USA Propylene Oxide Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD8430

November 2024

89

About the Report

USA Propylene Oxide Market Overview

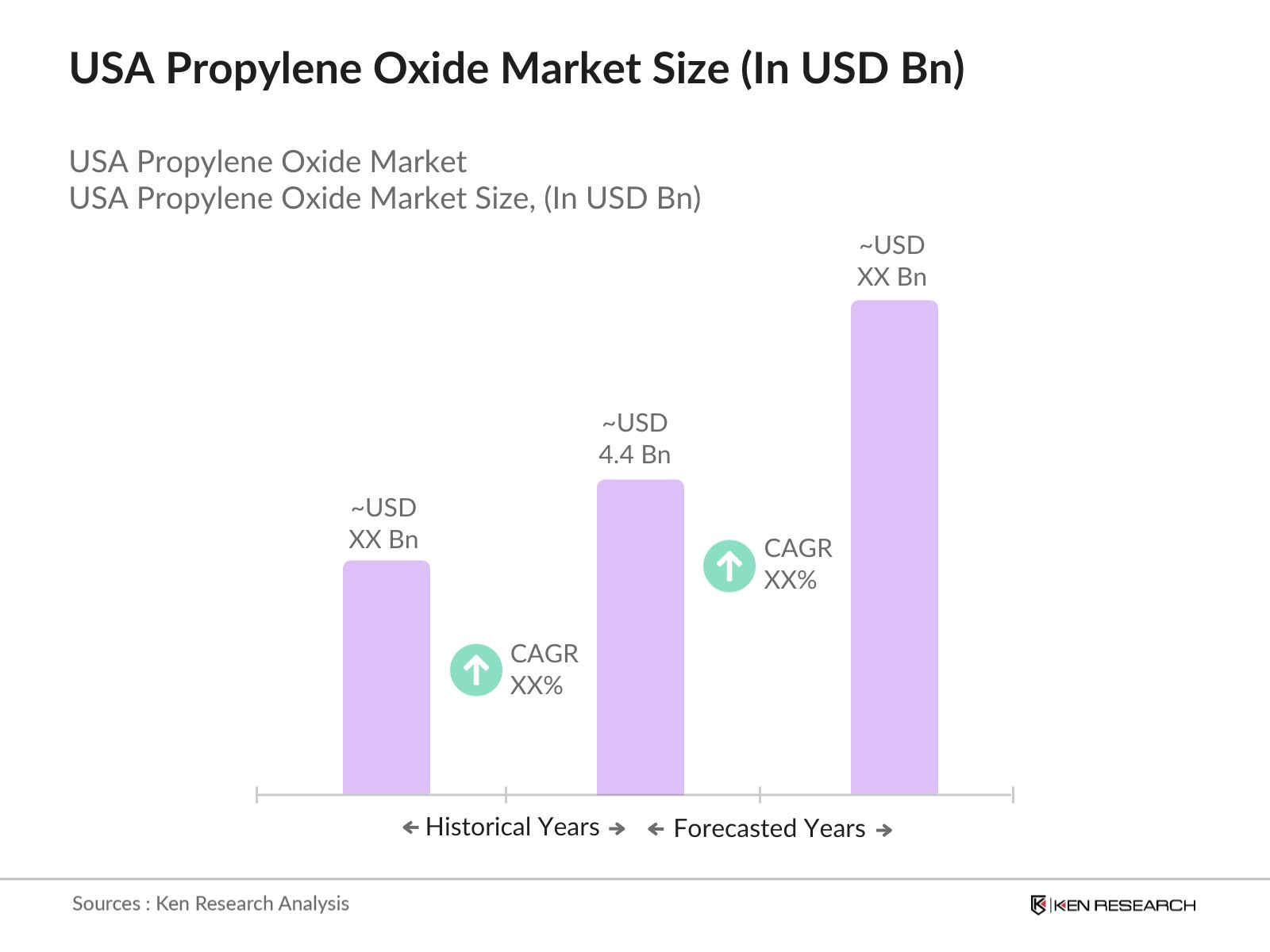

The USA Propylene Oxide market is valued at USD 4.4 billion, underpinned by consistent demand across the automotive, construction, and electronics sectors. This demand is largely due to the material's versatility in applications such as polyether polyols, used in producing polyurethane foam for automotive interiors and insulation in construction. The surge in environmentally friendly practices and advancements in bio-based propylene oxide production are also contributing to its stable market position, with significant regulatory support shaping industry standards.

