USA Picture Archiving & Communication System Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD10640

December 2024

80

About the Report

USA PACS Market Overview

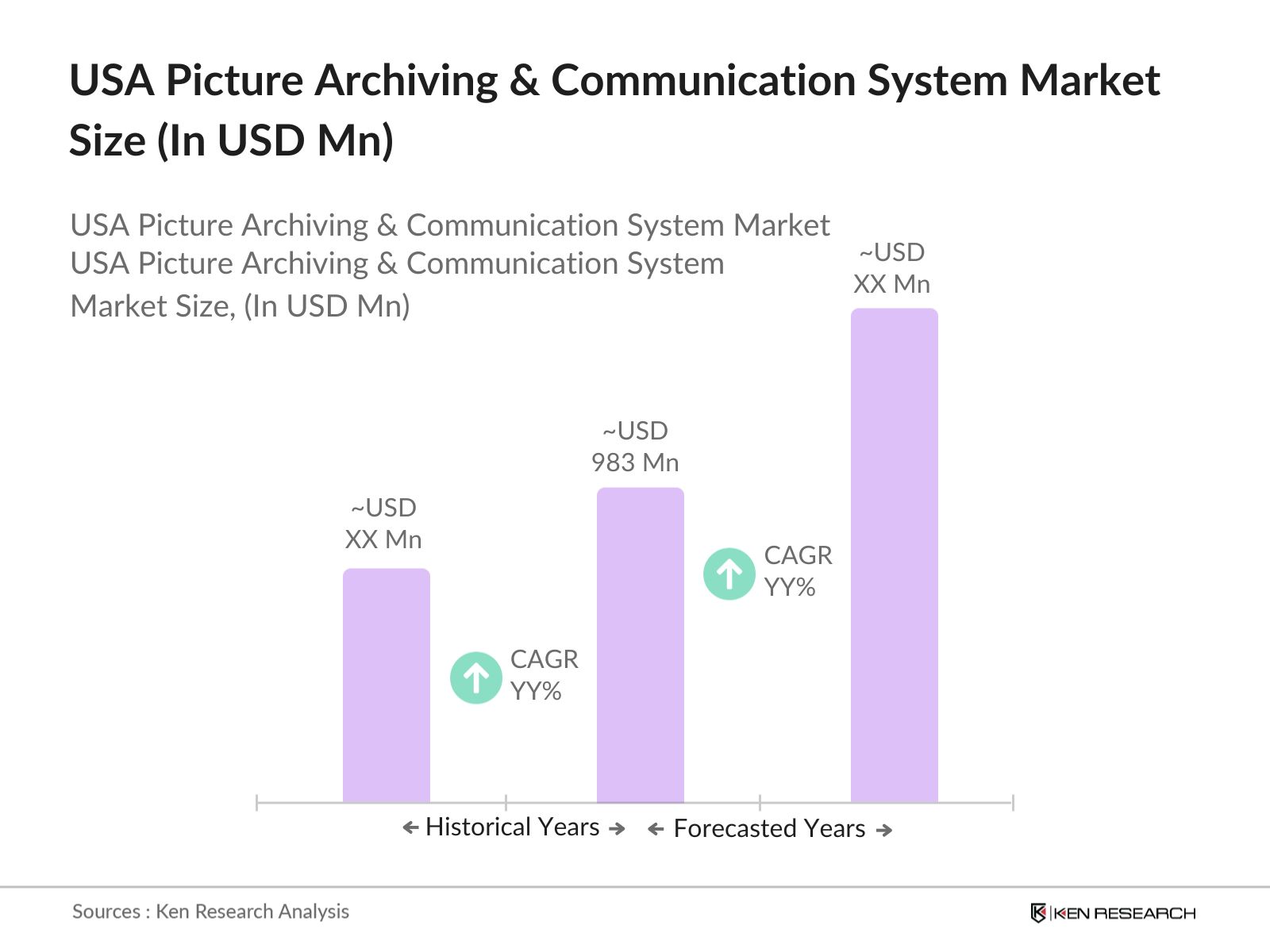

- The Picture Archiving & Communication System (PACS) market in the USA reached a valuation of USD 983 million, primarily driven by advancements in healthcare IT infrastructure and increasing demand for medical imaging solutions. With an estimated CAGR of 5.9% over the past five years, the market has shown substantial growth due to the rising prevalence of chronic diseases, such as cancer and cardiovascular conditions, which necessitate frequent diagnostic imaging.

