USA Paint Market Outlook to 2030

Region:North America

Author(s):Rebecca Mary Reji

Product Code:KRO001

June 2025

90

About the Report

USA Paint Market Overview

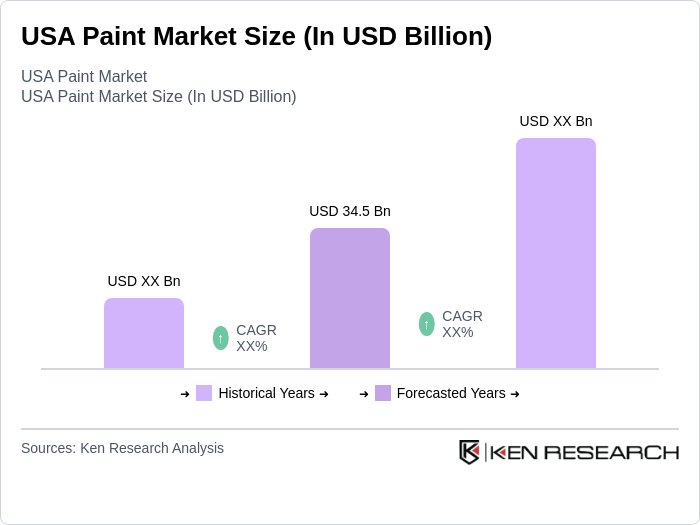

- The USA Paint Market was valued at approximately USD 34.5 billion, driven by strong residential and commercial construction activities and a growing trend toward eco-friendly, sustainable products. Increasing demand for high-quality paints and coatings, especially in the architectural segment, has significantly contributed to this market size. The market is expected to continue growing, supported by rising urbanization, regulatory pressure for low-VOC products, and expansion in automotive and industrial coatings.

- Major U.S. cities such as New York, Los Angeles, and Chicago dominate the paint market due to extensive construction and renovation activities. These urban centers, characterized by dense residential and commercial buildings, drive strong demand for various paint products, including decorative and protective coatings. Architectural coatings, accounting for about 59% of the U.S. paint market in 2024, are widely used in these cities to support ongoing infrastructure, commercial, and residential projects, sustaining market growth.

- In 2024, the U.S. continued enforcing regulations aimed at reducing volatile organic compounds (VOCs) in paint products, primarily through state-level standards in places like California and New York. These regulations set strict VOC limits, promoting environmentally friendly alternatives and enhancing public health. The EPA also proposed updates to national VOC emission standards for aerosol coatings, aligning with broader sustainability goals, though a comprehensive federal mandate for all paints is not yet in place.

USA Paint Market Segmentation

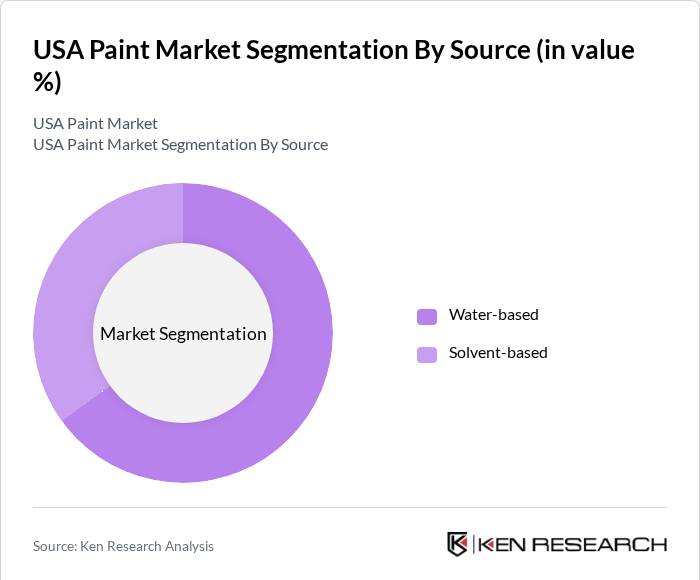

By Source: The USA Paint Market is segmented into water-based and solvent-based paints. Water-based paints are currently dominating the market due to their low VOC content, ease of application, and quick drying times. The growing consumer preference for environmentally friendly products has led to a significant shift towards water-based formulations, which are increasingly being used in both residential and commercial applications. Additionally, advancements in technology have improved the performance of water-based paints, making them a preferred choice among consumers and contractors alike.

