USA Paint Protection Film Market Outlook to 2030

Region:North America

Author(s):Mukul

Product Code:KROD5221

October 2024

93

About the Report

USA Paint Protection Film Market Overview

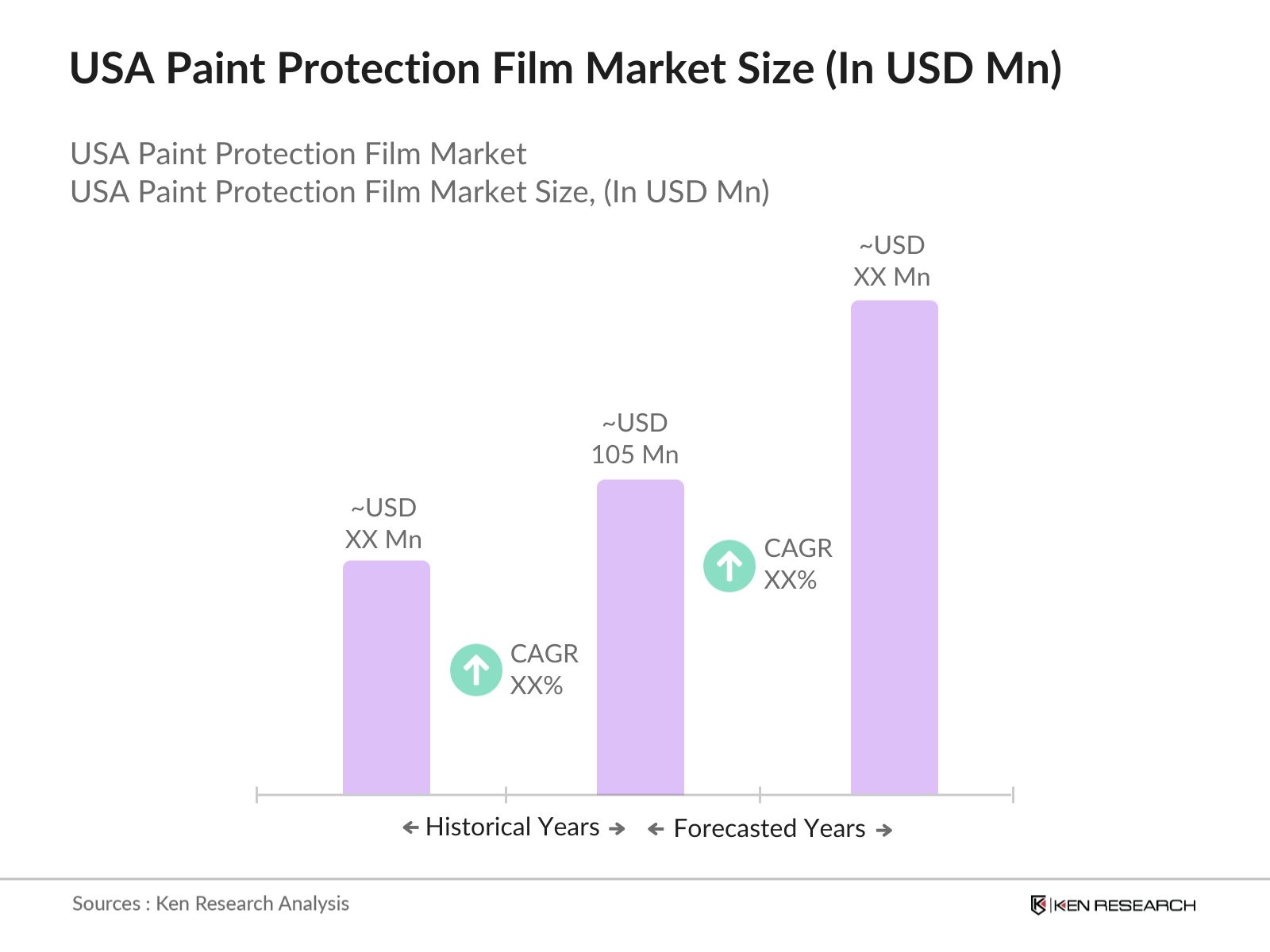

- The USA Paint Protection Film (PPF) market, valued at USD 105 million in 2023, is driven by the rising demand for automotive protective solutions, particularly in the luxury and sports vehicle segments. PPF has gained immense popularity due to its ability to protect vehicle surfaces from scratches, environmental pollutants, and UV damage. This growth has been bolstered by the increasing consumer preference for premium car protection and the expansion of the automotive aftermarket services. The market's historical data indicates consistent growth due to advancements in PPF technology and the increasing affordability of professional installation services.

