USA Nylon Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD9910

December 2024

91

About the Report

USA Nylon Market Overview

- The USA Nylon Market is valued at USD 4 billion, driven primarily by strong demand across the automotive, textiles, and packaging industries. The durability, strength, and versatility of nylon make it essential in high-performance applications such as automotive components, electrical insulation, and consumer textiles. The growth of industries that rely heavily on nylon as a material, such as automotive manufacturing and textiles, fuels the market.

- The dominant markets within the USA include major cities such as Detroit, Los Angeles, and New York. Detroit leads in the automotive sector due to the concentration of vehicle manufacturers that rely on nylon for durable and lightweight components. Los Angeles and New York, on the other hand, have strong fashion and textiles markets, making them key regions for nylon demand in apparel and industrial textiles. Additionally, these cities serve as hubs for research and development, driving innovation in nylon-based applications.

- The Federal Trade Commission (FTC) mandates specific labeling requirements for textiles, including nylon products, under the Textile Fiber Products Identification Act. As of 2023, U.S. manufacturers are required to disclose fiber content, origin, and care instructions on all nylon-based products. These regulations ensure transparency and consumer protection in the textile industry. Compliance with FTC standards is crucial for nylon manufacturers to maintain market access and consumer trust.

USA Nylon Market Segmentation

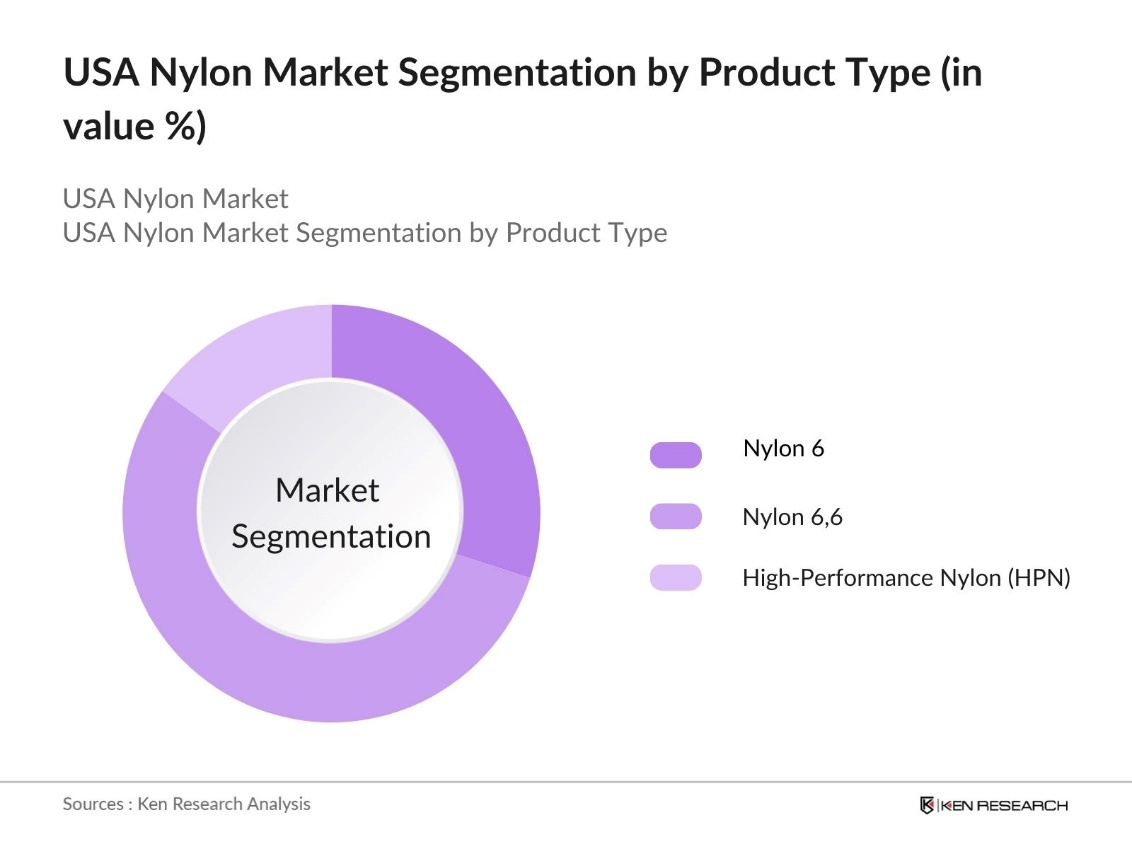

By Product Type: The USA Nylon market is segmented by product type into Nylon 6, Nylon 6,6, and High-Performance Nylon (HPN). Among these, Nylon 6,6 dominates the market, accounting for 55% of the total share in 2023. Nylon 6,6 is preferred in industries such as automotive and electrical due to its higher thermal stability, strength, and wear resistance. Its use in automotive components like air intake manifolds, radiator end tanks, and electronic connectors further solidifies its position. The materials superior performance under high temperatures and its compatibility with modern manufacturing processes, such as injection molding, drive its widespread adoption in high-stress applications.

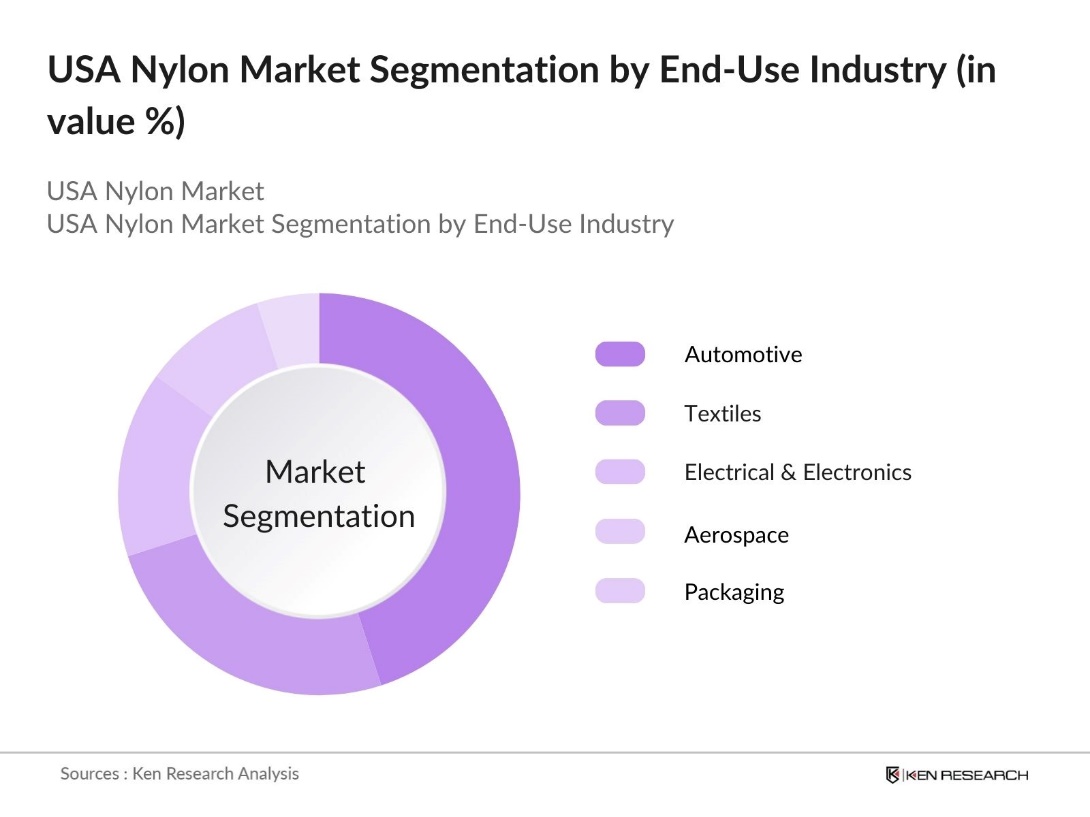

By End-Use Industry: The USA Nylon market is further segmented by End-Use Industry, including Automotive, Textiles, Electrical & Electronics, Aerospace, and Packaging. The Automotive segment holds the largest share, with 45% in 2023, primarily due to the materials lightweight properties and its ability to reduce vehicle weight, leading to improved fuel efficiency. Nylon is critical in manufacturing various automotive components that require high durability and resistance to wear and high temperatures, contributing to the significant use of nylon in this industry.

