USA Residential Outdoor Heating Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD4727

December 2024

92

About the Report

USA Residential Outdoor Heating Market Overview

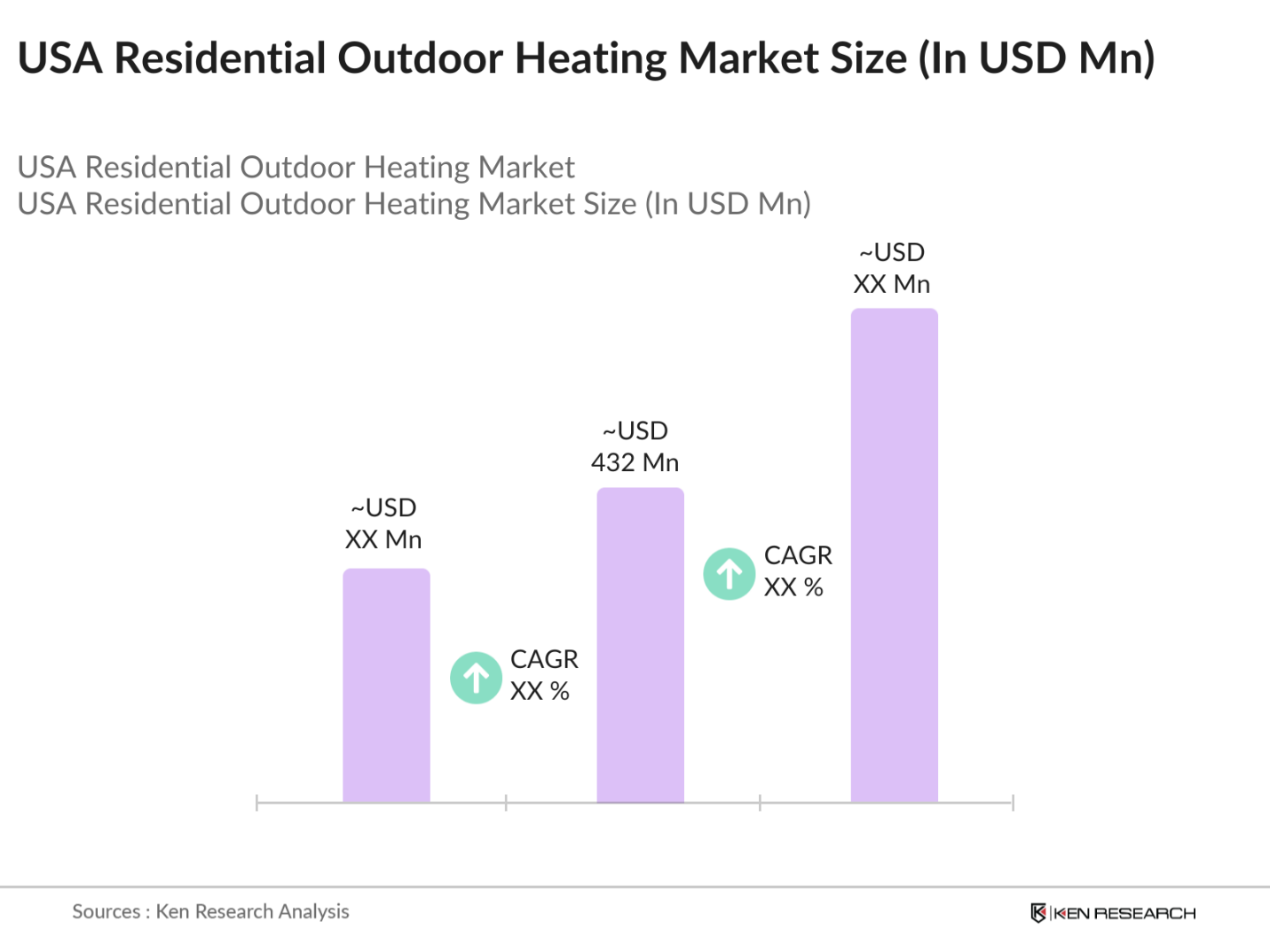

- The USA Residential Outdoor Heating market is valued at USD 432 million, based on a five-year historical analysis. This market is primarily driven by increased consumer interest in outdoor living spaces and a preference for home improvement projects that include backyard and patio upgrades. Technological advancements in heating systems, such as the integration of smart heating controls and energy-efficient models, have further boosted demand. With the trend of utilizing outdoor spaces for social gatherings, the adoption of advanced heating solutions has become a necessity, especially in suburban areas.

