USA Online Dating Services Market Outlook to 2030

Region:North America

Author(s):Shambhavi

Product Code:KROD9054

December 2024

80

About the Report

USA Online Dating Services Market Overview

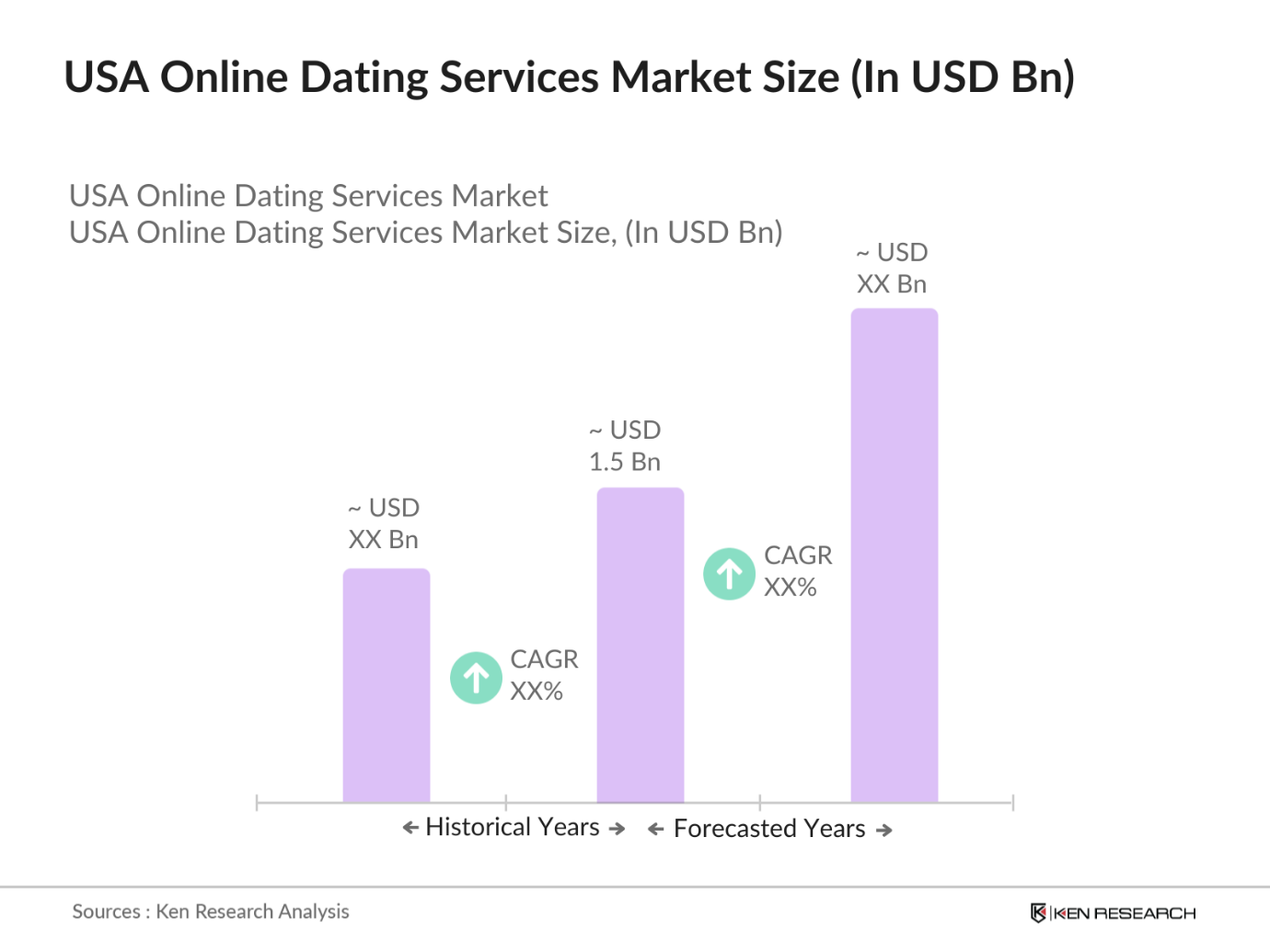

- The USA Online Dating Services Market is valued at USD 1.5 billion, based on a five-year historical analysis. The market's growth is driven by the increasing use of smartphones and internet connectivity, alongside rising social acceptance of online dating as a mainstream way to meet new people. Technological advancements, such as AI algorithms to enhance matchmaking and user engagement, are also pivotal in attracting a wider demographic. These factors significantly contribute to the market's upward trajectory.

