USA Potato Starch Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD7481

November 2024

99

About the Report

USA Potato Starch Market Overview

- The USA potato starch market is valued at USD 3 billion, driven by the increasing demand for clean-label and gluten-free products. The rising consumer awareness about natural food ingredients has led to a significant shift toward potato starch as a natural thickening and binding agent in processed foods, bakery, and sauces. Potato starch's unique qualities, such as its neutral flavor and high viscosity, make it the preferred choice across various industrial sectors, including food and non-food applications.

- Cities like Idaho Falls, Grand Forks, and Minneapolis dominate the USA potato starch market due to their well-established potato farming infrastructure and favorable climatic conditions for potato cultivation. Idaho is a prominent player as it produces over 30% of the countrys potatoes, supplying a steady stream of raw material for starch production. Additionally, Minnesota's advanced processing facilities further strengthen its leadership position in the market.

- The U.S. Department of Agriculture (USDA) plays a crucial role in setting standards for organic certification, which directly impacts the potato starch market. As of 2024, the USDA Organic Program enforces strict guidelines for organic starch production, mandating that organic potato starch must be free from synthetic pesticides, genetically modified organisms (GMOs), and artificial additives. Organic certification has become a key differentiator in the food industry, driving demand for USDA-certified organic potato starch. In 2024, over 9% of U.S. farmland is used for organic agriculture, a number that has increased annually due to government support for organic farming practices.