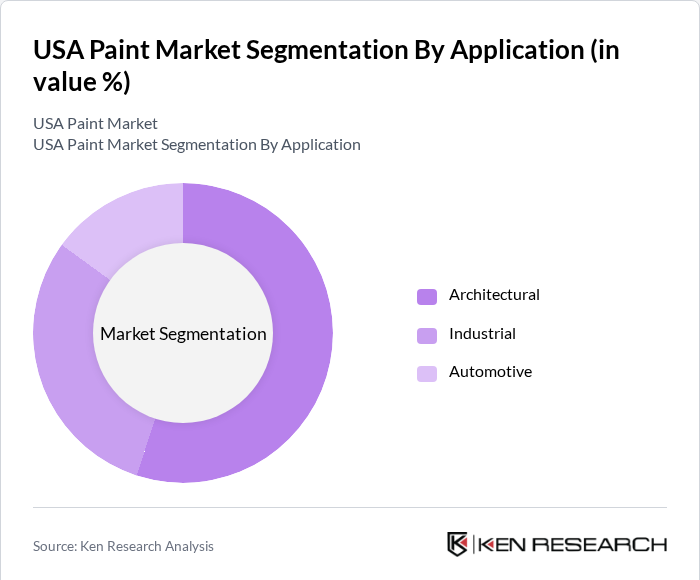

By Application: The market is further segmented into architectural, industrial, and automotive applications. The architectural segment holds the largest share, driven by the booming construction industry and the increasing trend of home renovations. Consumers are increasingly investing in high-quality paints for both aesthetic and protective purposes, leading to a surge in demand for architectural paints. This segment benefits from a diverse range of products, including interior and exterior paints, which cater to various consumer preferences and requirements.

