USA Pilot Training Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD5305

November 2024

94

About the Report

USA Pilot Training Market Overview

- The USA Pilot Training market is valued at USD 1.81 billion, based on a five-year historical analysis. This market is primarily driven by a rising demand for skilled pilots, fueled by increased air travel and a high rate of pilot retirements. Additionally, advancements in training technologies, including VR and AI-based simulation systems, are enhancing training efficiency and accessibility, which has attracted significant investments from both public and private sectors.

- Major cities such as Dallas, Phoenix, and Miami dominate the market due to their favorable climates, established aviation schools, and proximity to major airline hubs. These factors contribute to a higher concentration of flight training institutions and resources in these regions.

- The FAA enforces stringent standards to ensure aviation safety and pilot competence. These include comprehensive training requirements, such as a minimum of 1,500 flight hours for Airline Transport Pilot (ATP) certification, as stipulated in 14 CFR Part 61. Additionally, the FAA mandates recurrent training and proficiency checks to maintain pilot certifications, ensuring that pilots adhere to the highest safety standards.

USA Pilot Training Market Segmentation

By Aircraft Type: The market is segmented by aircraft type into airplanes and helicopters. Airplanes hold a dominant market share due to the extensive demand for commercial airline pilots. The proliferation of commercial flights and the expansion of airline fleets necessitate a larger workforce of trained airplane pilots, thereby driving this segment's prominence.

By License Type: The market is further segmented by license type into Commercial Pilot License (CPL), Private Pilot License (PPL), Airline Transport Pilot License (ATPL), and others. The CPL segment leads the market, reflecting the high demand for pilots in commercial aviation. The growth of the commercial aviation sector, coupled with the need for pilots to operate larger aircraft, underscores the dominance of the CPL segment.

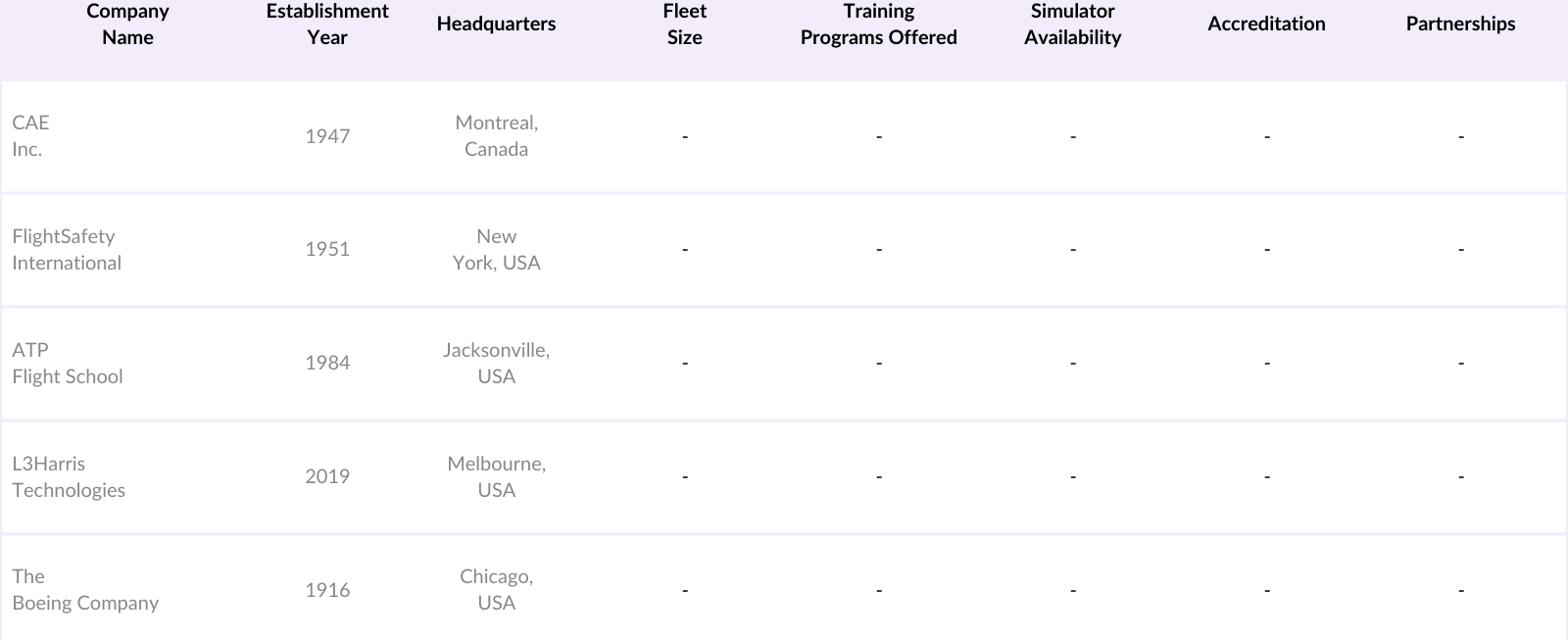

USA Pilot Training Market Competitive Landscape

The USA pilot training market is characterized by the presence of several key players offering comprehensive training programs. This competitive landscape underscores the significant influence of these companies in shaping the market dynamics.