- The USA remains a dominant player in the global PACS market, primarily due to the presence of major healthcare facilities in cities like New York, Los Angeles, and Houston. These cities house large medical institutions with high imaging volumes, driving demand for advanced PACS solutions. Additionally, the availability of a robust healthcare infrastructure and the integration of AI-based imaging solutions into PACS systems have positioned the USA as a leader in this market.

- The U.S. Food and Drug Administration (FDA) has implemented specific regulations for medical imaging systems like PACS to ensure safety and efficacy. By 2024, the FDA is expected to further streamline the approval process for PACS software that complies with medical device safety standards, leading to faster regulatory approvals and facilitating quicker market adoption. This regulatory support has already accelerated the integration of PACS into radiology departments across the country.

USA PACS Market Segmentation

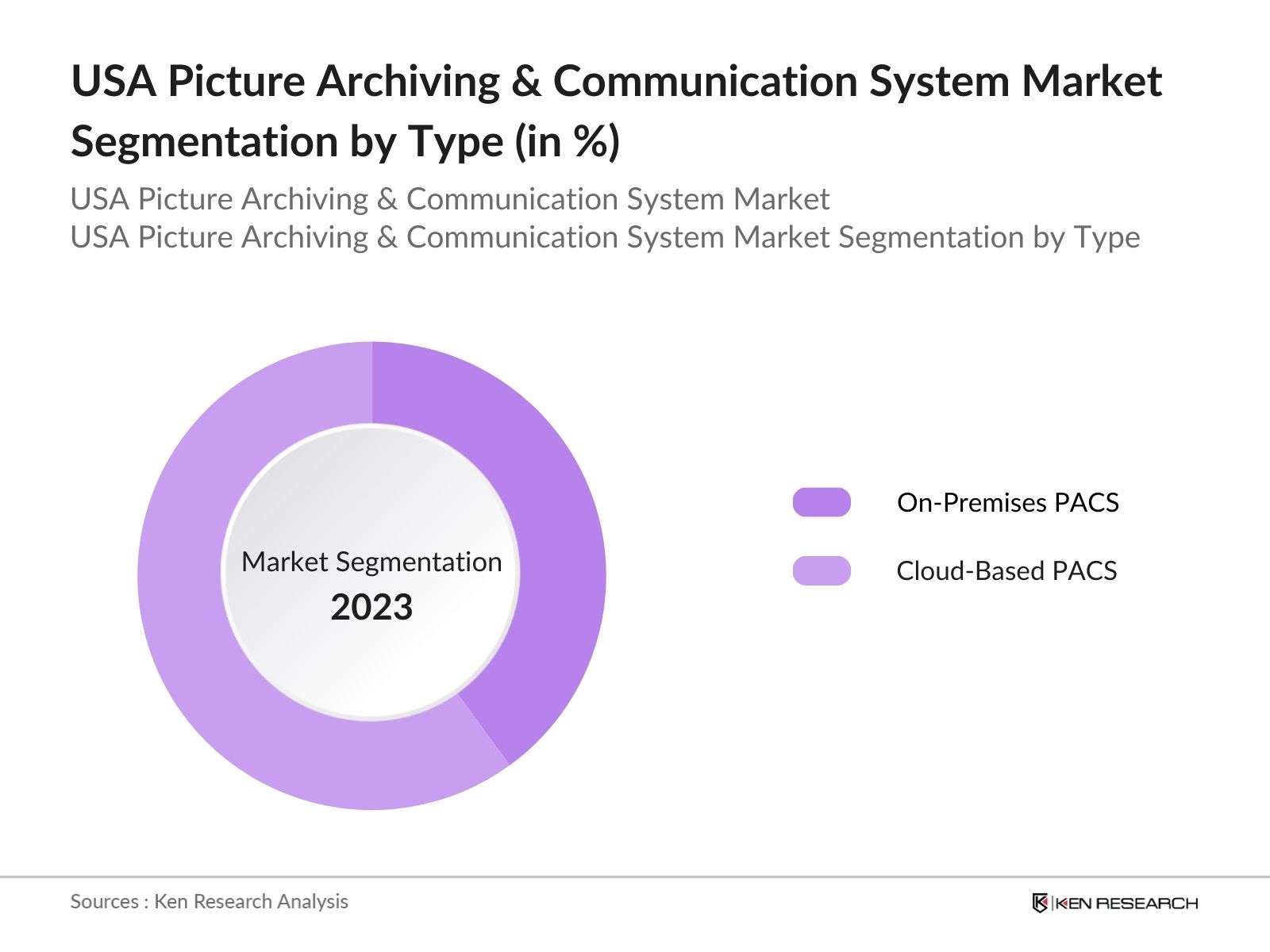

By Type: The market is segmented by type into On-Premises PACS and Cloud-Based PACS. On-premises PACS, while still widely used, is facing stiff competition from cloud-based solutions. Cloud-based PACS solutions are currently dominating due to their flexibility, scalability, and lower upfront infrastructure costs. Healthcare providers, particularly in smaller and mid-sized facilities, are increasingly adopting cloud solutions to reduce the complexity and expenses of maintaining in-house systems.

