USA Residential Lithium-ion Battery Energy Storage Systems Market outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7546

November 2024

99

About the Report

USA Residential Lithium-ion Battery Energy Storage Systems Market Overview

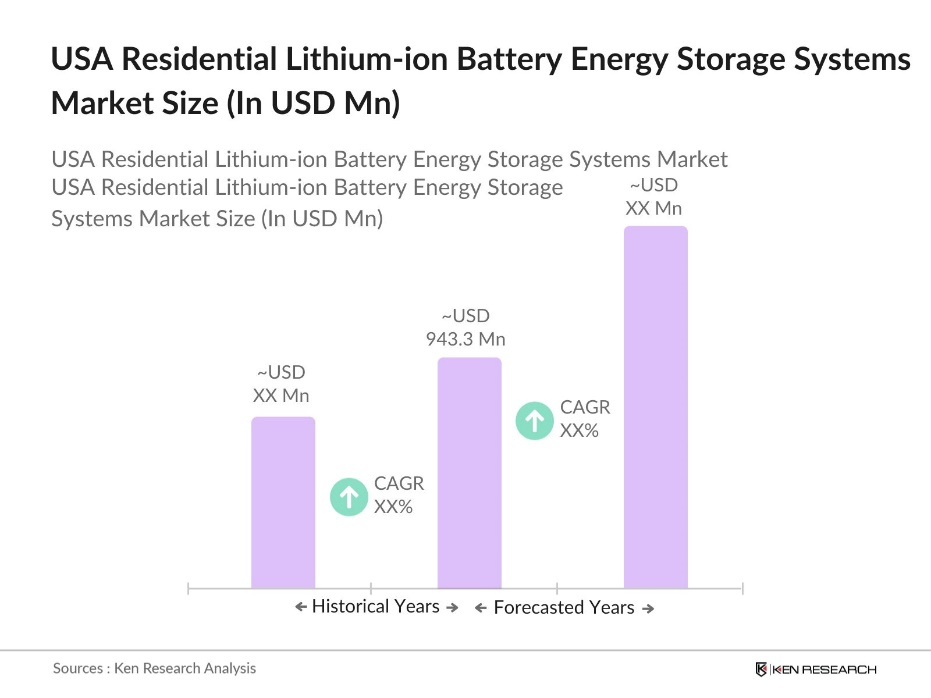

- The U.S. residential lithium-ion battery energy storage systems market is valued at USD 943.3 million, based on a five-year historical analysis. This growth is driven by increasing residential solar installations, declining battery costs, and supportive government policies. Homeowners are increasingly adopting energy storage solutions to enhance energy independence and resilience.

- California leads the market due to its progressive energy policies, high electricity costs, and frequent power outages. States like Texas and New York are also significant players, driven by similar factors and a growing emphasis on renewable energy integration.

- Net metering policies facilitate the financial viability of residential solar and battery systems by allowing homeowners to sell excess energy back to the grid. As of 2023, 38 states and Washington D.C. have net metering policies in place, enabling homeowners to offset the costs of their energy storage systems through credits for the energy they contribute to the grid. These policies enhance the economic attractiveness of investing in residential energy storage, as they provide an additional revenue stream while promoting the integration of renewable energy into the grid.