USA Pilot Training Industry Analysis

Growth Drivers

- Increasing Demand for Air Travel: In 2023, the U.S. Department of Transportation reported that U.S. airlines carried over 900 million passengers, a significant increase from the previous year. This surge in air travel necessitates a corresponding rise in trained pilots to meet operational demands. The Federal Aviation Administration (FAA) has noted a consistent uptick in commercial flight operations, underscoring the need for an expanded pilot workforce. The International Air Transport Association (IATA) also highlighted that North America experienced a robust recovery in passenger traffic, reaching near pre-pandemic levels.

- Pilot Shortage and Retirement Rates: The FAA's 2023 data indicates that approximately 5,000 pilots are expected to retire annually over the next decade, contributing to a significant shortage in the aviation industry. The Air Line Pilots Association (ALPA) has emphasized that this wave of retirements, coupled with increased air travel demand, has created a pressing need for new pilots. In response, airlines are intensifying recruitment and training efforts to bridge this gap, thereby boosting the pilot training market.

- Technological Advancements in Training Methods: The integration of advanced technologies such as Virtual Reality (VR) and Augmented Reality (AR) has revolutionized pilot training methodologies. The FAA has approved the use of VR simulators for certain training modules, enhancing the realism and effectiveness of pilot instruction. Additionally, the National Aeronautics and Space Administration (NASA) has been researching the application of AR in cockpit simulations to improve pilot situational awareness and decision-making skills.

Market Challenges

- High Training Costs: The cost of obtaining a commercial pilot license in the U.S. can exceed $100,000, posing a significant financial barrier for many aspiring pilots. The Aircraft Owners and Pilots Association (AOPA) has highlighted that these substantial expenses deter potential candidates, contributing to the ongoing pilot shortage. Despite the availability of scholarships and financing options, the high upfront costs remain a considerable challenge for the pilot training market.

- Regulatory Compliance and Certification Processes: The FAA's stringent regulations require pilot training programs to adhere to comprehensive standards, including a minimum of 1,500 flight hours for Airline Transport Pilot (ATP) certification. These rigorous requirements ensure safety but also extend the duration and complexity of training programs. Training institutions must invest in maintaining compliance, which can be resource-intensive and may limit the scalability of training operations.

USA Pilot Training Market Future Outlook

Over the next five years, the USA pilot training market is expected to experience significant growth, driven by continuous advancements in training technologies, increasing demand for air travel, and the need to address the pilot shortage due to retirements. The integration of virtual reality and artificial intelligence into training programs is anticipated to enhance training efficiency and effectiveness.

Market Opportunities

- Adoption of Virtual and Augmented Reality in Training: The FAA has approved the use of Virtual Reality (VR) and Augmented Reality (AR) technologies in pilot training programs, recognizing their potential to enhance learning experiences. These technologies provide immersive simulations that improve pilot skills and decision-making abilities. The National Training Aircraft Symposium has reported that VR and AR can reduce training time and costs, presenting a significant opportunity for training institutions to adopt these technologies and attract more candidates.

- Partnerships with Airlines and Aviation Institutes: Collaborations between airlines and aviation training institutes have become increasingly prevalent. For example, United Airlines has partnered with flight schools to create tailored training programs that ensure a steady pipeline of qualified pilots. Such partnerships provide training institutions with resources and employment pathways for graduates, enhancing the attractiveness of pilot training programs and supporting market growth.

Scope of the Report

|

Aircraft Type |

Airplane |

|

License Type |

Commercial Pilot License (CPL) |

|

Training Program |

Commercial Pilot Training Program |

|

Training Mode |

Flight Training |

|

Region |

Northeast |

Products

Key Target Audience

Airlines and Aviation Companies

Pilot Training Institutions

Aircraft Manufacturers

Aviation Maintenance Organizations

Government and Regulatory Bodies (e.g., Federal Aviation Administration)

Investment and Venture Capitalist Firms

Aviation Technology Providers

Airport Authorities

Companies

Players Mentioned in the Report

CAE Inc.

