USA Paraffin Wax Market Outlook to 2030

Region:North America

Author(s):Shubham

Product Code:KROD5811

November 2024

95

About the Report

USA Paraffin Wax Market Overview

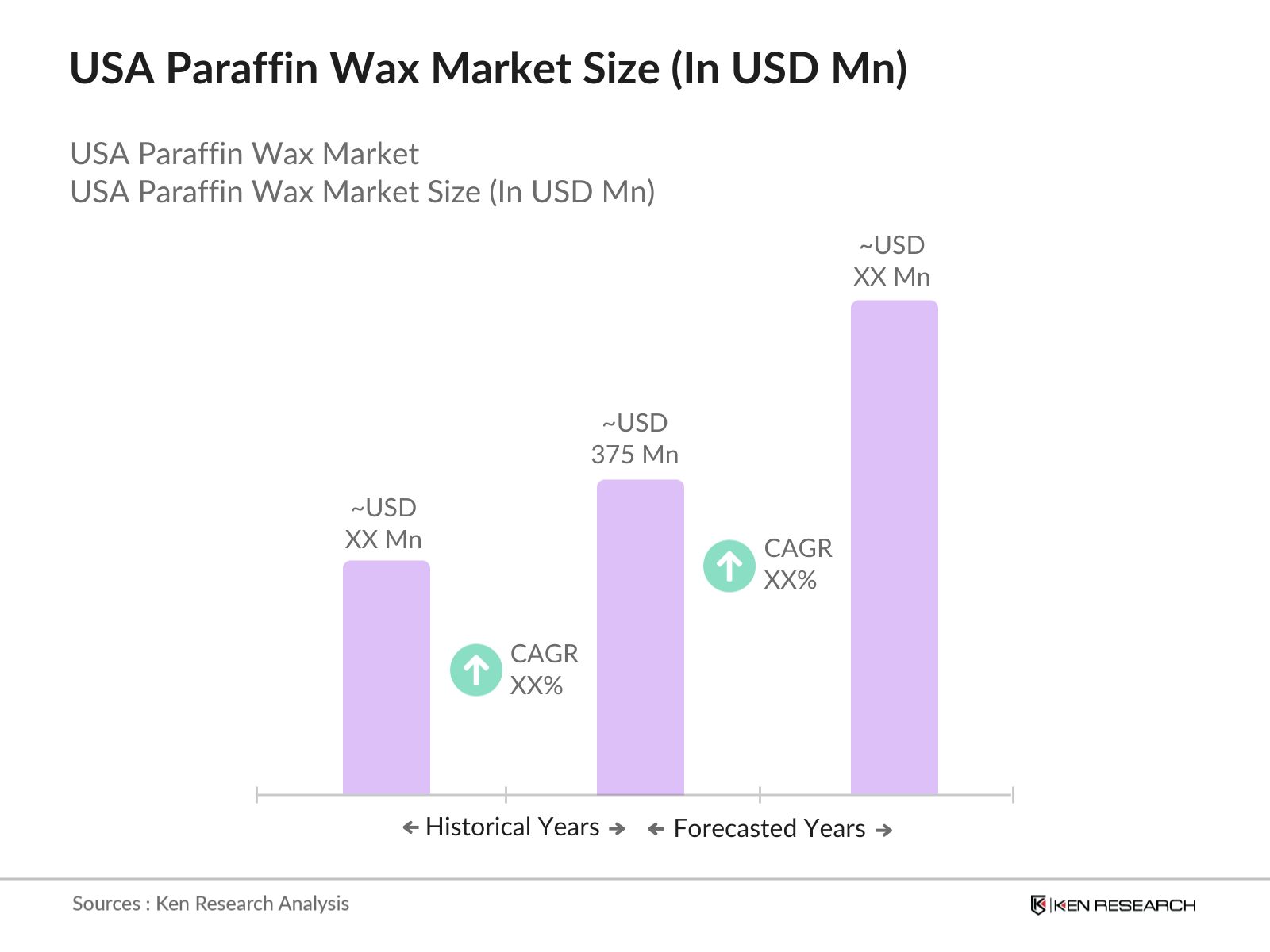

- The USA paraffin wax market is valued at USD 375 million, driven primarily by the increasing demand in industries such as packaging, cosmetics, and candle manufacturing. Paraffin wax is extensively utilized due to its versatility, low cost, and adaptability, which make it a preferred choice for applications that require water resistance, insulation, or burn properties. The consistent demand across these sectors has created steady growth opportunities, positioning the USA paraffin wax market as a key segment within the broader chemical and materials industry.