- Major cities such as Los Angeles, New York, and Miami dominate the USA PPF market due to high concentrations of affluent consumers and car enthusiasts who prioritize the preservation of vehicle aesthetics. California, in particular, has emerged as a leader due to its favorable climate, leading to increased demand for UV-resistant films. These cities also host numerous car shows and events, which amplify the demand for premium vehicle protection solutions like PPF. Additionally, the presence of top-tier professional installers in these areas contributes to the dominance of these regions in the market.

- PPF manufacturers must comply with strict environmental regulations in the U.S., particularly regarding emissions and waste disposal. The U.S. Environmental Protection Agency (EPA) has implemented stringent guidelines for manufacturers to limit volatile organic compounds (VOCs) in PPF production. In 2024, the EPA updated its standards, requiring manufacturers to reduce VOC emissions by 20%, impacting the production process and material choices for PPF products.

USA Paint Protection Film Market Segmentation

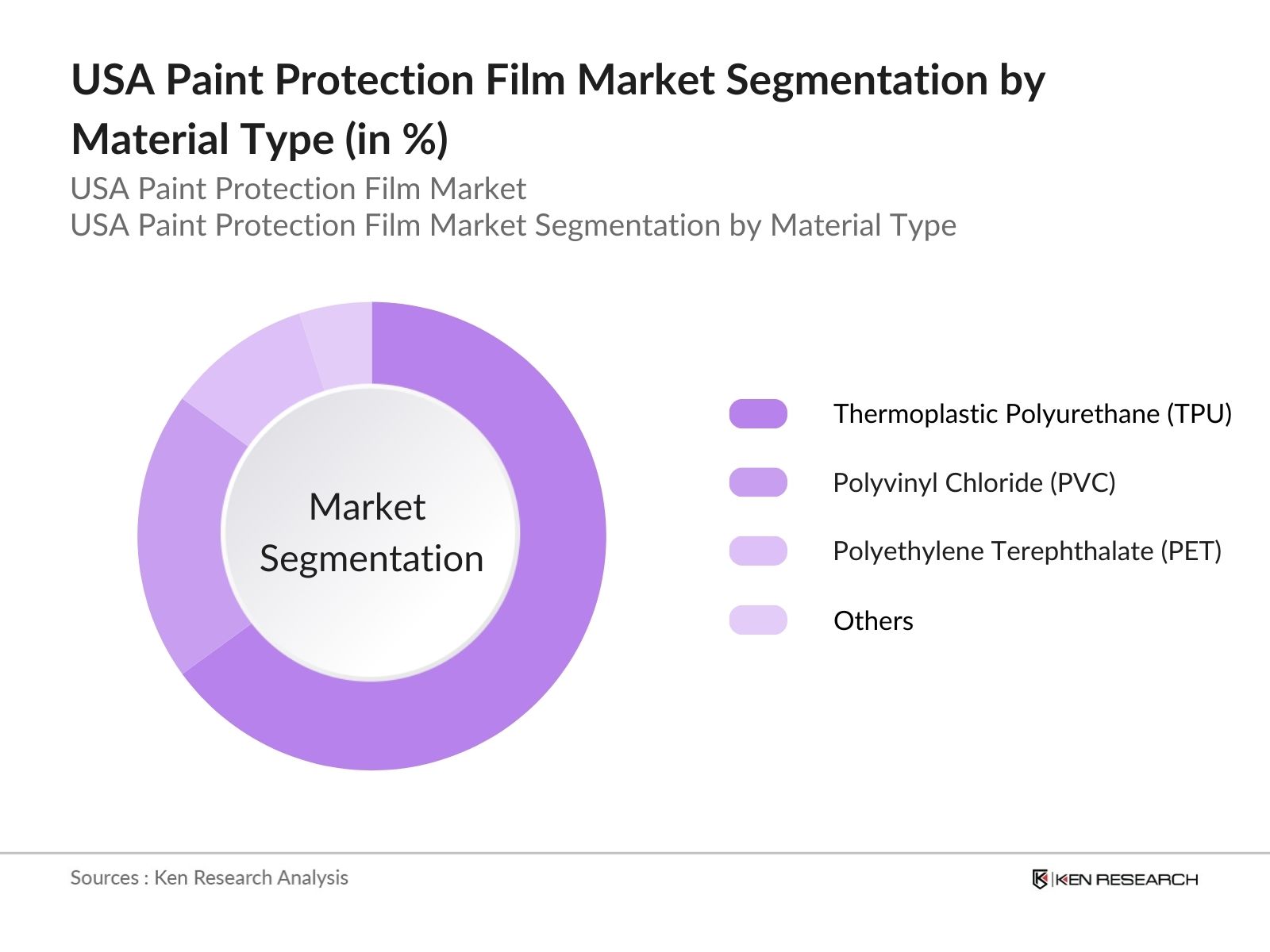

- By Material Type: The USA Paint Protection Film market is segmented by material type into Thermoplastic Polyurethane (TPU), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), and others. TPU dominates the market share under this segment due to its high elasticity, self-healing properties, and superior resistance to wear and tear. TPU films have become the material of choice for automotive applications, as they offer better protection against environmental damage and UV exposure. TPU also has longer durability compared to PVC and PET, which positions it as the preferred material for both professional and DIY installations in the USA market.