- The U.S. dominates the North American outdoor heating market, with strong contributions from regions like California, Texas, and Florida. These states have a combination of high disposable incomes, preference for year-round outdoor living, and a high number of residential properties with spacious backyards and patios. Additionally, advanced manufacturing and distribution networks in these regions ensure a steady supply and high availability of products, which further boosts the market growth.

- The U.S. Consumer Product Safety Commission (CPSC) sets and enforces safety regulations for the production and installation of outdoor heating products. These guidelines are designed to minimize hazards, ensure product safety, and maintain quality standards. Compliance with these regulations is crucial for manufacturers to legally enter the market and ensure consumer protection.

USA Residential Outdoor Heating Market Segmentation

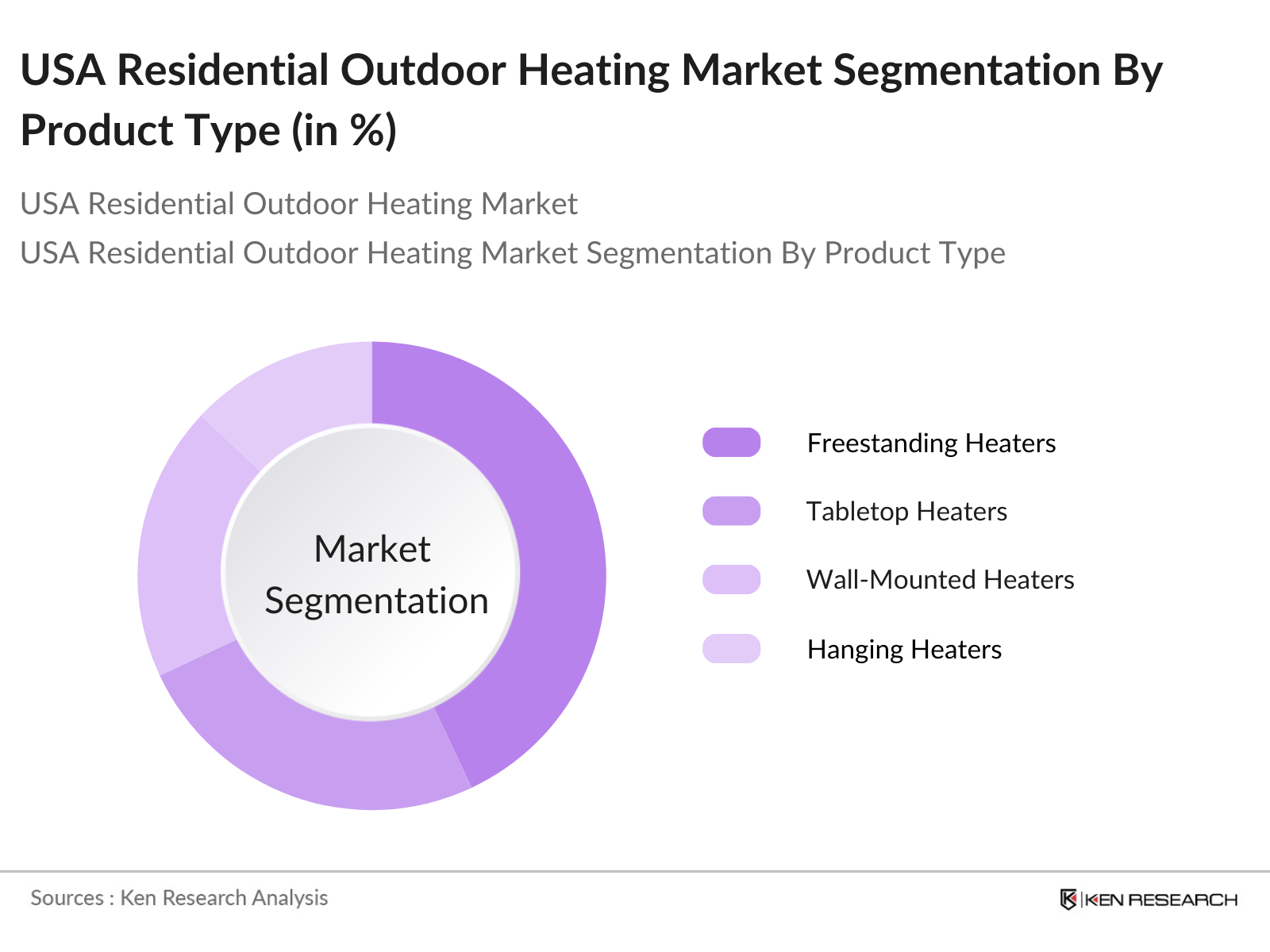

By Product Type: The U.S. residential outdoor heating market is segmented by product type into freestanding heaters, tabletop heaters, wall-mounted heaters, and hanging heaters. Among these, freestanding heaters held the dominant market share in 2023 due to their portability and ease of use. These heaters are versatile, can be installed in various outdoor spaces, and offer powerful heating capacity at a competitive price. This segment's growth is further bolstered by manufacturers providing a wide range of designs to cater to aesthetic and functional needs of residential consumers.

