USA Portable Generator Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD8988

December 2024

96

About the Report

USA Portable Generator Market Overview

- The USA Portable Generator Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing demand for backup power solutions due to frequent power outages and extreme weather events. Additionally, rising construction activities, particularly in the residential and commercial sectors, have created a steady demand for portable generators. Technological advancements like inverter generators that offer better fuel efficiency and reduced noise levels have further bolstered the markets expansion.

- The market is predominantly led by states like Texas, California, and Florida. These states experience frequent power outages due to hurricanes, wildfires, and heatwaves, leading to higher adoption rates of portable generators. Texas, with its substantial oil and gas industry, also sees increased use of portable generators for industrial applications. Californias focus on emergency preparedness and its exposure to natural disasters have made it a significant market for portable generators.

- In 2023, the U.S. imposed an average import tariff of 7.5% on portable generators manufactured in China, affecting pricing dynamics. The trade policy has influenced the supply chain, impacting the cost structure of imported generator models. This shift has made it more critical for U.S. manufacturers to optimize their supply chains to remain competitive in pricing.

USA Portable Generator Market Segmentation

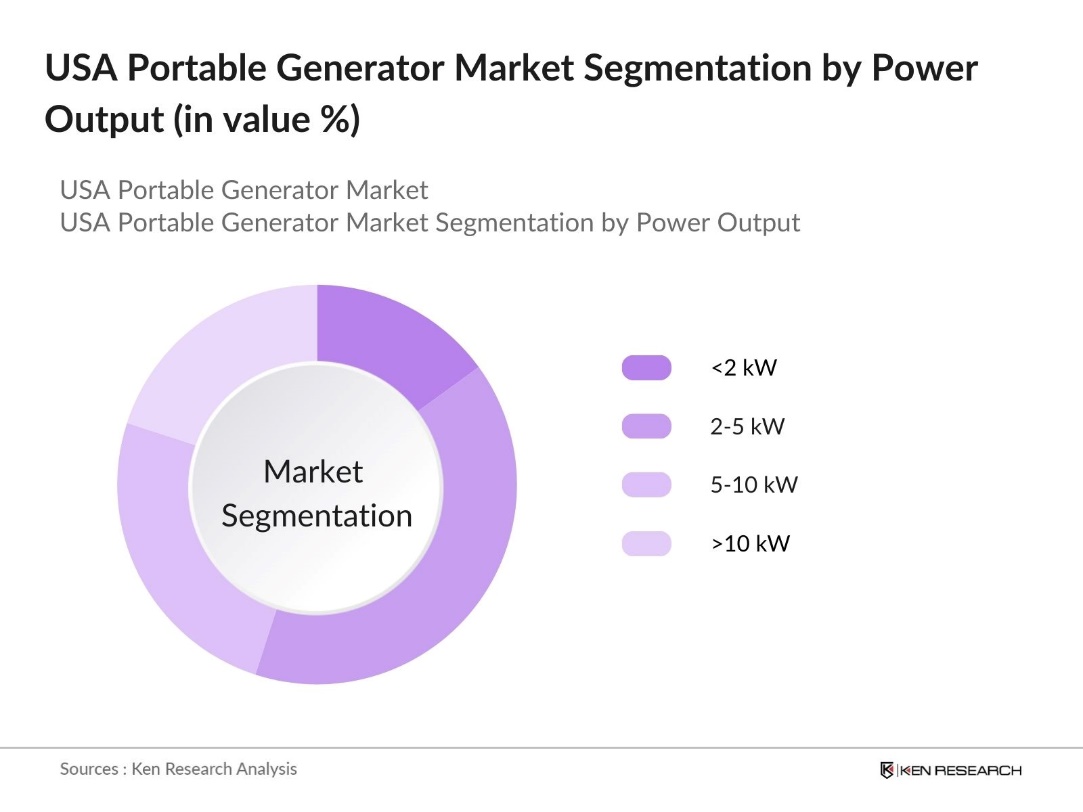

By Power Output: The USA Portable Generator market is segmented by power output into less than 2 kW, 2-5 kW, 5-10 kW, and more than 10 kW. Recently, the 2-5 kW segment has maintained a dominant market share. This is due to its suitability for residential and small commercial use, offering a balance between portability and power output. Its compatibility with most household appliances and moderate price range makes it a preferred choice among homeowners for backup power solutions during outages.

