USA Pharmaceutical Contract Manufacturing Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD1987

November 2024

94

About the Report

USA Pharmaceutical Contract Manufacturing Market Overview

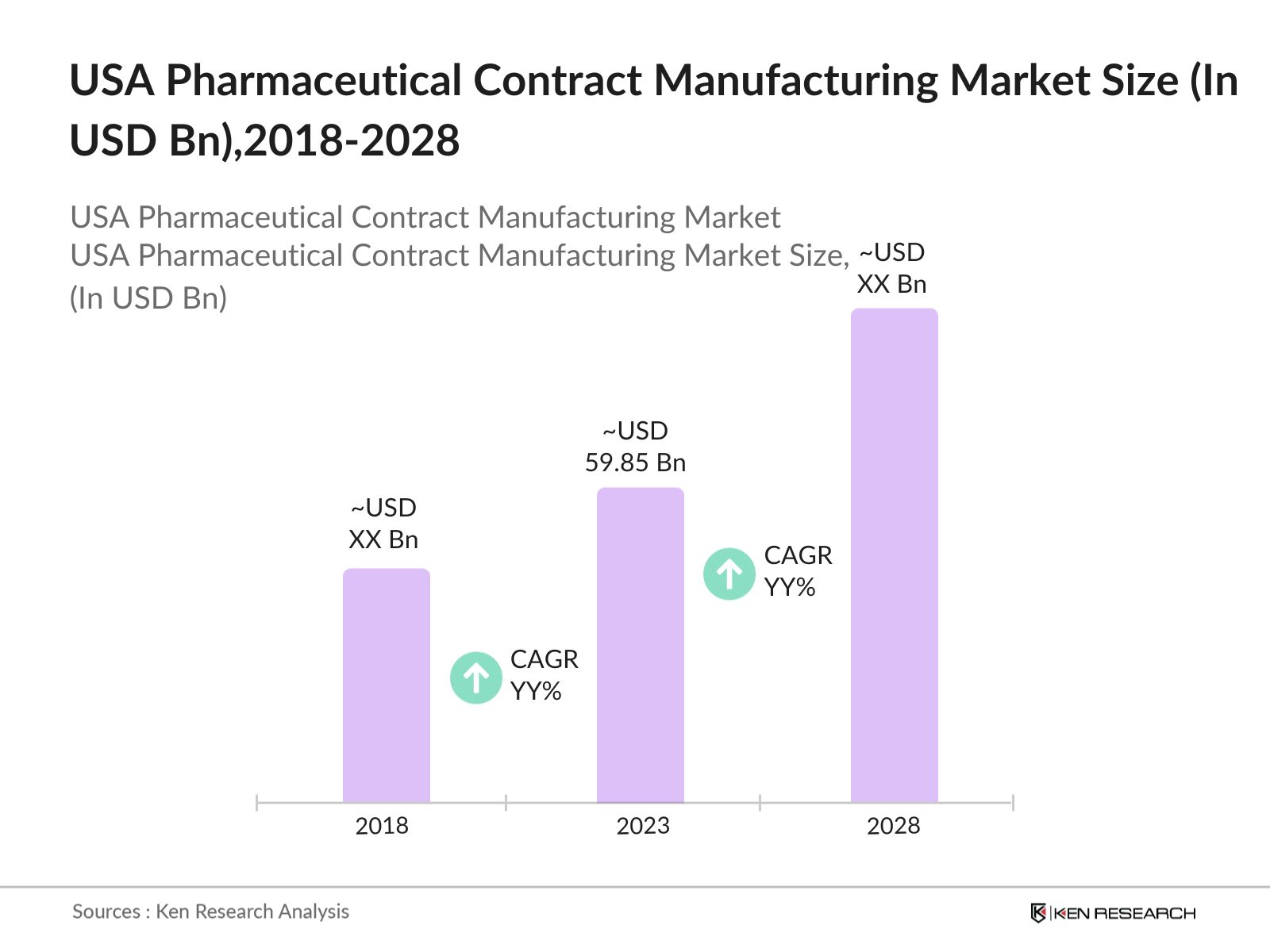

- TheUSA Pharmaceutical Contract Manufacturing Market size was valued at USD 59.85 billion in 2023. The growth has been propelled by rising outsourcing needs from pharmaceutical companies. With the increasing cost of drug development and the demand for more complex biologics, many companies are opting to outsource their production processes.