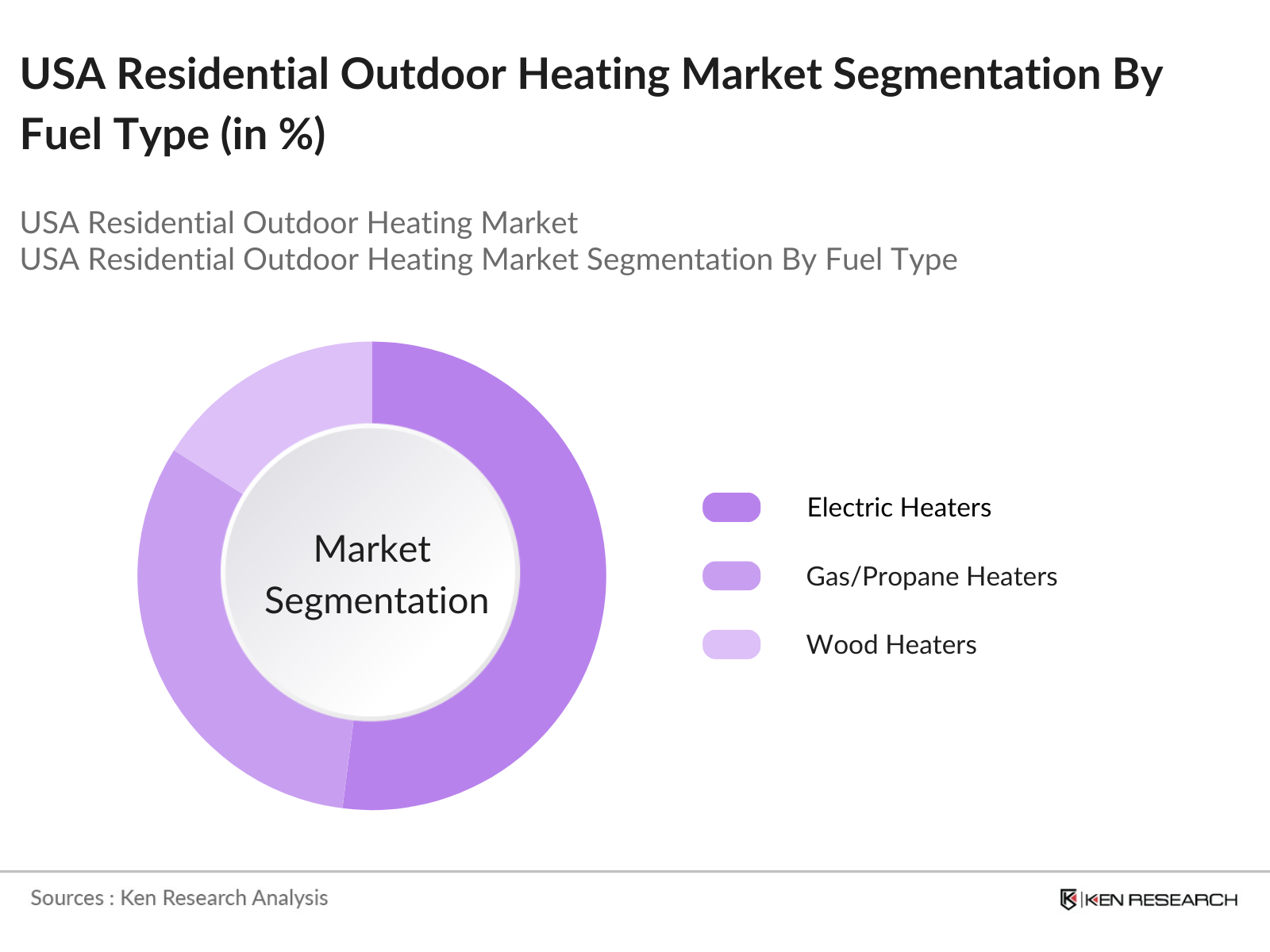

By Fuel Type: Based on fuel type, the market is divided into electric heaters, gas/propane heaters, and wood heaters. The electric heater segment is expected to dominate the market due to its eco-friendly nature and low operational cost. The federal government's stringent emission norms have discouraged the use of traditional gas and propane heaters, leading to a shift towards electric alternatives. Additionally, electric heaters offer more consistent heat distribution and are easier to maintain compared to other fuel types, driving their adoption in the residential segment.

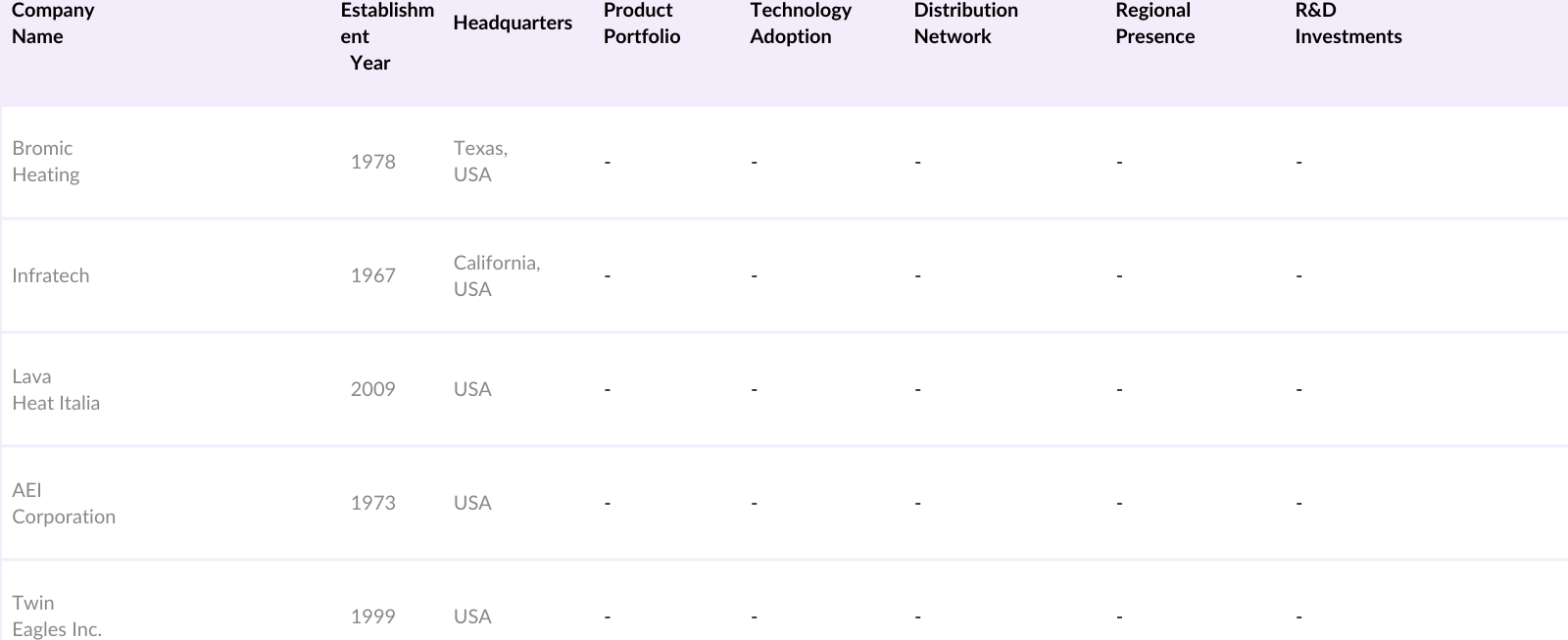

USA Residential Outdoor Heating Market Competitive Landscape

The U.S. residential outdoor heating market is dominated by several key players who control a significant portion of the market share through product innovation, strategic partnerships, and expanding distribution networks. The market landscape is characterized by significant consolidation, with key players focusing on expanding their product lines and investing in advanced technologies. Companies such as Bromic and Infratech are introducing heaters with smart control features and enhanced energy efficiency, which are likely to drive future growth

USA Residential Outdoor Heating Industry Analysis

Growth Drivers

- Consumer Inclination Towards Outdoor Living Spaces: The trend towards creating enhanced outdoor living environments has driven the adoption of residential outdoor heating solutions. As of 2022, approximately 56% of U.S. households engage in home improvements focused on outdoor areas, such as patios and decks, which often include heating installations to extend usability throughout the year. This trend is prevalent in the southern and western regions of the country, where 65% of households utilize some form of outdoor heating to facilitate year-round outdoor activities.

