USA Railroad Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD7562

December 2024

94

About the Report

USA Railroad Market Overview

- The USA Railroad Market is valued at USD 74 billion, reflecting significant contributions from freight and passenger rail services. This markets value is largely driven by growing domestic and international trade demands, with substantial federal funding and private investments in rail infrastructure. Key freight corridors, especially those connecting major economic centers, bolster this growth as they accommodate high volumes of bulk and container goods crucial for trade and industry.

- The USA Railroad Market is prominently dominated by metropolitan and industrial regions, particularly in the Northeast and Midwest. These regions are significant due to their established rail networks and high population densities, resulting in sustained demand for both freight and passenger rail services. The concentration of manufacturing industries and trade hubs in these areas also makes them central to the countrys rail infrastructure.

- The FRAs Federal Rail Safety Standards mandate strict regulations covering track integrity, operational safety, and crew certifications. In 2024, rail companies allocated around $1.5 billion to comply with these safety regulations, ensuring the safety of both freight and passenger services. These standards are essential for reducing accidents, protecting cargo, and maintaining public trust in rail services, which is critical for the industrys sustained growth and operational stability.

USA Railroad Market Segmentation

By Type of Service: The Market is segmented by type of service into freight rail and passenger rail. Freight rail holds a dominant market share within this segmentation due to its critical role in transporting bulk goods like coal, chemicals, and agricultural products over long distances. Major companies, such as Union Pacific and BNSF, capitalize on the demand for efficient, large-scale freight solutions, cementing this segment's prominence.

By Technology: The market is segmented by technology into conventional rail, high-speed rail, and autonomous rail. Conventional rail holds the largest share due to its established infrastructure, especially for freight services across the country. High-speed rail, though a smaller segment, is growing, driven by consumer demand for faster transit options in regions like the Northeast Corridor, where densely populated urban centers are closely connected.

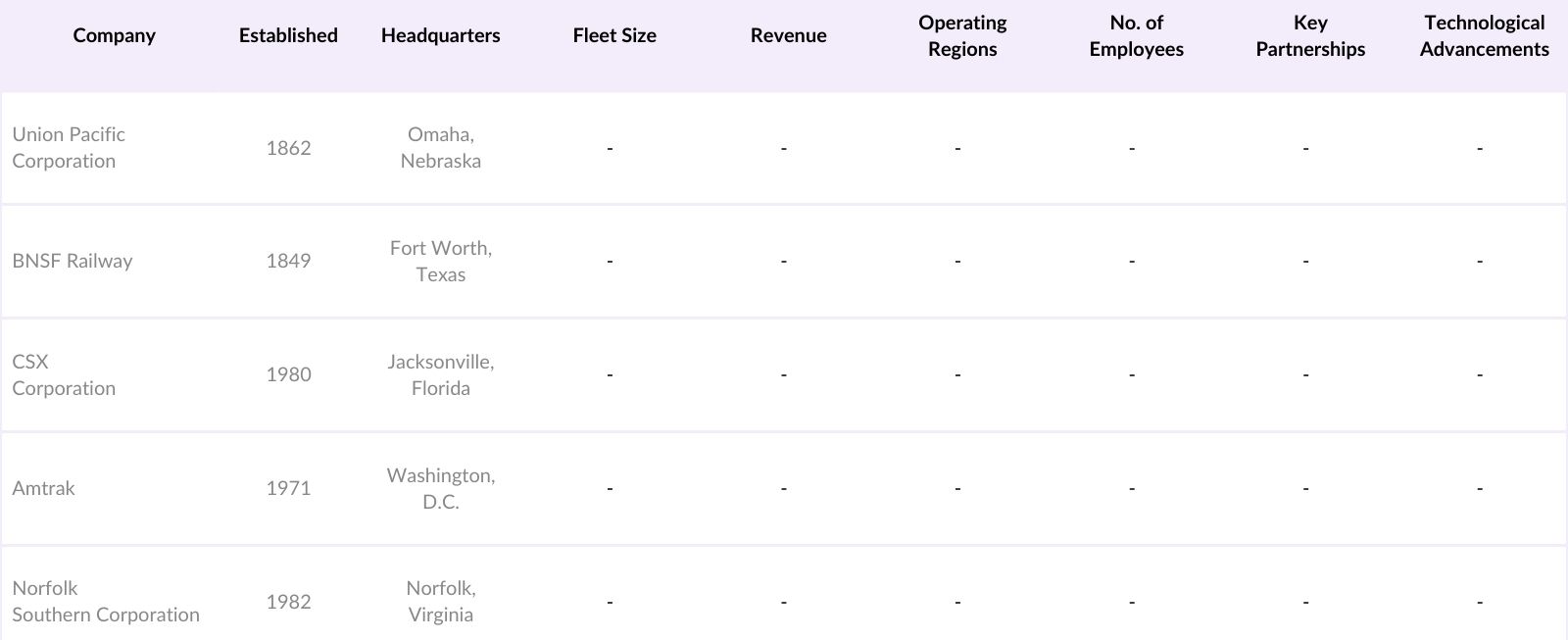

USA Railroad Market Competitive Landscape

The USA Railroad Market is dominated by a few major players, with Union Pacific, BNSF Railway, and CSX Corporation leading the industry. These companies maintain extensive networks and handle a large proportion of the countrys rail freight, emphasizing their strategic influence on the market.

