USA Precision Farming Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD1306

October 2024

95

About the Report

USA Precision Farming Market Overview

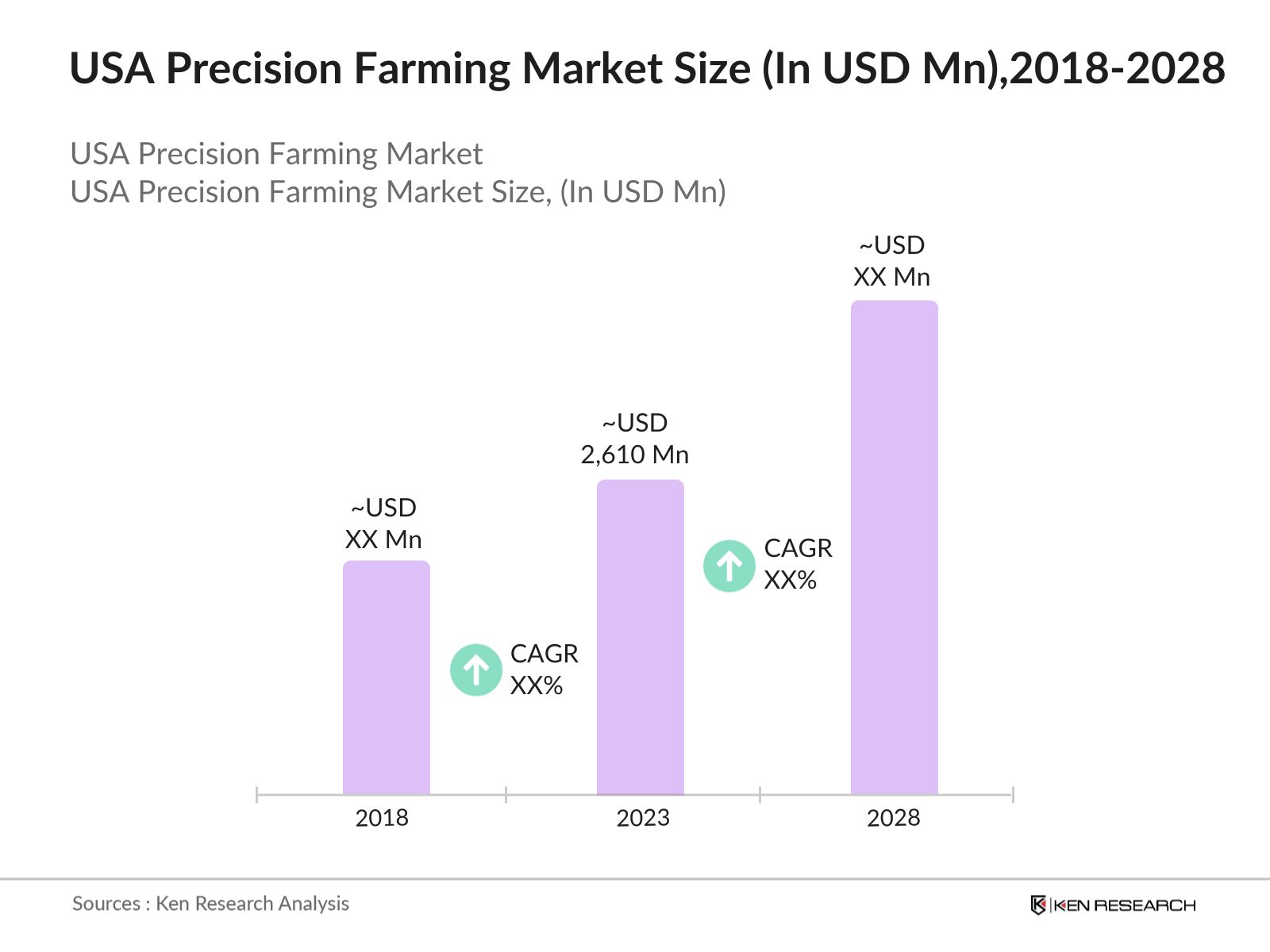

- The Precision Farming Market in the USA was valued at USD 2,610 million in 2023. The market's growth is driven by the increasing adoption of advanced technologies such as GPS, IoT, and AI to enhance agricultural productivity and efficiency. The need to optimize resource use and increase crop yields amidst challenges like climate change and rising global food demand is propelling the market forward.