USA Potato Starch Market Segmentation

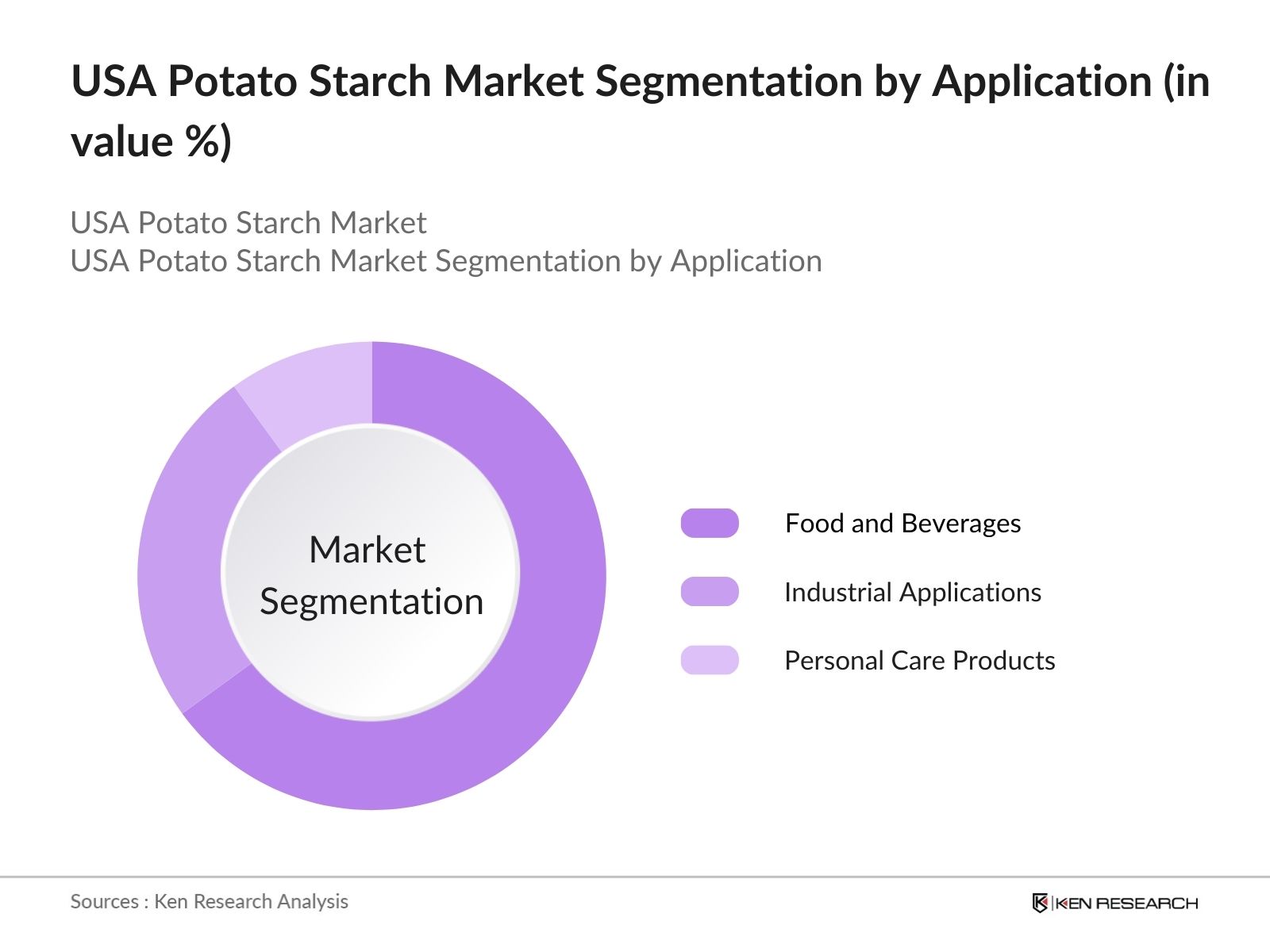

By Application: The USA potato starch market is segmented by application into food and beverages, industrial applications, and personal care products. Recently, food and beverages dominate this segment due to the increasing consumer demand for gluten-free and natural food products. Potato starch is extensively used in sauces, bakery products, and snacks due to its clean-label credentials and ability to enhance texture. Moreover, the shift towards healthier eating habits has further boosted the demand for gluten-free products, where potato starch plays a significant role.

