USA Property Management Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD2823

November 2024

80

About the Report

USA Property Management Market Overview

- The USA property management market is valued at USD 81.5 billion, according to recent industry analysis. This robust market size is primarily driven by an expanding rental demand and increasing property investments across the United States. Rising urbanization and demand for professional property management services among institutional investors play a crucial role in sustaining this market. Digital tools for property management, alongside enhanced tenant services, continue to drive industry growth, positioning the market to meet evolving needs in property maintenance and tenant relations.

- Certain metropolitan areas like New York, Los Angeles, and San Francisco stand out in the property management market. These regions are characterized by high population densities and a large number of rental properties, making them lucrative markets for property management companies. The combination of regulatory requirements, a competitive real estate landscape, and demand for high-quality management services solidify these cities as leaders in the market.

- Tenant protection laws are prominent in the U.S. property management landscape, especially in states like California and New York. In 2023, the U.S. Department of Housing and Urban Development highlighted tenant rights laws protecting over 60 million renters, mandating fair treatment, eviction procedures, and rental price limitations. These protections ensure tenant security but add compliance obligations for property managers, necessitating legal expertise and adjustments in rental policies

USA Property Management Market Segmentation

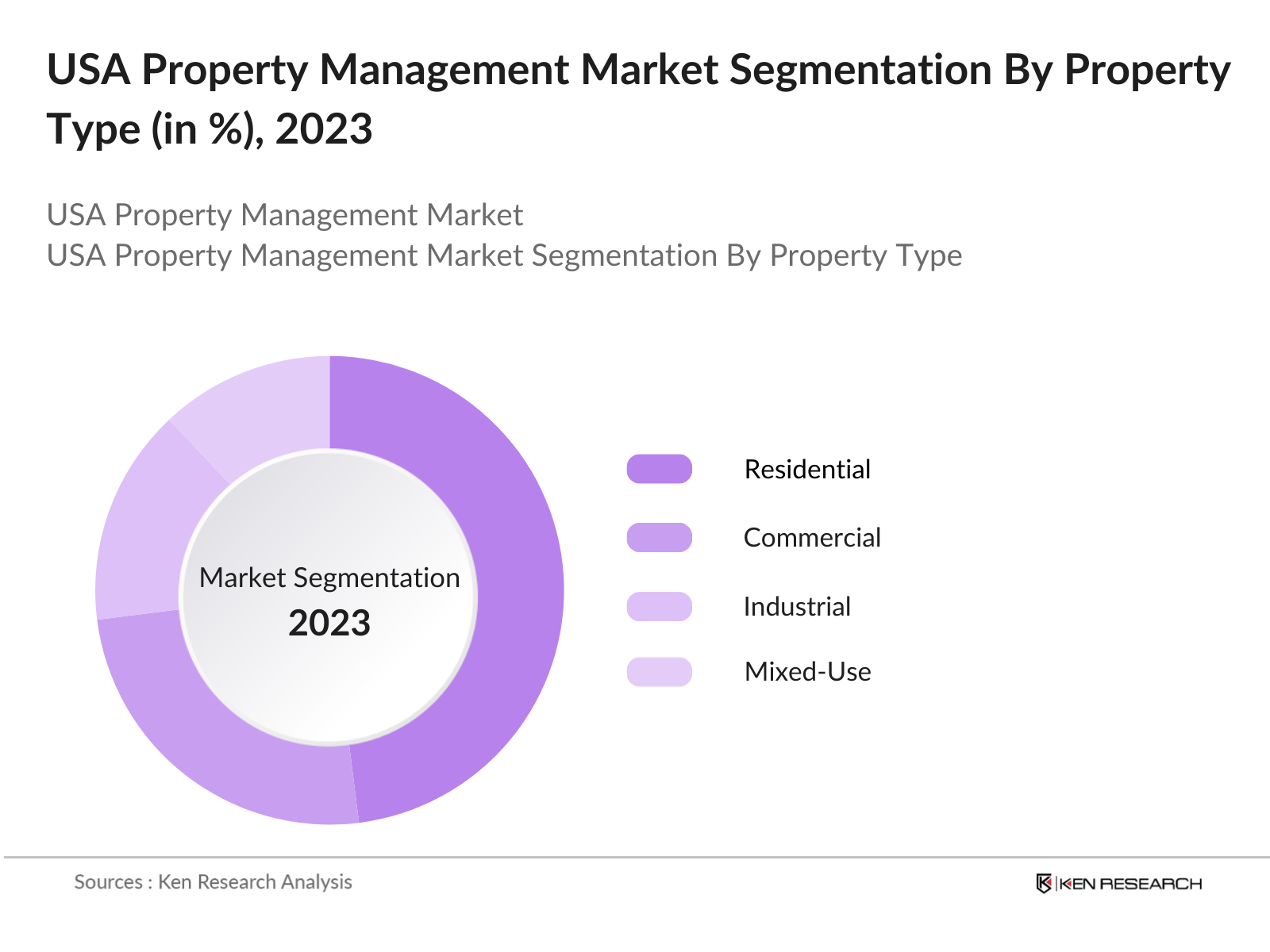

By Property Type: The USA property management market is segmented by property type into residential, commercial, industrial, and mixed-use properties. Residential properties, including single-family homes and multi-family units, dominate this segment due to high rental demand and a stable tenant base. This dominance is further strengthened by the continued shift towards urban living and rising demand for rented accommodation, especially in metropolitan areas where homeownership is increasingly challenging due to high property prices.