- Prominent players in the market include John Deere & Company, Trimble Inc., AG Leader Technology, Raven Industries, and Climate Corp. These companies play a significant role in advancing precision farming through their innovative technologies and solutions.

- In early 2024, John Deere launched its Startup Collaborator program, partnering with six innovative companies, including the AI firm Geminos. The program seeks to boost John Deeres precision farming capabilities by incorporating advanced technologies like AI-driven analytics to enhance farmer decision-making. The other collaborators are Constellr, SB Quantum, Fermata Energy, goFlux, and Cloudscape Labs, each offering unique solutions aligned with John Deeres agricultural and construction objectives.

- The Iowa and Illinois, dominates the market due to their extensive agricultural activities. The dominance to its large-scale farms and early adoption of precision farming technologies. The region's favorable agricultural conditions and high crop production volumes contribute to its market leadership.

USA Precision Farming Market Segmentation

The USA Precision Farming Market is segmented into different factors like by product, by application and region.

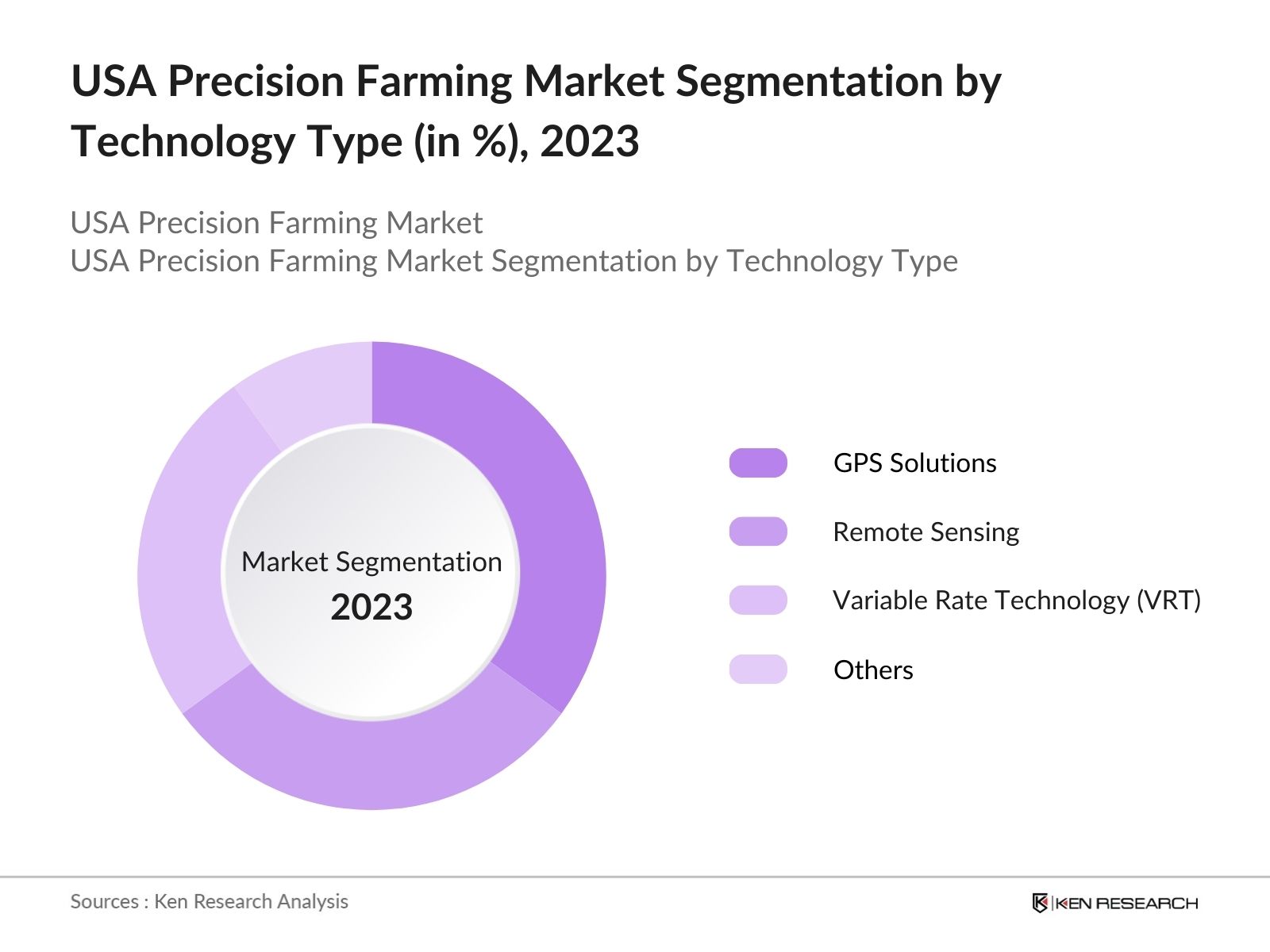

By Technology Type: The market is segmented by technology type into GPS Solutions, Remote Sensing, Variable Rate Technology (VRT) and others. In 2023, GPS Solutions dominated due to their foundational role in precision farming, providing critical guidance and mapping capabilities. Remote Sensing follows closely, driven by increasing adoption of drones and satellite imagery for real-time monitoring. VRT's significant share is attributed to its ability to optimize input use and reduce costs.

