USA Optical Character Recognition (OCR) Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD4054

December 2024

81

About the Report

USA Optical Character Recognition (OCR) Market Overview

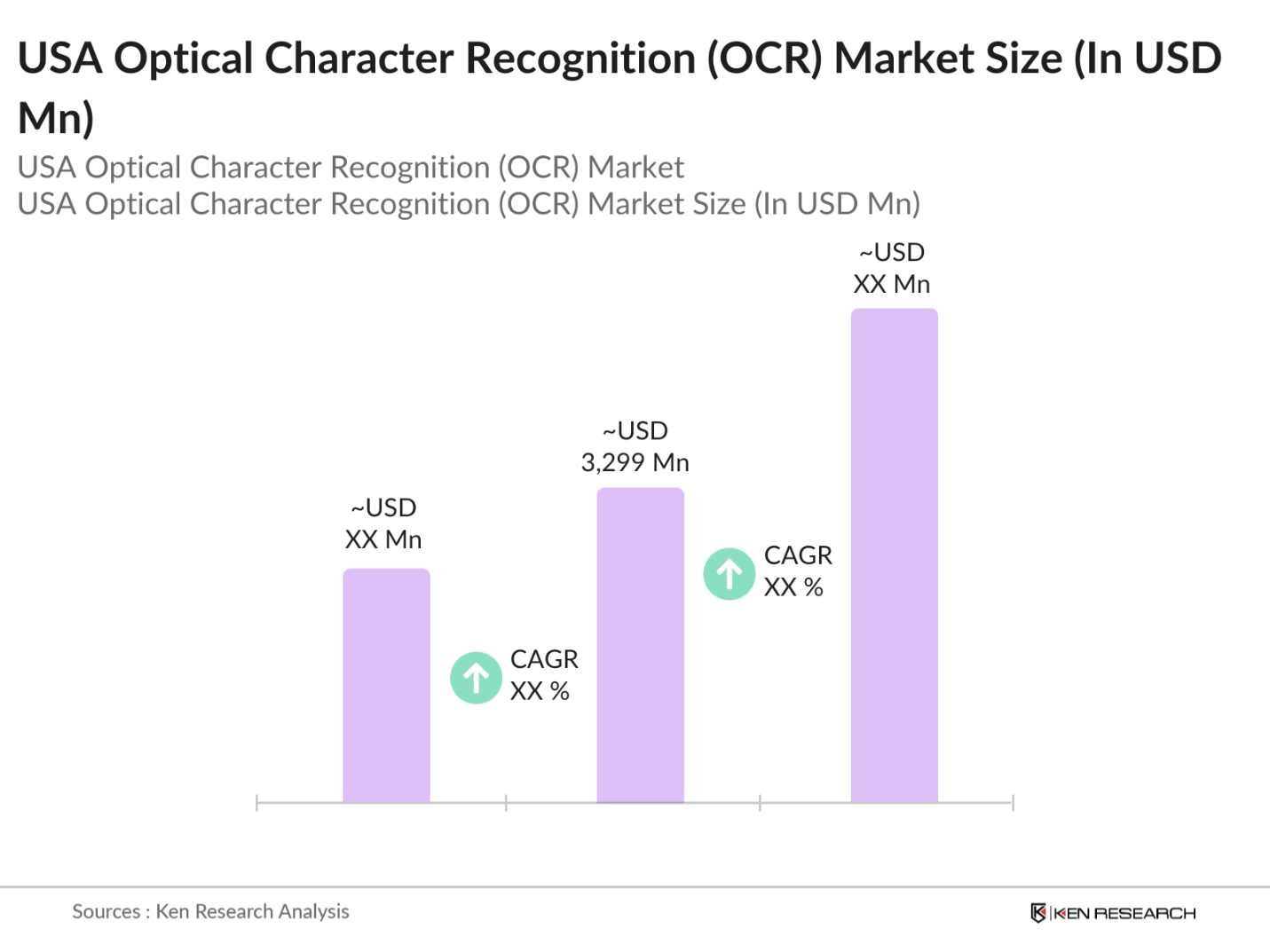

- The USA Optical Character Recognition (OCR) market is valued at USD 3,299 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of OCR technology across various industries, including banking, healthcare, and retail, aiming to enhance operational efficiency and reduce manual data entry errors. Advancements in artificial intelligence and machine learning have further propelled the integration of OCR solutions, making them more accurate and versatile.

