USA Recreational Boat Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD2918

November 2024

92

About the Report

USA Recreational Boat Market Overview

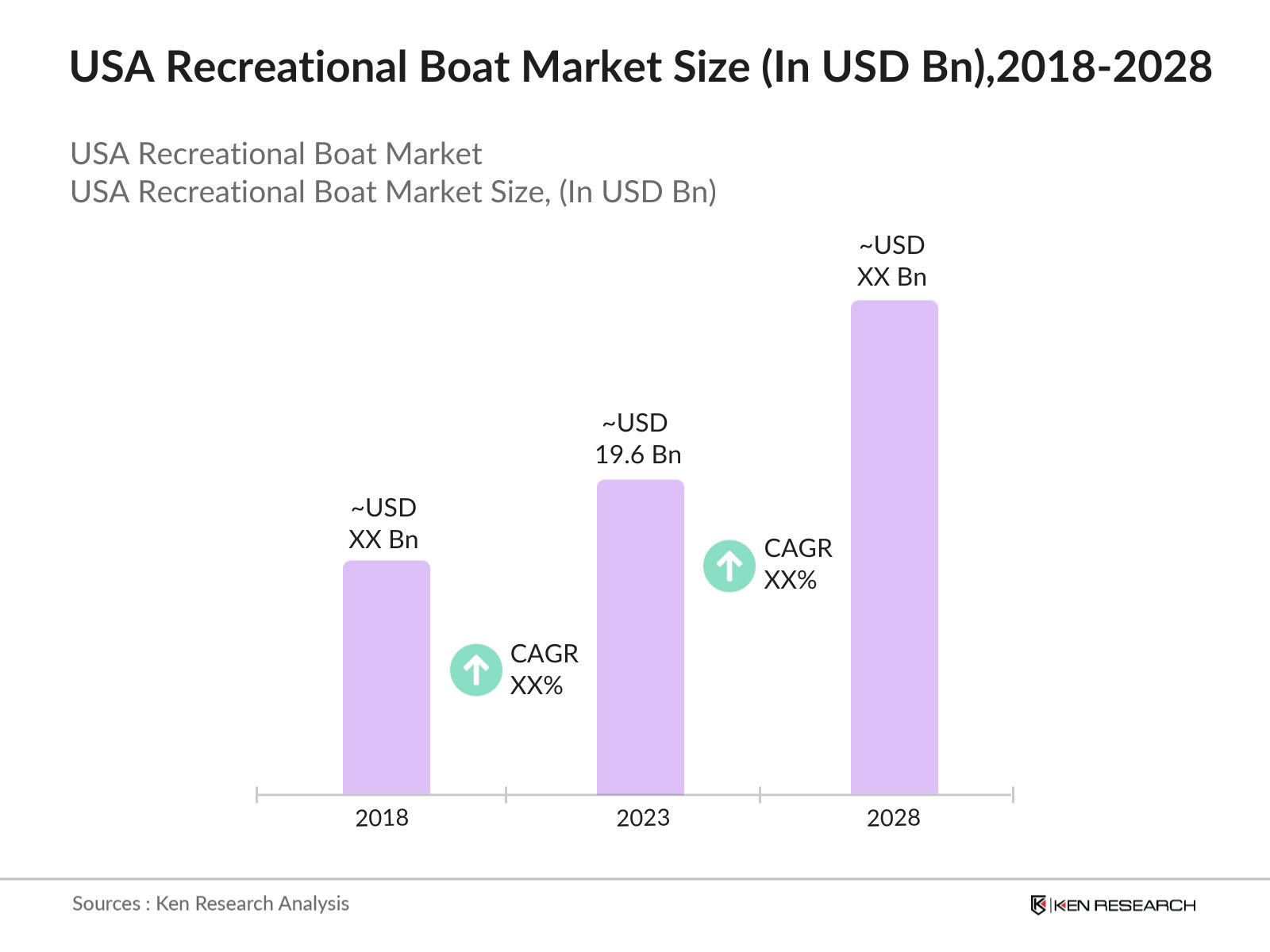

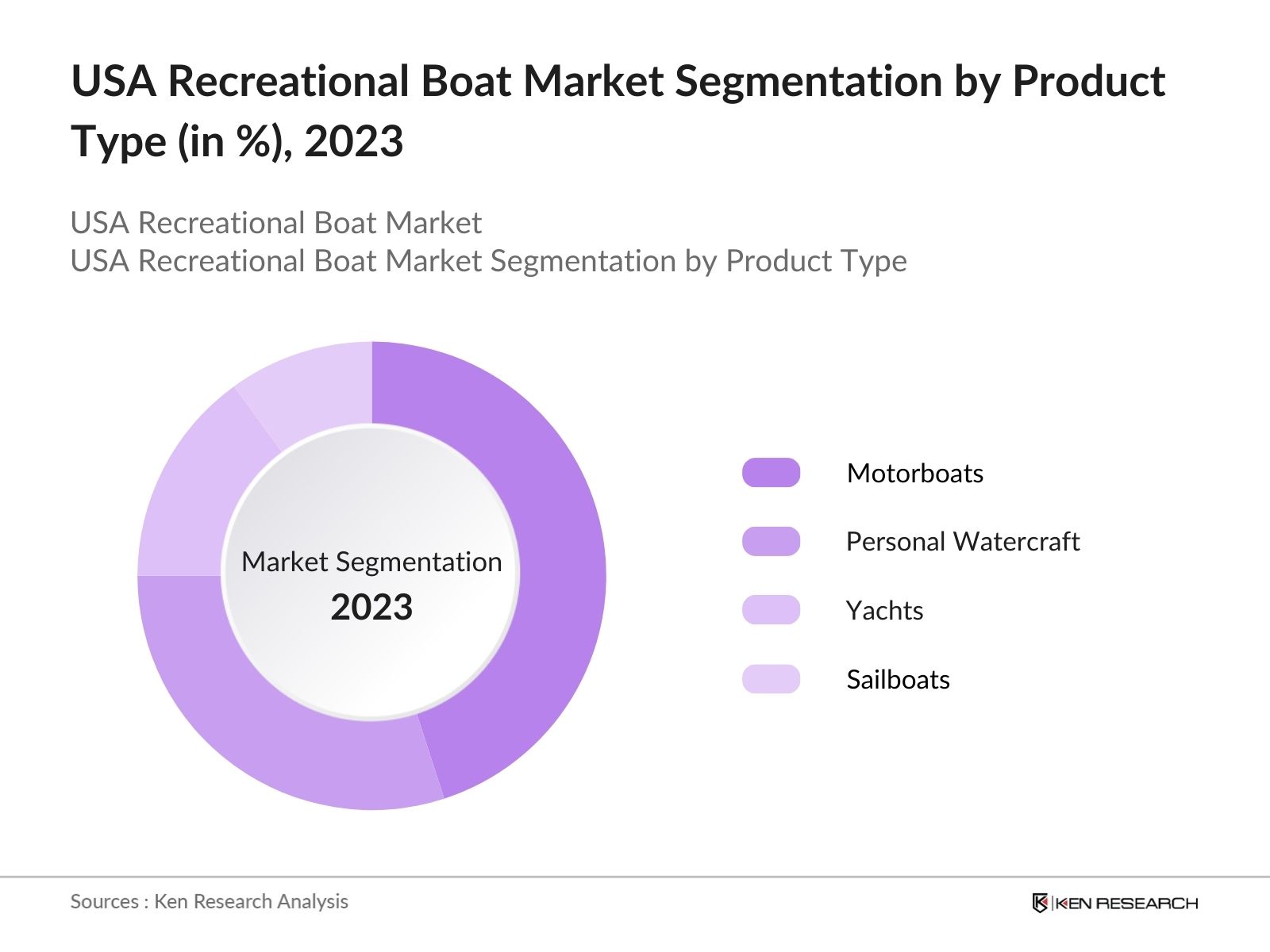

- The USA Recreational Boat Market was valued at USD 19.6 billion in 2023, driven by the increasing disposable income, rising interest in outdoor recreational activities, and expanding tourism. The market is segmented into motorboats, sailboats, personal watercraft, and yachts, with motorboats being the most dominant due to their affordability and wide usage.

- Major players in the USA Recreational Boat Market include Brunswick Corporation, Yamaha Motor Corporation, MasterCraft, and Malibu Boats. These companies lead the market with their diverse product offerings and focus on innovation, quality, and customer experience. Brunswick Corporation dominates with brands like Bayliner and Sea Ray, known for their reliability and performance.

- In the United States, Florida, California, and Michigan are the prominent markets due to favorable weather, high water body presence, and a strong boating culture. These regions are characterized by significant investments in marina infrastructure and a high concentration of recreational boat enthusiasts.

- In 2023, Yamaha Motor Corporation launched a new line of eco-friendly electric-powered boats aimed at reducing environmental impact and meeting the growing consumer demand for sustainable watercraft options. This development highlights the shift toward environmentally conscious boating solutions in the USA market.

