USA Off Road Vehicles Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD8382

December 2024

90

About the Report

USA Off Road Vehicles Market Overview

- The USA off-road vehicles market is valued at USD 10.8 billion, driven by several key factors. The growing consumer interest in outdoor recreational activities, especially in states like California and Texas, has bolstered demand. These vehicles are not just popular for sports but also for utility applications such as farming and military operations. The penetration of electric off-road vehicles is also creating additional growth opportunities as companies strive to introduce more sustainable options.

- When it comes to dominance, North America, especially the USA, holds the largest market share due to its vast and varied landscapes that cater to off-road activities. California leads due to its immense desert terrains and off-roading culture, while Texas, known for its rugged outdoor activities and strong agricultural industry, also contributes.

- In 2023, the U.S. government extended tax incentives to promote the purchase of electric ORVs as part of the broader push for environmentally friendly vehicles. Consumers purchasing electric UTVs and ATVs are eligible for a federal tax credit of up to $7,500, helping to drive the adoption of electric off-road vehicles. By 2024, the number of registered electric ORVs had risen to 150,000 units.

USA Off Road Vehicles Market Segmentation

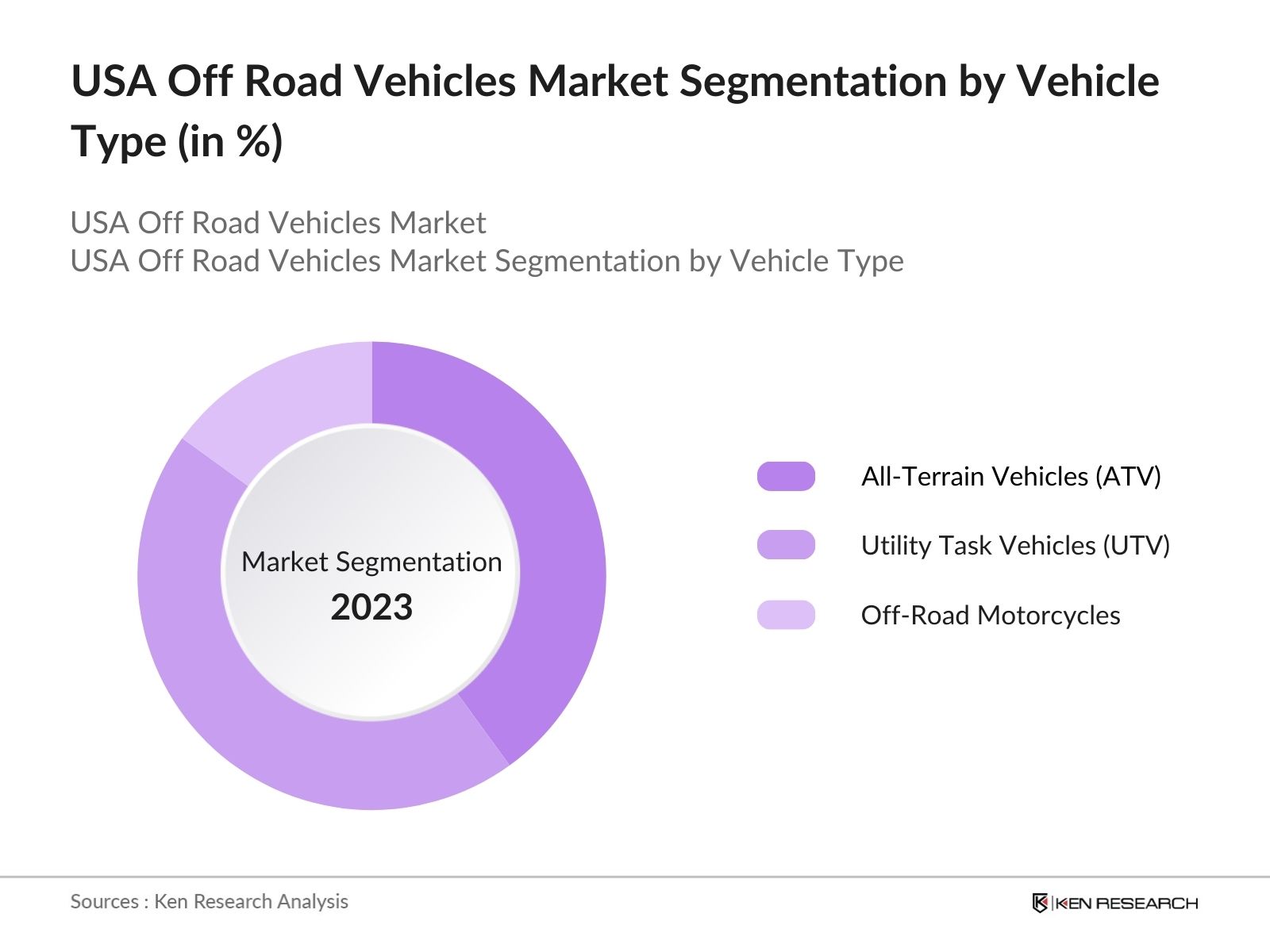

By Vehicle Type: The market is segmented by vehicle type into All-Terrain Vehicles (ATVs), Utility Task Vehicles (UTVs), and Off-Road Motorcycles. Among these, UTVs have been dominating the market, driven by their versatility and high demand for both recreational and utility purposes. UTVs offer greater comfort and capacity for off-road tasks such as hunting, farming, and trail exploration, making them a go-to choice for users seeking functionality combined with performance.

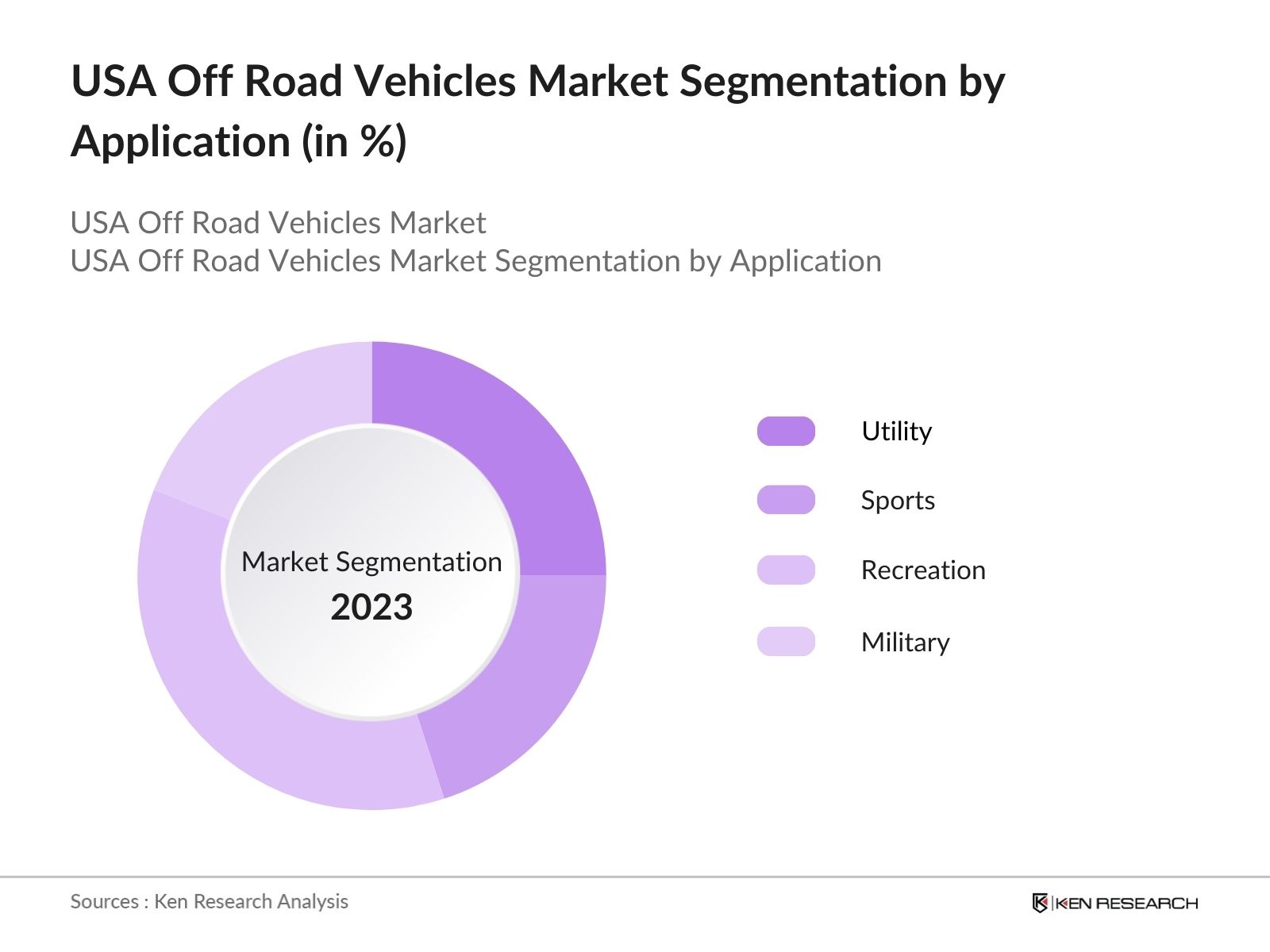

By Application: The market is further segmented by application into Utility, Sports, Recreation, and Military. The recreation segment dominates the market, largely driven by the popularity of outdoor sports and the extensive availability of trails and parks across the country. The rising trend of adventure sports and family off-road trips continues to drive this segment.