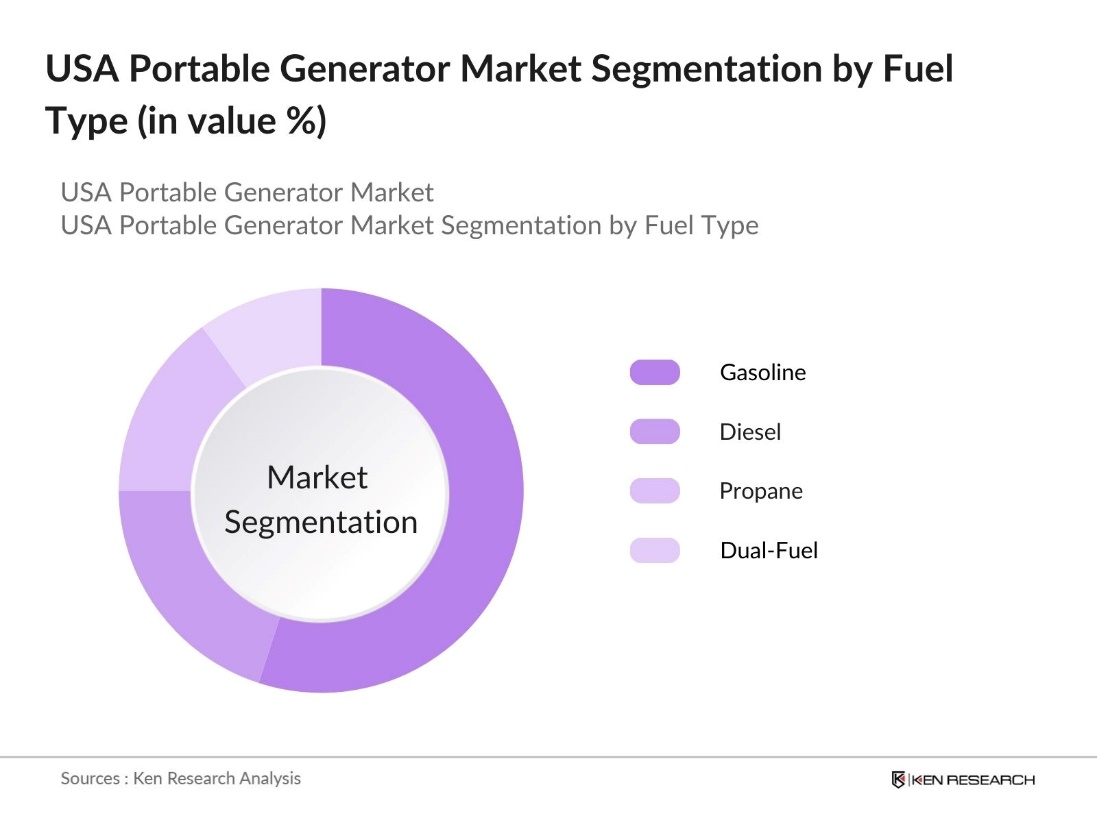

By Fuel Type: The USA Portable Generator market is segmented by fuel type into gasoline, diesel, propane, and dual-fuel generators. Gasoline-powered generators dominate the market due to their easy availability and lower initial costs. They are widely used in residential applications, making them a convenient choice for emergency backup during power outages. However, diesel generators are preferred for industrial and commercial use due to their durability and longer runtime, though they represent a smaller market share.

USA Portable Generator Market Competitive Landscape

The market is dominated by a mix of domestic and international players. The market is characterized by intense competition, with major companies offering a range of products catering to different power needs. The players also focus on innovations such as noise reduction and fuel efficiency to differentiate their offerings.

|

Company |

Establishment Year |

Headquarters |

Key Focus Areas |

Product Range |

R&D Expenditure |

Distribution Network |

Customer Segments |

Recent Developments |

Strategic Partnerships |

|

Generac Holdings Inc. |

1959 |

Waukesha, Wisconsin |

|||||||

|

Honda Power Equipment |

1946 |

Tokyo, Japan |

|||||||

|

Caterpillar Inc. |

1925 |

Deerfield, Illinois |

|||||||

|

Cummins Inc. |

1919 |

Columbus, Indiana |

|||||||

|

Briggs & Stratton Corp. |

1908 |

Milwaukee, Wisconsin |

USA Portable Generator Industry Analysis

Growth Drivers

- Increasing Demand for Backup Power (Power Outages): The United States experienced power outages, affecting millions of households. These disruptions, largely driven by severe weather events such as hurricanes and snowstorms, have increased the demand for portable generators as a reliable backup power solution. For instance, CORE Electric Cooperative reported a decrease in their average outage duration from 92 minutes in 2022 to 63 minutes in 2023. The frequency of such disruptions has led to a surge in consumer preference for portable generators to ensure continuity during power losses.