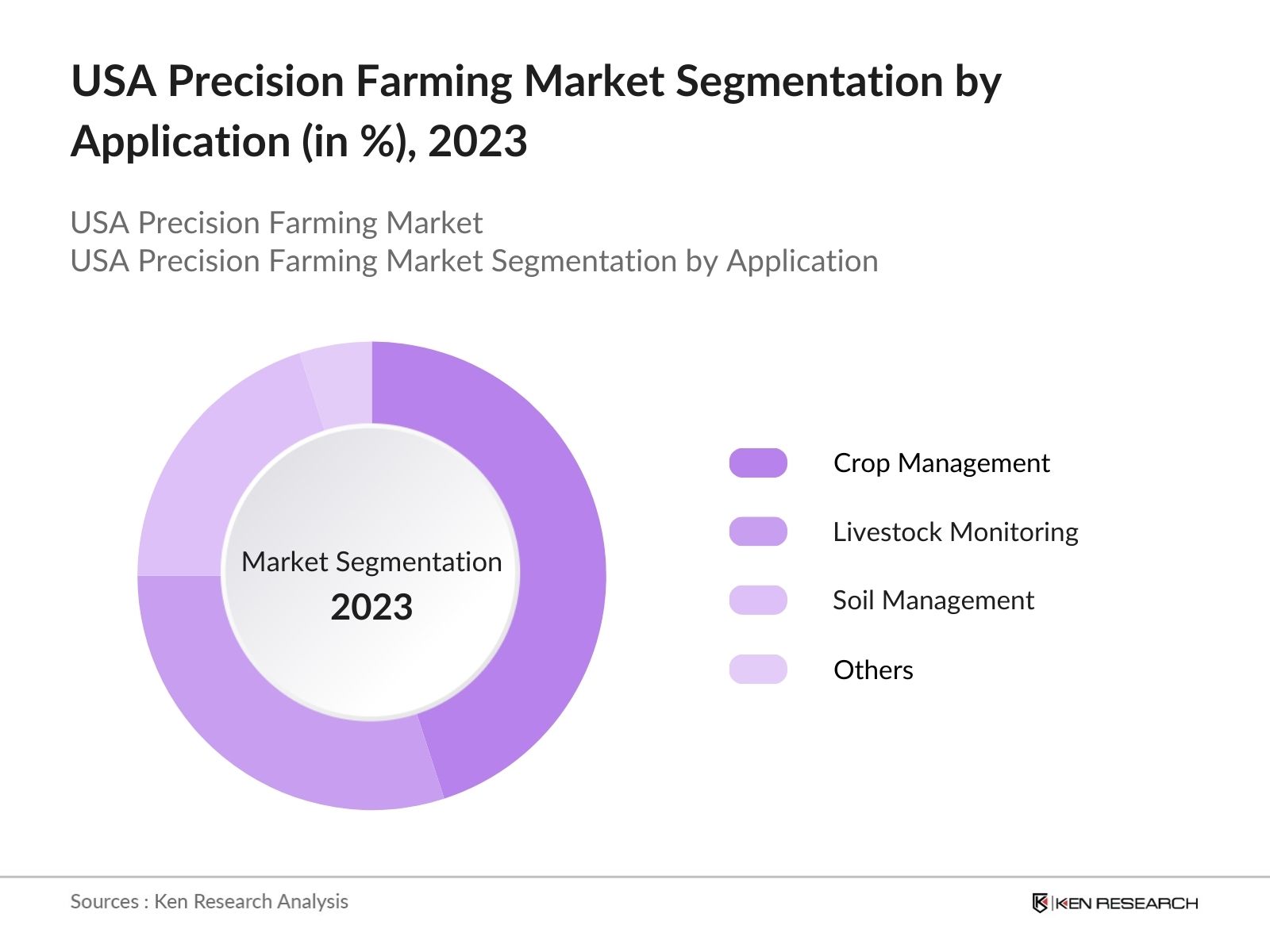

By Application: The market is segmented by application into Crop Management, Livestock Monitoring, Soil Management and Others. In 2023, Crop Management was dominating the market due to its direct impact on improving agricultural output and resource efficiency. Precision irrigation systems ensure that crops receive the optimal amount of water, reducing water waste and improving yield. Similarly, precision fertilizer management helps apply nutrients more effectively, enhancing crop growth while minimizing environmental impact. These technologies are essential for maximizing productivity and sustainability in crop farming.

By Region: The market is segmented by region into north, south, east and west. In 2023, the west region leads the market, driven by its emphasis on advanced farming technologies and sustainability initiatives. The regions agricultural sector prioritizes technological innovation to address water scarcity and environmental concerns, making precision farming technologies highly relevant. The focus on sustainable practices and advanced tools supports the West's strong position in the market.

USA Precision Farming Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

John Deere & Company |

1837 |

Moline, Illinois |

|

Trimble Inc. |

1978 |

Sunnyvale, California |

|

AG Leader Technology |

1992 |

Ames, Iowa |

|

Raven Industries |

1956 |

Sioux Falls, South Dakota |

|

Climate Corp. |

2006 |

San Francisco, California |

- Trimble Inc.: In August 2022,Trimble Inc. and CLAAS entered a strategic alliance to develop an advanced precision farming system for CLAAS tractors collaboratively, combines, and forage harvesters. The precision farming system comprises the cutting-edge CLAAS CEMIS 1200 smart display, GPS PILOT steering system, and the SAT 900 GNSS receiver. Within this system, the CEMIS display leverages Trimbles latest embedded modular software architecture, facilitating precise positioning, steering, and seamless connectivity to control and monitor implements in the field using ISOBUS technology.

- Raven Industries: On May 1, 2023, Raven Industries presented new advancements in their autonomous precision agriculture portfolio at Agrishow in Brazil. This event underscored their commitment to enhancing agricultural technology solutions, which are crucial for improving efficiency in farming practices.

