerospace sector alone contributes over $150 billion in export value annually, according to the World Bank. This growth necessitates rigorous testing and quality assurance processes such as NDT to maintain product safety and performance. With increased production rates, especially in commercial aviation, the application of NDT methods has become integral to the industry.

- Stringent Regulatory Norms and Safety Standards: The United States has stringent regulations and safety standards enforced by various agencies such as the Federal Aviation Administration (FAA) and the U.S. Department of Energy. Compliance with ASME standards, which are widely adopted for energy and industrial applications, necessitates the use of NDT methods. For instance, the FAA regulations require periodic inspections of aircraft components, pushing the adoption of advanced NDT methods like digital radiography and ultrasonic testing.

Market Challenges

- High Initial Costs of NDT Equipment: Advanced NDT equipment such as phased array ultrasonic testing (PAUT) and digital radiography systems are capital-intensive. According to data from the World Bank, the high costs of these sophisticated systems pose a barrier for small and medium-sized enterprises, which are crucial players in sectors like construction and manufacturing. The cost factor limits the adoption rate and slows market penetration of new technologies.

- Shortage of Skilled Workforce: The NDT industry faces a critical shortage of skilled professionals. A survey by the World Bank indicates that the lack of specialized training in newer techniques like advanced ultrasonic and electromagnetic testing methods has created a gap in the workforce. This shortage results in longer project timelines and increased costs for companies seeking to implement comprehensive NDT strategies.

USA Non-Destructive Testing (NDT) Market Future Outlook

Over the next five years, the USA NDT market is expected to witness considerable growth, driven by the increasing demand for advanced inspection technologies, growing focus on infrastructure development, and the need for enhanced safety standards across industries. The integration of AI and IoT in NDT equipment will further propel the adoption of these technologies in the USA. Regulatory standards are expected to become more stringent, especially in the aerospace and automotive sectors, which will further drive the market demand for reliable and precise NDT solutions.

Market Opportunities

- Technological Advancements (AI, Automation, IoT): The integration of artificial intelligence (AI) and automation in NDT processes is creating new opportunities for efficiency and accuracy. The World Bank reports that advancements in AI-driven image analysis and automated data interpretation can reduce the time required for inspections by up to 40%. The adoption of IoT-enabled sensors for continuous monitoring is also enhancing the capability to perform real-time assessments, particularly in sectors like power generation.

- Expansion in Emerging Industries (Renewables, Nuclear): Emerging sectors like renewable energy and nuclear power are adopting NDT techniques for asset management and maintenance. As per the U.S. Energy Information Administration, nuclear energy contributes about 20% of the country's electricity, necessitating rigorous testing for safety compliance. The expansion of wind and solar energy projects also presents new avenues for NDT applications in ensuring the structural integrity of turbines and solar panels.

Scope of the Report

|

By Testing Technology |

Radiography Testing Ultrasonic Testing Visual Inspection Testing Magnetic Particle Testing Liquid Penetrant Testing Eddy Current Testing Acoustic Emission Testing |

|

By Industry Vertical |

Manufacturing Oil & Gas Aerospace and Defense Automotive and Transportation Power Generation Public Infrastructure |

|

By Service Type |

Inspection Services Training Services Calibration Services Consulting Services |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

NDT Equipment Manufacturers

Oil & Gas Companies

Automotive Manufacturers

Aerospace Companies

Power Generation Companies

Government and Regulatory Bodies (e.g., OSHA, FAA)

Investments and Venture Capitalist Firms

Training and Certification Bodies

Companies

Players Mentioned in the Report

MISTRAS Group

Olympus Corporation

Bureau Veritas

Applus+

General Electric (GE)

Evident Corporation

Intertek Group PLC

Zetec Inc.

