USA Online Food Delivery Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD7407

December 2024

92

About the Report

USA Online Food Delivery Market Overview

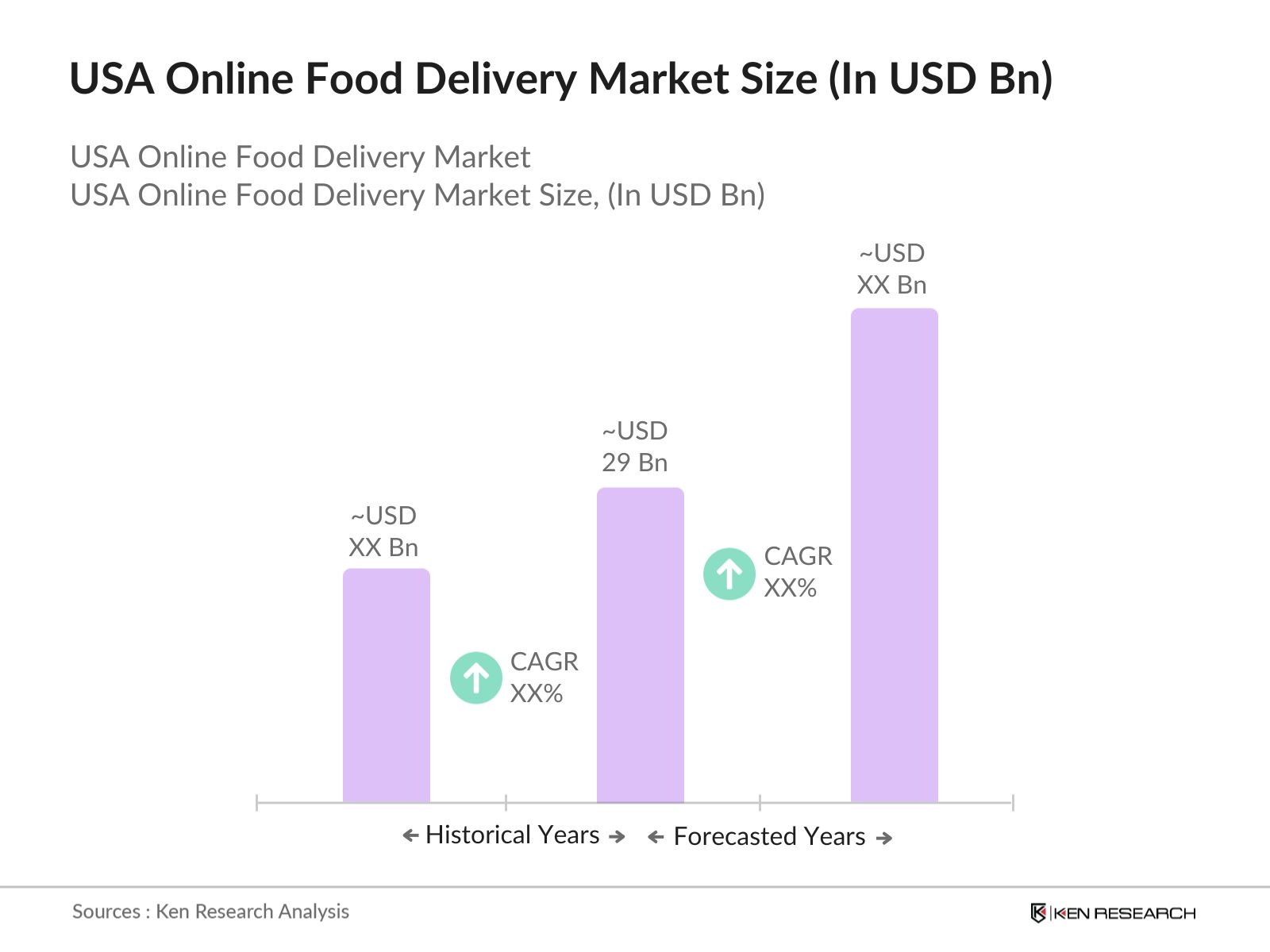

- The USA online food delivery market is valued at USD 29 billion, primarily driven by the increased convenience consumers find in digital ordering, quick delivery, and seamless payment options. Major digital platforms, in collaboration with local and national restaurants, have leveraged consumer demand for on-demand food, allowing the market to grow significantly. The integration of AI-driven technology, optimizing delivery times and personalizing user recommendations, has further accelerated market growth.