USA Railroad Market Analysis

Growth Drivers

- Economic Growth: The USA railroad market benefits from the country's robust economic activity, with U.S. GDP reaching $26.69 trillion in 2024, indicating a solid industrial output that directly fuels the demand for rail freight services. Rail transport, a crucial part of the national supply chain, supports the movement of large volumes of goods. The Bureau of Economic Analysis (BEA) notes increased manufacturing output, which drives demand for freight transportation solutions like rail, which is more energy-efficient over long distances. Consequently, economic stability and growth in production sectors continue to bolster the railroad market.

- Increased Trade Volumes: With the U.S. trade volume expanding, railways play a key role in transporting goods across states and to major ports. In 2024, the total trade volume reached approximately $6.95 trillion, according to the U.S. Census Bureau, highlighting the increased need for efficient freight systems to manage cargo flows. Rail transport aids in connecting various parts of the U.S. economy, from agricultural exports to manufactured goods, thereby sustaining market demand and reducing logistical delays through efficient rail networks.

- Expansion of Rail Freight Services: As rail companies extend services to cover more destinations, especially in underdeveloped routes, freight transport options have broadened. According to the Federal Railroad Administration (FRA), approximately 140,000 miles of rail freight routes have been optimized to handle heavier loads in 2024, reflecting rail companies' investments in capacity expansion. Enhanced connectivity and reliability offered by the rail network enable businesses to depend on rail for large-scale cargo, ensuring lower operational costs and faster delivery times, critical for growth in high-demand regions.

Market Challenges

- High Infrastructure Costs: Railroad infrastructure in the U.S. requires substantial investments for maintenance and expansion. In 2024, annual maintenance expenses reached $25 billion, driven by the need for track repairs, bridge reinforcements, and upgraded signaling systems. High infrastructure costs impact the profitability of rail operators, as these expenses must be balanced against revenue, making it challenging for companies to expand or modernize at the required pace without government or private funding support.

- Regulatory Constraints: U.S. railroads face stringent safety and environmental regulations that add to operational challenges. The Federal Railroad Administrations safety protocols require regular inspections and compliance with emission standards, adding approximately $3 billion in regulatory costs annually as of 2024. These regulations, while essential for public safety and environmental preservation, increase operational expenses and limit flexibility, making it harder for operators to implement changes quickly or economically.

USA Railroad Market Future Outlook

The USA Railroad Market is poised for continued growth due to advancements in technology, government support, and a rising demand for sustainable transport solutions. Freight rail will remain critical, while investments in high-speed and autonomous rail technologies are expected to expand passenger services and modernize traditional rail infrastructure.

Future Market Opportunities

- Technological Advancements in Rail Transport: The integration of technology into rail transport, such as automation and predictive maintenance systems, offers growth potential. The Federal Railroad Administration reports that in 2024, 40% of U.S. rail networks implemented some form of automation, enhancing safety and reducing operational disruptions. Technologies like autonomous locomotives and advanced data analytics provide rail companies with opportunities to improve efficiency, monitor equipment health in real time, and reduce manual labor costs, positioning the rail industry for technological progress.

- Increased Demand for Sustainable Transport Solutions: Railroads emit up to 75% less greenhouse gas emissions per ton-mile compared to trucks, as stated by the Environmental Protection Agency. As companies increasingly seek eco-friendly options, rail transport stands out as a low-emission alternative. With transportation accounting for 28% of U.S. greenhouse gas emissions in 2024, the shift towards sustainable logistics is a substantial opportunity for railroads to capture environmentally conscious businesses and support national emission reduction goals.

Scope of the Report

|

Type of Service |

Freight Rail Passenger Rail |

|

Technology |

Conventional Rail High-Speed Rail Autonomous Rail |

|

Component |

Rolling Stock Rail Infrastructure Control Systems |

|

Operation Type |

Manual Operation Semi-Automated Operation Fully Automated Operation |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Freight and Logistics Companies

Rail Infrastructure Providers

Rolling Stock Manufacturers

Rail Technology Innovators

Urban and Regional Planning Agencies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Railroad Administration, Department of Transportation)

Environmental and Sustainability Organizations

Companies

Major Players

Union Pacific Corporation

BNSF Railway

CSX Corporation

Amtrak

Norfolk Southern Corporation

Kansas City Southern

Genesee & Wyoming Inc.

Canadian Pacific Railway

Greenbrier Companies

Trinity Industries, Inc.