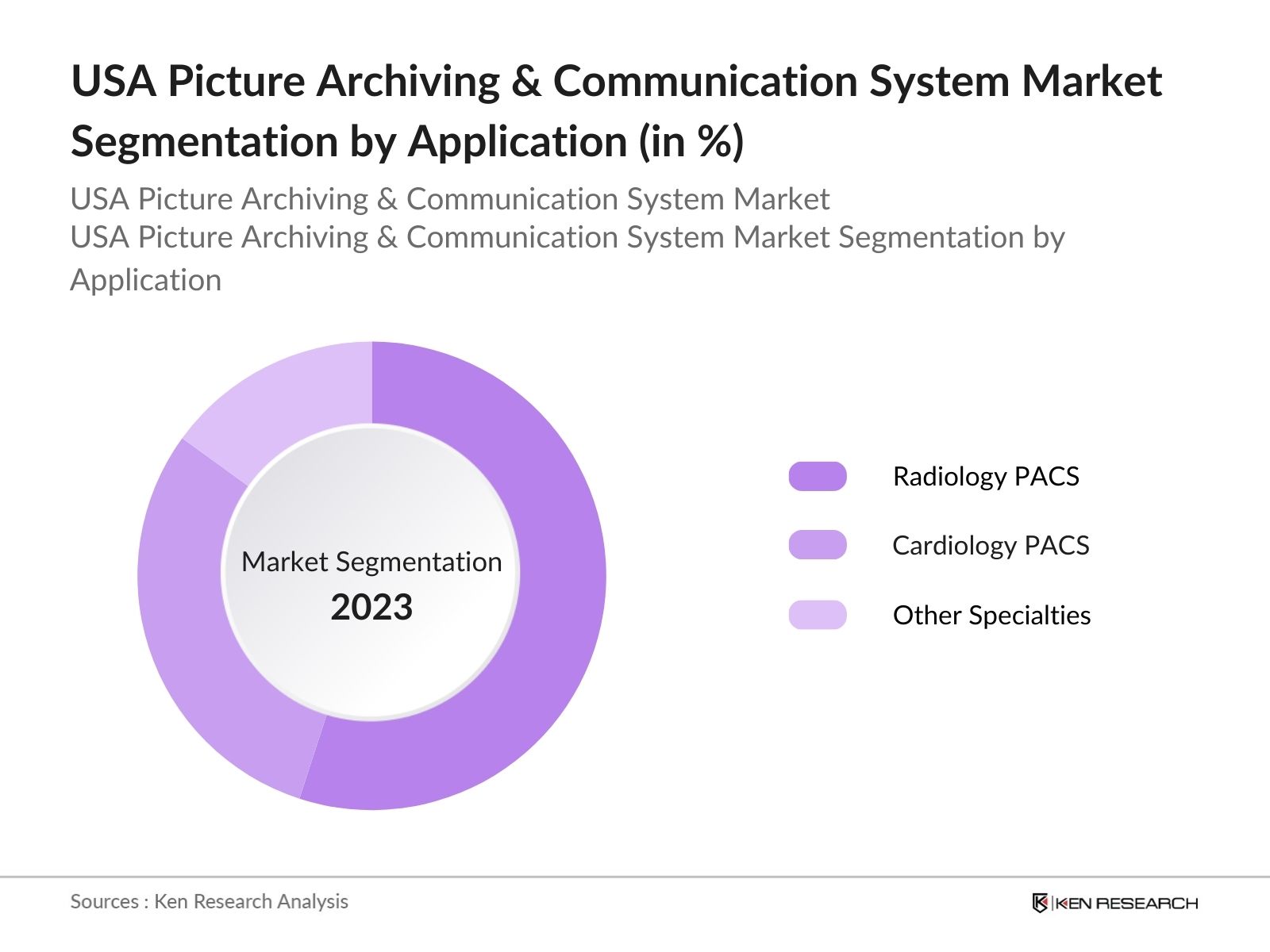

By Application: The market is further segmented by application into Radiology PACS, Cardiology PACS, and Other Specialties. Radiology PACS holds the largest share of the market, driven by the high volume of imaging studies generated in radiology departments. The growing use of advanced imaging technologies such as MRI, CT scans, and X-rays in radiology has ensured the segment's dominance.

USA PACS Market Competitive Landscape

The market is characterized by the presence of several key players, each of which contributes to the growth and technological advancements in the industry. These companies focus on innovation, partnerships, and product development to enhance the functionality of PACS systems.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

Key Product Offerings |

R&D Investment (USD Mn) |

Partnerships |

AI Integration |

|

GE Healthcare |

1892 |

Chicago, USA |

||||||

|

Philips Healthcare |

1891 |

Amsterdam, Netherlands |

||||||

|

Fujifilm Medical Systems |

1934 |

Tokyo, Japan |

||||||

|

Carestream Health |

2007 |

Rochester, USA |

||||||

|

Intelerad Medical Systems |

1999 |

Montreal, Canada |

USA PACS Market Analysis

Market Growth Drivers

- Increasing Implementation of PACS in Healthcare Facilities: The Picture Archiving and Communication System (PACS) is witnessing increased implementation in healthcare facilities across the USA, driven by the need for efficient storage and access to medical imaging data. In 2024, over 6,200 hospitals across the country are expected to continue adopting PACS for streamlining patient data and improving the accessibility of diagnostic imaging reports.

- Growing Adoption of Cloud-Based PACS Solutions: Cloud-based PACS solutions are experiencing growing demand due to their scalability and lower upfront costs compared to on-premise systems. By 2024, nearly 45% of healthcare organizations in the USA are projected to have shifted to cloud-based PACS, benefiting from its ease of access across multiple facilities and reduced IT infrastructure costs.

- Government Regulations Mandating Digital Health Record Systems: The U.S. government mandates for electronic health records (EHR) are driving the integration of PACS systems in healthcare facilities. By 2024, over 7,000 healthcare institutions are expected to meet government requirements for adopting digital health technologies, including PACS, in order to qualify for federal incentive programs.