- Key cities such as New York, Los Angeles, and Chicago dominate the online dating services market in the USA. The dominance of these cities is attributed to their high population density, diverse demographic profiles, and greater digital adoption rates. Additionally, the fast-paced urban lifestyle in these areas aligns well with the convenience online dating offers, allowing busy individuals to connect more efficiently.

- The FTC enforces consumer protection laws that apply to online dating services. In 2019, the FTC sued Match Group, Inc., alleging deceptive practices related to fake love interest advertisements on Match.com, highlighting the agency's role in regulating online dating platforms.

USA Online Dating Services Market Segmentation

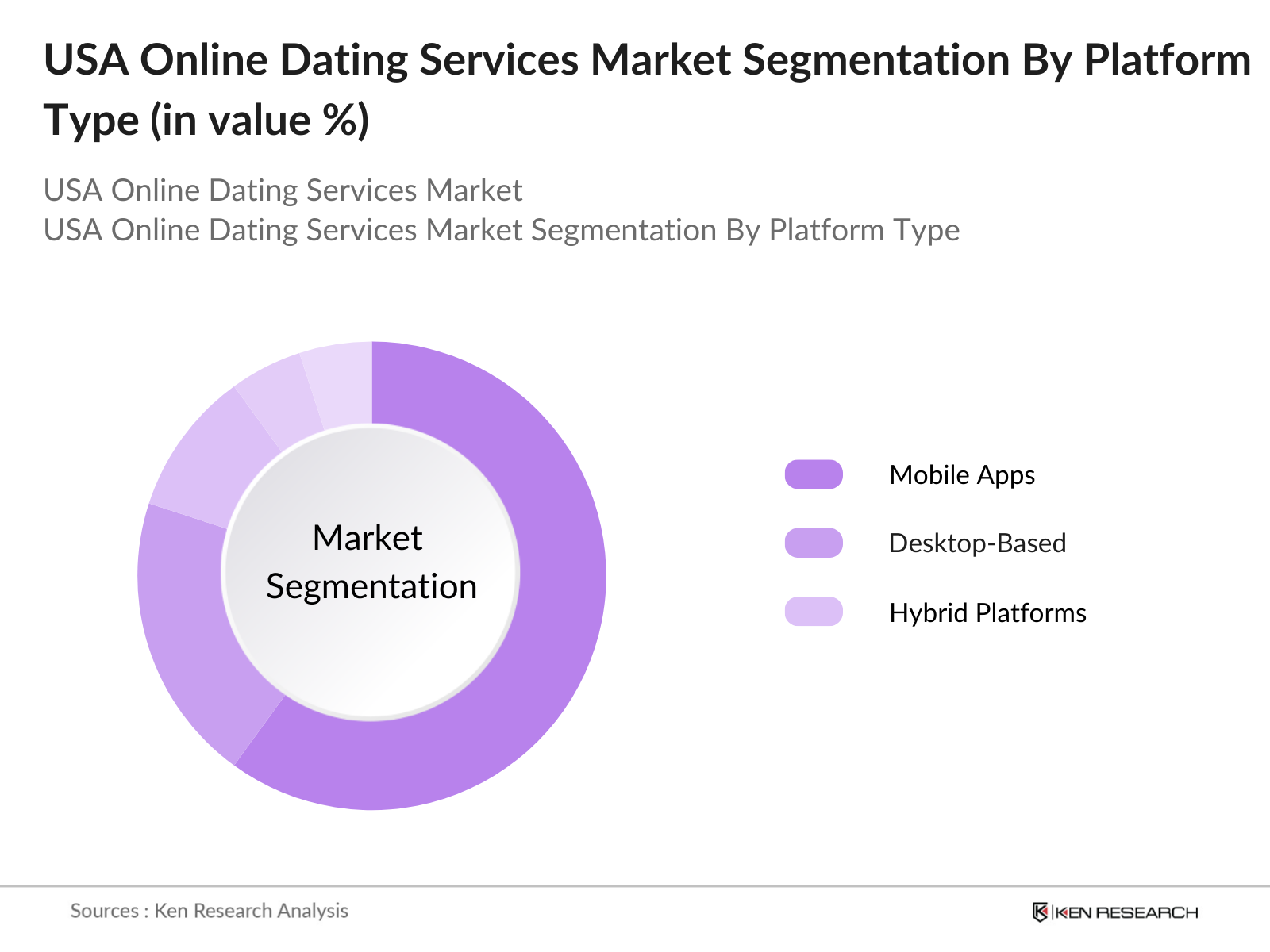

By Platform Type: The USA Online Dating Services Market is segmented by platform type into mobile apps, desktop-based platforms, and hybrid platforms. Mobile apps hold the dominant market share due to the widespread use of smartphones and their ability to deliver personalized, on-the-go experiences. Apps like Tinder and Bumble have gained traction by appealing to a younger demographic who prefer mobile-first solutions for dating, making mobile apps the primary choice for online dating.

