USA OTT Media Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD2419

December 2024

90

About the Report

USA OTT Media Market Overview

- The USA OTT (Over-the-Top) media market is expected to reach a market size of USD 128 bn in 2023. The market has seen significant growth over the past few years, driven by the shift in consumer behavior toward digital content consumption. This growth is supported by the increased penetration of high-speed internet and mobile devices, which have allowed consumers to access content from platforms like Netflix, Amazon Prime, and Hulu with ease.

- The key players dominating the USA OTT media market include major platforms like Netflix, Amazon Prime Video, Hulu, Disney+, and HBO Max. These companies hold a significant share due to their vast content libraries, original productions, and advanced subscription models. Netflix remains a frontrunner with its strong focus on original content, followed by Amazon Prime and Disney+, which have leveraged exclusive partnerships with renowned studios. Each platform is competing to secure its market share through innovative pricing models and technology-driven viewer experiences.

- In 2023, Disney+ witnessed significant growth in its ad-supported tier, which attracted 5.2 million subscribers. The platform saw a 35% increase in engagement from March to September 2023, as new content releases like original shows and live sports drove higher audience participation. Notably, 89% of viewers expressed a willingness to watch ads if it allowed access to content they enjoyed. These developments highlight Disney+'s strategy to balance subscriber growth with ad revenue generation in the AVOD market.

- Major cities such as Los Angeles, New York, and San Francisco dominate the OTT media market in the USA due to their tech-savvy populations, high internet penetration, and thriving entertainment industries. Los Angeles, home to Hollywood, remains a hub for content production, contributing to the OTT markets growth. New York, with its dense population and fast internet connectivity, serves as a major consumption hub for OTT services. These cities not only lead in terms of user base but also content production and distribution.

USA OTT Media Market Segmentation

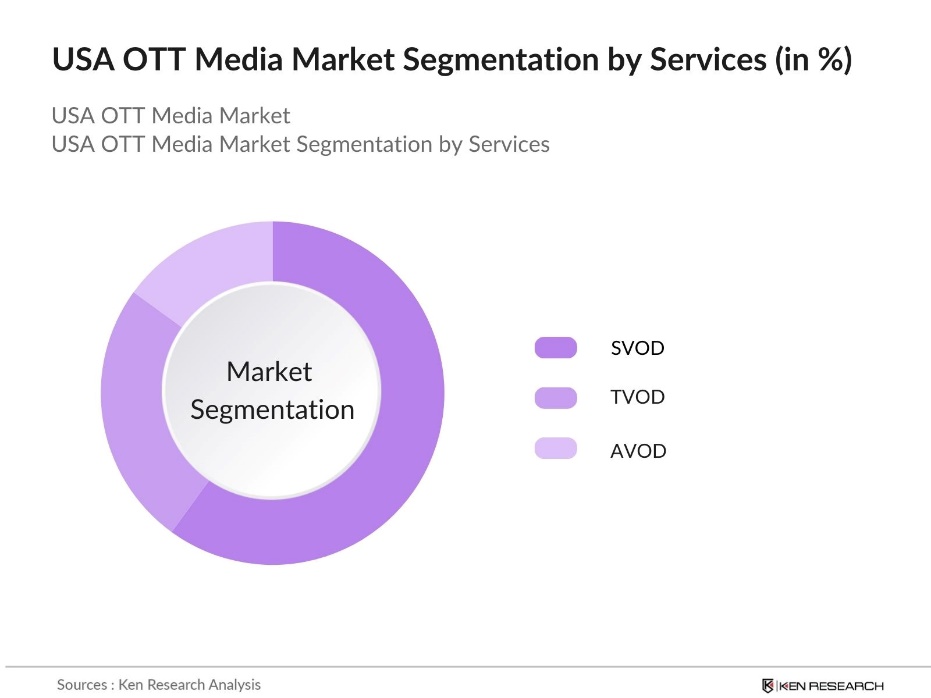

By Service Type: The USA OTT media market is segmented by service type into Subscription-based (SVOD), Transaction-based (TVOD), and Ad-supported (AVOD) services. In 2023, SVOD services dominated the market. This is largely due to the success of platforms like Netflix, Disney+, and Hulu, which have cultivated large subscriber bases through exclusive content and flexible subscription packages. The SVOD model allows users to access a wide variety of content without commercials, making it a preferred choice for premium content consumers.

