USA Quick Service Restaurants Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD8438

December 2024

85

About the Report

USA Quick Service Restaurants Market Overview

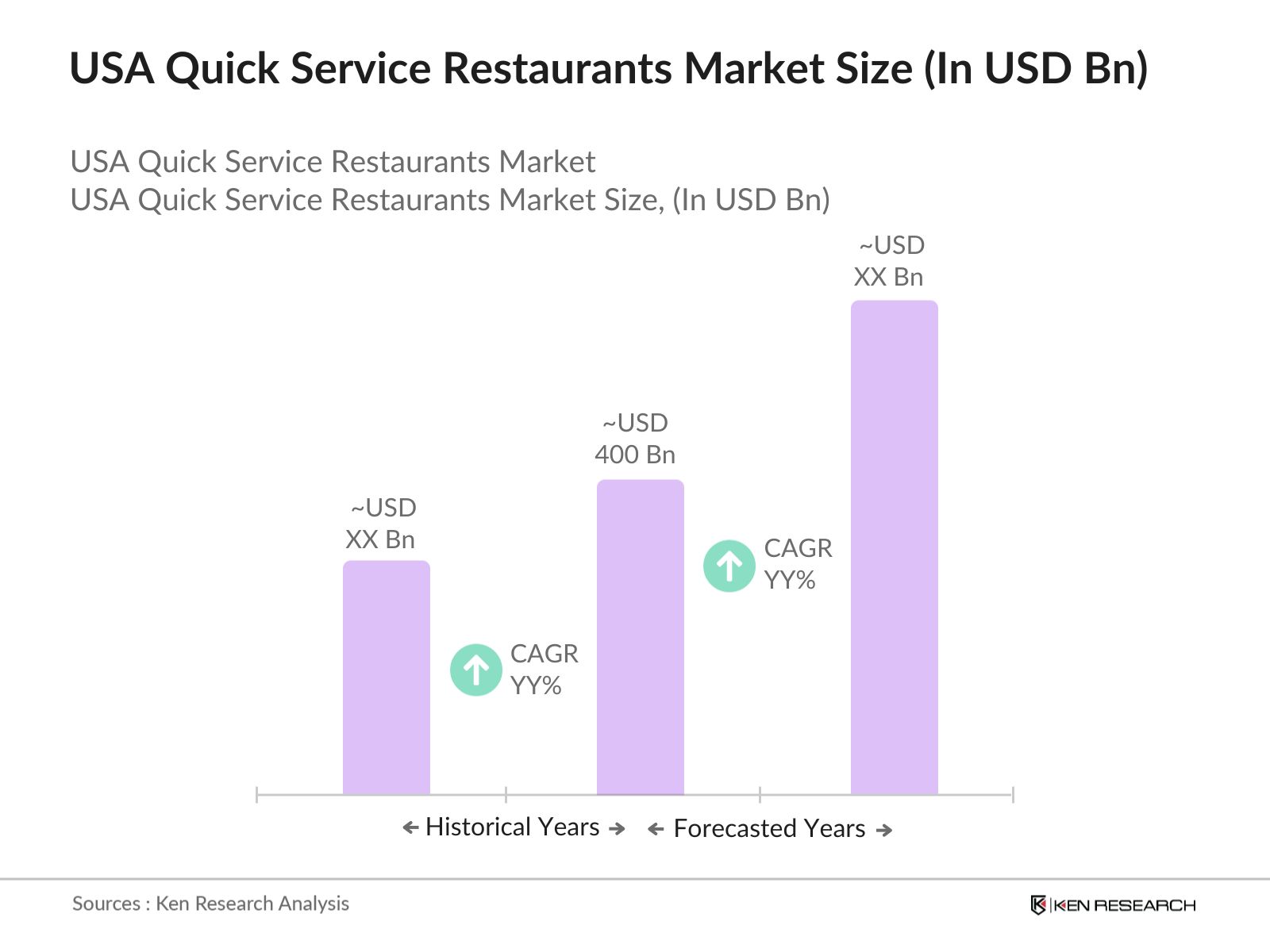

- The USA Quick Service Restaurants (QSR) market is valued at USD 400 billion, showing consistent growth driven by consumer demand for convenience, affordability, and fast service. The expansion of digital ordering platforms and mobile apps has accelerated QSR growth, especially after the pandemic, as consumers turned to quick, efficient dining solutions.

- The market dominance of cities such as New York, Los Angeles, and Chicago is largely due to their high population density, urbanization, and busy lifestyles, which naturally encourage the demand for quick-service dining options. These cities are also home to large commercial hubs and tourist attractions, further amplifying QSR demand.