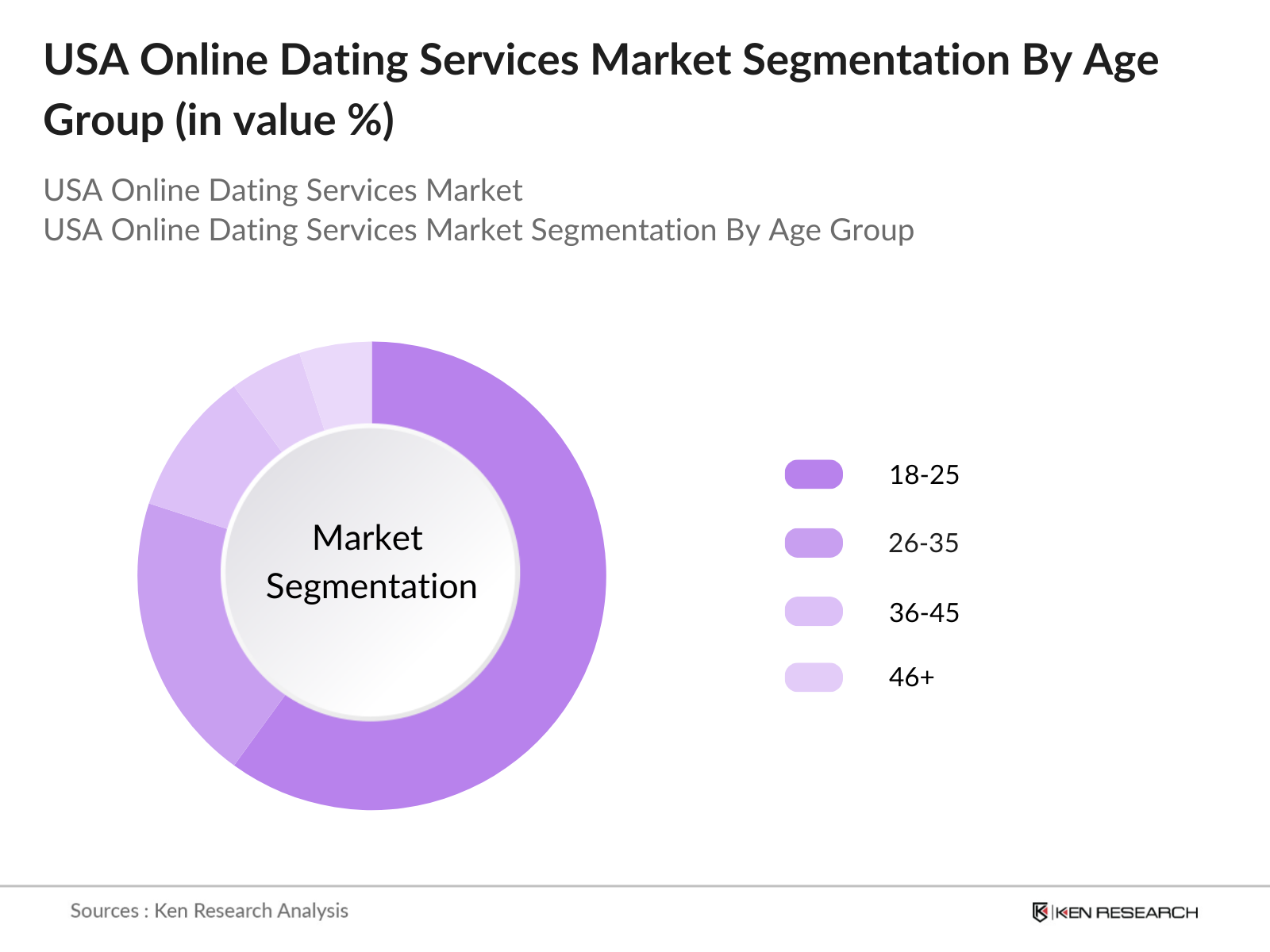

By Age Group: In terms of age segmentation, the market is divided into users aged 18-25, 26-35, 36-45, and 46+. The age group 26-35 dominates the market due to higher disposable income and a strong inclination towards digital and social networking solutions. This demographic is at a life stage where dating becomes a priority, and they are highly receptive to innovative online platforms.