USA Residential Lithium-ion Battery Energy Storage Systems Market Segmentation

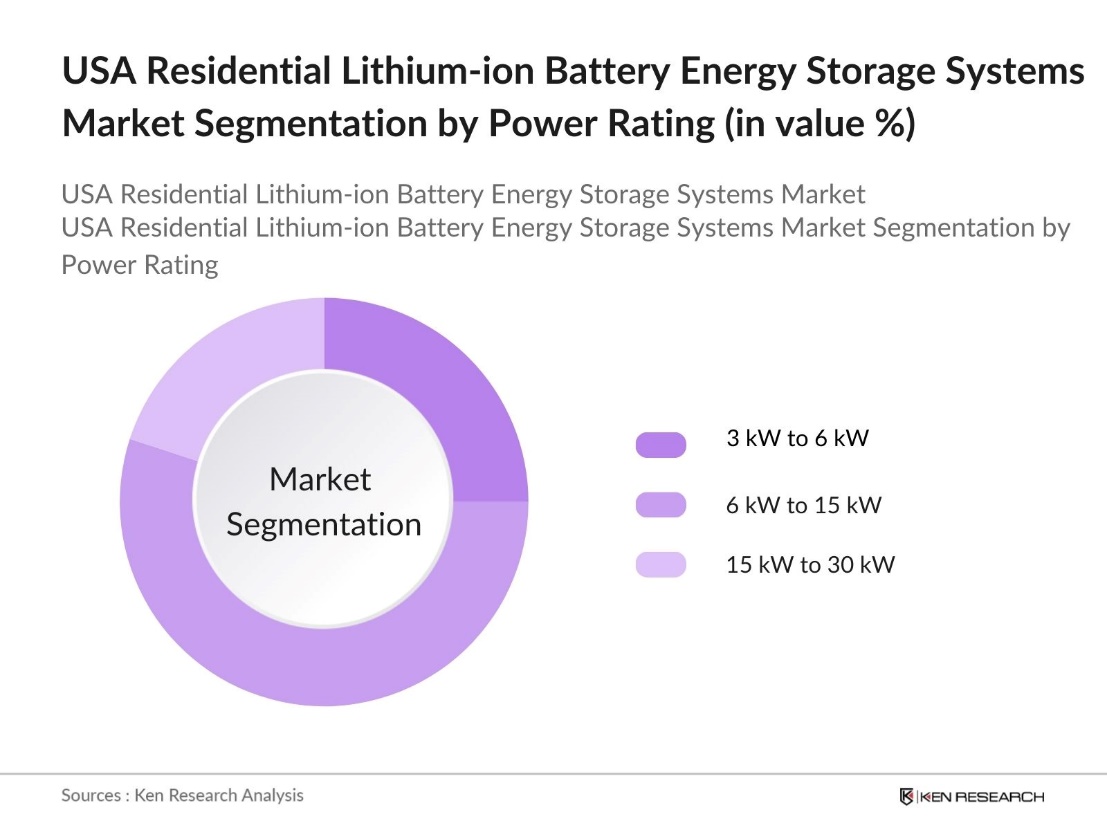

By Power Rating: The market is segmented by power rating into three categories: 3 kW to 6 kW, 6 kW to 15 kW, and 15 kW to 30 kW. Among these, the 6 kW to 15 kW segment holds the largest market share due to its balance of power capacity and cost, making it well-suited for typical household energy demands. This segment meets both affordability and efficiency standards, appealing to a broad consumer base looking to store and manage solar-generated energy effectively. Additionally, the range offers flexibility for households with medium to high energy consumption, enhancing its adoption rate across various residential applications.