USA Nylon Market Competitive Landscape

The market is dominated by several global and domestic players that control a significant portion of the market share. These companies focus on continuous innovation and expansion to stay competitive. Major players in the market include BASF, DuPont, and Honeywell. DuPont and BASF, for instance, lead in R&D investments, which has allowed them to develop high-performance and sustainable nylon variants to meet the growing demand for eco-friendly materials.

|

Company Name |

Year of Establishment |

Headquarters |

Global Presence |

R&D Investments |

Revenue (2023) |

Sustainability Initiatives |

Product Innovation |

Production Capacity |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

||||||

|

DuPont de Nemours, Inc. |

1802 |

Wilmington, USA |

||||||

|

Honeywell International |

1906 |

Charlotte, USA |

||||||

|

Ascend Performance Materials |

2009 |

Houston, USA |

||||||

|

Solvay S.A. |

1863 |

Brussels, Belgium |

USA Nylon Industry Analysis

Growth Drivers

- Demand in Automotive Sector (Automobile Manufacturing, Component Durability): The U.S. automotive industry remains a major consumer of nylon, primarily for components like air intake manifolds, gears, and under-the-hood parts that require durability and heat resistance. As of 2023, U.S. motor vehicle manufacturing exceeded 10.61 million units annually, driving demand for high-performance nylon. Nylon's thermal stability and lightweight properties make it a key material for reducing vehicle weight, essential for meeting federal fuel efficiency standards.

- Textile Industry Growth (Apparel, Industrial Fabrics): In 2024, the U.S. textile and apparel sector continued to drive nylon consumption, particularly for activewear and industrial fabrics. As of 2023, the employment in the textile mills subsector is approximately 138,000 workers. Nylon's elasticity, abrasion resistance, and moisture-wicking properties make it an ideal material for apparel and performance textiles. The growth of e-commerce, coupled with a demand for specialized clothing (e.g., athleisure), has bolstered nylons role in the industry.

- Advancements in Additive Manufacturing (3D Printing Materials): The U.S. market for additive manufacturing materials, including nylon, is growing due to its strength and flexibility, making it ideal for industries like aerospace and healthcare. Nylon filaments and powders are used to produce lightweight, durable prototypes and components. Advancements in 3D printing technology also reduce material waste significantly, supporting more sustainable and efficient manufacturing processes across multiple sectors.

Market Challenges

- Volatility in Raw Material Prices (Petrochemical Feedstocks): Nylon production relies heavily on petrochemical feedstocks, making it highly sensitive to fluctuations in crude oil and natural gas prices. Variability in oil prices directly impacts the cost of nylon production, leading to potential price instability in nylon products. Additionally, supply chain constraints in the petrochemical industry contribute to further uncertainty, making price fluctuations a persistent challenge for nylon manufacturers.

- Environmental Regulations (Emissions, Waste Management): The nylon industry must adhere to strict environmental regulations, particularly regarding emissions and waste management. Regulations enforced by the Environmental Protection Agency (EPA) aim to limit greenhouse gas emissions and manage hazardous waste from nylon production. Compliance with these regulations increases operational complexity and costs for manufacturers, making it crucial for the industry to continuously adapt to evolving environmental standards.

USA Nylon Market Future Outlook

The USA Nylon market is poised for significant growth over the next five years, driven by several key factors. Increasing demand for lightweight, durable materials in the automotive and aerospace sectors is expected to fuel growth. Furthermore, advancements in recycling technologies and a growing focus on sustainable manufacturing practices are set to revolutionize the industry, allowing for the production of bio-based and recycled nylon materials.

