USA Optoelectronics Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD9059

December 2024

90

About the Report

USA Optoelectronics Market Overview

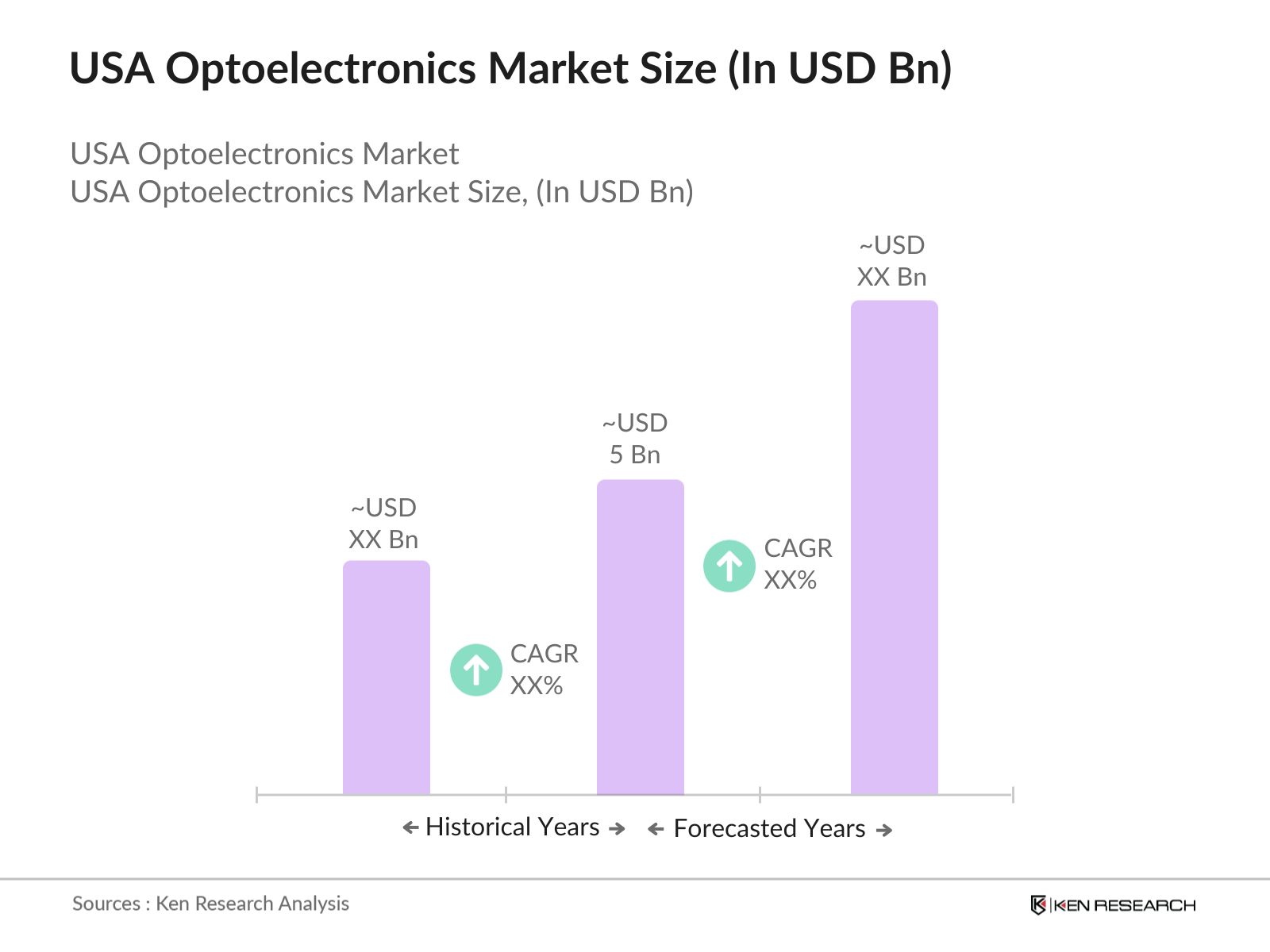

- The USA Optoelectronics market is valued at USD 5 billion, based on a five-year historical analysis. The growth of this market is primarily driven by the rising demand for advanced technologies in communication systems, healthcare, and consumer electronics. The increasing integration of optoelectronics in devices like smartphones, displays, and medical imaging equipment has significantly contributed to the market's growth. Furthermore, advancements in fiber optics and photonics have accelerated the adoption of optoelectronic components across multiple sectors, fueling the market expansion.