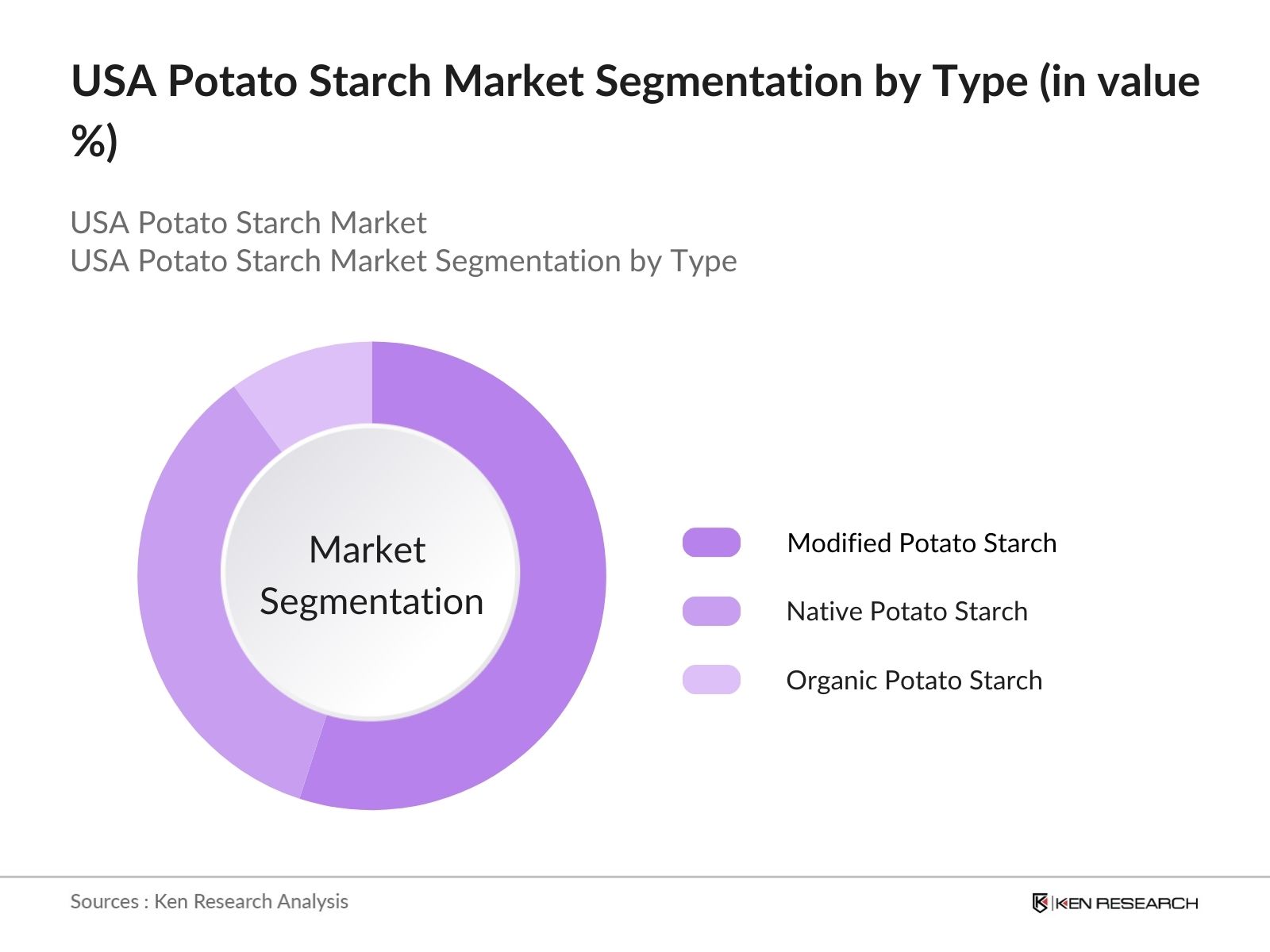

By Type: The USA potato starch market is also segmented by type into native potato starch, modified potato starch, and organic potato starch. Modified potato starch has a dominant market share within this segmentation. This is primarily due to its enhanced functionality in both food and non-food applications. Modified starch improves stability and water retention in industrial applications such as adhesives and paper production, making it an indispensable component in these sectors.

By Type: The USA potato starch market is also segmented by type into native potato starch, modified potato starch, and organic potato starch. Modified potato starch has a dominant market share within this segmentation. This is primarily due to its enhanced functionality in both food and non-food applications. Modified starch improves stability and water retention in industrial applications such as adhesives and paper production, making it an indispensable component in these sectors.

USA Potato Starch Market Competitive Landscape

USA Potato Starch Market Competitive Landscape

The USA potato starch market is dominated by a few key players who maintain a strong presence across food processing, industrial applications, and export markets. These companies leverage advanced extraction technologies, robust distribution networks, and innovative product formulations to maintain their competitive edge. The market is characterized by the presence of multinational companies like Cargill, Ingredion, and Roquette Frres, which have a strong foothold due to their large-scale production capabilities.

USA Potato Starch Market Analysis

Growth Drivers

- Increasing Demand for Clean-Label Starch Solutions: The growing consumer shift toward clean-label products has significantly driven demand for potato starch in the USA, particularly in the food industry. In 2024, consumers are increasingly scrutinizing product labels, with the U.S. Department of Agriculture (USDA) reporting that over 50% of U.S. consumers prefer products with minimal artificial additives. This trend is pushing food manufacturers to use natural ingredients like potato starch as a clean-label alternative. The rise of health-conscious diets and transparency in ingredient sourcing has enhanced the potato starch markets appeal, especially in processed foods and gluten-free products.

- Shift Toward Gluten-Free Diets: The USA's gluten-free market has been expanding rapidly, with the U.S. gluten-free food market expected to serve nearly 25 million Americans by 2024, many of whom are turning to potato starch as a key ingredient in gluten-free products. Potato starch is widely used in baked goods and snacks due to its neutral taste and ability to mimic the texture of gluten-containing flours. This shift toward gluten-free diets is also supported by the rise in diagnosed cases of celiac disease and gluten sensitivities, which are projected to affect over 3 million people.

- Expanding Usage in Biodegradable Packaging: The demand for sustainable and biodegradable packaging is surging in the USA, driven by environmental concerns and government regulations. Potato starch is emerging as a key material in the development of biodegradable films and packaging. Potato starch-based materials, which decompose naturally, are being adopted by major packaging firms as part of their eco-friendly initiatives, contributing to the increased demand for potato starch.

Challenges

- Volatility in Raw Potato Prices: USDA reported that fresh potato prices ranged from$21.20 to $23 per hundredweight (cwt)during the 2022/23 marketing year, whereas in the 2023/24 marketing year, these prices fell to a range of$10.20 to $10.60 per cwtbetween January and May 2024This volatility impacts the cost structure of potato starch producers, who rely heavily on consistent raw material prices. As global food prices remain unstable, potato starch manufacturers face increased production costs, which may be passed on to end consumers in processed food and industrial applications.

- Strict Regulatory Requirements for Food Applications: The U.S. Food and Drug Administration (FDA) imposes strict regulations on food-grade starches, including potato starch, which can create hurdles for manufacturers. Non-compliance can lead to significant financial penalties or product recalls, which may deter smaller manufacturers from entering the market. The regulatory complexity surrounding labeling and food safety certifications increases operational costs and delays product launches.