USA Precision Farming Market Analysis

USA Precision Farming Market Growth Drivers

- Technological Advancements in Precision Equipment: The precision farming market is increasingly driven by advancements in technology. The adoption of high-precision GPS systems, autonomous machinery, and advanced sensors is transforming farming practices. For instance, the market for precision agriculture technologies is expected to grow significantly due to innovations like real-time crop monitoring and automated irrigation systems.

- Expansion of IoT and Data Analytics in Farming: The integration of Internet of Things (IoT) devices and data analytics into farming practices is a key driver of market growth. IoT sensors provide real-time data on soil conditions, weather patterns, and crop health, allowing for more informed decision-making. In 2024, the market for IoT-based precision farming solutions is expected to increase in the U.S., driven by the proliferation of connected devices and data analytics platforms that enhance farm management.

- Increasing Agricultural Efficiency and Productivity: The demand for precision farming is driven by the need to enhance agricultural efficiency and productivity. With global food demand rising due to a growing population, precision farming technologies offer solutions to increase crop yields and optimize resource use. In 2024, the USDA projects a decrease in total crop receipts by 6.3% from 2023 levels, which reflects lower expected revenues from major crops such as corn and soybeans.

USA Precision Farming Market Challenges

- High Initial Cost of Precision Farming Equipment: The substantial initial investment required for precision farming technologies presents a significant hurdle for many farmers. Advanced equipment such as GPS-guided tractors, drones, and high-tech sensors can cost tens of thousands of dollars. This high upfront expense can be prohibitive for small to medium-sized farms, making it difficult for them to adopt these technologies despite their long-term benefits. The financial burden of purchasing and maintaining sophisticated equipment remains a critical challenge for widespread adoption.

- Limited Access to High-Speed Internet in Rural Areas: Effective use of precision farming technologies often requires reliable high-speed internet access, which is not always available in rural areas. Many farms are located in regions with inadequate internet connectivity, limiting their ability to utilize cloud-based data services and real-time monitoring tools. The lack of high-speed internet hampers the implementation of advanced precision farming solutions, reducing their potential benefits and creating a digital divide between well-connected and less-connected agricultural regions.

USA Precision Farming Market Government Initiatives

- USDA Climate-Smart Agriculture Initiative: In 2023, the USDA did indeed launch thePartnerships for Climate-Smart Commodities, which involves a total investment ofover $3.1 billionfor 141 selected projects aimed at promoting climate-smart practices in agriculture and forestry. This initiative is designed to provide technical and financial assistance to producers to implement climate-smart production practices on a voluntary basis, and it includes methods for quantifying, monitoring, and verifying greenhouse gas benefits.

- Support for Sustainable Farming Practices: The Farm Bill 2023 safeguard the $20 billion investment for sustainable agriculture made available by the Inflation Reduction Act. This initiative provides financial assistance for farmers to implement practices that reduce environmental impact, such as precision irrigation and nutrient management. The goal is to promote long-term sustainability in agriculture by encouraging the use of technologies that optimize resource use and minimize environmental footprints.

USA Precision Farming Market Future Outlook

The precision farming market in the USA is expected to continue its growth by 2028, driven by further advancements in technology and increased adoption of automation and data analytics. The integration of AI, machine learning, and real-time data analytics will likely lead to even greater efficiencies and productivity in agriculture, positioning precision farming as a critical component of modern farming practices.

Market Trends

- Expansion of AI and Machine Learning in Precision Farming: Over the next five years, AI and machine learning technologies are expected to play a crucial role in the precision farming market. By 2028, AI-driven systems will be increasingly integrated into farming equipment, providing advanced analytics and predictive capabilities. The use of AI is projected to enhance crop yield prediction and resource management, driving significant improvements in farming efficiency.