- Key regions within the USA, particularly urban centers like New York City, Los Angeles, and Chicago, dominate the online food delivery sector due to high population density and strong tech infrastructure. These cities have a high demand for diverse dining options and quick service, factors that continue to sustain their leading market positions. Additionally, the adaptability of local restaurants to join and expand delivery platforms adds to the strong market dominance of these areas.

- Countries across Asia-Pacific, including South Korea and Indonesia, have launched initiatives to support small businesses, including mobile food trucks. In 2024, these countries allocated USD 100 million to grant programs aimed at assisting new and existing food truck operators with startup capital and operational expenses.

USA Online Food Delivery Market Segmentation

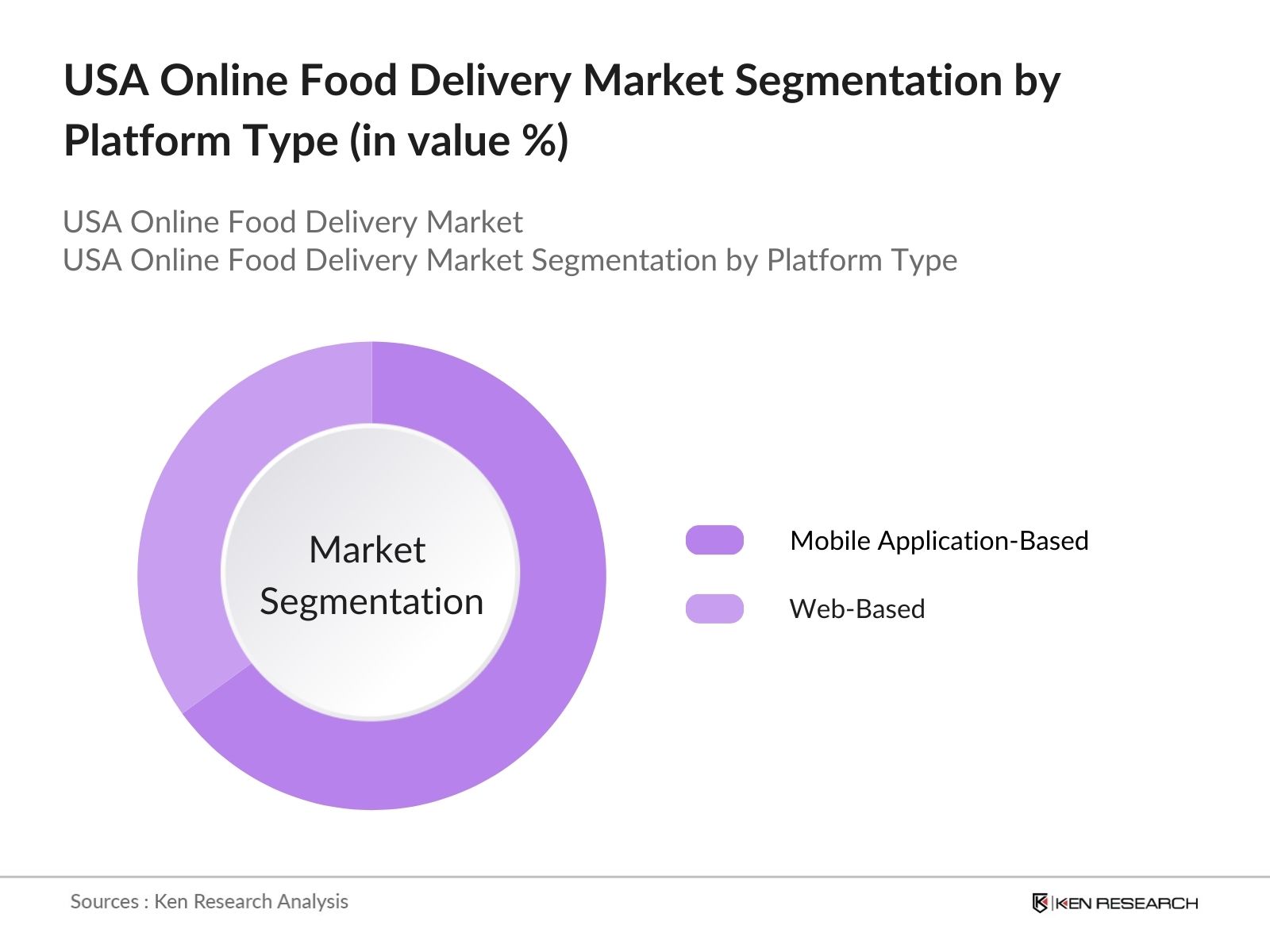

By Platform Type: The USA online food delivery market is segmented by platform type into mobile application-based and web-based services. Mobile applications currently dominate this segment as they provide easy access, improved user experience, and personalized features like rewards, special offers, and AI-driven suggestions. Additionally, the convenience of on-the-go ordering through apps has fostered higher engagement rates, reinforcing mobile applications as the preferred choice for users.