- Major cities like New York, Los Angeles, and Chicago are pivotal in the USA paraffin wax market due to their concentration of manufacturing and industrial facilities that consume paraffin wax. New York and Los Angeles host significant cosmetic and personal care production, where paraffin wax is an essential raw material. Chicago serves as a hub for candle production, leveraging paraffin wax for various products, which contributes to its dominance. The industrial infrastructure and proximity to distribution channels in these cities underpin their strong market presence.

- Environmental regulations play a pivotal role in the paraffin wax industry, as the U.S. continues to implement measures to curb emissions and promote sustainability. For instance, the EPAs Clean Air Act mandates limits on volatile organic compounds in wax manufacturing, affecting production processes. Regulatory compliance is crucial for paraffin wax manufacturers to avoid fines and meet sustainability standards, which are increasingly stringent in the face of rising environmental concerns.

USA Paraffin Wax Market Segmentation

By Type: The market is segmented by type into fully refined paraffin wax, semi-refined paraffin wax, and microcrystalline wax. Fully refined paraffin wax holds the largest market share within the type category. Its high purity and consistent properties make it suitable for applications in the cosmetics, pharmaceutical, and food packaging industries, where quality and safety are paramount. Fully refined paraffin wax is preferred for its stability, making it a premium choice in segments where stringent standards are enforced, thereby driving its demand and market dominance.