- Rise in Construction Activities (Infrastructure Development): The U.S. construction industry is reported to have contracted by 2.5% in real terms for 2023. This growth is largely driven by infrastructure upgrades and residential construction, as per the U.S. Census Bureau. With the rise in construction projects, the demand for portable generators has increased to support off-grid power needs at construction sites. These generators are essential for operating tools, lighting, and machinery at remote sites.

- Growing Adoption in Residential Sector (Home Backup Needs): The adoption of portable generators in U.S. homes has increased, driven by the need for reliable backup power during outages. Homeowners in disaster-prone regions, especially in states like Florida and Texas, are turning to these generators to maintain power during severe weather events. This trend supports energy resilience, ensuring that essential appliances can continue to operate during power interruptions, providing security and peace of mind.

Market Challenges

- Stringent Emission Regulations (EPA Standards): The Environmental Protection Agency (EPA) has implemented stricter emission regulations for portable generators, requiring significant reductions in particulate matter emissions. These regulations have posed challenges for manufacturers, necessitating updates to generator designs to meet the new standards. Compliance has led to increased production costs and extended development timelines, making it more challenging for some companies to bring new models to market. This shift has also pushed manufacturers to invest in cleaner technologies, impacting the pricing and availability of new generators.

- High Competition from Alternative Power Sources (Solar and Battery Solutions): The growing popularity of solar power systems and battery storage presents significant competition for portable generators. As consumers seek more sustainable and long-term energy solutions, many have turned to solar and battery options for home backup needs. Advancements in battery technology have enhanced the appeal of these alternatives, particularly in regions that offer incentives for adopting clean energy. This trend has influenced the market dynamics, slowing the growth of traditional portable generators in favor of greener, more efficient options.

USA Portable Generator Market Future Outlook

Over the next five years, the USA Portable Generator market is expected to continue its upward trajectory, driven by increasing demand for reliable backup power sources, particularly in regions prone to natural disasters. The growing trend of work-from-home setups has further amplified the need for uninterrupted power supply in residential areas. Additionally, advancements in hybrid and fuel-efficient models are likely to attract environmentally conscious consumers, contributing to market expansion.

Market Opportunities

- Adoption of Hybrid Generators (Solar Integration): The market is experiencing growing interest in hybrid generators, which combine solar panels with conventional engines to provide dual energy sources. These systems offer a balance between sustainable energy and reliable backup power, appealing to consumers who prioritize reducing their carbon footprint. The integration of solar power allows for lower fuel consumption, making these generators an attractive option for those seeking both environmental benefits and energy resilience in various weather conditions.

- Expansion in Off-Grid Applications (Rural Electrification): Demand for portable generators has increased in off-grid areas, particularly in rural communities lacking stable grid access. These generators serve as essential power solutions for remote farming and ranching locations, helping to address energy needs where infrastructure is limited. Programs and initiatives aimed at supporting rural energy access have highlighted the role of portable generators in bridging power gaps, enabling reliable electricity in areas where conventional grid connections remain out of reach.

Scope of the Report

|

By Power Output |

<2 kW 2-5 kW 5-10 kW >10 kW |

|

By Fuel Type |

Gasoline Diesel Propane Dual-Fuel |

|

By Application |

Residential Commercial Industrial Recreational |

|

By Power Rating |

Below 2 kW 2-4 kW 4-6 kW Above 6 kW |

|

By Distribution Channel |

Online Retail Offline Retail (Specialty Stores, Departmental Stores) Direct Sales |

Products

Key Target Audience

Portable Generator Manufacturers

Event Management Companies

Construction Equipment Rental Companies

Construction Companies

Government and Regulatory Bodies (EPA, U.S. Department of Energy)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Generac Holdings Inc.

Honda Power Equipment

Caterpillar Inc.

Cummins Inc.

Briggs & Stratton Corporation

Kohler Co.