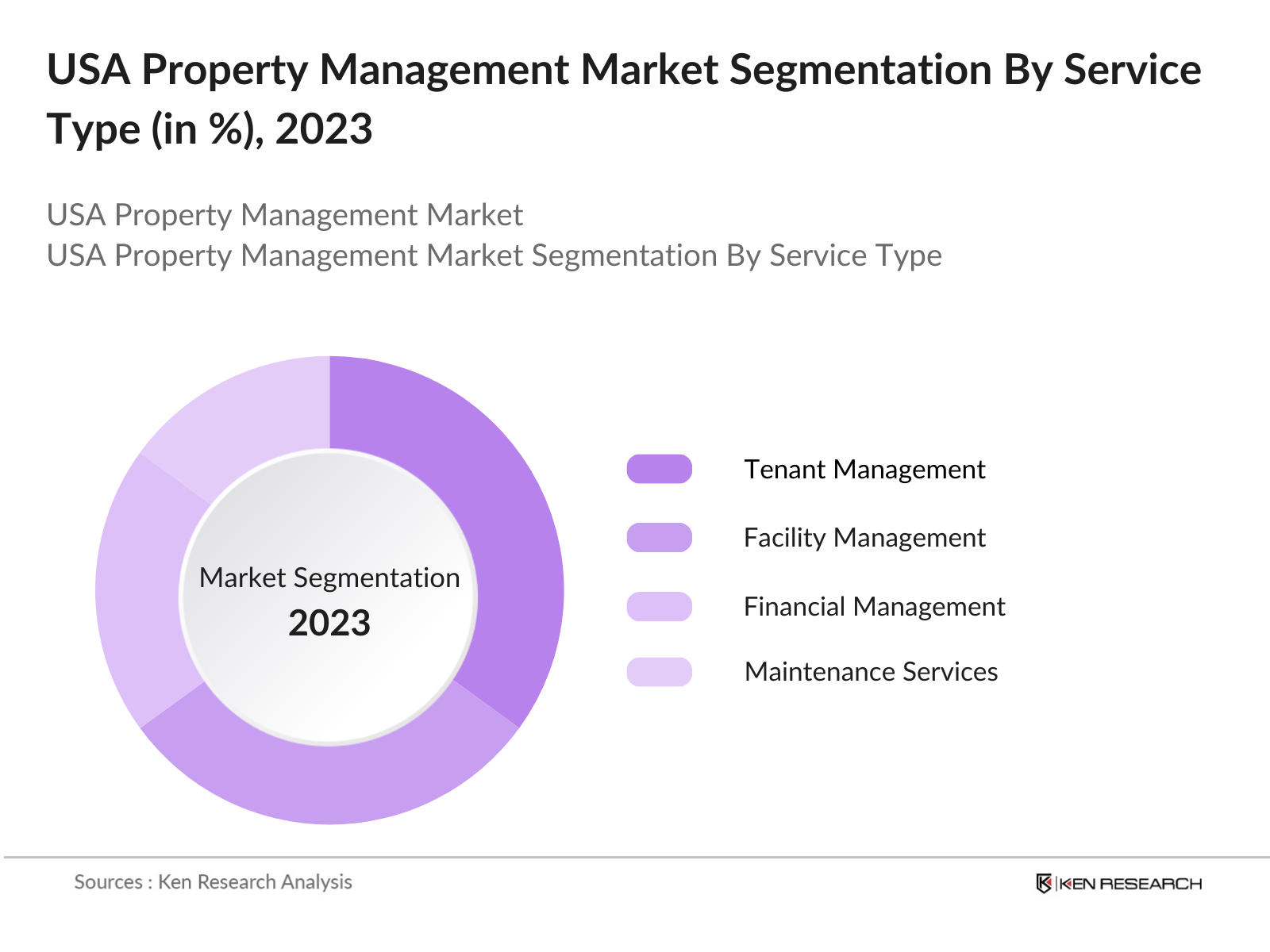

By Service Type: By service type, the market divides into tenant management, facility management, financial management, and maintenance services. Tenant management services have a dominant market share, given the essential role of tenant relations in property management. This segments prominence arises from the need to address tenant demands and maintain occupancy rates, which significantly impacts property profitability. Additionally, the adoption of digital platforms for tenant management, allowing landlords and property managers to handle lease agreements, payment collection, and maintenance requests efficiently, further propels growth in this segment.

USA Property Management Market Competitive Landscape

The USA property management market is dominated by key players who bring expertise in tenant management, digital service integration, and large property portfolios. Their presence across major cities and effective service delivery has helped consolidate their positions.

USA Property Management Industry Analysis

Growth Drivers

- Demand for Rental Properties: The USAs rental property demand has significantly grown, driven by shifts in demographics, urbanization, and housing affordability challenges. As of 2023, the U.S. Census Bureau reported that nearly 44 million households rent their homes, indicating a steady rental market. This demand is further reinforced by rising property costs, as the Federal Reserve highlighted increased median home prices in urban areas, pushing more Americans towards renting rather than owning. Rental demand is particularly strong in metro regions like New York and Los Angeles, where rental units account for over 65% of housing stock.

- Increasing Property Investment: Property investment in the U.S. is experiencing robust growth, with foreign direct investment in real estate reaching approximately USD 127 billion in 2023, as noted by the U.S. Department of Commerce. This trend is largely fueled by investors diversifying portfolios into residential and commercial properties to capture steady rental income. Urban areas are prime targets for this investment, accounting for 70% of real estate transactions. This influx has led to higher demand for property management services to maintain and optimize property assets.

- Technological Advancements in Property Management: Technological innovation in property management is enhancing operational efficiency and tenant satisfaction. The U.S. Bureau of Labor Statistics highlighted a notable increase in the adoption of property management software, with nearly 60% of medium to large firms integrating platforms for tenant screening, maintenance requests, and payment processing. Additionally, IoT integration for real-time property monitoring is becoming a standard, especially in high-end rentals, significantly reducing maintenance costs by around 20%.

