USA Oat Milk Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD4455

November 2024

97

About the Report

USA Oat Milk Market Overview

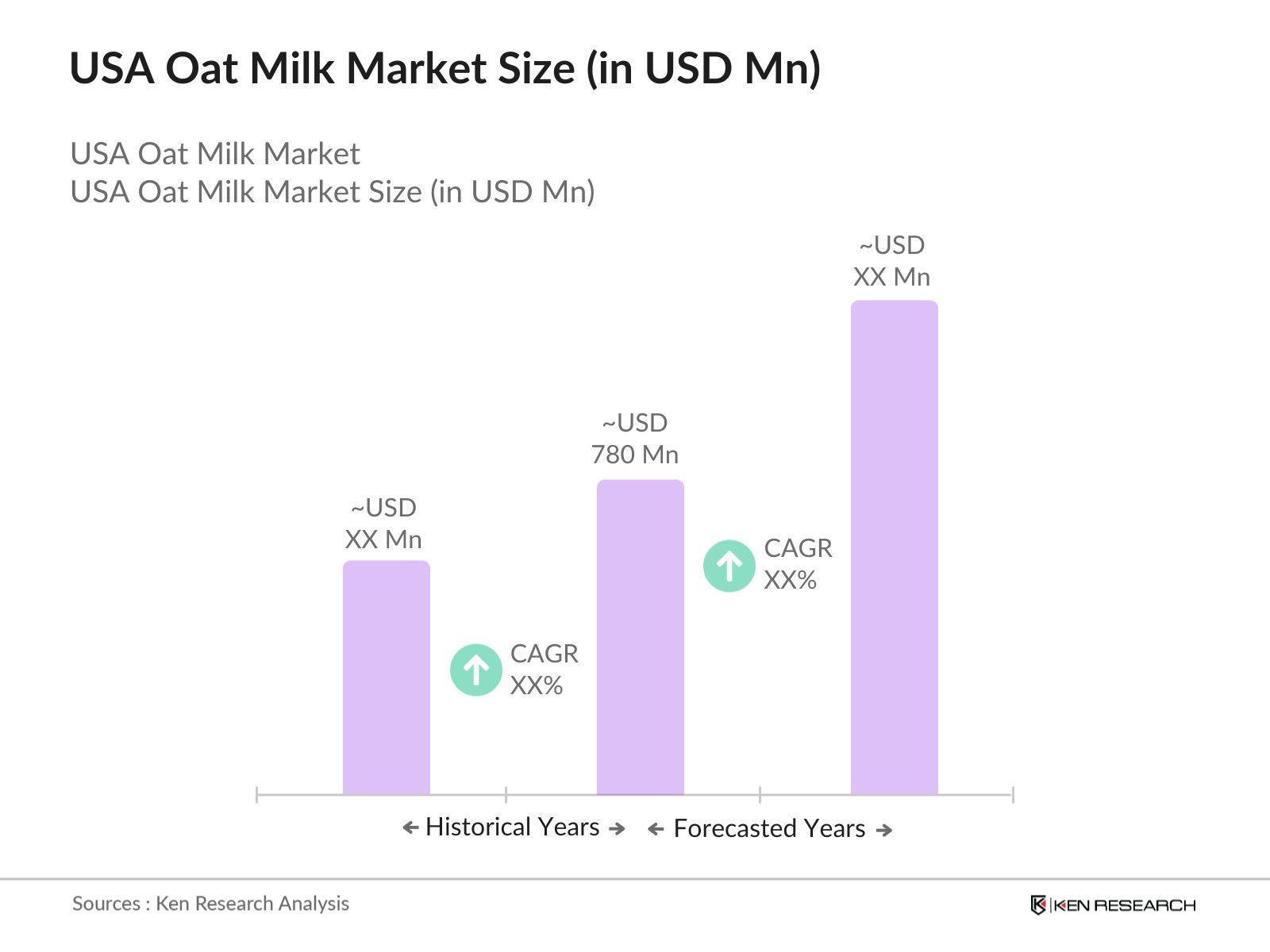

- The USA Oat Milk market is valued at USD 780 Mn, based on a five-year historical analysis. This growth is driven by increasing consumer preferences for plant-based alternatives, specifically driven by dietary shifts and environmental sustainability concerns. The rising popularity of dairy alternatives, particularly among lactose-intolerant consumers and individuals following vegan diets, is a factor fueling the demand for oat milk. Additionally, oat milk's creamy texture and rich nutritional profile have positioned it as a preferred choice in the plant-based beverage market, supporting its steady growth.