USA Potato Starch Market Future Outlook

USA potato starch market is expected to experience steady growth, driven by increasing consumer demand for gluten-free and organic food products. Advancements in potato starch extraction technology, combined with the rising application of starch in biodegradable packaging solutions, will further fuel the markets expansion. Industrial applications, particularly in the paper and adhesives sectors, are also expected to grow as potato starch continues to replace synthetic additives.

Market Opportunities

- Development of Organic Potato Starch: The demand for organic products is increasing in the USA. Organic potato starch, which meets USDA organic certification standards, is gaining traction among health-conscious consumers and environmentally responsible brands. The organic potato starch market represents a significant growth opportunity for manufacturers, especially in the clean-label and gluten-free product segments. As consumer preference for organic food rises, the demand for certified organic potato starch will likely follow suit.

- Increased R&D in Bioplastics and Starch Derivatives: The growing interest in bioplastics, driven by environmental regulations, is pushing research into starch derivatives such as thermoplastic starch. This opens opportunities for potato starch manufacturers to diversify their product offerings beyond the food industry and into industrial applications such as packaging and automotive sectors. The increased focus on biodegradable materials presents a lucrative market for starch-based bioplastics.

Scope of the Report

|

Segments |

Sub-Segments |

|

Application |

Food and Beverages (Bakery, Confectionery, Dairy, Soups, Sauces) |

|

Industrial (Textiles, Paper, Adhesives, Pharmaceuticals) |

|

|

Bioplastics and Packaging |

|

|

Animal Feed |

|

|

Personal Care Products |

|

|

Type |

Native Potato Starch |

|

Modified Potato Starch |

|

|

Organic Potato Starch |

|

|

Clean-Label Starch |

|

|

End-User Industry |

Food Processing Industry |

|

Pharmaceutical Industry |

|

|

Textile Industry |

|

|

Packaging Industry |

|

|

Personal Care and Cosmetics Industry |

|

|

Distribution Channel |

Direct Sales |

|

Online Retailers |

|

|

Specialty Stores |

|

|

Wholesalers |

|

|

Region |

North-East |

|

Mid-West |

|

|

South-East |

|

|

West |

Products

Key Target Audience

Food and Beverage Manufacturers

Industrial Starch Consumers (Adhesive, Paper, Textiles)

Potato Growers and Suppliers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Packaging Industry Players (Biodegradable Packaging Solutions)

Personal Care and Cosmetic Product Manufacturers

Pharmaceutical and Nutraceutical Companies

Companies

Players Mentioned in the Report

Cargill, Inc.

Ingredion Incorporated

Roquette Frres

Emsland Group

Avebe U.A.

Tereos

Agrana Beteiligungs-AG

Sdstrke GmbH

KMC

Tate & Lyle PLC

Table of Contents

1. USA Potato Starch Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Potato Starch Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Potato Starch Market Analysis

3.1. Growth Drivers (Industrial demand, food industry expansion, clean-label products, rising gluten-free products)

3.1.1. Increasing Demand for Clean-Label Starch Solutions

3.1.2. Rising Application in the Processed Food Industry

3.1.3. Shift Toward Gluten-Free Diets

3.1.4. Expanding Usage in Biodegradable Packaging

3.2. Market Challenges (Supply chain disruptions, raw material price fluctuations, competition from modified starch, regulatory hurdles)

3.2.1. Volatility in Raw Potato Prices

3.2.2. Strict Regulatory Requirements for Food Applications

3.2.3. Competition from Other Starches

3.2.4. Supply Chain Bottlenecks Post-Pandemic

3.3. Opportunities (Innovation in starch extraction, organic potato starch demand, increasing export opportunities)

3.3.1. Development of Organic Potato Starch

3.3.2. Technological Advancements in Starch Extraction

3.3.3. Growing Export Opportunities

3.3.4. Increased R&D in Bioplastics and Starch Derivatives

3.4. Trends (Sustainable packaging, hybrid starch formulations, plant-based product growth)

3.4.1. Adoption of Potato Starch in Sustainable Packaging Solutions

3.4.2. Emergence of Hybrid Starch Formulations for Food and Industrial Applications

3.4.3. Rising Preference for Plant-Based and Natural Ingredients

3.4.4. Increase in Starch Applications in Non-Food Sectors (Textiles, Pharmaceuticals)

3.5. Government Regulation (USDA, FDA food safety guidelines, eco-friendly production initiatives)

3.5.1. USDA Certification Standards for Organic Starch

3.5.2. FDA Guidelines for Potato Starch Use in Processed Foods

3.5.3. Tax Incentives for Eco-friendly Production Practices

3.5.4. Government Support for Biodegradable Packaging Solutions

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Potato Starch Market Segmentation