- Increased Preference for Entertainment and Leisure: With rising interest in outdoor leisure, nearly 88% of U.S. homes in 2020 utilized air conditioning, and the demand for outdoor heating followed a similar trajectory to ensure comfort during colder months. The preference for outdoor entertainment spaces, such as fire pits and patio heaters, reflects a lifestyle shift towards outdoor living. Additionally, this inclination is prominent among households with higher disposable incomes, especially in suburban areas where larger outdoor spaces are available.

- Expanding Disposable Income: The increase in disposable income has directly impacted the growth of the residential outdoor heating market. In 2023, U.S. median household income was reported at $74,580, supporting increased spending on home upgrades and outdoor heating solutions. The rise in income has been especially significant in urban and suburban regions, where a greater percentage of households have invested in outdoor improvements.

Market Challenges

- High Product Costs: The initial cost of advanced outdoor heating solutions, such as infrared and propane heaters, presents a barrier to widespread adoption. Many households still rely on traditional heating methods due to the high cost of modern systems. This is particularly relevant in lower-income households, where spending on non-essential heating solutions remains limited.

- Safety Regulations and Compliance: Compliance with safety regulations, such as those set by the Consumer Product Safety Commission (CPSC), can limit market growth. The stringent requirements for the installation and operation of gas heaters, coupled with the enforcement of emission norms by the Environmental Protection Agency (EPA), have made it challenging for manufacturers and consumers alike to adopt certain outdoor heating products.

USA Residential Outdoor Heating Market Future Outlook

Over the next few years, the U.S. residential outdoor heating market is expected to experience robust growth due to increasing consumer preferences for energy-efficient outdoor heating solutions, ongoing advancements in technology, and heightened consumer spending on residential renovations. The development of smart and connected outdoor heating devices that can be controlled through smartphones and smart home systems is a key trend expected to shape the market dynamics in the near future.

Market Opportunities

- Technological Advancements in Heating Solutions: Advancements in heating technologies, such as smart heating systems integrated with IoT, present new growth opportunities. Smart heaters that can be remotely controlled and monitored are gaining traction, particularly in high-income households that prioritize convenience and energy savings. In 2022, more than 40% of new outdoor heating products included some form of smart technology.

- Expansion into Underserved Rural Markets: Rural regions, which have been slower to adopt residential outdoor heating solutions, represent a significant growth opportunity. With only 30% of rural households currently using modern heating systems, there is ample potential for expansion, especially as infrastructure and distribution networks improve.

Scope of the Report

Products

Key Target Audience

Residential Property Developers

Outdoor Furniture and Equipment Retailers

Venture Capital and Investment Firms

Home Renovation and Landscaping Companies

Heating System Manufacturers

Government and Regulatory Bodies (EPA, DOE)

Smart Home Solution Providers

Residential Construction Firms

Companies

Players Mentioned in the Report

Bromic Heating

Infratech

Lava Heat Italia

Twin Eagles Inc.

AEI Corporation

Fire Sense

SUNHEAT International

Dayva International Inc.

Space-Ray

Nexgrill

Table of Contents

1. USA Residential Outdoor Heating Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. USA Residential Outdoor Heating Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Market Growth Rate (Year-On-Year Growth)

