USA Online Gambling Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD7388

November 2024

96

About the Report

USA Online Gambling Market Overview

- The USA online gambling market is valued at USD 24 billion, based on a five-year historical analysis. The market's growth is driven primarily by regulatory relaxations in various states, increased accessibility to internet services, and advancements in mobile technology. The convenience of online platforms and the introduction of more interactive gambling experiences have attracted a broad audience, resulting in consistent growth.

- Dominant regions in the USA, including Nevada and New Jersey, lead the market. These states have established robust regulatory frameworks, which attract both operators and players. Nevadas long-standing gambling culture and New Jerseys early adoption of online gambling legislation provide them a competitive edge, making them key players in the USA online gambling market.

- In response to industry demands, the USA government has allowed the expansion of payment options for online gambling platforms. In 2024, the Department of Treasury passed regulations permitting the use of digital currencies such as Bitcoin for transactions in states where online gambling is legal.

USA Online Gambling Market Segmentation

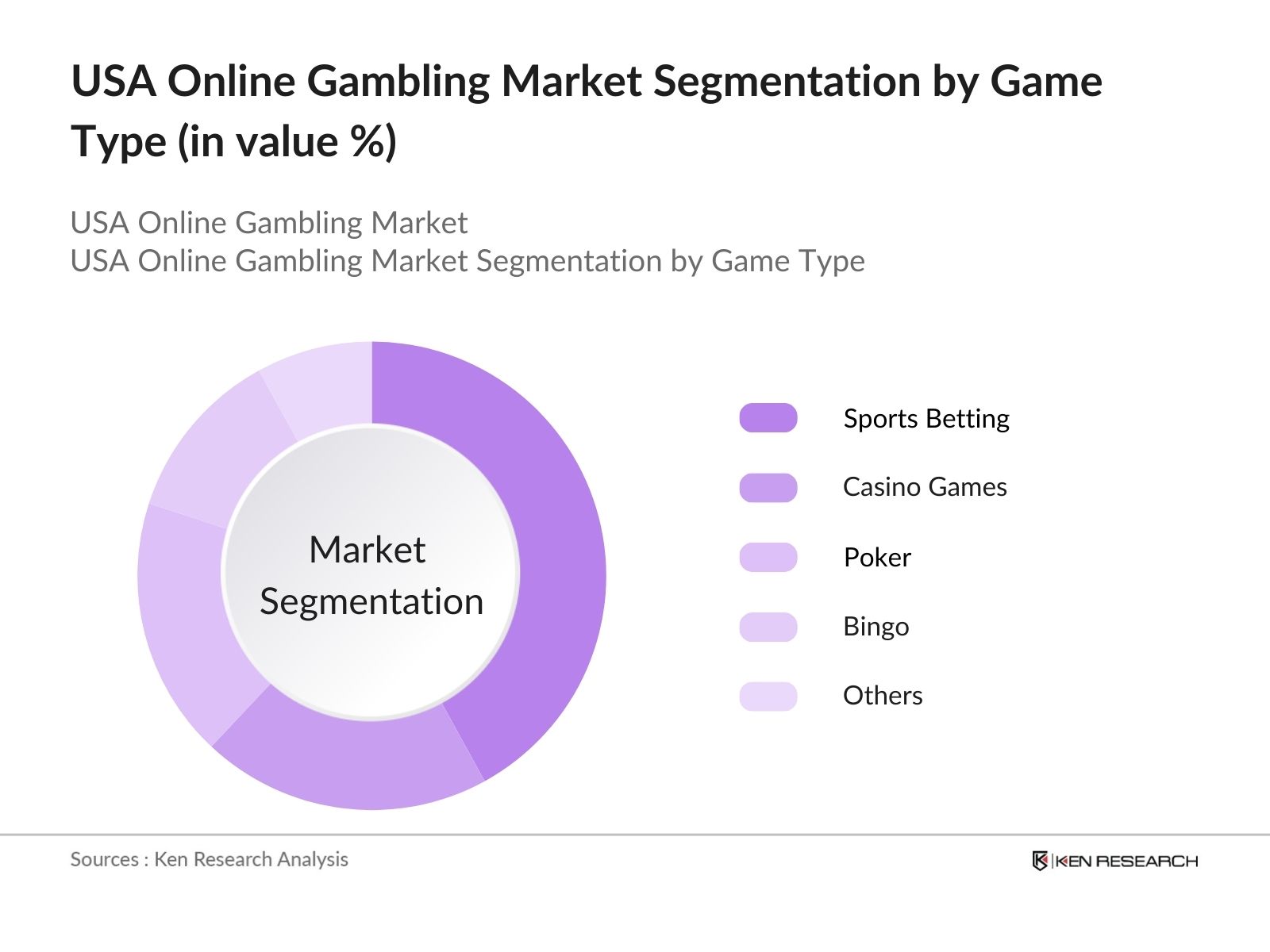

By Game Type: The market is segmented by game type into sports betting, casino games, poker, bingo, and others. Recently, sports betting has held a dominant market share due to the increasing legalization across states, particularly after the repeal of the PASPA act. This legal change, along with partnerships between sportsbooks and major sports leagues, has facilitated exponential growth in the segment.