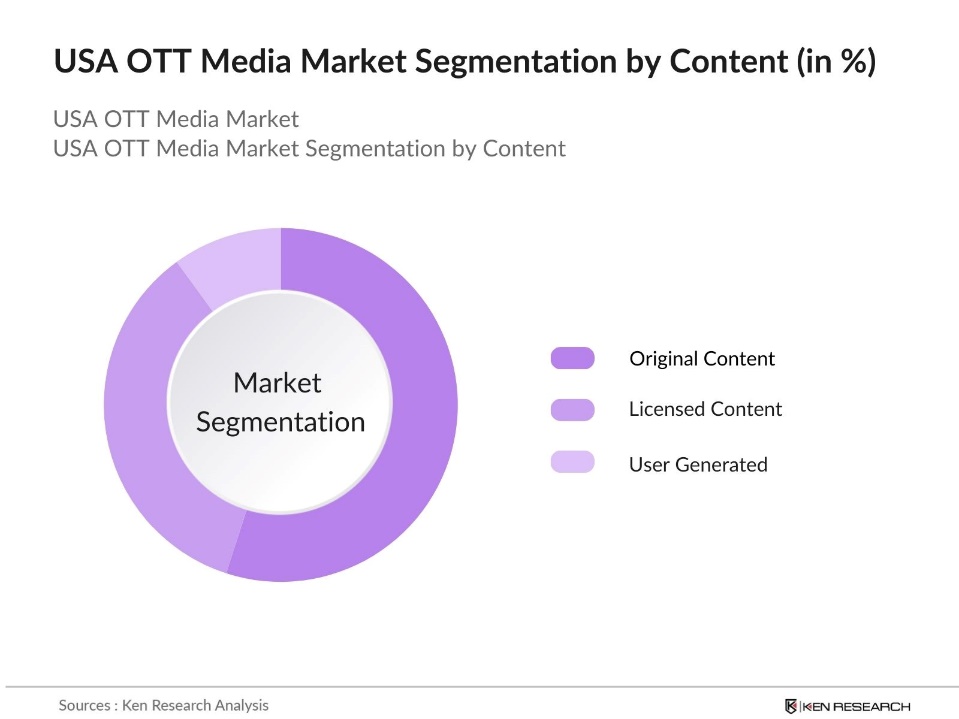

By Content Type: The USA OTT market is also segmented by content type into Original Content, Licensed Content, and User-generated Content. In 2023, Original Content emerged as the leading segment. The preference for original content can be attributed to the investments made by platforms like Netflix and Amazon Prime Video in creating exclusive, high-quality series and films. Licensed content continues to play a vital role but is slowly being overshadowed by platforms focusing on proprietary productions to retain and attract new subscribers.

By Region: The USA OTT market is segmented into North, South, East, and West regions. In 2023, the West region led the market. This dominance is not only due to contribution to high content consumption but also it serves as hubs for OTT content production and technology innovation. The North and East regions follow closely behind, driven by tech hubs and high-speed internet connectivity. The South region, while growing, still lags behind due to lower internet penetration in rural areas.

USA OTT Media Market Competitive Landscape

|

Company |

Year of Establishment |

Headquarters |

|---|---|---|

|

Netflix |

1997 |

Los Gatos, CA |

|

Amazon Prime |

2005 |

Seattle, WA |

|

Hulu |

2007 |

Santa Monica, CA |

|

Disney+ |

2019 |

Burbank, CA |

|

HBO Max |

2020 |

New York, NY |

- Netflix: In January 2024, Netflix revealed that its ad-supported tier reached 23 million monthly active users, up from 15 million in late 2023. This growth is driven by its lower-cost subscription plan, which attracts 30% of new subscribers. Additionally, 85% of ad-tier users spend over two hours daily on the platform.