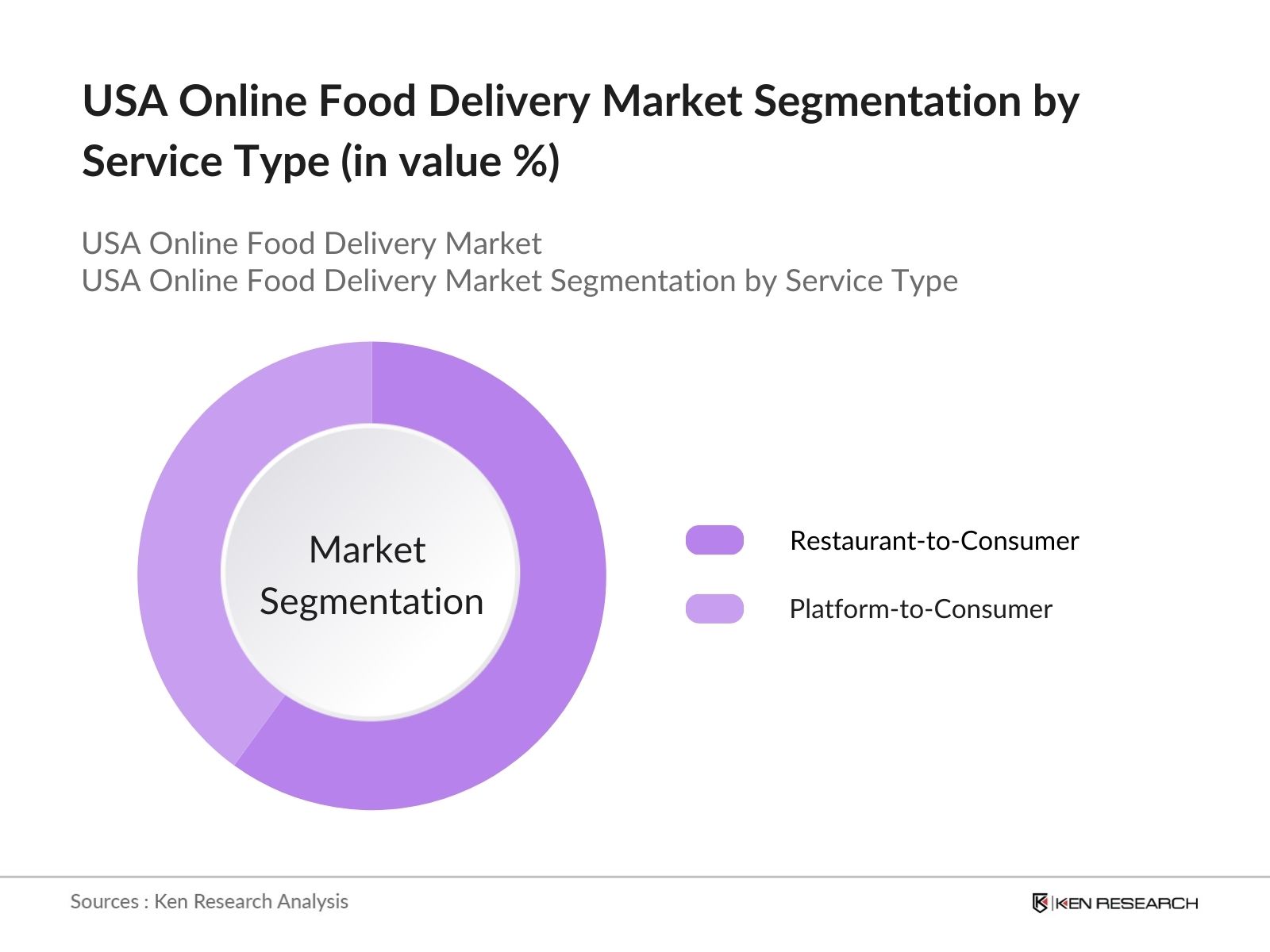

By Service Type: The market is also segmented by service type into restaurant-to-consumer delivery and platform-to-consumer delivery. Restaurant-to-consumer delivery holds a dominant position within this segment, driven by major fast-food and restaurant chains' established delivery models. Chains like McDonalds, Subway, and Dominos rely on their dedicated logistics and trained drivers, offering a unique brand-based delivery experience that appeals to a wide consumer base, thus maintaining its lead in market share.