- The market is dominated by key players such as Lonza Group, Catalent Inc., Patheon (Thermo Fisher Scientific), Baxter BioPharma Solutions, and Samsung Biologics. These companies offer a wide range of contract services, from active pharmaceutical ingredient (API) production to final drug formulation.

- Catalent is investing $350 million to expand its Bloomington, Indiana facility for biologics drug substance and drug product manufacturing. The project will include 2000-liter bioreactors, syringe filling lines, and lyophilization capabilities, expected to be operational by 2024.

- The state of California has emerged as the leading region in the market, due to its high concentration of biotech and pharmaceutical companies, particularly in the Bay Area. Additionally, the presence of world-class research institutions and a robust talent pool has made it a hub for pharmaceutical innovation, driving demand for contract manufacturing services.

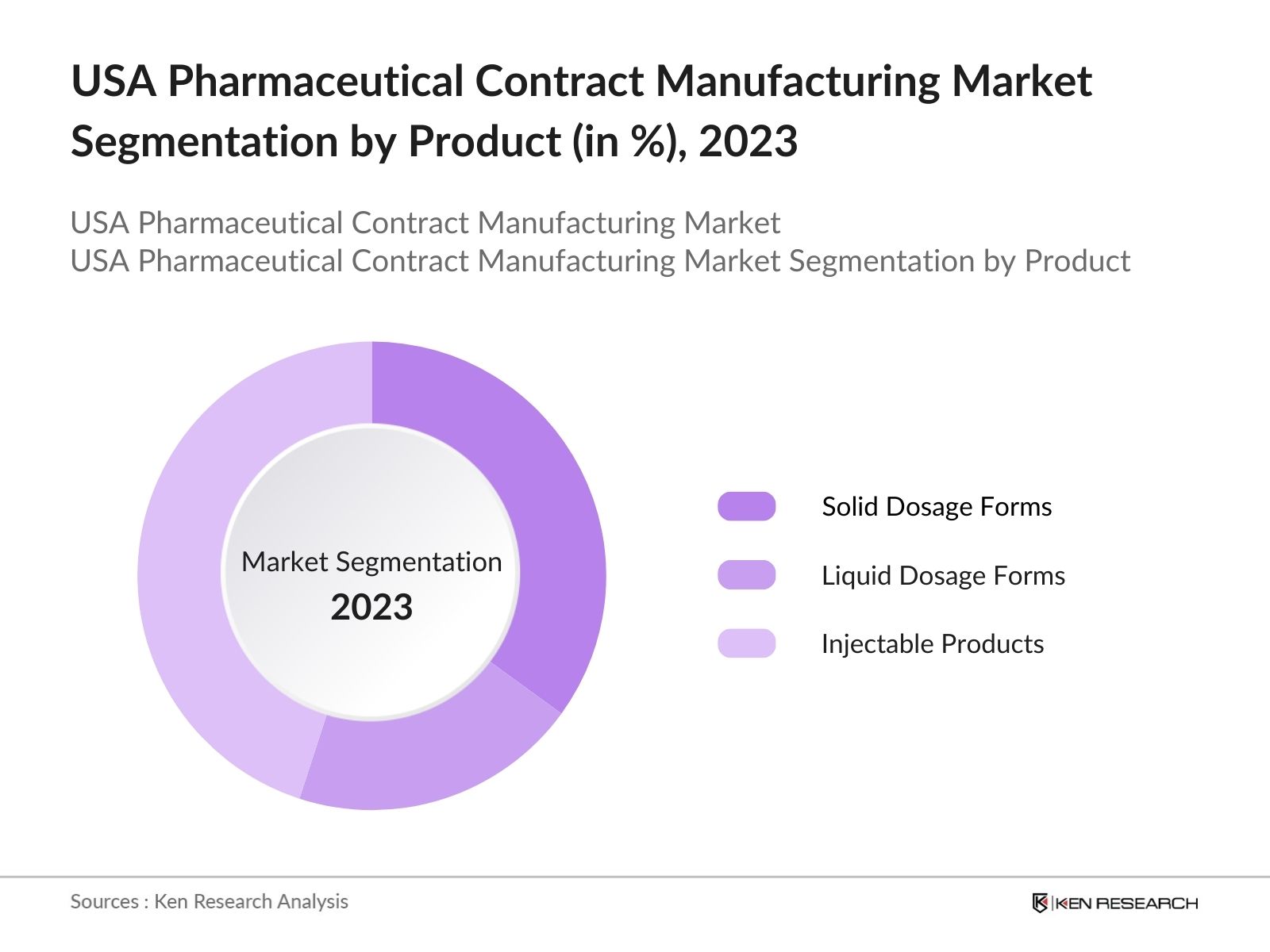

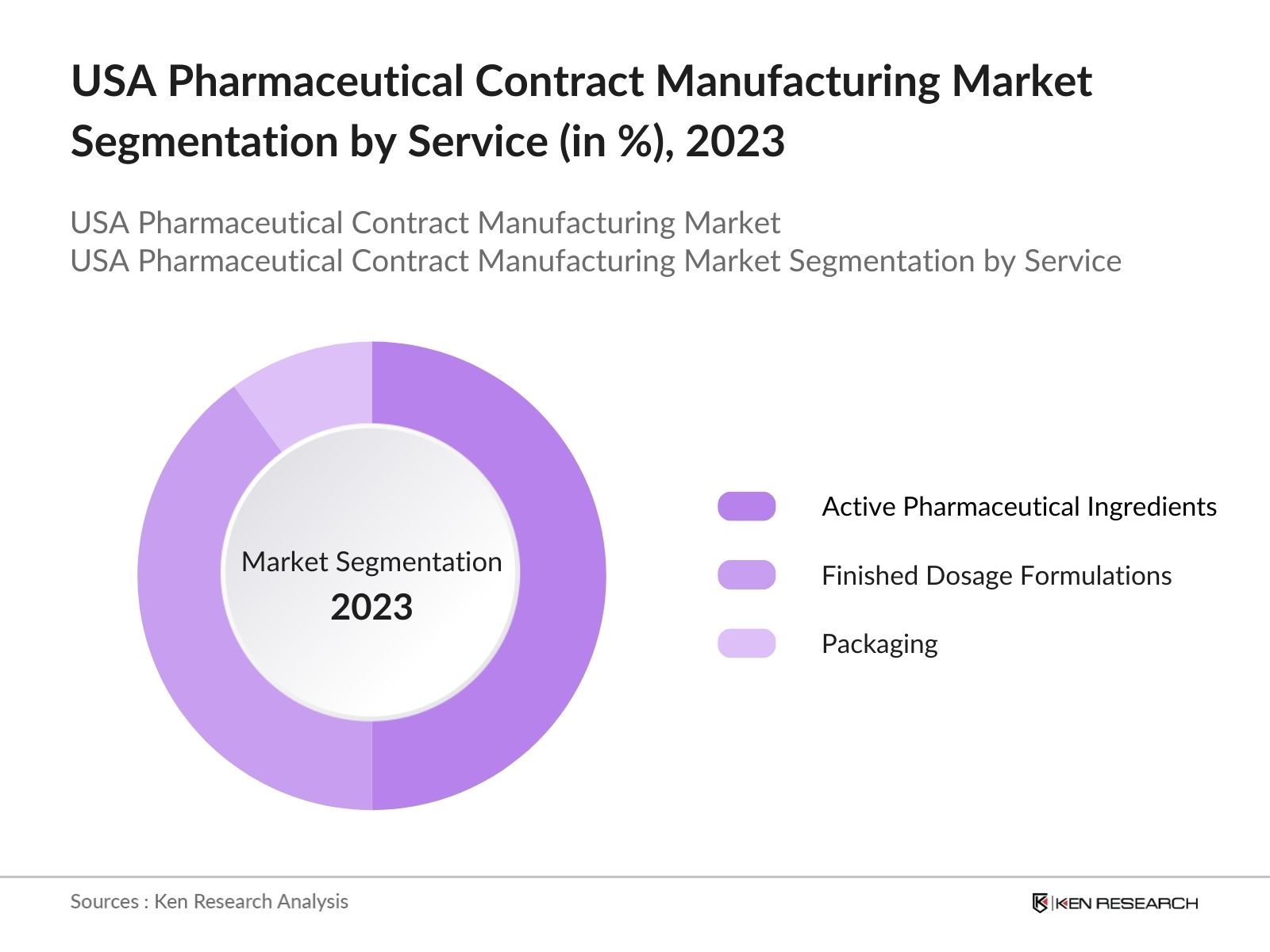

USA Pharmaceutical Contract Manufacturing Market Segmentation

The market is segmented into various factors like product, services, and region.

