USA Operational Technology Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7392

November 2024

90

About the Report

USA Operational Technology Market Overview

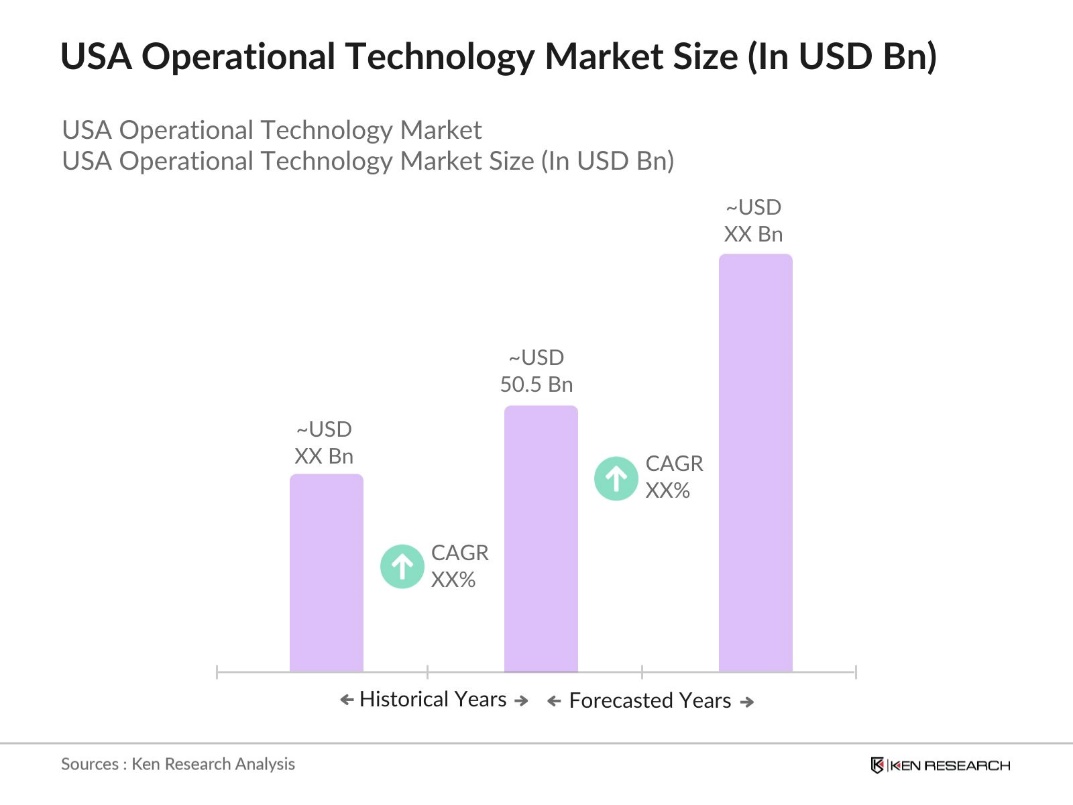

- The USA Operational Technology market, based on historical analysis, is valued at USD 50.5 billion. This valuation is driven primarily by a surge in demand for industrial automation and digital transformation initiatives across manufacturing, energy, and utility sectors. Increased adoption of IoT devices and cloud-based OT systems are boosting efficiency and reducing operational risks, further contributing to market growth.

- The USA Operational Technology market is dominated by regions such as California and Texas, where significant investments in industrial automation and energy sectors have spurred OT adoption. California leads due to its established tech ecosystem, promoting widespread OT innovation, while Texas benefits from a large oil and gas industry that requires extensive OT solutions for operational efficiency and safety.

- The U.S. government has implemented stringent operational technology security standards to safeguard critical infrastructure. In 2023, the Cybersecurity and Infrastructure Security Agency (CISA) issued comprehensive guidelines for securing industrial control systems, emphasizing the importance of robust cybersecurity measures. These standards mandate regular risk assessments, implementation of security controls, and continuous monitoring to protect against cyber threats.