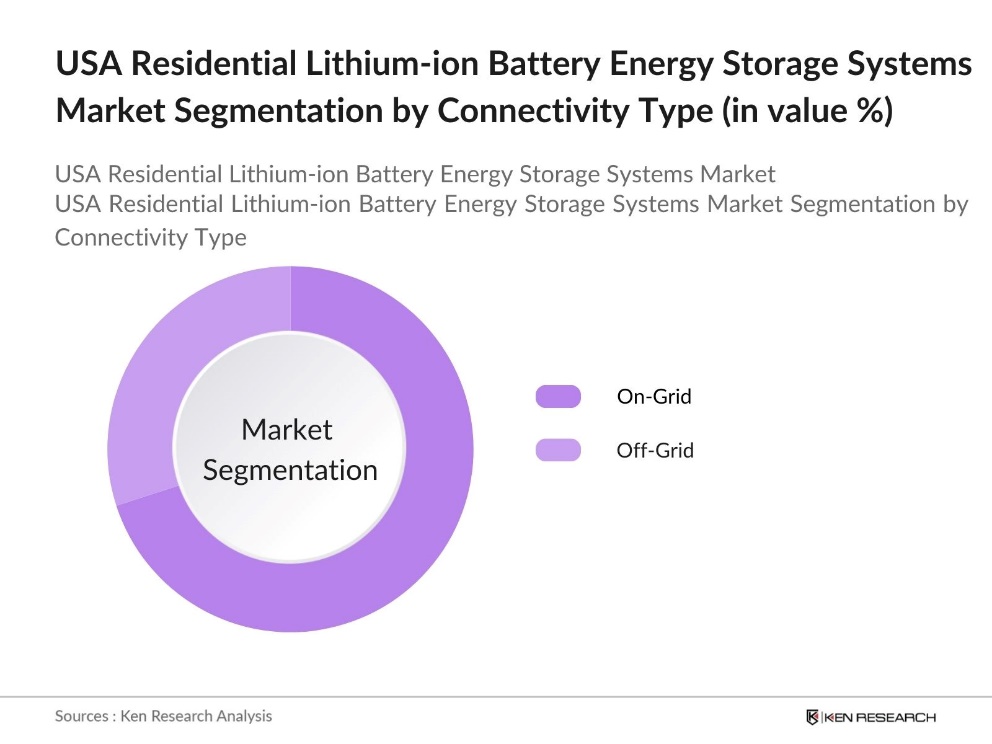

By Connectivity: The market is segmented by connectivity type, including on-grid and off-grid systems. On-grid systems dominate this segment due to their ability to store excess energy and feed it back into the grid, allowing homeowners to offset their energy costs. This option is especially attractive in states with favorable net metering policies, where users are compensated for the electricity they contribute to the grid. Additionally, on-grid systems offer increased reliability, as they can draw power from the grid during periods of low solar generation, making them ideal for households prioritizing both cost savings and uninterrupted power supply.

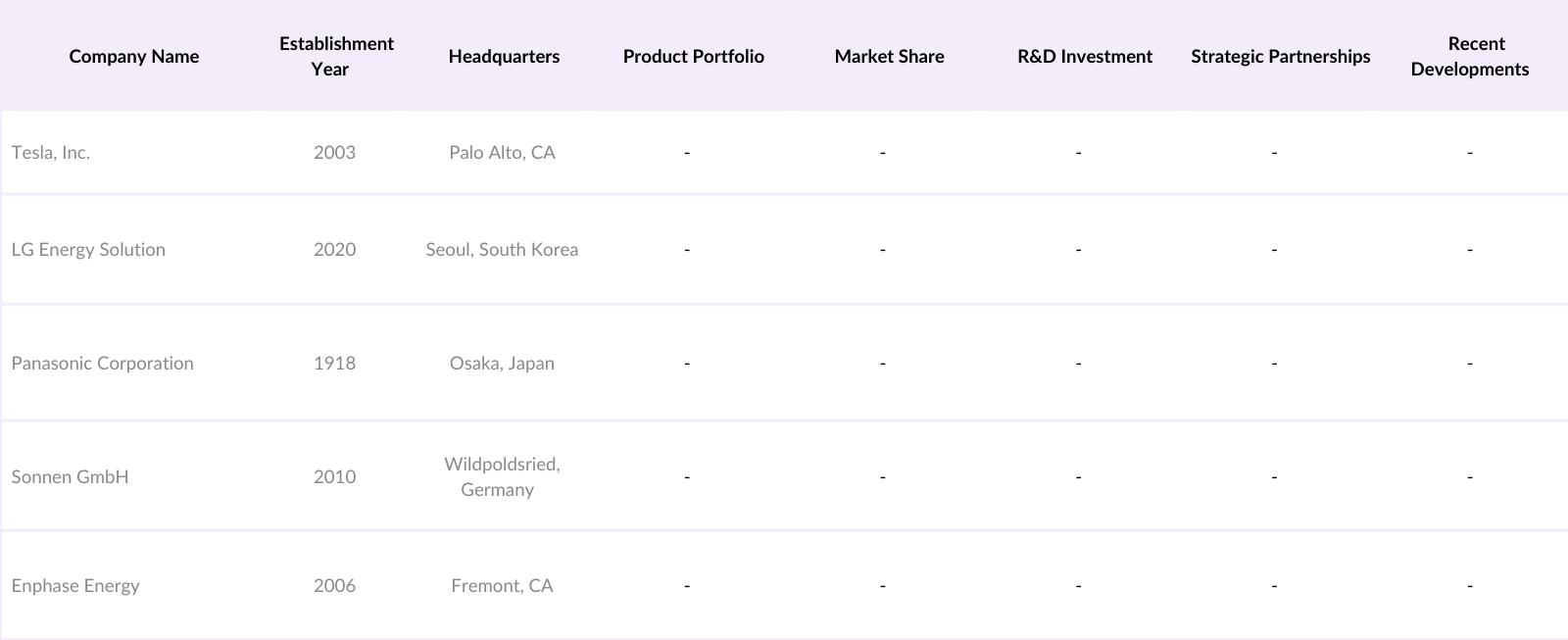

USA Residential Lithium-ion Battery Energy Storage Systems Market Competitive Landscape

The U.S. residential lithium-ion battery energy storage systems market is characterized by the presence of several key players who contribute to its growth and innovation. These companies offer a range of products and services tailored to meet the diverse needs of residential consumers seeking energy storage solutions.

