USA Refrigerants Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4903

November 2024

81

About the Report

USA Refrigerants Market Overview

- The USA refrigerants market is valued at USD 5.1 billion, driven by the increasing demand for refrigeration and air conditioning systems across commercial, residential, and industrial sectors. This growth is further fueled by stringent environmental regulations encouraging the adoption of low global warming potential (GWP) refrigerants. The transition towards energy-efficient cooling systems, driven by consumer demand and government mandates, is a major factor propelling market size.

- Key cities and regions dominating the USA refrigerants market include California, Texas, and Florida. These areas are due to their high concentration of urban populations, increased adoption of air conditioning systems, and robust commercial infrastructure. Moreover, these states lead in regulatory initiatives aimed at phasing out high-GWP refrigerants, fostering the adoption of alternatives like hydrofluoroolefins (HFOs) and natural refrigerants. This makes them key regions contributing to market dominance.

- The Clean Air Act provides a comprehensive regulatory framework for the management and phase-down of ozone-depleting substances and high-GWP refrigerants in the U.S. Under this law, the EPAs phasedown of HFCs is expected to continue through 2036, with specific targets set for 2024 . Businesses in the refrigeration and HVAC industries must comply with these guidelines, which impact the availability and usage of refrigerants across various sectors. This ongoing regulatory pressure ensures that businesses increasingly turn to low-GWP refrigerants and other environmentally friendly solutions to meet compliance standards.