- In 2024, the U.S. Small Business Administration (SBA) launched a program offering tax incentives for small and medium-sized QSR businesses investing in digital transformation and eco-friendly packaging. The initiative has already supported over 25,000 businesses by offering tax credits of up to $5,000 annually, encouraging them to adopt environmentally sustainable practices.

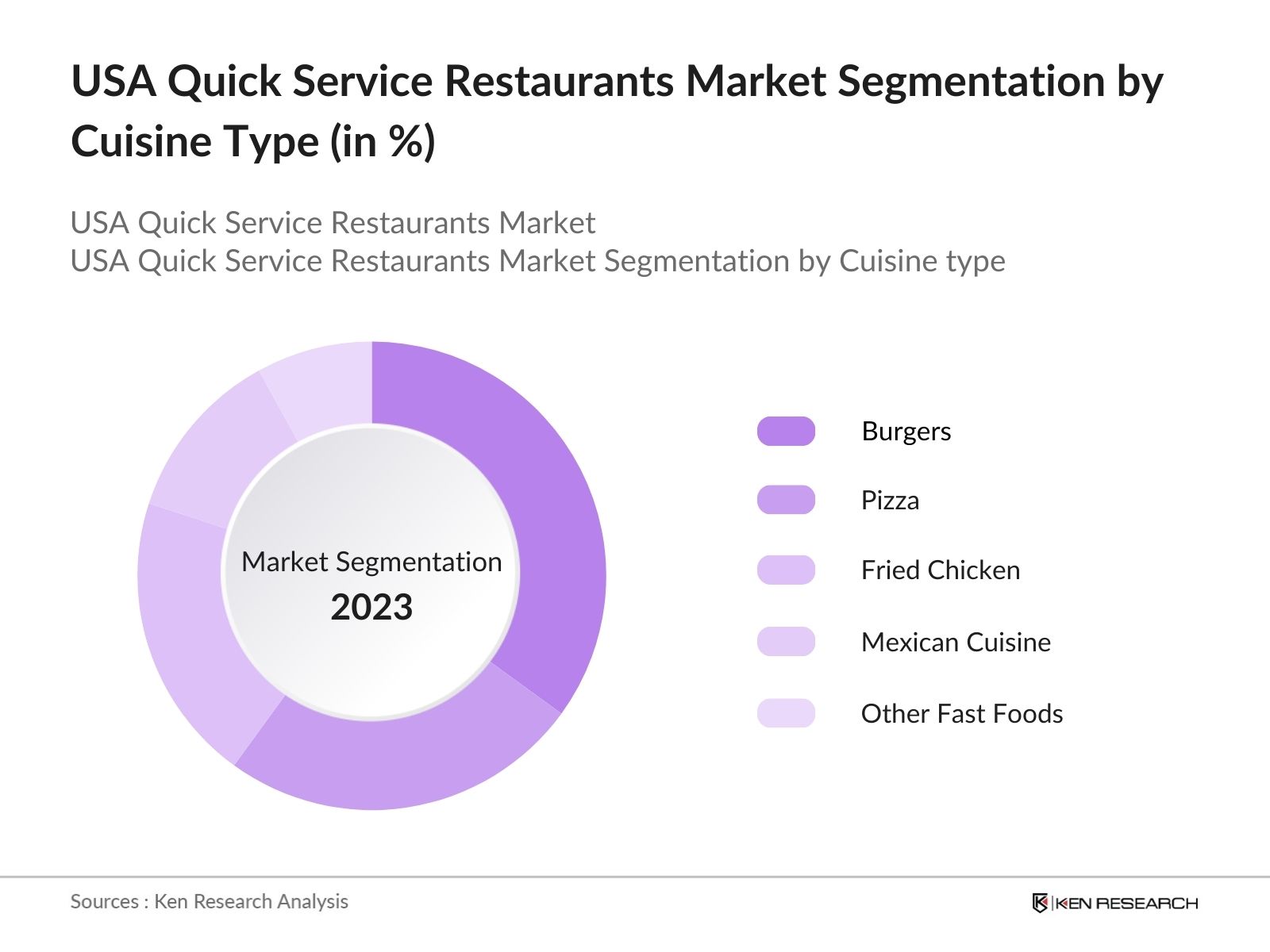

USA Quick Service Restaurants Market Segmentation

By Cuisine Type: The market is segmented by cuisine type into burgers, pizza, fried chicken, Mexican cuisine, and other fast foods. Burgers remain the dominant category within this segmentation due to their strong presence across popular QSR chains like McDonalds, Wendy's, and Burger King. The preference for burgers is driven by their affordability, customization options, and a well-established fan base that favors this quintessential fast food.