USA Recreational Boat Market Segmentation

The USA recreational boat market can be segmented by product type, by sales channel, and by region:

By Product Type: The market is segmented into motorboats, sailboats, yachts, and personal watercraft. In 2023, motorboats remain the dominant segment due to their ease of use, versatility, and cost-effectiveness. However, yachts are gaining traction among high-net-worth individuals, driven by luxury trends and rising interest in marine tourism.

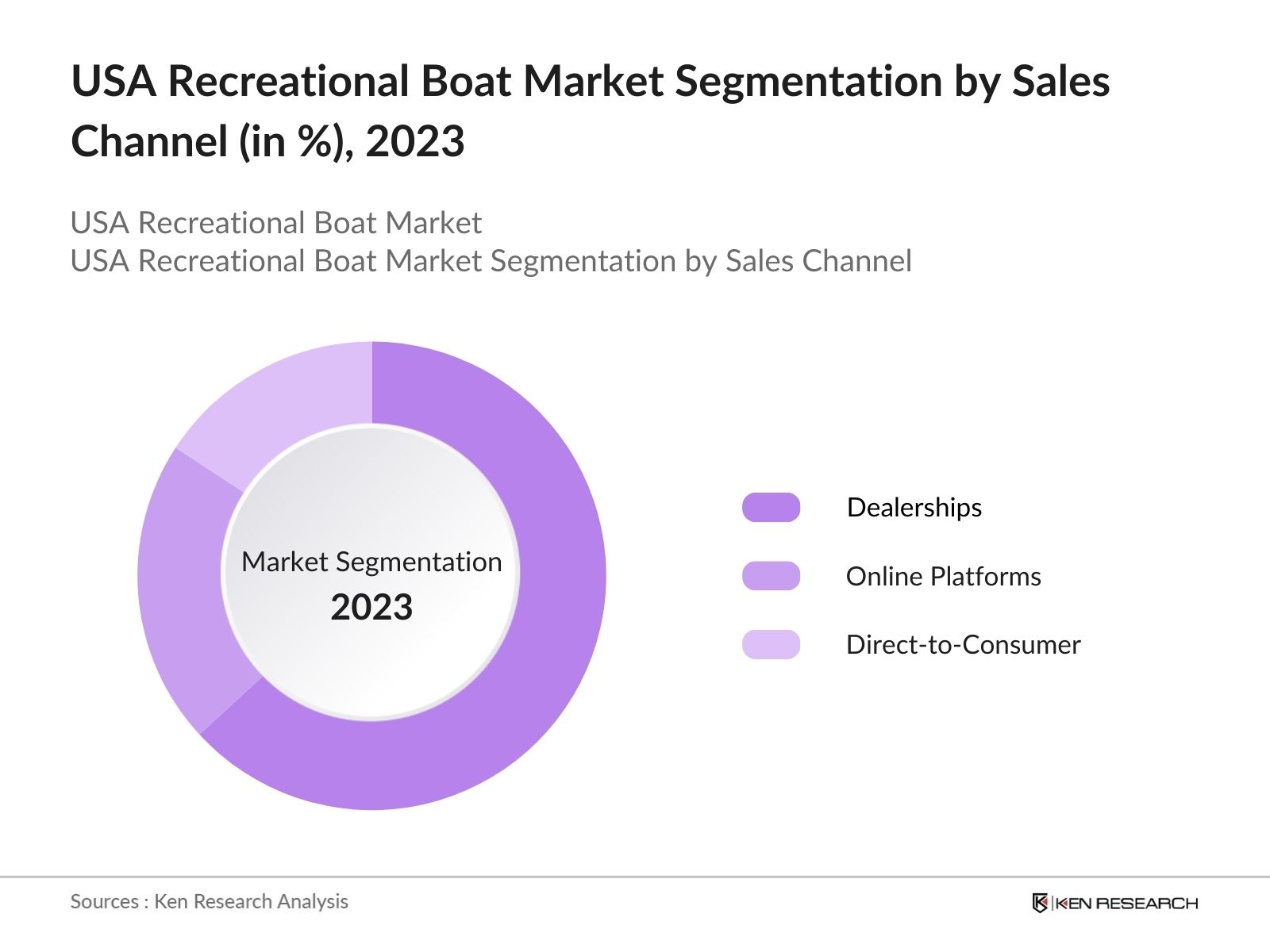

By Sales Channel: The market is segmented by sales channels into dealerships, online platforms, and direct-to-consumer. In 2023, dealerships dominate the market due to the personalized service they offer. However, online sales are growing rapidly due to convenience, particularly in the personal watercraft category.

By Region: The market is regionally segmented into East, West, North, and South. In 2023, South leads due to its extensive coastline, favorable boating regulations, and high recreational activity. The Midwest is also a significant market, driven by a large number of inland lakes and rivers.