- The dominance of cities like Los Angeles, New York, and Chicago in the oat milk market is attributed to the concentration of health-conscious consumers and a strong presence of specialty food retailers and cafes. These cities are trendsetters for plant-based diets, with a high demand for innovative food and beverage products, especially among millennials and urban consumers. Their cosmopolitan lifestyle, access to premium products, and active vegan and lactose-intolerant communities contribute to the leading market share of oat milk in these regions.

- Private label oat milk products are rapidly gaining popularity in the USA market, driven by competitive pricing and expanded retail distribution. According to the USDA, private-label plant-based milk sales grew by 20% in 2023, with oat milk being a significant contributor. Retail chains such as Costco and Target have introduced their own lines of oat milk to cater to budget-conscious consumers seeking affordable alternatives to branded products. This trend is expected to continue into 2025, with private-label products offering a cost-effective way to meet the increasing consumer demand for oat milk.

USA Oat Milk Market Segmentation

By Product Type: The market is segmented by product type into organic oat milk, conventional oat milk, flavored oat milk, and barista oat milk. Barista oat milk holds a dominant market share under this segment due to its rising popularity in cafes and among coffee enthusiasts. Barista oat milk is designed specifically to froth and blend seamlessly with coffee, making it an attractive option for the growing caf culture and home baristas. Its versatility in creating smooth, creamy lattes and cappuccinos has driven its adoption, particularly in cities with a vibrant coffee scene like Seattle and San Francisco. This demand is further bolstered by partnerships between oat milk brands and major coffee chains.