- The USA Optoelectronics market is predominantly driven by cities such as Silicon Valley in California and major metropolitan areas like New York and Texas, where there is a high concentration of technology firms and R&D centers. Silicon Valley's strong focus on innovation and the presence of global technology giants have made it a key contributor to the optoelectronics market. These regions dominate due to their established infrastructure, availability of skilled professionals, and substantial investments in technological advancements, creating a conducive environment for market growth.

- The U.S. Federal Communications Commission (FCC) plays a crucial role in regulating the optoelectronics industry, particularly concerning communication technologies. The FCC's rules governing spectrum allocation and optical fiber deployment, supported by a $20.4 billion fund for broadband expansion, directly impact optoelectronic components used in data transmission. Compliance with these regulations is essential for market players to ensure the efficient operation of photonics-based communication systems.

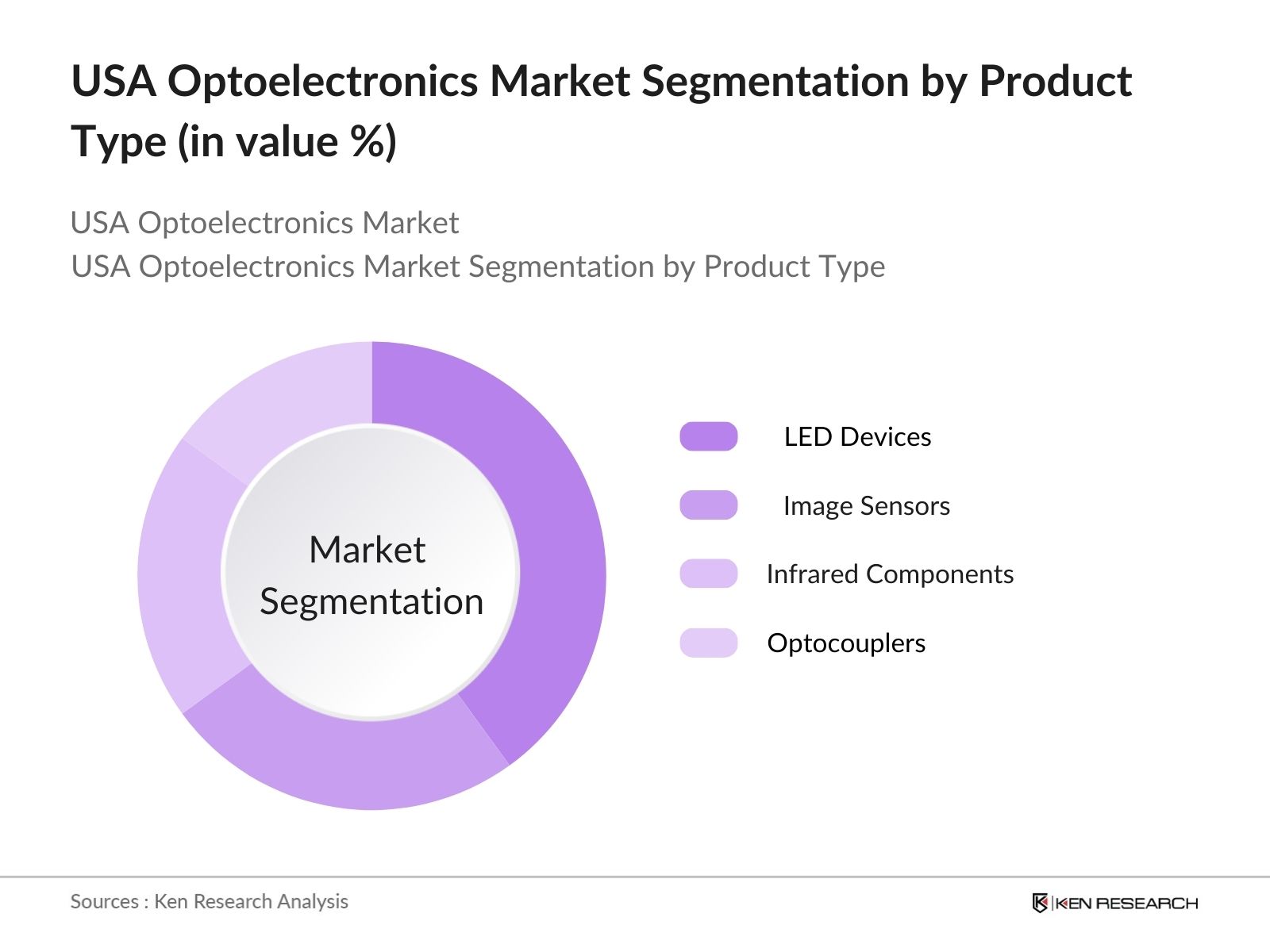

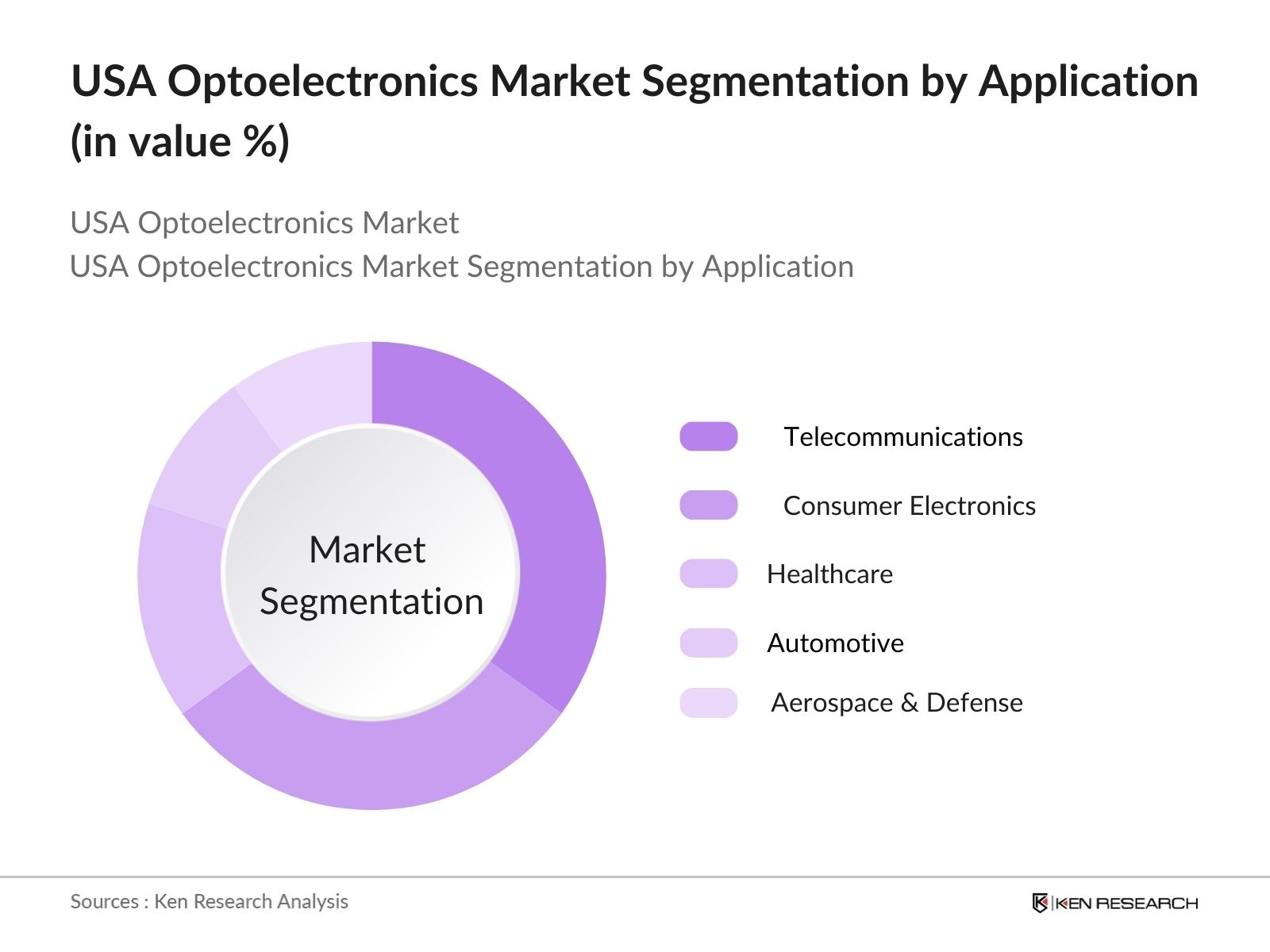

USA Optoelectronics Market Segmentation

- By Product Type: The market is segmented by product type into LED devices, Image Sensors, Infrared Components, and Optocouplers. Recently, LED devices have maintained a dominant market share in this segmentation, largely due to the widespread adoption of energy-efficient lighting solutions and display technologies. The demand for LED lighting in consumer electronics, automotive industries, and urban infrastructures has propelled this segment forward, with increasing governmental emphasis on sustainable and energy-saving products. The rapid transition from conventional lighting systems to LEDs in both public and private sectors has solidified their dominance.