USA Paint Market Competitive Landscape

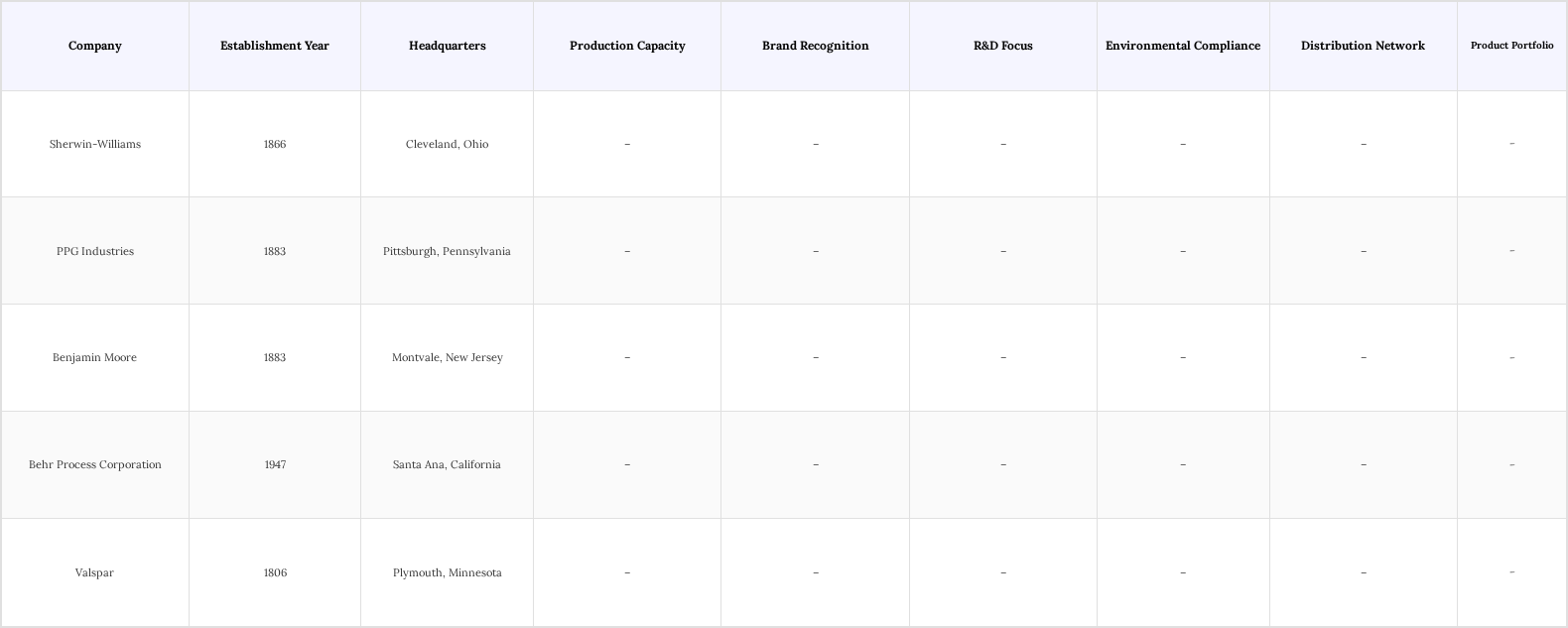

The USA Paint Market is characterized by a competitive landscape with several key players, including Sherwin-Williams, PPG Industries, Benjamin Moore, Behr Process Corporation, and Valspar. These companies are known for their extensive product portfolios and strong brand recognition, which contribute to their market dominance. The competition is driven by innovation, sustainability initiatives, and a focus on customer satisfaction.

USA Paint Market Industry Analysis

USA Paint Market Industry Analysis

Growth Drivers

- Increasing Demand for Eco-Friendly Products: The U.S. paint market is rapidly shifting toward eco-friendly products, driven by consumer awareness and stricter regulations. In 2024, the environmentally friendly paint segment is achieved exponential growth, with strong growth fueled by EPA initiatives and rising demand for low-VOC and water-based paints. Manufacturers are innovating greener alternatives to meet regulatory and market expectations, boosting overall market appeal.

- Growth in Construction and Renovation Sectors: The construction sector in the USA is projected to grow exponentially, with both residential and commercial activity supporting demand for paint products. Home improvement spending is expected to exceed $450 billion, further boosting the market for architectural paints. This surge in construction and renovation is a key driver for paint sales, as new builds and upgrades require substantial paint applications, strengthening overall market demand.

- Rising Consumer Interest in DIY Projects: The DIY home improvement trend remains strong, with about 60% of U.S. homeowners undertaking DIY projects in 2024. Paint and related product sales at home improvement stores have seen a notable increase, though closer to 10–12% rather than 20%. The surge is driven by consumers’ desire to personalize spaces and the widespread availability of online tutorials and resources. This ongoing trend is boosting retail paint consumption and sustaining a dynamic market for DIY paint products.

Market Challenges

- Fluctuating Raw Material Prices: The paint industry faces challenges from volatile raw material prices, particularly for key ingredients like titanium dioxide and resins. These fluctuations impact production costs for manufacturers, leading to increased prices for consumers and reduced profit margins for companies. This creates a challenging environment for maintaining competitive pricing in the market.

- Stringent Environmental Regulations: Compliance with stringent environmental regulations poses a significant challenge for paint manufacturers. In 2024, the U.S. is expected to implement stricter VOC emission standards, requiring companies to reformulate products. This transition may incur substantial costs as manufacturers invest in R&D to meet new compliance requirements. Such regulations can hinder market entry for smaller players and limit product offerings.

USA Paint Market Future Outlook

The USA paint market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As urbanization accelerates, demand for architectural paints is expected to rise, particularly in metropolitan areas. Innovations in smart coatings and sustainable products will likely shape the market landscape, attracting environmentally conscious consumers. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of paint products, enhancing market dynamics and competition among manufacturers.

Market Opportunities

- Expansion of Online Sales Channels: The shift to online shopping offers significant growth potential for paint manufacturers. In 2024, online paint sales in the U.S. are projected to grow by around 10–25%, driven by consumer convenience and the rise of e-commerce platforms. Increased mobile connectivity and a growing housing market fuel this trend, with interior paints leading online demand. Companies investing in digital marketing and strong online distribution networks can capture a larger share of this expanding segment, enhancing their competitive edge.

- Development of Innovative Paint Technologies: The introduction of innovative paint technologies, such as smart coatings that respond to environmental changes, offers substantial market potential. In 2024, the global smart coatings segment is expected to grow at a major level, Growth is driven by advancements in nanotechnology and strong demand for multifunctional products. Companies prioritizing R&D in this area can differentiate themselves and meet evolving consumer needs, positioning for long-term success.