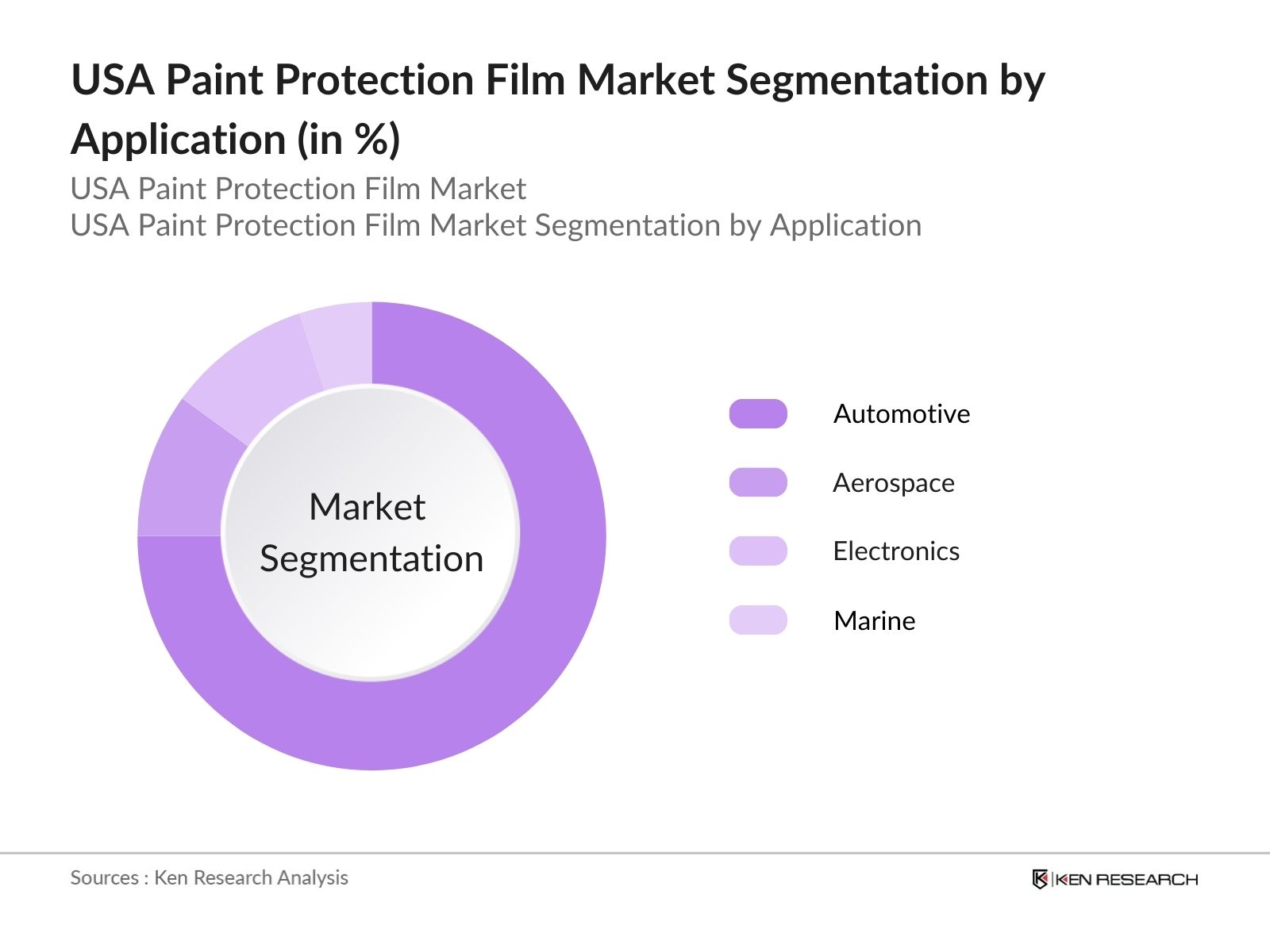

- By Application: The USA Paint Protection Film market is segmented by application into Automotive, Aerospace, Electronics, Marine, and Industrial Equipment. The automotive segment holds the largest market share due to the continuous rise in vehicle ownership, particularly luxury and high-performance cars. This trend has led to an increase in demand for PPF as vehicle owners seek long-lasting protective solutions for their investments. In particular, the customization of automotive protection solutions has fueled the demand for PPF in this sector, contributing to its dominance.

USA Paint Protection Film Market Competitive Landscape

The USA Paint Protection Film market is dominated by key players, both domestic and international, who have established strong footholds through innovation, strategic partnerships, and brand loyalty. Companies like 3M and XPEL have consistently led the market by offering high-quality PPF products that cater to various industries beyond automotive, including aerospace and electronics. These players have also invested in extensive research and development to enhance product durability, self-healing capabilities, and UV resistance.

|

Company Name |

Established |

Headquarters |

Product Range |

Distribution Channels |

Revenue (USD) |

Employee Strength |

R&D Investment |

Partnerships |

Sustainability Initiatives |

|

3M |

1902 |

Minnesota, USA |

|||||||

|

XPEL, Inc. |

1997 |

Texas, USA |

|||||||

|

Avery Dennison |

1935 |

Ohio, USA |

|||||||

|

Eastman Chemical Company |

1920 |

Tennessee, USA |

|||||||

|

Orafol Group |

1808 |

Georgia, USA |

USA Paint Protection Film Market

Market Growth Drivers

