USA Packaged Salads Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD6630

December 2024

100

About the Report

USA Packaged Salads Market Overview

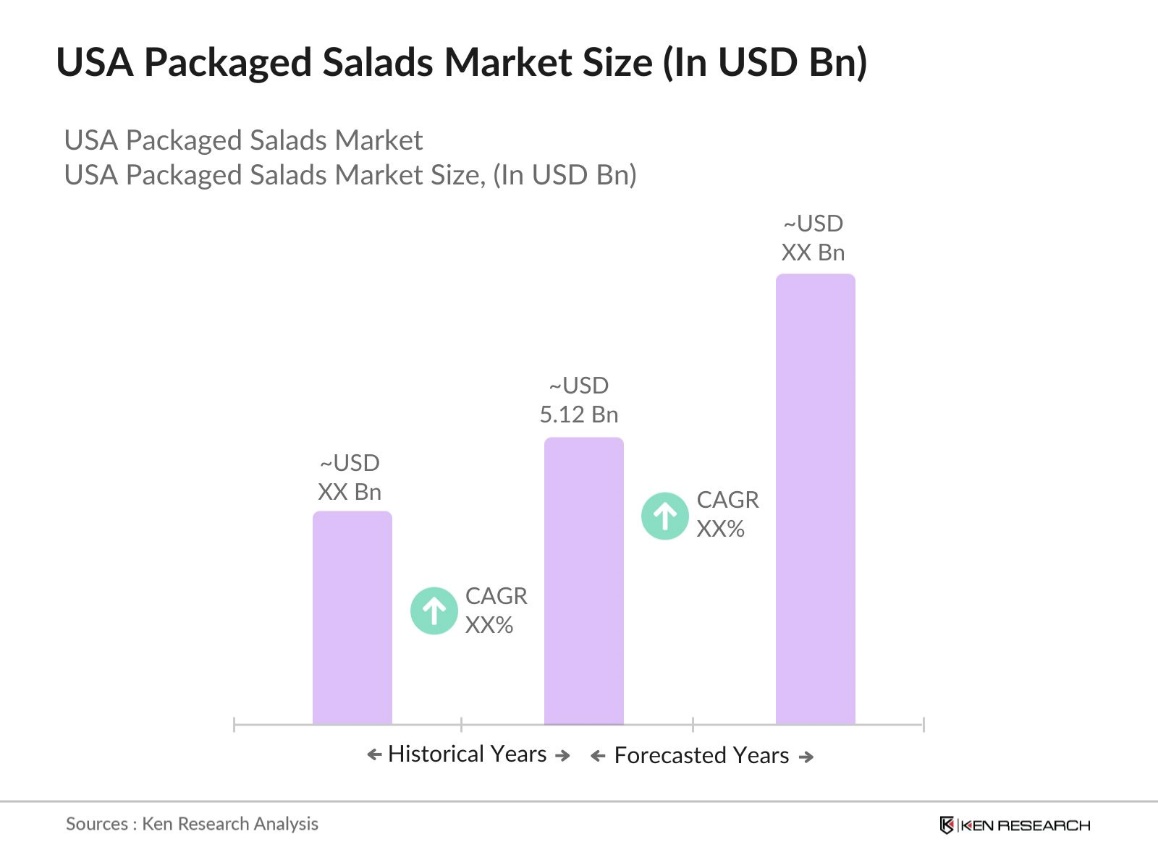

- The USA Packaged Salads Market is valued at USD 5.12 billion, driven by a growing trend towards convenience and healthy eating among consumers. The rise in health-conscious behavior, particularly after the pandemic, has significantly impacted the demand for ready-to-eat, fresh, and nutritious foods. Urbanization and the increasing number of working professionals seeking convenient yet nutritious meal options have played a major role in driving the market.

- The market is dominated by cities like New York, Los Angeles, and Chicago, where a higher population density, coupled with higher disposable incomes and an increasing preference for healthier lifestyle choices, drives demand. These urban hubs also see greater access to organized retail chains, making packaged salads more accessible to consumers. The availability of organic and gourmet salad options is another reason for the dominance of these cities, as they cater to a growing demographic of health-conscious, time-poor consumers who seek premium options.