- Amazon Prime: In 2024, Amazon Prime Video continues to focus on enhancing its OTT platform by investing in genre-specific original content, such as the release of The Wheel of Time and The Lord of the Rings series. These high-budget productions target dedicated fanbases, aiming to strengthen Amazon's position in the OTT market and attract a growing subscriber base. The company also explores partnerships and advanced technological innovations for improved streaming experiences.

USA OTT Media Market Analysis

Growth Drivers

- High Penetration of Smart Devices: The increasing use of smart devices, including smart TVs and mobile devices, has significantly driven OTT adoption in the USA. Consumers now prefer streaming content directly on these devices, with approximately half of OTT content being consumed through mobile or TV apps in 2024. This rise in device compatibility has enabled a seamless content experience, driving higher engagement.

- Flexible Subscription Models: Subscription video-on-demand (SVoD) services, such as those offered by Netflix and Amazon Prime, have grown rapidly due to their affordability and flexible pricing models. By the start 2024, nearly 30% of new subscribers opted for ad-supported tiers, further driving user growth. The availability of various subscription packages tailored to different user preferences continues to boost market adoption.

- Growth of Ad-Supported Video-on-Demand (AVOD): The AVOD model has seen significant growth in the USA, particularly as more consumers opt for free or low-cost streaming options. Platforms like Peacock and Tubi, which offer free content supported by ads, reported a major increase in user base in 2023, according to internal company data. In addition, advertising revenue in the OTT space reached $18 billion in 2023, driven by the AVOD model. As advertisers recognize the potential of targeted ads, this revenue stream is expected to grow by 10% annually through 2025, further driving the OTT markets expansion.

Market Challenges

- Content Piracy and Illegal Streaming: Content piracy remains a significant challenge for the OTT industry in the USA. This challenge is particularly detrimental to premium content platforms like Netflix and Disney+, which invest heavily in original content. Despite technological advancements in digital rights management (DRM), piracy continues to be a pervasive issue, creating barriers to monetizing content effectively.

- Rising Content Acquisition Costs: Content acquisition and production costs have surged in recent years, impacting the profitability of OTT platforms. As the competition for exclusive content intensifies, OTT platforms are facing increased pressure to secure top-tier talent and exclusive licensing deals. This rise in content costs has led some platforms to raise subscription prices, which could alienate price-sensitive consumers.

Government Initiatives

- Affordable Connectivity Program (ACP): The Affordable Connectivity Program (ACP) is a U.S. government initiative aimed at making broadband more affordable for low-income households. It provides eligible consumers with a discount of up to $30 per month for internet services, and up to $75 in high-cost areas. It also offers a one-time discount of up to $100 to purchase a laptop, desktop, or tablet through participating providers. The program helps to bridge the digital divide and expand internet access across the country.

- Digital Accessibility Act (2024): The Digital Accessibility Initiative involves evolving regulations under the Americans with Disabilities Act (ADA) and the Web Content Accessibility Guidelines (WCAG). In April 2024, the U.S. Department of Justice finalized regulations to improve web and mobile app accessibility for state and local governments under ADA Title II. This initiative aims to ensure that digital platforms, including OTT services, are accessible to all users, including those with disabilities.

USA OTT Media Market Future Outlook

The USA OTT Media market is projected to grow exponentially in coming years. This growth will be driven by high penetration of smart devices, flexible subscription models and surge in original and localized content production.

Future Trends

- Increased Focus on Niche Content: By 2028, the USA OTT media market is expected to see a shift toward niche content offerings, as platforms seek to differentiate themselves in an increasingly saturated market. Niche platforms focusing on genres like horror, documentaries, or international films are likely to attract dedicated user bases. Services like Shudder and Crunchyroll, which specialize in horror and anime content, respectively, are projected to grow significantly as more viewers opt for highly specialized content that traditional platforms do not offer.

- Integration of Augmented Reality (AR) and Virtual Reality (VR): The future of OTT content is expected to include AR and VR integration to create more immersive viewing experiences. By 2028, platforms like Netflix and Amazon Prime Video are likely to introduce AR/VR-compatible content, allowing users to engage with content in entirely new ways.