USA Residential Lithium-ion Battery Energy Storage Systems Industry Analysis

Growth Drivers

- Declining Lithium-ion Battery Costs: Over the past decade, the cost of lithium-ion batteries has dropped significantly, making residential energy storage more affordable for homeowners. By 2023, battery prices had fallen to approximately $139 per kilowatt-hour (kWh), a considerable decrease that has driven wider adoption of home energy storage systems, enabling more households to store energy efficiently and benefit from renewable sources.

- Increasing Residential Solar Installations: The United States has seen a notable rise in residential solar installations, contributing to the demand for home energy storage systems. In 2022, the country installed 20.2 GW of photovoltaic (PV) capacity, with a significant portion attributed to residential installations. This growth underscores the expanding market for residential lithium-ion battery energy storage systems, as homeowners seek to store excess solar energy for later use.

- Rising Energy Independence Among Homeowners: Homeowners are increasingly seeking energy independence to mitigate the impact of grid outages and rising electricity costs. Residential lithium-ion battery energy storage systems enable homeowners to store energy generated from renewable sources, such as solar panels, providing a reliable backup during power outages and reducing reliance on the grid. This trend is evident in states like California, where frequent wildfires and grid instability have led to a surge in residential energy storage installations.

Market Challenges

- High Initial Installation Costs: Despite declining battery prices, the upfront costs of installing residential energy storage systems remain a barrier for many homeowners. The total installation cost includes not only the battery but also inverters, control systems, and labor, which can collectively amount to several thousand dollars. This financial hurdle can deter potential adopters, especially in regions without substantial incentives or rebates.

- Technical Integration with Existing Home Systems: Integrating lithium-ion battery storage systems with existing home electrical systems can present technical challenges. Compatibility issues may arise with older electrical infrastructure, requiring additional upgrades or modifications. Furthermore, ensuring seamless communication between the energy storage system and home energy management systems is essential for optimal performance, necessitating professional installation and potential additional costs.

USA Residential Lithium-ion Battery Energy Storage Systems Market Future Outlook

The U.S. residential lithium-ion battery energy storage systems market is poised for substantial growth, driven by continuous advancements in battery technology, supportive government policies, and increasing consumer demand for energy independence. The integration of smart home technologies and the development of more efficient and cost-effective storage solutions are expected to further propel market expansion.

Market Opportunities

- Technological Advancements in Battery Efficiency: Ongoing research and development in lithium-ion battery technology are leading to improvements in energy density, charging speeds, and overall efficiency. These advancements enhance the performance and lifespan of residential energy storage systems, making them more attractive to consumers. For instance, newer battery models offer higher storage capacities within the same physical footprint, allowing homeowners to store more energy without requiring additional space.

- Expansion into Emerging Residential Markets: As awareness of energy storage benefits grows, there is significant potential for market expansion into regions with lower current adoption rates. States with increasing renewable energy installations but limited energy storage infrastructure present opportunities for growth. Targeted marketing and education campaigns can help tap into these emerging markets, encouraging homeowners to invest in energy storage solutions.

Scope of the Report

|

Power Rating |

3 kW to 6 kW |

|

Connectivity |

On-Grid |

|

Operation |

Standalone |

|

Battery Chemistry |

Lithium Iron Phosphate (LFP) |

|

Region |

California New York |

Products

Key Target Audience

Residential Manufacture

Solar Installation Companies

Energy Utility Industry

Battery Manufacturers

Government and Regulatory Bodies (e.g., U.S. Department of Energy)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Tesla, Inc.

LG Energy Solution

Panasonic Corporation

Sonnen GmbH

Enphase Energy

Generac Power Systems

BYD Company Ltd.