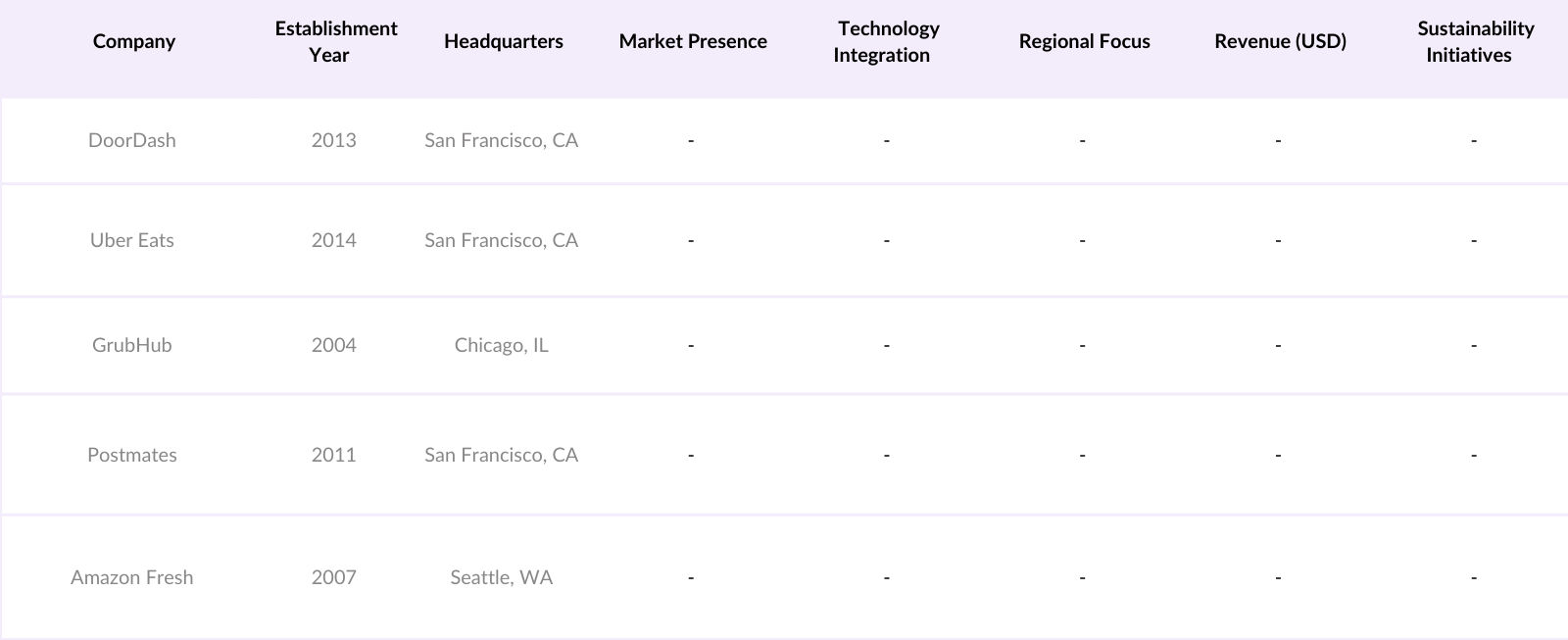

USA Online Food Delivery Market Competitive Landscape

The USA online food delivery market is dominated by key players offering distinct features that enhance their market positions. These companies capitalize on technology, logistics networks, and customer loyalty programs to maintain competitive advantages. Notably, the market is witnessing strategic partnerships and acquisitions as these companies seek to expand their service reach.