- Major metropolitan areas such as New York, San Francisco, and Chicago dominate the OCR market in the USA. These cities are hubs for financial services, technology firms, and large enterprises that require efficient data management solutions. The concentration of businesses in these regions leads to higher demand for OCR technologies to streamline document processing and information retrieval.

- Data protection laws in the U.S. like HIPAA and the California Consumer Privacy Act (CCPA) regulate OCR usage in handling sensitive data. In 2024, the U.S. Department of Justice documented over 1,500 compliance cases related to data misuse, reinforcing the need for OCR vendors to prioritize data privacy. These laws require OCR systems to have robust encryption and anonymization, particularly for sectors dealing with personal information.

USA Optical Character Recognition (OCR) Market Segmentation

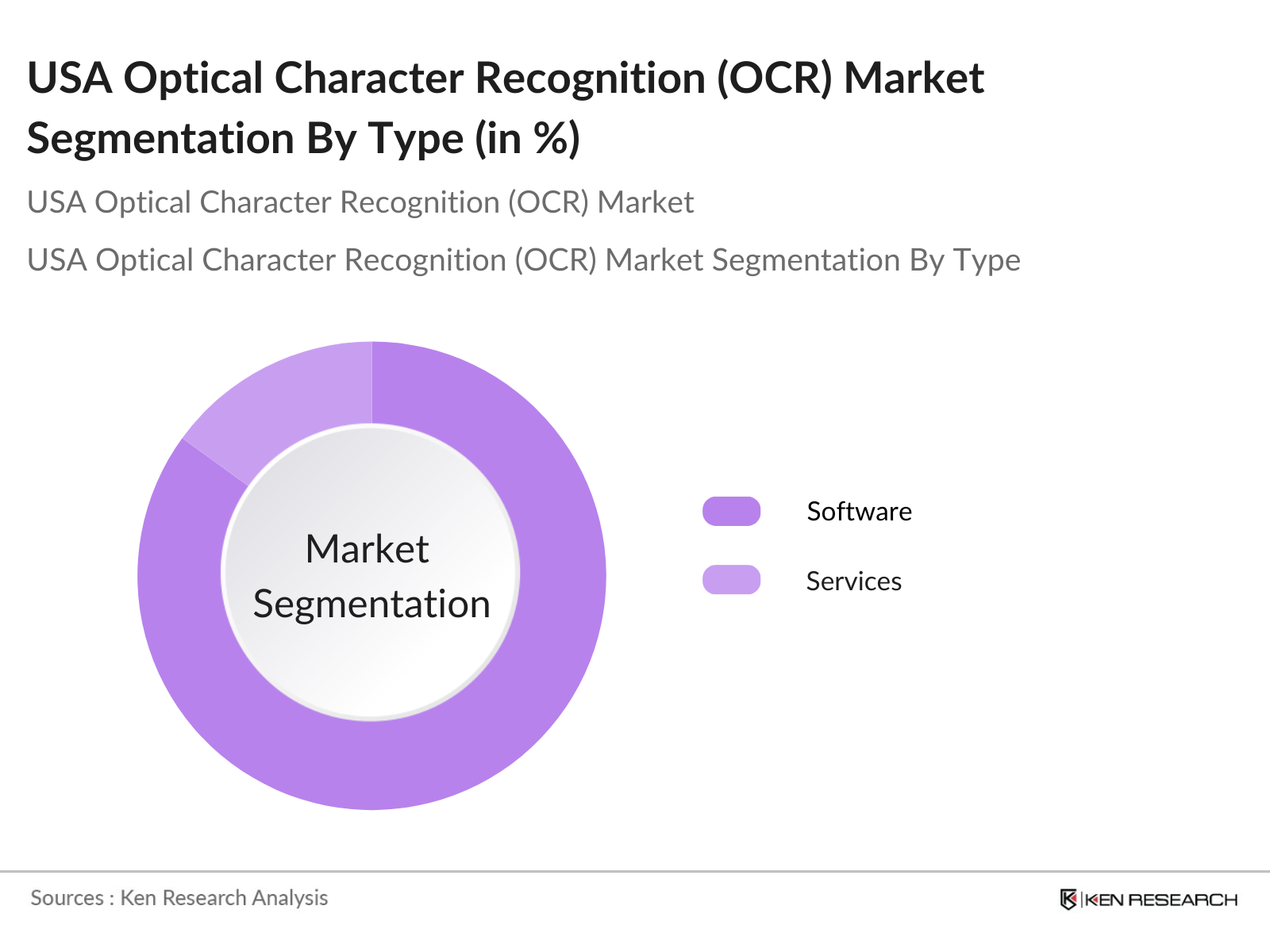

By Type: The market is segmented by type into software and services. Software solutions, including desktop-based, mobile-based, and cloud-based OCR, have a dominant market share due to their widespread adoption across various industries. The flexibility and scalability offered by cloud-based OCR solutions make them particularly appealing to businesses seeking efficient data processing capabilities.