- By Application: The market is also segmented by application into Consumer Electronics, Telecommunications, Healthcare, Automotive, and Aerospace & Defense. Among these, the Telecommunications segment holds the largest market share due to the increasing demand for high-speed internet and enhanced communication systems. Optoelectronics components like fiber optics and lasers play a critical role in the development of telecommunications infrastructure, including 5G networks. The reliance on optoelectronic technology for data transmission and network connectivity continues to strengthen this segment's position in the market.

USA Optoelectronics Market Competitive Landscape

The USA Optoelectronics market is dominated by both local and global players who are driving innovation and maintaining significant market influence. Companies like Finisar Corporation, Broadcom, and II-VI Incorporated have a strong presence, contributing to the market's competitiveness. These companies strong R&D capabilities, extensive product portfolios, and strategic investments have allowed them to retain market leadership.

|

Company Name |

Established |

Headquarters |

Revenue (USD Bn) |

R&D Expenditure |

|

Finisar Corporation |

1988 |

California, USA |

||

|

II-VI Incorporated |

1971 |

Pennsylvania, USA |

||

|

Broadcom Inc. |

1961 |

California, USA |

||

|

Lumentum Holdings Inc. |

2015 |

California, USA |

||

|

Sony Corporation |

1946 |

Tokyo, Japan |

USA Optoelectronics Industry Analysis

Market Growth Drivers

- Increased Demand for Communication Systems: The USA's optoelectronics market is seeing strong growth driven by the rising demand for advanced communication systems. In 2024, the U.S. telecommunications industry is undergoing major advancements, with fiber optics playing a critical role. Data from the U.S. Bureau of Economic Analysis shows that telecommunications services in the U.S. contributed over $600 billion to the GDP in 2022, with photonics-enabled communication systems facilitating high-speed data transmission. This growth is supported by government initiatives like the Federal Communication Commission's (FCC) $20.4 billion Rural Digital Opportunity Fund, aimed at improving rural broadband networks.