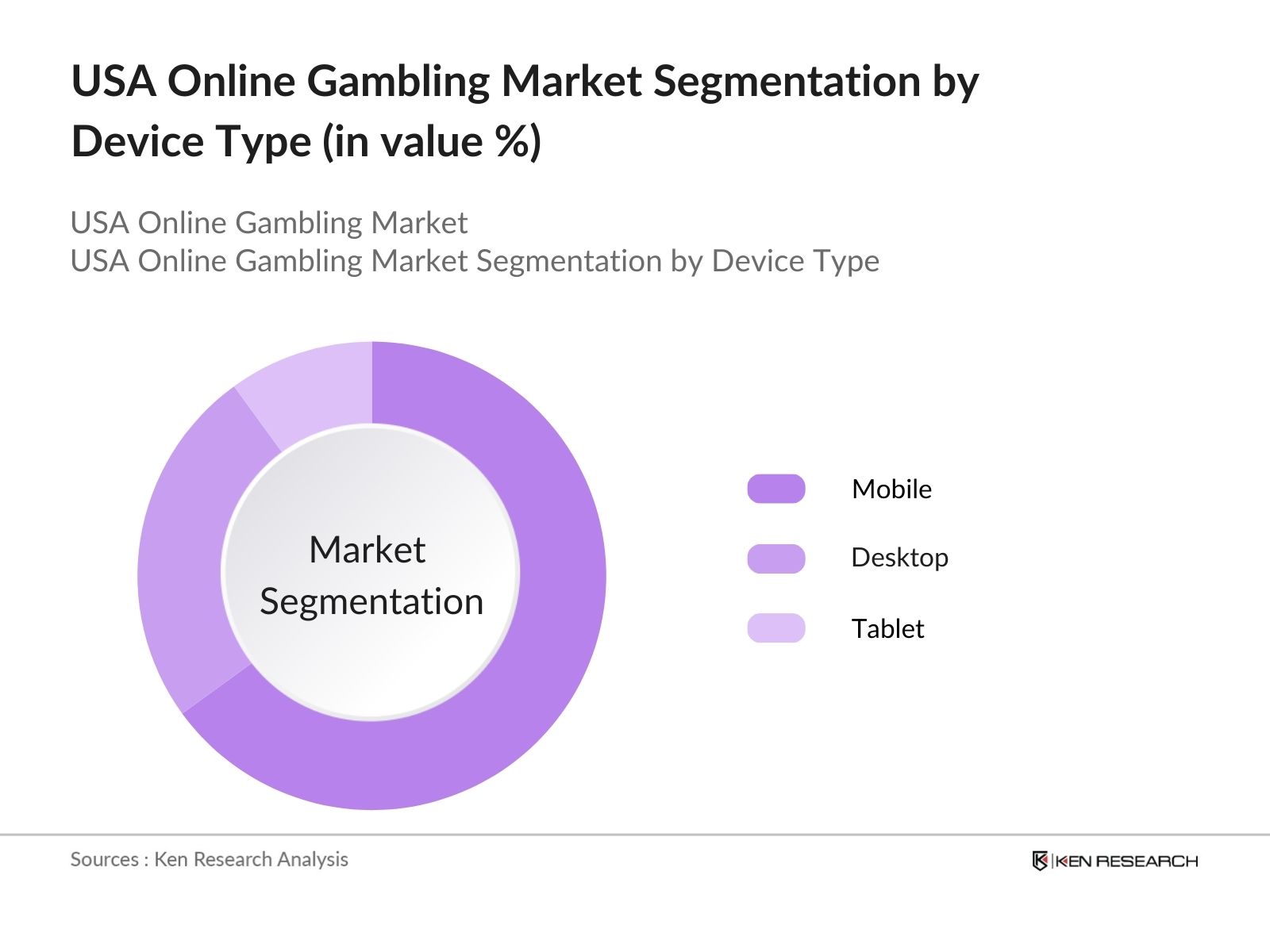

By Device Type: The market is segmented by device type into mobile, desktop, and tablet. Mobile platforms are dominating due to the growing trend of mobile-first gaming experiences, where apps and mobile-optimized websites offer users the flexibility to gamble on-the-go. The introduction of high-quality apps with real-time notifications and immersive interfaces has attracted both casual and professional players, making mobile gambling the preferred choice.

USA Online Gambling Market Competitive Landscape

The market is dominated by several key players, both domestic and international. The increasing partnerships and mergers among these companies highlight a consolidating market. Companies like DraftKings and FanDuel have dominated due to their extensive sports betting platforms.

|

Company Name |

Establishment Year |

Headquarters |

Market Revenue |

User Base |

Geographical Presence |

Partnerships |

Number of Games Offered |

Marketing Spend |

Customer Acquisition Cost |

|

DraftKings |

2012 |

Boston, MA |

|||||||

|

FanDuel |

2009 |

New York, NY |

|||||||

|

BetMGM |

2018 |

Jersey City, NJ |

|||||||

|

888 Holdings |

1997 |

Gibraltar |

|||||||

|

Caesars Entertainment |

1937 |

Las Vegas, NV |

USA Online Gambling Market Analysis

Market Growth Drivers

- Increased Consumer Engagement Due to the Legalization of Online Gambling The USA has been witnessing a rise in online gambling activity driven by the continuous legalization of online gambling across various states. In 2024, around 30 states have already legalized online sports betting, with more states expected to follow in the next few years. This legislative shift has opened up access to a large number of players who previously had no access to regulated gambling, boosting consumer engagement.

- Aggressive Marketing and Promotional Strategies by Key Players: Leading companies in the online gambling industry have invested heavily in marketing and promotional campaigns to attract new customers. In 2024, operators such as DraftKings, FanDuel, and BetMGM collectively spent over $1 billion on marketing campaigns, offering sign-up bonuses, referral incentives, and other attractive offers to entice new users.

- Growth in Online Sports Betting Due to Major Sports Events: Major sporting events such as the Super Bowl, the NBA Finals, and the FIFA World Cup have contributed to the rise in online sports betting in the USA. In 2024, the Super Bowl generated over $8 billion in wagers, and the upcoming 2026 FIFA World Cup, set to take place in the USA, is expected to generate even higher betting volumes.

Market Challenges

- High Competition Leading to Profitability Challenges: The market is becoming increasingly crowded, with numerous operators vying for market share. Major players like DraftKings, FanDuel, and BetMGM dominate, but smaller players struggle to compete due to high customer acquisition costs and intense price competition. In 2024, it was reported that the average cost to acquire a new customer in the online sports betting segment was over $400, forcing smaller companies to operate with thin profit margins, which hinders sustainable growth.