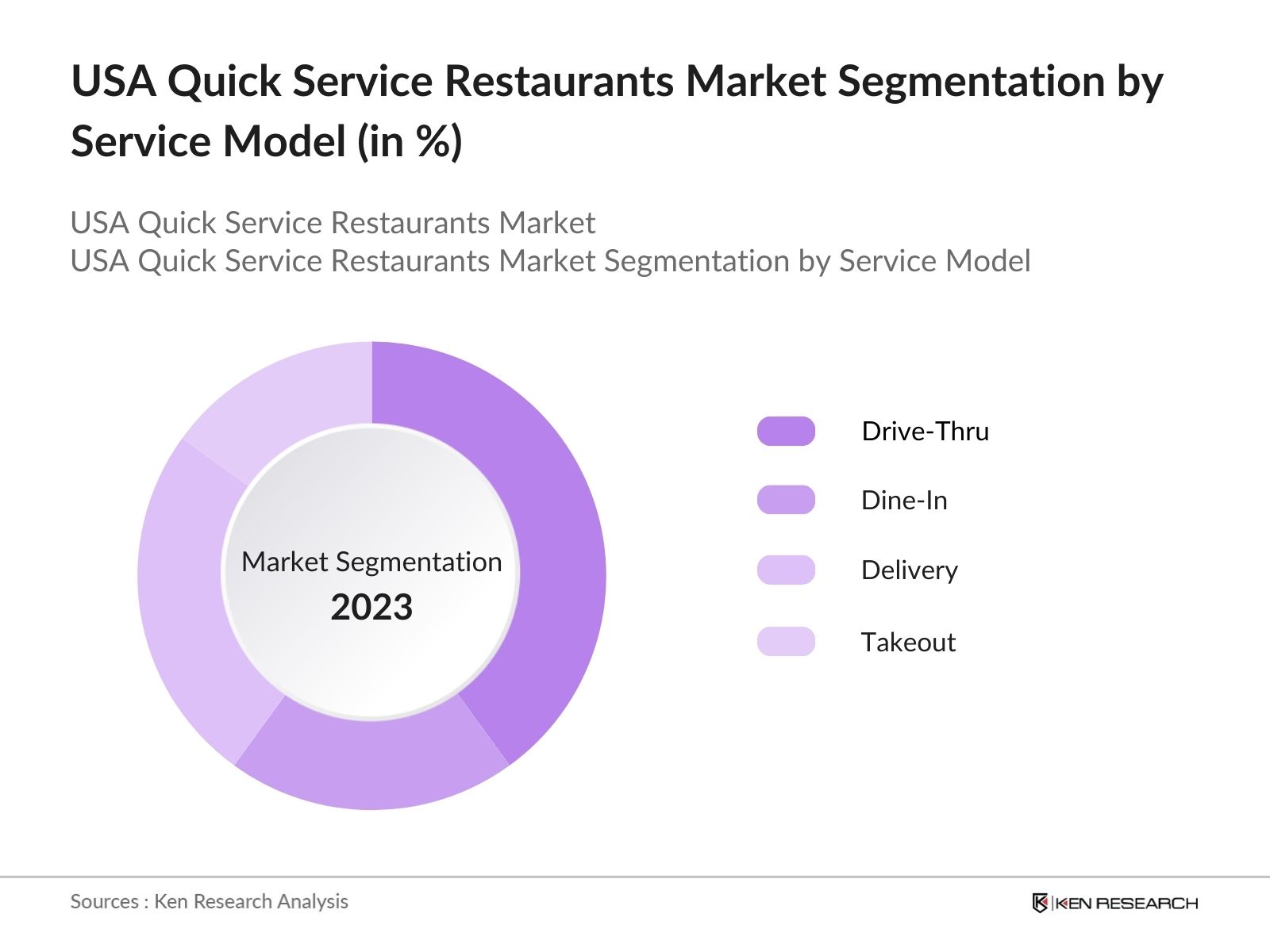

By Service Model: The market is also segmented by service model into drive-thru, dine-in, delivery, and takeout. The drive-thru service dominates the market due to its efficiency, especially during and post-pandemic when contactless options were favored. Fast-food giants like McDonald's and Starbucks have capitalized on this model by upgrading their drive-thru technology, reducing wait times, and integrating mobile ordering, leading to high customer retention rates.