The United States is the key player in the propylene oxide market, with states like Texas and Louisiana leading due to well-established petrochemical infrastructure and access to raw materials. Texas, for instance, benefits from the presence of major manufacturers, well-supported logistics, and easy access to export routes, allowing it to cater efficiently to both domestic and international demands. Louisiana follows with significant manufacturing capacities and support from state policies that favor large-scale petrochemical production.

The Environmental Protection Agency enforces strict environmental standards for propylene oxide production. Under the Clean Air Act, chemical manufacturers must limit VOC emissions, with the EPA reporting a 3.5% decrease in allowable VOC levels for 2024. These regulations require companies to invest in emission control technologies, impacting operational costs and driving innovation in clean manufacturing practices.

USA Propylene Oxide Market Segmentation

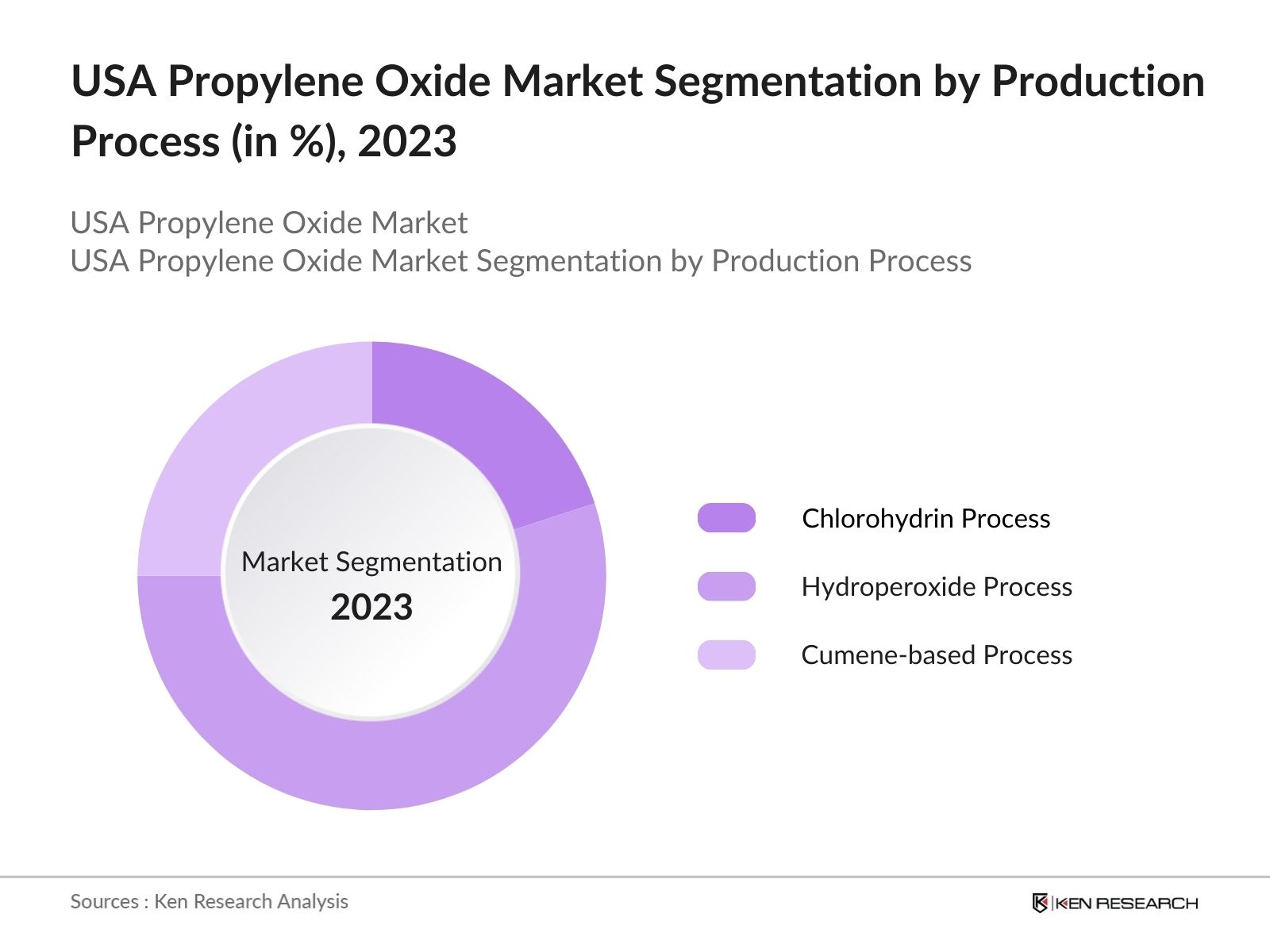

By Production Process: The market is segmented by production processes into chlorohydrin, hydroperoxide, and cumene-based processes. The hydroperoxide process holds a dominant share due to its cost-effectiveness and higher yield in industrial-scale production, essential in meeting the increasing demand from downstream applications such as polyols and propylene glycol. Manufacturers prefer this method because it provides operational efficiency and aligns with industry regulations on environmental impact.