- Data Privacy and Security Concerns: As online gambling platforms handle vast amounts of sensitive user data, concerns over data breaches and cyber-attacks are rising. In 2024, there were over 1,600 reported incidents of data breaches in the USA, impacting several industries, including online gambling. Regulatory bodies require gambling operators to implement robust cybersecurity measures, but this adds to operational costs, particularly for smaller firms.

USA Online Gambling Market Future Outlook

Over the next five years, the USA online gambling industry is expected to show consistent growth, driven by further state-level legalizations, increased consumer interest in digital gambling, and technological advancements. Mobile gambling is anticipated to lead the growth trajectory due to the proliferation of smartphones and better connectivity.

Future Market Opportunities

- Increased Adoption of Virtual Reality (VR) in Online Casinos: Online casinos are expected to incorporate virtual reality (VR) technology to offer immersive gaming experiences by 2027. Several major operators have already begun testing VR casino games, and it is anticipated that this technology will attract a new generation of gamers seeking more interactive and engaging experiences.

- Growth in Esports Betting: Esports betting is poised for growth in the next five years, fueled by the rising popularity of esports tournaments and competitions. In 2024, over 10 million Americans participated in esports betting, and this number is expected to double by 2029 as more states legalize the activity and the esports ecosystem expands with larger tournaments and prize pools.

Scope of the Report

|

Game Type |

Sports Betting Casino Games Poker Bingo Others |

|

Device Type |

Mobile Desktop Tablet |

|

Payment Method |

Credit/Debit Cards E-Wallets Cryptocurrencies Bank Transfers |

|

Player Type |

Casual Players Professional Players |

|

Region |

North West East South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Online Gambling Operators

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (New Jersey Division of Gaming Enforcement, Nevada Gaming Control Board)

Financial Institutions

Private Equity Firms

Software Developers and Tech Providers

Payment Gateway Providers

Companies

Players Mentioned in the Report:

DraftKings

FanDuel

BetMGM

888 Holdings

Caesars Entertainment

Golden Nugget Online Gaming

Penn National Gaming

WynnBET

Fox Bet

Bally's Corporation

Table of Contents

USA Online Gambling Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

USA Online Gambling Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Online Gambling Market Analysis

3.1. Growth Drivers (Regulatory Changes, Technological Integration, Changing Consumer Preferences, Increased Internet Penetration)

3.1.1. Regulatory Relaxations

3.1.2. Rising Smartphone Usage

3.1.3. Increased Demand for Convenient Entertainment

3.1.4. Access to Secure Payment Gateways

3.2. Market Challenges (Legal Barriers, Fraudulent Activities, Consumer Trust Issues, Addiction Concerns)

3.2.1. Varying State Regulations

3.2.2. Payment Restrictions

3.2.3. Risk of Cybersecurity Breaches

3.2.4. Lack of Standardization Across Platforms

3.3. Opportunities (Partnerships with Gaming Studios, E-Sports Integration, Customization of Gaming Experience, Blockchain Adoption)