USA Off Vehicles Market Competitive Landscape

The market is characterized by several key players, with Polaris Inc., Honda Motor Co., Ltd., and Yamaha Motor Co., Ltd. among the dominant firms. These companies continually focus on innovation, sustainability, and performance enhancement.

|

Company |

Established Year |

Headquarters |

No. of Employees |

Revenue (USD) |

Electric Vehicle Presence |

R&D Investment |

Global Presence |

|

Polaris Inc. |

1954 |

Minnesota, USA |

|||||

|

Honda Motor Co., Ltd. |

1948 |

Tokyo, Japan |

|||||

|

Yamaha Motor Co., Ltd. |

1955 |

Shizuoka, Japan |

|||||

|

Arctic Cat (Textron Inc.) |

1960 |

Minnesota, USA |

|||||

|

Bombardier Recreational |

1942 |

Quebec, Canada |

USA Off Vehicles Market Analysis

Market Growth Drivers

- Increasing Recreational and Adventure Tourism: The growing popularity of recreational activities such as off-roading, camping, and adventure sports in the U.S. has driven demand for off-road vehicles (ORVs). In 2023, over 50 million Americans participated in recreational off-roading events, contributing to the sales of all-terrain vehicles (ATVs) and utility terrain vehicles (UTVs).

- Rise in Disposable Income in Rural and Suburban Areas: Rural and suburban areas in the U.S. have seen steady income growth, directly influencing the sales of off-road vehicles. In 2024, the median income of rural households increased by $4,500 from the previous year, according to the U.S. Department of Agriculture.

- Increasing Farm and Agricultural Use of ORVs: The agricultural sector in the U.S. has seen an increase in the use of ORVs for operational purposes such as field monitoring, livestock management, and transportation. In 2024, over 15% of farms and ranches reported the use of utility vehicles to support their daily operations, leading to a significant rise in sales of UTVs.

Market Challenges

- Safety Concerns and Rising Accident Rates: The number of accidents involving off-road vehicles has been on the rise in the U.S., with over 120,000 ORV-related injuries reported in 2023, according to the U.S. Consumer Product Safety Commission. This has raised safety concerns among regulators and users, leading to potential restrictions or additional requirements, such as mandatory safety features in new models.

- Fluctuations in Fuel Prices Impacting ORV Use: Off-road vehicles are typically less fuel-efficient than their on-road counterparts, and fluctuations in fuel prices heavily impact their operational costs. In 2024, the average price of gasoline in the U.S. reached $3.70 per gallon, up from $3.40 the previous year.

USA Off Vehicles Market Future Outlook

Over the next five years, the USA off-road vehicle industry is projected to witness considerable growth. Key drivers for this expansion include technological advancements such as electric propulsion systems, increasing consumer interest in adventure and recreational activities, and rising government support for sustainable vehicle production.

Future Market Opportunities

- Adoption of Electric Off-Road Vehicles to Rise Substantially: In the next five years, electric off-road vehicles will see a rapid increase in adoption, driven by government incentives and environmental concerns. By 2028, it is projected that electric ORVs will account for nearly 30% of all off-road vehicle sales in the U.S.

- Increase in Off-Road Vehicle Customization Market: The customization of off-road vehicles, including suspension upgrades, specialty tires, and aesthetic modifications, is expected to grow significantly over the next five years. The market for ORV customization and aftermarket accessories will likely reach 500,000 annual modifications by 2028, as more consumers look for personalized vehicles for specific terrains and activities.

Scope of the Report

|

Vehicle Type |

All-Terrain Vehicles (ATV) Utility Task Vehicles (UTV) Off-Road Motorcycles |

|

Application |

Utility Sports Recreation Military |

|

Propulsion Type |

Gasoline Diesel Electric |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Banks and Financial Institution

Private Equity Firms

Outdoor Recreational Companies

Investor and Venture Capitalist Firms

Electric Vehicle Charging Infrastructure Companies

Government and Regulatory Bodies (e.g., EPA, National Highway Traffic Safety Administration)

Agricultural Equipment Distributors

Companies

Players Mentioned in the Report:

Polaris Inc.