USA Operational Technology Market Segmentation

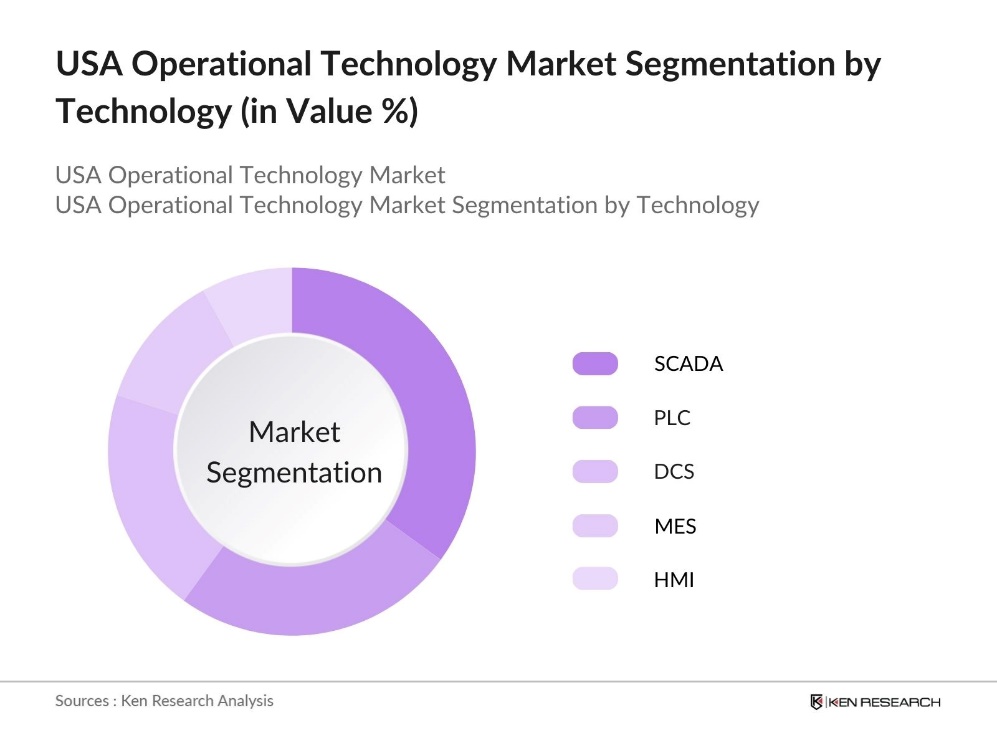

By Technology: The market is segmented by technology, including SCADA, PLC, DCS, MES, and HMI systems. Among these, SCADA holds a dominant market share due to its critical role in managing and controlling complex systems, particularly in industries such as oil & gas and utilities. SCADAs real-time monitoring and control capabilities allow for rapid response to potential system issues, ensuring operational efficiency. Additionally, advancements in SCADA software have allowed industries to adopt more scalable and flexible solutions, further reinforcing its dominance.