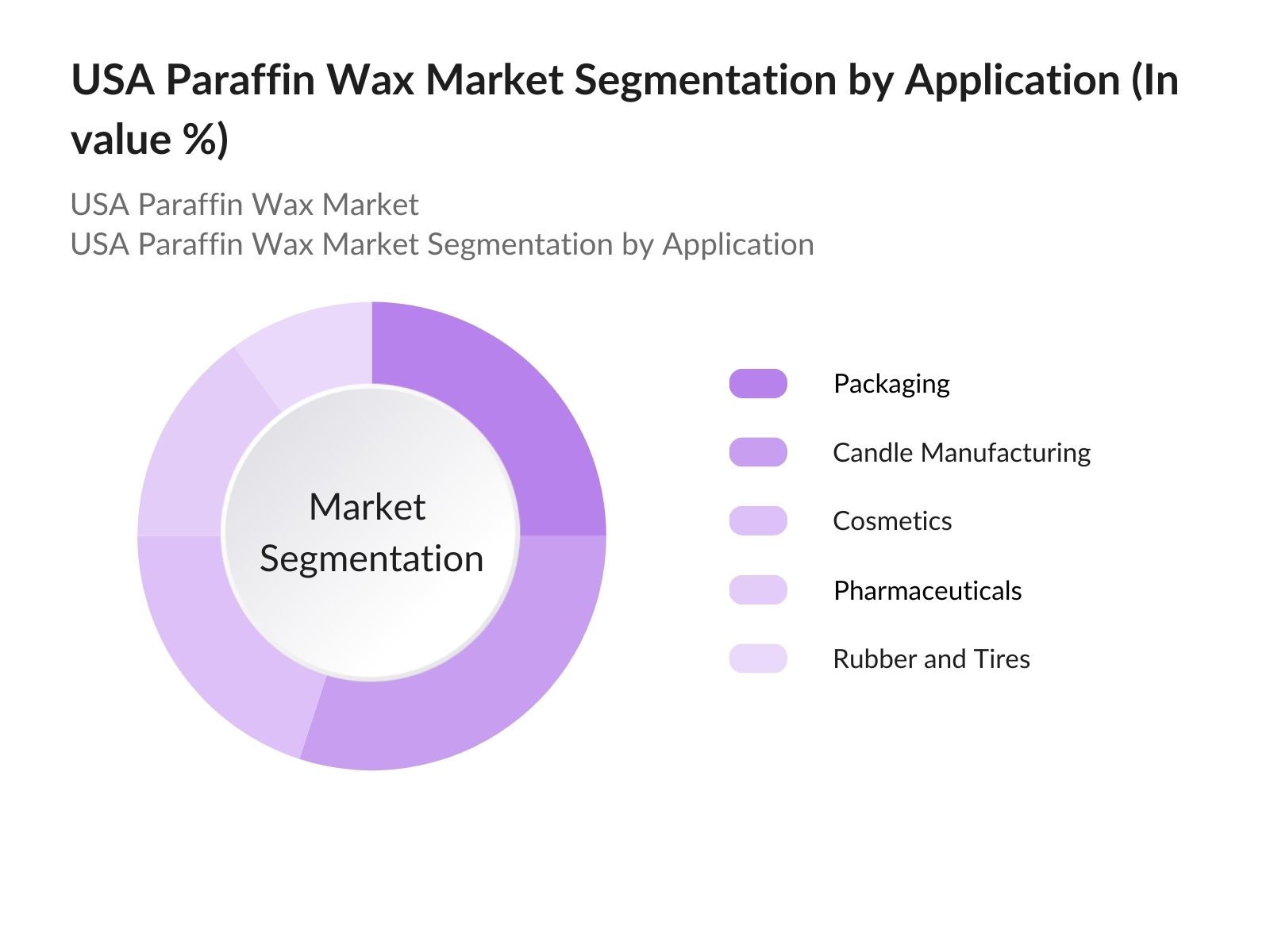

By Application: The market is segmented by application into packaging, candle manufacturing, cosmetics and personal care, pharmaceuticals, and rubber and tires. Candle manufacturing leads in the application segment, attributed to paraffin wax's cost-effectiveness, burn quality, and versatility, making it ideal for various types of candles. The USA sees robust demand for decorative, scented, and religious candles, all of which use paraffin as a primary ingredient. With increased consumer preference for high-quality, long-lasting candles, the segment's dominance is expected to continue, driven by both commercial and consumer demands.

By Application: The market is segmented by application into packaging, candle manufacturing, cosmetics and personal care, pharmaceuticals, and rubber and tires. Candle manufacturing leads in the application segment, attributed to paraffin wax's cost-effectiveness, burn quality, and versatility, making it ideal for various types of candles. The USA sees robust demand for decorative, scented, and religious candles, all of which use paraffin as a primary ingredient. With increased consumer preference for high-quality, long-lasting candles, the segment's dominance is expected to continue, driven by both commercial and consumer demands.

USA Paraffin Wax Market Competitive Landscape

The USA paraffin wax market is highly competitive, with leading chemical and materials companies striving for innovation and sustainable production practices. The market is primarily dominated by a few major players with strong distribution networks and substantial research capabilities. These companies emphasize product quality, strategic partnerships, and innovation to maintain their competitive position within the market.

USA Paraffin Wax Market Analysis

Growth Drivers

- Industrial and Consumer Demand for Wax Products: The paraffin wax market is witnessing significant growth due to industrial and consumer demand, especially in packaging and cosmetics sectors. In 2024, the global packaging market witnessed remarkable growth, with the U.S. accounting for largest share in the industry due to increased e-commerce and retail packaging needs. In cosmetics, the U.S. sector generated USD 60 billion in 2023, with paraffin wax commonly used for aesthetic appeal in skincare products, lip balms, and moisturizing creams. This consistent demand drives the paraffin wax market in the U.S. due to its widespread application.

- Increasing Applications in Coating and Candle Manufacturing: Paraffin wax is extensively used in coating applications for corrosion resistance in construction, automotive, and packaging industries, all substantial contributors to the U.S. economy. In 2023, the construction industry in the U.S. reached all-time high, while automotive and transportation contributed nearly USD 500 billion. Additionally, candle manufacturing alone generated USD 13 billion in revenue in 2023, with paraffin wax comprising majority of candle production materials, underscoring its essential role in coating and candle manufacturing.

- Expanding Demand in Pharmaceuticals and Healthcare Products: In the U.S., the healthcare industry value exceeds $4.3 trillion, representing a major growth sector for paraffin wax due to its use in therapeutic and healthcare products, particularly in treatment therapies for arthritis and related conditions. Paraffin wax, commonly used in heat therapy treatments, has found growing demand in hospitals and rehabilitation centers, especially with increasing cases of musculoskeletal conditions among aging populations. This trend has created robust demand for high-quality, medical-grade paraffin wax products in the healthcare sector.