Scope of the Report

|

By Service Type |

Subscription-based (SVOD) Transaction-based (TVOD) Ad-supported (AVOD) |

|

By Content Type |

Original Content Licensed Content User-generated Content |

|

By Region |

North South East West |

|

By Revenue Model |

Subscription-Based Model |

|

By Platform Type |

Mobile Applications |

Products

Key Target Audience

OTT Platform Operators

Advertising Agencies

Telecom Companies

Broadband Service Providers

Content Creators and Studios

Technology Solution Providers

Media and Entertainment Companies

Smart TV Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC)

Companies

Players Mentioned in the Report:

Netflix

Amazon Prime Video

Hulu

Disney+

HBO Max

Roku

Apple TV+

YouTube TV

Peacock

Paramount+

Discovery+

Tubi

Sling TV

Crackle

Pluto TV

Table of Contents

1. USA OTT Media Market Overview

1.1 Definition and Scope of OTT Media

1.2. Market Taxonomy (Service Type, Content Type, Revenue Model)

1.3. Market Growth Rate (Historical and Current)

1.4. Market Segmentation Overview (By Service Type, By Content Type, By Revenue Model, By Platform, By Region)

1.5. Key Market Developments (Technological Advancements, Strategic Alliances, Regulatory Impact)

1.6. Macroeconomic Indicators Impacting OTT Media (GDP, Internet Penetration, Mobile Usage)

2. USA OTT Media Market Size (in USD)

2.1. Historical Market Size (Growth and Expansion Over 5 Years)

2.2. Year-on-Year Growth Analysis (Past and Current Year Trends)

2.3. Revenue Breakdown by Service Type (Subscription-Based, Ad-Supported, Transaction-Based)

2.4. Contribution to the Media & Entertainment Industry (OTT vs Traditional Media)

2.5. Key Milestones in Market Growth (Adoption of AVOD, Entry of New Players)

3. USA OTT Media Market Analysis

3.1. Growth Drivers

3.1.1. High Penetration of Smart Devices

3.1.2. Flexible Subscription Models

3.1.3. Surge in Original and Localized Content Production

3.2. Restraints

3.2.1. High Content Production and Licensing Costs

3.2.2. Increasing Competition from New Market Entrants

3.2.3. Content Piracy and Digital Rights Management (DRM) Challenges

3.3. Opportunities

3.3.1. Expansion into Underserved Regions (Rural Broadband Penetration)

3.3.2. Growth of Hybrid Revenue Models (Subscription + Ad-Supported)

3.3.3. Strategic Partnerships with Telecom Providers (Bundled OTT Services)

3.4. Recent Trends

3.4.1. Shift Toward Ad-Supported Streaming Models

3.4.2. Increased Focus on Interactive and Immersive Content

3.4.3. Rise of Localized and Culturally Relevant Content

3.5. Government Regulations Impacting OTT

3.5.1. Streaming Tax Initiatives

3.5.2. Digital Accessibility Regulations

3.5.3. Federal and State-Level Net Neutrality Policies

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Value Chain Analysis (Content Creation, Distribution, User Acquisition)