- Rising Automotive Demand: The demand for luxury and sports cars in the U.S. has significantly increased in recent years, driven by rising disposable income. In 2024, over 12 million vehicles were sold in the U.S., with a growing proportion consisting of high-end vehicles such as Teslas, Ferraris, and Porsches, according to the U.S. Bureau of Economic Analysis (BEA). This surge fuels the demand for paint protection film (PPF), especially in the luxury car segment, as consumers seek premium protective solutions for their expensive vehicles.

- Increased Focus on Vehicle Aesthetics: The U.S. auto industry, worth over $1.5 trillion in 2024, sees rising consumer interest in vehicle aesthetics as a key driver of PPF adoption. Paint protection films offer UV resistance and scratch protection, extending the visual appeal of cars. More than 60% of U.S. car buyers now prioritize aesthetic enhancement over functional upgrades, according to the National Automobile Dealers Association (NADA). PPF manufacturers benefit from this trend, focusing on products that enhance the look and longevity of automotive finishes.

- Demand for Longer-Lasting Protective Solutions: Vehicle owners in the U.S. demand durable, long-lasting protective films that can withstand harsh weather, UV rays, and minor abrasions. In 2023, data from the U.S. Department of Transportation showed that the average age of a vehicle on U.S. roads was 12.2 years. With this trend, car owners increasingly seek protection solutions to extend the lifespan of their vehicles appearance. This demand drives the adoption of advanced PPF technologies that offer UV protection, scratch resistance, and weather resilience.

Market Restraints

- Technical Complexity in Application: PPF application requires specialized skills to ensure durability and precision, which presents a barrier to market expansion. The U.S. automotive service industry, with over 2.3 million jobs in 2023, is still facing a skills gap, particularly in high-tech protective film applications. Inadequate training or improper installation can result in peeling, bubbling, or uneven coverage, reducing the films efficacy. These technical challenges can impede broader consumer adoption of PPF technology.