Westinghouse Electric Corporation

Yamaha Motor Corporation

Champion Power Equipment

WEN Products

Table of Contents

1. USA Portable Generator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Portable Generator Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Portable Generator Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Backup Power (Power Outages)

3.1.2. Rise in Construction Activities (Infrastructure Development)

3.1.3. Growing Adoption in Residential Sector (Home Backup Needs)

3.1.4. Advancements in Portable Generator Technologies (Inverter Technology)

3.2. Market Challenges

3.2.1. Stringent Emission Regulations (EPA Standards)

3.2.2. High Competition from Alternative Power Sources (Solar and Battery Solutions)

3.2.3. Fluctuations in Fuel Prices (Impact on Operational Costs)

3.3. Opportunities

3.3.1. Adoption of Hybrid Generators (Solar Integration)

3.3.2. Expansion in Off-Grid Applications (Rural Electrification)

3.3.3. Increasing Demand in Disaster-Prone Regions (Emergency Preparedness)

3.4. Trends

3.4.1. Shift Towards Compact & Lightweight Generators (Ease of Mobility)

3.4.2. Integration of Smart Control Systems (Remote Monitoring)

3.4.3. Rise of Silent Portable Generators (Noise Reduction Technology)

3.5. Government Regulation

3.5.1. Emission Control Regulations (EPA Tier 4)

3.5.2. Safety Standards (UL and ANSI Certifications)

3.5.3. Import Tariffs and Trade Policies (Impact on Pricing)

3.5.4. Incentives for Green Technology Adoption (Clean Energy Programs)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Retailers, End-users)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. USA Portable Generator Market Segmentation

4.1. By Power Output (In Value %)

4.1.1. <2 kW

4.1.2. 2-5 kW

4.1.3. 5-10 kW

4.1.4. >10 kW

4.2. By Fuel Type (In Value %)

4.2.1. Gasoline

4.2.2. Diesel

4.2.3. Propane

4.2.4. Dual-Fuel

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Recreational

4.4. By Power Rating (In Value %)

4.4.1. Below 2 kW

4.4.2. 2-4 kW

4.4.3. 4-6 kW

4.4.4. Above 6 kW

4.5. By Distribution Channel (In Value %)

4.5.1. Online Retail

4.5.2. Offline Retail (Specialty Stores, Departmental Stores)

4.5.3. Direct Sales

5. USA Portable Generator Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Generac Holdings Inc.

5.1.2. Honda Power Equipment

5.1.3. Caterpillar Inc.

5.1.4. Cummins Inc.

5.1.5. Briggs & Stratton Corporation

5.1.6. Kohler Co.

5.1.7. Westinghouse Electric Corporation

5.1.8. Yamaha Motor Corporation

5.1.9. Champion Power Equipment

5.1.10. WEN Products

5.1.11. DuroMax Power Equipment

5.1.12. Pulsar Products

5.1.13. A-iPower

5.1.14. Ryobi (Techtronic Industries)

5.1.15. Firman Power Equipment

5.2. Cross Comparison Parameters (Market Share, Product Portfolio, Technological Advancements, R&D Expenditure, Pricing Strategy, Distribution Network, Customer Reach, Brand Reputation)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Portable Generator Market Regulatory Framework

6.1. Emission Standards (EPA Regulations)

6.2. Compliance Requirements (Safety Certifications)

6.3. Certification Processes (UL, CARB Certification)

7. USA Portable Generator Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Portable Generator Future Market Segmentation

8.1. By Power Output (In Value %)

8.2. By Fuel Type (In Value %)

8.3. By Application (In Value %)

8.4. By Power Rating (In Value %)

8.5. By Distribution Channel (In Value %)

9. USA Portable Generator Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Portable Generator Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA Portable Generator Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of product performance statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

tep 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple portable generator manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Portable Generator market.

Frequently Asked Questions

01. How big is the USA Portable Generator Market?

The USA Portable Generator Market is valued at USD 3.5 billion, driven by increasing demand for backup power solutions and rising construction activities. The markets steady growth is supported by technological advancements like inverter technology.

02. What are the challenges in the USA Portable Generator Market?

Challenges in USA Portable Generator Market include compliance with stringent emission regulations, competition from alternative power sources like solar, and fluctuations in fuel prices, which impact the overall cost of operation.

03. Who are the major players in the USA Portable Generator Market?

Key players in USA Portable Generator Market include Generac Holdings Inc., Honda Power Equipment, Caterpillar Inc., Cummins Inc., and Briggs & Stratton Corporation. These companies dominate due to their extensive product ranges and established distribution networks.

04.What are the growth drivers of the USA Portable Generator Market?

The USA Portable Generator Market is propelled by frequent power outages, increased demand for residential backup power, and rising construction activities. Innovations in fuel efficiency and noise reduction have also contributed to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.