4.1. By Application (In Value %)

4.1.1. Food and Beverages (Bakery, Confectionery, Dairy, Soups, Sauces)

4.1.2. Industrial (Textiles, Paper, Adhesives, Pharmaceuticals)

4.1.3. Bioplastics and Packaging

4.1.4. Animal Feed

4.1.5. Personal Care Products

4.2. By Type (In Value %)

4.2.1. Native Potato Starch

4.2.2. Modified Potato Starch

4.2.3. Organic Potato Starch

4.2.4. Clean-Label Starch

4.3. By End-User Industry (In Value %)

4.3.1. Food Processing Industry

4.3.2. Pharmaceutical Industry

4.3.3. Textile Industry

4.3.4. Packaging Industry

4.3.5. Personal Care and Cosmetics Industry

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Online Retailers

4.4.3. Specialty Stores

4.4.4. Wholesalers

4.5. By Region (In Value %)

4.5.1. North-East

4.5.2. Mid-West

4.5.3. South-East

4.5.4. West

5. USA Potato Starch Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cargill, Inc.

5.1.2. Ingredion Incorporated

5.1.3. Roquette Frres

5.1.4. Emsland Group

5.1.5. Avebe U.A.

5.1.6. Tereos

5.1.7. KMC

5.1.8. Agrana Beteiligungs-AG

5.1.9. Sdstrke GmbH

5.1.10. Tate & Lyle PLC

5.2. Cross Comparison Parameters (Revenue, Headquarters, Number of Employees, Market Share, Key Products, Innovation Index, Sustainability Index, Product Portfolio Strength)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Potato Starch Market Regulatory Framework

6.1. Food Safety Standards (FDA, USDA)

6.2. Certification Processes (Organic Certification, Clean Label Certification)

6.3. Compliance Requirements (Manufacturing Standards, Labeling Requirements)

6.4. Environmental Regulations (Waste Management, Water Use Efficiency)

7. USA Potato Starch Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Potato Starch Future Market Segmentation

8.1. By Application (In Value %)

8.2. By Type (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. USA Potato Starch Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first stage involved identifying key variables in the USA Potato Starch Market through comprehensive desk research. This research mapped the markets stakeholder ecosystem, including food processors, industrial consumers, and starch manufacturers, to define the driving factors influencing market dynamics.

Step 2: Market Analysis and Construction

We analyzed historical data regarding potato starch production and consumption. In particular, we focused on its penetration in the food and beverage industry, as well as its applications in industrial sectors like paper and adhesives. Revenue generation from key segments was also assessed to ensure the accuracy of market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through structured interviews with industry experts. These interviews provided first-hand insights into product innovation, distribution strategies, and demand shifts that could impact future market growth.

Step 4: Research Synthesis and Final Output

The final phase involved consolidating data from primary and secondary sources. Key market players were contacted to verify data on production capacity, technological developments, and regional sales. This synthesis ensured the delivery of a reliable, data-backed market report.

Frequently Asked Questions

01. How big is the USA Potato Starch Market?

The USA potato starch market was valued at USD 3 billion, driven by the increasing demand for clean-label and gluten-free products in both food and industrial applications.

02. What are the key challenges in the USA Potato Starch Market?

The key challenges in USA potato starch market include supply chain disruptions, fluctuations in raw potato prices, and competition from modified starch and synthetic additives. Meeting regulatory standards for food safety and sustainability is also a significant challenge for manufacturers.

03. Who are the major players in the USA Potato Starch Market?

Major players in USA potato starch market include Cargill, Inc., Ingredion Incorporated, Roquette Frres, Emsland Group, and Avebe U.A. These companies dominate due to their advanced processing technologies, extensive distribution networks, and large-scale production capabilities.

04. What are the growth drivers in the USA Potato Starch Market?

USA potato starch market is driven by the rising demand for clean-label, gluten-free, and organic food products, as well as the expanding use of potato starch in industrial sectors like paper and adhesives. Its versatility as a natural thickening and binding agent enhances its appeal across industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.