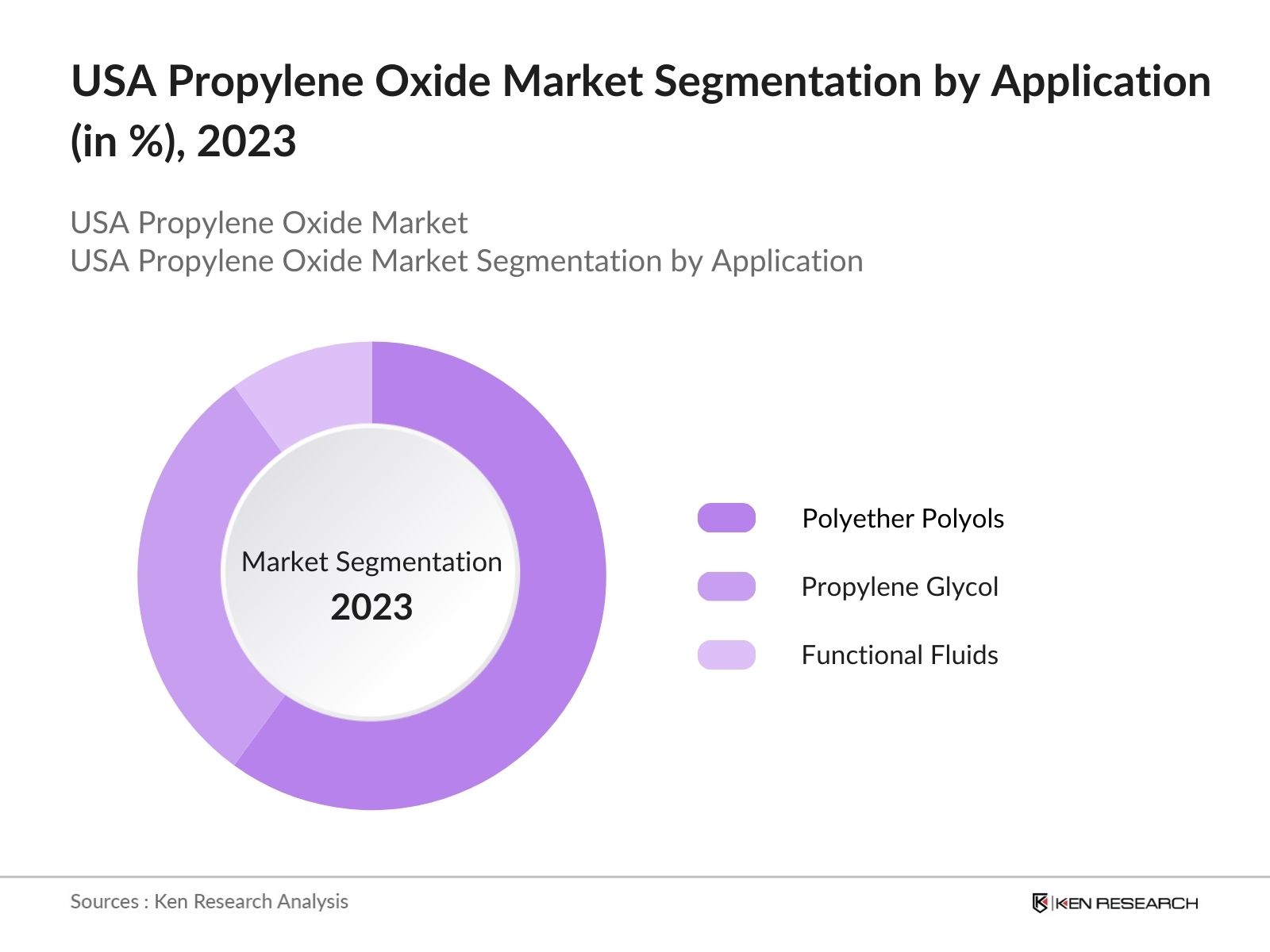

By Application: The market is segmented by application into polyether polyols, propylene glycol, and functional fluids. Polyether polyols dominate due to their widespread use in polyurethane production, which serves key industries such as construction and automotive. This sub-segments dominance is attributed to the high demand for flexible and rigid foams, adhesives, and coatings, particularly in industries prioritizing insulation and lightweight materials.

USA Propylene Oxide Market Competitive Landscape

The USA Propylene Oxide market is consolidated with a few major players, including both multinational corporations and regional firms. Companies such as LyondellBasell and Dow Chemical maintain substantial market influence due to their integrated supply chains and production capacities. This competitive landscape emphasizes the impact of these players on market standards and pricing dynamics.

|

Company |

Year Established |

Headquarters |

Production Capacity |

R&D Investment |

Technology Adoption |

Distribution Network |

Environmental Compliance |

Strategic Partnerships |

|

LyondellBasell Industries |

1956 |

Houston, TX |

- | - | - | - | - | - |

|

Dow Chemical |

1897 |

Midland, MI |

- | - | - | - | - | - |

|

Huntsman Corporation |

1970 |

The Woodlands, TX |

- | - | - | - | - | - |

|

BASF SE |

1865 |

Florham Park, NJ |

- | - | - | - | - | - |

|

INEOS Group |

1998 |

London, UK |

- | - | - | - | - | - |

USA Propylene Oxide Industry Analysis

Growth Drivers

Industrial and Manufacturing Sector Demand: The U.S. propylene oxide market is driven by its essential role in producing polyurethane, a key component in the manufacturing and automotive sectors. In 2024, the manufacturing sector contributed $2.3 trillion to the GDP, underscoring the scale of demand for materials like