- Advancements in Display Technologies: Display technology advancements are fueling demand in the USA's optoelectronics sector, with innovations in OLED and microLED displays being at the forefront. According to the U.S. International Trade Commission, imports of display technology-related components amounted to $20 billion in 2023, highlighting the growing need for higher-resolution, energy-efficient displays. Consumer electronics like smartphones and TVs are major applications, with the global supply of OLED panels being bolstered by semiconductor innovations. The shift to foldable and flexible displays also contributes to the sectors expansion.

- Expansion of 5G Networks: The rollout of 5G networks is a key driver of the optoelectronics market, requiring advanced photonic components for high-speed, low-latency communication. The U.S. governments investment of over $2 billion into 5G infrastructure in 2023 is fueling demand for optical transceivers and photonic integrated circuits. These components are essential for handling the increased data loads expected with widespread 5G adoption. According to the FCC, 5G deployment will cover 70% of the U.S. population by the end of 2024, driving optoelectronic component demand across telecommunications.

Market Challenges

- High Costs of R&D: R&D costs in optoelectronics are a challenge, with the U.S. spending over $150 billion on technology development in 2023, according to the National Science Foundation. This high cost is particularly notable in the development of cutting-edge photonic devices, which require substantial capital for innovation and prototyping. The challenge is amplified by the need for high-precision manufacturing processes and cleanroom environments, making it difficult for smaller companies to compete in this space.