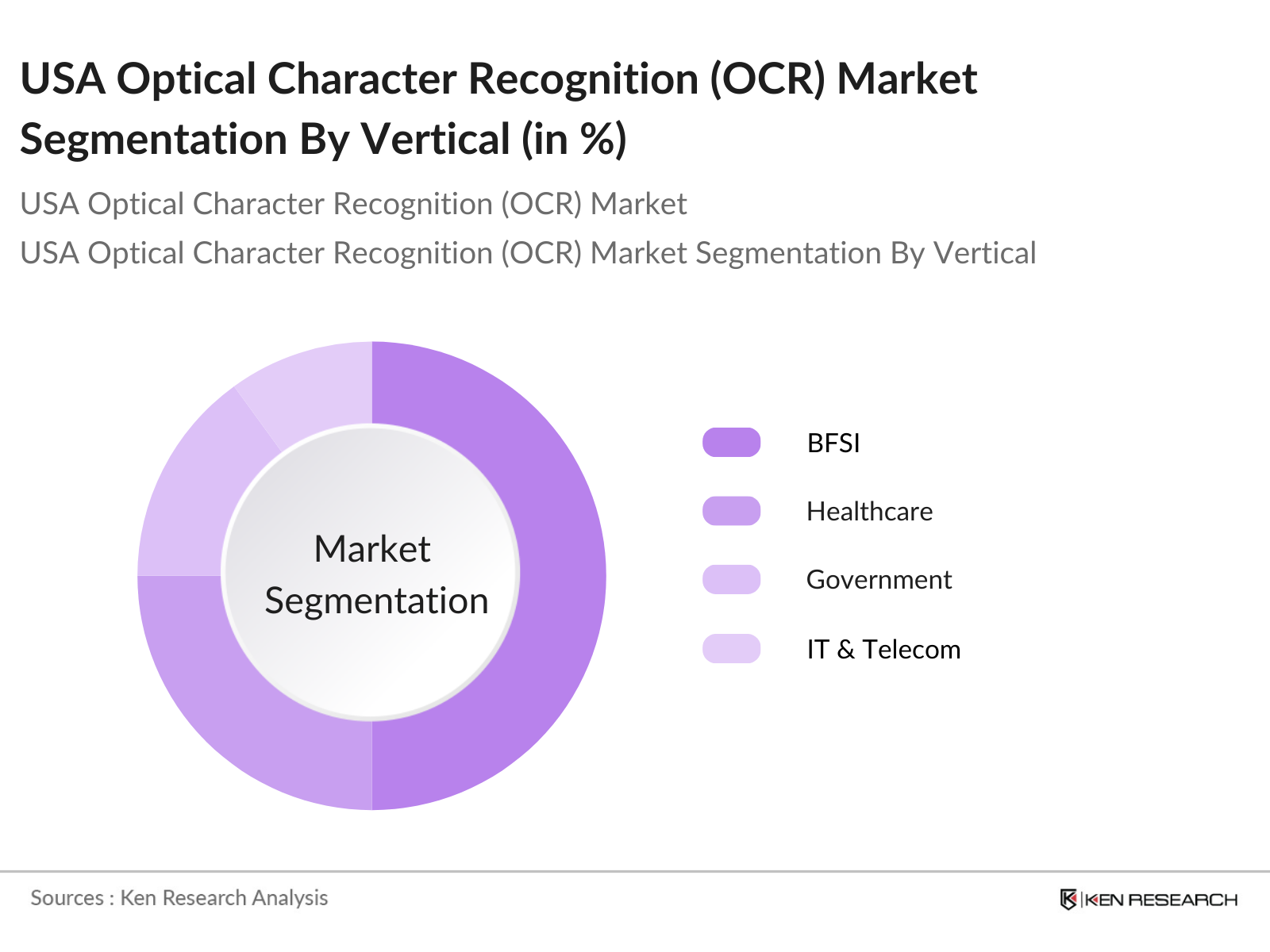

By Vertical: The market is further segmented by verticals, including retail, BFSI (Banking, Financial Services, and Insurance), government, education, transport and logistics, healthcare, IT & telecom, manufacturing, and others. The BFSI sector holds a significant market share, driven by the need for automated document processing and compliance with regulatory requirements. The healthcare industry also exhibits substantial adoption of OCR technology to digitize patient records and streamline administrative tasks.