Market Opportunities

- Technological Innovations (Nanotechnology, High-Performance Fibers): Nanotechnology is transforming the U.S. nylon market by enabling the development of high-performance fibers with enhanced strength, flexibility, and resistance to wear. Nylon infused with nanoparticles is used to create advanced fabrics with superior thermal properties, making them ideal for applications in textiles, aerospace, and electronics. Ongoing research and development in nanotechnology continue to drive innovations in nylon products for high-tech industries.

- Collaborations Between Industry Players: Collaborative efforts among U.S. nylon manufacturers, academic institutions, and government agencies have led to significant advancements in research and development. These partnerships have resulted in innovations like bio-based nylons and improved recycling technologies. Joint ventures and R&D initiatives are essential for promoting innovation and advancing the commercialization of sustainable nylon products, supporting industry growth and environmental goals.

Scope of the Report

|

By Product Type |

Nylon 6 Nylon 6,6 High-Performance Nylon |

|

By End-Use Industry |

Automotive Textiles Electrical & Electronics Aerospace Packaging |

|

By Manufacturing Process |

Injection Molding Extrusion Casting Blown Film |

|

By Application |

Fibers Engineering Plastics Films and Sheets Coatings |

|

By Region |

Northeast, Midwest South West |

Products

Key Target Audience

Automotive Manufacturers

Textile Manufacturers

Electrical & Electronics Manufacturers

Aerospace Manufacturers

Packaging Industry Players

Sustainability and Recycling Firms

Government and Regulatory Bodies (Environmental Protection Agency, Federal Trade Commission)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

BASF SE

DuPont de Nemours, Inc.

Solvay S.A.

Honeywell International Inc.

Invista

Ascend Performance Materials

Royal DSM N.V.

Lanxess AG

Ube Industries Ltd.

Arkema S.A.

Table of Contents

1. USA Nylon Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Value Chain Analysis (Raw Material to Finished Products)

1.6. Key Stakeholders and Distribution Channels

2. USA Nylon Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Market Expansion, Mergers & Acquisitions, Technological Adoption)

2.4. Market Contribution by Segments (Product Types, End-Use Applications)

3. USA Nylon Market Analysis

3.1. Growth Drivers

3.1.1. Demand in Automotive Sector (Automobile Manufacturing, Component Durability)

3.1.2. Textile Industry Growth (Apparel, Industrial Fabrics)

3.1.3. Advancements in Additive Manufacturing (3D Printing Materials)

3.1.4. Increased Demand for Sustainable Nylon (Recycling Technologies, Bio-based Nylon)

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices (Petrochemical Feedstocks)

3.2.2. Environmental Regulations (Emissions, Waste Management)

3.2.3. Competition from Substitutes (Polyester, Polypropylene)

3.2.4. Supply Chain Disruptions (COVID-19 Impact, Trade Restrictions)

3.3. Opportunities

3.3.1. Technological Innovations (Nanotechnology, High-Performance Fibers)

3.3.2. Collaborations Between Industry Players (Joint Ventures, Research & Development)

3.3.3. Adoption in Aerospace Applications (Lightweight, Heat-Resistant Materials)

3.3.4. Expansion of Green Nylon Initiatives (Sustainability Certifications, Circular Economy Practices)

3.4. Trends

3.4.1. Shift to Bio-Based Nylon (Bio-Nylon Production, Reduced Carbon Footprint)

3.4.2. Integration with Smart Materials (Conductive Nylon, IoT Integration)

3.4.3. Customization in Fashion Industry (Personalized Fabrics, Rapid Prototyping)

3.4.4. Increased Recycling of Nylon Waste (Post-Consumer Waste, Industrial Waste Management)

3.5. Government Regulations

3.5.1. Environmental Protection Agency (EPA) Standards

3.5.2. Federal Trade Commission (FTC) Textile Labeling Requirements

3.5.3. Carbon Emission Regulations in Manufacturing

3.5.4. Incentives for Sustainable Manufacturing (Green Manufacturing Initiatives)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Suppliers, Manufacturers, Distributors, End-Users)