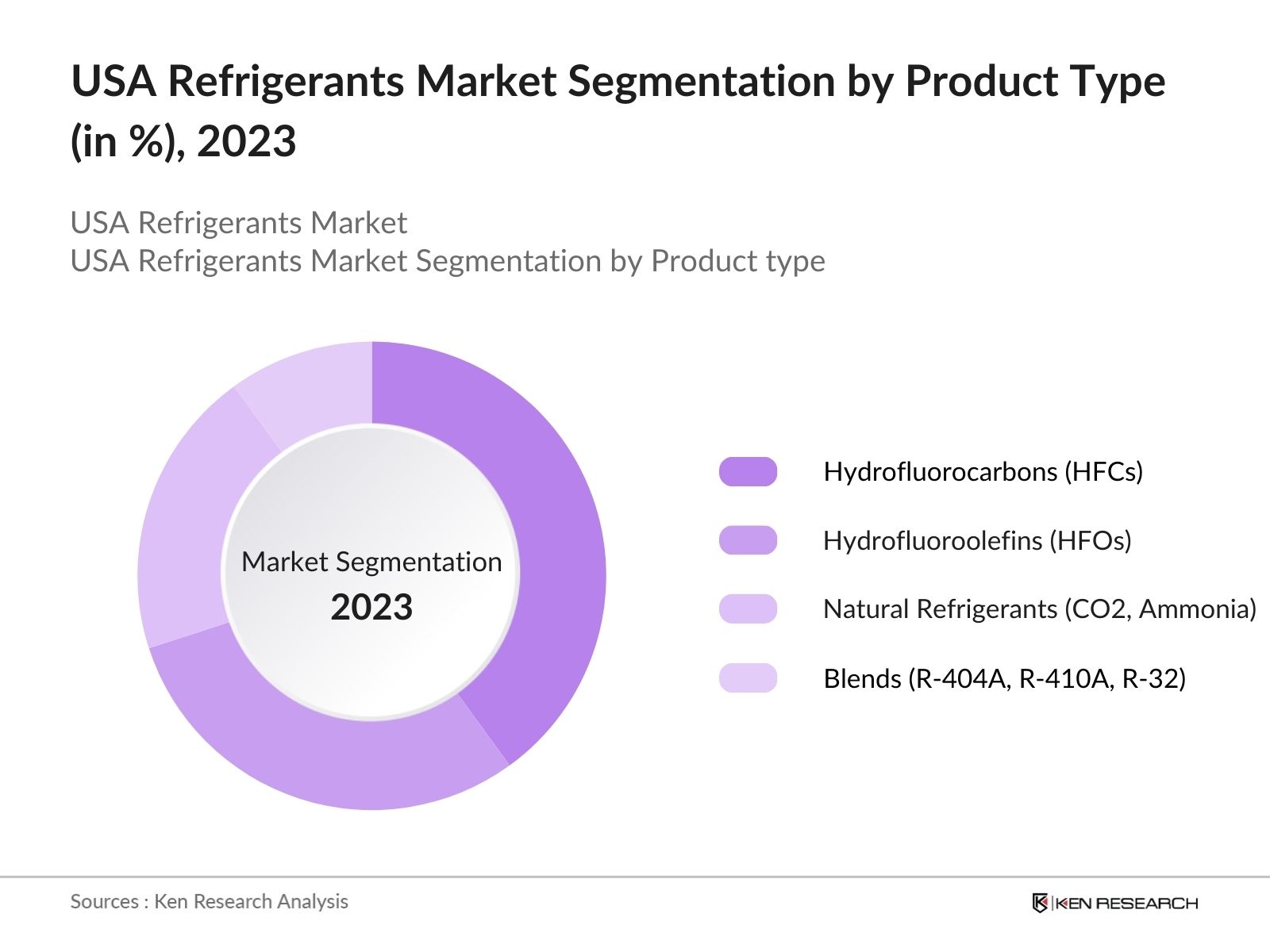

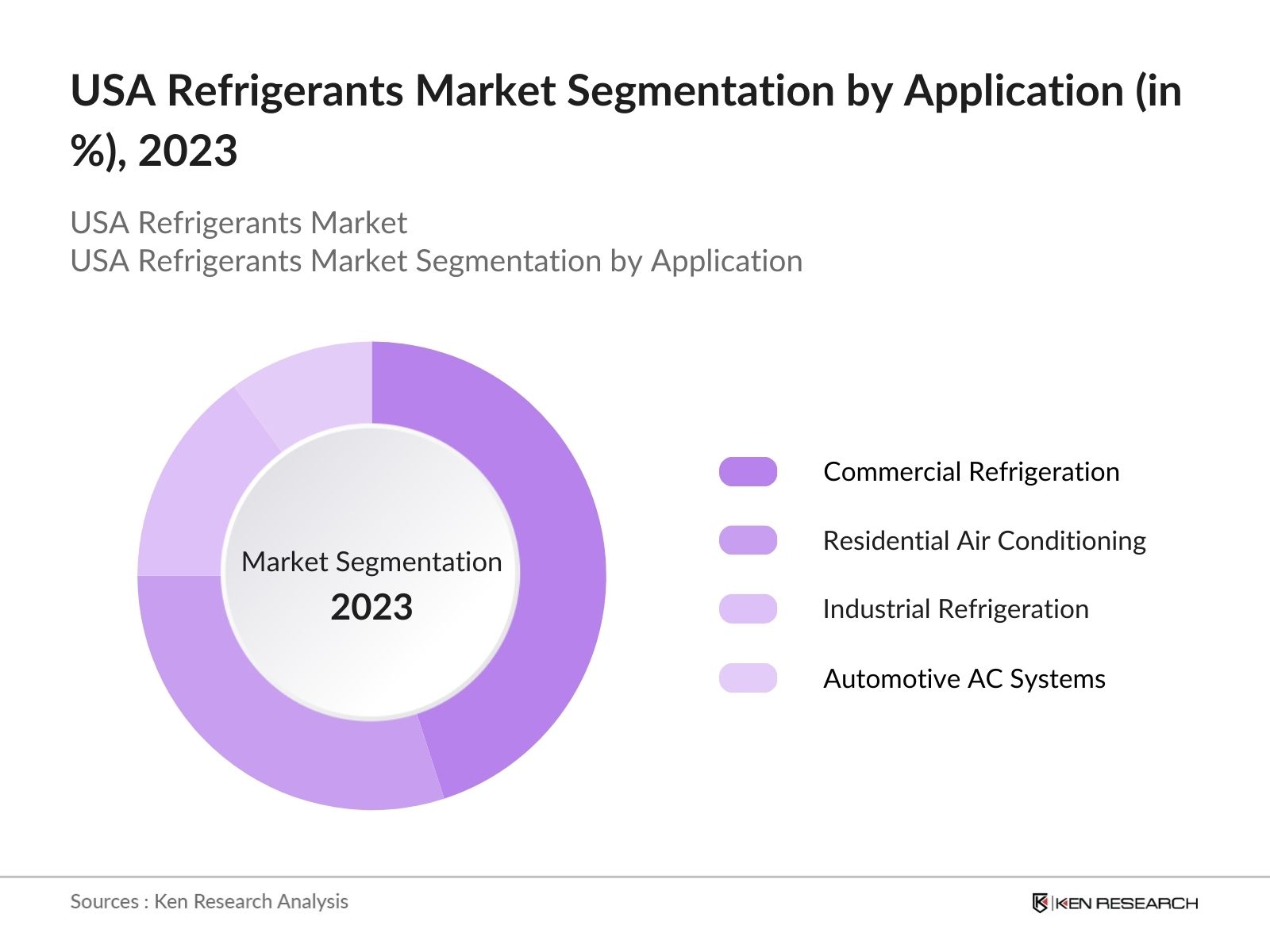

USA Refrigerants Market Segmentation

By Product Type: The market is segmented by product type into hydrofluorocarbons (HFCs), hydrofluoroolefins (HFOs), natural refrigerants (such as CO2 and ammonia), and refrigerant blends (R-404A, R-410A, R-32). Recently, hydrofluorocarbons (HFCs) have maintained a market share in the USA refrigerants market. HFCs have been widely used due to their efficiency in cooling and heating systems, especially in commercial air conditioning units and refrigeration systems. However, despite their market dominance, HFCs face regulatory restrictions due to their high GWP, leading to a gradual shift towards low-GWP alternatives such as HFOs and natural refrigerants.

By Application: The market is also segmented by application into commercial refrigeration, residential air conditioning, industrial refrigeration, and automotive AC systems. Among these, commercial refrigeration holds the dominant market share. This is primarily due to the widespread use of refrigerants in grocery stores, warehouses, and other cold storage facilities across the country. The growing demand for cold chain logistics in food distribution and pharmaceuticals has been a key driver for the commercial refrigeration segment.

USA Refrigerants Market Competitive Landscape