By Product: The market is segmented by product into solid dosage forms, liquid dosage forms, and injectable products. Injectable products held the largest market share, due to the increasing number of biologics and complex therapies requiring injectable delivery systems. Moreover, contract manufacturers have ramped up production capacity for injectables, particularly for biologics like monoclonal antibodies and gene therapies.

By Services: The market is segmented by services into active pharmaceutical ingredients (APIs), finished dosage formulations, and packaging. APIs led the market due to the increasing outsourcing of bulk drug substances. Many pharmaceutical companies prefer outsourcing API production to contract manufacturers, particularly for complex molecules and biologics.

By Region: The market is segmented by region into North, South, East, and West. The North region, which includes major hubs like New York and Massachusetts, held a dominant share by the concentration of pharmaceutical companies, strong regulatory frameworks, and extensive investments in life sciences research.

USA Pharmaceutical Contract Manufacturing Market Competitive Landscape

|

Company |

Established |

Headquarters |

|

Lonza Group |

1897 |

Basel, Switzerland |

|

Catalent Inc. |

1933 |

New Jersey, USA |

|

Patheon (Thermo Fisher) |

1974 |

North Carolina, USA |

|

Baxter BioPharma Solutions |

1931 |

Illinois, USA |

|

Samsung Biologics |

2011 |

Seoul, South Korea |

- Patheon (Thermo Fisher): Thermo Fisher announced a USD 200 million investment in expanding its North Carolina facility, focusing on sterile drug production. This move reflects the growing demand for sterile injectables and high-potency API manufacturing.

- Lonza Group: Lonza struck a $1.2 billion deal to acquire Roche's large biologics manufacturing plant in Vacaville, California. The site, one of the largest by volume, boasts 330,000 liters of bioreactor capacity. Lonza plans a $561 million expansion, aiming to boost mammalian biologics manufacturing for next-gen therapies.

USA Pharmaceutical Contract Manufacturing Market Analysis

Market Growth Drivers

- Rising Demand for Generic Drugs: The USA is experiencing increased demand for generic drugs due to the rising costs of branded medications. According to the FDA's reports, there were 90 first generic drug approvals in 2023. This includes approvals for various medications that allow manufacturers to market generic alternatives in the United States, which are essential for providing affordable treatment options to patients.

- Increased R&D Investments: Global pharmaceutical R&D spending hit a record $244 billion, driven by a focus on innovation and new drug development. The top 20 pharmaceutical companies invested $145 billion in R&D in 2023, a 4.5% increase from the previous year.AstraZeneca spent over 23% of its prescription drug revenues on R&D.