Challenges

- Fluctuating Raw Material Prices: The paraffin wax market is susceptible to fluctuating raw material costs, particularly influenced by global oil prices, as petroleum-derived products are primary sources. Crude oil prices can vary significantly, affecting downstream production costs for paraffin wax. This volatility challenges manufacturers ability to maintain stable production costs, impacting profit margins and product pricing in a competitive market where price stability is critical for consistent demand.

- Environmental Concerns and Alternatives: Growing environmental concerns regarding petroleum-based products affect the paraffin wax market, as a significant portion of the U.S. market is actively transitioning toward eco-friendly alternatives. This shift is largely due to emissions from paraffin wax production and its lack of biodegradability. Government initiatives promoting sustainable alternatives, such as bio-based and biodegradable waxes, are creating challenges for traditional paraffin wax producers. Increased regulatory pressures are prompting companies to innovate while facing potential restrictions.

USA Paraffin Wax Market Future Outlook

The USA paraffin wax market is anticipated to witness steady growth through 2028, driven by evolving demand across applications in packaging, cosmetics, and candle manufacturing. The market is expected to see increased adoption of sustainable and biodegradable alternatives as companies respond to environmental concerns. Advances in wax refining technology and production efficiency are likely to enhance product quality, positioning the market for sustained growth. The growing use of paraffin in niche applications within the pharmaceutical and personal care sectors will further contribute to this market's expansion.

Future Market Opportunities

- Bio-based Paraffin Wax Alternatives: The shift towards bio-based wax products presents a lucrative opportunity for the paraffin wax market, as U.S. bio-based product sales reached all time high in 2023. Bio-based paraffin wax alternatives are increasingly popular in the cosmetics, personal care, and food industries due to their reduced environmental impact. This rising interest in bio-based solutions supports demand for sustainable alternatives, opening pathways for market growth in both traditional and emerging sectors that prioritize environmentally friendly products.

- Regional Market Expansion: The paraffin wax market is positioned for regional expansion, particularly in areas with rising demand for packaging, personal care, and industrial applications. In the southern U.S., manufacturing output was USD 2.9 trillion in 2023, underscoring a high concentration of industries requiring paraffin wax . Expanding regional operations allows paraffin wax manufacturers to cater to industrial hubs across the country, meeting localized demand and reducing logistical challenges associated with long-haul distribution.

Scope of the Report

|

By Type |

Fully Refined Paraffin Wax |

|

By Application |

Packaging |

|

By Distribution Channel |

Direct Sales |

|

By Grade |

Food-Grade Paraffin Wax |

|

By Region |

Northeast |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (EPA, FDA)

Paraffin Wax Manufacturers

Pharmaceutical Manufacturers

Personal Care and Cosmetics Manufacturers

Food Packaging Companies

Rubber and Tire Manufacturers

Companies

Players Mentioned in the Report

Sasol Ltd.

Exxon Mobil Corporation

China National Petroleum Corporation

Royal Dutch Shell plc

Repsol S.A.

International Group, Inc.

Lukoil

BP p.l.c.

Nippon Seiro Co. Ltd.

Petrobras

Sonneborn LLC

Blended Waxes, Inc.

Sasol Wax GmbH

MOL Group

Chevron Corporation

Table of Contents

1. USA Paraffin Wax Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate and Trends

1.4. Market Segmentation Overview

2. USA Paraffin Wax Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Paraffin Wax Market Analysis

3.1. Growth Drivers

3.1.1. Industrial and Consumer Demand for Wax Products (Packaging, Cosmetics)

3.1.2. Increasing Applications in Coating and Candle Manufacturing

3.1.3. Technological Advancements in Wax Processing

3.1.4. Expanding Demand in Pharmaceuticals and Healthcare Products

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Environmental Concerns and Alternatives

3.2.3. Supply Chain Constraints

3.3. Opportunities

3.3.1. Bio-based Paraffin Wax Alternatives

3.3.2. Regional Market Expansion

3.3.3. Innovative Applications in Emerging Sectors

3.4. Trends

3.4.1. Sustainable and Bio-based Wax Products

3.4.2. Enhanced Efficiency in Manufacturing Processes

3.4.3. Increased Demand in Eco-friendly Packaging Solutions

3.5. Regulatory Overview

3.5.1. Environmental Regulations

3.5.2. Quality Standards for Cosmetic and Food-Grade Waxes

3.5.3. Import/Export Tariffs and Duties

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. USA Paraffin Wax Market Segmentation