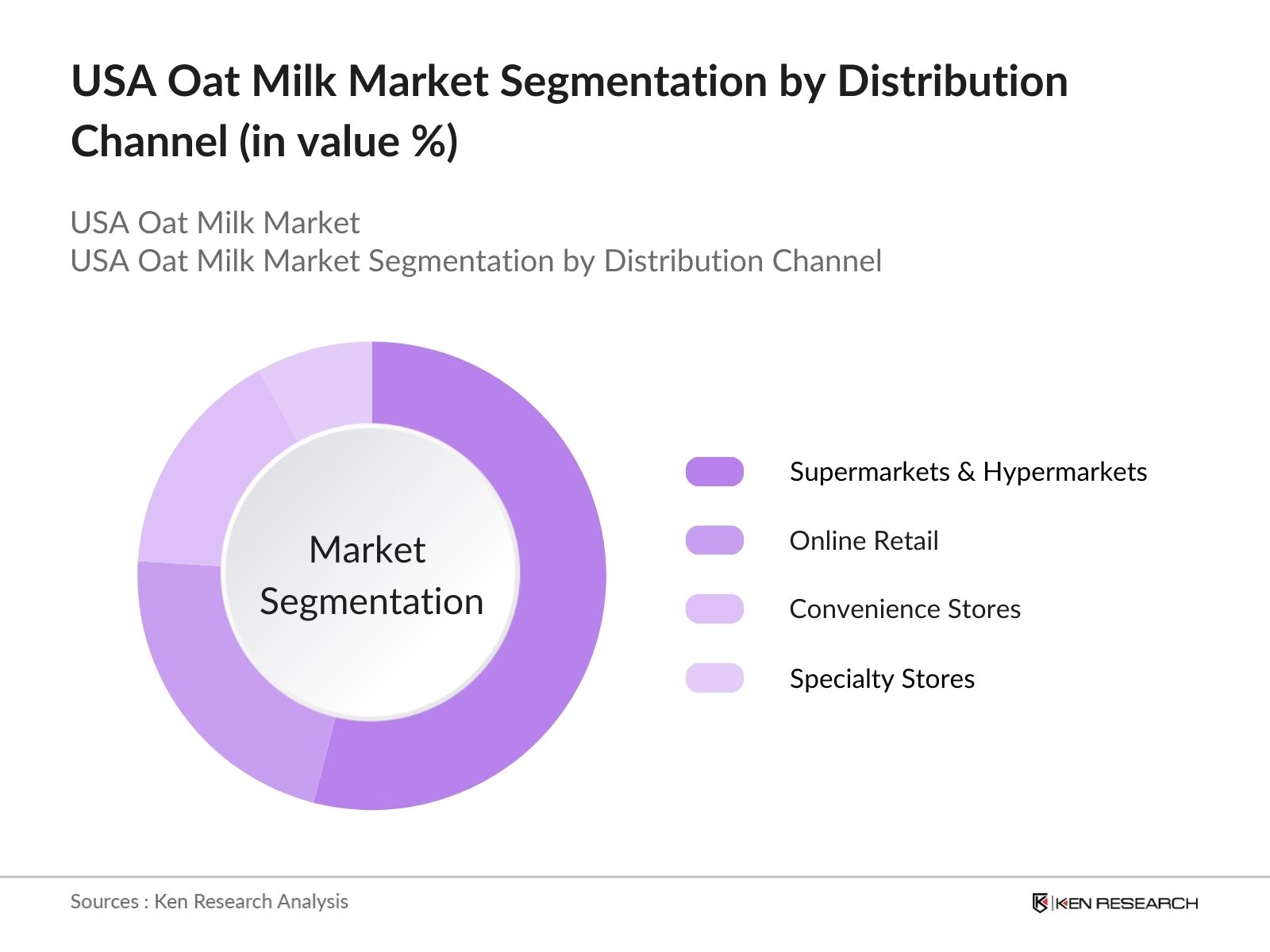

By Distribution Channel: The market is segmented by distribution channel into supermarkets & hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets & hypermarkets dominate this segment due to their wide availability of various brands and product variants in one place. Consumers prefer purchasing oat milk from these retail outlets because they offer competitive pricing, promotions, and convenience. Additionally, the accessibility of oat milk in both urban and suburban supermarkets has made it the go-to option for many consumers, enhancing its market penetration.

USA Oat Milk Market Competitive Landscape

The USA oat milk market is dominated by a few key players that hold market influence. These companies have established themselves through innovative product offerings, strategic partnerships, and strong distribution networks. The competitive landscape highlights the importance of branding and consumer loyalty in this rapidly growing market.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Distribution Reach |

Partnerships |

|

Oatly Inc. |

1994 |

Malm, Sweden |

||||||

|

Chobani LLC |

2005 |

New York, USA |

||||||

|

Califia Farms |

2010 |

California, USA |

||||||

|

Planet Oat (HP Hood) |

1846 |

Massachusetts, USA |

||||||

|

Elmhurst 1925 |

1925 |

New York, USA |

USA Oat Milk Industry Analysis

Growth Drivers

- Plant-Based Trend: The rising awareness about plant-based diets is driving significant growth in the USA oat milk industry. As of 2024, around 9.7 million Americans follow a plant-based diet, including vegan and vegetarian lifestyles, according to USDA statistics. Oat milk serves as a key alternative to dairy products, contributing to the growing demand. Oat milks popularity has surged due to its creamy texture and sustainability. The market benefits from the ongoing trend in adopting eco-friendly and health-conscious lifestyles. This increase in consumer dietary preferences also aligns with rising concerns over reducing carbon footprints and the environmental impact of traditional dairy farming.

- Dietary Preferences: The growing prevalence of lactose intolerance in the U.S. has spurred the demand for oat milk, as it offers a lactose-free alternative. In 2024, the National Institutes of Health estimates that 36 million Americans have lactose intolerance, creating a robust market for dairy alternatives like oat milk. Consumers seeking healthier, lower-calorie alternatives to dairy are also gravitating toward oat milk for its perceived health benefits, such as lower cholesterol levels and better heart health. Additionally, USDA reports indicate that the preference for non-dairy milk has grown by 24% between 2022 and 2024, driven by dietary shifts in the population.

- Environmental Impact: The shift towards environmentally sustainable food choices is contributing to the rise of oat milk consumption. According to the EPA, oat milk production has a considerably lower environmental impact compared to dairy milk. It requires 80% less land and uses less water, with production generating 70% fewer greenhouse gases. This environmental benefit appeals to a growing number of consumers looking to reduce their ecological footprint. Oat milk productions alignment with sustainable agricultural practices has led to greater adoption among environmentally conscious consumers, contributing to the market's growth in the USA in 2024.

Market Challenges

- Supply Chain Issues: Supply chain disruptions continue to pose challenges for the oat milk market in the USA. According to the USDA, ongoing issues such as delayed shipments of raw materials, including oats, impact production timelines and lead to product shortages. In 2023, logistical delays accounted for an estimated $1.8 billion in losses across the plant-based milk industry. Additionally, global supply chain constraints caused by geopolitical tensions have further strained the availability of oats and other essential materials, creating challenges in maintaining a steady supply of oat milk products to retailers across the country.