USA Online Dating Services Competitive Landscape

The USA Online Dating Services Market is dominated by several key players, many of which are well-established with innovative business models and strong user bases. The major companies leverage advanced AI for user matching and data analytics to improve user experience, fostering their competitive edge.

USA Online Dating Services Market Analysis

Growth Drivers

- Increasing Smartphone Penetration: The penetration of smartphones in the United States continues to rise, with over 85% of the population now owning a smartphone as of 2023. This accessibility fuels the growth of online dating services, enabling users to connect more easily and frequently. As mobile users increase, so does the potential customer base for dating platforms, allowing these services to expand their reach and improve user engagement. The growing reliance on mobile devices for social interactions suggests that dating apps will continue to gain popularity, further driving market growth.

- Rise in Internet Connectivity: In 2023, approximately 90% of Americans had access to high-speed internet, up from 80% in 2019. This increase in internet connectivity, particularly among younger demographics, significantly boosts the online dating market. Enhanced access allows users to explore a wider array of dating services, promoting user interaction and increasing subscription rates. The availability of faster internet also improves user experience, making online dating platforms more appealing and effective for users seeking meaningful connections.

- Changing Social Norms: The acceptance of online dating has shifted dramatically, with 44% of Americans indicating they know someone who has used a dating app. This change in perception has made online dating more mainstream, particularly among younger generations. As societal views evolve, individuals are increasingly open to finding partners online, which enhances the user base for dating services. The normalization of online dating as a legitimate means of forming relationships continues to stimulate growth in the market

Challenges

- Competition from Free Platforms: The online dating landscape is highly competitive, with a significant portion of users gravitating towards free services. In 2023, over 60% of online daters reported using free platforms, posing a challenge for paid services to attract and retain subscribers. The saturation of free dating apps, which often offer sufficient features for casual users, creates a barrier for paid services to justify subscription costs. As the market evolves, paid platforms must innovate and provide distinct value propositions to differentiate themselves and maintain a competitive edge in a crowded market.

- Safety and Privacy Concerns: Safety and privacy remain paramount issues in the online dating industry. With the rise of scams and fraudulent accounts, approximately 35% of users express concerns about their safety while using dating apps. These apprehensions can deter potential users from engaging with online dating services. Platforms must prioritize user safety by implementing robust verification processes and enhancing security features. Failure to address these concerns can lead to decreased user trust and ultimately impact market growth.

USA Online Dating Services Future Outlook

Over the next five years, the USA Online Dating Services Market is expected to grow considerably, propelled by evolving user preferences, continuous advancements in AI-driven matchmaking, and the integration of augmented reality (AR) and virtual reality (VR) to enhance user interaction. Companies are focusing on data privacy and security to address rising concerns, which is expected to attract even more users to these platforms.

Market Opportunities

- Technological Advancements: The integration of artificial intelligence (AI) and machine learning in dating platforms presents significant growth opportunities. AI-driven features such as personalized matching algorithms and chatbots can enhance user experience and engagement. In 2023, approximately 30% of dating services reported utilizing AI technologies to improve their platforms. This trend indicates a growing market potential for tech-savvy dating services that leverage advanced technologies to create unique user experiences and foster deeper connections among users.

- Expansion of Niche Dating Platforms: The emergence of niche dating platforms catering to specific demographics or interests offers substantial market growth opportunities. As of 2023, nearly 20% of online daters expressed a preference for specialized dating services that align with their lifestyle, beliefs, or interests. By targeting specific user groups, these platforms can cultivate dedicated communities, improving user engagement and retention rates. This trend allows companies to diversify their offerings and tap into underserved market segments, driving future growth in the industry.

Scope of the Report

|

Segment |

Sub-segment |

|

By Service Type |

Free Services |

|

Paid Services |

|

|

By User Demographics |

Age Groups (18-24, 25-34, 35-44, 45+) |

|

Gender (Male, Female, Non-binary) |

|

|

By Platform Type |

Mobile Applications |

|

Websites |

|

|

By Geographic Region |

West Coast |

|

East Coast |

|

|

Midwest |

|

|

South |

|

|

By Relationship Type |

Casual Dating |

|

Serious Relationships |

|

|

Friendships |

Products

Key Target Audience

Online Dating Service Providers

Social Networking App Developers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Communications Commission)

Digital Advertising Companies

Technology and Data Security Providers

Consumer Advocacy Groups

AI and Data Analytics Firms

Companies

Players mentioned in the report

Match Group

Bumble Inc.