- U.S. federal and state governments have implemented various sustainability and recycling regulations to reduce waste and encourage the use of eco-friendly materials. In 2023, the U.S. Environmental Protection Agency introduced new guidelines for food packaging waste reduction. These regulations require packaged food producers to increase the recyclability of their packaging, influencing the development of sustainable packaging options for salads.

USA Packaged Salads Market Segmentation

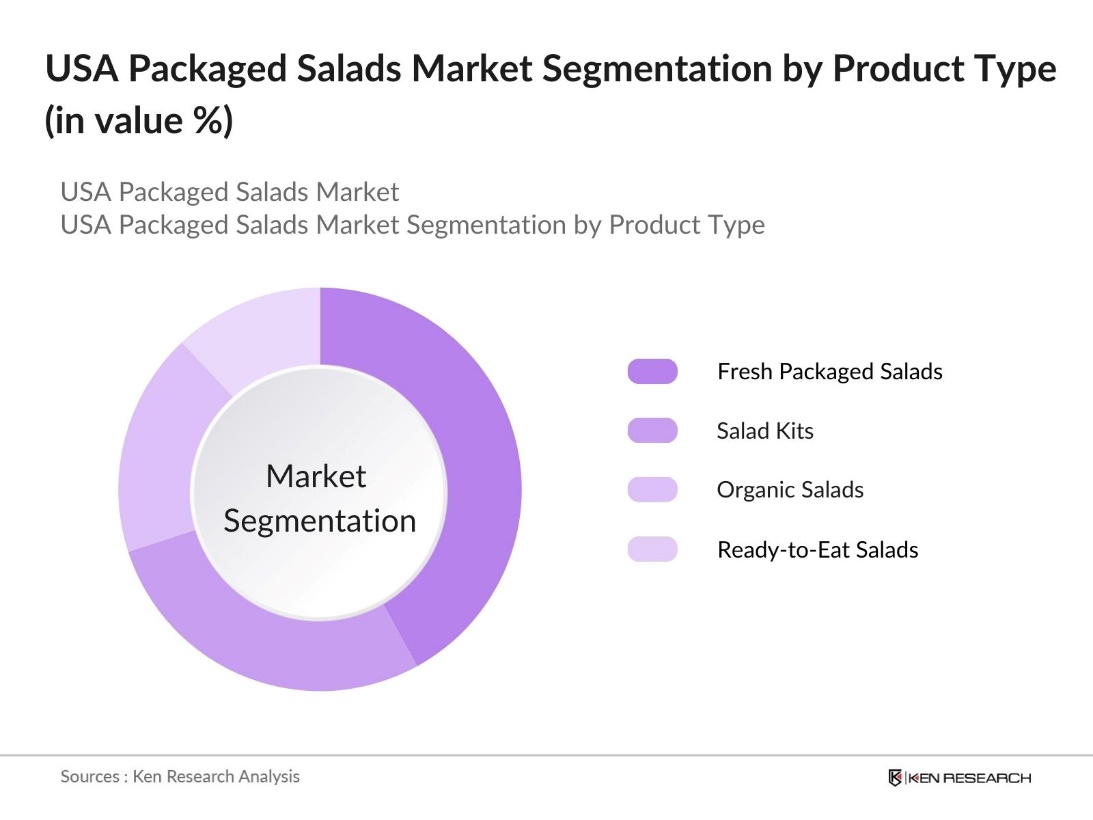

By Product Type: The USA packaged salads market is segmented by product type into fresh packaged salads, salad kits, organic salads, and ready-to-eat salads. Among these, fresh packaged salads dominate due to their convenience and appeal to health-conscious consumers. The increasing awareness regarding fresh produce and clean eating has driven the preference for fresh packaged salads. Brands such as Fresh Express and Taylor Farms have built strong reputations around freshness and variety, contributing to the dominance of this segment.