The USA refrigerants market is highly competitive, with several major players leading the industry. These companies dominate the market due to their strong presence in the production and distribution of various refrigerants, as well as their focus on developing environmentally friendly products. The market is characterized by both global players and local manufacturers, with Honeywell International and Chemours leading in the development of low-GWP refrigerants. These companies have made investments in research and development to comply with regulatory changes and meet the growing demand for eco-friendly solutions. Below is a comparison of major players in the market:

|

Company |

Year of Establishment |

Headquarters |

Product Range |

Revenue (USD) |

R&D Investments |

GWP Reduction Initiatives |

Manufacturing Capacity |

Key Patents |

|

Honeywell International |

1906 |

Charlotte, NC |

||||||

|

Chemours Company |

2015 |

Wilmington, DE |

||||||

|

Arkema SA |

2004 |

Colombes, France |

||||||

|

Daikin Industries Ltd. |

1924 |

Osaka, Japan |

||||||

|

Orbia Advance Corporation |

1953 |

Mexico City, Mexico |

USA Refrigerants Industry Analysis

Growth Drivers

- Increasing Demand for HVAC Systems: The demand for HVAC systems in the U.S. is driven by growing urbanization and residential construction. In 2023, the U.S. added 1.6 million new housing units, increasing the need for residential HVAC systems to maintain comfort in varying climates. In the commercial sector, the ongoing expansion of retail, office spaces, and industrial units contributes to the demand for HVAC solutions. In 2024, around 600 million square feet of new commercial construction is expected to be completed in the U.S. This expansion of real estate drives refrigerant demand as more systems are installed.