USA Quick Service Restaurants Market Competitive Landscape

The market is highly competitive, with several well-established players leading the industry. These companies benefit from extensive franchise networks, strong brand loyalty, and technological advancements like mobile app integration.

|

Company |

Year Established |

Headquarters |

Revenue (USD Billion) |

Number of Outlets |

Specialization |

Digital Integration |

Sustainability Practices |

Delivery Partnerships |

Franchise Presence |

|

McDonald's Corporation |

1955 |

Chicago, Illinois |

|||||||

|

Yum! Brands, Inc. (KFC, Taco Bell, Pizza Hut) |

1997 |

Louisville, Kentucky |

|||||||

|

Restaurant Brands International (Burger King, Popeyes) |

2014 |

Toronto, Ontario |

|||||||

|

Subway IP LLC |

1965 |

Milford, Connecticut |

|||||||

|

The Wendys Company |

1969 |

Dublin, Ohio |

USA Quick Service Restaurants Market Analysis

Market Growth Drivers

Market Challenges

- Tax Incentives for Small and Medium-Sized QSR Businesses: In 2024, the U.S. Small Business Administration (SBA) launched a program offering tax incentives for small and medium-sized QSR businesses investing in digital transformation and eco-friendly packaging. The initiative has already supported over 25,000 businesses by offering tax credits of up to $5,000 annually, encouraging them to adopt environmentally sustainable practices.

- USDAs Support for Local Sourcing Initiatives: The U.S. Department of Agriculture (USDA) has increased funding for local farm-to-table programs, promoting partnerships between QSRs and local farms. By 2024, more than $1 billion in grants will be distributed to restaurants sourcing locally grown produce and ingredients.

- FDAs Nutritional Labeling Regulations: The U.S. FDA continues to enforce stricter nutritional labeling laws for QSRs. As of 2024, all restaurants with over 20 locations must clearly display calorie counts and nutritional information on their menus. Over 100,000 QSRs have already complied with these regulations. This initiative is aimed at promoting transparency and helping consumers make healthier dietary choices.

USA Quick Service Restaurants Market Future Outlook

Over the next five years, the USA QSR industry is expected to experience growth, driven by technological advancements, the expansion of delivery services, and growing consumer preference for fast, convenient dining solutions.

Future Market Opportunities

- Increased Investment in Drive-Thru and Delivery Innovations: Over the next five years, U.S. QSRs will invest heavily in optimizing drive-thru and delivery services. By 2029, more than 75,000 QSR locations will offer advanced drive-thru experiences, including voice-activated AI order systems and real-time delivery tracking.

- Adoption of Plant-Based and Alternative Protein Products: The plant-based food trend is expected to dominate the U.S. QSR market over the next five years, with major chains offering a wider range of meat alternatives. By 2029, the number of QSR locations offering plant-based options will exceed 60,000, with annual sales of plant-based meals projected to surpass 1 billion units.

Scope of the Report

|

Service Model |

Drive-Thru Dine-In Delivery Takeout |

|

Structure |

Independent Outlets Chained Outlets |

|

Consumer Demographics |

Millennials Gen Z Baby Boomers |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institution

Investors and Venture Capitalist Firms

Private Equity Firms

Food and Beverage Equipment Manufacturers

Digital Payment Solution Providers

Packaging and Sustainability Companies

Government and Regulatory Bodies (e.g., USDA, FDA)

QSR Technology Providers (e.g., AI, Mobile Integration Firms)

Companies

Players Mentioned in the Report:

McDonalds Corporation

Yum! Brands, Inc. (KFC, Taco Bell, Pizza Hut)

Restaurant Brands International (Burger King, Popeyes)

Subway IP LLC

The Wendy's Company

Domino's Pizza Inc.

Starbucks Corporation

Chick-fil-A, Inc.

Dunkin' Brands Group, Inc.

Chipotle Mexican Grill

Table of Contents

USA Quick Service Restaurants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

USA Quick Service Restaurants Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Quick Service Restaurants Market Analysis