- Increased Biopharmaceutical Production: The surge in demand for biopharmaceuticals is a primary driver for the market. In 2023, biopharmaceutical companies required a large production space due to the increased focus on monoclonal antibodies and gene therapies. Contract manufacturers have stepped in to meet this demand.

Market Challenges

- Supply Chain Disruptions: The global supply chain disruptions, exacerbated by geopolitical tensions and transportation delays, have impacted the market. There were delays in the import of raw materials such as APIs from key markets like China and India, leading to production backlogs and increased costs. These disruptions have highlighted the need for contract manufacturers to diversify their supplier base to maintain a steady flow of materials.

- Cost Pressure and Pricing Challenges: Pharmaceutical companies are facing increasing pressure to reduce drug costs, which is transferred to contract manufacturers. Contract manufacturers faced a 10% rise in raw material costs, especially for APIs and packaging materials. These rising costs have put significant pressure on profit margins, making it more challenging for contract manufacturers to maintain profitability while meeting demand.

Government Initiatives

- Biomedical Advanced Research and Development Authority (BARDA): In 2024, BARDA awarded $500 million through Project NextGen to support Phase 2b clinical trials, including oral and nasal vaccines. These trials aim to advance innovative, easily administered vaccines. The funding supports Vaxart, Castlevax, and Cyanvac to accelerate vaccine development and improve public health preparedness.

- Drug Supply Chain Security Act (DSCSA) Implementation: The full implementation of the DSCSA in 2024 will require pharmaceutical manufacturers to comply with stricter tracking and tracing requirements for drugs throughout the supply chain. Contract manufacturers must invest in serialization technologies to comply with these regulations, which will increase production costs but also improve the transparency and security of the drug supply chain.

USA Pharmaceutical Contract Manufacturing Market Future Outlook

The future trends in USA pharmaceutical contract manufacturing market include the adoption of continuous manufacturing technologies, the rise of personalized medicines, and expansion in biologics production capabilities.

Future Market Trends

- Shift Towards Continuous Manufacturing: Over the next five years, contract manufacturers will increasingly adopt continuous manufacturing technologies, which can improve production efficiency. Continuous manufacturing allows for the uninterrupted production of drugs, reducing downtime and increasing output.

- Rise in Personalized Medicine: The future of the pharmaceutical contract manufacturing industry will be driven by personalized medicine, which is expected to grow by 2028. With over 300 personalized therapies currently in development, contract manufacturers will be required to scale up their production capacities for smaller, specialized batches of drugs.

Scope of the Report

|

By Product Type |

Solid Dosage Forms Liquid Dosage Forms Injectable Products |

|

By Service |

Active Pharmaceutical Ingredients (APIs) Finished Dosage Formulations Packaging |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmaceutical companies

Biopharmaceutical companies

Generic drug manufacturers

Biotech startups

Government Regulatory Bodies

Financial institutions and investors

Health insurance companies

Venture Capitalist

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Lonza Group

Catalent Inc.

Patheon (Thermo Fisher Scientific)

Baxter BioPharma Solutions

Samsung Biologics

Jubilant Life Sciences

Recipharm

WuXi AppTec

Siegfried Holding

AMRI (Albany Molecular Research Inc.)

PCI Pharma Services

Famar

Piramal Pharma Solutions

Cambrex Corporation

Aenova Group

Table of Contents

1. USA Pharmaceutical Contract Manufacturing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Pharmaceutical Contract Manufacturing Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Pharmaceutical Contract Manufacturing Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Biopharmaceutical Production