USA Recreational Boat Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Brunswick Corporation |

1845 |

Mettawa, USA |

|

Yamaha Motor Corporation |

1955 |

Iwata, Japan |

|

MasterCraft |

1968 |

Vonore, USA |

|

Malibu Boats |

1982 |

Loudon, USA |

|

Beneteau Group |

1884 |

Saint-Gilles-Croix-de-Vie, France |

- Brunswick Corporation: In 2023, Brunswick introduced a new range of electric-powered boats under the Bayliner brand, aimed at meeting the rising demand for eco-friendly and sustainable boating solutions. This launch reinforces Brunswicks market leadership by tapping into the growing trend of electric propulsion systems, aligning with its commitment to innovation and environmental sustainability.

- Yamaha Motor Corporation: In 2024, Yamaha expanded its marine product line with the release of high-performance electric watercraft, responding to the increasing consumer demand for green boating options. The new watercraft feature advanced battery technology and eco-friendly designs, further solidifying Yamahas position as a leader in sustainable and high-tech boating solutions.

USA Recreational Boat Market Analysis

Market Growth Drivers:

- Increasing Participation in Boating Activities: The number of registered recreational boats in the USA reached 12 million in 2023, indicating a growing interest in boating activities across the country. The National Marine Manufacturers Association (NMMA) reported a surge in new boat sales, with 300,000 units sold in 2023.

- Rising Disposable Incomes: The USA's average household income increased to USD 75,000 in 2023, fueling consumer spending on leisure activities, including boat purchases. This rise in disposable income has made recreational boating more accessible to a broader demographic.

- Growth in Marina Development: In 2023, the USA added more than 250 new marinas across key boating regions such as Florida, California, and the Great Lakes. These developments are improving access to waterways and providing better infrastructure for boaters.

Market Challenges:

- Rising Manufacturing Costs: The rising costs of materials such as fiberglass, aluminum, and advanced propulsion systems are driving up the production costs of recreational boats. This is leading to increased retail prices, which may deter budget-conscious consumers, particularly in the entry-level and mid-range segments.

- Environmental Regulations: Stringent environmental regulations, especially related to emissions and fuel consumption, are placing pressure on manufacturers to adopt eco-friendly technologies. Compliance with these standards requires significant investments in research and development, which can be challenging for smaller players.

- Limited Infrastructure for Electric Boats: While electric boats are gaining popularity, the lack of widespread charging infrastructure and supporting marinas is a major obstacle to their adoption. Without sufficient charging points, boaters may be hesitant to switch to electric-powered vessels, limiting market growth.

Government Initiatives:

- USA Clean Marina Program: The USA Clean Marina Program was launched with a budget of USD 15 million to promote sustainable marina development and eco-friendly boating practices. The program encourages boat manufacturers to adopt greener production techniques and provides incentives for marinas that meet environmental standards.

- National Boating Safety Program: The National Boating Safety Program, with an allocated budget of USD 50 million, aims to improve recreational boating safety across the country. The initiative focuses on educational campaigns, safety equipment mandates, and partnerships with boating industry leaders to reduce accidents and promote safe boating practices.

USA Recreational Boat Market Future Outlook

The USA Recreational Boat Market is projected to grow steadily, driven by the expansion of the boating community and innovations in product offerings, particularly electric and hybrid boats.

Future Market Trends:

- Growth of Subscription-based Boating Services: Subscription-based recreational boat services, where users gain access to boats without the need for ownership, are expected to rise in popularity. This model offers flexibility, reduces maintenance costs, and allows consumers to enjoy boating without the long-term commitment of purchasing a vessel.

- Increased Focus on Sustainable Boating: There will be a growing emphasis on eco-friendly and sustainable boating solutions, including electric and hybrid boats. Manufacturers are expected to invest heavily in green technologies to meet consumer demand and regulatory requirements for reducing environmental impact.

Scope of the Report

|

By Region |

West East North South |

|

By Sales Channel |

Dealerships Online Platforms Direct-to-Consumer |

|

By Price Segment |

Economy Mid-range Premium |

|

By Boat Size |

Small (up to 20 feet) Medium (21-35 feet) Large (36-50 feet) Extra Large (above 50 feet) |

|

By Product Type |

Motorboats Sailboats Yachts Personal Watercraft |

Products

Key Target Audience:

Banks and Financial Institutions

Venture Capitalists

Government and Regulatory Bodies (USCG, NMMA)

Boat Manufacturers

Marinas and Marine Services

E-commerce Companies

Boating Rental Companies

Environmental Organizations

Boating Clubs and Associations

Marine Insurers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Brunswick Corporation