3.1. Growth Drivers (Consumer Preferences, Tech Innovations, and More)

3.1.1. Rise in Digital Ordering Platforms

3.1.2. Demand for Customization and Speed

3.1.3. Expansion of QSR Chains

3.1.4. Health-Conscious Menu Innovations

3.2. Market Challenges (Competitive Intensity, Cost Structures)

3.2.1. Rising Costs of Ingredients and Labor

3.2.2. High Competition Among Chains and Independents

3.2.3. Regulatory Pressures on Nutrition and Transparency

3.2.4. Supply Chain Disruptions

3.3. Opportunities (Tech Integration, International Expansion)

3.3.1. Integration of AI and Automation

3.3.2. Franchising Growth Opportunities

3.3.3. Green Initiatives and Sustainable Practices

3.3.4. Niche Market Expansion (Plant-Based Options)

3.4. Trends (Consumer Behavior Shifts, Operational Models)

3.4.1. Rise of Virtual Kitchens (Ghost Kitchens)

3.4.2. Drive-Thru Dominance and Expansion

3.4.3. Increasing Mobile Ordering and Loyalty Programs

3.4.4. Preference for Contactless Payment Systems

3.5. Government Regulation (Labor Laws, Health Guidelines)

3.5.1. Compliance with Nutritional Labeling Laws

3.5.2. Employment and Minimum Wage Regulations

3.5.3. Safety Standards in Food Handling

3.5.4. Impact of Environmental Policies on Packaging

USA Quick Service Restaurants Market Segmentation

4.1. By Cuisine Type (In Value %)

4.1.1. Burgers

4.1.2. Pizza

4.1.3. Fried Chicken

4.1.4. Mexican Cuisine

4.1.5. Other Fast Foods (Sandwiches, Salads)

4.2. By Service Model (In Value %)

4.2.1. Drive-Thru

4.2.2. Dine-In

4.2.3. Delivery

4.2.4. Takeout

4.3. By Structure (In Value %)

4.3.1. Independent Outlets

4.3.2. Chained Outlets

4.4. By Consumer Demographics (In Value %)

4.4.1. Millennials

4.4.2. Gen Z

4.4.3. Baby Boomers

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

USA Quick Service Restaurants Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. McDonald's Corporation

5.1.2. Yum! Brands, Inc.

5.1.3. Restaurant Brands International (Burger King, Popeyes)

5.1.4. The Wendy's Company

5.1.5. Subway IP LLC

5.1.6. Domino's Pizza Inc.

5.1.7. Chick-fil-A, Inc.

5.1.8. Starbucks Corporation

5.1.9. Chipotle Mexican Grill

5.1.10. Dunkin' Brands Group, Inc.

5.1.11. Panera Bread Company

5.1.12. Little Caesar Enterprises Inc.

5.1.13. Wingstop Inc.

5.1.14. Five Guys Enterprises, LLC

5.1.15. In-N-Out Burgers

5.2. Cross Comparison Parameters (Revenue, Number of Outlets, Average Order Value, Menu Innovation, Customer Loyalty, Digital Integration, Expansion Strategies, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA Quick Service Restaurants Market Regulatory Framework

6.1. Food Safety Standards

6.2. Minimum Wage and Labor Laws

6.3. Environmental and Sustainability Regulations

6.4. Compliance with Health and Sanitation Guidelines

USA Quick Service Restaurants Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Quick Service Restaurants Future Market Segmentation

8.1. By Cuisine Type (In Value %)

8.2. By Service Model (In Value %)

8.3. By Structure (In Value %)

8.4. By Consumer Demographics (In Value %)

8.5. By Region (In Value %)

USA Quick Service Restaurants Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on identifying critical variables influencing the USA QSR market. These include consumer behavior patterns, digital transformation in food services, and competitive dynamics. Extensive desk research and secondary data collection help pinpoint key factors shaping the market.

Step 2: Market Analysis and Construction

In this step, historical data is compiled and analyzed to understand the market structure. Key indicators such as average order value, service delivery models, and outlet density are evaluated to provide a comprehensive view of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted to validate market hypotheses. Interviews with industry experts from QSR chains and independent outlets offer valuable insights into operational challenges, technological adoption, and growth potential.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data from both primary and secondary research to ensure accuracy. This includes direct engagement with industry players to gather insights on consumer trends, product preferences, and technological advancements, ensuring a robust market analysis.

Frequently Asked Questions

01. How big is the USA Quick Service Restaurants Market?

The USA QSR market is valued at USD 400 billion, driven by the growing demand for fast and convenient dining options, the expansion of delivery services, and technological advancements in ordering systems.

02. What are the challenges in the USA QSR Market?

The key challenges in the USA QSR market include rising operational costs, supply chain disruptions, and heightened competition. Additionally, regulatory pressures related to food safety and nutritional transparency pose challenges for operators.

03. Who are the major players in the USA QSR Market?

Major players in the USA QSR market include McDonald's, Yum! Brands (KFC, Taco Bell), Restaurant Brands International (Burger King, Popeyes), Subway, and The Wendy's Company.

04. What are the growth drivers of the USA QSR Market?

Growth in the USA QSR market is propelled by consumer demand for convenience, the rise of digital ordering and delivery platforms, and increased menu innovation catering to health-conscious customers.

05. What trends are shaping the USA QSR Market?

Key trends in the USA QSR market include the rise of ghost kitchens, increased investment in mobile app ordering, contactless payment systems, and menu innovations that prioritize health and sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.