propylene oxide in industrial applications. This demand is further intensified as manufacturing companies continue increasing production volumes to meet domestic and international needs, with the Bureau of Economic Analysis reporting a 2.2% growth in industrial outputs across relevant manufacturing categories. Given the high demand for polyurethane in auto and insulation applications, propylene oxide remains integral to production lines, supporting steady consumption growth.

Increase in Polyurethane Foam Applications: Polyurethane foam, a major product of propylene oxide, is widely used in furniture, bedding, automotive seating, and construction insulation. Data from the U.S. Census Bureau shows that the domestic furniture manufacturing industry alone reached nearly $140 billion in revenue in 2023, with consistent demand for high-density foams. Similarly, automotive manufacturing utilized over 600,000 tons of polyurethane foam in 2023, indicating strong end-user consumption for propylene oxide. As the construction and automotive sectors remain robust, the need for polyurethane foam applications continues to anchor demand for propylene oxide across industries.

Regulatory Policies Supporting Green Manufacturing: Recent U.S. regulatory policies encourage the shift toward sustainable manufacturing processes. The Environmental Protection Agency (EPA) has implemented stringent guidelines on reducing volatile organic compound (VOC) emissions, impacting propylene oxide producers and pushing them toward cleaner, efficient methods. According to the U.S. Department of Energy, the increased use of green production technologies has reduced VOC emissions by 4.5% in the chemical manufacturing sector since 2022. This regulatory support aligns with market growth as companies adopt eco-friendly practices to meet compliance requirements and remain competitive.