- High Production Costs: The oat milk industry faces challenges due to high production costs, especially for organic oats. USDA reports from 2024 reveal that the cost of oat production rose by 7% year-on-year due to increased input costs such as fuel and fertilizers. These costs are passed down the supply chain, leading to higher retail prices. Additionally, producing oat milk requires specialized machinery and processes, which add further costs. This challenge is compounded by inflationary pressures in the U.S. economy, where production costs continue to rise, reducing profit margins for manufacturers and pushing prices up for consumers.

USA Oat Milk Market Future Outlook

Over the next five years, the USA oat milk market is expected to show substantial growth, driven by increasing consumer awareness of plant-based diets, environmental concerns, and the shift towards sustainable food production. Growing investments in R&D for new oat milk formulations and expansion of distribution networks will continue to support market expansion. Additionally, the rise of caf culture and partnerships between oat milk brands and major coffee chains will further solidify the market's growth trajectory. Regulatory support for dairy alternatives and health-focused food trends will also play a pivotal role in shaping the market.

Future Market Opportunities

- New Product Launches: Oat milk producers are actively diversifying their product offerings by launching flavored oat milk, barista blends, and oat milk-based yogurts. In 2023, over 200 new oat milk products were introduced in the U.S., according to USDA records. These product innovations cater to consumers' evolving tastes and preferences, driving market expansion. New product launches by well-known brands and private-label offerings are accelerating consumer adoption and driving sales. As more consumers demand convenient and versatile plant-based milk alternatives, oat milk producers are capitalizing on these opportunities by introducing creative and health-focused products to the market.

- Increased Consumer Awareness: Consumer awareness about the health and environmental benefits of oat milk has grown significantly. A USDA report published in 2024 states that awareness campaigns by leading plant-based milk companies have reached over 10 million consumers through digital and social media platforms. This increased awareness, combined with the endorsement of oat milk by nutritionists and environmental advocates, has boosted consumer interest. The heightened focus on reducing carbon footprints and eating sustainably has led to a rise in demand for oat milk as an environmentally friendly and health-conscious choice, further driving market growth opportunities.

Scope of the Report

|

By Product Type |

Organic Conventional Flavored Barista |

|

By Distribution Channel |

Supermarkets Convenience Stores Online Retail Specialty Stores |

|

By Packaging Type |

Cartons Bottles Cans |

|

By Consumer Type |

Residential Foodservice |

|

By Region |

North West South East |

Products

Key Target Audience

Oat Milk Manufacturers

Plant-Based Beverage Companies

Retailers & Supermarkets Chains

Foodservice Providers & Cafes

Distribution & Logistics Partners

Banks and Financial Institutes

Investments and Venture Capitalist Firms

Government & Regulatory Bodies (FDA, USDA)

Environmental Sustainability Advocacy Groups

Companies

Major Players

Oatly Inc.

Chobani LLC

Califia Farms

Silk (Danone North America)

Elmhurst 1925

Planet Oat (HP Hood LLC)

Pacific Foods (Campbell Soup Company)

Good Karma Foods

Minor Figures

Thrive Market

Rise Brewing Co.

Alpro (Danone)

Forager Project

Mooala

Happy Planet Foods

Table of Contents

1. USA Oat Milk Market Overview

1.1. Definition and Scope (Market Definition, Scope of Oat Milk Products)

1.2. Market Taxonomy (Retail Channels, Oat Milk Varieties)

1.3. Market Growth Rate (Growth Trajectory, Market Dynamics)

1.4. Market Segmentation Overview (Segmentation by Product Type, Distribution Channel, Region)

2. USA Oat Milk Market Size (in USD Mn)

2.1. Historical Market Size (Market Size by Year)

2.2. Year-On-Year Growth Analysis (Growth Analysis of Past Years)

2.3. Key Market Developments and Milestones (Major Industry Milestones, Key Players' Impact)

3. USA Oat Milk Market Analysis

3.1. Growth Drivers

3.1.1 Plant-Based Trend

3.1.2 Dietary Preferences

3.1.3 Environmental Impact

3.2. Challenges

3.2.1 Supply Chain Issues

3.2.2 High Production Costs

3.2.3 Competition from Dairy Substitutes

3.3. Opportunities

3.3.1 Expansion into Functional Foods

3.3.2 New Product Launches

3.3.3 Increased Consumer Awareness

3.4. Trends

3.4.1 Sustainability Practices

3.4.2 Health-Conscious Consumers

3.4.3 Private Label Growth

3.5. Regulatory Landscape

3.5.1 FDA Regulations

3.5.2 Labeling Guidelines

3.5.3 Nutritional Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Retailers, Distributors, Producers)

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers, Buyers, Competitive Rivalry)