3.3.1. Introduction of Virtual Reality (VR)

3.3.2. Cross-Industry Collaborations

3.3.3. Expansion into Untapped States

3.3.4. Enhanced User Engagement with AI

3.4. Trends (Live Betting, Crypto Integration, Interactive Gambling, Personalization Algorithms)

3.4.1. Rise in Sports Betting

3.4.2. Mobile-first Platforms

3.4.3. Real-Time Engagement Features

3.4.4. Emergence of Responsible Gambling Tools

3.5. Government Regulations (Gambling Laws, Licensing Procedures, Taxation Policies, Advertising Standards)

3.5.1. State-wise Licensing Requirements

3.5.2. Tax Compliance on Winnings

3.5.3. Consumer Data Protection Regulations

3.5.4. Advertising Restrictions for Online Gambling

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

USA Online Gambling Market Segmentation

4.1. By Game Type (In Value %)

4.1.1. Sports Betting

4.1.2. Casino Games

4.1.3. Poker

4.1.4. Bingo

4.1.5. Others

4.2. By Device Type (In Value %)

4.2.1. Mobile

4.2.2. Desktop

4.2.3. Tablet

4.3. By Payment Method (In Value %)

4.3.1. Credit/Debit Cards

4.3.2. E-Wallets

4.3.3. Cryptocurrencies

4.3.4. Bank Transfers

4.4. By Player Type (In Value %)

4.4.1. Casual Players

4.4.2. Professional Players

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. East

4.5.4. South

USA Online Gambling Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. DraftKings

5.1.2. FanDuel

5.1.3. MGM Resorts

5.1.4. Caesars Entertainment

5.1.5. BetMGM

5.1.6. 888 Holdings

5.1.7. PointsBet

5.1.8. BetRivers

5.1.9. Bally's Corporation

5.1.10. Golden Nugget Online Gaming

5.1.11. Flutter Entertainment

5.1.12. William Hill

5.1.13. WynnBET

5.1.14. Fox Bet

5.1.15. Penn National Gaming

5.2. Cross Comparison Parameters (Revenue, Market Share, User Base, Geographical Reach, Customer Acquisition Cost, Number of Game Offerings, Partnerships, Marketing Spend)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA Online Gambling Market Regulatory Framework

6.1. State-level Gambling Laws

6.2. Licensing Procedures

6.3. Taxation and Compliance Requirements

6.4. Advertising Standards for Online Gambling

USA Online Gambling Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Online Gambling Future Market Segmentation

8.1. By Game Type (In Value %)

8.2. By Device Type (In Value %)

8.3. By Payment Method (In Value %)

8.4. By Player Type (In Value %)

8.5. By Region (In Value %)

USA Online Gambling Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Retention Strategies

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step in analyzing the USA online gambling market involves identifying key variables such as regulatory developments, consumer behavior, and technological innovations. A comprehensive map of stakeholders is constructed based on desk research and secondary data sources.

Step 2: Market Analysis and Construction

During this stage, historical data on market penetration, state-level regulation analysis, and service providers offerings are compiled. This ensures an accurate estimation of the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews with industry leaders from online gambling companies are conducted to validate market projections and gather insights into operational strategies. These interviews further enhance the reliability of the market data.

Step 4: Research Synthesis and Final Output

A thorough synthesis of research findings is conducted to compile final data and insights. Engagement with operators ensures detailed information on product segments, customer preferences, and market challenges, ensuring a comprehensive analysis of the USA online gambling market.

Frequently Asked Questions

01. How big is the USA Online Gambling Market?

The USA online gambling market is valued at USD 24 billion, driven by increasing legalization in key states, rising internet penetration, and the proliferation of mobile platforms.

02. What are the challenges in the USA Online Gambling Market?

Challenges in the USA online gambling market include inconsistent state regulations, cybersecurity risks, and the rise of illegal gambling platforms. Fraud prevention and compliance with varying local laws add complexities for operators.

03. Who are the major players in the USA Online Gambling Market?

Key players in the USA online gambling market include DraftKings, FanDuel, BetMGM, 888 Holdings, and Caesars Entertainment. These companies dominate due to their strong user bases, partnerships with sports leagues, and diverse gambling offerings.

04. What are the growth drivers of the USA Online Gambling Market?

Growth in the USA online gambling market is propelled by increasing legalization across states, partnerships between sports leagues and gambling platforms, and technological innovations in mobile gaming and payment systems.

05. What technological trends are shaping the USA Online Gambling Market?

Key trends in the USA online gambling market include the integration of blockchain for secure transactions, the adoption of virtual reality (VR) to enhance user experience, and the use of artificial intelligence (AI) for personalized betting recommendations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.