Honda Motor Co., Ltd.

Yamaha Motor Co., Ltd.

Arctic Cat (Textron Inc.)

Bombardier Recreational Products (BRP)

Kawasaki Heavy Industries

Mahindra & Mahindra Ltd.

CFMOTO

KUBOTA Corporation

Can-Am

Table of Contents

USA Off-Road Vehicles Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

USA Off-Road Vehicles Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

USA Off-Road Vehicles Market Analysis

3.1 Growth Drivers (Recreational Activities, Electric Vehicle Adoption)

3.2 Market Challenges (Safety Concerns, Regulatory Compliance)

3.3 Opportunities (Electric UTVs, Expanding Adventure Tourism)

3.4 Trends (Sustainable Vehicles, Smart Connectivity, Electric Off-Road Vehicles)

3.5 Government Regulations (Emission Standards, Noise Pollution Laws)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Landscape

USA Off-Road Vehicles Market Segmentation

4.1 By Vehicle Type (In Value %)

4.1.1 All-Terrain Vehicles (ATVs)

4.1.2 Utility Task Vehicles (UTVs)

4.1.3 Off-Road Motorcycles

4.2 By Application (In Value %)

4.2.1 Utility

4.2.2 Sports

4.2.3 Recreation

4.2.4 Military

4.3 By Propulsion Type (In Value %)

4.3.1 Gasoline

4.3.2 Diesel

4.3.3 Electric

4.4 By Region (In Value %)

4.4.1 North

4.4.2 East

4.4.3 West

4.4.4 South

USA Off-Road Vehicles Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Polaris Inc.

5.1.2 Honda Motor Co.

5.1.3 BRP (Bombardier Recreational Products)

5.1.4 Arctic Cat (Textron Inc.)

5.1.5 Yamaha Motor Co., Ltd.

5.1.6 Kawasaki Heavy Industries

5.1.7 Mahindra & Mahindra Ltd.

5.1.8 Deere & Company

5.1.9 Suzuki Motor Corporation

5.1.10 American Landmaster

5.1.11 CFMOTO

5.1.12 Can-Am

5.1.13 KUBOTA Corporation

5.1.14 Segway Technology Co., Ltd.

5.1.15 Taiga Motors Inc.

Cross Comparison Parameters

(No. of Employees, Headquarters, Revenue, Market Share, R&D Investment, Strategic Initiatives, M&A, Venture Capital Funding)

USA Off-Road Vehicles Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

USA Off-Road Vehicles Future Market Size (In USD Bn)

7.1 Market Projections

7.2 Key Factors Driving Future Growth

USA Off-Road Vehicles Future Market Segmentation

8.1 By Vehicle Type

8.2 By Application

8.3 By Propulsion Type

8.4 By Region

USA Off-Road Vehicles Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step involves creating an ecosystem map of key players in the USA Off-Road Vehicles Market. Extensive secondary research, along with proprietary databases, is utilized to define the variables affecting market dynamics, such as consumer demand trends and technological developments.

Step 2: Market Analysis and Construction

Historical data is gathered to analyze the penetration of off-road vehicles across various regions and sectors, including recreation, utility, and defense. Revenue generation and growth trends are assessed to ensure accuracy in market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts, including representatives from leading off-road vehicle manufacturers, are conducted to validate market trends and future projections. Insights from these interviews are used to refine the data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with off-road vehicle manufacturers to gather detailed data on sales, product performance, and technological advancements. This information is then cross-referenced with bottom-up estimates to ensure accuracy.

Frequently Asked Questions

How big is the USA Off-Road Vehicles Market?

The USA Off-Road Vehicles Market is valued at USD 10.8 billion, driven by increasing recreational activities and advancements in electric off-road technology.

What are the challenges in the USA Off-Road Vehicles Market?

The USA Off-Road Vehicles Market faces challenges such as stringent environmental regulations regarding emissions and noise pollution, as well as safety concerns related to off-road driving.

Who are the major players in the USA Off-Road Vehicles Market?

Major players in the USA Off-Road Vehicles Market include Polaris Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Arctic Cat, and Bombardier Recreational Products, all of whom dominate the market due to their strong R&D and extensive distribution networks.

What are the growth drivers of the USA Off-Road Vehicles Market?

The USA Off-Road Vehicles Market is driven by the rising popularity of off-road recreational activities, technological advancements in vehicle performance, and the adoption of electric UTVs and ATVs.

What is the future outlook for the USA Off-Road Vehicles Market?

The USA Off-Road Vehicles Market is expected to see growth over the next five years due to increasing consumer demand for eco-friendly and electric off-road vehicles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.