3.1.2. Expansion in Generic Drug Manufacturing

3.1.3. Rising Demand for Complex Drug Formulations

3.1.4. Growing Outsourcing Needs

3.2. Challenges

3.2.1. Regulatory Compliance Hurdles

3.2.2. Supply Chain Vulnerabilities

3.2.3. Labor Shortages

3.2.4. Rising Material Costs

3.3. Opportunities

3.3.1. Personalized Medicine Growth

3.3.2. Expansion in Biologics Production

3.3.3. Technological Advancements in Manufacturing

3.3.4. Increased Global Collaboration

3.4. Emerging Trends

3.4.1. Adoption of Continuous Manufacturing

3.4.2. Rise of mRNA Technology

3.4.3. Innovations in Drug Delivery Systems

3.4.4. Sustainability Initiatives in Manufacturing

4. Government Initiatives in the USA Pharmaceutical Contract Manufacturing Market

4.1. FDA Regulations and Guidelines

4.2. National Drug Supply Chain Security Act (DSCSA)

4.3. Advanced Manufacturing Initiatives

4.4. BARDA Investments and Public Health Programs

5. USA Pharmaceutical Contract Manufacturing Market Segmentation

5.1. By Service Type

5.1.1. API Manufacturing

5.1.2. Finished Dosage Form Manufacturing

5.1.3. Packaging and Labeling Services

5.2. By Product Type

5.2.1. Solid Dosage Forms

5.2.2. Injectable Products

5.2.3. Liquid Dosage Forms

5.3. By Region

5.3.1. North

5.3.2. South

5.3.3. East

5.3.4. West

6. USA Pharmaceutical Contract Manufacturing Market Competitive Landscape

6.1. Market Share Analysis

6.2. Key Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Private Equity and Venture Capital Funding

6.4.2. Government Grants

6.4.3. Corporate Partnerships

6.5. Detailed Profiles of Major Companies

6.5.1. Lonza Group

6.5.2. Catalent Inc.

6.5.3. Patheon (Thermo Fisher Scientific)

6.5.4. Baxter BioPharma Solutions

6.5.5. Samsung Biologics

6.5.6. Jubilant Life Sciences

6.5.7. Recipharm

6.5.8. WuXi AppTec

6.5.9. AMRI (Albany Molecular Research Inc.)

6.5.10. Vetter Pharma

6.5.11. Cambrex Corporation

6.5.12. Aenova Group

6.5.13. PCI Pharma Services

6.5.14. Piramal Pharma Solutions

6.5.15. Siegfried Holding

7. USA Pharmaceutical Contract Manufacturing Market Regulatory Framework

7.1. FDA Compliance Requirements

7.2. Good Manufacturing Practices (GMP) Regulations

7.3. Import-Export Regulations

7.4. Drug Supply Chain Security and Compliance

8. Future USA Pharmaceutical Contract Manufacturing Market Size Projections

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

8.3. New Market Opportunities in Biologics and Personalized Medicine

9. USA Pharmaceutical Contract Manufacturing Market Segmentation, 2028

9.1. By Service Type

9.2. By Product Type

9.3. By Region

10. USA Healthcare Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Pharmaceutical Contract Manufacturing Market Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing

We are building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output

Our team will approach multiple pharmaceutical companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such pharmaceutical companies.

Frequently Asked Questions

01 How big is the USA Pharmaceutical Contract Manufacturing Market?

The USA Pharmaceutical Contract Manufacturing Market size was valued at USD 59.85 billion in 2023. The growth has been propelled by rising outsourcing needs from pharmaceutical companies.

02 What are the challenges in the USA Pharmaceutical Contract Manufacturing Market?

Major challenges in the USA Pharmaceutical Contract Manufacturing Market include supply chain disruptions, regulatory compliance, rising raw material costs, and labor shortages in skilled manufacturing.

03 Who are the major players in the USA Pharmaceutical Contract Manufacturing Market?

Major players in the USA Pharmaceutical Contract Manufacturing Market include Lonza Group, Catalent Inc., Patheon (Thermo Fisher), Baxter BioPharma Solutions, and Samsung Biologics.

04 What are the main growth drivers of the USA Pharmaceutical Contract Manufacturing Market?

Key drivers of the USA Pharmaceutical Contract Manufacturing Market include increasing demand for outsourcing, advancements in biologics, and the rising number of complex drug formulations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.