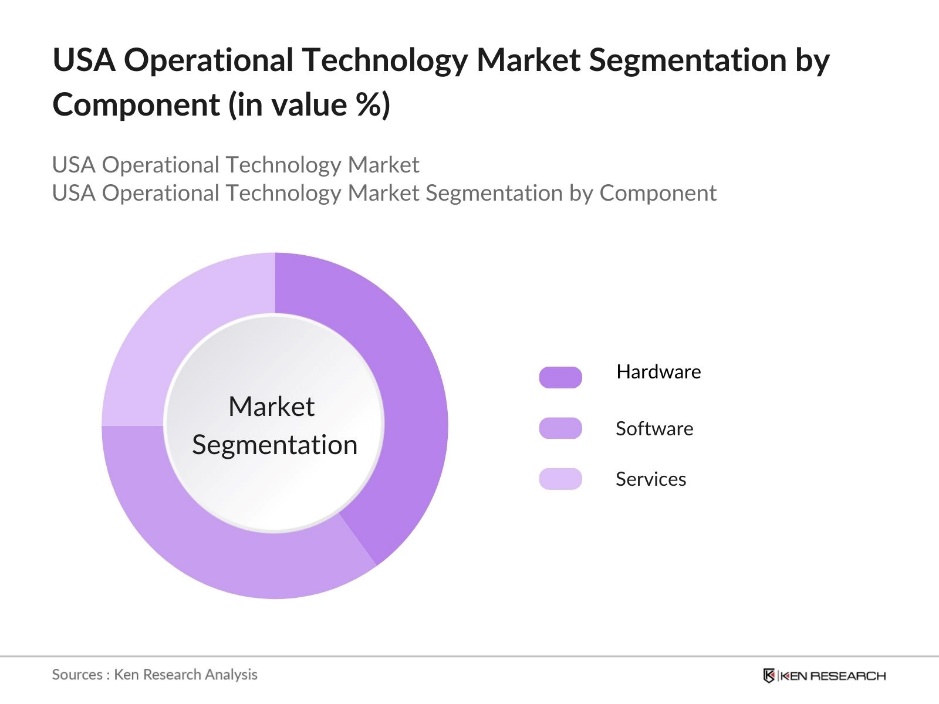

By Component: The market is segmented by component, encompassing Hardware, Software, and Services. The Hardware segment dominates due to the substantial investments required for industrial automation equipment such as controllers, sensors, and networking hardware. These components are essential for seamless operational connectivity and data collection, allowing companies to enhance production efficiency. The durability and long-term investment nature of OT hardware further support its leading market position.

USA Operational Technology Market Competitive Landscape

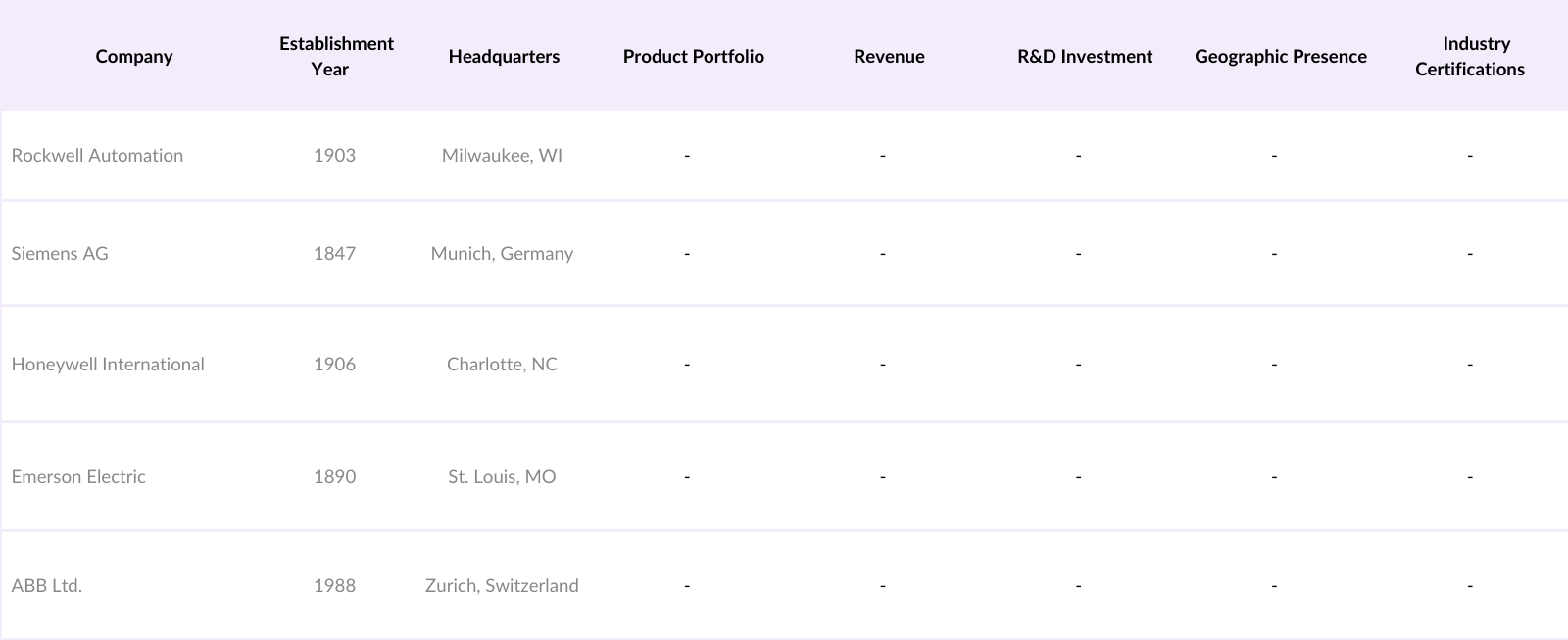

The USA Operational Technology market is characterized by a mix of established global players and emerging tech firms, offering a diverse range of solutions. Key companies include Rockwell Automation, Siemens AG, and Honeywell International, each with strong expertise in OT system integration. These companies capabilities in creating advanced, secure, and scalable OT solutions position them as market leaders. Their collaboration with end-users across various industries demonstrates their influence in shaping the market landscape.