Yamaha Motor Corp

MasterCraft

Malibu Boats

Bayliner

Sea Ray

Boston Whaler

Chaparral Boats

Regal Boats

Beneteau

Jeanneau

Tracker Boats

Lund Boats

Formula Boats

Cobalt Boats

Table of Contents

1. USA Recreational Boat Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Recreational Boat Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Recreational Boat Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Participation in Boating Activities

3.1.2. Rising Disposable Incomes

3.1.3. Growth in Marina Development

3.2. Restraints

3.2.1. Rising Manufacturing Costs

3.2.2. Environmental Regulations

3.2.3. Limited Infrastructure for Electric Boats

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Expansion of Green Boating Solutions

3.3.3. Growing Rental Services Market

3.4. Trends

3.4.1. Growth of Subscription-based Boating Services

3.4.2. Increased Focus on Sustainable Boating

3.4.3. Development of Smart Boating Technologies

3.5. Government Regulation

3.5.1. USA Clean Marina Program

3.5.2. National Boating Safety Program

3.5.3. Federal and State-Level Environmental Guidelines

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. USA Recreational Boat Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Motorboats

4.1.2. Sailboats

4.1.3. Yachts

4.1.4. Personal Watercraft

4.2. By Sales Channel (in Value %)

4.2.1. Dealerships

4.2.2. Online Platforms

4.2.3. Direct-to-Consumer

4.3. By Region (in Value %)

4.3.1. East

4.3.2. West

4.3.3. North

4.3.4. South

4.4. By Boat Size (in Value %)

4.4.1. Small (up to 20 feet)

4.4.2. Medium (21-35 feet)

4.4.3. Large (36-50 feet)

4.4.4. Extra Large (above 50 feet)

4.5. By Price Segment (in Value %)

4.5.1. Economy

4.5.2. Mid-range

4.5.3. Premium

5. USA Recreational Boat Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Brunswick Corporation

5.1.2. Yamaha Motor Corporation

5.1.3. MasterCraft

5.1.4. Malibu Boats

5.1.5. Beneteau Group

5.1.6. Sea Ray

5.1.7. Bayliner

5.1.8. Boston Whaler

5.1.9. Regal Boats

5.1.10. Chaparral Boats

5.1.11. Jeanneau

5.1.12. Tracker Boats

5.1.13. Lund Boats

5.1.14. Formula Boats

5.1.15. Cobalt Boats

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6.USA Recreational Boat Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Recreational Boat Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Recreational Boat Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Recreational Boat Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Sales Channel (in Value %)

9.3. By Region (in Value %)

9.4. By Boat Size (in Value %)

9.5. By Price Segment (in Value %)

10. USA Recreational Boat Market Analysts' Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

11. Disclaimer

12. Contact Us

Research Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and boating trends. We also assess regulatory impacts and market dynamics specific to the USA recreational boat market.

Step 2: Market Building

We collect historical data on market size, growth rates, product segmentation (motorboats, sailboats, yachts, and personal watercraft), and the distribution of sales channels (dealerships, online platforms, direct-to-consumer). We also analyze market share and revenue generated by leading brands, emerging trends in boating technology, and consumer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading boat manufacturers, dealers, and retailers. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, supply chain management, and consumer buying patterns.

Step 4: Research Output

Our team interacts with boat manufacturers, marine services, boating enthusiasts, and market analysts to understand the dynamics of market segments, evolving consumer preferences, and sales trends. This process helps validate the derived statistics using a bottom-up approach, ensuring that the final data accurately reflects actual market conditions.

Frequently Asked Questions

01. How large is the USA Recreational Boat Market?

In 2023, the USA Recreational Boat Market was valued at approximately USD 19.6 billion. The market's growth is driven by the increasing popularity of outdoor recreation, rising disposable incomes, and technological advancements in the boating industry.

02. What are the challenges in the USA Recreational Boat Market?

Challenges in the USA Recreational Boat Market include rising fuel and operational costs, environmental regulations, and stringent safety requirements. Additionally, competition among established brands and the need to innovate in sustainable boating solutions pose significant challenges.

03. Who are the major players in the USA Recreational Boat Market?

Major players in the USA Recreational Boat Market include Brunswick Corporation, Yamaha Motor Corp, MasterCraft, Malibu Boats, and Sea Ray. These companies lead the market with diverse product portfolios, strong brand recognition, and continuous innovation in boating technology.

04. What are the growth drivers of the USA Recreational Boat Market?

Key growth drivers include the increasing interest in outdoor recreational activities, expanding marina infrastructure, and advancements in boating technology. The trend toward eco-friendly and electric-powered boats is also contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.