3.8. Stakeholder Ecosystem (Content Creators, OTT Platforms, Consumers, Advertisers)

4. USA OTT Media Market Segmentation

4.1. By Service Type (in Value %)

4.1.1. Subscription Video on Demand (SVOD)

4.1.2. Transaction Video on Demand (TVOD)

4.1.3. Advertising Video on Demand (AVOD)

4.2. By Content Type (in Value %)

4.2.1. Original Content

4.2.2. Licensed Content

4.2.3. User-Generated Content

4.3. By Revenue Model (in Value %)

4.3.1. Subscription-Based Model

4.3.2. Ad-Supported Model

4.3.3. Transactional Model

4.4. By Platform Type (in Value %)

4.4.1. Mobile Applications

4.4.2. Smart TV Apps

4.4.3. Web-Based Platforms

4.5. By Region (in Value %)

4.5.1. West USA (Los Angeles, San Francisco)

4.5.2. East USA (New York, Boston)

4.5.3. South USA (Florida, Texas)

4.5.4. North USA (Chicago, Michigan)

5. Cross Comparison of Major Competitors

5.1. Detailed Profiles of 15 Major Competitors

5.1.1. Netflix

5.1.2. Amazon Prime Video

5.1.3. Hulu

5.1.4. Disney+

5.1.5. HBO Max

5.1.6. YouTube TV

5.1.7. Peacock

5.1.8. Apple TV+

5.1.9. Paramount+

5.1.10. Sling TV

5.1.11. Roku

5.1.12. Pluto TV

5.1.13. Tubi

5.1.14. Discovery+

5.1.15. Crackle

5.2. Cross Comparison Parameters (Market Share, Content Library Size, Subscription Plans, Revenue Model, Headquarters)

6. USA OTT Media Market Competitive Landscape

6.1. Market Share Analysis of Major Players

6.2. Strategic Initiatives (Partnerships, Collaborations, Content Deals)

6.3. Mergers and Acquisitions in the OTT Space

6.4. Investment Analysis (Funding Rounds, IPOs, Venture Capital)

6.4.1. Private Equity and Venture Capital Funding

6.4.2. Government Grants for Broadband Expansion

6.4.3. Corporate Investments in Original Content

7. USA OTT Media Market Regulatory Framework

7.1. Compliance Requirements (Digital Content Distribution Laws)

7.2. Certification Processes for Streaming Platforms

7.3. Intellectual Property Regulations and Copyright Compliance

7.4. Impact of Streaming Tax and Government Mandates

8. Future USA OTT Media Market Projections

8.1. Market Size Projections (in USD)

8.2. Key Growth Drivers for the Next 5 Years (New Technology Adoption, Expanding Content Offerings)

8.3. Anticipated Impact of Regulatory Changes (Net Neutrality, Content Laws)

8.4. Future Challenges (Content Saturation, Competition)

8.5. Future Opportunities (New Content Formats, Global Expansion)

9. USA OTT Media Market Future Segmentation

9.1. By Service Type (SVOD, AVOD, TVOD)

9.2. By Content Type (Original, Licensed, User-Generated)

9.3. By Platform Type (Mobile, TV, Web)

9.4. By Revenue Model (Subscription, Ad-Supported, Transaction-Based)

9.5. By Region (North, South, East, West USA)

10. USA OTT Media Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

10.2. Consumer Cohort Analysis (Viewer Preferences, Subscriber Retention Strategies)

10.3. Strategic Marketing Initiatives (Targeted Advertising, Affiliate Partnerships)

10.4. White Space Opportunity Identification (Emerging Platforms, Untapped Regions)

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping key stakeholders and identifying influential variables within the Asia Pacific Currency Count Machine Market. This step utilizes desk research, drawing from proprietary and secondary databases to establish a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data on the Asia Pacific Currency Count Machine Market, including assessing transaction volumes across various end-use industries. Additionally, service quality metrics are reviewed to ensure reliable revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through industry expert interviews, which provide insights into operational and technological trends. These consultations reinforce market data accuracy and align findings with real-world applications.

Step 4: Research Synthesis and Final Output

The concluding phase engages directly with industry stakeholders to verify and supplement bottom-up data, ensuring a validated, comprehensive analysis of the Asia Pacific Currency Count Machine market. This step synthesizes data from all phases, resulting in a precise market report.

Frequently Asked Questions

1. How big is the USA OTT Media Market?

The USA OTT Media Market was valued at USD 128 billion in 2023. This growth is fueled by the increasing shift toward digital content consumption, expanding broadband infrastructure, and the rising demand for original and localized content.

2. What are the challenges in the USA OTT Media Market?

Key challenges in USA OTT Media Market include rising content production costs, content piracy, and increasing competition among OTT platforms. Additionally, saturation in major urban markets poses a challenge to acquiring new subscribers.

3. Who are the major players in the USA OTT Media Market?

Major players in the USA OTT Media Market include Netflix, Amazon Prime Video, Hulu, Disney+, and HBO Max. These companies lead the market with their extensive content libraries, exclusive offerings, and strong subscriber bases.

4. What are the growth drivers of the USA OTT Media Market?

The USA OTT Media Market is driven by high penetration of smart devices, flexible subscription models and surge in original and localized content production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.