Market Challenges

- Regulatory Hurdles: Property management in the U.S. faces complex regulatory requirements, including tenant rights, zoning laws, and rental price controls. According to the U.S. Department of Housing and Urban Development, over 50 major cities have rent control regulations, impacting profitability and requiring careful compliance. For instance, New Yorks rent stabilization laws cover approximately 1 million rental units, restricting rental increases and requiring strict tenant protection protocols. Compliance costs are estimated to consume up to 15% of operational budgets for property management firms.

- High Operational Costs: The property management sector encounters substantial operational costs, especially for maintenance and labor. Data from the U.S. Bureau of Economic Analysis shows that maintenance costs for multi-family buildings have surged, with maintenance and repair expenses increasing by about USD 8 per square foot since 2022. Labor costs also contribute significantly; for instance, property maintenance roles saw a wage increase to a national average of USD 18 per hour in 2023, affecting overall service pricing and profitability.

USA Property Management Market Future Outlook

The USA property management market is anticipated to experience continued growth driven by strong demand for rental properties, advancements in digital management technologies, and a shift towards eco-friendly and tenant-centric services. Increasing investment in multifamily housing and expanding services, such as IoT-integrated facility management, will likely shape the market landscape. A trend towards consolidating services into bundled packages for property owners will further drive operational efficiencies, making the market more competitive.

Opportunities

- Growth in Multi-family Housing: The multi-family housing sector presents strong opportunities as urbanization continues to drive demand. The U.S. Census Bureau reported a 15% rise in multi-family housing permits issued in 2023, indicating substantial growth in urban centers. Property managers are increasingly needed to handle the operational complexity of these large units, providing services like tenant coordination and common area maintenance, which can lead to increased revenue potential and a stable client base.

- Expanding Tenant Services: The demand for enhanced tenant services is a growing opportunity. Approximately 75% of renters expect added conveniences like online rent payments and 24/7 maintenance requests, according to the American Housing Survey 2023. Firms offering premium services such as package management, smart home amenities, and concierge services can achieve higher tenant satisfaction and retention. The U.S. Bureau of Labor Statistics indicates that properties with integrated tenant services report 10-15% higher occupancy rates.

Scope of the Report

|

Property Type |

Residential Commercial Industrial Mixed-Use |

|

Service Type |

Tenant Management Facility Management Financial Management Maintenance Services |

|

End-User |

Individual Property Owners Real Estate Investors Corporate Real Estate |

|

Technology Adoption |

Software-Based Management AI-Powered Solutions IoT Integration |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Real Estate Companies

Real Estate Development and Building Companies

Property Management Companies

Government and Regulatory Bodies (e.g., U.S. Department of Housing and Urban Development)

Financial Institutions and Banks

Technology Providers in Real Estate Companies

Investors and Venture Capitalist Firms

Utility Providers and Maintenance Service Companies

Companies

Players Mentioned in the Report

Greystar Real Estate Partners

Cushman & Wakefield

CBRE Group, Inc.

Lincoln Property Company

Jones Lang LaSalle (JLL)

Colliers International

Apartment Management Consultants, LLC

BH Management Services, LLC

Bozzuto Group

Pinnacle Property Management Services

Table of Contents

1. USA Property Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. USA Property Management Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Developments and Milestones