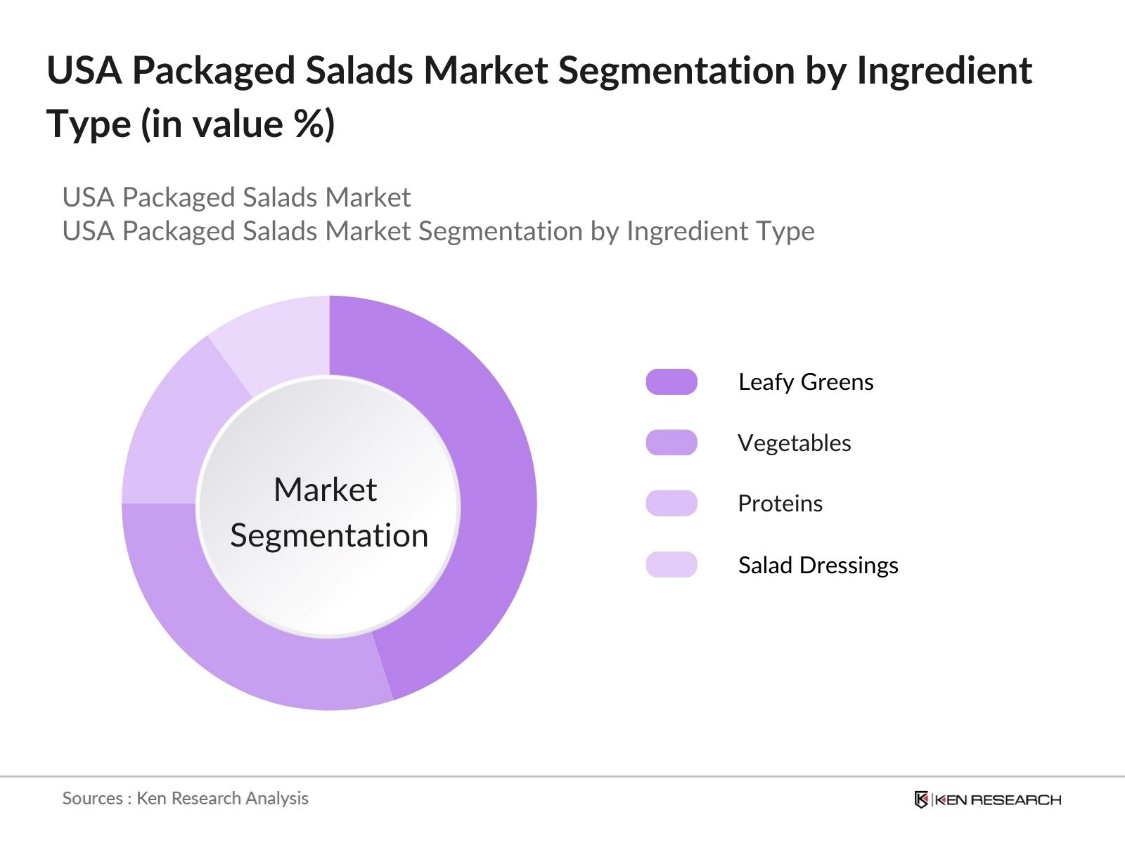

By Ingredient Type: The USA packaged salads market is also segmented by ingredient type, including leafy greens, vegetables, proteins (such as chicken, tofu, and eggs), and salad dressings. The segment of leafy greens leads the market due to their essential role in providing the nutritional base for salads. The demand for dark leafy greens such as spinach, kale, and arugula has surged, driven by their health benefits, which include being rich sources of vitamins and minerals.

USA Packaged Salads Market Competitive Landscape

The market is moderately consolidated, with a few key players dominating the landscape. These companies focus on innovative product offerings, sustainability in packaging, and expanding distribution networks. The market is characterized by a combination of global food giants and local, health-focused brands, all competing to meet the evolving consumer demand for fresh, convenient, and nutritious products.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue |

Product Portfolio |

Sustainability Initiatives |

Distribution Networks |

Digital Integration |

|

Fresh Express |

1926 |

Salinas, California |

||||||

|

Dole Food Company |

1851 |

Westlake Village, CA |

||||||

|

Taylor Farms |

1995 |

Salinas, California |

||||||

|

Earthbound Farm |

1984 |

San Juan Bautista, CA |

||||||

|

Ready Pac Foods |

1969 |

Irwindale, California |

USA Packaged Salads Industry Analysis

Growth Drivers

- Growth of Organic and Natural Products: The market for organic and natural products in the USA, including packaged salads, continues to grow significantly. Consumers increasingly prefer products with clean labels, and according to the Organic Trade Association, organic food sales in the United States reached $61.7 billion in 2022, marking a significant milestone as it accounted for 6% of total food sales. The demand for organic certification in packaged salads, ensuring no synthetic chemicals are used, is a key driver.