- Limited Adoption in Non-Automotive Sectors: The U.S. paint protection film market is heavily concentrated in the automotive industry, limiting its expansion into other sectors like aviation, marine, and electronics. According to the Federal Aviation Administration (FAA), the aviation maintenance sector alone is worth $15 billion, yet PPF remains underutilized in this space. Challenges in creating films that meet the specific needs of different industries, combined with limited awareness, have stunted the growth of PPF in non-automotive applications.

USA Paint Protection Film Market Future Outlook

Over the next five years, the USA Paint Protection Film market is expected to show consistent growth driven by technological advancements in self-healing films, increasing consumer awareness about vehicle preservation, and expansion into new sectors such as electronics and aerospace. The ongoing shift toward sustainable products and the use of recyclable materials will also play a crucial role in shaping the future of the market. The rising adoption of PPF in industries such as industrial equipment protection and marine applications will further contribute to the markets long-term growth potential.

Market Opportunities

- Expansion into New Applications: The U.S. electronics market, valued at over $300 billion in 2024, presents a promising opportunity for PPF manufacturers. As consumers demand increased durability in electronics, from smartphones to tablets, PPF can offer scratch and impact resistance. Additionally, the U.S. marine and aviation industries, worth billions annually, represent potential sectors for protective films. The marine industry alone contributed over $170 billion to the U.S. economy in 2023, underscoring the scale of opportunity for PPF expansion into these markets.

- Technological Advancements: The development of self-healing films and anti-contaminant coatings has revolutionized the paint protection industry. In 2024, the U.S. National Institute of Standards and Technology (NIST) reported advances in nanomaterials, contributing to the durability and self-repair capabilities of PPF products. These films automatically heal minor scratches and abrasions, extending the product's lifespan and appeal. Anti-contaminant coatings, designed to repel dust, water, and pollutants, further enhance the value proposition for consumers

Scope of the Report

|

By Material Type |

Thermoplastic Polyurethane (TPU) |

|

Polyvinyl Chloride (PVC) |

|

|

Polyethylene Terephthalate (PET) |

|

|

Others |

|

|

By Application |

Automotive |

|

Electronics |

|

|

Aerospace |

|

|

Marine |

|

|

Industrial Equipment |

|

|

By Installation Method |

DIY Kits |

|

Professional Installation |

|

|

By End-User |

Commercial |

|

Residential |

|

|

Industrial |

|

|

By Region |

North-East USA |

|

West Coast |

|

|

Mid-West |

|

|

Southern USA |

Products

Key Target Audience

Automotive Manufacturers

Automotive Aftermarket Service Providers

Paint Protection Film Manufacturers

OEMs (Original Equipment Manufacturers)

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Environmental Protection Agency, Department of Transportation)

Aerospace and Defense Contractors

Electronics Manufacturers

Companies

Players Mentioned in the Report:

3M Company

XPEL, Inc.

Avery Dennison Corporation

Eastman Chemical Company

Orafol Group

Hexis S.A.

STEK Automotive

SunTek Films

PremiumShield

Johnson Window Films, Inc.

Profilm

Llumar Films

VViViD Vinyl

Expel Marketing Pvt. Ltd.

Saint-Gobain Performance Plastics

Table of Contents

1. USA Paint Protection Film Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Material Type, Application, End-User)

1.3. Market Growth Rate (CAGR %, Volume, Value)

1.4. Market Segmentation Overview (Geographical, Product Type, Industry Application)

2. USA Paint Protection Film Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Major Innovations, Partnerships, Regulatory Shifts)

3. USA Paint Protection Film Market Analysis

3.1. Growth Drivers

3.1.1. Rising Automotive Demand (Luxury & Sports Cars Segment)

3.1.2. Increased Focus on Vehicle Aesthetics

3.1.3. Demand for Longer-Lasting Protective Solutions (UV, Scratch Resistance)

3.1.4. Consumer Shift Toward DIY Application Kits

3.2. Market Challenges

3.2.1. High Initial Installation Cost

3.2.2. Technical Complexity in Application (Film Durability, Wrapping Precision)

3.2.3. Limited Adoption in Non-Automotive Sectors

3.3. Opportunities

3.3.1. Expansion into New Applications (Electronics, Marine, Aviation)

3.3.2. Technological Advancements (Self-Healing Films, Anti-Contaminant Coatings)

3.3.3. OEM Partnerships for Standard Integration (Automotive)

3.4. Trends

3.4.1. Adoption of High-Performance TPU Materials

3.4.2. Customizable Film Designs (Textures, Colors)

3.4.3. Rise of E-commerce and Online Sales Platforms

3.4.4. Growing Awareness for Sustainable PPF Solutions

3.5. Government Regulation

3.5.1. Environmental Impact Standards for Manufacturing

3.5.2. Vehicle Modification Compliance

3.5.3. Trade Regulations (Imports/Exports of PPF Materials)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces (Suppliers, Buyers, Competitors, Substitutes, New Entrants)