USA Optical Character Recognition (OCR) Market Competitive Landscape

The USA OCR market is characterized by the presence of several key players offering diverse solutions to meet industry-specific needs. This competitive environment fosters innovation and continuous improvement in OCR technologies.

USA Optical Character Recognition (OCR) Industry Analysis

Growth Drivers

- Increasing Adoption Across Diversified Verticals: The U.S. OCR market is seeing rapid adoption across various sectors including healthcare, finance, and logistics. In 2024, the U.S. healthcare sector alone has reported a significant increase in digital documentation efforts due to federal requirements for electronic health records (EHR). The U.S. Department of Health and Human Services notes that over 90% of hospitals are now using EHRs, increasing demand for OCR tools to streamline patient documentation and ensure compliance.

- Integration of Advanced Capabilities: Modern OCR systems in the U.S. are integrating artificial intelligence and machine learning to enhance accuracy and efficiency. According to the National Institute of Standards and Technology (NIST), advancements in AI-based OCR technology have reduced error rates by nearly 15% in document processing for industries like banking and insurance. In the U.S., over 1,000 banks and financial institutions are adopting AI-OCR systems to meet the growing demand for faster document verification processes, especially for applications in fraud detection and regulatory compliance.

- Rising Investments in OCR Startups: Investment in OCR-focused startups is gaining momentum, with an estimated $2 billion directed towards AI and OCR innovation in 2023, as reported by the U.S. Small Business Administration. This surge is attributed to venture capital interest in OCR applications that support digital transformation initiatives across industries. Notable funding rounds include OCR firms focusing on niche applications like legal document analysis and retail transaction processing.

Market Challenges

- Limitations in Delivering Accurate Output: OCR accuracy remains a concern due to language nuances, image quality, and varied document formats. A report from NIST indicates that OCR error rates for unstructured documents can reach as high as 30% without advanced AI support. Despite enhancements, these limitations persist in sectors such as healthcare and law, where critical data errors could impact patient care or legal proceedings. In 2023, U.S. companies experienced over $500 million in document correction costs associated with OCR inaccuracies.

- Data Privacy Concerns: With increased OCR usage, data privacy risks have become prominent. The U.S. Department of Homeland Security reported a rise in data breach incidents involving digital documents in 2023, underscoring security vulnerabilities in OCR systems. U.S. compliance laws like the Health Insurance Portability and Accountability Act (HIPAA) mandate stringent data security measures, and penalties for breaches have reached over $1 billion annually. These privacy concerns impose additional compliance costs on businesses using OCR for sensitive data processing.

USA Optical Character Recognition (OCR) Market Future Outlook

Over the next five years, the USA OCR market is expected to show significant growth driven by continuous advancements in artificial intelligence and machine learning, increasing digitization across industries, and the growing need for efficient data management solutions. The integration of OCR with other emerging technologies, such as robotic process automation and natural language processing, is anticipated to create new opportunities and enhance the capabilities of OCR systems.

Market Opportunities

- Technological Advancements: Advances in natural language processing and AI are creating new OCR functionalities, including multi-language support and real-time text recognition in images and videos. A report from the U.S. Department of Commerce highlights that AI-enabled OCR can now process over 500 million pages per day across multiple languages, improving accessibility in multinational organizations. This technological progression allows for potential integration in sectors such as education, where multilingual document handling is becoming essential.

- Expansion into New Sectors: OCR technology is expanding beyond traditional industries, with potential in sectors such as e-commerce and education. According to the U.S. Census Bureau, online retail transactions in the U.S. reached nearly 21 billion transactions in 2023, increasing the need for OCR systems to process receipts, invoices, and digital contracts. In education, U.S. schools are adopting OCR to digitize resources for over 50 million students, enhancing remote learning capabilities. This expansion demonstrates the untapped potential for OCR in emerging markets.