- Expansion of Retail and Online Channels: The retail and e-commerce sectors in the USA have experienced significant expansion, with 2023 marking a sharp rise in online grocery sales. In April 2024, grocery e-commerce sales were reported at $8.5 billion, marking a 4% increase compared to the same month in 2023. Retailers and e-commerce platforms now offer a wider variety of packaged salads, meeting growing consumer demand for convenient shopping experiences and healthy products.

- Increasing Disposable Income: Rising disposable income in the USA is encouraging consumers to spend more on healthier food choices, including packaged salads. As economic conditions improve, individuals with greater purchasing power are increasingly opting for premium and organic salads that are associated with higher quality and health benefits. This shift in spending behavior reflects a growing consumer focus on wellness and nutrition, with packaged salads becoming a convenient choice for those seeking fresh, ready-to-eat meal options.

Market Challenges

- Supply Chain Disruptions: Supply chain disruptions in the U.S. are affecting the availability of packaged salads, driven by labor shortages, limited cold storage, and fluctuating raw material supplies. These challenges can result in stock shortages and increased prices, complicating the market's ability to provide fresh produce consistently. Efficient supply chain management is critical to maintaining product availability and meeting consumer demand for fresh salads.

- Rising Costs of Ingredients: Rising agricultural input costs, such as fertilizers and labor, are impacting the profitability of packaged salad producers. These cost pressures are further complicated by weather-related disruptions that affect crop yields, leading to fluctuations in pricing and availability. Producers face the challenge of maintaining competitive pricing while managing increased production expenses, putting strain on the market's overall cost structure.

USA Packaged Salads Market Future Outlook

The USA packaged salads market is expected to grow steadily over the next few years, driven by increased consumer demand for convenience and healthy eating. Ongoing innovation in product variety, particularly in the organic and plant-based categories, will continue to attract health-conscious consumers. Sustainability, in both product sourcing and packaging, is becoming a critical factor, as companies align themselves with consumer expectations for eco-friendly practices.

Market Opportunities

- Innovation in Packaging: The U.S. packaged salads market is benefiting from ongoing advancements in packaging technologies. Innovations in eco-friendly and convenient packaging, such as biodegradable materials and resealable options, are becoming more popular among consumers who prioritize sustainability. These innovations not only enhance the convenience and freshness of salads but also align with growing environmental concerns, offering producers opportunities to appeal to eco-conscious consumers.

- Growth of Plant-Based Diets: The increasing adoption of plant-based diets in the USA is driving demand for salads, especially those that include plant-based proteins. This shift towards vegetarian and vegan preferences presents an opportunity for salad producers to introduce diverse, plant-based ingredients, catering to a broader audience seeking healthier and more sustainable meal options. The trend supports innovation in salad offerings, appealing to health-conscious consumers.

Scope of the Report

|

Product Type |

Fresh Packaged Salads Pre-Cut Salad Kits Organic Packaged Salads Ready-to-Eat Salads |

|

Ingredient Type |

Leafy Greens Vegetables Proteins (Chicken, Tofu, etc.) Dressings |

|

Packaging Type |

Plastic Containers Paper-Based Packaging Eco-Friendly Packaging |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

Region |

North East South West |

Products

Key Target Audience

Packaged Salad Manufacturers

Supermarkets and Hypermarkets

Convenience Stores

Online Retailers

Health and Wellness Brands

Government and Regulatory Bodies (FDA, USDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Fresh Express

Dole Food Company

Taylor Farms

Earthbound Farm

Ready Pac Foods

Gotham Greens

Bonduelle Fresh Americas

BrightFarms

Mann Packing Co.

Tanimura & Antle

Table of Contents

1. USA Packaged Salads Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Packaged Salads Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Packaged Salads Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Demand for Healthy Eating (consumer preferences, health awareness)