Market Challenges

- Data Security and Privacy Concerns: The increasing reliance on digital systems for storing sensitive patient data has heightened concerns about data breaches and privacy violations. By 2024, healthcare institutions in the USA are expected to encounter over 2,200 cases of data breaches annually, many of which could potentially compromise patient medical records stored in PACS systems.

- Lack of Skilled IT Personnel in Healthcare: The PACS market in the USA is hindered by a shortage of skilled IT personnel capable of managing and troubleshooting these complex systems. As of 2024, an estimated 20% of healthcare facilities face challenges in maintaining PACS due to a shortage of IT professionals with the necessary expertise.

USA PACS Market Future Outlook

Over the next five years, the USA Picture Archiving & Communication System Industry is expected to experience steady growth, fueled by continuous advancements in imaging technologies and increasing demand for cloud-based PACS solutions.

Future Market Opportunities

- Increased Adoption of AI-Integrated PACS Systems: In the next five years, the adoption of AI-integrated PACS systems is expected to rise, driven by the demand for faster and more accurate diagnostic imaging. By 2028, over 2,000 hospitals in the USA are anticipated to implement AI-powered PACS solutions, allowing for automated analysis of imaging data and improved diagnostic precision.

- Expansion of Cloud-Based PACS: The transition to cloud-based PACS systems is expected to accelerate in the coming years, with nearly 70% of hospitals in the USA projected to adopt cloud-based PACS by 2028. The scalability and cost efficiency of cloud solutions will drive this shift, enabling healthcare organizations to store vast amounts of imaging data securely while improving data accessibility for radiologists and healthcare providers across multiple locations.

Scope of the Report

|

By Type |

On-Premises PACS Cloud-Based PACS |

|

By Application |

Radiology PACS Cardiology PACS Oncology PACS |

|

By End-User |

Hospitals Diagnostic Imaging Centers Clinics Ambulatory Care Centers |

|

By Mode of Access |

Web-Based PACS Mobile PACS Desktop-Based PACS |

|

By Region |

North West East South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Hospitals and Healthcare Providers

Banks and Financial Institution

Medical Device Manufacturers

Government and Regulatory Bodies (e.g., FDA, HIPAA)

Healthcare IT Service Providers

Investors and Venture Capitalist Firms

Cloud Infrastructure Providers

Telehealth and Teleradiology Service Providers

Companies

Players Mentioned in the Report:

GE Healthcare

Philips Healthcare

Agfa Healthcare

Fujifilm Medical Systems

Carestream Health

Intelerad Medical Systems

Siemens Healthineers

IBM Watson Health

Merge Healthcare

Sectra AB

Table of Contents

USA Picture Archiving & Communication System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

USA Picture Archiving & Communication System Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Picture Archiving & Communication System Market Analysis