Scope of the Report

|

Type |

Software |

|

Vertical |

Retail |

|

End-Use |

B2B |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Financial Institutions

Healthcare Providers

Retail Companies

Government Agencies (e.g., Department of Homeland Security)

Educational Institutions

IT & Telecom Companies

Manufacturing Firms

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report

ABBYY Inc.

Adobe Inc.

Amazon Web Services Inc.

Google LLC

IBM Corporation

Microsoft Corporation

Nuance Communications Inc.

Open Text Corporation

Kofax Inc.

LEAD Technologies Inc.

Table of Contents

1. USA Optical Character Recognition Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Optical Character Recognition Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Optical Character Recognition Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Adoption Across Diversified Verticals

3.1.2 Integration of Advanced Capabilities

3.1.3 Rising Investments in OCR Startups

3.2 Market Challenges

3.2.1 Limitations in Delivering Accurate Output

3.2.2 High Initial Setup Costs

3.2.3 Data Privacy Concerns

3.3 Opportunities

3.3.1 Technological Advancements

3.3.2 Expansion into New Sectors

3.3.3 International Collaborations

3.4 Trends

3.4.1 Adoption of AI and Machine Learning

3.4.2 Cloud-Based OCR Solutions

3.4.3 Mobile-Based OCR Applications

3.5 Government Regulations

3.5.1 Data Protection Laws

3.5.2 Compliance Standards

3.5.3 Public-Private Partnerships

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. USA Optical Character Recognition Market Segmentation

4.1 By Type (In Value %)

4.1.1 Software

4.1.1.1 Desktop-Based OCR

4.1.1.2 Mobile-Based OCR

4.1.1.3 Cloud-Based OCR

4.1.1.3.1 Private Cloud-Based OCR

4.1.1.3.2 Public Cloud-Based OCR

4.1.1.4 Others

4.1.2 Services

4.1.2.1 Consulting

4.1.2.2 Outsourcing

4.1.2.3 Implementation & Integration

4.2 By Vertical (In Value %)

4.2.1 Retail

4.2.2 BFSI (Banking, Financial Services, and Insurance)

4.2.3 Government

4.2.4 Education

4.2.5 Transport and Logistics

4.2.6 Healthcare

4.2.7 IT & Telecom

4.2.8 Manufacturing

4.2.9 Others

4.3 By End-Use (In Value %)

4.3.1 B2B

4.3.2 B2C

4.4 By Region (In Value %)

4.4.1 Northeast

4.4.2 Midwest

4.4.3 South

4.4.4 West

5. USA Optical Character Recognition Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ABBYY Inc.

5.1.2 Adobe Inc.

5.1.3 Amazon Web Services Inc.

5.1.4 Google LLC

5.1.5 IBM Corporation

5.1.6 Microsoft Corporation

5.1.7 Nuance Communications Inc.

5.1.8 Open Text Corporation

5.1.9 Kofax Inc.

5.1.10 LEAD Technologies Inc.

5.1.11 Foxit Software Inc.

5.1.12 NAVER Corporation

5.1.13 Biotricity Inc.

5.1.14 Nano Net Technologies Inc. (NanoNets)

5.1.15 Envision

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, Key Clients, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. USA Optical Character Recognition Market Regulatory Framework

6.1 Data Protection and Privacy Laws

6.2 Compliance Requirements

6.3 Certification Processes

7. USA Optical Character Recognition Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Optical Character Recognition Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Vertical (In Value %)

8.3 By End-Use (In Value %)

8.4 By Region (In Value %)

9. USA Optical Character Recognition Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA OCR Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA OCR Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple OCR solution providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA OCR market.

Frequently Asked Questions

01. How big is the USA Optical Character Recognition (OCR) Market?

The USA Optical Character Recognition (OCR) market is valued at USD 3,299 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of OCR technology across various industries, including banking, healthcare, and retail, aiming to enhance operational efficiency and reduce manual data entry errors.

02. What are the challenges in the USA OCR Market?

Challenges include high initial setup costs, data privacy concerns, and limitations in delivering accurate output, especially with complex or poor-quality documents.

03. Who are the major players in the USA OCR Market?

Key players in the market include ABBYY Inc., Adobe Inc., Google LLC, Microsoft Corporation, and Nuance Communications Inc.

04. What are the growth drivers of the USA OCR Market?

Key growth drivers in the USA OCR market include expanding adoption across various industries, enhanced technological capabilities, and increased investment in OCR solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.