- Stringent Environmental Regulations: U.S. regulations on refrigerants are a key driver for the market. The Environmental Protection Agency (EPA) enforces stringent laws under the Clean Air Act, including the phasedown of hydrofluorocarbons (HFCs). The EPA aims to reduce HFC consumption by 85% by 2036 under the Kigali Amendment, a legally binding global agreement. The 2023 phase-out plan is already underway, prompting HVAC manufacturers to shift to low-global warming potential (GWP) alternatives. The adoption of natural refrigerants and hydrofluoroolefins (HFOs) is supported by these environmental regulations, driving demand for compliant products.

- Expansion in Cold Chain Logistics: The cold chain sector has expanded , particularly in food and pharmaceutical logistics. In 2022, the U.S. cold storage capacity exceeded 4 billion cubic feet. This growth is driven by the increasing demand for frozen foods and the need for precise temperature control in vaccine distribution. The COVID-19 pandemic accelerated cold chain investments, particularly in pharmaceutical logistics. By 2023, over 800 million doses of vaccines were stored and distributed using cold storage facilities. This sustained demand drives the need for advanced refrigerants in these systems.

Market Challenges

- Regulatory Compliance and Phase-out of HFCs: Compliance with the phase-out of HFCs is a major challenge for manufacturers and service providers. Under Section 608 of the Clean Air Act, the EPA requires technicians to use certified refrigerants and follow strict handling guidelines. In 2024, the EPAs allocation framework for HFCs will limit the supply of high-GWP refrigerants, making it difficult for smaller businesses to access compliant alternatives. The cost of retrofitting existing systems to low-GWP refrigerants can also present financial and logistical challenges for HVAC operators.

- High Costs of Low-GWP Alternatives: While low-GWP refrigerants such as hydrofluoroolefins (HFOs) and natural refrigerants are environmentally friendly, their high initial costs pose a challenge. For example, the cost of HFOs is generally higher than traditional HFCs, sometimes by a factor of two or more. This cost differential makes it difficult for smaller operators to transition, especially in residential and light commercial applications. The adoption of these alternatives is slowed down by the economic burden they place on consumers and service providers, particularly in the context of retrofitting older HVAC systems.

USA Refrigerants Market Future Outlook

Over the next five years, the USA refrigerants market is poised for transformation. The increasing emphasis on reducing greenhouse gas emissions, coupled with government initiatives to phase out high-GWP refrigerants, will push the market towards adopting environmentally friendly alternatives. Additionally, advancements in refrigeration technology and the rising demand for energy-efficient cooling solutions will continue to shape the market's growth trajectory. As more industries, particularly the commercial and industrial refrigeration sectors, transition to low-GWP refrigerants, the market will witness a gradual decline in the use of HFCs and a rise in demand for HFOs and natural refrigerants.

Future Market Opportunities

- Transition to Natural Refrigerants: The transition to natural refrigerants such as ammonia (NH3) and carbon dioxide (CO2) presents an opportunity. These refrigerants have a negligible global warming potential and are exempt from current phase-out regulations. Ammonia is widely used in large-scale industrial refrigeration, particularly in food processing and cold storage, where U.S. capacity exceeded 4 billion cubic feet in 2022. CO2 is gaining traction in commercial applications due to its efficiency and environmental benefits, especially in supermarket refrigeration systems. This trend is expected to create more demand for natural refrigerants as industries adapt to sustainability goals.

