USA Orthodontics Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD3707

October 2024

94

About the Report

USA Orthodontics Market Overview

- The USA Orthodontics Market is valued at USD 2.85 billion, based on a comprehensive five-year historical analysis. The market is primarily driven by increasing consumer demand for orthodontic treatments such as braces and clear aligners, attributed to a growing awareness of dental aesthetics and oral health. Advancements in orthodontic technology, including digital scanning and 3D printing for custom orthodontic devices, have also fueled the market's growth.

- The market is dominated by cities like Los Angeles, New York, and Chicago, where high disposable incomes and strong access to specialized dental services drive demand for cosmetic orthodontics. These cities also host numerous dental schools and private practices that promote advanced orthodontic care. Furthermore, states with strong healthcare infrastructure and insurance coverage for orthodontic treatments, such as California and Texas, also contribute significantly to the market's dominance.

- The FDA has introduced the Quality Management System Regulation (QMSR) Final Rule, which updates manufacturing requirements for orthodontic devices in the U.S. under 21 CFR Part 820. This amendment is designed to align U.S. regulations with the international ISO 13485:2016 standard for medical devices. The new rule, set to take effect on February 2, 2026, aims to streamline compliance for manufacturers by harmonizing with global standards, ensuring that orthodontic devices meet both U.S. and international quality and safety requirements.

USA Orthodontics Market Segmentation

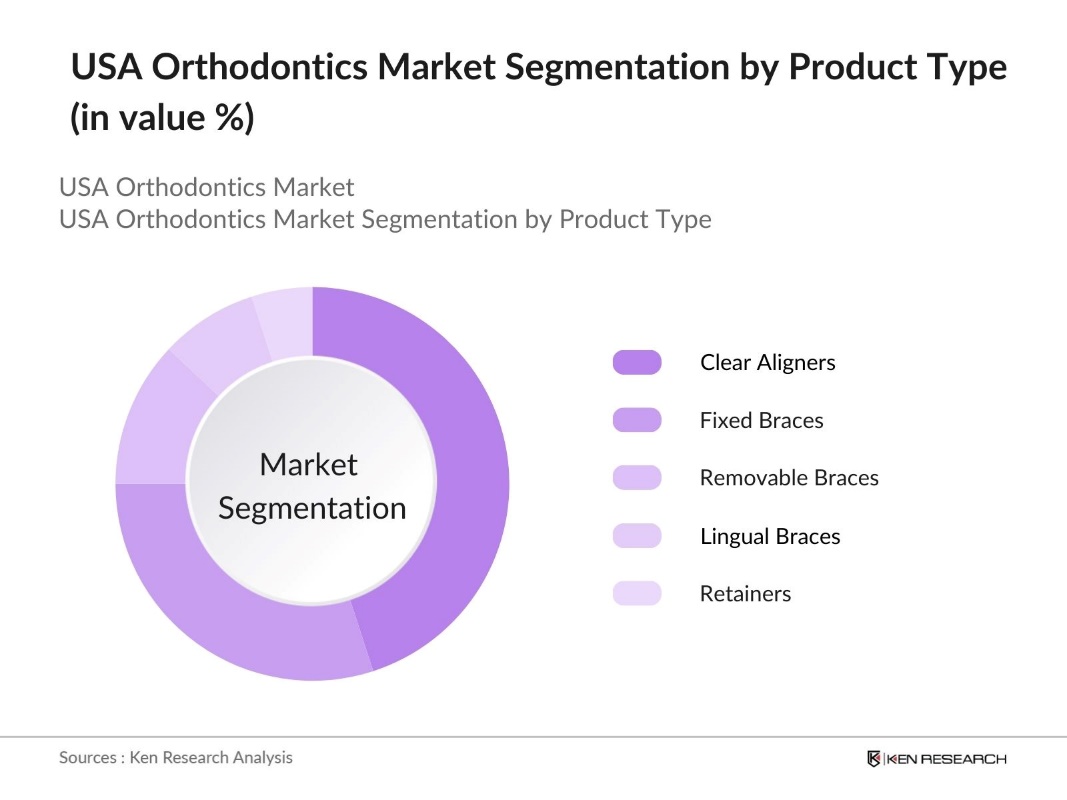

- By Product Type: The USA Orthodontics market is segmented by product type into Fixed Braces, Removable Braces, Lingual Braces, Clear Aligners, and Retainers. Clear aligners dominate the market share under this segmentation due to their aesthetic appeal, comfort, and flexibility. Major brands like Invisalign have popularized these products, which are highly sought after by adults and teenagers who prefer a less noticeable treatment option. The increasing shift towards digital orthodontics, which allows for custom treatment planning, also supports the dominance of this segment.

- By End-User: The USA Orthodontics market is segmented by end-user into Hospitals, Dental Clinics, and Orthodontic Centers. Dental clinics hold the largest share in this segmentation as they provide specialized services that cater to the increasing demand for personalized orthodontic treatments. The availability of advanced orthodontic equipment and expert practitioners in clinics enhances patient satisfaction and drives growth in this segment.