USA Operational Technology Industry Analysis

Growth Drivers

- Industrial Automation Demand: The U.S. manufacturing sector has been a significant contributor to the nation's economy, with manufacturing output. This substantial output underscores the critical role of industrial automation in enhancing productivity and efficiency across various industries. The integration of advanced technologies such as robotics and AI has been pivotal in maintaining and boosting this output. For instance, the automotive industry, a major segment of U.S. manufacturing, produced over 9 million vehicles in 2022, highlighting the reliance on automation to meet production demands.

- Digital Transformation Initiatives: The digital transformation efforts, aiming to modernize operations and enhance competitiveness. For instance, a report highlighted that 45% of companies aimed for business growth through digital transformation initiatives. The manufacturing sector, in particular, has been a significant beneficiary, with companies adopting advanced digital tools to optimize production and supply chain management. These initiatives are supported by government programs that encourage technological adoption, further driving the demand for operational technology solutions.

- Rise in Cybersecurity Concerns: The U.S. has faced a growing number of cyber incidents targeting critical infrastructure, spotlighting the intensifying threat landscape. This rise in cyber threats has driven organizations to prioritize security investments for their operational technology (OT) environments. The escalating sophistication and frequency of cyberattacks emphasize the need for strong cybersecurity frameworks, prompting industries to implement measures that safeguard OT systems against potential breaches.

Market Challenges

- High Initial Investment Costs: Deploying advanced operational technology (OT) solutions typically demands substantial upfront capital, which can be prohibitive for small and medium-sized enterprises. The high initial costs of comprehensive industrial control systems make it challenging for some organizations to adopt cutting-edge OT technologies. Additionally, the need for ongoing maintenance and specialized training increases the overall financial burden, making it harder for certain businesses to justify the investment in OT solutions.

- System Integration Complexities: Integrating new OT solutions with existing legacy systems presents considerable challenges. Organizations often struggle with compatibility and interoperability issues, leading to potential operational inefficiencies and downtime. The complexity of integrating diverse technologies can extend project timelines and escalate implementation costs, creating hurdles for businesses trying to modernize their OT environments.

USA Operational Technology Market Future Outlook

Over the next five years, the USA Operational Technology market is anticipated to experience robust growth, driven by continuous advancements in IoT, AI, and machine learning for industrial applications. Increased cybersecurity measures and government regulations focusing on critical infrastructure are expected to further fuel market expansion. As OT solutions become increasingly integrated with IT infrastructure, companies are likely to see improved operational efficiencies and cost savings, strengthening the demand for OT solutions in multiple sectors.

Market Opportunities

Advancements in IoT and Edge Computing: The growing trend toward interconnected systems presents significant opportunities for operational technology (OT) providers to develop solutions that utilize real-time data analytics and edge computing. By processing data closer to the source, organizations can make faster, more informed decisions and improve operational efficiency. This capability enhances their competitive advantage, as immediate data insights lead to quicker responses to operational needs.

Strategic Collaborations and Partnerships: Strategic partnerships between technology firms and industrial companies are fostering innovation and expanding market reach. These collaborations enable the development of integrated OT solutions tailored to specific industry needs, facilitating the adoption of advanced technologies across diverse sectors. By combining expertise and resources, companies can accelerate product development and offer enhanced value to customers, driving broader adoption of OT innovations.

Scope of the Report

|

Technology |

SCAD PLC DCS MES HMI |

|

Component |

Hardware Software Services |

|

End-User Industry |

Manufacturing Utilities Oil & Gas Transportation Energy and Power |

|

Connectivity |

Wired Wireless |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Manufacturing Companies

Utilities and Energy Sector Companies

Oil & Gas Industry

Transportation Industry

Technology Industry

Cybersecurity Companies

Government and Regulatory Bodies (e.g., U.S. Department of Energy, NIST)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Rockwell Automation

Siemens AG

Honeywell International

ABB Ltd.

Emerson Electric Co.

Schneider Electric

General Electric

Yokogawa Electric Corporation

Mitsubishi Electric Corporation

Hitachi Ltd.