- Growth in Renewable Energy-Powered Cooling Solutions: Renewable energy-powered cooling solutions are emerging as a promising opportunity in the refrigerants market. The U.S. generated over 1,200 terawatt-hours (TWh) of renewable electricity in 2023, providing a robust foundation for integrating solar and wind-powered cooling systems. These systems, which use environmentally friendly refrigerants such as HFOs or natural alternatives, reduce energy costs and emissions. The growing focus on sustainability and reducing operational costs is expected to drive adoption in both residential and commercial sectors. Government incentives for renewable energy adoption further boost this opportunity.

Scope of the Report

|

By Dialysis Type |

Peritoneal Dialysis (CAPD, APD) Hemodialysis (Conventional, Nocturnal, Home-Based) |

|

By End-User |

Dialysis Centers Hospitals Home Care Settings |

|

By Modality |

Continuous Ambulatory Peritoneal Dialysis (CAPD) Conventional Hemodialysis Automated Peritoneal Dialysis (APD) Home-Based Hemodialysis |

|

By Patient Age Group |

Pediatric Adult Geriatric |

|

By Region |

East Asia South Asia Southeast Asia Oceania |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (EPA, DOE)

Refrigerant Manufacturers

HVAC System Integrators

Cold Chain Logistics Companies

Banks and Financial Institutes

Automotive OEMs

Commercial Refrigeration Equipment Suppliers

Industrial Refrigeration System Providers

Companies

Major Players

Honeywell International Inc.

Chemours Company

Arkema SA

Daikin Industries Ltd.

Orbia Advance Corporation (Mexichem)

Linde plc

Air Liquide

SRF Limited

A-Gas

Tazzetti S.p.A.

Harp International

The Dow Chemical Company

National Refrigerants Inc.

Sinochem Lantian Co.

DAIKIN AMERICA INC.

Table of Contents

1. APAC Peritoneal Dialysis vs Hemodialysis Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Peritoneal Dialysis vs Hemodialysis Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Peritoneal Dialysis vs Hemodialysis Market Analysis

3.1. Growth Drivers

3.1.1. Rising Incidence of End-Stage Renal Disease (ESRD)

3.1.2. Increasing Aging Population

3.1.3. Technological Advancements in Dialysis Systems

3.1.4. Government Health Programs and Subsidies

3.2. Market Challenges

3.2.1. High Cost of Dialysis Treatment

3.2.2. Inadequate Healthcare Infrastructure in Emerging Economies

3.2.3. Complexity in Home-Based Peritoneal Dialysis Systems

3.3. Opportunities

3.3.1. Growth in Telemedicine for Remote Monitoring

3.3.2. Advances in Automated Peritoneal Dialysis Systems

3.3.3. Rising Demand for Portable Hemodialysis Devices

3.4. Trends

3.4.1. Adoption of Wearable Artificial Kidneys

3.4.2. Growth of At-Home Hemodialysis Treatment

3.4.3. Integration of AI in Dialysis Treatment Management

3.5. Government Regulation

3.5.1. Healthcare Reimbursement Policies

3.5.2. Medical Device Regulatory Frameworks

3.5.3. Guidelines for Dialysis Treatment Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. APAC Peritoneal Dialysis vs Hemodialysis Market Segmentation

4.1. By Dialysis Type (In Value %)

4.1.1. Peritoneal Dialysis (CAPD, APD)

4.1.2. Hemodialysis (Conventional, Nocturnal, Home-Based)

4.2. By End-User (In Value %)

4.2.1. Dialysis Centers

4.2.2. Hospitals

4.2.3. Home Care Settings

4.3. By Modality (In Value %)

4.3.1. Continuous Ambulatory Peritoneal Dialysis (CAPD)

4.3.2. Automated Peritoneal Dialysis (APD)

4.3.3. Conventional Hemodialysis

4.3.4. Home-Based Hemodialysis

4.4. By Patient Age Group (In Value %)

4.4.1. Pediatric

4.4.2. Adult

4.4.3. Geriatric

4.5. By Region (In Value %)

4.5.1. East Asia

4.5.2. South Asia

4.5.3. Southeast Asia

4.5.4. Oceania

5. APAC Peritoneal Dialysis vs Hemodialysis Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Baxter International Inc.