- Growth in Autonomous Farming Machinery: The market for autonomous farming machinery is anticipated to expand substantially in the coming years. By 2028, autonomous tractors and harvesters are expected to become more prevalent, with advancements in robotics and automation. The adoption of autonomous machinery is projected to increase productivity and reduce labor costs, transforming farming practices.

Scope of the Report

|

By Technology Type |

GPS Solutions Remote Sensing Variable Rate Technology (VRT) Others |

|

By Application |

Crop Management Livestock Monitoring Soil Management Others |

|

By Region |

North South West East |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Agricultural Equipment Manufacturers

Crop Production Companies

Livestock Management Firms

Agrochemical Companies

Farm Management Software Companies

Precision Agriculture Technology Companies

Investor and VC Firms

Government and Regulatory Bodies (U.S. Department of Agriculture (USDA), Environmental Protection Agency (EPA))

Financial Institutions and Banks

Companies

Players Mentioned in the Report:

John Deere & Company

Trimble Inc.

AG Leader Technology

Raven Industries

Climate Corp.

PrecisionHawk

The Climate Corporation

Kubota Corporation

Syngenta AG

Bosch

Topcon Positioning Systems

Drones for Agriculture

Taranis

AG Leader Technology

Sentera

Table of Contents

1. USA Precision Farming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Precision Farming Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Precision Farming Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements

3.1.2. Increasing Agricultural Efficiency

3.1.3. Expansion of IoT and Data Analytics

3.1.4. Government Support and Incentives

3.2. Restraints

3.2.1. High Initial Costs

3.2.2. Data Security and Privacy Concerns

3.2.3. Limited Internet Connectivity in Rural Areas

3.3. Opportunities

3.3.1. Adoption of AI and Machine Learning

3.3.2. Autonomous Farming Machinery

3.3.3. Sustainable Farming Technologies

3.4. Trends

3.4.1. Precision Irrigation Systems

3.4.2. Integration with Smart Farming

3.4.3. Advancements in Remote Sensing

3.5. Government Regulations

3.5.1. Precision Agriculture Connectivity Act

3.5.2. Farm Bill Initiatives

3.5.3. Environmental Quality Incentives Program (EQIP)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. USA Precision Farming Market Segmentation, 2023

4.1. By Technology (in Value %)

4.1.1. Sensors

4.1.2. Control Systems

4.1.3. Software

4.2. By Application (in Value %)

4.2.1. Crop Management

4.2.2. Livestock Management

4.2.3. Field Mapping

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. USA Precision Farming Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. John Deere & Company

5.1.2. Trimble Inc.

5.1.3. AG Leader Technology

5.1.4. Raven Industries

5.1.5. Climate Corp.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Precision Farming Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Precision Farming Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Precision Farming Market Future Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Precision Farming Market Future Segmentation, 2028

9.1. By Technology (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10 USA Precision Farming Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on USA Precision Farming Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Precision Farming Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple farming companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from farming companies.

Frequently Asked Questions

01 How big is the USA Precision Farming Market?

The Precision Farming Market in the USA was valued at USD 2,610 million in 2023. It is influenced by technological advancements, increasing demand for agricultural efficiency, and supportive government initiatives.

02 What are the challenges in the USA Precision Farming Market?

Challenges in USA Precision Farming Market include the high initial cost of precision farming equipment, data security and privacy concerns, limited access to high-speed internet in rural areas, and the complexity of integrating new technologies into existing farming practices.

03 Who are the major players in the USA Precision Farming Market?

Major players in the USA Precision Farming Market include John Deere & Company, Trimble Inc., AG Leader Technology, Raven Industries, and CNH Industrial. These companies are prominent due to their advanced technology offerings and significant market presence.

04 What are the growth drivers of the USA Precision Farming Market?

Growth drivers in USA Precision Farming Market include technological advancements in precision equipment, increased agricultural efficiency and productivity, the expansion of IoT and data analytics in farming, and the growing emphasis on sustainable farming practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.