4. USA Oat Milk Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Organic Oat Milk

4.1.2. Conventional Oat Milk

4.1.3. Flavored Oat Milk

4.1.4. Barista Oat Milk

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By Packaging Type (In Value %)

4.3.1. Cartons

4.3.2. Bottles

4.3.3. Cans

4.4. By Consumer Type (In Value %)

4.4.1. Residential Consumers

4.4.2. Foodservice

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. South

4.5.4. East

5. USA Oat Milk Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Oatly Inc.

5.1.2. Chobani LLC

5.1.3. Califia Farms

5.1.4. Silk (Danone North America)

5.1.5. Elmhurst 1925

5.1.6. Planet Oat (HP Hood LLC)

5.1.7. Pacific Foods (Campbell Soup Company)

5.1.8. Good Karma Foods

5.1.9. Minor Figures

5.1.10. Thrive Market

5.1.11. Rise Brewing Co.

5.1.12. Alpro (Danone)

5.1.13. Forager Project

5.1.14. Mooala

5.1.15. Happy Planet Foods

5.2. Cross Comparison Parameters (Revenue, Market Share, Headquarters, Employee Strength, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Collaborations, Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital, Private Equity Investments)

5.7. Government Grants (Subsidies for Plant-Based Products)

5.8. Consumer Preferences Analysis (Consumer Behavior, Trends)

6. USA Oat Milk Market Regulatory Framework

6.1. FDA Regulations (Ingredient Standards, Labeling Guidelines)

6.2. Environmental Regulations (Sustainability Certifications)

6.3. Packaging Compliance (Recycling Standards, Sustainable Packaging)

7. USA Oat Milk Future Market Size (In USD Mn)

7.1. Future Market Size Projections (Forecasting and Expected Growth)

7.2. Key Factors Driving Future Market Growth (Health Trends, Market Expansion)

8. USA Oat Milk Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Consumer Type (In Value %)

8.5. By Region (In Value %)

9. USA Oat Milk Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market)

9.2. Consumer Behavior Analysis

9.3. White Space Opportunity Analysis

9.4. Product Development Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, we constructed an ecosystem map encompassing all major stakeholders within the USA Oat Milk Market. This step was underpinned by extensive desk research, utilizing secondary databases to gather industry-level information. The primary objective was to identify and define critical variables such as product preferences, regulatory factors, and distribution channels that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data pertaining to the USA Oat Milk Market. This included market penetration levels, sales channels, and revenue generation. A detailed evaluation of consumption trends and consumer preferences was conducted to ensure the reliability and accuracy of our projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and subsequently validated through consultations with industry experts. Interviews were conducted with executives from leading oat milk manufacturers, retailers, and distribution companies to acquire detailed insights into product trends, sales performance, and emerging challenges in the market.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the research findings into a comprehensive report. Key insights from market leaders were integrated to complement the quantitative data derived from our bottom-up approach, ensuring a robust and accurate analysis of the USA Oat Milk Market.

Frequently Asked Questions

01. How big is the USA Oat Milk Market?

The USA oat milk market is valued at USD 780 Mn, driven by the rise of plant-based dietary preferences and growing demand for dairy alternatives across the country.

02. What are the challenges in the USA Oat Milk Market?

Challenges in the USA oat milk market include high production costs, limited supply chain infrastructure for oats, and competition from other plant-based milk alternatives like almond and soy milk.

03. Who are the major players in the USA Oat Milk Market?

Key players include in USA oat milk market are Oatly Inc., Chobani LLC, Califia Farms, and Elmhurst 1925. These companies dominate the market due to their innovative product offerings, wide distribution networks, and strong brand loyalty.

04. What are the growth drivers of the USA Oat Milk Market?

The USA oat milk market is propelled by increased awareness of plant-based diets, sustainability concerns, and consumer demand for lactose-free alternatives. The growing caf culture has also contributed to oat milks popularity.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.