USA Online Food Delivery Market Analysis

Growth Drivers

- Urbanization and Digital Adoption: The U.S. online food delivery market is fueled by the growing urban population, projected to reach around 274 million by 2024, leading to an increased concentration of digital and tech-savvy consumers in urban areas. This shift has encouraged the adoption of online food delivery apps, driving significant growth across metropolitan and suburban regions.

- Rising Consumer Demand for Convenience: Increased work hours and busy schedules for nearly 157 million U.S. workers in 2024 are creating demand for convenience in food access. This demand has directly impacted the online food delivery market, as consumers seek to save time and avoid in-store dining, opting instead for app-based ordering for meals and groceries.

- Restaurant Partnerships with Delivery Platforms: The number of U.S. restaurants partnering with online delivery platforms has grown substantially, with over 1 million restaurant partnerships in 2024. These collaborations have broadened delivery options for customers, with more restaurants offering exclusive items and incentives through delivery apps, driving both brand loyalty and app downloads.

Market Challenges

- Intense Competition and Profit Margins: With over 25 active food delivery platforms in the U.S., competition has intensified, impacting profit margins as companies vie for customer loyalty through discounts and promotions. This trend has raised concerns about sustainability for many smaller platforms facing high operational costs without significant returns.

- Delivery Infrastructure and Logistics Costs: High costs for logistics and last-mile delivery remain challenging, with delivery fees reaching up to $8 per order in 2024. This cost pressure, driven by rising fuel prices and vehicle maintenance costs, complicates efforts for food delivery companies to remain profitable while meeting customer expectations for affordable delivery.

USA Online Food Delivery Market Future Outlook

Over the next five years, the USA online food delivery market is expected to continue its upward trajectory, spurred by increasing consumer demand for fast, convenient meal options and further advancements in AI and logistics technology. Partnerships between delivery platforms and grocery stores, along with a growing emphasis on sustainability and eco-friendly packaging, are anticipated to play a crucial role in shaping the future of the industry. Additionally, smaller cities and suburban areas are likely to see improved access and service expansion, further driving market growth.

Market Opportunities

- Adoption of AI and Automation for Order Processing: AI-driven automation has emerged as a significant opportunity for streamlining order processing and delivery assignments, reducing delays in high-demand periods. Many platforms report that AI-assisted routing has decreased delivery time by up to 20 minutes, improving customer satisfaction and order frequency.

- Expansion of Regional Market Coverage: Growing demand in suburban and rural areas presents an untapped opportunity, with approximately 50 million rural residents with limited access to convenient dining options in 2024. Expanding delivery networks to cover these regions can open new revenue channels, benefiting both consumers and smaller local restaurants.

Scope of the Report

|

By Platform Type |

Mobile Application-Based Web-Based |

|

By Service Type |

Restaurant-to-Consumer Delivery Platform-to-Consumer Delivery |

|

By Cuisine Type |

Fast Food Vegan/Vegetarian Multi-Cuisine |

|

By Delivery Model |

Dedicated Driver Model Shared Delivery Model |

|

By Geography |

East Coast West Coast Midwest Southern States |

Products

Key Target Audience

Technology Solution Providers (AI, ML Integrators)

Urban Logistics Providers

Online Payment Gateway Companies

Fast-Food Chains and Restaurant Partners

Environmental Advocacy Groups

Consumer Behavior Analysts

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, FTC)

Companies

Players Mentioned in the Report:

DoorDash

Uber Eats

GrubHub

Postmates

Amazon Fresh

Instacart

Caviar

Blue Apron

FreshDirect

HelloFresh

Table of Contents

1. USA Online Food Delivery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Industry Stakeholders

2. USA Online Food Delivery Market Size (in USD Billion)

2.1. Historical Market Size

2.2. Growth Rate Analysis

2.3. Key Developments and Milestones

3. USA Online Food Delivery Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Digital Adoption

3.1.2. Rising Consumer Convenience Demand

3.1.3. Restaurant Partnerships

3.2. Market Challenges

3.2.1. Intense Competition and Margins

3.2.2. Delivery Infrastructure and Logistics

3.2.3. Regulatory Compliance

3.3. Opportunities

3.3.1. Adoption of AI and Automation

3.3.2. Expansion of Regional Market Coverage

3.3.3. Customizable Menu Options

3.4. Trends

3.4.1. Subscription-Based Meal Plans

3.4.2. Demand for Sustainable Packaging

3.4.3. Integration with Health Apps

3.5. Regulatory Compliance (Food Safety & Delivery Regulations)

3.5.1. Food Safety Standards

3.5.2. Data Privacy and Consumer Protection

3.5.3. Wage and Labor Regulations

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Stakeholder Ecosystem

4. USA Online Food Delivery Market Segmentation

4.1. By Platform Type

4.1.1. Mobile Application-Based

4.1.2. Web-Based

4.2. By Service Type

4.2.1. Restaurant-to-Consumer Delivery

4.2.2. Platform-to-Consumer Delivery

4.3. By Cuisine Type

4.3.1. Fast Food

4.3.2. Vegan/Vegetarian

4.3.3. Multi-Cuisine

4.4. By Delivery Model

4.4.1. Dedicated Driver Model

4.4.2. Shared Delivery Model

4.5. By Geography

4.5.1. East Coast

4.5.2. West Coast

4.5.3. Midwest

4.5.4. Southern States

5. USA Online Food Delivery Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. DoorDash

5.1.2. Uber Eats

5.1.3. GrubHub

5.1.4. Postmates

5.1.5. Instacart

5.1.6. Amazon Fresh

5.1.7. FreshDirect

5.1.8. EatStreet

5.1.9. Caviar

5.1.10. HelloFresh

5.1.11. Blue Apron

5.1.12. Zomato

5.1.13. Papa Johns Delivery

5.1.14. Dominos Delivery

5.1.15. Seamless

5.2 Cross Comparison Parameters (Revenue, Delivery Reach, Service Speed, Number of Active Users, Cuisine Variety, Customer Retention Rate, Funding Sources, Innovation Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

6. USA Online Food Delivery Market Regulatory Landscape

6.1. Food and Drug Administration (FDA) Standards

6.2. Data Protection Regulations (GDPR Compliance)

6.3. Employment and Contractor Regulations

7. USA Online Food Delivery Future Market Size (in USD Billion)

7.1. Future Market Growth Rate

7.2. Key Growth Drivers

8. USA Online Food Delivery Market Future Segmentation

8.1. By Platform Type

8.2. By Service Type

8.3. By Cuisine Type

8.4. By Delivery Model

8.5. By Geography

9. USA Online Food Delivery Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Partnership Opportunities

9.3. Market Entry Tactics

9.4. Niche Market Opportunities

Research Methodology

Step 1: Identification of Key Variables

This step involves comprehensive desk research to identify essential factors driving the USA online food delivery market. Data is gathered from government publications, industry reports, and proprietary databases, focusing on consumer preferences and technological advancements.

Step 2: Market Analysis and Construction

Historical data and current trends are analyzed to understand market penetration and delivery model success rates. This step ensures accurate estimates by evaluating service volume and customer engagement across various market segments.

Step 3: Hypothesis Validation and Expert Consultation

Through structured interviews with industry experts, we validate market hypotheses and gather insights into operational efficiencies, customer satisfaction metrics, and revenue patterns, ensuring an accurate depiction of market dynamics.

Step 4: Research Synthesis and Final Output

The final report consolidates insights from data and expert interviews, covering market segmentation, competition, and technological trends. This synthesis validates the USA online food delivery market's growth projections and emerging opportunities.

Frequently Asked Questions

1. How big is the USA Online Food Delivery Market?

The USA online food delivery market is valued at USD 29 billion, with high consumer demand for convenience and technology-driven delivery solutions driving its growth.

2. What are the challenges in the USA Online Food Delivery Market?

Challenges in the USA online food delivery market include high competition among providers, logistical constraints in non-urban areas, and the increasing cost of maintaining delivery staff, impacting profitability and service efficiency.

3. Who are the major players in the USA Online Food Delivery Market?

Key players in the USA online food delivery market include DoorDash, Uber Eats, GrubHub, Postmates, and Amazon Fresh, known for their extensive delivery networks and innovative service models.

4. What drives growth in the USA Online Food Delivery Market?

Growth of USA online food delivery market is propelled by consumer preference for convenience, urban demand for diverse food options, and significant investments in AI and logistics to optimize delivery services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.