Market Challenges

Raw Material Price Fluctuations: The prices of raw materials such as propylene glycol, a feedstock for propylene oxide, are subject to fluctuations influenced by petrochemical market dynamics. In 2024, the Energy Information Administration (EIA) reported a 5% increase in propylene glycol prices due to supply chain disruptions. Such volatility affects production costs in the propylene oxide market, challenging manufacturers to stabilize operational expenses. With dependence on petroleum derivatives, the cost pressures reflect broader market vulnerability, especially with international oil price adjustments impacting supply chains.

Environmental Regulations and Compliance: Compliance with environmental regulations is a significant challenge, as propylene oxide production often results in carbon emissions. The EPA's Clean Air Act enforces strict limits on air pollutants, requiring producers to invest in emission control technologies. In 2023, the American Chemistry Council indicated that U.S. chemical manufacturers collectively invested over $12 billion in emissions management, directly impacting profitability margins for smaller propylene oxide producers. This mandatory compliance requires continual operational adjustments, intensifying regulatory pressures across the market.

USA Propylene Oxide Market Future Outlook

The USA Propylene Oxide market is poised for continuous growth driven by increased applications across automotive and construction industries, coupled with advancing sustainable production practices. Growth in bio-based production methods is expected to further reshape the industry, addressing the growing environmental concerns and meeting stringent regulatory requirements. This trajectory points to a significant transformation in production techniques and regulatory alignment, influencing both market players and end consumers.

Future Market Opportunities

Expansion of Production Capacities: Given the high demand for propylene oxide in multiple industries, companies are investing in expanded production facilities. In 2023, the U.S. Energy Department recorded a 6% increase in new chemical manufacturing projects, many of which focus on producing essential chemicals like propylene oxide. Companies that leverage this expansion to build or upgrade plants will benefit from economies of scale, improving output efficiency and serving increasing demand across industries like construction and automotive.

Technological Advancements in Propylene Oxide Production: Innovations in production technology, such as advanced catalytic processes, are making propylene oxide production more efficient and environmentally friendly. Data from the National Institute of Standards and Technology (NIST) indicates that new catalytic methods have improved production output by 4.8% while reducing energy consumption by 3.2% in 2024. These advancements enable manufacturers to meet regulatory standards more effectively and increase throughput, creating an opportunity for more sustainable and cost-efficient production.

Scope of the Report

|

Segment |

Sub-segments |

|

Production Process |

Chlorohydrin Process Styrene Monomer Process Hydrogen Peroxide Process |

|

Application |

Polyether Polyols Propylene Glycol Others |

|

End-User Industry |

Automotive Construction Electronics Textiles Chemicals |

|

Distribution Channel |

Direct Sales Distributors Online Channels |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Automotive Manufacturers

Polyurethane Foam Producers

Insulation Material Suppliers

Environmental Protection Agencies (EPA)

Government and Regulatory Bodies (OSHA, DOT)

Investor and Venture Capitalist Firms

Chemical Distributors and Suppliers

Construction Industry Stakeholders

Companies

Major Players

Dow Inc.

LyondellBasell Industries

BASF SE

Huntsman Corporation

Shell Chemicals

Repsol S.A.

Sumitomo Chemical

AGC Chemicals

Evonik Industries

SKC Co., Ltd.

SABIC

Eastman Chemical Company

Covestro AG

INEOS Group

PJSC Nizhnekamskneftekhim

Table of Contents

1. USA Propylene Oxide Market Overview

Definition and Scope

Market Taxonomy

Market Lifecycle and Dynamics

Supply Chain and Value Chain Analysis

2. USA Propylene Oxide Market Size (In USD Bn)

Historical Market Size

Current Market Size

Demand-Supply Balance

Key Market Milestones and Developments

3. USA Propylene Oxide Market Analysis

Growth Drivers

Industrial and Manufacturing Sector Demand

Increase in Polyurethane Foam Applications

Regulatory Policies Supporting Green Manufacturing

Market Challenges

Raw Material Price Fluctuations

Environmental Regulations and Compliance

Safety Concerns in Handling and Transportation

Opportunities

Expansion of Production Capacities

Technological Advancements in Propylene Oxide Production

Export Opportunities due to Demand in Emerging Markets

Trends

Shift towards Bio-based Propylene Oxide Production

Adoption of Advanced Catalytic Processes

Integration of Sustainable Practices in Manufacturing

Government Regulations

Environmental Protection Standards (EPA)