- Complexity in Integration of Optical Components: The complexity involved in integrating optical components with existing electronic systems remains a challenge in the U.S. optoelectronics market. The industry faces difficulties in aligning optical and electronic systems to meet performance standards, particularly in high-frequency applications like 5G and quantum computing. According to a 2023 report from the National Institute of Standards and Technology, over $10 billion has been spent on solving integration issues in photonic-electronic convergence, but barriers remain due to differences in material properties and signal transmission methods.

USA Optoelectronics Market Future Outlook

Over the next five years, the USA Optoelectronics market is expected to see substantial growth, driven by continuous advancements in photonic technologies and the increasing demand for energy-efficient solutions. The expansion of 5G networks, smart cities, and the growing adoption of autonomous vehicles are anticipated to be key growth drivers. Moreover, the healthcare industry's shift toward advanced imaging and diagnostic tools will further fuel the demand for optoelectronics components.

Market Opportunities

- Adoption in Autonomous Vehicle Industry: The growing use of optoelectronics in the U.S. autonomous vehicle industry represents a significant opportunity. In 2024, the U.S. Department of Transportation allocated over $1 billion to support autonomous vehicle research, with a strong focus on LIDAR systems, which rely on advanced photonic technology. LIDAR is expected to be integral to vehicle safety and navigation systems, and its adoption in self-driving cars is forecasted to grow exponentially. Current testing in multiple states, including California and Arizona, highlights the expanding role of optoelectronics in automotive technologies.

- Growing Focus on Renewable Energy: The U.S. government's increased emphasis on renewable energy creates opportunities for optoelectronics, particularly in photovoltaic systems. According to the U.S. Energy Information Administration, photovoltaic systems accounted for 4% of the U.S. energy supply in 2023, and the governments $370 billion climate package, signed in 2022, aims to boost solar energy production. Optoelectronics components, such as laser-based sensors and high-efficiency solar cells, are expected to play a vital role in this transformation, with continued investments in clean energy infrastructure driving demand.

Scope of the Report

|

LED Devices Image Sensors Infrared Components Optocouplers |

|

|

By Application |

Consumer Electronics Telecommunications Healthcare, Automotive Aerospace & Defense |

|

By Material Type |

Gallium Nitride (GaN) Silicon Carbide (SiC) Gallium Arsenide (GaAs) |

|

By End User |

Industrial Residential Commercial |

|

By Region |

North East West South |

Products

Key Target Audience

Optoelectronics Manufacturers

Semiconductor Equipment Companies

Consumer Electronics Firms

Telecommunications Providers

Automotive Manufacturers

Aerospace & Defense Contractors

Government and Regulatory Bodies (Federal Communications Commission, National Institute of Standards and Technology)

Banks and Financial Instittutes

Investment and Venture Capitalist Firms

Companies

Major Players in the USA Optoelectronics Market

Finisar Corporation

II-VI Incorporated

Broadcom Inc.

Lumentum Holdings Inc.

Sony Corporation

Texas Instruments Inc.

Samsung Electronics Co. Ltd.

Omnivision Technologies, Inc.

Hamamatsu Photonics K.K.

OSRAM Licht AG

Toshiba Corporation

ON Semiconductor

Panasonic Corporation

Teledyne Technologies Incorporated

Newport Corporation

Table of Contents

1. USA Optoelectronics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Optoelectronics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Optoelectronics Market Analysis

3.1. Growth Drivers (Photonics Innovations, Consumer Electronics Demand, Fiber Optic Growth)

3.1.1. Expanding Application in Telecommunications

3.1.2. Rising Demand for Smart Devices

3.1.3. Increasing Use in Automotive and Aerospace

3.2. Market Challenges (High Production Costs, Integration Challenges, Supply Chain Constraints)

3.2.1. Technological Complexity

3.2.2. High R&D Investment

3.2.3. Scalability Issues in Production

3.3. Opportunities (Energy-Efficient Technologies, Miniaturization, Government Investments in 5G)

3.3.1. Adoption in Smart Cities

3.3.2. Growing Use in Healthcare for Diagnostic Equipment

3.3.3. Government Incentives for Sustainable Technologies

3.4. Trends (Optical Sensing, Integration with IoT, Photonic Computing)

3.4.1. Adoption of Photonic Technologies in Computing

3.4.2. Rising Demand for OLED Displays

3.4.3. Use of Infrared Components in Security Systems

3.5. Government Regulation (Energy Efficiency Compliance, Industry Certifications, Patent Regulation)

3.5.1. RoHS Compliance

3.5.2. Intellectual Property Protection

3.5.3. Energy Efficiency Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Optoelectronics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. LED Devices