4.1. By Type (In Value %)

4.1.1. Fully Refined Paraffin Wax

4.1.2. Semi-Refined Paraffin Wax

4.1.3. Other Types (Microcrystalline, etc.)

4.2. By Application (In Value %)

4.2.1. Packaging

4.2.2. Candle Manufacturing

4.2.3. Cosmetics and Personal Care

4.2.4. Pharmaceutical

4.2.5. Rubber and Tires

4.3. By Distribution Channel (In Value %)

4.3.1. Direct Sales

4.3.2. Distributors and Wholesalers

4.3.3. E-commerce

4.4. By Grade (In Value %)

4.4.1. Food-Grade Paraffin Wax

4.4.2. Industrial-Grade Paraffin Wax

4.4.3. Cosmetic-Grade Paraffin Wax

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Paraffin Wax Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sasol Ltd.

5.1.2. Exxon Mobil Corporation

5.1.3. China National Petroleum Corporation

5.1.4. Sinopec Group

5.1.5. Repsol S.A.

5.1.6. International Group, Inc.

5.1.7. Royal Dutch Shell plc

5.1.8. Lukoil

5.1.9. BP p.l.c.

5.1.10. Nippon Seiro Co. Ltd.

5.1.11. PetroBras

5.1.12. Sonneborn LLC

5.1.13. Blended Waxes, Inc.

5.1.14. Sasol Wax GmbH

5.1.15. MOL Group

5.2. Cross Comparison Parameters (Annual Production Capacity, Distribution Network, Revenue, Key Application Sectors, Headquarters, Employee Count, R&D Investments, Manufacturing Units)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Landscape

5.7. Government and Regulatory Grants

5.8. Private and Public Equity Investments

6. USA Paraffin Wax Market Regulatory Framework

6.1. Health and Safety Standards for Consumer Products

6.2. FDA and EPA Regulations on Chemical Manufacturing

6.3. Import Tariff Policies and Export Restrictions

7. USA Paraffin Wax Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Growth Drivers for Future Market Expansion

8. USA Paraffin Wax Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Grade (In Value %)

8.5. By Region (In Value %)

9. USA Paraffin Wax Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Key End-User Segmentation Insights

9.3. Marketing and Brand Positioning Strategies

9.4. Opportunities in White Spaces

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins by mapping out the paraffin wax market ecosystem. This includes identifying relevant stakeholders across the supply chain and obtaining essential data through secondary research sources. Critical variables like production capacity, demand across application sectors, and market regulations are prioritized for comprehensive analysis.

Step 2: Market Analysis and Construction

In this phase, historical data is collected and analyzed to understand market performance. By comparing market penetration levels, the analysis provides insights into industry dynamics, ensuring accuracy in the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and growth drivers are validated through consultations with industry experts. Engaging with stakeholders provides nuanced insights that contribute to data accuracy and reinforces the validity of the projected market size.

Step 4: Research Synthesis and Final Output

Final data synthesis includes validation with paraffin wax manufacturers and distributors, ensuring alignment with market conditions. This comprehensive approach assures accuracy in the markets projected future trajectory.

Frequently Asked Questions

01. How big is the USA Paraffin Wax Market?

The USA paraffin wax market is valued at USD 375 million, supported by robust demand from packaging, cosmetics, and candle industries.

02. What are the major challenges in the USA Paraffin Wax Market?

Challenges in the USA paraffin wax market include fluctuating raw material prices, environmental concerns around paraffin use, and competition from bio-based alternatives.

03. Who are the leading players in the USA Paraffin Wax Market?

Major players in the USA paraffin wax market include Sasol Ltd., Exxon Mobil Corporation, and Royal Dutch Shell plc, with a strong presence in the paraffin wax supply chain.

04. What drives the demand in the USA Paraffin Wax Market?

The USA paraffin wax market demand is driven by applications in personal care, packaging, and candle manufacturing, where paraffin wax is valued for its versatile properties.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.