OSHA Compliance for Safe Manufacturing

Import and Export Tariffs and Policies

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competition Ecosystem

4. USA Propylene Oxide Market Segmentation

By Production Process (In Value %)

Chlorohydrin Process

Styrene Monomer Process

Hydrogen Peroxide Process

By Application (In Value %)

Polyether Polyols

Propylene Glycol

Others (Flame Retardants, Stabilizers)

By End-User Industry (In Value %)

Automotive

Construction

Electronics

Textiles

Chemicals

By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Channels

By Region (In Value %)

Northeast

Midwest

South

West

5. USA Propylene Oxide Market Competitive Analysis

Detailed Profiles of Major Companies

Dow Inc.

LyondellBasell Industries

BASF SE

Huntsman Corporation

Shell Chemicals

Repsol S.A.

Sumitomo Chemical

AGC Chemicals

Evonik Industries

SKC Co., Ltd.

SABIC

Eastman Chemical Company

Covestro AG

INEOS Group

PJSC Nizhnekamskneftekhim

Cross-Comparison Parameters

Revenue, Market Share, Production Capacity, Production Process, End-User Reach, Strategic Initiatives, Geographical Presence, Technological Advancements

Market Share Analysis

Strategic Initiatives and Partnerships

Mergers and Acquisitions

Investment and R&D Analysis

Government Grants and Incentives

Private Equity and Venture Capital Involvement

6. USA Propylene Oxide Market Regulatory Framework

Emission Standards and Environmental Compliance

Health and Safety Standards

Transportation and Hazardous Material Regulations

Certification and Licensing Requirements

7. USA Propylene Oxide Future Market Size (In USD Bn)

Future Market Projections

Key Factors Expected to Drive Future Growth

8. USA Propylene Oxide Future Market Segmentation

By Production Process (In Value %)

By Application (In Value %)

By End-User Industry (In Value %)

By Distribution Channel (In Value %)

By Region (In Value %)

9. USA Propylene Oxide Market Analysts Recommendations

Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

Customer Segment Analysis

Targeted Marketing Strategies

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing a comprehensive ecosystem map that includes major stakeholders within the USA Propylene Oxide Market. Extensive desk research was conducted using secondary databases to define critical variables influencing the market's dynamics.

Step 2: Market Analysis and Construction

This stage entailed the compilation and analysis of historical data for the USA Propylene Oxide Market, focusing on key metrics such as production capacity, supply chains, and revenue generation across end-user industries. These metrics were analyzed to ensure the reliability of market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through interviews with industry experts, including executives and technical specialists from key companies. These consultations offered insights into industry-specific challenges and production capacities.

Step 4: Research Synthesis and Final Output

Direct engagement with major propylene oxide producers provided critical insights into production segments, application preferences, and emerging trends. This interaction ensured a validated analysis with high accuracy and relevance to the USA Propylene Oxide market.

Frequently Asked Questions

How big is the USA Propylene Oxide Market?

The USA Propylene Oxide Market is valued at USD 4.4 billion, driven by steady demand from sectors like automotive and construction, which require polyurethane and propylene glycol-based applications.

What are the challenges in the USA Propylene Oxide Market?

Challenges in the USA Propylene Oxide Market include fluctuating raw material costs, regulatory compliance, and the need for sustainable production practices, which collectively impact operational and environmental costs.

Who are the major players in the USA Propylene Oxide Market?

Key players in the USA Propylene Oxide Market include Dow Inc., BASF SE, and Huntsman Corporation, each distinguished by extensive production capacities, sustainable production techniques, and strong market presence.

What are the growth drivers of the USA Propylene Oxide Market?

The USA Propylene Oxide Market is driven by demand in the automotive and construction sectors, with additional momentum from environmental regulations encouraging sustainable production techniques.

Which regions in the USA dominate the Propylene Oxide Market?

Texas and Louisiana lead in the USA Propylene Oxide Market due to their advanced petrochemical infrastructure, favorable regulatory conditions, and logistical advantages for domestic and international distribution.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.