4.1.2. Image Sensors

4.1.3. Infrared Components

4.1.4. Optocouplers

4.2. By Application (In Value %)

4.2.1. Consumer Electronics

4.2.2. Telecommunications

4.2.3. Healthcare

4.2.4. Automotive

4.2.5. Aerospace & Defense

4.3. By Technology (In Value %)

4.3.1. Photonic Technologies

4.3.2. Fiber Optic Communication

4.3.3. Laser Diodes

4.3.4. OLED Displays

4.4. By Material Type (In Value %)

4.4.1. Gallium Nitride (GaN)

4.4.2. Gallium Arsenide (GaAs)

4.4.3. Silicon Carbide (SiC)

4.4.4. Indium Phosphide (InP)

4.5. By Region (In Value %)

4.5.1. West

4.5.2. East

4.5.3. North

4.5.4. South

5. USA Optoelectronics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Finisar Corporation

5.1.2. Broadcom Inc.

5.1.3. Lumentum Holdings Inc.

5.1.4. II-VI Incorporated

5.1.5. Sony Corporation

5.1.6. Texas Instruments Inc.

5.1.7. Omnivision Technologies, Inc.

5.1.8. Samsung Electronics Co. Ltd.

5.1.9. Hamamatsu Photonics K.K.

5.1.10. Toshiba Corporation

5.1.11. ON Semiconductor

5.1.12. OSRAM Licht AG

5.1.13. Panasonic Corporation

5.1.14. Teledyne Technologies Incorporated

5.1.15. Newport Corporation

5.2. Cross Comparison Parameters (Revenue, Headquarters, Inception Year, R&D Expenditure, Product Portfolio, Patents, Market Cap, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. USA Optoelectronics Market Regulatory Framework

6.1. Industry Standards (RoHS Compliance, Energy Star Certification)

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Optoelectronics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Optoelectronics Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. USA Optoelectronics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we identify and map key stakeholders in the USA Optoelectronics Market through extensive desk research. This includes understanding the major technological advancements and key market drivers, such as increasing demand for LED lighting and photonic communication devices. Proprietary databases and government reports are utilized to gather essential industry data.

Step 2: Market Analysis and Construction

This phase focuses on compiling historical data to evaluate the market’s growth over the past five years. We analyze the product penetration of LEDs and other optoelectronic devices in various end-user industries, along with the sales figures of key market players. This data is then used to construct revenue models and market growth projections.

Step 3: Hypothesis Validation and Expert Consultation

We consult with industry professionals via computer-assisted telephone interviews (CATIs) to validate the hypotheses generated in the earlier stages. These interviews provide insight into operational trends and financial forecasts, allowing us to refine our research methodology and ensure the accuracy of the findings.

Step 4: Research Synthesis and Final Output

In the final phase, we synthesize all the gathered data and perform a detailed analysis of the competitive landscape, regulatory framework, and future opportunities. The output includes validated market size estimates, growth drivers, and detailed segmentation, ensuring a comprehensive report that reflects the current market dynamics.

Frequently Asked Questions

01. How big is the USA Optoelectronics Market?

The USA Optoelectronics market is valued at USD 5 billion, with strong growth driven by advancements in LED technology, fiber optics, and increasing demand for efficient communication systems.

02. What are the challenges in the USA Optoelectronics Market?

Challenges in the USA Optoelectronics market include high R&D costs, integration complexities with existing systems, and supply chain disruptions, which can affect the timely delivery of key optoelectronic components.

03. Who are the major players in the USA Optoelectronics Market?

Key players in the USA Optoelectronics market include Finisar Corporation, II-VI Incorporated, Broadcom Inc., Lumentum Holdings Inc., and Sony Corporation. These companies dominate the market due to their extensive product portfolios, R&D investments, and global reach.

04. What are the growth drivers of the USA Optoelectronics Market?

The USA Optoelectronics market is propelled by increasing demand for energy-efficient lighting, advancements in communication technologies like 5G, and the growing adoption of optoelectronics in the healthcare sector for diagnostic tools.

05. What are the applications of optoelectronics in the USA market?

Optoelectronic components are widely used in telecommunications, consumer electronics, automotive industries, and healthcare for various applications such as fiber optic communications, LED displays, medical imaging, and more.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.