Eguana Technologies

SimpliPhi Power

Pika Energy

Table of Contents

1. USA Residential Lithium-ion Battery Energy Storage Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Residential Lithium-ion Battery Energy Storage Systems Market Size (USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Residential Lithium-ion Battery Energy Storage Systems Market Analysis

3.1. Growth Drivers

3.1.1. Declining Lithium-ion Battery Costs

3.1.2. Increasing Residential Solar Installations

3.1.3. Government Incentives and Policies

3.1.4. Rising Energy Independence Among Homeowners

3.2. Market Challenges

3.2.1. High Initial Installation Costs

3.2.2. Technical Integration with Existing Home Systems

3.2.3. Regulatory and Permitting Hurdles

3.3. Opportunities

3.3.1. Technological Advancements in Battery Efficiency

3.3.2. Expansion into Emerging Residential Markets

3.3.3. Integration with Smart Home Technologies

3.4. Trends

3.4.1. Adoption of Virtual Power Plants (VPPs)

3.4.2. Growth in Third-Party Ownership Models

3.4.3. Development of Modular and Scalable Systems

3.5. Government Regulations

3.5.1. Federal Investment Tax Credit (ITC)

3.5.2. State-Level Incentive Programs

3.5.3. Net Metering Policies

3.5.4. Building Codes and Safety Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter's Five Forces Analysis

3.9. Competitive Landscape

4. USA Residential Lithium-ion Battery Energy Storage Systems Market Segmentation

4.1. By Power Rating (Value %)

4.1.1. 3 kW to 6 kW

4.1.2. 6 kW to 15 kW

4.1.3. 15 kW to 30 kW

4.2. By Connectivity (Value %)

4.2.1. On-Grid

4.2.2. Off-Grid

4.3. By Operation (Value %)

4.3.1. Standalone

4.3.2. Solar-Integrated

4.4. By Battery Chemistry (Value %)

4.4.1. Lithium Iron Phosphate (LFP)

4.4.2. Lithium Nickel Manganese Cobalt Oxide (NMC)

4.5. By Region (Value %)

4.5.1. California

4.5.2. Texas

4.5.3. New York

4.5.4. Florida

4.5.5. Others

5. USA Residential Lithium-ion Battery Energy Storage Systems Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla, Inc.

5.1.2. LG Energy Solution

5.1.3. Panasonic Corporation

5.1.4. Sonnen GmbH

5.1.5. Enphase Energy

5.1.6. Generac Power Systems

5.1.7. BYD Company Ltd.

5.1.8. Eguana Technologies

5.1.9. SimpliPhi Power

5.1.10. Pika Energy

5.1.11. Electriq Power

5.1.12. Sunverge Energy

5.1.13. Blue Planet Energy

5.1.14. Fortress Power

5.1.15. OutBack Power Technologies

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Residential Lithium-ion Battery Energy Storage Systems Market Regulatory Framework

6.1. Federal Energy Policies

6.2. State-Specific Regulations

6.3. Compliance Requirements

6.4. Certification Processes

7. USA Residential Lithium-ion Battery Energy Storage Systems Future Market Size (USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Residential Lithium-ion Battery Energy Storage Systems Future Market Segmentation

8.1. By Power Rating (Value %)

8.2. By Connectivity (Value %)

8.3. By Operation (Value %)

8.4. By Battery Chemistry (Value %)

8.5. By Region (Value %)

9. USA Residential Lithium-ion Battery Energy Storage Systems Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. residential lithium-ion battery energy storage systems market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. residential lithium-ion battery energy storage systems market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple battery manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. residential lithium-ion battery energy storage systems market.

Frequently Asked Questions

01. How big is the U.S. residential lithium-ion battery energy storage systems market?

The USA residential lithium-ion battery energy storage systems market is valued at USD 943.3 million, driven by increasing adoption of renewable energy sources and declining battery costs.

02. What are the challenges in the U.S. residential lithium-ion battery energy storage systems market?

Challenges in USA residential lithium-ion battery energy storage systems market include high initial installation costs, technical integration with existing home systems, and regulatory and permitting hurdles.

03. Who are the major players in the U.S. residential lithium-ion battery energy storage systems market?

Key players in USA residential lithium-ion battery energy storage systems market include Tesla, Inc., LG Energy Solution, Panasonic Corporation, Sonnen GmbH, and Enphase Energy.

04. What are the growth drivers of the U.S. residential lithium-ion battery energy storage systems market?

The USA residential lithium-ion battery energy storage systems market growth drivers encompass declining lithium-ion battery costs, increasing residential solar installations, supportive government incentives, and a rising desire for energy independence among homeowners.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.