eHarmony

Grindr

OkCupid

Tinder

Plenty of Fish

Hinge

Coffee Meets Bagel

Zoosk

The League

HER

Clover

Happn

Badoo

Table of Contents

1. USA Online Dating Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Online Dating Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Online Dating Services Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Smartphone Penetration (Mobile User Base Growth)

3.1.2. Rise in Internet Connectivity (Broadband and Mobile Data Usage)

3.1.3. Changing Social Norms (Acceptance of Online Dating)

3.1.4. Demographic Shifts (Millennial and Gen Z User Adoption)

3.2. Market Challenges

3.2.1. Competition from Free Platforms (Market Saturation)

3.2.2. Safety and Privacy Concerns (User Trust Issues)

3.2.3. Regulatory Challenges (Compliance with Data Protection Laws)

3.3. Opportunities

3.3.1. Technological Advancements (AI and Machine Learning Integration)

3.3.2. Expansion of Niche Dating Platforms (Targeted Services)

3.3.3. Partnerships and Collaborations (Strategic Alliances)

3.4. Trends

3.4.1. Growth of Subscription Models (Recurring Revenue Streams)

3.4.2. Emergence of Video Dating Features (Enhanced User Engagement)

3.4.3. Increase in Online Events and Meetups (Community Building)

3.5. Government Regulations

3.5.1. Federal Trade Commission Guidelines (Consumer Protection)

3.5.2. Data Protection Regulations (GDPR and CCPA Compliance)

3.5.3. Age Verification Laws (Protecting Minors Online)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. USA Online Dating Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Free Services

4.1.2. Paid Services

4.2. By User Demographics (In Value %)

4.2.1. Age Groups (18-24, 25-34, 35-44, 45+)

4.2.2. Gender (Male, Female, Non-binary)

4.3. By Platform Type (In Value %)

4.3.1. Mobile Applications

4.3.2. Websites

4.4. By Geographic Region (In Value %)

4.4.1. West Coast

4.4.2. East Coast

4.4.3. Midwest

4.4.4. South

4.5. By Relationship Type (In Value %)

4.5.1. Casual Dating

4.5.2. Serious Relationships

4.5.3. Friendships

5. USA Online Dating Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Match Group Inc.

5.1.2. Bumble Inc.

5.1.3. eHarmony

5.1.4. Tinder (Match Group)

5.1.5. OkCupid (Match Group)

5.1.6. Plenty of Fish (Match Group)

5.1.7. Hinge (Match Group)

5.1.8. Coffee Meets Bagel

5.1.9. Zoosk

5.1.10. EliteSingles

5.1.11. Christian Mingle

5.1.12. JSwipe

5.1.13. Her

5.1.14. Tantan

5.1.15. Feeld

5.2. Cross Comparison Parameters (User Base, Headquarters, Inception Year, Revenue, Subscription Model, Market Share, Geographic Reach, Unique Features)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Online Dating Services Market Regulatory Framework

6.1. Data Protection Regulations

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Online Dating Services Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Online Dating Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By User Demographics (In Value %)

8.3. By Platform Type (In Value %)

8.4. By Geographic Region (In Value %)

8.5. By Relationship Type (In Value %)

9. USA Online Dating Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase entails developing a comprehensive map of stakeholders within the USA Online Dating Services Market. We conduct extensive desk research using primary and secondary databases to identify variables that shape the market's evolution.

Step 2: Market Analysis and Construction

Historical data on the USA Online Dating Services Market is analyzed, focusing on user growth, subscription models, and revenue streams. Additionally, the reliability and accuracy of the revenue estimates are ensured through thorough evaluation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through interviews with experts across various online dating service providers. This step provides insights into the operational aspects of these companies and enhances the quality of data collected.

Step 4: Research Synthesis and Final Output

The final stage involves direct engagement with major market players to refine data on user demographics, usage patterns, and revenue models, leading to a validated and comprehensive market analysis.

Frequently Asked Questions

01. How big is the USA Online Dating Services Market?

The USA Online Dating Services Market is valued at USD 1.5 billion, supported by a high user base and growth in mobile app usage.

02. What are the challenges in the USA Online Dating Services Market?

Challenges include user privacy concerns, data security issues, and high competition among platforms, which impact market profitability and trust.

03. Who are the major players in the USA Online Dating Services Market?

Major players include Match Group, Bumble Inc., eHarmony, Grindr, and OkCupid. Their dominance is due to strong brand presence and innovative features.

04. What are the growth drivers in the USA Online Dating Services Market?

Growth drivers include the increasing use of mobile apps, advancements in AI for improved matchmaking, and the normalization of online dating.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.