3. USA Property Management Market Analysis

3.1. Growth Drivers

3.1.1. Demand for Rental Properties

3.1.2. Increasing Property Investment

3.1.3. Technological Advancements in Property Management

3.2. Market Challenges

3.2.1. Regulatory Hurdles

3.2.2. High Operational Costs

3.2.3. Property Market Volatility

3.3. Opportunities

3.3.1. Growth in Multi-family Housing

3.3.2. Expanding Tenant Services

3.3.3. Integration of Smart Technologies

3.4. Trends

3.4.1. Rise of Remote Property Management

3.4.2. Increased Use of Data Analytics

3.4.3. Sustainability Initiatives in Property Management

3.5. Regulatory Environment

3.5.1. Tenant Protection Laws

3.5.2. Licensing and Compliance Requirements

3.5.3. Environmental Standards for Rental Properties

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Landscape

4. USA Property Management Market Segmentation

4.1. By Property Type (In Value %)

4.1.1. Residential

4.1.2. Commercial

4.1.3. Industrial

4.1.4. Mixed-Use

4.2. By Service Type (In Value %)

4.2.1. Tenant Management

4.2.2. Facility Management

4.2.3. Financial Management

4.2.4. Maintenance Services

4.3. By End-User (In Value %)

4.3.1. Individual Property Owners

4.3.2. Real Estate Investors

4.3.3. Corporate Real Estate

4.4. By Technology Adoption (In Value %)

4.4.1. Software-Based Management

4.4.2. AI-Powered Solutions

4.4.3. IoT Integration

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Property Management Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Greystar Real Estate Partners

5.1.2. Cushman & Wakefield

5.1.3. CBRE Group, Inc.

5.1.4. Lincoln Property Company

5.1.5. Jones Lang LaSalle (JLL)

5.1.6. Colliers International

5.1.7. Apartment Management Consultants, LLC

5.1.8. BH Management Services, LLC

5.1.9. Bozzuto Group

5.1.10. Pinnacle Property Management Services

5.1.11. RealPage, Inc.

5.1.12. Equity Residential

5.1.13. FirstService Residential

5.1.14. Alliance Residential

5.1.15. MAA (Mid-America Apartments)

5.2. Cross Comparison Parameters (Revenue, Market Presence, Digital Capabilities, Customer Base, Service Range, Property Portfolio, Technological Investments, Market Position)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Property Management Market Regulatory Framework

6.1. Licensing Requirements

6.2. Tenant Rights and Protections

6.3. Environmental and Sustainability Standards

7. USA Property Management Future Market Size (In USD Mn)

7.1. Projected Market Size and Growth Rate

7.2. Key Factors Driving Future Market Growth

8. USA Property Management Future Market Segmentation

8.1. By Property Type (In Value %)

8.2. By Service Type (In Value %)

8.3. By End-User (In Value %)

8.4. By Technology Adoption (In Value %)

8.5. By Region (In Value %)

9. USA Property Management Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Expansion Strategies

9.4. White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

Our initial step involves mapping the ecosystem of the USA property management market, focusing on primary stakeholders, service providers, and regulatory bodies. This identification process relies on desk research utilizing comprehensive databases to define the market structure and dynamics.

Step 2: Market Analysis and Construction

The next phase includes an extensive analysis of historical market data to assess growth trajectories and major trends in property management services. The assessment includes the property-to-service ratio and revenue metrics for deeper insights into market penetration.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from our analysis are validated through direct interviews and surveys with industry experts. This step ensures that qualitative insights from market practitioners are integrated to refine our research conclusions.

Step 4: Research Synthesis and Final Output

The final stage involves integrating findings from secondary research and expert consultations to validate data points and analysis conclusions, providing a complete and verified understanding of the USA property management market.

Frequently Asked Questions

01. How big is the USA Property Management Market?

The USA property management market is valued at USD 81.5 billion, driven by the rise in rental demand, urbanization, and technological adoption in tenant and facility management services.

02. What are the challenges in the USA Property Management Market?

Challenges in this market include high operational costs, stringent regulatory compliance, and the complexity of managing diverse property types in large metropolitan areas.

03. Who are the major players in the USA Property Management Market?

Leading players include Greystar Real Estate Partners, CBRE Group, Cushman & Wakefield, Jones Lang LaSalle (JLL), and Lincoln Property Company, known for their extensive portfolios and national service networks.

04. What are the growth drivers of the USA Property Management Market?

Key drivers include the expansion of rental housing, advancements in property management technology, and increased demand for streamlined property management services among institutional investors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.