3.8. Porters Five Forces Analysis (Competitive Rivalry, Threat of New Entrants, Bargaining Power)

3.9. Competitive Ecosystem Analysis (Market Concentration, Competitive Landscape)

4. USA Nylon Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Nylon 6

4.1.2. Nylon 6,6

4.1.3. High-Performance Nylon (HPN)

4.2. By End-Use Industry (In Value %)

4.2.1. Automotive

4.2.2. Textiles (Clothing, Technical Textiles)

4.2.3. Electrical & Electronics

4.2.4. Aerospace

4.2.5. Packaging

4.3. By Manufacturing Process (In Value %)

4.3.1. Injection Molding

4.3.2. Extrusion

4.3.3. Casting

4.3.4. Blown Film

4.4. By Application (In Value %)

4.4.1. Fibers

4.4.2. Engineering Plastics

4.4.3. Films and Sheets

4.4.4. Coatings

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Nylon Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. BASF SE

5.1.2. DuPont de Nemours, Inc.

5.1.3. Solvay S.A.

5.1.4. Honeywell International Inc.

5.1.5. Invista

5.1.6. Ascend Performance Materials

5.1.7. Royal DSM N.V.

5.1.8. Lanxess AG

5.1.9. Ube Industries Ltd.

5.1.10. Arkema S.A.

5.1.11. Radici Group

5.1.12. EMS-Chemie Holding AG

5.1.13. Toray Industries, Inc.

5.1.14. Mitsubishi Chemical Corporation

5.1.15. Asahi Kasei Corporation

5.2. Cross Comparison Parameters (Product Portfolio, R&D Spending, Global Presence, Revenue Share, Product Innovation, Sustainability Initiatives, Production Capacity, Vertical Integration)

5.3. Market Share Analysis (Top Companies Market Share)

5.4. Strategic Initiatives (Partnerships, Collaborations, Licensing)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (R&D Investments, Infrastructure Expansion)

5.7. Venture Capital Funding

5.8. Private Equity Investments

5.9. Government Grants and Subsidies

6. USA Nylon Market Regulatory Framework

6.1. Environmental Standards and Guidelines (Emission Standards, Waste Management)

6.2. Certification Processes (ISO Standards, Industry-Specific Certifications)

6.3. Compliance Requirements (Product Labeling, Safety Standards)

7. USA Nylon Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Technological Innovation, Sustainability)

8. USA Nylon Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Manufacturing Process (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. USA Nylon Market Analysts' Recommendations

9.1. Total Addressable Market (TAM) / Serviceable Addressable Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Sales Strategies

9.4. White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial stage, we mapped the ecosystem of the USA Nylon Market by identifying all key stakeholders across the value chain. We relied on proprietary databases, combined with government reports and industry publications, to define the key variables driving the market dynamics.

Step 2: Market Analysis and Construction

Next, we analyzed historical data related to the USA Nylon Market. This included data on market penetration, supply-demand metrics, and the distribution of revenue across key market segments. The analysis ensured the accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

We validated our market hypotheses through expert consultations via interviews with industry professionals from leading nylon manufacturers. These interviews helped refine our data and provided critical insights into ongoing market trends and challenges.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the data and insights gathered from the research, allowing us to present a detailed and validated analysis of the USA Nylon market. This was further corroborated with input from multiple manufacturers.

Frequently Asked Questions

01 How big is the USA Nylon Market?

The USA Nylon Market is valued at USD 4 billion, driven by high demand in industries such as automotive, textiles, and packaging.

02 What are the challenges in the USA Nylon Market?

Challenges in USA Nylon Market include volatile raw material prices, stringent environmental regulations, and competition from alternative materials such as polyester and polypropylene.

03 Who are the major players in the USA Nylon Market?

Major players in USA Nylon Market include BASF SE, DuPont de Nemours, Inc., Solvay S.A., Honeywell International Inc., and Ascend Performance Materials.

04 What are the growth drivers of the USA Nylon Market?

Key growth drivers in USA Nylon Market include increasing demand from the automotive sector, advancements in nylon recycling technologies, and the rise of sustainable manufacturing practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.