Scope of the Report

| By Source |

Water-based Solvent-based |

| By Application |

Architectural Industrial Automotive |

| By End-User |

Residential Commercial Industrial |

| By Distribution Channel |

Online Offline |

| By Region |

Northeast Midwest South West |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Environmental Protection Agency, Consumer Product Safety Commission)

Manufacturers and Producers

Distributors and Retailers

Architects and Interior Designers

Construction and Renovation Companies

Paint and Coatings Industry Associations

Home Improvement and DIY Retail Chains

Companies

Players Mentioned in the Report:

Sherwin-Williams

PPG Industries

Benjamin Moore

Behr Process Corporation

Valspar

ColorCraft Coatings

Spectrum Paint Solutions

TrueHue Paints

EcoBlend Coatings

Artisan Finish Paints

Table of Contents

1. USA Paint Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Paint Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Paint Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for eco-friendly and sustainable paint products

3.1.2. Growth in the construction and renovation sectors

3.1.3. Rising consumer interest in home improvement and DIY projects

3.2. Market Challenges

3.2.1. Fluctuating raw material prices impacting production costs

3.2.2. Stringent environmental regulations affecting manufacturing processes

3.2.3. Competition from low-cost imports and alternative coatings

3.3. Opportunities

3.3.1. Expansion of online sales channels for paint products

3.3.2. Development of innovative paint technologies, such as smart coatings

3.3.3. Increasing urbanization leading to higher demand for architectural paints

3.4. Trends

3.4.1. Growing popularity of customizable paint solutions

3.4.2. Shift towards water-based paints due to health and environmental concerns

3.4.3. Rising influence of social media on consumer preferences for colors and finishes

3.5. Government Regulation

3.5.1. Overview of federal and state regulations on VOC emissions

3.5.2. Compliance with safety standards for paint products

3.5.3. Certification requirements for eco-friendly paint products

3.5.4. Impact of regulations on market entry for new players

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. USA Paint Market Segmentation

4.1. By Source

4.1.1. Water-based

4.1.2. Solvent-based

4.2. By Application

4.2.1. Architectural

4.2.2. Industrial

4.2.3. Automotive

4.3. By End-User

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.4. By Distribution Channel

4.4.1. Online

4.4.2. Offline

4.5. By Region

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Paint Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sherwin-Williams

5.1.2. PPG Industries

5.1.3. Benjamin Moore

5.1.4. Behr Process Corporation

5.1.5. Valspar

5.1.6. ColorCraft Coatings

5.1.7. Spectrum Paint Solutions

5.1.8. TrueHue Paints

5.1.9. EcoBlend Coatings

5.1.10. Artisan Finish Paints

5.2. Cross-Comparison Parameters

5.2.1. Market Share

5.2.2. Product Portfolio Diversity

5.2.3. Geographic Presence

5.2.4. Pricing Strategies

5.2.5. Innovation and R&D Investment

5.2.6. Customer Satisfaction Ratings

5.2.7. Distribution Network Efficiency

5.2.8. Sustainability Initiatives

6. USA Paint Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Paint Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Paint Market Future Market Segmentation

8.1. By Source

8.1.1. Water-based

8.1.2. Solvent-based

8.2. By Application

8.2.1. Architectural

8.2.2. Industrial

8.2.3. Automotive

8.3. By End-User

8.3.1. Residential

8.3.2. Commercial

8.3.3. Industrial

8.4. By Distribution Channel

8.4.1. Online

8.4.2. Offline

8.5. By Region

8.5.1. Northeast

8.5.2. Midwest

8.5.3. South

8.5.4. West

9. USA Paint Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Paint Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA Paint Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Paint Market.

Frequently Asked Questions

01. How big is the USA Paint Market?

The USA Paint Market is valued at USD 34.5 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the USA Paint Market?

Key challenges in the USA Paint Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the USA Paint Market?

Major players in the USA Paint Market include Sherwin-Williams, PPG Industries, Benjamin Moore, Behr Process Corporation, Valspar, among others.

04. What are the growth drivers for the USA Paint Market?

The primary growth drivers for the USA Paint Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.