Sonatest

Magnaflux

Table of Contents

1. USA NDT Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA NDT Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA NDT Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Infrastructure Maintenance

3.1.2. Growth in Manufacturing Sector (Automotive, Aerospace)

3.1.3. Stringent Regulatory Norms and Safety Standards

3.2. Market Challenges

3.2.1. High Initial Costs of NDT Equipment

3.2.2. Shortage of Skilled Workforce

3.2.3. Lack of Standardization in Some NDT Methods

3.3. Opportunities

3.3.1. Technological Advancements (AI, Automation, IoT)

3.3.2. Expansion in Emerging Industries (Renewables, Nuclear)

3.3.3. Increasing Adoption in Power Generation and Public Infrastructure

3.4. Trends

3.4.1. Integration of Advanced Technologies like Phased Array Ultrasonic Testing (PAUT)

3.4.2. Emergence of Digital Radiography

3.4.3. Expansion of Portable and Remote NDT Inspection Systems

3.5. Government Regulations

3.5.1. U.S. Department of Transportation Standards

3.5.2. FAA Regulations for Aerospace NDT

3.5.3. ASME Standards for Energy and Industrial Applications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA NDT Market Segmentation

4.1. By Testing Technology (In Value %)

4.1.1. Radiography Testing

4.1.2. Ultrasonic Testing

4.1.3. Visual Inspection Testing

4.1.4. Magnetic Particle Testing

4.1.5. Liquid Penetrant Testing

4.1.6. Eddy Current Testing

4.1.7. Acoustic Emission Testing

4.2. By Industry Vertical (In Value %)

4.2.1. Manufacturing

4.2.2. Oil & Gas

4.2.3. Aerospace and Defense

4.2.4. Automotive and Transportation

4.2.5. Power Generation

4.2.6. Public Infrastructure

4.2.7. Construction

4.3. By Service Type (In Value %)

4.3.1. Inspection Services

4.3.2. Training Services

4.3.3. Calibration Services

4.3.4. Consulting Services

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

5. USA NDT Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. MISTRAS Group

5.1.2. Olympus Corporation

5.1.3. Bureau Veritas

5.1.4. General Electric

5.1.5. Applus+

5.1.6. Eddyfi Technologies

5.1.7. Intertek Group PLC

5.1.8. Zetec Inc.

5.1.9. Team Inc.

5.1.10. TUV Rheinland

5.1.11. Magnaflux

5.1.12. Ashtead Technology

5.1.13. SGS Socit Gnrale de Surveillance SA

5.1.14. Sonatest

5.1.15. Element Materials Technology

5.2. Cross Comparison Parameters

(Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Technology Focus, Service Capabilities, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA NDT Market Regulatory Framework

6.1. National and International Standards

6.2. Compliance Requirements by Sector

6.3. Certification Processes

7. USA NDT Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA NDT Market Segmentation

8.1. By Testing Technology (In Value %)

8.2. By Industry Vertical (In Value %)

8.3. By Service Type (In Value %)

8.4. By Region (In Value %)

9. USA NDT Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA NDT Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA NDT Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple NDT companies to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA NDT market.

Frequently Asked Questions

01. How big is the USA NDT Market?

The USA Non-Destructive Testing (NDT) market is valued at USD 5 billion, based on a five-year historical analysis. This market is driven by the increasing focus on infrastructure maintenance, technological advancements, and stringent safety standards across key industries such as oil & gas, aerospace, and automotive.

02. What are the key growth drivers in the USA NDT Market?

Key growth drivers include rising infrastructure development, technological advancements in NDT techniques such as ultrasonic testing, and stringent safety regulations across industries like automotive and aerospace.

03. Who are the major players in the USA NDT Market?

Major players in the USA NDT market include MISTRAS Group, Olympus Corporation, Bureau Veritas, Applus+, and General Electric (GE). These companies dominate due to their strong technological capabilities and extensive service portfolios.

04. What are the challenges in the USA NDT Market?

Challenges include high initial costs of NDT equipment, shortage of skilled workforce, and lack of standardization in some NDT methodologies, which can hinder market growth and the adoption of advanced techniques.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.