2.3. Key Market Developments and Milestones

3. USA Residential Outdoor Heating Market Analysis

3.1. Market Growth Drivers

3.1.1. Consumer Inclination Towards Outdoor Living Spaces

3.1.2. Increased Preference for Entertainment and Leisure

3.1.3. Expanding Disposable Income

3.1.4. Growing Adoption of Sustainable and Energy-efficient Heating Solutions

3.2. Market Challenges

3.2.1. High Product Costs

3.2.2. Safety Regulations and Compliance

3.2.3. Market Saturation in Urban Areas

3.2.4. Seasonal Dependency

3.3. Market Opportunities

3.3.1. Technological Advancements in Heating Solutions

3.3.2. Expansion into Underserved Rural Markets

3.3.3. Rising Trend of Eco-friendly and Portable Heating Solutions

3.3.4. Product Customization and Design Innovations

3.4. Market Trends

3.4.1. Integration of Smart Control Systems

3.4.2. Adoption of Hybrid Heating Solutions

3.4.3. Emergence of Modular and Portable Outdoor Heating Products

3.4.4. Utilization of Renewable Energy Sources

3.5. Government Regulation

3.5.1. Safety Standards for Outdoor Heating Products

3.5.2. Emission Norms and Regulations

3.5.3. Incentives for Eco-friendly Heating Solutions

3.5.4. Local Ordinances Governing Outdoor Heating Equipment Usage

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem Analysis

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem Analysis

4. USA Residential Outdoor Heating Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fire Pits & Bowls

4.1.2. Patio Heaters

4.1.3. Outdoor Fireplaces

4.1.4. Tabletop Heaters

4.2. By Fuel Type (In Value %)

4.2.1. Gas

4.2.2. Electric

4.2.3. Wood

4.2.4. Bioethanol

4.3. By Distribution Channel (In Value %)

4.3.1. Offline (Specialty Stores, Hypermarkets/Supermarkets, Others)

4.3.2. Online (Company Websites, E-commerce Platforms)

4.4. By End-User (In Value %)

4.4.1. Residential

4.4.2. Commercial

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Residential Outdoor Heating Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dimplex North America Limited

5.1.2. Mr. Heater Corporation

5.1.3. Napoleon Group of Companies

5.1.4. Infrared Dynamics Inc.

5.1.5. Lava Heat Italia

5.1.6. AZ Patio Heaters LLC

5.1.7. Blue Rhino Global Sourcing, Inc.

5.1.8. Bromic Heating Pty Ltd

5.1.9. Schwank USA

5.1.10. Heatstrip USA

5.1.11. Fire Sense

5.1.12. Superior Radiant Products

5.1.13. Sunglo

5.1.14. Lynx Grills, Inc.

5.1.15. Sunpak Infrared Heaters

5.2. Cross Comparison Parameters (Product Portfolio, Price Differentiation, Technology Adoption, Service Offerings, Market Presence, Regional Footprint, Distribution Network, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Residential Outdoor Heating Market Regulatory Framework

6.1. Safety Regulations and Standards

6.2. Emission Standards and Compliance Requirements

6.3. Certification Processes and Testing Requirements

6.4. Product Recalls and Safety Notifications

7. USA Residential Outdoor Heating Market Future Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Residential Outdoor Heating Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Fuel Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USA Residential Outdoor Heating Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Entry and Growth Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves creating an ecosystem map of stakeholders in the U.S. residential outdoor heating market. Extensive desk research is conducted using secondary databases to identify critical variables affecting market trends and dynamics.

Step 2: Market Analysis and Construction

The historical data is collected and analyzed to determine key market metrics such as penetration rates, customer preferences, and regional demand. This data is then used to estimate market size and future growth prospects.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are validated through expert consultations, involving interviews with stakeholders such as manufacturers, distributors, and technology providers. These insights help refine the market projections.

Step 4: Research Synthesis and Final Output

The final step consolidates all the research findings into a comprehensive report, ensuring all data is verified and cross-checked against multiple sources.

Frequently Asked Questions

01. How big is the USA Residential Outdoor Heating Market?

The USA Residential Outdoor Heating market is valued at USD 432 million, based on a five-year historical analysis. This market is primarily driven by increased consumer interest in outdoor living spaces and a preference for home improvement projects that include backyard and patio upgrades.

02. What are the growth drivers of the USA Residential Outdoor Heating Market?

The market growth is propelled by factors such as increased interest in outdoor living, advancements in energy-efficient heating solutions, and the popularity of smart, connected heating devices.

03. Who are the major players in the USA Residential Outdoor Heating Market?

Key players include Bromic Heating, Infratech, Lava Heat Italia, Twin Eagles Inc., and AEI Corporation. These companies dominate due to their innovative product offerings and strong distribution networks.

04. What are the challenges in the USA Residential Outdoor Heating Market?

The main challenges include strict regulatory requirements, seasonal demand fluctuations, and the high cost of advanced heating solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.