FlightSafety International

ATP Flight School

L3Harris Technologies

The Boeing Company

United Airlines Flight Training Center

American Airlines Training Center

Delta Air Lines Training Center

Embry-Riddle Aeronautical University

University of North Dakota Aerospace

Table of Contents

1. USA Pilot Training Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Pilot Training Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Pilot Training Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Air Travel

3.1.2. Pilot Shortage and Retirement Rates

3.1.3. Technological Advancements in Training Methods

3.1.4. Expansion of Airline Fleets

3.2. Market Challenges

3.2.1. High Training Costs

3.2.2. Regulatory Compliance and Certification Processes

3.2.3. Limited Access to Advanced Simulators

3.3. Opportunities

3.3.1. Adoption of Virtual and Augmented Reality in Training

3.3.2. Government Initiatives and Funding

3.3.3. Partnerships with Airlines and Aviation Institutes

3.4. Trends

3.4.1. Integration of Artificial Intelligence in Training Programs

3.4.2. Emphasis on Safety and Emergency Procedures

3.4.3. Online and Remote Training Modules

3.5. Government Regulations

3.5.1. Federal Aviation Administration (FAA) Standards

3.5.2. Certification Requirements for Training Institutions

3.5.3. Pilot Licensing Procedures

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. USA Pilot Training Market Segmentation

4.1. By Aircraft Type (In Value %)

4.1.1. Airplane

4.1.2. Helicopter

4.2. By License Type (In Value %)

4.2.1. Commercial Pilot License (CPL)

4.2.2. Private Pilot License (PPL)

4.2.3. Airline Transport Pilot License (ATPL)

4.2.4. Others

4.3. By Training Program (In Value %)

4.3.1. Commercial Pilot Training Program

4.3.2. Cadet Pilot Training Program

4.3.3. Others

4.4. By Training Mode (In Value %)

4.4.1. Flight Training

4.4.2. Simulator Training

4.4.3. Ground Training

4.4.4. Recurrent Training

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Pilot Training Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. CAE Inc.

5.1.2. FlightSafety International

5.1.3. ATP Flight School

5.1.4. L3Harris Technologies

5.1.5. The Boeing Company

5.1.6. United Airlines Flight Training Center

5.1.7. American Airlines Training Center

5.1.8. Delta Air Lines Training Center

5.1.9. Embry-Riddle Aeronautical University

5.1.10. University of North Dakota Aerospace

5.1.11. Spartan College of Aeronautics and Technology

5.1.12. Simcom Aviation Training

5.1.13. Pan Am International Flight Academy

5.1.14. AeroGuard Flight Training Center

5.1.15. Skyborne Airline Academy

5.2. Cross Comparison Parameters (Fleet Size, Training Programs Offered, Simulator Availability, Accreditation, Partnerships, Student Enrollment, Training Locations, Technological Integration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Pilot Training Market Regulatory Framework

6.1. FAA Training Standards

6.2. Compliance Requirements for Training Institutions

6.3. Certification Processes for Pilots

6.4. Safety and Operational Guidelines

7. USA Pilot Training Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Pilot Training Future Market Segmentation

8.1. By Aircraft Type (In Value %)

8.2. By License Type (In Value %)

8.3. By Training Program (In Value %)

8.4. By Training Mode (In Value %)

8.5. By Region (In Value %)

9. USA Pilot Training Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA pilot training market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA pilot training market. This includes assessing market penetration, the ratio of training institutions to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple pilot training institutions to acquire detailed insights into training programs, enrollment trends, technological integration, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA pilot training market.

Frequently Asked Questions

01. How big is the USA pilot training market?

The USA Pilot Training market is valued at USD 1.81 billion, based on a five-year historical analysis. This market is primarily driven by a rising demand for skilled pilots, fueled by increased air travel and a high rate of pilot retirements.

02. What are the challenges in the USA pilot training market?

Challenges include high training costs, regulatory compliance complexities, and limited access to advanced simulators. Additionally, the need to keep pace with rapidly evolving aviation technologies poses a significant challenge for training institutions.

03. Who are the major players in the USA pilot training market?

Key players include CAE Inc., Flight Safety International, ATP Flight School, L3Harris Technologies, and The Boeing Company. These companies dominate due to their extensive training programs, advanced simulators, and strategic partnerships with airlines.

04. What are the growth drivers of the USA pilot training market?

The USA pilot training market is propelled by factors such as increasing air travel demand, a high rate of pilot retirements, and the expansion of airline fleets. Furthermore, advancements in training technology, including VR and AI, are enhancing training efficiency and accessibility, driving market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.