3.1.2. Growth of Organic and Natural Products (organic certification, clean labels)

3.1.3. Expansion of Retail and Online Channels (distribution networks, digitalization)

3.1.4. Increasing Disposable Income (consumer spending, economic factors)

3.2. Market Challenges

3.2.1. Supply Chain Disruptions (logistics, cold storage, raw material availability)

3.2.2. Rising Costs of Ingredients (input prices, agricultural volatility)

3.2.3. Competition from Alternative Products (substitutes, consumer switching behavior)

3.3. Opportunities

3.3.1. Innovation in Packaging (sustainability, convenience packaging)

3.3.2. Growth of Plant-Based Diets (consumer trends, plant-based food adoption)

3.3.3. Increased Demand in Urban Areas (urbanization, retail expansion)

3.4. Trends

3.4.1. Shift Towards Single-Serve and Grab-and-Go Salads (convenience, portion control)

3.4.2. Expansion of Premium and Gourmet Salad Offerings (premiumization, gourmet products)

3.4.3. Use of Eco-Friendly Packaging Materials (sustainability initiatives, recycling trends)

3.5. Government Regulation

3.5.1. FDA Regulations for Packaged Foods (food safety, labeling requirements)

3.5.2. Organic Certification Standards (organic labeling, certification bodies)

3.5.3. Sustainability and Recycling Regulations (waste reduction, eco-initiatives)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (suppliers, manufacturers, retailers, consumers)

3.8. Porters Five Forces (bargaining power, competitive rivalry, threat of new entrants, etc.)

3.9. Competition Ecosystem

4. USA Packaged Salads Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fresh Packaged Salads

4.1.2. Pre-Cut Salad Kits

4.1.3. Organic Packaged Salads

4.1.4. Ready-to-Eat Salads

4.2. By Ingredient Type (In Value %)

4.2.1. Leafy Greens

4.2.2. Vegetables

4.2.3. Proteins (Chicken, Tofu, Eggs, etc.)

4.2.4. Dressings

4.3. By Packaging Type (In Value %)

4.3.1. Plastic Containers

4.3.2. Paper-Based Packaging

4.3.3. Eco-Friendly Packaging

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets/Hypermarkets

4.4.2. Convenience Stores

4.4.3. Online Retail

4.4.4. Specialty Stores

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. USA Packaged Salads Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Fresh Express

5.1.2. Dole Food Company

5.1.3. Taylor Farms

5.1.4. Earthbound Farm

5.1.5. Ready Pac Foods

5.1.6. Bonduelle Fresh Americas

5.1.7. Gotham Greens

5.1.8. BrightFarms

5.1.9. Chiquita Brands International

5.1.10. Mann Packing Co.

5.1.11. Tanimura & Antle

5.1.12. VegPro International

5.1.13. Bowery Farming

5.1.14. Little Leaf Farms

5.1.15. Organicgirl

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Portfolio, Sustainability Initiatives, Digital Integration, Partnerships, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Packaged Salads Market Regulatory Framework

6.1. FDA Food Safety Modernization Act (FSMA)

6.2. Organic Certification and Labeling Requirements

6.3. Food Packaging and Sustainability Regulations

6.4. Compliance with Health Standards

7. USA Packaged Salads Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Packaged Salads Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient Type (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. USA Packaged Salads Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Market Expansion Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved identifying all key stakeholders in the USA Packaged Salads Market. Extensive desk research was conducted using proprietary databases and industry reports to map the ecosystem, focusing on consumer behavior, product trends, and regulatory factors.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data from various sources, focusing on product penetration and the relationship between supply chains and market demand. This phase involved assessing market segmentation and pricing strategies to generate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Key industry experts were interviewed to validate market trends and hypotheses. These consultations provided valuable operational and strategic insights from leading companies, aiding in fine-tuning the market analysis.

Step 4: Research Synthesis and Final Output

A bottom-up approach was used to verify data obtained through market research, supplemented by direct input from packaged salad manufacturers and distributors. This synthesis ensured the final reports accuracy and comprehensiveness.

Frequently Asked Questions

01. How big is the USA Packaged Salads Market?

The USA Packaged Salads Market is valued at USD 5.12 billion, driven by consumer demand for convenient, healthy food options and increasing adoption of organic and premium salads.

02. What are the challenges in the USA Packaged Salads Market?

Challenges in USA Packaged Salads Market include rising costs of raw ingredients, supply chain disruptions, and competition from alternative ready-to-eat meal options, all of which impact the markets profitability.

03. Who are the major players in the USA Packaged Salads Market?

Key players in USA Packaged Salads Market include Fresh Express, Dole Food Company, Taylor Farms, Earthbound Farm, and Ready Pac Foods, who dominate due to strong distribution networks and brand loyalty.

04. What are the growth drivers of the USA Packaged Salads Market?

The USA Packaged Salads Market is driven by growing consumer awareness about healthy eating, the convenience of ready-to-eat salads, and increasing adoption of organic products and sustainable packaging solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.