USA Orthodontics Market Competitive Landscape

The USA Orthodontics market is dominated by a few major players, including globally renowned companies and specialized orthodontic manufacturers. The consolidation within the market highlights the significant influence of these key players, which are known for their extensive product portfolios, technological innovations, and strong market presence.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

No. of Patents |

R&D Investments |

Revenue (USD Bn) |

Market Presence |

Strategic Partnerships |

|

Align Technology |

1997 |

San Jose, CA |

||||||

|

Ormco Corporation |

1960 |

Orange, CA |

||||||

|

3M Company |

1902 |

St. Paul, MN |

||||||

|

Henry Schein |

1932 |

Melville, NY |

||||||

|

Dentsply Sirona |

1899 |

Charlotte, NC |

USA Orthodontics Industry Analysis

Growth Drivers

- Increasing Prevalence of Dental Malocclusions: The USA has seen a rising prevalence of dental malocclusions individuals undergoing orthodontic treatment each year. According to the American Association of Orthodontists (AAO), the demand for orthodontic services has grown significantly due to the rising incidence of malocclusions, particularly among children and adolescents. Malocclusion is one of the most prevailing clinical dental conditions, affecting approximately 60 to 75 percent of the global population. Annually, approximately 21 million people globally elect treatment by orthodontists. This has driven the need for orthodontic intervention, emphasizing the role of specialized dental care in the broader healthcare landscape.

- Increased Awareness Regarding Oral Hygiene: Increased awareness about oral hygiene, largely driven by public health campaigns, has led to a higher demand for orthodontic services. A recent survey indicated that 75% of adults brush their teeth multiple times each day, and 60% routinely use mouthwash. This awareness has led to a rise in preventative orthodontic treatments, as more individuals seek to correct dental issues early. Public health initiatives by bodies such as the CDC have contributed to educating the population about the long-term benefits of maintaining proper dental alignment.

- Technological Advancements in Orthodontics (3D Imaging, Digital Scanning): Technological innovations in orthodontics are transforming the way treatments are delivered, leading to more efficient and precise outcomes. The increasing use of 3D imaging allows for more accurate diagnosis and tailored treatment plans, while digital scanning techniques enhance patient comfort by eliminating the need for traditional molds. These advancements are not only improving the overall patient experience but also enabling orthodontists to provide faster and more accurate treatments.

Market Challenges

- High Treatment Costs: Orthodontic treatments are known to be expensive, making them inaccessible to a large portion of the population. The high cost of procedures such as braces and invisible aligners presents a significant barrier, especially for individuals and families with limited financial resources. Without more affordable options or enhanced healthcare reimbursement policies, many people may continue to be unable to pursue necessary orthodontic care.

- Lack of Insurance Coverage for Cosmetic Procedures: Many cosmetic orthodontic treatments, such as invisible aligners and veneers, are not typically covered by insurance plans. This lack of coverage limits the number of patients who can afford these aesthetic treatments, as they are often considered elective and require out-of-pocket payments. Without financial support from insurance, the high cost of these procedures becomes a barrier for many individuals, particularly those seeking treatment for purely cosmetic reasons.

USA Orthodontics Market Future Outlook

Over the next five years, the USA Orthodontics market is expected to witness significant growth, driven by the increasing demand for aesthetic dental solutions, the rise of digital orthodontics, and advancements in clear aligner technology. Furthermore, the market is set to benefit from the growing acceptance of orthodontic treatments among adult patients, who seek discreet and convenient options like invisible aligners.

Market Opportunities

- Growing Adoption of Invisible Aligners: Invisible aligners are becoming increasingly popular due to their aesthetic appeal and convenience. Unlike traditional metal braces, these aligners offer a more discreet treatment option, making them especially attractive to adults and teenagers. The growing preference for aligners over braces has created new opportunities for orthodontic practices and manufacturers to meet the rising demand. As more people seek out these innovative solutions, the market is experiencing a notable shift towards aligner-based treatments.

- Expansion of Dental Clinics and Orthodontic Centers: The growing number of dental clinics and orthodontic centers, particularly in urban and suburban areas, is improving access to orthodontic care. As more clinics expand their services to include specialized orthodontics, patients have more options for treatment. This expansion is driven by investments in healthcare infrastructure and the increasing presence of dental clinic chains, making orthodontic services more widely available. As a result, more people are able to access the orthodontic treatments they need, contributing to the overall growth of the market.