3.1. Growth Drivers

3.1.1. Integration of AI in PACS (Increased efficiency through machine learning)

3.1.2. Adoption of Cloud-Based Solutions (Lower infrastructure costs, scalability)

3.1.3. Rise in Telehealth and Remote Diagnostics (Demand for virtual consultations)

3.1.4. Aging Population and Chronic Diseases (Higher demand for diagnostic imaging)

3.2. Market Challenges

3.2.1. Data Privacy Concerns (Risk of breaches in healthcare systems)

3.2.2. High Implementation Costs (Infrastructure and integration expenses)

3.2.3. Regulatory Compliance (Stringent healthcare data regulations)

3.2.4. Limited Interoperability (Challenges in system integration)

3.3. Opportunities

3.3.1. Expansion into Ambulatory Services (Growing demand for outpatient care)

3.3.2. Increased Demand for Specialized PACS (Cardiology, Oncology)

3.3.3. Technological Advancements in Imaging (Enhanced image processing and resolution)

3.3.4. Public-Private Partnerships in Healthcare IT (Collaborations to improve healthcare infrastructure)

3.4. Trends

3.4.1. Cloud PACS Adoption in Research and Academic Institutions

3.4.2. Growth of Mobile Imaging and Teleradiology

3.4.3. AI-Powered Diagnostic Tools Integrated with PACS

3.4.4. Increasing Investment in PACS Security Measures

USA Picture Archiving & Communication System Market Segmentation

4.1. By Type (In Value %)

4.1.1. On-Premises PACS

4.1.2. Cloud-Based PACS

4.2. By Application (In Value %)

4.2.1. Radiology PACS

4.2.2. Cardiology PACS

4.2.3. Oncology PACS

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Diagnostic Imaging Centers

4.3.3. Clinics and Physician Offices

4.3.4. Ambulatory Care Centers

4.4. By Mode of Access (In Value %)

4.4.1. Web-Based PACS

4.4.2. Mobile PACS

4.4.3. Desktop-Based PACS

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

USA Picture Archiving & Communication System Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. GE Healthcare

5.1.2. Philips Healthcare

5.1.3. Agfa Healthcare

5.1.4. Fujifilm Medical Systems

5.1.5. McKesson Corporation

5.1.6. Carestream Health

5.1.7. Siemens Healthineers

5.1.8. IBM Watson Health

5.1.9. Merge Healthcare

5.1.10. INFINITT Healthcare

5.1.11. Novarad

5.1.12. Intelerad Medical Systems

5.1.13. Canon Medical Systems

5.1.14. Sectra AB

5.1.15. RamSoft

5.2. Cross Comparison Parameters (Headquarters, Market Share, Revenue, Employees, Partnerships, Number of Installations, Key Offerings, Key Customers)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Mergers, Acquisitions)

5.5. Investment Analysis (Private Equity, Government Investments)

5.6. Venture Capital Funding in PACS Startups

USA Picture Archiving & Communication System Market Regulatory Framework

6.1. Healthcare Data Compliance (HIPAA, GDPR)

6.2. FDA Regulations on Medical Imaging Software

6.3. Cybersecurity Standards for Healthcare IT Systems

6.4. Certification Processes for PACS Systems

USA Picture Archiving & Communication System Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Picture Archiving & Communication System Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Mode of Access (In Value %)

8.5. By Region (In Value %)

USA Picture Archiving & Communication System Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical variables influencing the USA PACS market, including regulatory factors, technological advancements, and key stakeholders. Data collection will encompass proprietary databases and secondary research.

Step 2: Market Analysis and Construction

The analysis will compile historical data on PACS installations, the adoption of cloud-based solutions, and the impact of AI integration, resulting in accurate revenue projections and growth trends.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and healthcare professionals will be consulted to validate market assumptions and provide insights into future market opportunities and potential challenges.

Step 4: Research Synthesis and Final Output

Data from multiple sources will be synthesized into a final comprehensive report, ensuring accuracy and reliability in the findings. The final output will provide actionable insights for stakeholders.

Frequently Asked Questions

01. How big is the USA Picture Archiving & Communication System (PACS) Market?

The USA PACS market was valued at USD 983 million, driven by the increasing demand for medical imaging solutions and the integration of cloud-based technologies in healthcare IT.

02. What are the challenges in the USA PACS Market?

Key challenges in the USA PACS market include concerns over data privacy and security, high infrastructure costs for smaller healthcare facilities, and compliance with stringent regulatory requirements.

03. Who are the major players in the USA PACS Market?

Major players in the USA PACS market include GE Healthcare, Philips Healthcare, Fujifilm Medical Systems, Carestream Health, and Intelerad Medical Systems, each leading in product innovation and cloud-based solutions.

04. What are the growth drivers of the USA PACS Market?

The USA PACS market is propelled by the rising demand for diagnostic imaging, the growing prevalence of chronic diseases, and the increasing adoption of cloud-based PACS solutions in both small and large healthcare facilities.

05. What trends are shaping the future of the USA PACS Market?

Key trends in the USA PACS market include the integration of AI into PACS for diagnostic accuracy, the shift towards cloud-based solutions, and the rising demand for teleradiology services, especially in rural and underserved areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.