3.9. Competition Ecosystem

4. USA Paint Protection Film Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Thermoplastic Polyurethane (TPU)

4.1.2. Polyvinyl Chloride (PVC)

4.1.3. Polyethylene Terephthalate (PET)

4.1.4. Others

4.2. By Application (In Value %)

4.2.1. Automotive

4.2.2. Electronics

4.2.3. Aerospace

4.2.4. Marine

4.2.5. Industrial Equipment

4.3. By Installation Method (In Value %)

4.3.1. DIY Kits

4.3.2. Professional Installation

4.4. By End-User (In Value %)

4.4.1. Commercial

4.4.2. Residential

4.4.3. Industrial

4.5. By Region (In Value %)

4.5.1. North-East USA

4.5.2. West Coast

4.5.3. Mid-West

4.5.4. Southern USA

5. USA Paint Protection Film Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. 3M Company

5.1.2. XPEL, Inc.

5.1.3. Eastman Chemical Company

5.1.4. Avery Dennison Corporation

5.1.5. Saint-Gobain Performance Plastics

5.1.6. Hexis S.A.

5.1.7. Orafol Group

5.1.8. PremiumShield

5.1.9. SunTek Films

5.1.10. STEK Automotive

5.1.11. Profilm

5.1.12. Expel Marketing Pvt. Ltd.

5.1.13. Johnson Window Films, Inc.

5.1.14. Llumar Films

5.1.15. VViViD Vinyl

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Film Durability, R&D Spending, Material Innovation, Environmental Certifications, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Paint Protection Film Market Regulatory Framework

6.1. Environmental Standards (Emission Limits, Toxicity of Materials)

6.2. Compliance Requirements (Consumer Safety Regulations, OEM Standards)

6.3. Certification Processes (ISO, ANSI, UL Certifications)

7. USA Paint Protection Film Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Technological Developments, Changing Consumer Preferences, Supply Chain Advancements)

8. USA Paint Protection Film Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Application (In Value %)

8.3. By Installation Method (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USA Paint Protection Film Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying the critical variables within the USA Paint Protection Film market, focusing on automotive, aerospace, and industrial equipment sectors. Extensive desk research using secondary databases helps create a comprehensive market map, identifying trends and influencing factors.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled, focusing on market penetration rates, key drivers, and industry growth patterns. A detailed assessment of market performance across product types and applications is conducted to establish a baseline for further analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth trends and consumer preferences are validated through interviews with industry experts, including professionals from leading PPF manufacturers. These insights help refine the data collected and ensure its accuracy.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the gathered data into a coherent report, ensuring that the findings are validated against industry benchmarks and expert opinions. The report includes both top-down and bottom-up analyses to provide a comprehensive overview of the USA Paint Protection Film market.

Frequently Asked Questions

01. How big is the USA Paint Protection Film Market?

The USA Paint Protection Film market is valued at USD 105 million in 2023, driven by the automotive sector's rising demand for protective solutions. Increasing vehicle ownership, especially in luxury segments, has contributed to this market size.

02. What are the challenges in the USA Paint Protection Film Market?

Challenges include the high cost of professional PPF installations and the technical complexity of applying films on intricate surfaces. Additionally, there is limited consumer awareness about PPF benefits in sectors beyond automotive, which restricts wider market adoption.

03. Who are the major players in the USA Paint Protection Film Market?

Key players include 3M Company, XPEL, Avery Dennison, Eastman Chemical Company, and Orafol Group. These companies dominate the market due to their robust distribution networks, high-quality product offerings, and strong presence in the automotive sector.

04. What are the growth drivers of the USA Paint Protection Film Market?

The market is propelled by increasing consumer demand for vehicle preservation, advancements in self-healing PPF technologies, and the growing trend of DIY installation kits. Additionally, the rising popularity of luxury cars in the USA is boosting the demand for protective solutions like PPF.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.