Scope of the Report

|

Product Type |

Fixed Braces Removable Braces Lingual Braces Clear Aligners Retainers |

|

End-User |

Hospitals Dental Clinics Orthodontic Centers |

|

Age Group |

Children Teenagers Adults |

|

Distribution Channel |

Offline Online |

|

Region |

North East Midwest South West |

Products

Key Target Audience

Teledentistry Companies

3D Printing Companies for Dental Devices

Orthodontic Device Manufacturers

Clear Aligner Companies

Investors and Venture Capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (FDA, ADA)

Companies

Major Players

Align Technology

Ormco Corporation

3M Company

Henry Schein

Dentsply Sirona

G&H Orthodontics

Rocky Mountain Orthodontics

Great Lakes Orthodontics

TP Orthodontics

American Orthodontics

Dynaflex

Dentaurum

Straumann Group

ClearCorrect

Forestadent

Table of Contents

1. USA Orthodontics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Orthodontics Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Orthodontics Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Dental Malocclusions

3.1.2. Rising Demand for Cosmetic Dentistry

3.1.3. Technological Advancements in Orthodontics (3D Imaging, Digital Scanning)

3.1.4. Increased Awareness Regarding Oral Hygiene

3.2. Market Challenges

3.2.1. High Treatment Costs

3.2.2. Lack of Insurance Coverage for Cosmetic Procedures

3.2.3. Limited Access to Orthodontic Care in Rural Areas

3.3. Opportunities

3.3.1. Growing Adoption of Invisible Aligners

3.3.2. Expansion of Dental Clinics and Orthodontic Centers

3.3.3. Increasing Use of AI in Treatment Planning

3.4. Trends

3.4.1. Integration of Digital Dentistry Solutions

3.4.2. Adoption of Clear Aligners Over Traditional Braces

3.4.3. Rise in Teledentistry and Virtual Consultations

3.5. Government Regulation

3.5.1. FDA Approvals for Orthodontic Devices

3.5.2. American Dental Association (ADA) Guidelines

3.5.3. HIPAA Compliance for Digital Records

3.5.4. Reimbursement Policies for Orthodontic Procedures

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Orthodontics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fixed Braces

4.1.2. Removable Braces

4.1.3. Lingual Braces

4.1.4. Clear Aligners

4.1.5. Retainers

4.2. By End-User (In Value %)

4.2.1. Hospitals

4.2.2. Dental Clinics

4.2.3. Orthodontic Centers

4.3. By Age Group (In Value %)

4.3.1. Children

4.3.2. Teenagers

4.3.3. Adults

4.4. By Distribution Channel (In Value %)

4.4.1. Offline (Dental Clinics, Orthodontic Centers)

4.4.2. Online

4.5. By Region (In Value %)

4.5.1. North East

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Orthodontics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Align Technology

5.1.2. Ormco Corporation

5.1.3. 3M Company

5.1.4. Dentsply Sirona

5.1.5. Henry Schein

5.1.6. G&H Orthodontics

5.1.7. Rocky Mountain Orthodontics

5.1.8. Great Lakes Orthodontics

5.1.9. TP Orthodontics

5.1.10. American Orthodontics

5.1.11. Dynaflex

5.1.12. Dentaurum

5.1.13. Straumann Group

5.1.14. ClearCorrect

5.1.15. Forestadent

5.2 Cross Comparison Parameters (Revenue, No. of Patents, Product Portfolio, Market Presence, Regional Dominance, R&D Investments, Employee Strength, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Orthodontics Market Regulatory Framework

6.1 FDA Regulations for Orthodontic Products

6.2 Compliance with ADA Standards

6.3 Certification Processes for Orthodontists

6.4 Health Insurance Portability and Accountability Act (HIPAA) Compliance

7. USA Orthodontics Market Future Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Orthodontics Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Age Group (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. USA Orthodontics Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 White Space Opportunity Analysis

9.4 Marketing Initiatives

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Orthodontics Market. Extensive desk research was conducted using secondary and proprietary databases to gather comprehensive industry-level information. The primary objective was to identify critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data related to the USA Orthodontics Market. This included assessing the market penetration of orthodontic services, revenue generation across different segments, and the performance of key industry players.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with orthodontic practitioners and industry experts. These interviews provided operational insights that refined the accuracy of our data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with orthodontic device manufacturers and dental service providers to acquire detailed insights into product segments, sales performance, and market trends, ensuring a comprehensive and validated analysis of the market.

Frequently Asked Questions

01. How big is the USA Orthodontics Market?

The USA Orthodontics Market is valued at USD 2.85 billion, driven by the increasing adoption of clear aligners, rising consumer awareness about dental health, and advancements in orthodontic technologies.

02. What are the challenges in the USA Orthodontics Market?

Challenges in the USA Orthodontics market include high treatment costs, limited insurance coverage for cosmetic procedures, and the growing competition from teledentistry and DIY orthodontic kits.

03. Who are the major players in the USA Orthodontics Market?

Key players in the USA Orthodontics Market include Align Technology, Ormco Corporation, 3M Company, Henry Schein, and Dentsply Sirona. These companies dominate due to their innovative products and extensive market presence.

04. What are the growth drivers of the USA Orthodontics Market?

The USA Orthodontics Market is propelled by increasing demand for aesthetic orthodontic treatments, technological advancements in clear aligners, and the rise in adult orthodontics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.