Table of Contents

1. USA Operational Technology Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Operational Technology Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Operational Technology Market Analysis

3.1 Growth Drivers

3.1.1 Industrial Automation Demand

3.1.2 Digital Transformation Initiatives

3.1.3 Government Infrastructure Projects

3.1.4 Rise in Cybersecurity Concerns

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 System Integration Complexities

3.2.3 Limited Skilled Workforce

3.3 Opportunities

3.3.1 Advancements in IoT and Edge Computing

3.3.2 Strategic Collaborations and Partnerships

3.3.3 Expansion into Non-Traditional Sectors

3.4 Trends

3.4.1 Growth in Predictive Maintenance Adoption

3.4.2 Increased AI and ML Integration

3.4.3 Cloud-Based OT Solutions Adoption

3.5 Government Regulations

3.5.1 National OT Security Standards

3.5.2 Infrastructure Investment Programs

3.5.3 Cybersecurity Compliance Requirements

3.5.4 Federal and State-Level Funding Initiatives

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. USA Operational Technology Market Segmentation

4.1 By Technology (In Value %)

4.1.1 SCADA (Supervisory Control and Data Acquisition)

4.1.2 PLC (Programmable Logic Controllers)

4.1.3 DCS (Distributed Control Systems)

4.1.4 MES (Manufacturing Execution Systems)

4.1.5 HMI (Human-Machine Interface)

4.2 By Component (In Value %)

4.2.1 Hardware

4.2.2 Software

4.2.3 Services

4.3 By End-User Industry (In Value %)

4.3.1 Manufacturing

4.3.2 Utilities

4.3.3 Oil & Gas

4.3.4 Transportation

4.3.5 Energy and Power

4.4 By Connectivity (In Value %)

4.4.1 Wired

4.4.2 Wireless

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Operational Technology Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Rockwell Automation, Inc.

5.1.2 Siemens AG

5.1.3 Honeywell International Inc.

5.1.4 ABB Ltd.

5.1.5 Schneider Electric

5.1.6 Emerson Electric Co.

5.1.7 General Electric

5.1.8 Yokogawa Electric Corporation

5.1.9 Mitsubishi Electric Corporation

5.1.10 Hitachi Ltd.

5.1.11 IBM Corporation

5.1.12 Cisco Systems, Inc.

5.1.13 SAP SE

5.1.14 Honeywell Process Solutions

5.1.15 Advantech Co., Ltd.

5.2 Cross Comparison Parameters (Headquarters, Product Portfolio, Market Share, Revenue, Recent Innovations, Operational Regions, Industry Certifications, R&D Investments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Operational Technology Market Regulatory Framework

6.1 Federal and State Regulations

6.2 Cybersecurity Standards

6.3 Certification Processes

6.4 Environmental Compliance Requirements

7. USA Operational Technology Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Operational Technology Future Market Segmentation

8.1 By Technology (In Value %)

8.2 By Component (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Connectivity (In Value %)

8.5 By Region (In Value %)

9. USA Operational Technology Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map of the USA Operational Technology Market was created, outlining key stakeholders and market drivers. Comprehensive desk research using proprietary databases helped identify critical variables influencing market dynamics, including industry demand, regional factors, and technological advancements.

Step 2: Market Analysis and Construction

Historical data was collected and analyzed to understand the growth trajectory of the OT market. Key data points, such as industry penetration and revenue generation, were evaluated to create an accurate representation of market size and growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were established and validated through consultations with industry experts. Interviews were conducted with OT practitioners from diverse sectors, offering practical insights that strengthened the market analysis.

Step 4: Research Synthesis and Final Output

The final research phase involved gathering data from OT manufacturers and technology firms to verify and complement findings. The bottom-up approach ensured accuracy, enabling a reliable analysis of the USA Operational Technology market.

Frequently Asked Questions

01 How big is the USA Operational Technology Market?

The USA Operational Technology market is valued at USD 50.5 billion, with growth driven by rising industrial automation and digital transformation across sectors like manufacturing, energy, and utilities.

02 What are the challenges in the USA Operational Technology Market?

Challenges in USA Operational Technology market include high initial investment costs, system integration complexities, and a shortage of skilled workforce, which limits the widespread adoption of OT solutions in various industries.

03 Who are the major players in the USA Operational Technology Market?

Key players in the USA Operational Technology market include Rockwell Automation, Siemens AG, Honeywell International, ABB Ltd., and Emerson Electric, which hold strong positions due to their expertise in OT systems and industrial automation solutions.

04 What drives growth in the USA Operational Technology Market?

Growth in the OT market is fueled by demand for industrial automation, increasing cybersecurity measures, and advancements in IoT and AI, which enhance operational efficiencies and cost savings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.