Wabtec Corporation

Siemens Mobility

Alstom

Caterpillar Inc.

Hitachi Rail

Table of Contents

USA Railroad Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Stakeholders

1.4 Market Segmentation Overview

USA Railroad Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Major Market Developments and Milestones

USA Railroad Market Analysis

3.1 Growth Drivers

3.1.1 Economic Growth

3.1.2 Increased Trade Volumes

3.1.3 Expansion of Rail Freight Services

3.1.4 Government Funding for Rail Infrastructure

3.2 Market Challenges

3.2.1 High Infrastructure Costs

3.2.2 Regulatory Constraints

3.2.3 Competition from Road and Air Transport

3.3 Opportunities

3.3.1 Technological Advancements in Rail Transport

3.3.2 Increased Demand for Sustainable Transport Solutions

3.3.3 Expansion into New Freight Markets

3.4 Trends

3.4.1 Adoption of Autonomous Rail Technology

3.4.2 Increased Use of Electrification in Rail Networks

3.4.3 Digital Transformation and Smart Rail Systems

3.5 Regulatory Environment

3.5.1 Federal Rail Safety Standards

3.5.2 Environmental Compliance Requirements

3.5.3 Public-Private Partnerships in Rail Projects

3.6 Stakeholder Ecosystem

3.7 Porters Five Forces Analysis

3.8 Competitive Landscape

USA Railroad Market Segmentation

4.1 By Type of Service (In Value %)

4.1.1 Freight Rail

4.1.2 Passenger Rail

4.2 By Technology (In Value %)

4.2.1 Conventional Rail

4.2.2 High-Speed Rail

4.2.3 Autonomous Rail

4.3 By Component (In Value %)

4.3.1 Rolling Stock

4.3.2 Rail Infrastructure

4.3.3 Control Systems

4.4 By Operation Type (In Value %)

4.4.1 Manual Operation

4.4.2 Semi-Automated Operation

4.4.3 Fully Automated Operation

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

USA Railroad Market Competitive Analysis

5.1 Profiles of Major Competitors

5.1.1 Union Pacific Corporation

5.1.2 BNSF Railway

5.1.3 CSX Corporation

5.1.4 Norfolk Southern Corporation

5.1.5 Amtrak

5.1.6 Canadian Pacific Railway

5.1.7 Kansas City Southern

5.1.8 Genesee & Wyoming Inc.

5.1.9 Trinity Industries, Inc.

5.1.10 Greenbrier Companies

5.1.11 Alstom

5.1.12 Wabtec Corporation

5.1.13 Siemens Mobility

5.1.14 Caterpillar Inc.

5.1.15 Hitachi Rail

5.2 Cross Comparison Parameters (Revenue, Headquarters, Fleet Size, Employees, Market Share, Operating Regions, Technological Advancements, Key Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Government Incentives

5.8 Private Equity and Venture Capital Involvement

USA Railroad Market Regulatory Framework

6.1 Federal Rail Safety Regulations

6.2 Environmental Compliance Standards

6.3 Certification and Licensing Processes

USA Railroad Future Market Segmentation

7.1 By Type of Service

7.2 By Technology

7.3 By Component

7.4 By Operation Type

7.5 By Region

USA Railroad Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Customer Cohort Analysis

8.3 Marketing and Sales Strategies

8.4 Market Expansion Opportunities

Research Methodology

Step 1: Identification of Key Variables

This initial phase involved mapping out stakeholders within the USA Railroad Market, supported by extensive desk research using secondary and proprietary databases. The objective was to identify variables like service types, technological advancements, and freight capacities that impact market dynamics.

Step 2: Market Analysis and Construction

We analyzed historical data for rail service usage and infrastructure development, focusing on metrics like freight volumes, transit times, and service demand. This analysis provided the foundation for understanding the distribution between freight and passenger services.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts from key rail companies, providing operational insights that refined our understanding of current market challenges and growth drivers.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from freight operators, technology developers, and regulatory sources to validate findings, ensuring a comprehensive, reliable analysis of the USA Railroad Market.

Frequently Asked Questions

01. How big is the USA Railroad Market?

The USA Railroad Market is valued at USD 74 billion, largely driven by extensive freight operations and a growing passenger network.

02. What are the key challenges in the USA Railroad Market?

Key challenges in the USA Railroad Market include high infrastructure costs, regulatory restrictions, and competition from road and air transport.

03. Who are the major players in the USA Railroad Market?

Major players in the USA Railroad Market include Union Pacific, BNSF, CSX, Amtrak, and Norfolk Southern, dominating due to their expansive networks and operational scale.

04. What drives growth in the USA Railroad Market?

Growth in the USA Railroad Market is driven by increasing trade volumes, government investments, and technological advancements in rail infrastructure.

05. Which segments are dominant in the USA Railroad Market?

Freight rail leads the USA Railroad Market due to its ability to handle large-scale goods transport efficiently across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.