5.1.2. Fresenius Medical Care AG & Co. KGaA

5.1.3. Nipro Corporation

5.1.4. B. Braun Melsungen AG

5.1.5. DaVita Inc.

5.1.6. Diaverum

5.1.7. Asahi Kasei Medical Co., Ltd.

5.1.8. Medtronic plc

5.1.9. Terumo Corporation

5.1.10. NxStage Medical, Inc.

5.1.11. Kawasumi Laboratories, Inc.

5.1.12. Toray Medical Co., Ltd.

5.1.13. JMS Co., Ltd.

5.1.14. Quanta Dialysis Technologies

5.1.15. Outset Medical, Inc.

5.2. Cross Comparison Parameters (Company Revenue, Employee Size, Operational Markets, Product Portfolio, Innovation Index, R&D Investment, Manufacturing Locations, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Funding

5.8. Private Equity and Venture Capital Investment

6. APAC Peritoneal Dialysis vs Hemodialysis Market Regulatory Framework

6.1. Healthcare Standards and Dialysis Equipment Approval

6.2. Compliance Requirements for Dialysis Centers

6.3. Safety Protocols for Home-Based Dialysis Systems

7. APAC Peritoneal Dialysis vs Hemodialysis Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Peritoneal Dialysis vs Hemodialysis Future Market Segmentation

8.1. By Dialysis Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Modality (In Value %)

8.4. By Patient Age Group (In Value %)

8.5. By Region (In Value %)

9. APAC Peritoneal Dialysis vs Hemodialysis Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Identification

9.3. Strategic Marketing Initiatives

9.4. Partnerships and Collaborations Recommendations

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, the USA refrigerants market ecosystem was mapped, identifying major stakeholders such as manufacturers, distributors, and regulatory bodies. Desk research, supported by secondary data from trusted sources, was used to capture industry insights and trends. The goal was to identify critical variables like product types and applications.

Step 2: Market Analysis and Construction

Historical data on refrigerant usage and regulatory changes in the USA were analyzed to understand market dynamics. This included evaluating refrigerant sales, technology adoption rates, and regulatory impacts on different sectors, ensuring the accuracy of market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through direct consultations with industry experts from top companies in the refrigerants market. Their insights were gathered through interviews, focusing on both operational challenges and market opportunities.

Step 4: Research Synthesis and Final Output

The final stage included synthesizing all data from previous steps, with further validation through interactions with refrigerant manufacturers. This data was then cross-checked with bottom-up approaches to provide a complete and accurate analysis of the USA refrigerants market.

Frequently Asked Questions

01. How big is the USA Refrigerants Market?

The USA refrigerants market is valued at USD 5.1 billion, driven by the adoption of energy-efficient cooling systems and increasing regulatory mandates.

02. What are the challenges in the USA Refrigerants Market?

Key challenges in the USA refrigerants market include regulatory pressures to phase out high-GWP refrigerants and the high cost of transitioning to low-GWP alternatives.

03. Who are the major players in the USA Refrigerants Market?

Major players in the USA refrigerants market include Honeywell International, Chemours, Arkema, Daikin, and Orbia. These companies lead due to their strong focus on eco-friendly refrigerants and technological innovations.

04. What are the growth drivers of the USA Refrigerants Market?

The USA refrigerants market is driven by increasing demand for air conditioning systems, stringent environmental regulations, and the growth of cold chain logistics in the food and pharmaceutical sectors.

05. Which product type dominates the USA Refrigerants Market?

Hydrofluorocarbons (HFCs) currently dominate the market, but their share is expected to decline as low-GWP alternatives like HFOs gain traction due to regulatory pressures in the USA refrigerants market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.